This New Woodlands EC May Launch at $1,850 PSF: Here’s Why

January 14, 2026

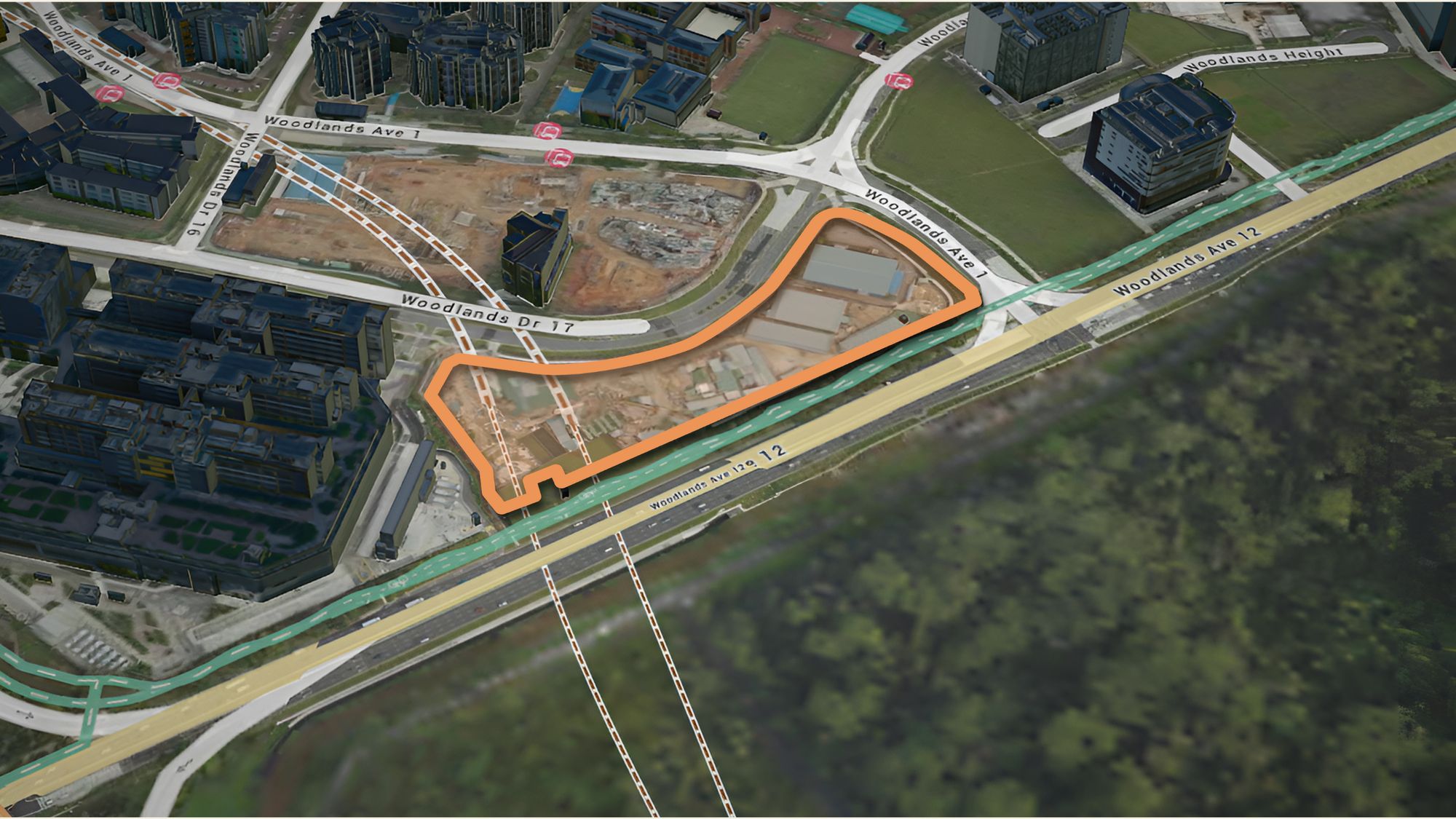

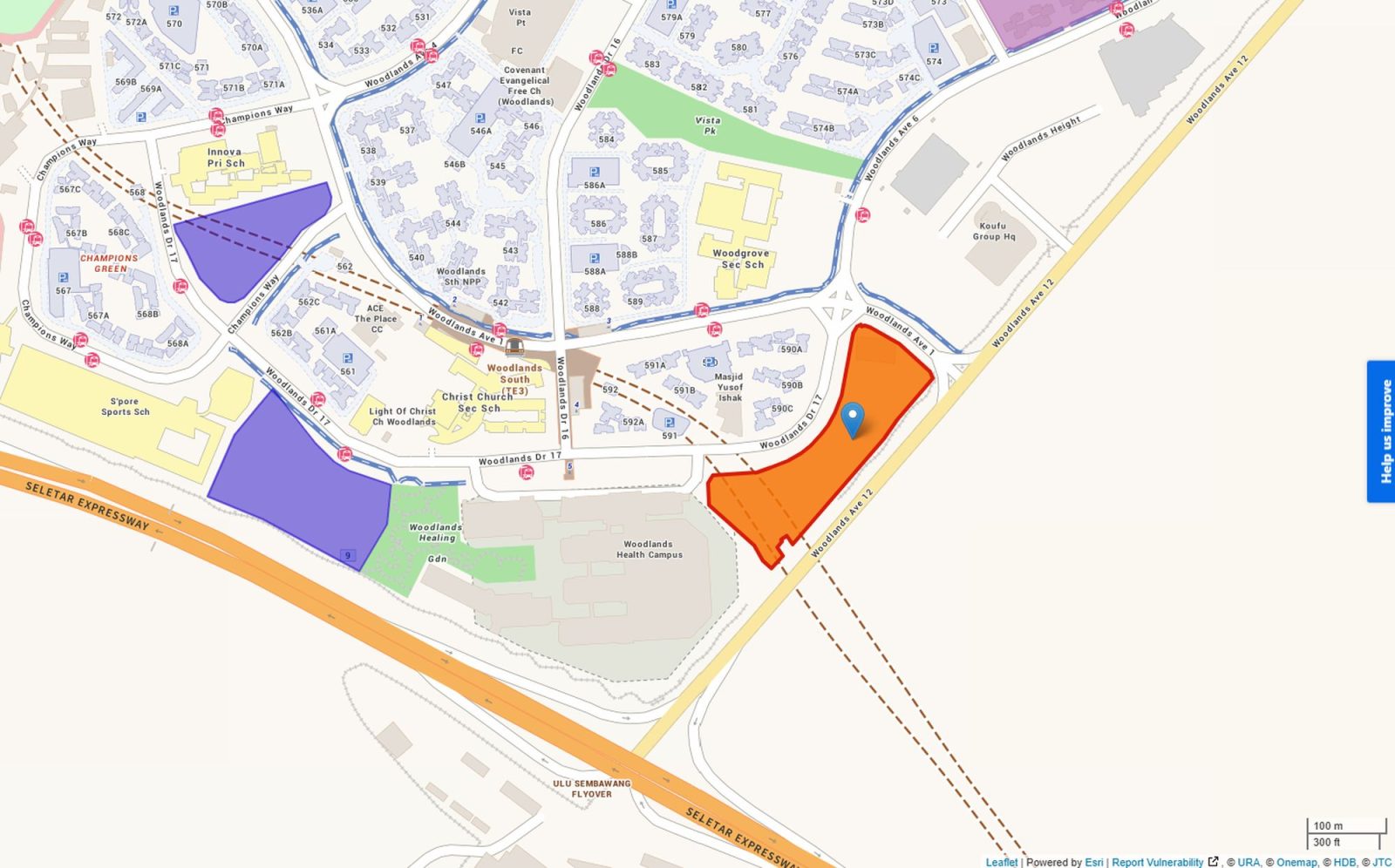

Property developer Sim Lian Group submitted a record $484 million bid for an Executive Condo (EC) site on Woodlands Drive 17 when the government land sales (GLS) tender closed on Jan 13.

Market analysts like Wong Siew Ying, head of research and content at PropNex Realty, estimate that the average selling price of the new EC may start from $1,850 psf when it goes on sale. The site is expected to yield 560 units.

The EC site is next to Woodlands Health Campus and close to Woodlands South MRT station on the Thomson-East Coast Line (TEL). The station is one stop away from Woodlands North, which will be a terminus for the upcoming Rapid Transit System (RTS) to Johor Bahru by the end of this year.

Recently, we explained how Woodland’s proximity to the RTS will fuel the area into a regional hub, and overturn the area’s ‘ulu’ status. Read the article here.

Competition heats up among developers

Turning back to the newest EC site in Woodlands. Sim Lian’s bid price translates to a land rate of $794 psf per plot ratio (ppr), and when the site is awarded it will set a new record land price for an EC site.

“A mid-sized EC development of up to 560 units offers an attractive entry into the EC market for developers. With a manageable size and a price quantum of less than $500 million, it presents developers with a more measured level of risk,” says Eugene Lim, key executive officer of ERA Singapore.

Previously, the record land price was $782 psf ppr when City Developments (CDL) won the tender last August for an earlier EC site that is also on Woodlands Drive 17. CDL’s winning bid for that plot was $360.89 million.

Incidentally, Sim Lian lost out on that EC site by less than a percentage point after its $360.28 million ($781 psf) was beaten by CDL.

Developers didn’t pull their punches when it came to this latest EC site, which attracted three bids.

| Developer(s) | Bid price ($) | Land rate ($psf ppr) |

| Sim Lian Group | 484,000,000 | 794 |

| Qingjian Realty, Forsea Holdings, Jianan Realty Investments | 482,093,836 | 790 |

| Hong Leong Holdings and TID | 463,498,700 | 760 |

The bid price tabled by the Qingjian-led joint venture (JV) lost out by a mere 0.4% compared to Sim Lian. There’s also only a 4% difference between the Hong Leong-TID bid price compared to the top bid.

“This suggests that developers are broadly aligned on their views regarding the site’s potential and optimism about EC demand in that area,” says Wong. She adds that the price for the earlier EC site won by CDL also acted as a reference point for developers in this latest tender.

Other market analysts like Mohan Sandrasegeran, head of research and data analytics at SRI, say that the back-to-back introduction of EC sites in this location offers insight into how developers are calibrating land bids amid stubbornly high construction costs and a more stable EC demand outlook.

What he means is that developers are walking a thin tightrope amid external market conditions, like how high construction costs have been since 2022.

We also know that the EC projects launching this year will soak up a lot of pent up demand, since EC launches in the recent years have been quite sparse. Only 1,360 new EC units were launched last year, but we expect a launch pipeline of over 2,300 EC units this year.

This means demand for new ECs will be much more measured when this project is expected to launch next year. In this article, we mapped out five upcoming ECs to uncover which holds the most promise for buyers this year.

Nearby schools and MRT drawn in buyers

More from Stacked

5 Upcoming Executive Condo Sites in 2026: Which Holds the Most Promise for Buyers?

Executive Condominiums (ECs) are more important than ever to buyers in 2025. With private homes now reaching $1.8 million or…

Demand factors aside, the locational attributes of this site are easy to recognise. The accessibility to an MRT station and proximity to several schools are all attributes that homebuyers, especially those with families, tend to prioritise.

Based on OneMap, at least three primary schools are within 1km of the new EC site, namely, Innova Primary School, Woodgrove Primary School, and Woodlands Ring Primary School. Other schools in the vicinity include Singapore Sports School, Christ Church Secondary School, and Woodgrove Secondary School.

Additionally, the area has strong growth potential, supported by ongoing development of the North Coast Innovation Corridor and the Woodlands Regional Centre. These factors are expected to have strengthened developer interest, as they seek to meet the evolving needs of the growing town, says Lim of ERA.

This corner of Woodlands South is already reasonably well-established but still has space to support new private and public residential projects, such as Woodlands South Plains, a 630-unit Build-To-Order project that launched in August 2022. This BTO project is expected to be completed next year, and you can read our write up of this project here.

Pent up EC demand and MOP flats in Woodlands

In 2026 and 2027, the number of four- and five-room flats in Woodlands, Sembawang, and Yishun will reach their minimum occupation period (MOP) and this will further contribute to upgrader demand, says Justin Quek, deputy group CEO of Realion (OrangeTee & ETC) Group.

“The increase in housing supply here will continue to support the development of the North Region, encouraging more people to move closer to the up-and-coming transformation of Woodlands with new employment nodes and amenities,” says Quek.

There is likely a lot of pent-up demand for new ECs in Woodlands since the last EC project was Northwave nearly a decade ago. Before that, the previous EC launch was BelleWoods back in 2014, says Wong of PropNex. “It is likely that the depth of demand for new EC units, including among HDB upgraders, may be able to support sales at the two future EC projects in Woodlands Drive 17,” she says.

Northwave is a 358-unit EC project on Woodlands View, off Woodlands Avenue 7. The development was completed in 2019. BelleWoods is a 561-unit EC on Woodlands Avenue 5, and the EC was completed in 2017.

Sandrasegeran opines that ECs remain a highly sought-after option, especially among young families and HDB upgraders, who value them as an attractive bridge between public and private housing. “Their affordability relative to private condominiums, coupled with condominium-like amenities, will continue to drive demand,” he says.

However, given the rapid uptick in EC prices in recent years, some buyers have started to feel that ECs are increasingly out of reach for them. The median price for new EC projects in 2025 was $1,754 psf. In this article, Ryan J Ong asks if there is even a point to the EC scheme anymore.

Nevertheless, the latest GLS tender that closed yesterday is a continuation of the overall optimism that has bathed the private residential market since the second half of last year, underpinned by the exceptional performance of the new launches then.

In the coming months, competition for GLS sites will heat up as more developers proactively move to replenish their land banks, in order to position themselves well to capture the next wave of buyer demand, says Lim or ERA.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

How old is the new Woodlands EC site?

What is the estimated price for the new Woodlands EC?

Why is the Woodlands area becoming more popular?

How many units will the new Woodlands EC have?

What factors make this EC site attractive to buyers?

Why are developers bidding aggressively for this EC site?

Timothy Tay

As Editor-in-Chief of Stacked, Timothy leads the newsroom and shapes our editorial direction, ensuring readers receive timely, thoughtful, and well-researched news and analysis. He brings over eight years of experience as a business and real estate journalist, with a strong track record across both print and digital platforms. His reporting spans luxury residential, commercial real estate, and capital markets, alongside in-depth coverage of sustainability and design.Need help with a property decision?

Speak to our team →Read next from Singapore Property News

Singapore Property News Two New Prime Land Sites Could Add 485 Homes — But One Could Be Especially Interesting For Buyers

Singapore Property News Why Some Singaporean Parents Are Considering Selling Their Flats — For Their Children’s Sake

Singapore Property News Nearly 1,000 New Homes Were Sold Last Month — What Does It Say About the 2026 New Launch Market?

Singapore Property News The Unexpected Side Effect Of Singapore’s Property Cooling Measures

Latest Posts

Property Advice We Sold Our EC And Have $2.6M For Our Next Home: Should We Buy A New Condo Or Resale?

Pro This 130-Unit Condo Launched 40% Above Its District — And Prices Struggled To Grow

Property Investment Insights These Freehold Condos Barely Made Money After Nearly 10 Years — Here’s What Went Wrong

0 Comments