We analysed 87 en bloc condos. Here’s what we learnt.

October 7, 2019

En bloc condos were all the rage in 2017 and 2018, which isn’t surprising at all given that you could potentially make double what your property was actually worth. With the exception of certain en bloc sagas (Gillman Heights comes to mind), most people walk away from an en bloc sale flushed with cash and feeling on top of the world! So naturally one of the questions that we get asked most on Stacked Homes is: How do you spot en bloc potential?

To help answer this question, we analysed all 87 en bloc condos from 2016 to 2019 to find out are what are the similarities between all the developments and if there any characteristics which we can glean from the information. While we can say that there isn’t a magical formula, it is quite clear that there are some common attributes that we can learn that will result in a condo having a higher en bloc potential.

Note: Some of the data for the older condos TOP date cannot be found, and even though we can do a guesstimate, we decided it was best to exclude and leave it as unknown.

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

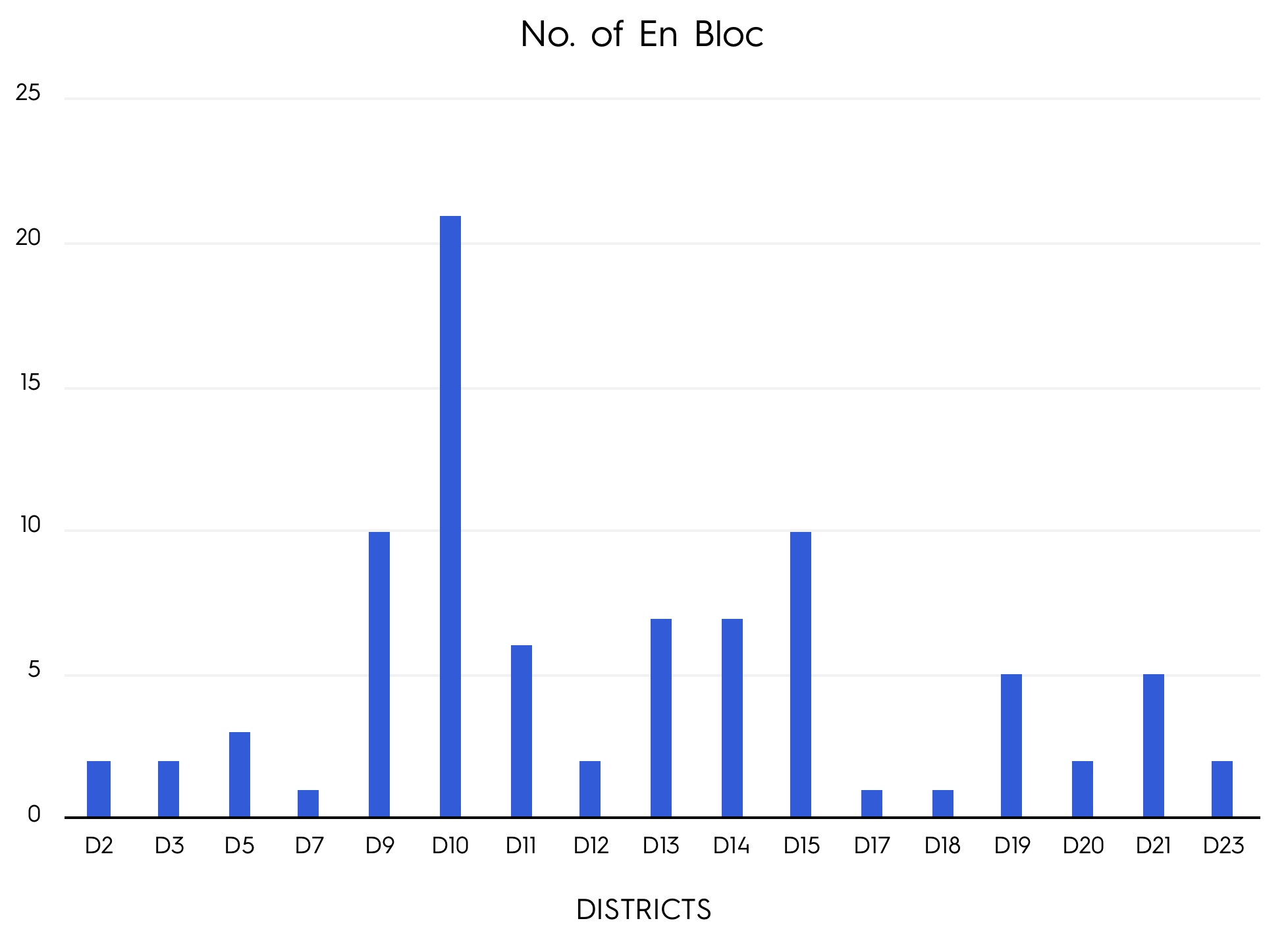

The Ideal En Bloc Condos Location Are Districts 9, 10, and 15.

After analysing the 87 condos that have gone en bloc between 2016 to 2019, these districts were the most common in terms of location.

From here you can see that the districts that developers were most concentrated on were the higher-end districts, namely District 9 (11.5%), District 10 (24.1%) and District 15 (11.5%). District 10 took home the prize of the most popular district, garnering nearly a quarter of all the en bloc condos in the timeframe. The results here are unsurprising for two reasons. Firstly, as these are the more mature districts, they have a greater density of private developments and hence the bigger number of condominiums which would mean a bigger choice for developers to choose from. The second reason is that as these are traditionally the premium districts, they are obviously more in demand by people as well.

Does that mean you should ignore other districts if you are looking for an en bloc potential property? Not at all. As the popular districts get filled up with newer developments, during the next cycle developers might start looking at other districts too.

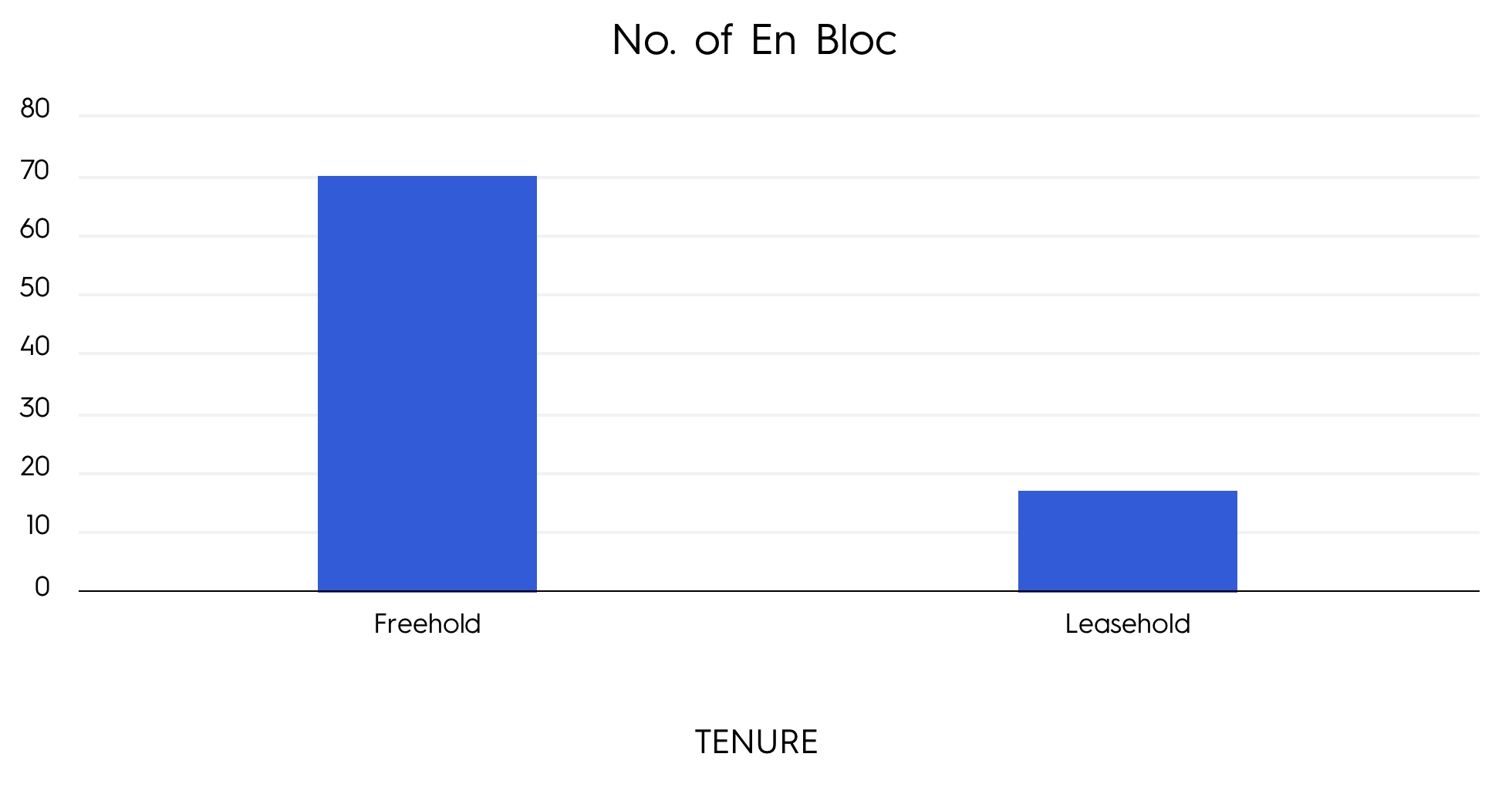

Developers Prefer Freehold Condos

Seeing how Singaporeans hold freehold properties in such high regard, it was expected that developers chose to look at more freehold properties as compared to leasehold. What was really surprising here was the gulf between the two, with freehold properties garnering a massive 80% of all the en bloc condos so far! One reason could be that Government Land Sales (GLS) no longer release freehold plots, hence the need for developers to resort to collective sales to top up their freehold land bank.

On the flip side, this data does not paint the complete picture as it is segregated by individual developments. If you were to further delve down into units, it could be a different story as many of the en bloc developments were larger leasehold sites like Eunosville and Tampines Court. Former HUDC (Housing and Urban Development Company) estates were really popular in this en bloc cycle as they are large and comparatively cheaper in terms of land rate on a per square foot per plot ratio basis as compared to other sites. Whereas many of the freehold sites are much smaller in size in terms of units.

More from Stacked

We Moved To A 38-Year-Old Executive Maisonette: Here’s What It’s Like To Stay In An Old EM In Jurong West

When Winnie (*not her real name for privacy reasons) and her husband were looking for a home for their future…

Property Investment InsightsFreehold vs Leasehold: Can You Really Prove Which Is Better? (Part 1)

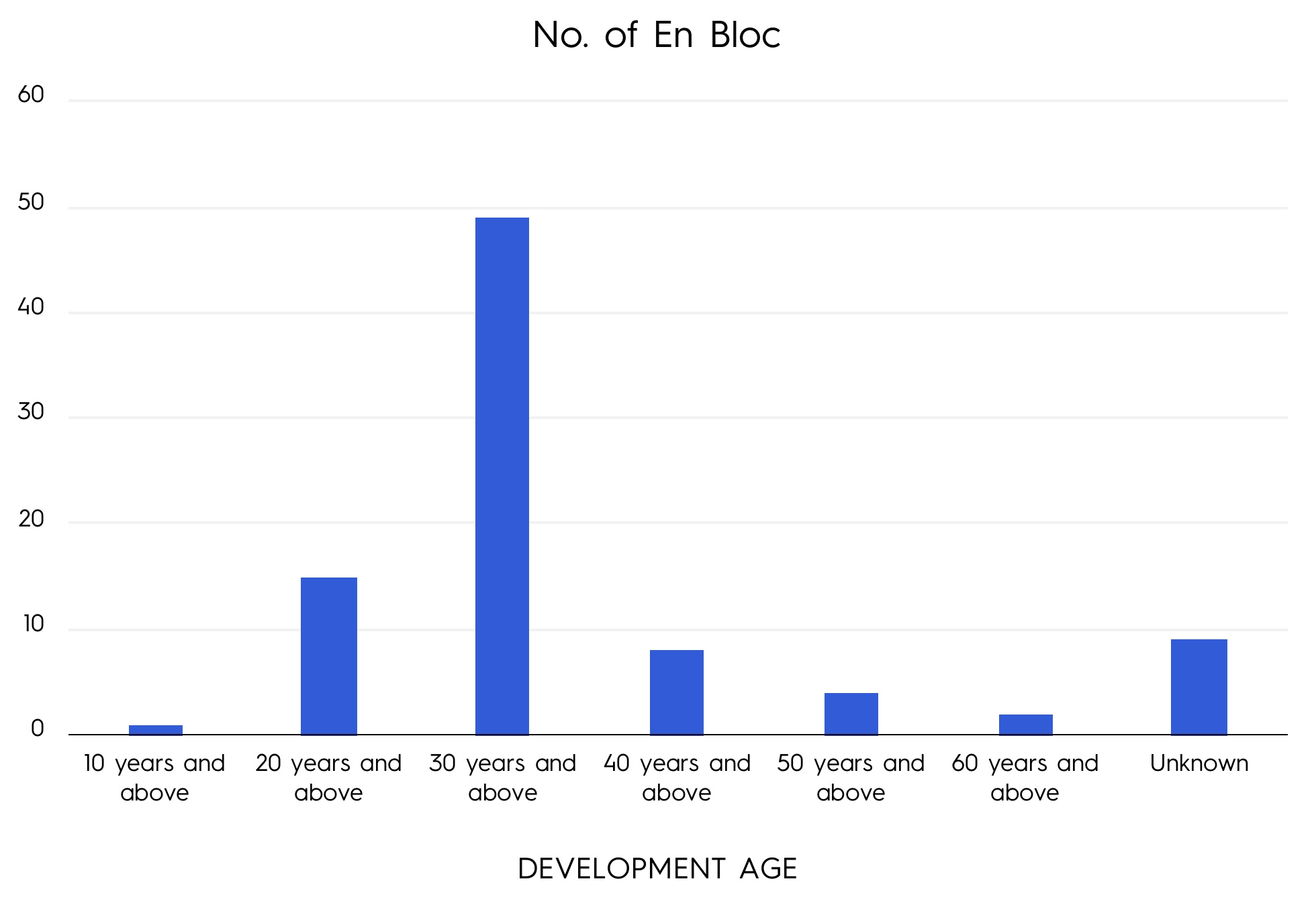

by Sean GohThe Most Ideal Age Range is 30 Years and Above

Another huge factor that you have to consider for en bloc potential is the age of the condo. From here you can see that it is very clear that for “newer” condos which we classified as 10 years and above, the chances of an en bloc happening is very slim. In this case, only 1 managed to get through to a collective sale. The main bulk of the en bloc condos were between 20 – 30 (17%) and 30 – 40 (56%) years old. Generally, you can expect the older developments to have a much higher chance of achieving an en bloc success.

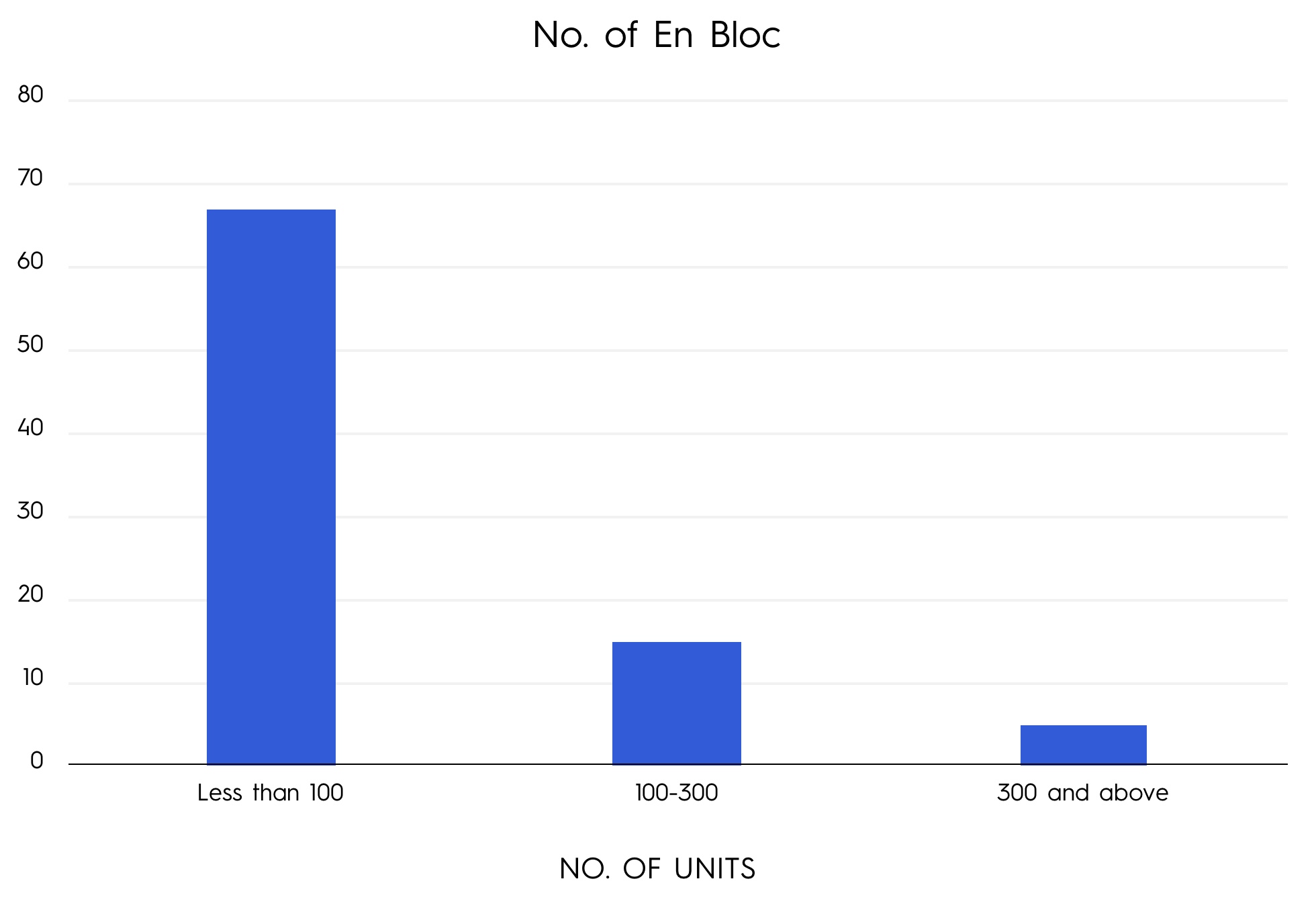

There is a Significant Preference for Smaller Developments with less than 100 units

From our analysis, it is very apparent that in this en bloc cycle, most developers favoured smaller developments. Again, this conclusion is not surprising at all given the recent ruling in 2018 which raised the development charge for developers. Not to mention, the non-remissible 5 per cent ABSD plus remissible ABSD of 25 per cent. This has led to smaller estates being more popular because of the lower price and hence, lower risks.

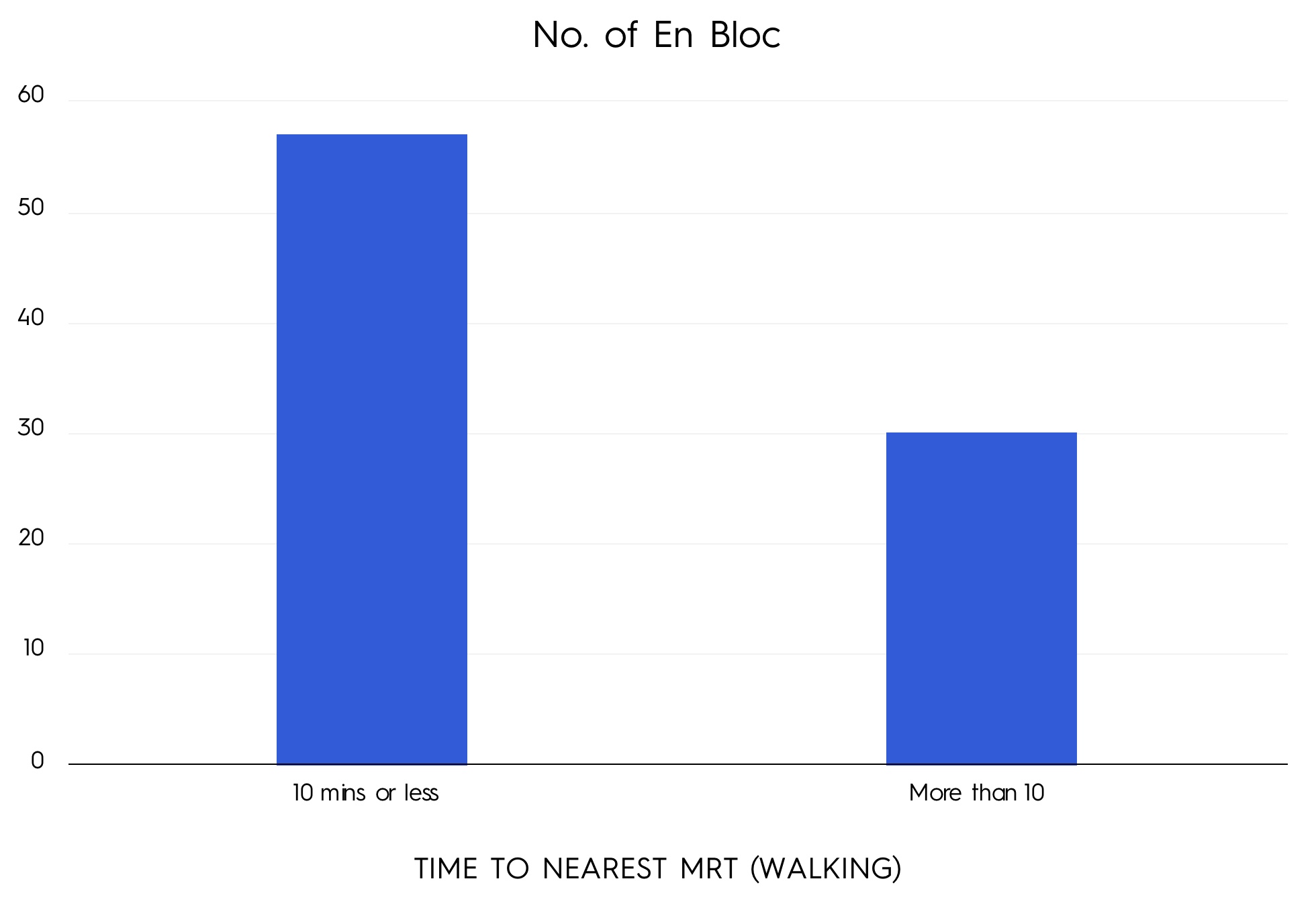

Distance to MRT Can Be A Factor, But Not As Much As You’d Think

The distance to MRT is always a big factor for most people when they are considering a condo. As a result, it wasn’t surprising that a higher proportion of developments that had gone en bloc was within a 10 minute or less walk to the MRT. What was surprising to us was that of the 35% that was more than 10 minutes walk away from the MRT, a good percentage of those were 20 minutes and above! Which in our books it basically means the development isn’t considered to be near an MRT at all. So is the distance to MRT important? Yes, but it really isn’t as crucial as you might think judging from the data!

So how can you use this to analyse a condo’s potential for en bloc?

Now, we really aren’t saying that there is a magical formula for determining a condo’s potential for an en bloc scenario to happen. However, if you take all the most common attributes from the data: District 10, freehold, aged 30 years and above, less than 100 units, and 10 minutes or less walk to the MRT, you should be on the right path! If you have any questions on the data, feel free to reach out to us at stories@stackedhomes.com.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

What districts in Singapore are most likely to have en bloc condo sales?

Are freehold or leasehold condos more likely to be sold en bloc?

What is the ideal age of a condo for it to have higher chances of en bloc success?

Do smaller developments have better chances of en bloc sale?

How important is proximity to MRT stations for en bloc potential?

Druce Teo

Druce is one of the co-founders at the Stacked Editorial. He was first interested in property since university but never had any aspiration to become an agent, so this is probably the next best thing.Need help with a property decision?

Speak to our team →Read next from Property Market Commentary

Property Market Commentary How I’d Invest $12 Million On Property If I Won The 2026 Toto Hongbao Draw

Property Market Commentary We Review 7 Of The June 2026 BTO Launch Sites – Which Is The Best Option For You?

Property Market Commentary Why Some Old HDB Flats Hold Value Longer Than Others

Property Market Commentary We Analysed HDB Price Growth — Here’s When Lease Decay Actually Hits (By Estate)

Latest Posts

Property Investment Insights This 55-Acre English Estate Owned By A Rolling Stones Legend Is On Sale — For Less Than You Might Expect

Singapore Property News I’m Retired And Own A Freehold Condo — Should I Downgrade To An HDB Flat?

New Launch Condo Reviews What $1.8M Buys You In Phuket Today — Inside A New Beachfront Development

62 Comments

Hi Druce

Great article. My daughter wants to look for a small 2 bedrm condo with budget of 1.3m or less with en bloc potential. She is thinking of novena/ district 10/11/. is it a great idea. any recommendtaion.

Hi Lyn, thank you for the kind words will drop you an email!

Hi Druce,

Good read ad I’m keen to learn more. Looking to move to suitable sized 3 bedroom Apartment freehold in district 03, 09 or 15 with future potential enbloc possibilities. Please advise.

Hi Reza, sure let me drop you an email!

Hi Druce,

Thanks very much for the insights.

I ‘m looking for a condo unit with en bloc potential. Any recommendation please?

Hi Kim,

Thanks, will drop you an email!

Hi Bruce,

Really great article. It is very methodological in your analysis.

I am looking for a freehold condo with enbloc potential in clementi, pasir panjang, novena and district 10 area.

Can you advise?

Hi Mike, thanks for reaching out will drop you an email!

Hi Druce, this is a very helpful article. I’m looking at FH properties with en bloc potential in District 3 & 15, do you have anything to recommend? Thank you.

Hi Andy, thank you for your kind comments. Let me drop you an email for easier correspondence. Thanks!

Hi Druce, thanks for the helpful article. We are looking to buy our first property and it would be great to find one with en bloc potential in D3, D11, D12, D13. Do you have any recommendations? Thanks.

Hi Justin, thanks! Let me drop you an email

Hi Druce,

Great analysis in the article. My aunt made a windfall in Pacific Mansion, but that was a fortuitous buy on her part. Looking for some insights on getting a value 2/3 bedder in district 9/10 (may even consider 15 but less inclined to) with reasonable en bloc potential in the next cycle but more importantly, livable till whenever that happens!

Hi Shandy, thanks for the compliments! Great, will drop you an email.

Hi Druce,

Nicely written article!

Do you think Pasir Ris as a location would have a higher chance of enbloc once the Cross Island MRT is built and once Pasir Ris is being rejuvenated say ~2030? Also, what do you think of Eastvale Condo’s enbloc potential?

Thanks so much!

Hi Darius,

Thank you! I think Pasir Ris should definitely have some upside given the upcoming rejuvenation plans and also how the launch of the Ryse Residences will play out. Eastvale is quite well placed as it is the closest by site that a developer can en bloc, but bear in mind there are quite a few reserved sites around the area too which depending on what they will be used for in the future, can affect any en bloc potential.

Thanks Druce for the great insight!

Reason I’m curious is because Eastvale units are selling at about $600+ psf as compared to newer developments within range such as Coco Palms which are going at $1300 psf. Do you think the 20 year difference in age warrants such a drastic difference in psf (Almost more than double)? Or is it a normal affair? Looking forward to your response.

Also, in the event that there isn’t any enbloc of Eastvale past 30 years of age, would you recommend selling the unit in Eastvale then? Saying this because of the lease decay someone in the replies section mentioned as well as the fact that most enblocs happen when they reach 30 years old.

Thanks so much!

Hi Darius,

Apologies for the late reply. I think to make it a fairer comparison, you will need to pro rate Eastvale’s psf to something close to Coco Palms age. So at about $800+ psf as compared to the $1,200+ at Coco Palms would be a better gauge. You’d also have to note here that an EC and condo will usually have a price gap even though they are essentially the same product, and also to take into account the much newer building and facilities at Coco Palms.

As to if an en bloc of Eastvale past 30 years doesn’t happen, of course if you see at that point that prices are on a decline and there aren’t any surrounding factors in the future that would change anything then perhaps it would be time to let go. That said, from the Master Plan of the immediate area, it does seem that quite a bit will be happening in that space, Ryse Residences, upcoming residential sites and the huge reserve site just opposite etc.

Hello Druce

It is really great article! I am keen to learn more. I was looking for a 2-3 bedroom condo with a budget of 1.25m in district 03, 09, 13, 15, 18. When I search near the Green, Circle, and Thompson-EastCost line, could see some condos like 1995-2000 built with 99 tenure. I am thinking to sell it after 10-15 years later. Will it riskier than focusing on a bit newer one? Could you share insight on this? Thanks!

Hi Alex,

So sorry for the late reply, missed this out! Other than the usual lease decay issue that old leasehold condos face, you will also have to watch out for potential maintenance costs as this could escalate depending on management plus how well the unit was kept in the first place. Also, banks will not finance properties with 30 years or less on the lease – while this doesn’t seem to affect the condos you are looking at the moment, this ruling might possibly change in the future so it is something that you should look out for given that it would be harder to find buyers for the property if that ever does happen.

Hi Druce, great article indeed. We are looking for a 2-3 bedroom condo with en-bloc potential near NUS, preferably quite area, yet accessible by MRT. Around 1.25M. Appreciate your reply!

Thank you.

Hi Vashi,

Appreciate the kind words! Will drop you an email.

Given the economic uncertainties from CV19 and the previously implemented cooling measures to-date (e.g. 30% ABSD), in your opinion, what is the potential of Ivory Heights, situated in a prime western “Lake District” area, going en bloc in the near future (e.g. 2021/2022)?

A equally interested to buy enbloc potential . Can u pls share your advise ?

HI Druce, nice work! I did a similar work with geospatial info and other driving factors. Maybe we can have work something out together

HI Druce

just read yr article, good. am interested in novena , bukit timah, Lor chuan areas for investment. any suggestions appreciated. would like to read yr replies to those below tks.

Hi Tiong lk, will reach out to you over email thanks!

Hi Druce

I find your article quite intriguing. I’ve been living in district 9 for the past 18 years. My wife and I are thinking of buying a 4 bedder. We’ve sort of narrowed down to the Mirage at district 9 (as it is next to the river), or The Caribbean @ Keppel. For The Caribbean, we really enjoy the fact that it’s next to the Marina. Which would you seriously consider, with Mirage at around $1750psf, FH and Caribbean at around $1600psf, LH with less than 80 years to go?

Also, wouldn’t you think Cavenagh House has great en-bloc potential, since it’s FH and been built in the 70s?

I thank you in advance.

Hi Jeffrey, If I had to choose between the 2, Mirage would probably be the easier bet given it is much smaller as compared to the nearly 1k number of units over at Caribbean. Its neighbours, Reflections and Corals haven’t sold out completely yet so I think there will be hesitation to even consider taking on such a big project for now.

As for Cavenagh House, I’ve heard that there could be complications over any future redevelopment as it is located right next to the CTE tunnel, so any en bloc deal could be tricky.

Totally agree with Drue on Cavenagh house. Do note that it is also has a height limitation due to proximity to Istana

Hi Druce,

Very helpful article and shared many good insights.

What are your thoughts on the en bloc potential of International Plaza?

Hi, thanks for the great article. May I know where the data was taken from? Thank you!

Hi Druce,

Thank you for your articles. I am looking to purchase a freehold condo within 10 mins walking distance from MRT, 2 or 3 bedrooms in the East area with enbloc potential. I don’t require amenities like swimming pool etc as I don’t use them. My budget is below S$1.3mil. Thanking you in advance

Hi Sam, will drop you an email, thanks!

Hi Druce do you think Sin Ming Plaza has en bloc potential?

Hi there, interesting stats. Would you be able to share the only enbloc that was done for a “new” 10+ year old condo? Which development was this?

Hi Druce,

Nice article! Do you have any recommendations for condo with enbloc potential yet rental yield is decent while waiting for the opportunity?

Hi there. What do you think about the en-bloc potential of Heritage View in Dover?

great info. looking to buy one. any recommendation

Hi Druce, what are your thoughts on the en bloc potential of Kovan Residence?

I am looking to buy a unit there for own stay but hesitant as it is 99-yr lease starting from 2007 – aging has kicked in. The prices are fairly steep so I am afraid the value is on the decline and I would be going in at peak pricing now. If an en bloc is on the horizon say 20 years down the road, then that would make the purchase decision easier.

Thank you! Look forward to hearing your expert views.

NEPTUNE COURT potential of En Bloc?

Hello Druce,

Thank you for an interesting write-up.

What is your take on mega plots like Pine Grove, Laguna Park and Braddell View succeeding in an en-bloc sale?

Would appreciate your thoughts on this.

Hi Sherry, apologies for the late reply. Thanks for the kind words! It’s tough now in this climate given the ABSD deadline that developers face. As you can see from the last few en-bloc deals the preference has been for mid-sized plots. Mega plots such as these will need a much bigger risk appetite to take on, and also owners there will have to be more realistic should they want to push for a collective sale.

Hi Druce,

Would like to seek your professional help to provide insight on this condo Sunglade in Serangoon.

– As a buyer what are the pros and cons of this condo. Is there any upside such as enbloc potentials or capital

appreciation.

– As a seller is it time to swap for another freehold condo…

Awaiting your reply. Thanks.

Hi Druce, just saw this article. useful statistic as reference. May I know the impact of plot ratio? We have a unit at the Meadows @ Peirce. We are weighting the option of cashing out on this unit and buy another cheaper leasehold property for rental investment. Any advice? Thanks.

Good read! I’m keen to learn more. Looking to buy a <1600 sqft 3BR/3BT Freehold Condominium Apartment in district 15/16 with future potential enbloc possibilities. Please advise.

Hi Druce

Given that more clarity on the future development in Pasir Ris has been shed over the years, do you think you can make an updated piece covering Pasir Ris, Punggol & Tampines as a regional hub.

It seems that Pasir Ris will be the centrepiece for the 3 estates with Cross Island Line providing a critical connectivity to other parts of Singapore.

Some of condominiums in Pasir Ris such as Eastvale look very attractive in terms of quantum for 3 bedrooms. It seems to provide a hidden value in the current market.