All 5 New Launch Executive Condos On The Market In 2021 (February Update)

February 11, 2021

Upgrading to a condo might sound great – but if the thought of upfront Additional Buyers Stamp Duty (ABSD) and a high quantum are off-putting, remember you always have the option of an Executive Condominium (EC). There’s no ABSD when upgrading from an HDB property; and with its much lower price tag, the sale of your flat may cover the entire cost.

So for upgraders in 2021, here are the EC options you can consider – both new launches, and resale ECs that are reaching their Minimum Occupancy Period (MOP) this year.

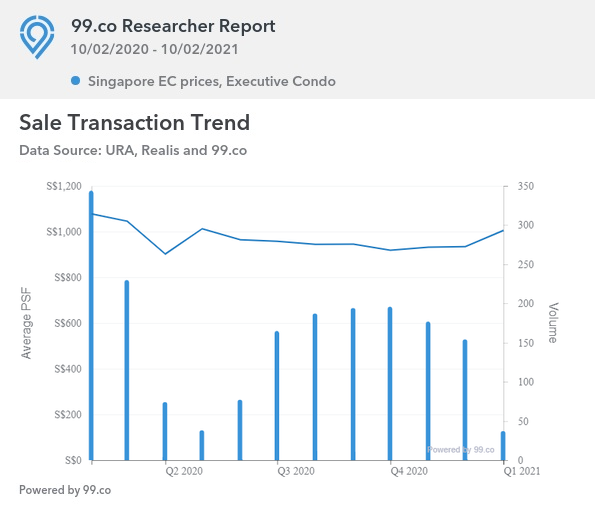

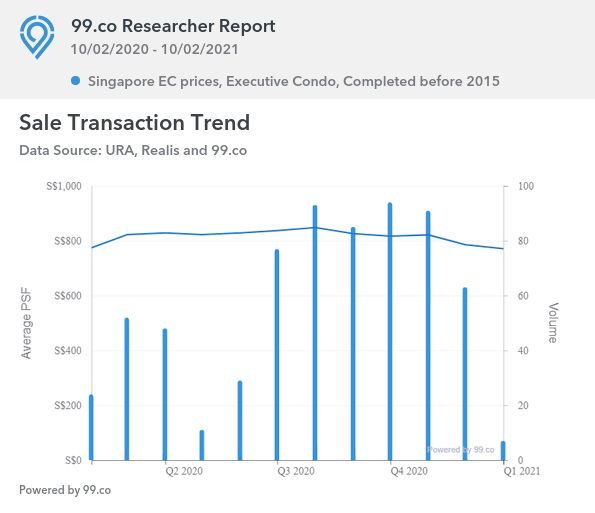

A look at current EC prices

On an overall basis, ECs across Singapore averaged $935 psf Q4 2020. The average quantum island-wide was $1,090,166.

By comparison, resale ECs (completed in 2015 or before) were at around $785 psf in Q4 2020, with an average quantum of $982,665.

New ECs (upcoming / ongoing sales) for 2020 / 2021

- Parc Canberra

- Parc Central Residences

- Parc Greenwich

- Piermont Grand

- The Ola

1. Parc Canberra

Location: Canberra Link (District 27)

Developer: Hoi Hup Sunway Canberra Pte. Ltd.

Expected TOP: Sept. 2023

Current take-up rate: 89.1%

Number of units: 496

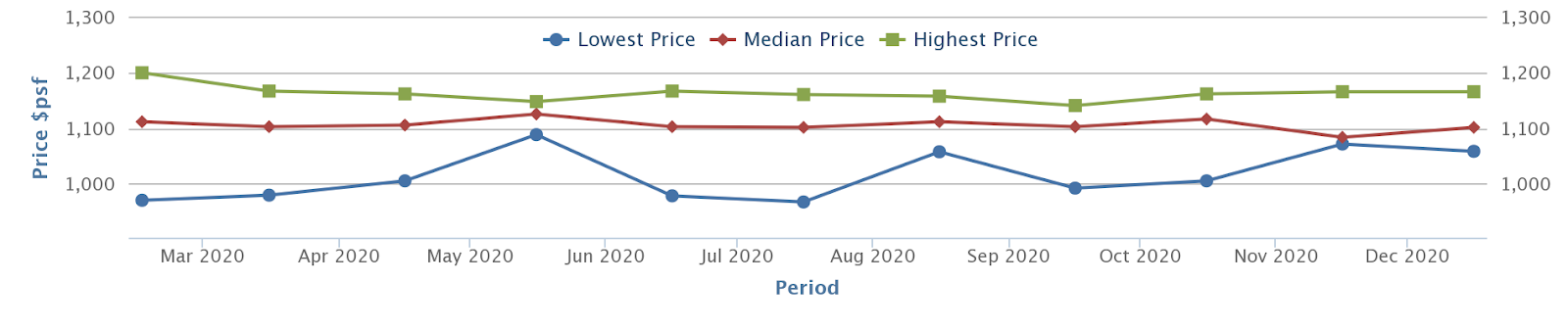

According to Square Foot Research, the last known developer pricing was at a median of $1,101 psf, with a high of $1,165 psf and a low of $1,068 psf. These were the last five transactions in January this year:

| Date | Unit size | Price PSF | Price |

| 28 Jan 2021 | 926 sq. ft. | $1,090 | $1,009,000 |

| 28 Jan 2021 | 926 sq. ft. | $1,129 | $1,045,000 |

| 28 Jan 2021 | 947 sq. ft. | $1,065 | $1,009,000 |

| 27 Jan 2021 | 947 sq. ft. | $1,120 | $1,061,000 |

| 26 Jan 2021 | 947 sq. ft. | $1,083 | $1,026,000 |

Key highlights

By the time you read this, Parc Canberra will be nearing its “last chance to buy” phase; at the time of writing, about 10 per cent of the units are unsold.

This EC is one of the closest residential units (350 metres) to the Canberra MRT station, which was opened in 2019. This is a rarity among ECs, which tend to be further from train stations.

It’s also 1.6 kilometres to the Bukit Canberra hub, which is one of the biggest upgrades to the location in years – this is a 12-hectare sports and community club, with the usual abundance of dining and retail that comes with it.

While Parc Canberra has been spared some of the inconvenience associated with non-mature neighbourhoods, buyers should keep in mind that Sembawang is still sparse. This is definitely not the location for those who want a more urban lifestyle (lots of malls, late night entertainment, etc.).

There are also a number of condos already in close vicinity; chief among these are The Visionaire and The Brownstone. Given that Parc Canberra is the closest to the MRT however, it has an edge over the future competition.

2. Parc Central Residences

Location: Tampines Street 86 (District 18)

Developer: Hoi Hup Sunway Tampines JV Pte. Ltd.

Expected TOP: Q2 2023

Current take-up rate: 59 per cent

Number of units: 700

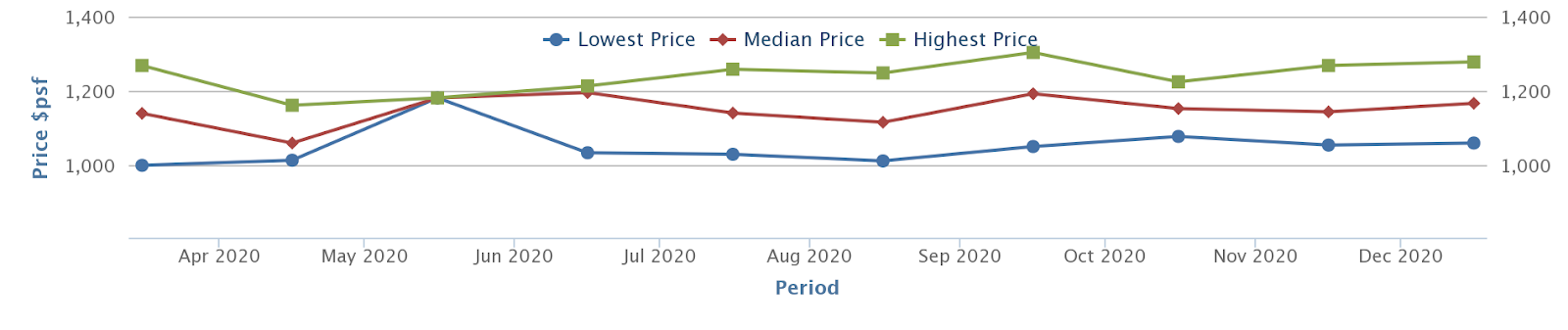

The price chart is not yet available, as the launch is too recent (23rd January). However, the indicative pricing from Square Foot Research is between $1,021 to $1,286 psf, with an average of $1,177 psf.

These were the last five transactions in January:

| Date | Unit size | Price PSF | Price |

| 28 Jan 2021 | 1,432 sq. ft. | $1,190 | $1,704,000 |

| 28 Jan 2021 | 1,227 sq. ft. | $1,135 | $1,393,000 |

| 28 Jan 2021 | 1,464 sq. ft. | $1,161 | $1,699,500 |

| 27 Jan 2021 | 936 sq. ft. | $1,148 | $1,075,000 |

| 27 Jan 2021 | 1,119 sq. ft. | $1,156 | $1,294,000 |

Key highlights

Parc Central Residences had a strong response on its launch weekend, with 414 out of the 700 units sold. There hasn’t been an EC in Tampines since CityLife @ Tampines way back in 2013, which probably helped to push sales.

Tampines is also a strong location, being both mature and the regional centre for the East. That said, buyers should be aware that Parc Central Residences is not within walking distance to Tampines Hub – it’s about 1.3 kilometres away, and roughly a five-minute drive along Tampines Avenue 5. This means there’s also no MRT station within walking distance. We understand there will be shuttle services though.

For the more investment-minded, you probably want something closer to Tampines Hub; especially if your intent is to rent out the unit after MOP. For pure home owners, you’d be hard pressed to find many newer condos (besides Treasure @ Tampines) that can match this for value.

New Launch Condo ReviewsTreasure At Tampines Review: Affordable Pricing At The Expense Of Privacy

by Reuben Dhanaraj3. Parc Greenwich

Location: 8 Fernvale Lane (District 19)

Developer: Frasers Property SG (Fernvale Lane) Pte. Ltd.

Expected TOP: Q4 2023

Current take-up rate: N/A

Number of units: 496

Transactions have not yet been recorded. Follow Stacked for an update, as soon prices and transactions become available.

Key highlights

Like Parc Canberra, Parc Greenwich manages to escape some of the sparsity associated with non-mature areas. This development is around 450 metres (six minutes’ walk) to Greenwich V. This is a small mall with limited retail, but it does have a Cold Storage, childcare, and a food court.

Further away at 750 metres (around nine minutes’ walk), you can find Seletar Mall – this is the major mall for the area, and it’s linked to the Fernvale LRT station.

More from Stacked

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

5 Cheapest 3-Bedroom Units Under $1.2 Million

While we looked at some freehold 3-bedroom units at a price point of under $1.5 million last week, there is…

Fernvale Primary School is just around 450 metres away as well, while Pei Hwa Secondary is about 850 metres (about 10 minutes’ walk). Sengkang Green Primary is about the same distance.

As such, some home buyers will find Parc Greenwich well located, despite the fact that Sengkang as a whole is not heavily built up.

The biggest gripe will be having to use the LRT to connect to the wider MRT network; but lack of nearby train stations is a baked-in reality for most ECs anyway. We’ll have a more formulated opinion once we get a better sense of the median pricing.

4. Piermont Grand

Location: Sumang Walk (District 19)

Developer: CDL Constellation Pte. Ltd. and TID Residential Pte. Ltd.

Expected TOP: 2023

Current take-up rate: 84.3 per cent

Number of units: 820

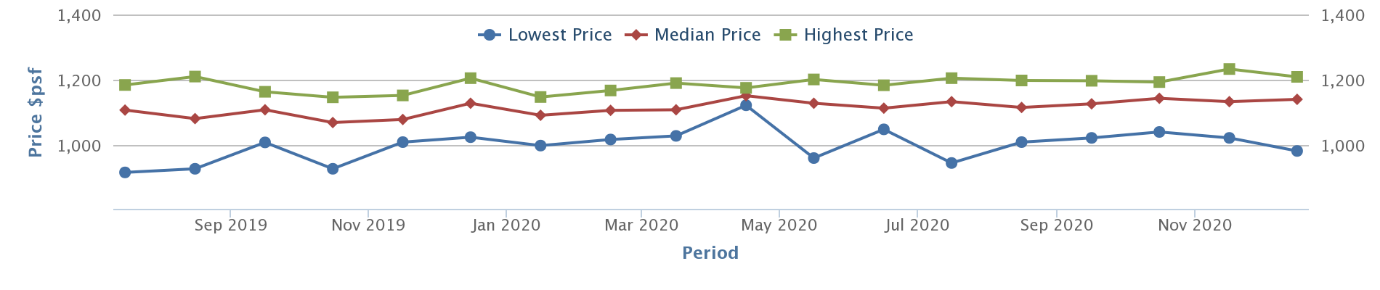

According to Square Foot Research, the last known developer pricing was at a median of $1,140 psf, with a high of $1,209 psf and a low of $982 psf. These were the last five transactions in January this year:

| Date | Unit size | Price PSF | Price |

| 31 Jan 2021 | 872 sq. ft. | $1,147 | $1,000,400 |

| 30 Jan 2021 | 1,507 sq. ft. | $1,096 | $1,651,480 |

| 26 Jan 2021 | 1,335 sq. ft. | $1,151 | $1,536,400 |

| 24 Jan 2021 | 1,572 sq. ft. | $1,068 | $1,679,100 |

| 24 Jan 2021 | 1,507 sq. ft. | $1,123 | $1,747,500 |

Key highlights

Piermont Grand launched with good timing, being the only EC launch of 2019. It also got a lot of publicity in the media, as the developers paid a princely sum of $509.37 million for the site (approx. $583 psf).

This led to assumptions that it would be expensive; but as you can see above, prices for Piermont Grand have been more or less comparable to other recent ECs.

As with many ECs, there’s the usual problem of not having an MRT station nearby. However, we did try walking, and note that the distance to the Punggol MRT station is roughly a 12-minute walk, despite Google maps suggesting it’s much further (1.2 kilometres and a 15-minute walk). Waterway Point is the closest mall, adjacent to the Punggol MRT station. This is a major mall with a FairPrice.

At any rate, if you don’t mind using the LRT, Sumang Walk station is just two minutes away on foot.

The main highlight of Piermont Grand would be the waterfront view, and quick access to Punggol Waterway Park; it’s only about 1km, or 15 minutes’ walk, to this family recreation area.

That said, we still suggest you pick Piermont Grand only if you’re okay to drive or use PHVs often. Sumang Walk is not in the most central part of Punggol, which itself is already a fringe district.

5. The Ola

We have a full review on The Ola on Stacked, but here’s a quick update as of February of 2021:

Location: Anchorvale Crescent (District 19)

Developer: Gamuda Land and Evia Real Estate

Expected TOP: 2023

Current take-up rate: 38.9 per cent

Number of units: 548

According to Square Foot Research, the last known developer pricing was at a median of $1,166 psf, with a high of $1,278 psf and a low of $1,059 psf. These were the last five transactions in January this year:

| Date | Unit size | Price PSF | Price |

| 31 Jan 2021 | 1,389 sq. ft. | $1,116 | $1,550,000 |

| 31 Jan 2021 | 1,055 sq. ft. | $1,157 | $1,220,000 |

| 31 Jan 2021 | 926 sq. ft. | $1,158 | $1,072,000 |

| 29 Jan 2021 | 1,389 sq. ft. | $1,032 | $1,433,000 |

| 27 Jan 2021 | 947 sq. ft. | $1,133 | $1,073,000 |

Key highlights

The Ola is one of the first ECs to be marketed as a luxury EC, and offerings are creative. Examples include a tele-health booth, where you can consult with doctors and get a prescription via video-conference; and over 500 hours of complementary courses (from cooking to exercise classes).

In terms of location, The Ola is close to Sengkang General Hospital – this can be a pro or a con depending on your preference (some families like the close access to healthcare, others worry about ambulance sirens in the night). It’s also close to Springdale Primary School, which is roughly 400 metres or six minutes’ walk away.

The Ola is about 730 metres to Sengkang MRT station, or about 10 minutes on foot. This is good for an EC, as most of them aren’t even in walking distance. If you don’t want to do the 10-minute stretch, you can use the Cheng Lim LRT station to get there – this is just three minutes away on foot.

Unfortunately, there isn’t much else in the immediate vicinity – and Sengkang is not the most developed area. Do be prepared to venture out, for most of your retail and entertainment.

ECs are likely to do well in the near-term, due to most buyers being upgraders; do expect some competition for units

ECs are favoured by upgraders because you don’t have to pay the ABSD upfront, if you choose to buy a unit before selling your flat. In addition, the MOP for ECs only applies to the first batch of buyers – this makes resale ECs quite attractive after the first five years, and there’s good potential for gains in a fairly short time.

That said, ECs do have certain drawbacks; they’re always 99-year leasehold units, for instance, and tend to be in the more fringe areas. If you’re not certain whether they’re right for you, contact us for an in-depth consultation.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

What are the benefits of choosing an Executive Condominium over a regular condo in Singapore?

Which new Executive Condominiums are available in Singapore in 2021?

How do resale EC prices compare to new EC prices in Singapore?

What are some key features of Parc Canberra EC?

What should buyers consider about EC locations and amenities?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Property Picks

Property Picks Where to Find Singapore’s Oldest HDB Flats (And What They Cost In 2025)

Property Picks Where To Find The Cheapest 2 Bedroom Resale Units In Central Singapore (From $1.2m)

Property Picks 19 Cheaper New Launch Condos Priced At $1.5m Or Less. Here’s Where To Look

Property Picks Here’s Where You Can Find The Biggest Two-Bedder Condos Under $1.8 Million In 2025

Latest Posts

Singapore Property News This 88-Year Leasehold HDB Shophouse on Bedok Reservoir Rd Is on Sale for $4M

Singapore Property News We Toured A New Co-Living Space In Bugis With Ice Baths, Gyms And Chef Dinners

On The Market Here Are Some Of The Cheapest Newly MOP 4-Room HDB Flats You Can Still Buy

5 Comments

Love OLA, beautiful layout and there are alot of upcoming developments in that area.

For Piermont Grand, you mention that it takes around 12 minutes to walk to MRT but it only takes 10 minutes to walk to Punggol waterway park.

From the map, looks like waterway park is further away as compared to mrt/mall ?!

Walking along the PCN (along river thru side gate) to Waterway Point / MRT is only 6-8min.