Unless you have been living under a rock, you would have heard by now of the new cooling measures that were announced on July 5th. Although we cannot say we are surprised that measures have been taken to counter the rise in prices of private property, it must be said that it is still shocking that the moves have been so swift and are actually quite significant. So much so that crowds of potential buyers thronged showflats across Singapore yesterday, in hopes that their purchases can be squeezed in before the new rates come into effect on July 6th.

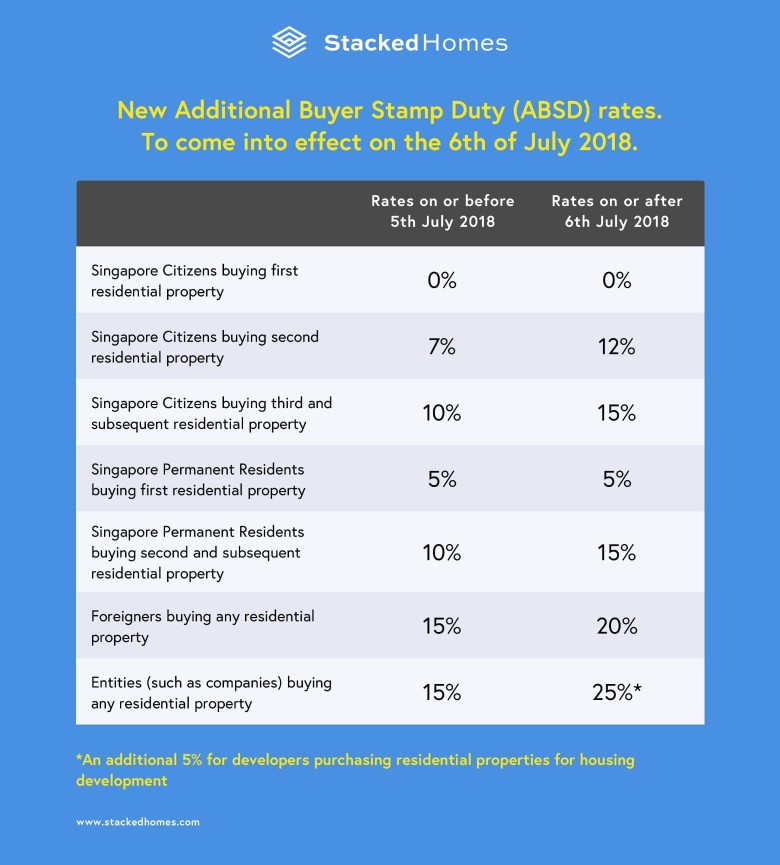

Additional Buyer Stamp Duty – So what are the changes?

As you can see, for SC buying their first residential property, there will be no additional buyer stamp duty, which is rightly so. So no changes there. Don’t forget additional buyer stamp duty is payable on top of the normal buyers stamp duty. If you have forgotten the existing BSD rates, here you go:

Buyers stamp duty

First $180,000 1%

Next $180,000 2%

Next $640,000 3%

Remaining Amount 4%

For SC buying their second, or third and subsequent properties, the increase of 5% is really substantial. Let us show you an example of how this new cooling measures will affect any future purchases.

SC buying second residential property of $1 million

Before

Buyers stamp duty = $24,600

Additional buyer stamp duty (7%) = $70,000

Total stamp duty = $94,600

After this new round of cooling measures

Buyers stamp duty = $24,600

Additional buyer stamp duty (12%) = $120,000

Total stamp duty = $144,600

This means an increase of $50,000 in ABSD rates.

IMPORTANT:

If you signed your sale and purchase agreement in Singapore, the BSD and ABSD have to be paid within 14 days of the agreement being signed.

If you signed it overseas, you have a bigger leeway of 30 days after the agreement was received in Singapore.

Lastly, and please do not forget this. If the BSD and ABSD is not paid by the due date, the penalties are:

- Delay in payment for up to 3 months – $10 or an amount equal to the BSD and ABSD payable, whichever is higher

- Delay in payment exceeding 3 months – $25 or an amount equal to 4 times the BSD and ABSD payable, whichever is higher

So based on our previous figures, if you are late in payment beyond 3 months, this will result in a maximum penalty of $578,400! Which is clearly not an amount to be trifled with.

More from Stacked

We Waited 5 Years For Our BTO At Dakota Breeze: Our Review Of What It’s Like To Live There

Everyone wants a BTO, but you aren’t guaranteed one due to the luck of the draw of the balloting system.…

Property Market CommentaryABSD remission in Singapore – Everything you need to know

by Druce TeoSo how does the additional buyer stamp duty changes affect me?

With this new round of cooling measures, it is abundantly clear that the Government is looking to put a check on the rising prices in the property market. Prices in Singapore were slated to rise 8% in this year and again in 2019. So perhaps in their view, if left unchecked, prices could actually get out of hand.

Not to mention, HDB resale flat prices are falling, and the supply of Build-to-Order (BTO) flats will be cut to about 16,000 from 17,000 previously. So this move was possibly done to combat the dropping resale HDB flat prices. This was also not helped by the earlier announcement that not all old HDB flats will be eligible for the Selective En bloc Redevelopment Scheme (SERS).

So you may be asking here, why would we be talking about HDB?

It’s quite simple.

It matters because if HDB resale flat prices are falling and private homes are rising, this would create a wider and wider price gap, which is not favoured by the Government. This is because should the price gap continue to widen, it will get tougher for Singaporeans to upgrade from an HDB to a private property. Also this would mean a worse income inequality for Singapore, which is already one of the highest in the world. Obviously Singaporeans would not be happy with such a situation which would in turn create problems for the Government.

Lastly, property developers will also be affected by this current round of changes. They will now have to pay 25 per cent on any en bloc purchase based on the land cost instead of the 15 per cent previously. Although this is remissible if they manage to sell all the units within the 5 years. If not, there will be a new additional 5 per cent ABSD tax. This will definitely tamper the enthusiasm for en bloc deals as this means more upfront capital costs for developers as well as more risks in the event all the units are not cleared. So you can expect a more muted response from the developers in this regard.

As always, you can leave a comment down below or feel free to reach out to us at hello@stackedhomes.com!

Druce Teo

Druce is the Chief Editor at the Stacked Editorial. He was first interested in property since university but never had any aspiration to become an agent, so this is probably the next best thing.Read next from Property Market Commentary

Property Market Commentary We Tracked The Rise Of Million-Dollar HDB Flats By Estate — And The Results May Surprise You

Property Market Commentary 2-Bedder vs 2+Study Units: Which Condo Layout Has Better Returns Over The Last Decade?

Property Market Commentary A First-Time Condo Buyer’s Guide To Evaluating Property Developers In Singapore

Property Market Commentary Why More Young Families Are Moving to Pasir Ris (Hint: It’s Not Just About the New EC)

Latest Posts

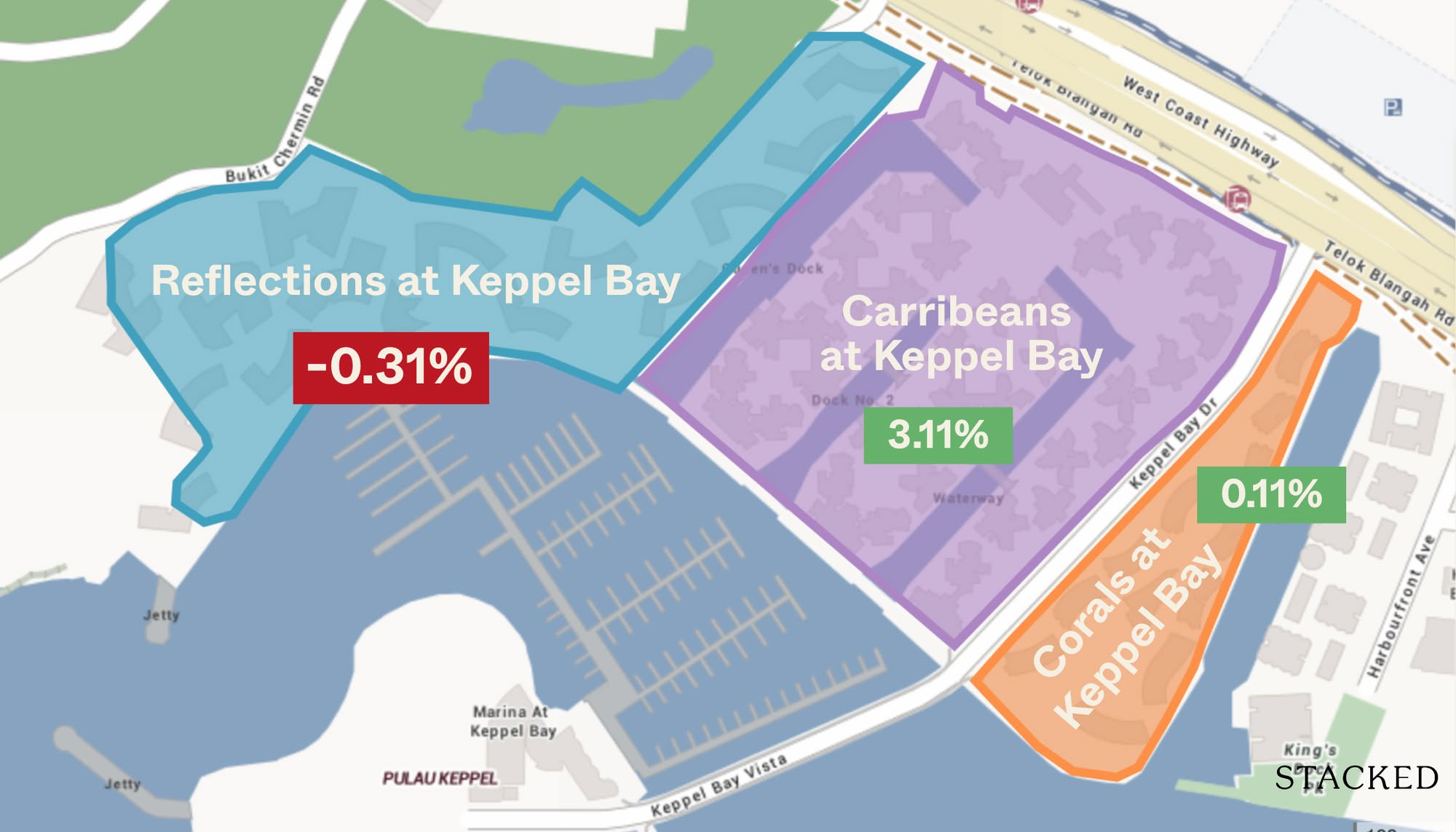

Pro 7 Reasons Reflections at Keppel Bay Underperformed—Despite Its Iconic Design and Prime Waterfront Location

New Launch Condo Analysis This New River Valley Condo Starts At $1.2M: And It’s Cheaper Than Some City-Fringe Launches

New Launch Condo Analysis This New 376-Unit Condo In Sembawang Might Be The Best Pick For Young Families: Here’s Why

Landed Home Tours Where To Find Freehold Semi-D Landed Homes From $4.4m: Touring Gilstead Road

Singapore Property News The Trick to Seeing Through a Condo Showflat (Most Buyers Never Do This)

Overseas Property Investing Can You Really Buy A House In Italy For €1? Here’s What Singaporeans Should Know

On The Market 5 Cheapest 5-Room HDB Flats Near MRT Stations From $550k

Pro Why Seletar Park Residence Underperformed—Despite Its District 28 Location And Large Unit Sizes

On The Market Inside A Luxury Waterfront Home at The Residences At W Singapore Sentosa Cove

New Launch Condo Analysis Singapore’s Tallest New Condo Comes With the Highest Infinity Pool: Is The 63-Storey Promenade Peak Worth A Look?

Editor's Pick LyndenWoods Condo Pricing Breakdown: We Compare Its Pricing Against Bloomsbury Residences, Normanton Park & One-North Eden

Homeowner Stories Does The “Sell One, Buy Two” Strategy Still Work In 2025? 3 Real Stories From Singapore Homeowners

Editor's Pick Where $4 Million Semi-Ds Sit Next To $40 Million GCBs: Touring First Avenue In Bukit Timah

Singapore Property News So Is The 99-1 Property Split Strategy Legal Or Not?

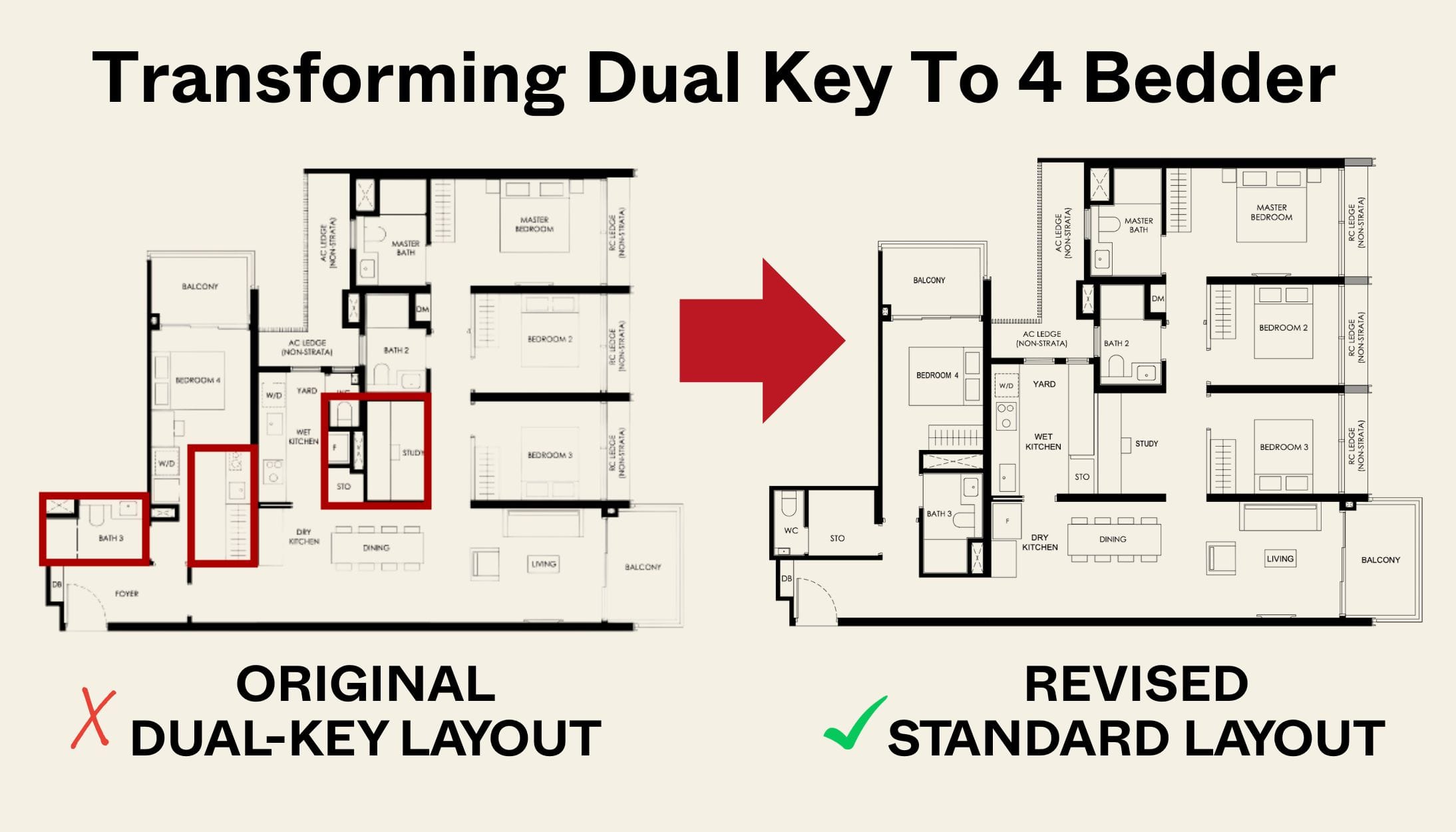

New Launch Condo Reviews Transforming A Dual-Key Into A Family-Friendly 4-Bedder: We Revisit Nava Grove’s New Layout

Great write up. I am looking to invest in a 2nd property. Given the current crisis do you think it’s worth waiting and seeing if the ABSD rule would be relaxed? TIA