Why Some Central 2 Bedroom Homeowners In Singapore Are Stuck

May 18, 2025

Maybe it’s because of my age, but I prefer space over convenience these days; and that sets me apart from recent homebuyers.

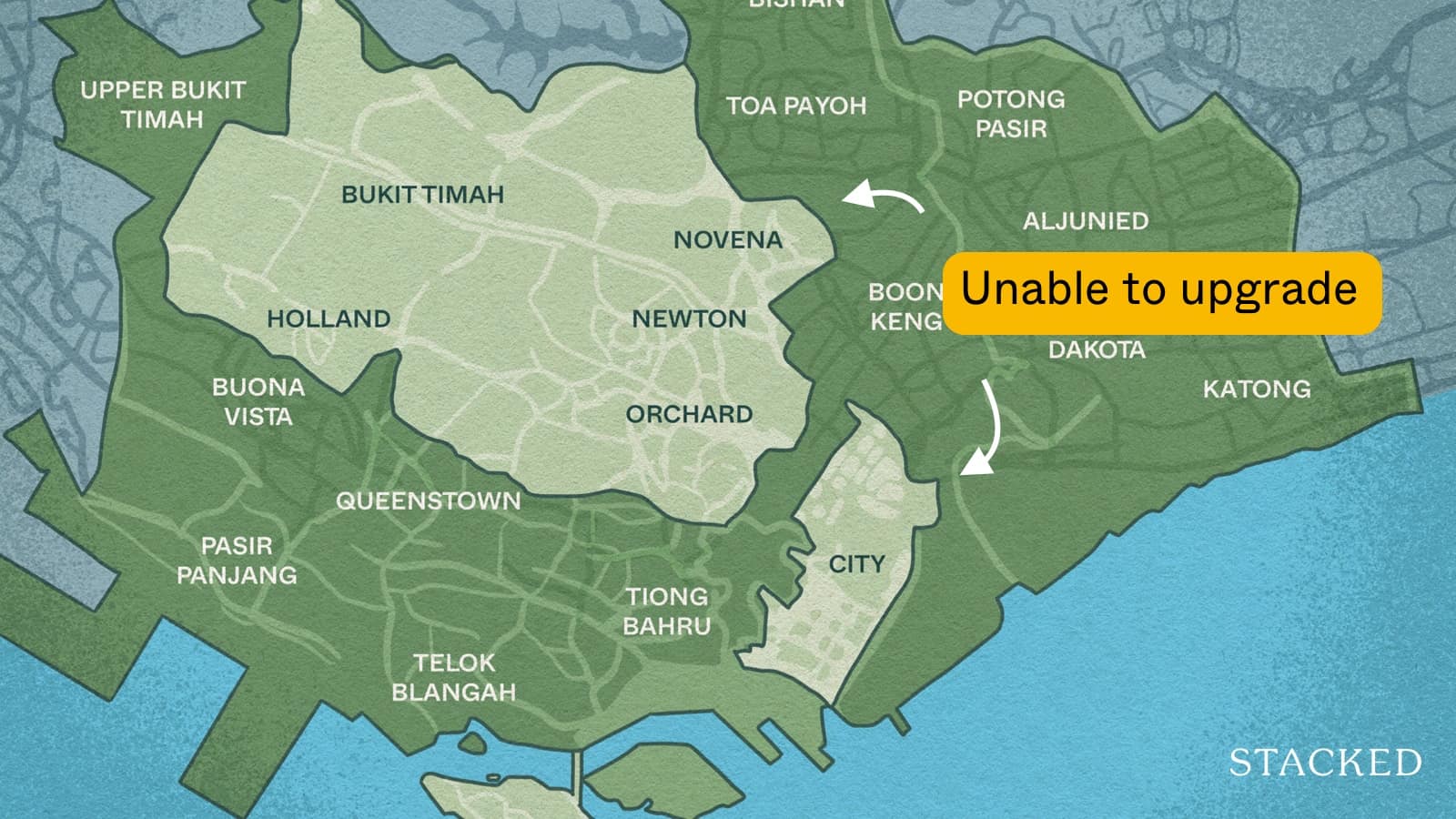

I’m talking about the number of homebuyers who are interested in living within the Core Central Region (CCR), where prices typically require a compromise. Quite often, that compromise is having to own a two-bedder first, and then hoping everything works out well enough to upgrade. But here’s the tough, chewy bit that’s hard to digest:

Going from a two-bedder to a three-bedder, in the prime CCR districts, is a big challenge. The median asking prices for a two-bedder in the CCR right now are about $2,900+ psf for a new launch, or about $2,450 psf for resale. So, assuming a two-bedder is about 700 sq. ft., you’d usually be looking at prices of around $1.8 million; possibly more than $2 million for some fancier new launches.

Now, what does it cost to add another bedroom?

For three-bedders, you can expect about $2.7 million to $3 million to be the norm. Case in point: One Marina Gardens had prices reaching from $2.57 million to over $3 million for three-bedders, ranging from 904 to 1,012 sq. ft.

This is around an extra $1 million just for that one added bedroom; and barring a windfall, it’s not something many two-bedder owners can comfortably envision. For example:

Current situation:

- Couple owns a two-bedroom CCR condo.

- They sell it for $2 million (typical resale value for a CCR two-bedder)

- Outstanding loan: S$800,000 (assume they’ve paid down some over time)

- Net proceeds from sale:

$2 million – $800,000 = $1.2 million (let’s loosely assume this is any combination of cash or CPF, available for the next property)

Target upgrade:

- A new three-bedroom in CCR costs about $3 million (based on recent launches like One Marina Gardens)

- Downpayment: 25 per cent minimum ($750,000), and the rest via loan (S$2.25 million).

- Stamp duties & legal fees: Approx. $120,000 (Buyer’s Stamp Duty alone on a $3 million property is already about $114,600)

Couple’s combined income:

- Let’s assume both earn around $8,000 a month each (it’s reasonable to assume it’s above median income, as they’re already living in private property in the CCR)

- Given the Total Debt Servicing Ratio (TDSR) of 55 per cent, this means a monthly loan repayment limit of $8,800 per month (assuming no other debts)

- At a rate of four per cent per annum, on a 25-year loan tenure, this is a loan quantum of between $1.75 million to $1.8 million.

Shortfall Calculation:

- Required loan: $2.25 million

- Eligible loan: Approx. $1.75 million to $1.8 million

- Loan shortfall: Approx. $450,000 to $500,000

Even with $1.2 million in sales proceeds, the couple cannot borrow enough to finance the remaining amount, and must cover the $250,000 to $300,000 gap to make up the shortfall.

More from Stacked

HDB resale portal – Easier resale HDB transactions in 2018?

If you have always thought of buying or selling your own HDB, there is no better time to do that…

Bear in mind that these are already optimistic calculations, with assumptions that the couple have no other loans, have steady incomes of $8,000 per month each, already have a two-bedder in the CCR, etc.

Nonetheless, the CCR is where the majority of new launches will be

We go over some of the main reasons here; but just to recap, 14 of the roughly 22 remaining new launches this year are in the CCR. Coupled with the limited supply of resale units, some buyers may not have much choice; they may have to settle for two-bedder layouts, or some compromises on space.

Meanwhile, in other property news…

- If you’re selling your condo, watch out for this one potentially invisible factor that could impact your chances.

- Can you survive on higher floors without a lift? Yes? Then perhaps a walk-up apartment, like this one, affords more advantage than you realised.

- If you’re willing to settle for resale, here are some of the cheapest two-bedder CCR options right now (from $1.2 million)

- Is paying the premium for a nice view unnecessary? Tell that to the folks who made around $200k just with a nice sea view, at Clement Canopy.

Weekly Sales Roundup (05 May – 11 May)

Top 5 Most Expensive New Sales (By Project)

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| 21 ANDERSON | $24,000,000 | 4489 | $5,347 | FH |

| AUREA | $6,010,945 | 1798 | $3,344 | 99 yrs (2024) |

| WATTEN HOUSE | $5,011,000 | 1539 | $3,255 | FH |

| CHUAN PARK | $4,093,100 | 1550 | $2,641 | 99 yrs (2024) |

| THE ORIE | $3,827,000 | 1453 | $2,634 | 99 yrs (2024) |

Top 5 Cheapest New Sales (By Project)

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| ONE MARINA GARDENS | $1,250,320 | 420 | $2,978 | 99 yrs (2023) |

| PARKTOWN RESIDENCE | $1,262,000 | 506 | $2,495 | 99 yrs (2023) |

| BLOOMSBURY RESIDENCES | $1,400,000 | 570 | $2,454 | 99 yrs (2024) |

| LUMINA GRAND | $1,451,000 | 980 | $1,481 | 99 yrs (2022) |

| CANNINGHILL PIERS | $1,456,000 | 484 | $3,006 | 99 yrs (2021) |

Top 5 Most Expensive Resale

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| THE GLYNDEBOURNE | $7,438,000 | 3541 | $2,100 | FH |

| VIVA | $5,180,000 | 1991 | $2,601 | FH |

| GALLOP GABLES | $4,080,000 | 1733 | $2,354 | FH |

| MARINA BAY SUITES | $3,830,000 | 2056 | $1,863 | 99 yrs (2007) |

| OUE TWIN PEAKS | $3,740,000 | 1604 | $2,332 | 99 yrs (2010) |

Top 5 Cheapest Resale

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| PARC ROSEWOOD | $630,000 | 431 | $1,463 | 99 yrs (2011) |

| THE INFLORA | $700,000 | 463 | $1,512 | 99 yrs (2012) |

| RIPPLE BAY | $718,000 | 484 | $1,482 | 99 yrs (2011) |

| NOTTINGHILL SUITES | $735,000 | 398 | $1,845 | FH |

| HIGH PARK RESIDENCES | $740,000 | 452 | $1,637 | 99 yrs (2014) |

Top 5 Biggest Winners

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | RETURNS | HOLDING PERIOD |

| THE TESSARINA | $3,100,000 | 1335 | $2,323 | $21,448,000 | 18 Years |

| CARABELLE | $2,580,000 | 1389 | $1,858 | $3,991,000 | 24 Years |

| SERAYA VILLE | $2,150,888 | 1432 | $1,502 | $2,180,000 | 24 Years |

| WILLYN VILLE | $1,980,000 | 926 | $2,139 | $1,661,000 | 13 Years |

| THE MINTON | $2,338,000 | 1324 | $1,766 | $1,412,888 | 14 Years |

Top 5 Biggest Losers

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | RETURNS | HOLDING PERIOD |

| THE SCOTTS TOWER | $1,900,000 | 872 | $2,179 | -$950,000 | 7 Years |

| OUE TWIN PEAKS | $3,740,000 | 1604 | $2,332 | -$827,050 | 11 Years |

| MARINA BAY SUITES | $3,830,000 | 2056 | $1,863 | -$609,000 | 15 Years |

| ONE SHENTON | $1,200,000 | 603 | $1,991 | -$156,750 | 13 Years |

| SKYSUITES@ANSON | $930,000 | 398 | $2,335 | -$121,200 | 12 Years |

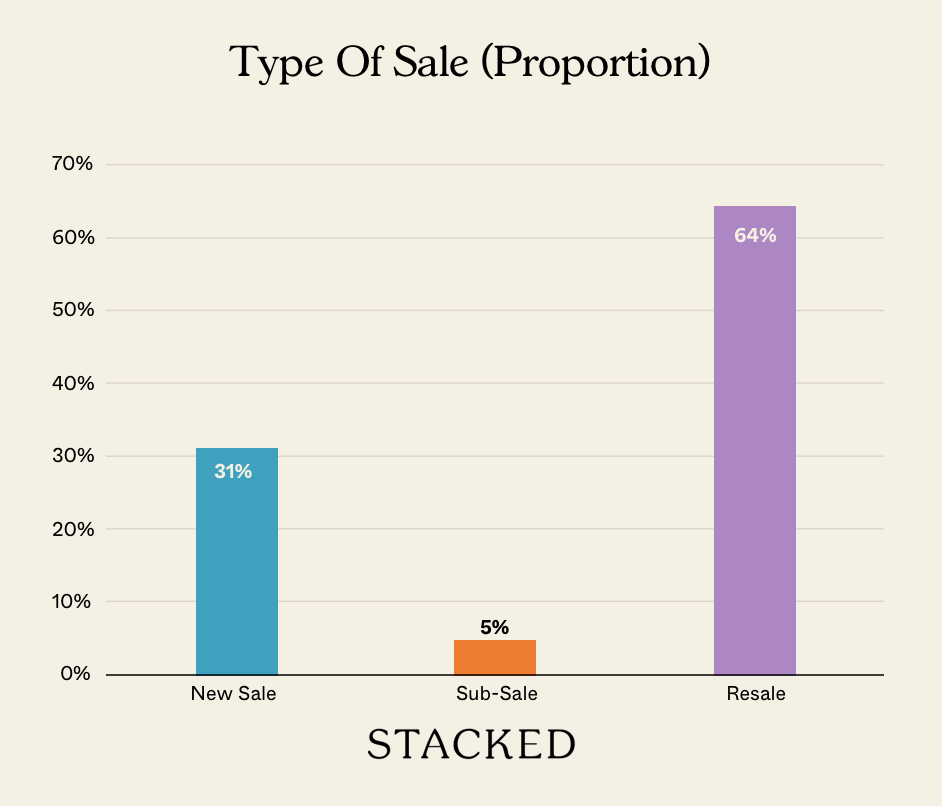

Transaction Breakdown

For more property news around Singapore, follow us on Stacked.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

Why is it difficult for some homeowners in Singapore's central region to upgrade from a two-bedroom to a three-bedroom condo?

What are the typical costs involved in buying a three-bedroom condo in Singapore's Core Central Region?

How does the price difference impact homeowners looking to upgrade within Singapore's CCR?

Are there affordable options for two-bedroom condos in Singapore's CCR?

What factors contribute to some homeowners being unable to upgrade in Singapore's CCR?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Singapore Property News

Singapore Property News This Rare Type Of HDB Flat Just Set A $1.35M Record In Ang Mo Kio

Singapore Property News A Rare New BTO Next To A Major MRT Interchange Is Coming To Toa Payoh In 2026

Singapore Property News New Tampines EC Rivelle Starts From $1.588M — More Than 8,000 Visit Preview

Singapore Property News Executive Condo Prices Have Doubled In A Decade — Raising New Questions About Affordability In 2026

Latest Posts

Overseas Property Investing In Niseko’s Booming Property Market, Investors Are Buying Individual Hotel Rooms

On The Market Here Are Some Of The Cheapest Newly MOP 4-Room HDB Flats You Can Still Buy

Property Market Commentary A 60-Storey HDB Is Coming To Pearl’s Hill — The First Public Housing Here In 40 Years

0 Comments