3 Surprising Upcoming Changes That May Affect Property Prices (And En Bloc) In 2023

April 19, 2023

Back in 2022, we were told that URA, BCA, SLA, and even the SCDF were going to acknowledge a new and shared definition of the term Gross Floor Area (GFA). That’s about to come into effect as of June this year, and realtors say it may already be affecting developer decisions – especially concerning en-bloc efforts. Here’s what you need to know about the harmonisation of GFA:

What’s wrong with the existing definition of GFA?

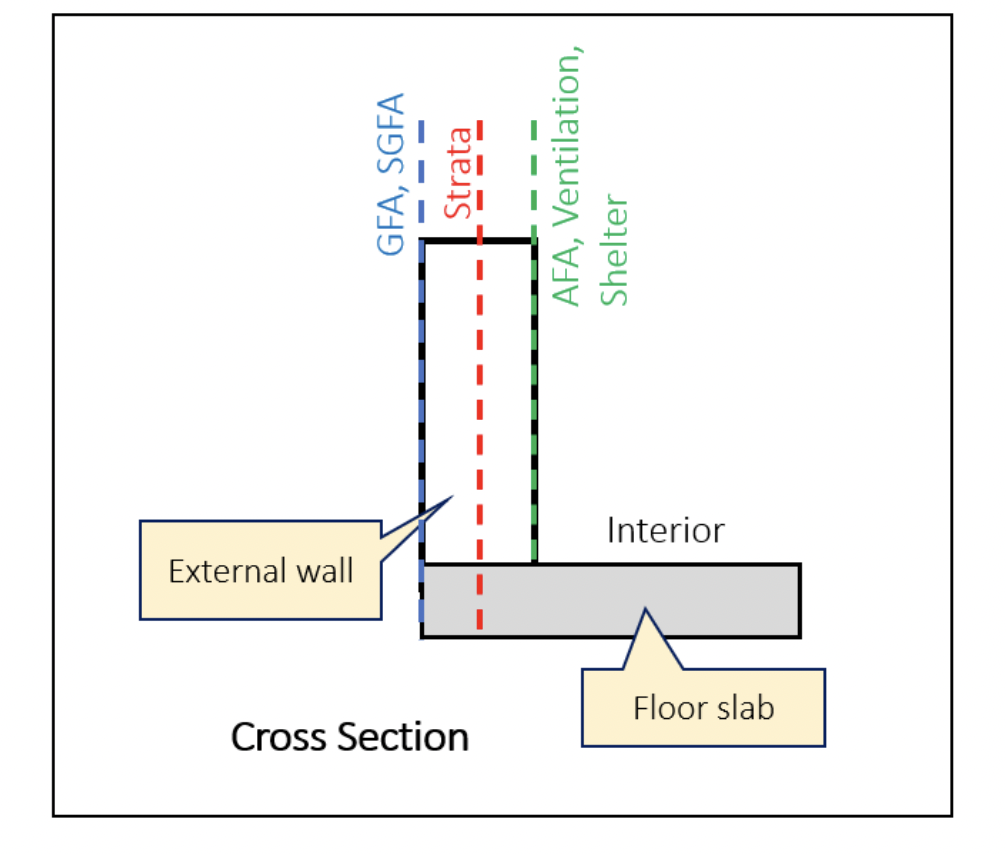

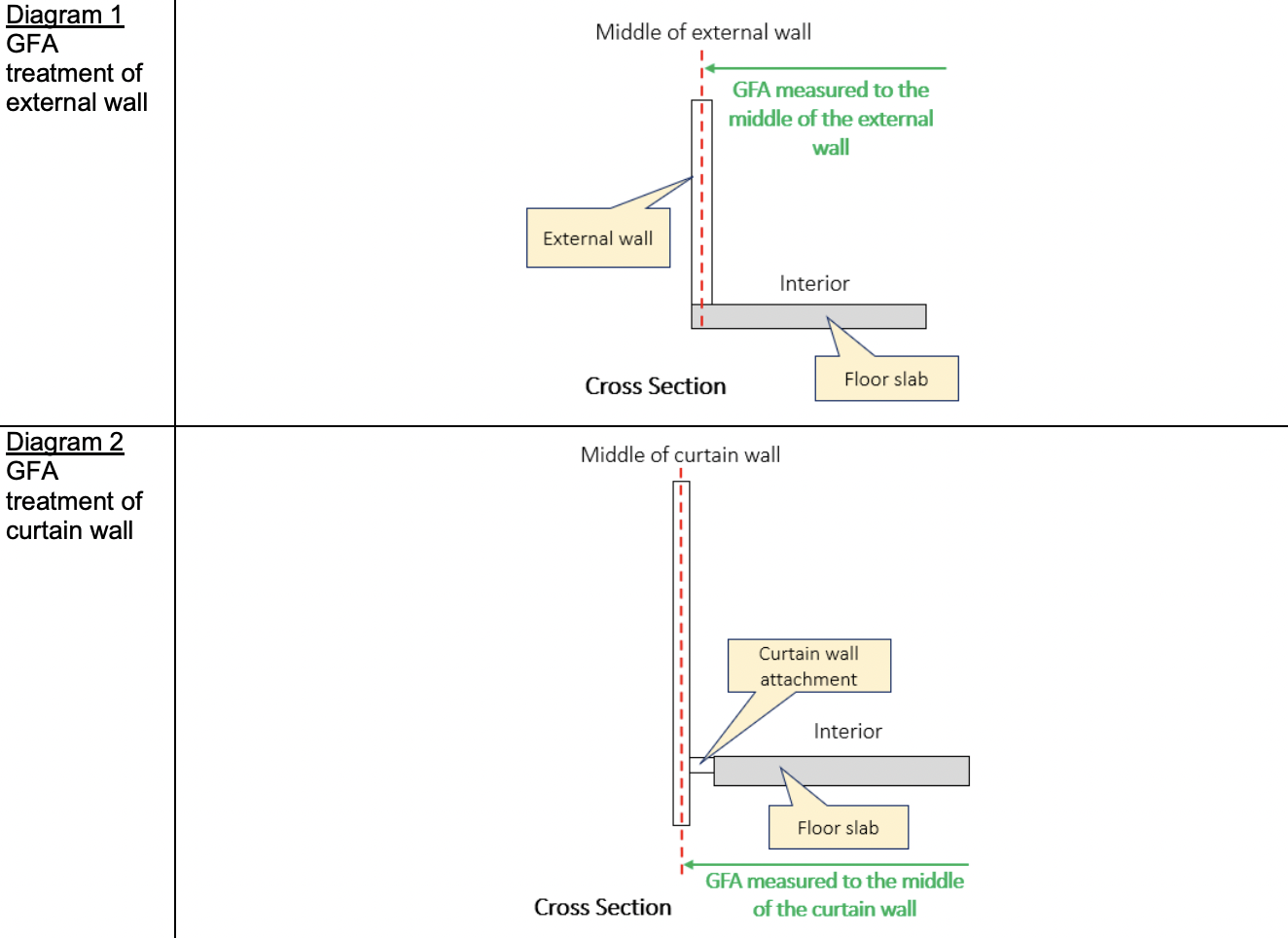

One of the reasons cited by the government is the way various agencies have differing definitions. For example, under the current definition, URA considers GFA to include the full thickness of external walls, whereas SLA measures up to the middle of the wall to determine GFA.

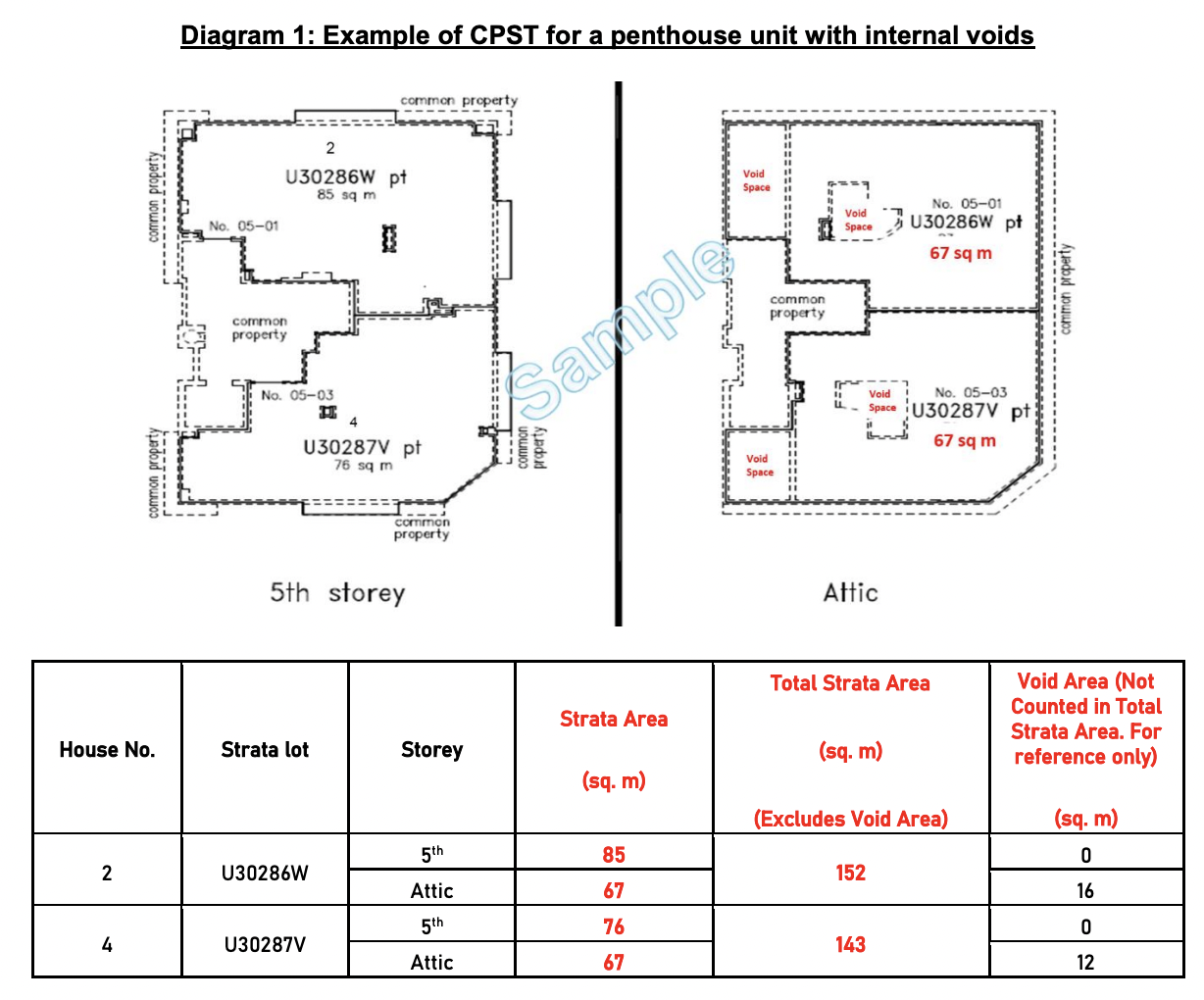

URA also doesn’t include void spaces (e.g., the vertical space between floor to ceiling) in the total GFA, whereas SLA does.

The calculations are different because they’re used for different purposes. SLA uses its form of GFA to determine the size of property owned, whereas BCA uses it more for engineering and architectural purposes, and SCDF is focused on fire safety requirements.

This has caused bureaucratic issues, and confusion even among some industry professionals.

The new definition of GFA harmonisation and its implications

Starting from 1st June 2023, the following changes will be made:

- Floor areas are measured to the middle of the wall, for all agencies

- All strata areas will be included under the total GFA count

- Void spaces will no longer count toward the GFA

This has some implications for home buyers:

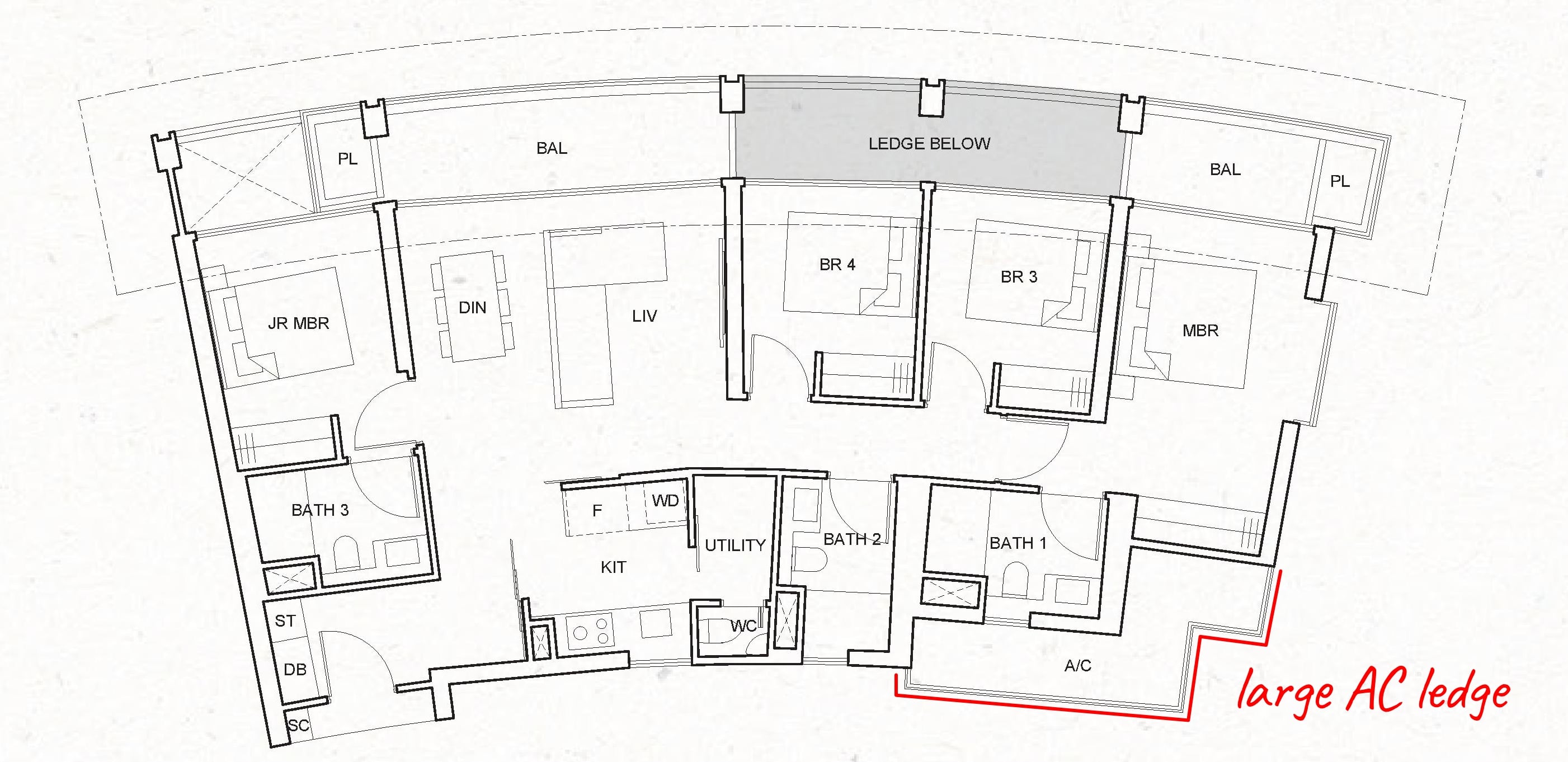

First, there are no more shenanigans with air-con ledges

As we mentioned in previous articles, big air-con ledges used to be a way to wring more cash out of home buyers. This was because air-con ledges counted toward the square footage bought by homeowners, but not toward the total GFA of the project.

URA did already issue some clarifications over this exploit – but with the new definition, this trick is well and truly done for. The total strata area is now part of the GFA, so there’s no motive for oversized air-con ledges anymore.

This will be much better for homeowners moving forward, as there will be less space wasted.

Property Advice6 Potential Money Wasters To Avoid When Buying Property

by Ryan J. OngSecond, there’s no more strata void space

This means developers can’t add the “empty air” to the total square footage, and then give you a price per square foot that only appears lower. For example:

Say a property has a literal ground area of 1,000 sq. ft., but has an unusually high floor-to-ceiling height that adds 200 sq. ft. “strata void space”. The quantum is $2 million.

Under the current definition, a developer could claim a price of around ($2 million/1,200 sq. ft.) = $1,667 psf. This would be misleading, as the void space is not habitable, and you’re actually paying ($2 million/1,000 liveable sq. ft.) = $2,000 psf.

Once the new definition is adopted, this practice will no longer be possible.

Finally, the new shared definition can help with extensive renovations

There’s less need for Qualified Persons (QPs), such as licensed engineers and contractors, to prepare separate documentation to meet each different governing body’s standards. There’s also less likely to be a slip-up, where approvals are granted or denied because of trivial differences in a measurement (e.g., someone sent measurements made to the middle of the wall instead of the full thickness of the wall).

More from Stacked

New Launches Near The 5-Year ABSD Deadline In 2021: Will We Be Seeing Developer Discounts?

As condos come close to their five-year ABSD time limit, homebuyers and investors start to pay more attention. There’s every…

Realtors said that this would be of greatest help to landed property owners, particularly those looking to fully rebuild a house, or to implement extensive Addition & Alteration works.

However, the new definition of GFA may be affecting developer appetite for en-bloc sales

The main issue is that all this eats into the total saleable area that developers can charge buyers for.

For example, air-con ledges can account for as much as five per cent of the price (depending on the project). Likewise, many projects use curtain walls, which actually juts outside the edge of the floor a little; you can read a full definition of it here. This also adds about another two per cent to the saleable area.

As such, one realtor told us this is something of a double-edged sword:

“I think buyers will welcome the clearer definition, and many of us are quite against being sold ‘useless’ space like the air-con ledge. But if you take away something like five per cent of the strata area they can sell, and multiply it over several hundred units, this is quite a serious chunk of revenue.

It’s likely that developers are not going to give it up, and I think we will see property prices go up to compensate for it.”

As we’ve mentioned in our previous article, developers are already seeing slimmer margins. Cutting down on saleable space is an added blow, given they’re already struggling with higher Land Betterment Charges and increased interest rates.

That said given the uncertain economic outlook, besides price adjustments, homeowners may also see further ways of cost-cutting in projects. Today, we can already see some new launches start to do away with certain white goods. Just like how the head of American Airlines once calculated that removing a single olive from each salad could save them $100,000 a year in fuel costs, this could see other developments start to follow suit and do away with certain “gifts”.

Besides new launches, a senior professional in a property firm (speaking in confidence) has also said the new GFA harmonisation has cropped up in some collective sales. Some developers have begun to reconsider their offers, and have switched to a more cautious footing. With the loss of saleable areas, developers need to re-work plans and estimations for future projects.

Nonetheless, most realtors and home buyers we spoke to felt this was a step forward. While it may cause a bump in prices, most homeowners said they’d rather pay more for space they can truly use, than for something useless like a thicker wall or wider ledge.

For more on the situation as it unfolds, follow us on Stacked. We’ll keep you up to date on changes in the Singapore property market, and provide you with in-depth reviews of new and resale projects alike.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

How will the new GFA definition affect property prices in Singapore in 2023?

What changes are being made to how property space is measured in Singapore?

How does the new GFA rule impact air-con ledges and void spaces?

Will the new GFA rules make renovations easier for homeowners?

Could the new GFA rules influence en-bloc property sales?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Singapore Property News

Singapore Property News New Lentor Condo Could Start From $2,700 PSF After Record Land Bid

Singapore Property News This Tampines EC Will Preview on Friday — It Is One of Two New ECs in the East in 2026

Singapore Property News I’m Retired And Own A Freehold Condo — Should I Downgrade To An HDB Flat?

Singapore Property News REDAS-NUS Talent Programme Unveiled to Attract More to Join Real Estate Industry

Latest Posts

Pro This 130-Unit Boutique Condo Launched At A Premium — Here’s What 8 Years Revealed About The Winners And Losers

On The Market A Rare Freehold Conserved Terrace In Cairnhill Is Up For Sale At $16M

Property Investment Insights This 55-Acre English Estate Owned By A Rolling Stones Legend Is On Sale — For Less Than You Might Expect

1 Comments

So what does it mean to existing owners. Eg if an individual owns a 1044 sq ft internal with 120 sq ft loft and a roof terrace/PES, 840 sq ft. SLA ‘s GFA will be 1884 sq ft. URA will be 1764 sq ft.

resale/enbloc , will be based on 1764 sq ft or 1884 sq ft? or valuer will do another valuation on PES /roof terrace area? How will bankers value? So far, no proper interpretation heard.

Will appreciate if you guys have an answer.