Are New Executive Condos Still For The “Sandwich Class” In Singapore?

Get The Property Insights Serious Buyers Read First: Join 50,000+ readers who rely on our weekly breakdowns of Singapore’s property market.

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.

Is there even a point to the Executive Condominium (EC) scheme anymore?

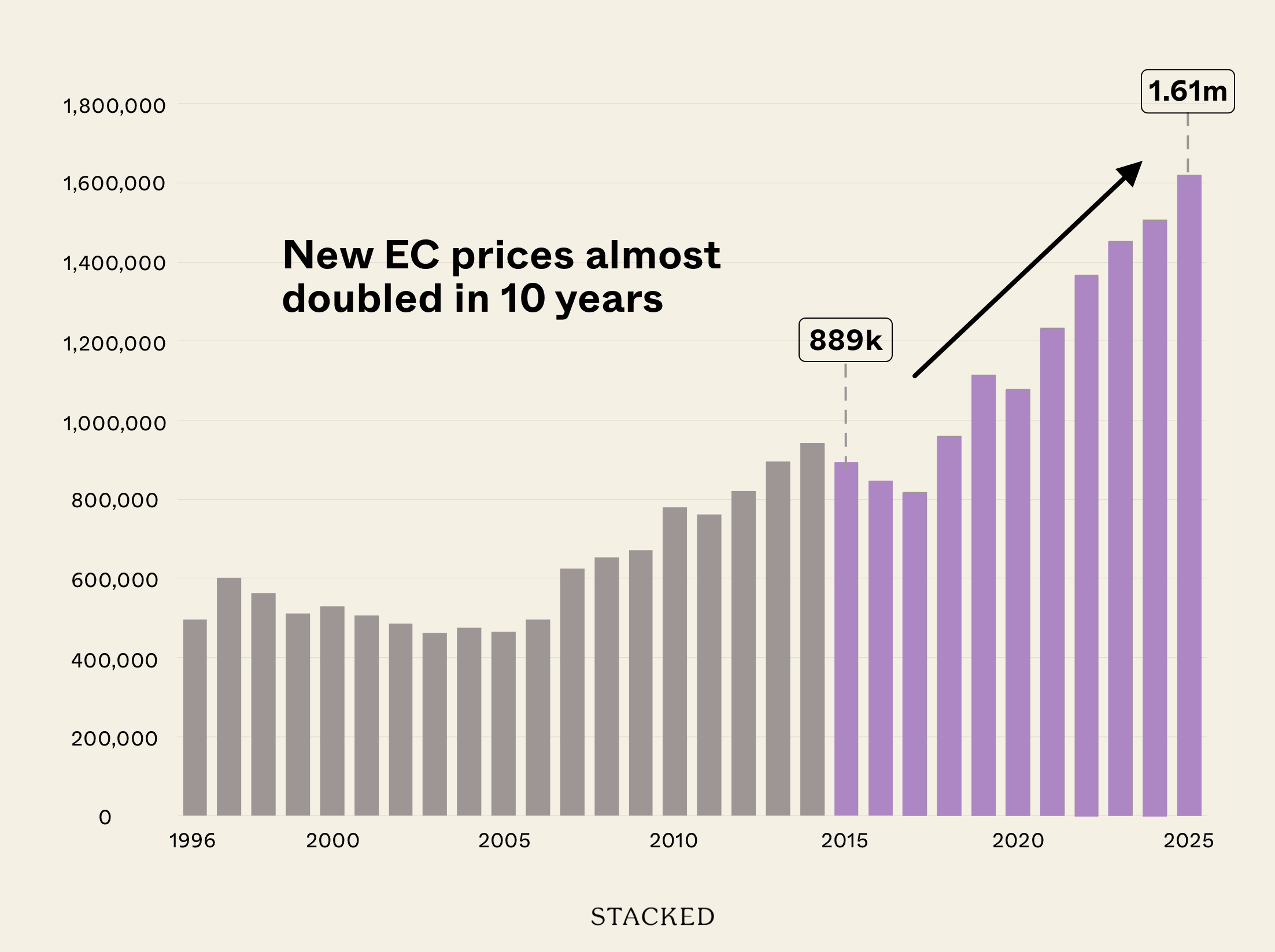

I know this will ruffle some feathers, but it’s time we gave this some thought. The EC scheme, which dates back to 1995, was designed as a form of sandwich-class housing: a home for those who earned too much to buy a regular flat, but too little to buy private housing. But the recent dynamite performance of Hundred Palms EC, along with the rising cost and quality of new ECs, suggests some rethinking might be in order.

First, it may be time to ponder if like Central area BTO flats before Plus and Prime – ECs have become more of a lottery ticket than genuine sandwich housing.

From interactions on the ground, it’s clear to me that no small number of buyers see ECs as a waiting windfall: assuming you can get one, it’s sure to go up in price in the short span of just five years. Hundred Palms is the most recent example, but check out some of the gains we’re seeing. The fact is, buyers who expect their ECs to be windfalls are seldom disappointed – and this explains why almost every EC sells fast, including Aurelle of Tampines quite recently.

So in principle, we’re already running a bit contrary to the original intent of sandwich housing.

Then there’s the issue of how affordable an EC is these days.

As I’ve mentioned before, buyers who are at or below the $16,000 per month income ceiling for ECs probably have to make a bigger down payment. To quickly repeat: the MSR of the home loan cannot exceed 30 per cent of your monthly income. So at the ceiling of $16,000 per month, the maximum home loan repayment is about $4,800 per month, which caps the loan amount to $910,000.

Assuming a three-bedder at Aurelle is around $1.689 million (indicative), you would need to borrow $1.26 million+ to make the minimum down payment of 25 per cent. So buyers are going to have to cover a shortfall. Raising the income ceiling would fix that, but it would still be a sign that our EC prices are getting on the high side.

If we’re still committed to the idea of ECs as housing first, albeit sandwich housing, we have to be careful that we don’t neglect affordability. Something that’s misleadingly easy to do, because of the temptation to handwave it and say they can “go buy a resale flat” instead.

Let’s not forget the price gap with private condos either

When we checked last year, the price gap between resale ECs and condos is still there (whew!), but as we mentioned, the coming of higher-end ECs may bring a change (I mentioned this regarding Aurelle in the linked article). Barring the largest units like five-bedders, the price gap between an EC and a private condo has generally narrowed in the past three years.

But this could be the start of an unwanted trend: as more expensive new ECs hit the market, and resale gains start climbing, we may soon see the two segments nearing in price (e.g., Hundred Palms’ $3 million+ transaction). As the gap narrows further, the question of ECs’ relevance as “sandwich housing” will come into further question.

To be fair, the high prices do match the better quality we’re seeing – but this further differentiates the EC concept today from yesteryears

I’m not going to point at any specific projects and affect property values here, but since around 2017 (the last land cycle), EC quality has jumped tremendously – a change that may also explain the higher prices.

Earlier batches of ECs were quite different: ask agents or buyers in the past, and most will affirm that ECs used to mean:

More from Stacked

6 Common Misleading Claims Property Agents Make That All Savvy Buyers Know About

Most property agents are honest, if for no other reason than having a license to lose. However, whether through inexperience…

- A very inaccessible location, far from the MRT station

- Cramped or closely packed blocks

- Lower quality finishing

- Facilities that are smaller or limited than a fully private condo

This is no longer the case today. Recent launches like Novo Place, Aurelle, etc. have layouts, facilities, and finishing that are on par with fully private counterparts. I’ve actually tried asking people on the ground to spot the EC versus the private condo, from the project details and pictures. Barely a third of the people I ask can tell the difference (and I suspect some of them were just lucky guessers.)

This may lead to a further narrowing of price gaps over time. Some examples of this can already be seen in the Punggol area:

Prive, an EC in Punggol, is fetching average prices of $1,455 psf; and yet River Isles, a fully private condo also in Punggol, currently averages $1,444 psf. There’s an interesting transaction to note here:

In February 2025, a 1,173 sq.ft. unit at River Isles transacted for $1.7 million. But a month earlier Prive EC saw a slightly smaller unit (1,087 sq.ft.) transact for a slightly higher $1.72 million!

The Prive transaction also very nearly beat A Treasure Trove; this is a private condo in Punggol where, in February 2025, a 1,044 sq.ft. unit transacted for $1.733 million; barely higher than Prive, despite the units being almost similar in size.

We can also consider Flo Residence, another private condo in the Punggol area. Units here average $1,356 psf. This is lower than two other ECs in Punggol: The Terrace ($1,409 psf) and Twin Waterfalls ($1,489 psf).

Even if we acknowledge that factors such as floor level, facing, state of maintenance etc. play a role, these are empirical signs that the gap between ECs and condos are closing in Punggol; and other neighbourhoods may follow in time.

Whilst I do think we’ll always have and need a sandwich housing scheme, the nature of that scheme can change

We also tried once with DBSS, for example, although that didn’t last long. But I do expect that, with the way ECs are closing in on fully private counterparts – in terms of both price and quality – we might soon see some alternatives.

Meanwhile in other property news:

- Can you find an almost new three-bedder unit for under $1.5 million? Here are some possible places to check out.

- Is emptying out your CPF to pay your home loan always the best idea? It’s situational, and there are some things to consider first.

- Here’s a homeowner experience we can all relate to: wanting to keep renovation rates sane. Here’s one many of us fail to relate to: people who actually manage to do it.

- Integrated developments: love them or hate them, they’re here to stay on our ever more populated island. Here are some experiences of the people who live in them.

Weekly Sales Roundup (24 March – 30 March)

Top 5 Most Expensive New Sales (By Project)

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| 32 GILSTEAD | $13,000,000 | 3821 | $3,402 | FH |

| THE CONTINUUM | $5,052,960 | 1690 | $2,990 | FH |

| MEYER BLUE | $4,786,000 | 1528 | $3,131 | FH |

| PINETREE HILL | $4,632,000 | 1733 | $2,673 | 99 yrs (2022) |

| THE ORIE | $3,983,000 | 1453 | $2,741 | 99 yrs (2024) |

Top 5 Cheapest New Sales (By Project)

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| LENTOR CENTRAL RESIDENCES | $1,197,000 | 463 | $2,586 | 99 yrs (2023) |

| NOVO PLACE | $1,398,000 | 872 | $1,603 | 99 yrs (2023) |

| LUMINA GRAND | $1,418,000 | 936 | $1,514 | 99 yrs (2022) |

| NORTH GAIA | $1,419,000 | 1033 | $1,373 | 99 yrs (2021) |

| AURELLE OF TAMPINES | $1,434,000 | 840 | $1,708 | 99 years |

Top 5 Most Expensive Resale

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| LEEDON RESIDENCE | $16,000,000 | 6125 | $2,612 | FH |

| THE CLAYMORE | $11,380,000 | 3348 | $3,399 | FH |

| GOODWOOD RESIDENCE | $7,330,000 | 2454 | $2,987 | FH |

| CUSCADEN RESERVE | $7,299,000 | 2099 | $3,477 | 99 yrs (2018) |

| THE DRAYCOTT | $6,250,000 | 2637 | $2,370 | FH |

Top 5 Cheapest Resale

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| RIVERBAY | $640,000 | 388 | $1,652 | 999 yrs (1882) |

| KOVAN GRANDEUR | $640,000 | 388 | $1,652 | 99 yrs (2010) |

| 8@WOODLEIGH | $680,000 | 398 | $1,707 | 99 yrs (2008) |

| THE INFLORA | $682,000 | 463 | $1,473 | 99 yrs (2012) |

| SKYSUITES17 | $718,000 | 355 | $2,021 | FH |

Top 5 Biggest Winners

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | RETURNS | HOLDING PERIOD |

| THE CLAYMORE | $11,380,000 | 3348 | $3,399 | $6,370,000 | 26 Years |

| THE REGALIA | $5,650,000 | 2648 | $2,134 | $4,270,000 | 21 Years |

| LEEDON RESIDENCE | $16,000,000 | 6125 | $2,612 | $4,000,000 | 8 Years |

| NEWTON 21 | $3,980,000 | 2411 | $1,651 | $2,270,000 | 19 Years |

| TANGLIN PARK | $3,880,000 | 1507 | $2,575 | $2,250,000 | 25 Years |

Top 5 Biggest Losers

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | RETURNS | HOLDING PERIOD |

| ORCHARD SCOTTS | $3,900,000 | 2282 | $1,709 | -$430,000 | 12 Years |

| URBAN TREASURES | $1,000,000 | 517 | $1,935 | -$17,000 | 4 Years |

| PINETREE HILL | $3,213,000 | 1292 | $2,487 | $0 | 5 Months |

| THE ARDEN | $2,344,000 | 1410 | $1,662 | $0 | 2 Months |

| PINETREE HILL | $2,056,000 | 797 | $2,581 | $0 | 1 Years |

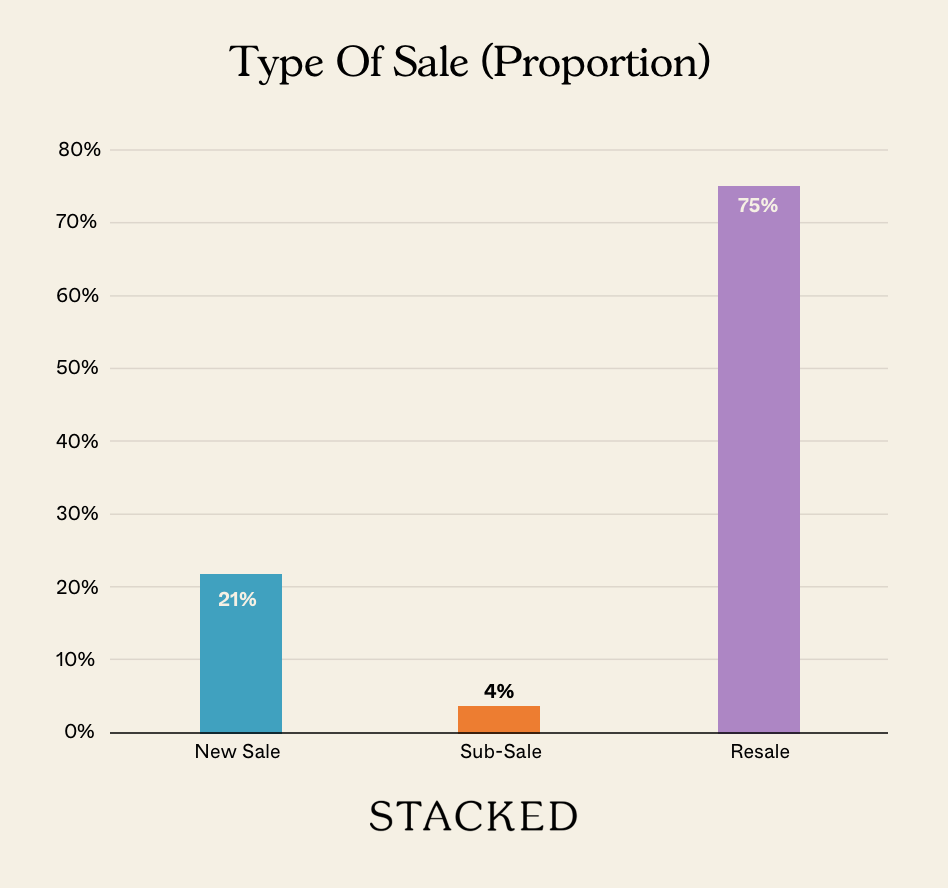

Transaction Breakdown

For more on the Singapore property market, follow us on Stacked.

Ryan J

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Read next from Singapore Property News

Singapore Property News They Paid Rent On Time—And Still Got Evicted. Here’s The Messy Truth About Subletting In Singapore.

Singapore Property News Is Our Housing Policy Secretly Singapore’s Most Effective Birth Control?

Singapore Property News URA’s 2025 Draft Master Plan: 80,000 New Homes Across 10 Estates — Here’s What To Look Out For

Singapore Property News She Lost $590,000 On A Shop Space That Didn’t Exist: The Problem With Floor Plans In Singapore

Latest Posts

Property Market Commentary A First-Time Condo Buyer’s Guide To Evaluating Property Developers In Singapore

New Launch Condo Analysis This Rare 999-Year New Launch Condo Is The Redevelopment Of Robertson Walk. Is Robertson Opus Worth A Look?

Pro We Compared New Vs Resale Condo Prices In District 10—Here’s Why New 2-Bedders Now Cost Over $600K More

New Launch Condo Reviews LyndenWoods Condo Review: 343 Units, 3 Pools, And A Pickleball Court From $1.39m

Landed Home Tours We Tour Affordable Freehold Landed Homes In Balestier From $3.4m (From Jalan Ampas To Boon Teck Road)

Property Market Commentary Why More Young Families Are Moving to Pasir Ris (Hint: It’s Not Just About the New EC)

On The Market A 10,000 Sq Ft Freehold Landed Home In The East Is On The Market For $10.8M: Here’s A Closer Look

On The Market 5 Spacious Old But Freehold Condos Above 2,650 Sqft

Property Investment Insights We Compared New Launch And Resale Condo Prices Across Districts—Here’s Where The Price Gaps Are The Biggest

Pro Similar Layout, Same District—But Over $500K Cheaper? We Compare New Launch Vs Resale Condos In District 5

New Launch Condo Analysis The First New Condo In Science Park After 40 Years: Is LyndenWoods Worth A Look? (Priced From $2,173 Psf)

Editor's Pick Why The Johor-Singapore Economic Zone Isn’t Just “Iskandar 2.0”

Pro Analysing Forest Woods Condo at Serangoon: Did This 2016 Project Hold Up Over Time?

Property Advice We Ranked The Most Important Things To Consider Before Buying A Property In Singapore: This One Came Top

Property Market Commentary This Upcoming 710-Unit Executive Condo In Pasir Ris Will Be One To Watch For Families