Why Old ECs Now Make More Sense Than Million-Dollar Flats

September 28, 2025

With the state of the resale HDB market, Executive Condos (ECs) now make more sense than ever.

In 2025, we’re seeing flats transact at prices that, back in 2010, could have bought you a full-blown private condo. As I write this, around 39 per cent of the flats in Bukit Timah (4-room and 5-room) are at the million-dollar mark, and in the Central Area and Bishan, almost a quarter of 4 and 5-room flats have reached that point.

Granted, these are flats in the more desirable areas; but even in the heartland towns, the psychology is shifting. Yishun, Woodlands, and Sengkang now see five-room and executive flats routinely brushing the $900,000 to $1.1 million range. That’s the kind of money I was promised if I became a doctor, back when I was in Primary school.

Enter ECs: once semi-private homes for the “sandwich” class. And as it seems in the aftermath of COVID, we’re all fillings between the bread of poverty & unaffordability right now.

About a decade back, we used to joke that one day resale flats would be so expensive, some of them would cost more than ECs. Well, here we are. For around $1.2 million, you could get an EC unit in places in Woodsvale and Northoaks, perhaps The Visionaire if you push it a bit further (say $1.35 million). That is below the prices of 5-room flats in places like Bishan and Toa Payoh; and bear in mind the current record holder is $1.73 million for a DBSS flat at Dawson.

An older EC like Lilydale (TOP 2003) averages about $1.17 million (roughly $880 psf) for sizable 3-bed units of around 1,195 sq ft, about the size of a 4-room flat. A slightly newer EC, The Canopy (TOP 2014), even saw a few 3-bedroom units (1,033 sq ft) change hands for just under $1.3 million.

This allows upgraders to maintain a decent family-sized unit, whilst being free of HDB restrictions (note that the five-year MOP for ECs only applies to the first batch of buyers, not subsequent buyers in the resale market).

And all of this would come without restrictions like an ethnic quota; not to mention a chance at an en-bloc exit.

After their 10th year, ECs get fully privatised. Now no one cares anymore that foreigners can buy them (it’s pretty clear by now that few foreigners care about ECs, and even less so when there’s a 60 per cent ABSD on them.) But what might matter is a longer-term view:

The last SERS exercise has been concluded, and we don’t know when we’ll see one again. This means the exit plan for an HDB flat is now the less palatable VERS, which is a far less generous scheme. ECs, however, have an escape through a collective sale, I’m not saying that’s guaranteed for an EC, but it is a proverbial light at the end of the tunnel; something that HDB flats don’t have.

And this is where the case for older ECs really firms up.

If you’re paying a million-plus for a flat, you’re already past the psychological threshold where affordability is the main draw. I’m betting that, at this quantum, you’re now in the zone where what you want is value.

And that’s a space where older ECs have been punching above their weight.

More from Stacked

How Much Would You Save By Buying An Assisted Living HDB Flat?

If you’re like most Singaporeans, you have at some point tried to plan out your “final home”, the property where…

For roughly the same quantum as a million-dollar flat,you get full suite condo facilities, private security*, and quite likely better long-term appreciation.

*I know some people think security guards are just there to shout at us about where our dogs poo. But private security helps when there are dementia-prone residents who may need help, and also to prevent scammers from knocking at the gate.

Plus, you’re also likely paying less than a full-blown private condo (although price gaps between the two are definitely narrowing). So in effect, you could be getting a better deal, while spending more or less the same amount.

It goes without saying that – depending on specific needs and locations – this isn’t going to be a solution for every buyer. But if you are at the $1 million to $1.4 million price point, this is worth considering. I also think the market is likely to notice this in the near future, which is likely to drive more interest and demand toward ECs nearing their MOP.

Meanwhile in other property news…

- Formerly “ulu” estates may not be that way much longer; and decentralisation is kicking in faster than we may think. Here’s why.

- Spaciousness counts, but prices are high – what’s the solution? Check out the biggest condos you can get for $1.8 million or under.

- How do you tell when condo prices are about to turn? There’s no perfect method, but there will be signs.

- Join our Stacked Pro readers, as we investigate the price gap between leasehold three and four-bedders in the famed District 9. How well can a 20+ year old condo stand against time?

Weekly Sales Roundup (15 – 21 September)

Top 5 Most Expensive New Sales (By Project)

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| GRAND DUNMAN | $4,527,000 | 1787 | $2,534 | 99 yrs (2022) |

| TEMBUSU GRAND | $4,076,000 | 1711 | $2,382 | 99 yrs (2022) |

| NAVA GROVE | $4,051,700 | 1550 | $2,614 | 99 yrs (2024) |

| BAGNALL HAUS | $3,678,000 | 1528 | $2,406 | FH |

| THE ROBERTSON OPUS | $3,509,000 | 1044 | $3,361 | 999 yrs (1841) |

Top 5 Cheapest New Sales (By Project)

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| CANBERRA CRESCENT RESIDENCES | $1,336,200 | 667 | $2,002 | 99 yrs (2024) |

| THE ROBERTSON OPUS | $1,398,000 | 431 | $3,247 | 999 yrs (1841) |

| UPPERHOUSE AT ORCHARD BOULEVARD | $1,495,000 | 474 | $3,157 | 99 yrs (2024) |

| GRAND DUNMAN | $1,520,000 | 549 | $2,769 | 99 yrs (2022) |

| THE LAKEGARDEN RESIDENCES | $1,590,000 | 678 | $2,345 | 99 yrs (2023) |

Top 5 Most Expensive Resale

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| LEEDON RESIDENCE | $7,500,000 | 2669 | $2,810 | FH |

| REFLECTIONS AT KEPPEL BAY | $6,400,000 | 3993 | $1,603 | 99 yrs (2006) |

| ST THOMAS SUITES | $5,900,000 | 2605 | $2,265 | FH |

| 111 EMERALD HILL | $5,000,000 | 2121 | $2,358 | FH |

| SILVERSEA | $4,950,000 | 2465 | $2,008 | 99 yrs (2007) |

Top 5 Cheapest Resale

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| HIGH PARK RESIDENCES | $625,000 | 388 | $1,613 | 99 yrs (2014) |

| RIVERSOUND RESIDENCE | $720,000 | 474 | $1,520 | 99 yrs (2011) |

| EUHABITAT | $735,000 | 527 | $1,394 | 99 yrs (2010) |

| AIRSTREAM | $740,000 | 474 | $1,562 | FH |

| EUHABITAT | $748,000 | 527 | $1,418 | 99 yrs (2010) |

Top 5 Biggest Winners

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | RETURNS | HOLDING PERIOD |

| CLAREMONT | $4,050,000 | 2024 | $2,001 | $2,900,000 | 21 Years |

| SOMMERVILLE PARK | $4,628,000 | 2508 | $1,845 | $2,738,000 | 19 Years |

| LEEDON RESIDENCE | $7,500,000 | 2669 | $2,810 | $2,530,650 | 10 Years |

| TREVISTA | $3,268,000 | 1733 | $1,886 | $1,825,300 | 16 Years |

| MODENA | $2,930,000 | 2777 | $1,055 | $1,713,718 | 26 Years |

Top 5 Biggest Losers

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | RETURNS | HOLDING PERIOD |

| OUE TWIN PEAKS | $1,250,000 | 570 | $2,191 | -$535,500 | 9 Years |

| 111 EMERALD HILL | $5,000,000 | 2121 | $2,358 | -$122,135 | 13 Years |

| THE TRE VER | $890,000 | 495 | $1,797 | -$60,000 | 4 Years |

| THE LINE @ TANJONG RHU | $1,400,000 | 581 | $2,409 | -$10,000 | 6 Years |

| THE ORIENT | $1,310,000 | 721 | $1,816 | -$7,400 | 9 Years |

Top 5 Biggest Winners (ROI%)

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | ROI (%) | HOLDING PERIOD |

| CLAREMONT | $4,050,000 | 2024 | $2,001 | 252.0% | 21 Years |

| EMERALD PARK | $2,000,000 | 1561 | $1,281 | 249.0% | 20 Years |

| THE CLEARWATER | $1,865,000 | 1378 | $1,354 | 206.0% | 27 Years |

| MAPLE WOODS | $2,080,000 | 915 | $2,273 | 183.0% | 16 Years |

| DENG FU VILLE | $1,830,000 | 1119 | $1,635 | 173.0% | 19 Years |

Top 5 Biggest Losers (ROI%)

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | ROI (%) | HOLDING PERIOD |

| OUE TWIN PEAKS | $1,250,000 | 570 | $2,191 | -30.0% | 9 Years |

| THE TRE VER | $890,000 | 495 | $1,797 | -6.0% | 4 Years |

| 111 EMERALD HILL | $5,000,000 | 2121 | $2,358 | -2.0% | 13 Years |

| THE LINE @ TANJONG RHU | $1,400,000 | 581 | $2,409 | -1.0% | 6 Years |

| THE ORIENT | $1,310,000 | 721 | $1,816 | -1.0% | 9 Years |

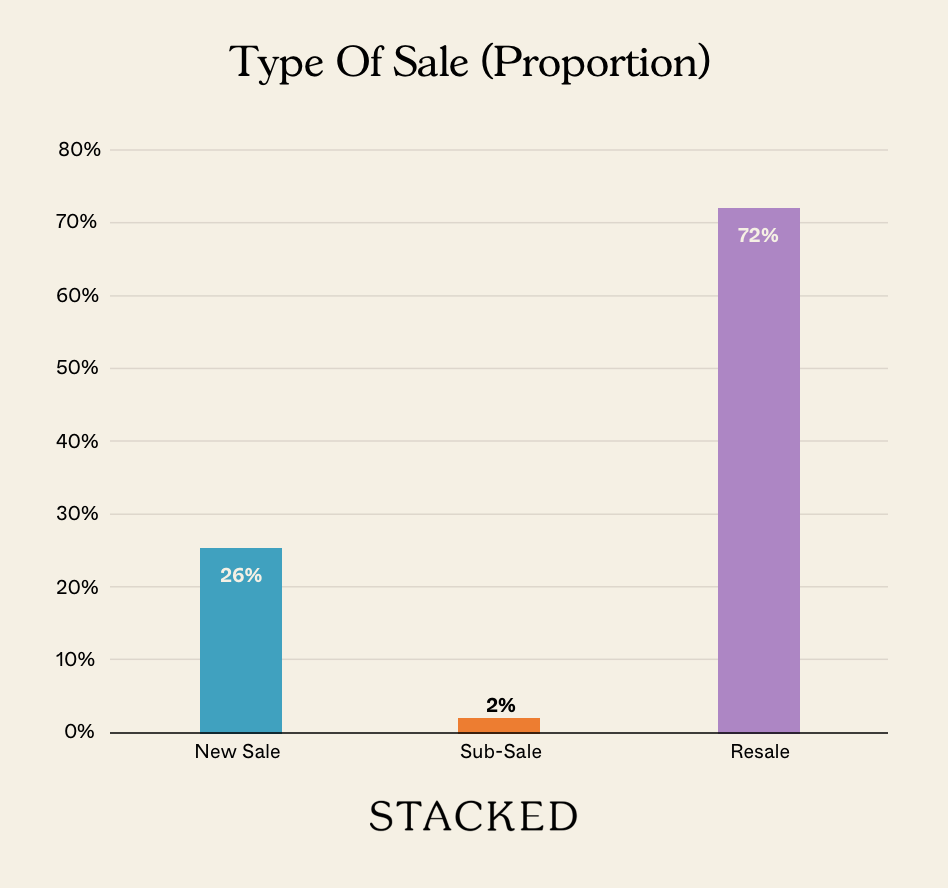

Transaction Breakdown

Follow us on Stacked for more news and events in the Singapore property market.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

Why are older ECs now considered a better investment than new flats?

How do ECs compare to million-dollar flats in terms of price and features?

What are the long-term benefits of buying an EC over a resale flat?

Are ECs suitable for buyers looking for a family-sized home with good amenities?

What makes ECs more appealing now compared to the past?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Singapore Property News

Singapore Property News I’m Retired And Own A Freehold Condo — Should I Downgrade To An HDB Flat?

Singapore Property News REDAS-NUS Talent Programme Unveiled to Attract More to Join Real Estate Industry

Singapore Property News Three Very Different Singapore Properties Just Hit The Market — And One Is A $1B En Bloc

Singapore Property News Singapore Could Soon Have A Multi-Storey Driving Centre — Here’s Where It May Be Built

Latest Posts

New Launch Condo Reviews What $1.8M Buys You In Phuket Today — Inside A New Beachfront Development

Overseas Property Investing This Singaporean Has Been Building Property In Japan Since 2015 — Here’s What He Says Investors Should Know

On The Market Here Are Hard-To-Find 3-Bedroom Condos Under $1.5M With Unblocked Landed Estate Views

0 Comments