A Surprising Lack Of Bids For Bukit Timah And Hillview GLS Sites: Are Developers Less Confident?

November 8, 2022

The bids for two land plots at Bukit Timah and Hillview were a surprise to market watchers this week. These mid-sized plots in proven areas were expected to draw substantial developer attention; especially with new launches seeing continued demand and a low supply of new homes. However, developer interest was lacklustre; and it may be a worry for anyone hoping for en-bloc deals this year.

Two GLS sites with notable locations

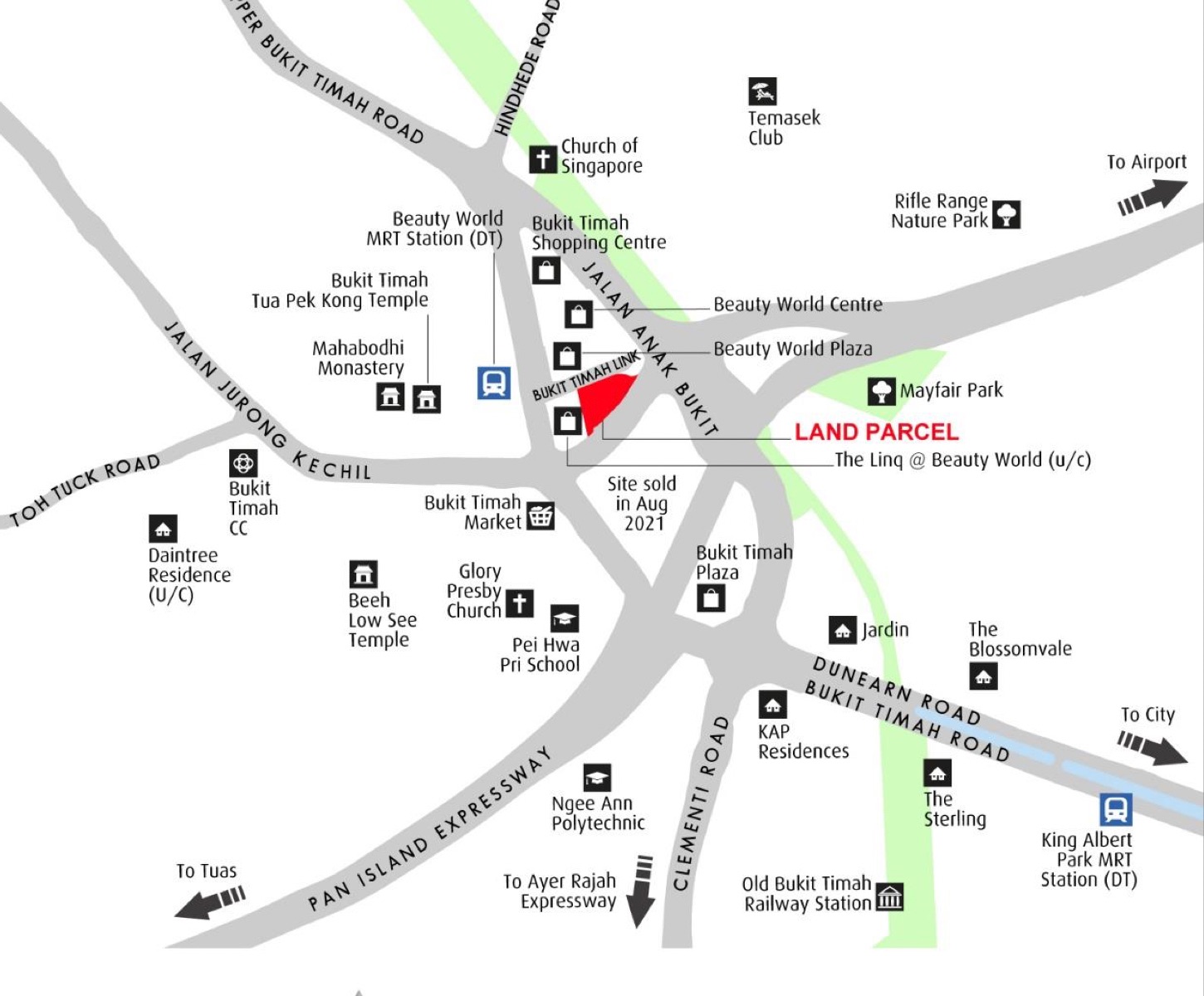

The Bukit Timah Link site (99-year lease) has a land area of around 4,611 sqm., and a GFA of 13,834 sqm. This is a small plot that would yield around 160 units.

The location of the Bukit Timah plot will be immediately recognisable to most market watchers: it’s located next to Linq @ Beauty World, one of the fastest-selling projects in 2021. (Linq @ Beauty World sold 115 of its 120 units over its launch weekend).

Like its under-construction counterpart, this site offers walking access to Beauty World MRT (Downtown Line), as well as Beauty World Plaza. In addition, the Jalan Anak Bukit land plot, right across the road, will add a major retail component once completed (see below).

The winning bid for this site was from Bukit Sembawang Estates, at $1,343.13 psf, or $200 million. This was a notable jump of over 15 per cent from the next highest bid (Wing Tai) at $1,161.05 psf. It’s a surprising price given that Jalan Anak Bukit GLS was sold at $989.4 psf, even if it was more than a year ago.

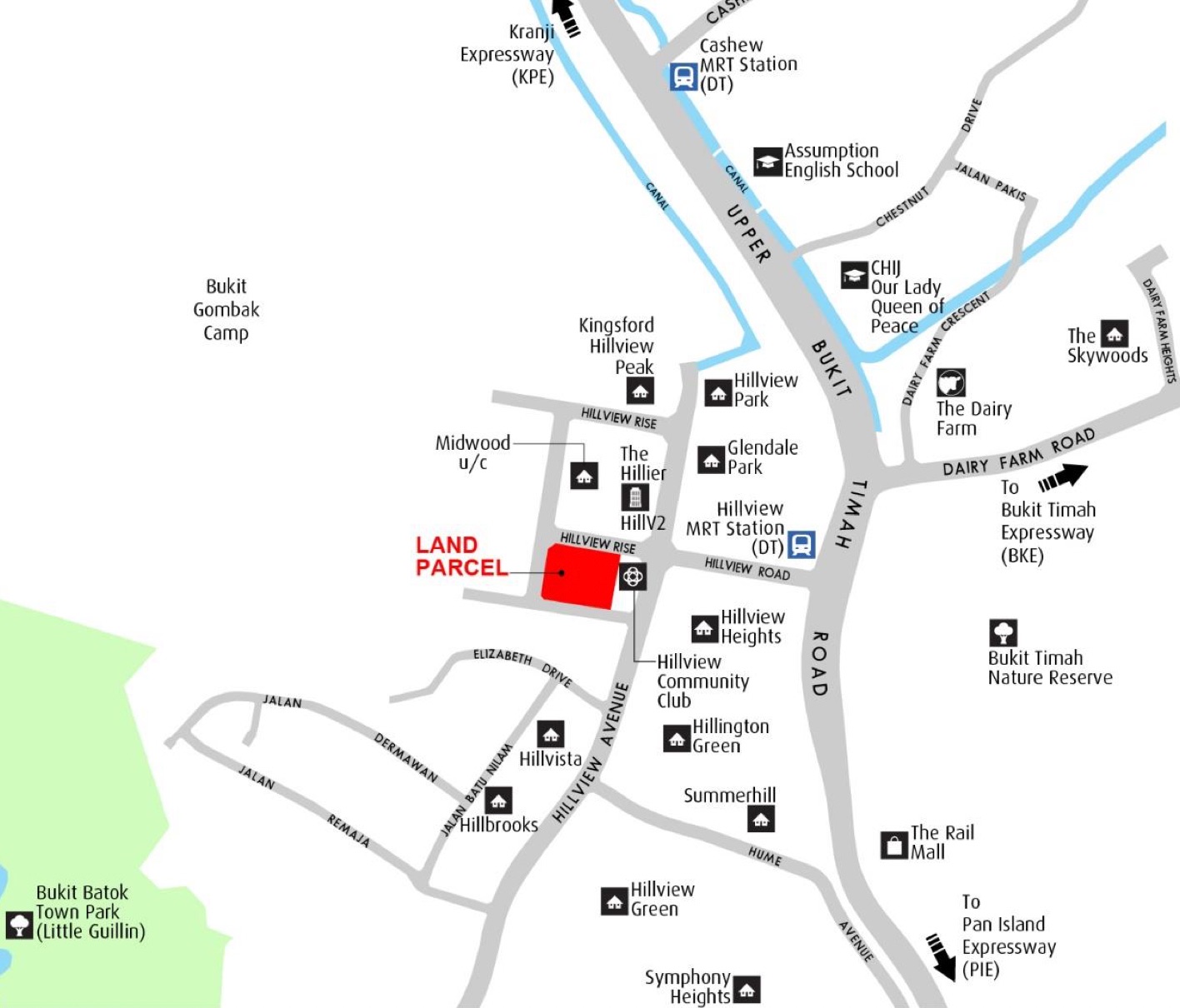

The second GLS site was Hillview Rise (99-year lease). This site area is around 10,395 sqm., with a GFA of 29,107 sqm. This is sufficient for a small development of around 335 units.

This site is across the road from Midwood, which was launched in 2019 and is currently under construction. This site is within walking distance to Hillview MRT (Downtown Line), and is notably close to HillV2 mall (just across the road). The Rail Mall is also just around a five-minute drive from here.

The winning bid for this site was from Far East Organization, at $1,023.85 psf, or $320.78 million. This only narrowly topped CDL’s bid, the second highest at $1,011.16 psf.

| BIDDERS | BID PRICE (S$M) | S$PSF PPR |

| HILLVIEW RISE | ||

| Far East Civil Engineering (Far East Organization) and Sekisui House | 320.78 | 1,023.85 |

| CDL Constellation (City Developments) | 316.80 | 1,011.16 |

| United Venture Development No. 6 (UOL Group and Singapore Land Group) | 308.38 | 984.28 |

| Sim Lian Land and Sim Lian Development | 283.00 | 903.27 |

| BUKIT TIMAH LINK | ||

| Bukit One (Bukit Sembawang Estates) | 200.00 | 1,343.13 |

| Winchamp Investment (Wing Tai) | 172.89 | 1,161.05 |

| Sims Park (Far East Organization) | 161.78 | 1,086.42 |

| Sing Holdings | 155.20 | 1,042.26 |

| TID Residential (Hong Leong Holdings and Mitsui Fudosan) | 138.49 | 930.00 |

Locations drew fewer bids than expected

Market watchers noted that Hillview Rise drew just four bids, with a difference of just over 13.3 per cent between the lowest and highest bids. The Bukit Timah Link site also drew just five bids, despite the attractive city fringe location, and the proven success of Linq @ Beauty World.

Market watchers expected higher bids for these sites for two main reasons:

The first is that both sites are considered small, with fewer units to move. This is essential in the current market, where ABSD rates for developers are high, and developers must complete and sell every unit in five years.

More from Stacked

Slower Sales At One Marina Gardens And Bloomsbury Residences: A Sign That Buyer Sentiment Is Cooling?

The fast sales of Parktown Residence, Lentor Central Residences, and previously Emerald of Katong have set expectations quite high. A…

The low number of bids suggests that small developments or not, developers are inclined to play it cautiously in 2022.

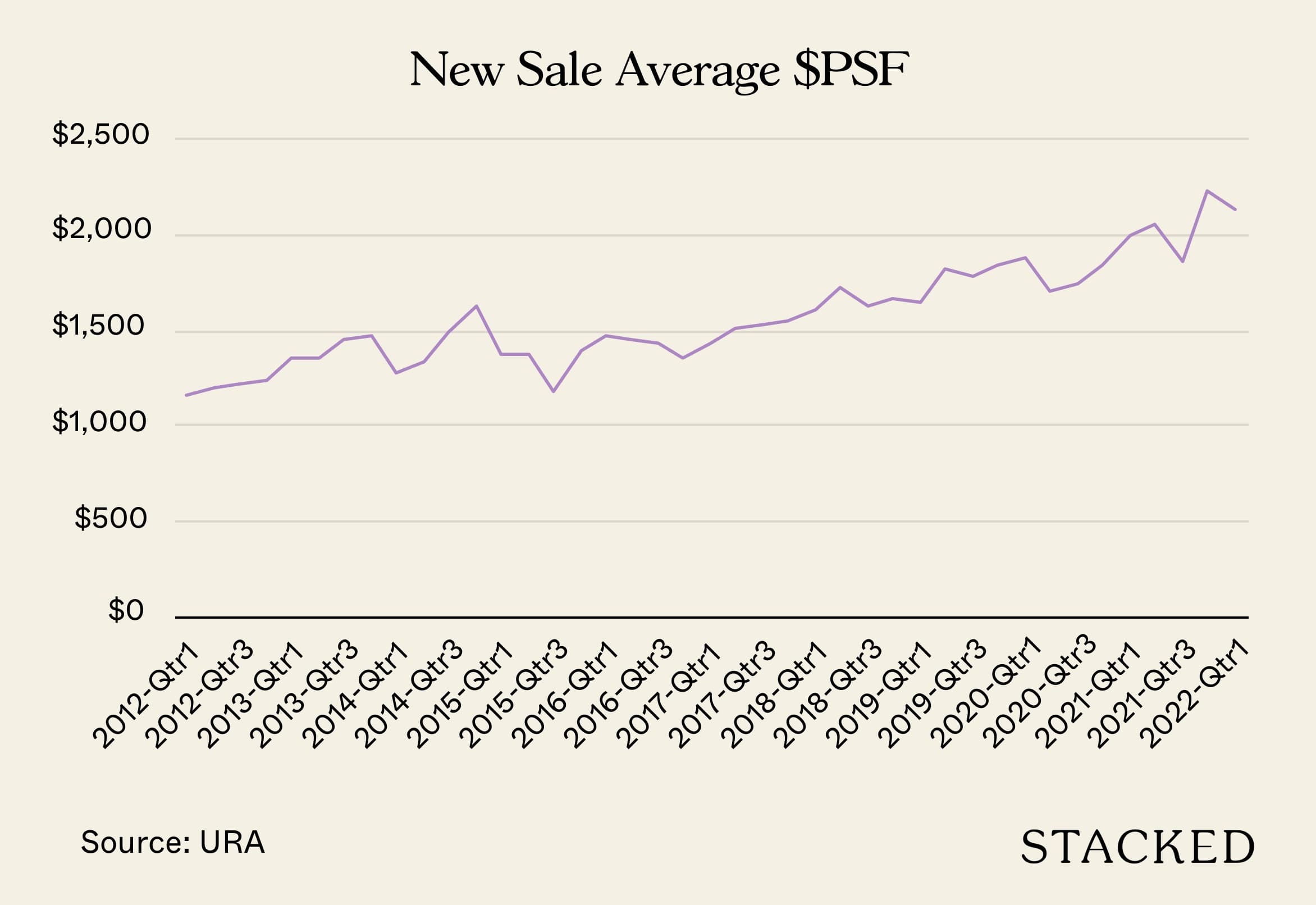

The second reason is that new launch prices of $2,000 psf are becoming normalised even for fringe region properties, and demand is rising on the back of shrinking housing supply. Both conditions were expected to raise developer confidence.

Nonetheless, realtors we spoke to said that despite the smaller number of bids, prices are broadly in line with expectations. They expect eventual prices to be upward of $1,800 psf for the Hillview Rise plot, and prices to be north of $2,200 psf for the Bukit Timah Link plot.

What’s dissuading developers from biting?

Realtors pinpointed the September 2022 cooling measures as one of the possible reasons. One realtor said that the market takes time to adapt to cooling measures, and buyers may resort to a wait-and-see approach in the immediate aftermath of 2022.

Singapore Property NewsBiggest Winners And Losers Of The Latest Cooling Measures In 2022: How Does This Affect You?

by Ryan J. OngShe feels the recent round of cooling measures are “especially impactful due to loan restrictions” such as the increased interest rate floor, which may disqualify more HDB upgraders from more expensive new launches.

Another realtor said that, for the Bukit Timah Link plot, one of the issues is the 3.22 hectare Jalan Anak Bukit land plot that Far East Organization and Sino Group snapped up in 2021. This is right across the road from Linq @ Beauty World and the Bukit Timah Link plot; and it’s an integrated development that will include 700 residential units and 150 serviced apartments.

The realtor feels that developers want to avoid competing with such upcoming integrated developments, to which buyers have been better inclined from the recent few such projects.

Besides this, the general performance of the new launches here previously does give rise to some concern. Only The Linq @ Beauty World can be said to have sold well. Others like Midwood, Dairy Farm Residences, and Verdale definitely experienced slow sales in the early days, only to pick up once supply was constrained in other areas of Singapore.

Cautious developers may be bad news for those seeking en-bloc deals

The general consensus on the ground is that, for developers buying in 2022, there’s a high chance they’ll have to launch during an expected recession in 2023 or 2024.

A particular worry is rising interest rates – these not only raise financing costs for developers, they impact the affordability of homes, and HDB upgraders (the majority of buyers) are increasingly priced out of new launches. High-interest rates may also turn investors away from property assets, such as if the rates begin to eat significantly into returns and rental yields.

At present, en-bloc sales for 2022 beat last year by as early as July; but we have yet to see the effects of heightened interest rates sink in.

If developers aren’t rushing for GLS sites, however, that’s an ominous portent for those who are counting on en-bloc sales.

For more updates on the situation, follow us on Stacked. We’ll also provide in-depth reviews on new and resale projects alike.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

Why were the bids for the Bukit Timah and Hillview GLS sites considered surprising?

What factors might be causing developers to be less confident about bidding on these land sites?

How many bids did the Hillview Rise and Bukit Timah Link sites receive, and how does this compare to expectations?

What are the potential price expectations for these sites based on current market conditions?

How might rising interest rates impact developers and the property market in 2022 and beyond?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Singapore Property News

Singapore Property News Why Some Singaporean Parents Are Considering Selling Their Flats — For Their Children’s Sake

Singapore Property News Nearly 1,000 New Homes Were Sold Last Month — What Does It Say About the 2026 New Launch Market?

Singapore Property News The Unexpected Side Effect Of Singapore’s Property Cooling Measures

Singapore Property News The Most Expensive Resale Flat Just Sold for $1.7M in Queenstown — Is There No Limit to What Buyers Will Pay?

Latest Posts

Pro This 130-Unit Condo Launched 40% Above Its District — And Prices Struggled To Grow

Property Investment Insights These Freehold Condos Barely Made Money After Nearly 10 Years — Here’s What Went Wrong

Pro River Modern Starts From $1.548M For A Two-Bedder — How Its Pricing Compares In River Valley

0 Comments