5 Top Property Picks For Lifelong, Work-from-home Types

August 26, 2020

Perhaps you were already working from home before, in which case Covid-19 has probably been a breeze to you. Or perhaps you only started during the quarantine, but work-from-home has now become an ongoing standard.

In either case, dedicated work-from-home types have different needs. You don’t want to end up having to go to town for meals (distraction!), get on the MRT to buy work supplies (shopping distraction!) or go stir-crazy from limited activity (lack of distraction?)

So we’ve put together some properties where everything – from entertainment to food – are more or less within the same confines. In these places, you can stay put for months or even a year while still working, and staying entertained:

1. Tan Quee Lan Suites

Address: Tan Quee Lan Street (District 07)

Developer: Dawnatron Pte. Ltd.

Tenure: 999-years

Completion: 2005

Number of units: 26

Land size: 8,256 sq.ft.

Average price range: $1,717 psf

Average rental range: $2.97 – $4.70 psf (est. rental yield 3%)

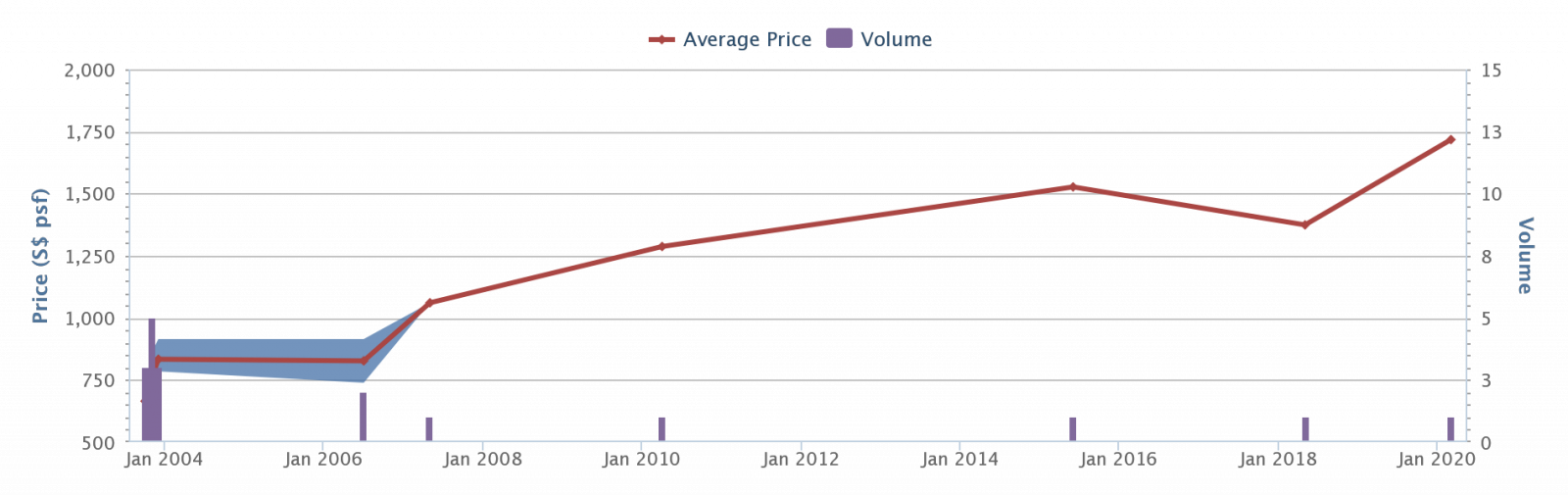

Price movement:

Average of $834 psf in 2004, to average of $1,717 psf (105.8 per cent increase)

Previous rental contracts:

| Date | Unit size | Price | Approx. Price PSF |

| Jul 2020 | 1,700 – 1,800 | $5,200 | $3 |

| Jun2020 | 700 – 800 | $3,528 | $4.70 |

| May 2020 | 700 – 800 | $3,248 | $4.30 |

| May 2020 | 900 – 1,000 | $4,200 | $4.40 |

| Apr 2020 | 700 – 800 | $3,400 | $4.50 |

It’s overshadowed by recent developments like Midtown Bay and Midtown Modern, but Tan Quee Lan Suites took advantage of the location long before those new developments came about.

Tan Quee Lan Suites is a mixed-development that includes two restaurants and shops on the ground floor, six offices on the second floor, and just 26 residential units within the third to fifth floor. Even the smallest units range from 700 to 800 sq.ft., with the larger ones reaching up to 1,800 sq. ft; combined with the mixed-use units, this is ideal for setting up a home office that you almost never leave.

The central location also makes it easy for clients to get to you; Tan Quee Lan suites is only four minutes’ walk from the Bugis MRT station.

As far as investment goes though, this one is a bit of a 50/50 shot.

Long term investors will appreciate that it’s a 999-year lease property; tantalising in a neighbourhood that’s recently beat Orchard in price. But as we’ve said above, the rush of new condos in the area like Midtown Bay, Midtown Modern, and the soon-to-be-replaced Shaw Tower are bringing a lot of supply to the area.

The small number of units (26) is also a concern; with these sorts of boutique developments, the low volume of transactions can make resale prices a bit volatile.

The main appeal should be to genuine home buyers, who want a long term home-office, or who prize work-from-home convenience over factors like resale, rental, etc.

2. The Woodleigh Residences

Address: Bidadari Park Drive (District 13)

Developer: SPH, Kajima Development Pte. Ltd.

Tenure: 99-years

Completion: Under construction

Number of units: 667

Land size: 273,842 sq. ft.

Average price range: $ 1,732 – S$ 2,230 psf (average $1,881 psf)

Average rental range: N/A, under construction

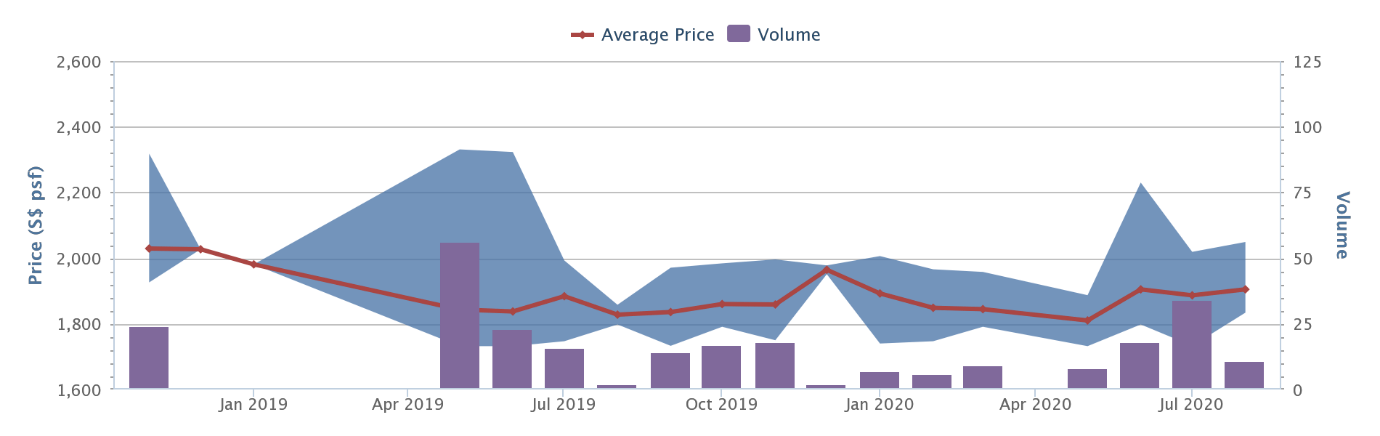

Price movement:

Average of $2,029 psf in 2018, to average of $1,905 psf (6.1 per cent decrease).

The Woodleigh Residences is the first integrated development in the Bidadari area, and the first one we know of that even incorporates the local police station. The main appeal to lifelong work-from-home types will be the mall.

The upcoming Woodleigh Mall will house around 300,000 square feet of retail, dining, and entertainment; it’s also directly connected to the Woodleigh MRT station, and an underground bus interchange.

Another 60,000 square feet is given over to the community centre, which is integrated with this project. This will also include healthcare, a supermarket, and childcare services.

Mind you, this is all for the work-from-home dweller who prizes convenience over noise and crowds. You should be braced for the fact that, because you’re practically living on top of the community centre + neighbourhood mall, this will never be the most peaceful, low-traffic project.

(Road traffic is also heavier in the area of course; but as you work from home, this is less of a drawback to you).

3. Bedok Residences

Address: Bedok North Drive (District 16)

Developer: Brilliance Residential (1) Pte. Ltd. / Brilliance Trustee Pte. Ltd.

Tenure: 99-years

Completion: 2015

Number of units: 583

Land size: 268,042 sq. ft.

Average price range: $1,468 psf

Average rental range: $2.80 – $4.91 psf (est. rental yield 3.2%)

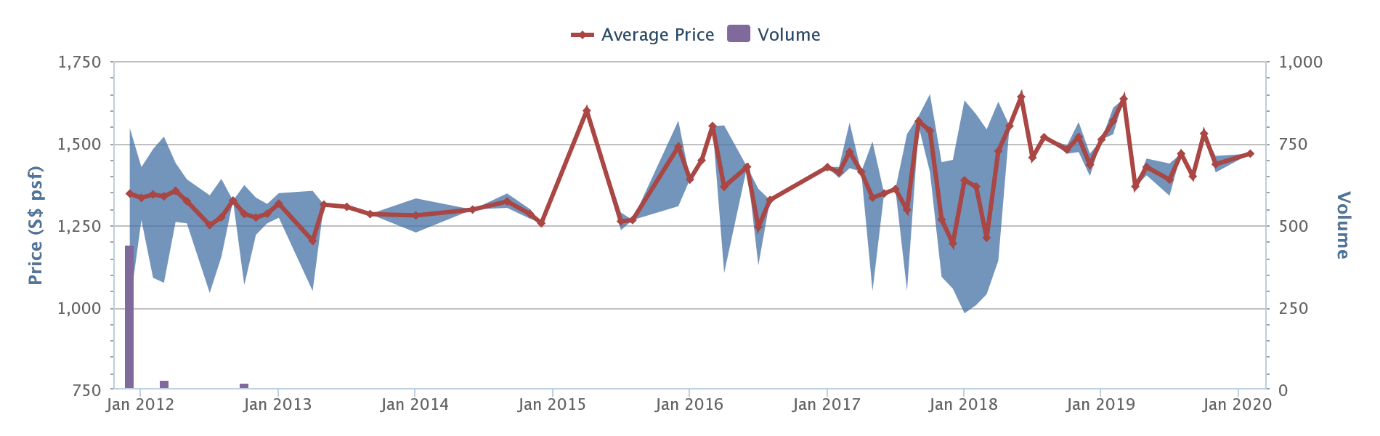

Price movement:

Average of $1,347 psf in 2011, to average of $1,468 psf (8.98 per cent increase).

Previous rental contracts:

| Date | Unit size | Price | Approx. Price PSF |

| Jul 2020 | 500 – 600 | $2,250 | $4.10 |

| Jul 2020 | 500 – 600 | $2,500 | $4.50 |

| Jul 2020 | 500 – 600 | $2,300 | $4.20 |

| Jul 2020 | 800 – 900 | $3,300 | $3.90 |

| Jul 2020 | 500 – 600 | $2,400 | $4.40 |

Bedok Residences stands out for work-from-home types for one reason: lack of comparable alternatives. There are few mixed-use developments in the east, and this is the only one you’ll find in the mature Bedok neighbourhood.

More from Stacked

5 Freehold Units With A Private Pool Under $2 Million

This isn't the first time we're covering such a category (see here for the previous), but given the popularity of…

There are 583 residential units sitting on top of two floors of retail and dining. Immediate facilities are also quite generous, with an infinity lap pool, and a generous stretch of pavilions and exercise areas (that’s in addition to the clubhouse gym).

Bedok is also well built-up, so when push comes to shove and you need to leave the house, you at least won’t be travelling far for healthcare, groceries, etc.

The only thing to watch for here is the noise – if you’re the sort who needs to work in silence, be careful to avoid the units that are closer to the MRT track (or facing it). You’ll also want the higher floors, given the bustle of the shopping mall downstairs.

4. The Ola EC

Address: Anchorvale Crescent (District 19)

Developer: Anchorvale Pte. Ltd.

Tenure: 99-years

Completion: Under construction

Number of units: 548

Land size: 184,466 sq. ft.

Average price range: $999 – $1,268 psf (average $1,133 psf)

Average rental range: Under construction

Average of $1,136 psf as of March 2020, to average of $1,096 psf at present (decrease of 3.5 per cent)

New Launch Condo ReviewsOla EC Review: Challenging The Definitions Of An EC (Updated with Prices!)

by Reuben DhanarajFor a full review of The Ola EC, check out our previous Stacked article. But in quick summary, Ola is branded as a “luxury Executive Condominium”; and it’s noted for the emphasis on family / lifestyle-oriented amenities. By coincidence, these also suit work-at-home types to a tee.

For example, one of the highlights are HiDoc medical booths – these allow you to consult doctors (and get prescriptions delivered) via a tele-health video call. Consultation fees are even waived for the first two years. For busy work-at-home types who don’t want to waste time queuing at a polyclinic or GP, this is a godsend.

For the first batch buying from the developer, Ola also provides 500 hours of complimentary courses that take place in the development; these range from skincare workshops to aquatic Zumba classes in the pool. This will cater to work-from-home types who want to head right downstairs for recreation, not travel out and come back after work.

We’ll warn you right now though, at an average of $1,133 psf, this is not going to be most budget friendly EC on the market (hence the “luxury EC positioning). It’s worth making a serious comparison to other, fully privatised condos, as some of them may be in the same price range.

5. Wallich Residence

Address: Wallich Street (District 02)

Developer: GuocoLand

Tenure: 99-years (from 2011)

Completion: 2017

Number of units: 181

Land size: 161,708 sq. ft.

Average price range: $3,006 – $3,851 psf (average $3,410 psf)

Average rental range: $7.26 – $9.58 psf (est. 3.07 per cent rental yield)

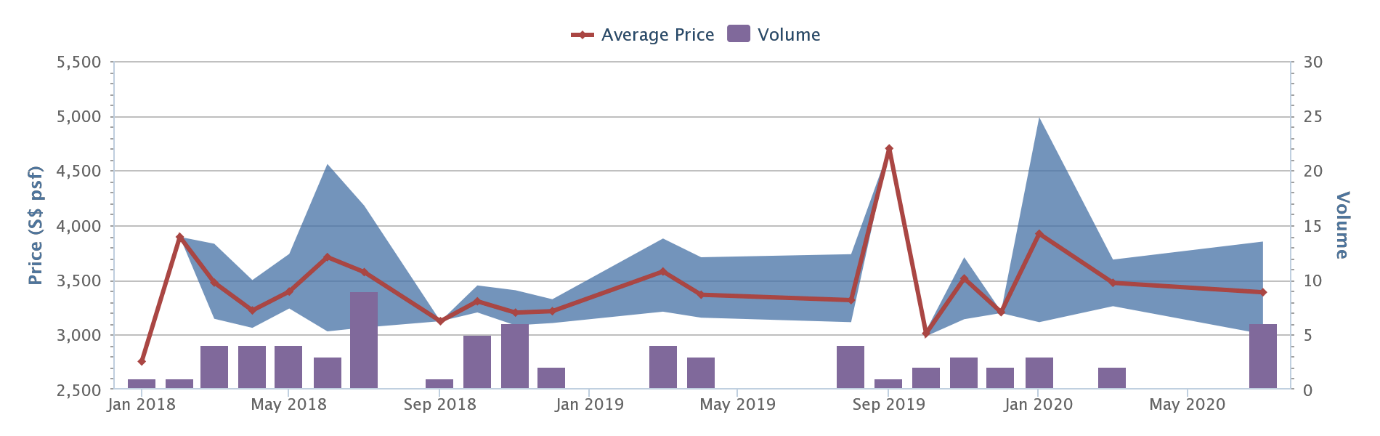

Price movement:

From an average of $2,756 psf in 2018, to $3,388 psf at present (approx. 22.9 per cent increase)

Previous rental contracts:

| Date | Unit size | Price | Approx. Price PSF |

| Jul 2020 | 1,300 – 1,400 | $9,800 | $7.30 |

| Jul 2020 | 800-900 | $7,500 | $8.80 |

| Jul 2020 | 1,700 – 1,800 | $14,500 | $8.30 |

| Apr 2020 | 1,000 – 1,100 | $9,600 | $9.10 |

| Apr 2020 | 600 – 700 | $6,200 | $9.50 |

This list wouldn’t be complete without the ultimate in home office options: Wallich Residence. If you can afford it, this is the tallest (290 metres) skyscraper in Singapore.

The development is right on top of the Tanjong Pagar MRT station. Also part of the development is Gucco Tower (around 890,000 sq.ft. of grade A office space), and about six storeys worth of retail and dining.

For work-from-home types who receive clients, this is about as good as you can get. There’s even a concierge service, and private dining amenities; the prime office facilities also mean you can access corporate-style conference and meeting rooms.

The main drawback here is of course the price – this is one of the most expensive properties in Singapore, and $3,388 psf prices it way above many surrounding alternatives. This development, like fine wine or expensive art, may be more of an investment in your cultural capital than in dollars and sense.

If you’re a lifelong work-from-home type, however, and you’re a corporate consultant or running your own small firm, this is more or less the peak of convenience.

Above all, make sure your savings on office space justify the higher price of your residential unit

Many of the developments mentioned above do cost more than a comparable, “normal” private property. In addition, certain options that are ideal for work-from-home, such as a dual-key unit with split office and home segments, cost more per square foot.

The advantage of a good work-from-home property isn’t just convenience; it’s also that you save on renting an office. Make sure the unit doesn’t end up costing so much, you’d be better off buying a cheaper property and renting a nearby office.

(If you’re uncertain, drop us a message and we can work out the optimum solution for you; it differs based on which district you’re working from).

You can also follow Stacked for more in-depth reviews of the developments above, or to get updates on new options.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

What are some good properties for working from home in Singapore?

Which property is best for long-term home office use in Singapore?

Are there properties with integrated shopping and entertainment for remote workers?

What should I consider when choosing a property for working from home?

Is Wallich Residence a good option for work-from-home professionals?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Property Picks

Property Picks Where to Find Singapore’s Oldest HDB Flats (And What They Cost In 2025)

Property Picks Where To Find The Cheapest 2 Bedroom Resale Units In Central Singapore (From $1.2m)

Property Picks 19 Cheaper New Launch Condos Priced At $1.5m Or Less. Here’s Where To Look

Property Picks Here’s Where You Can Find The Biggest Two-Bedder Condos Under $1.8 Million In 2025

Latest Posts

Pro River Modern Starts From $1.548M For A Two-Bedder — How Its Pricing Compares In River Valley

New Launch Condo Reviews River Modern Condo Review: A River-facing New Launch with Direct Access to Great World MRT Station

On The Market Here Are The Cheapest 5-Room HDB Flats Near An MRT You Can Still Buy From $550K

0 Comments