Why No Property Developers Bid For Media Circle Parcel B (And What It Means For One-North)

April 29, 2025

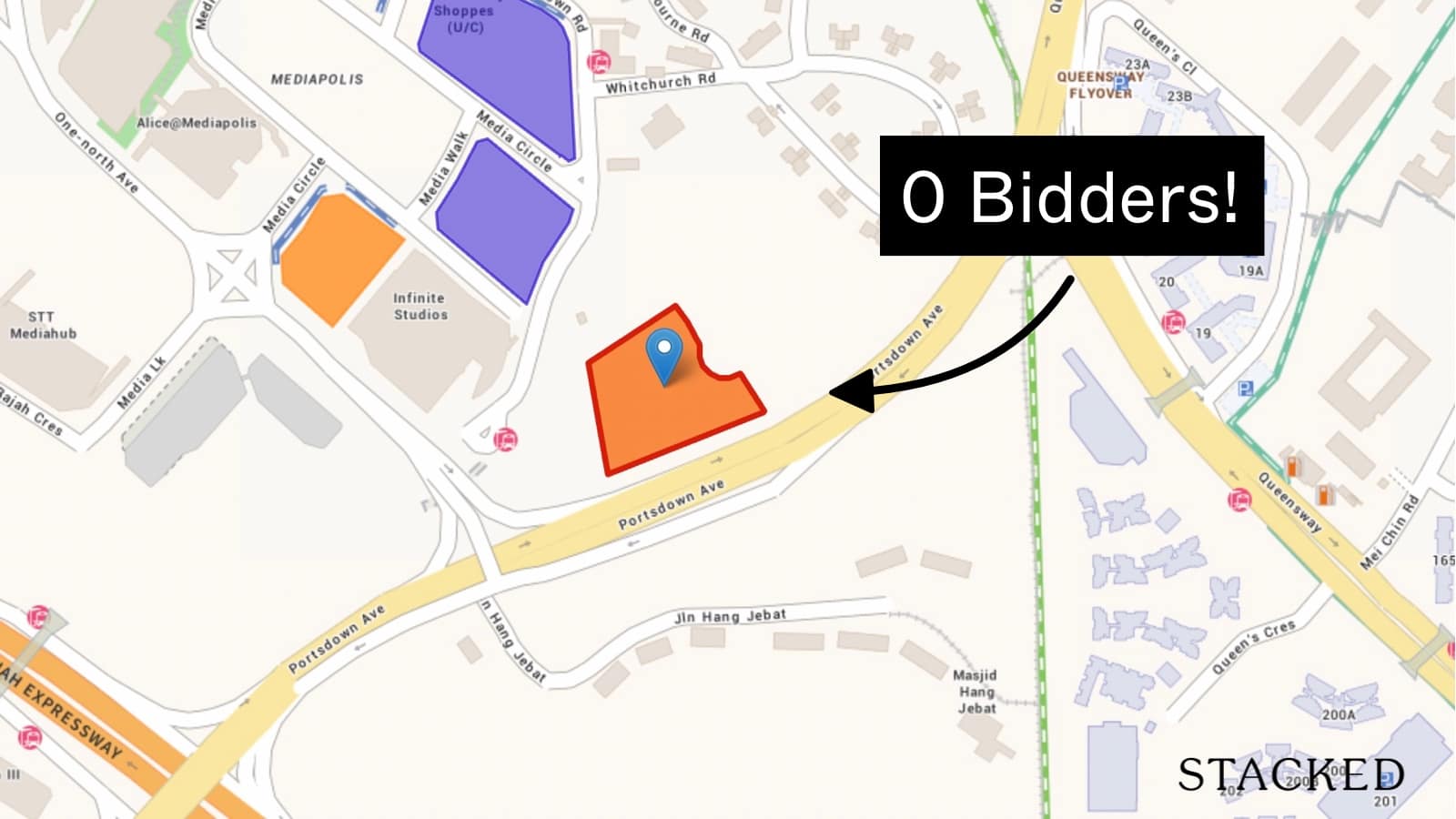

It seems Media Circle Parcel B won’t be doing much for the government coffers, with zero bids received. A GLS site failing to draw interest is a rare (though increasingly less uncommon) outcome. This time, the afflicted area is in the tech and media hub of One-North, the same neighbourhood where we recently saw the launch of Bloomsbury Residences. This raises the question as to why bids are limited when One-North is meant to be an up-and-coming hub. Let’s take a look:

About Media Circle (Parcel B)

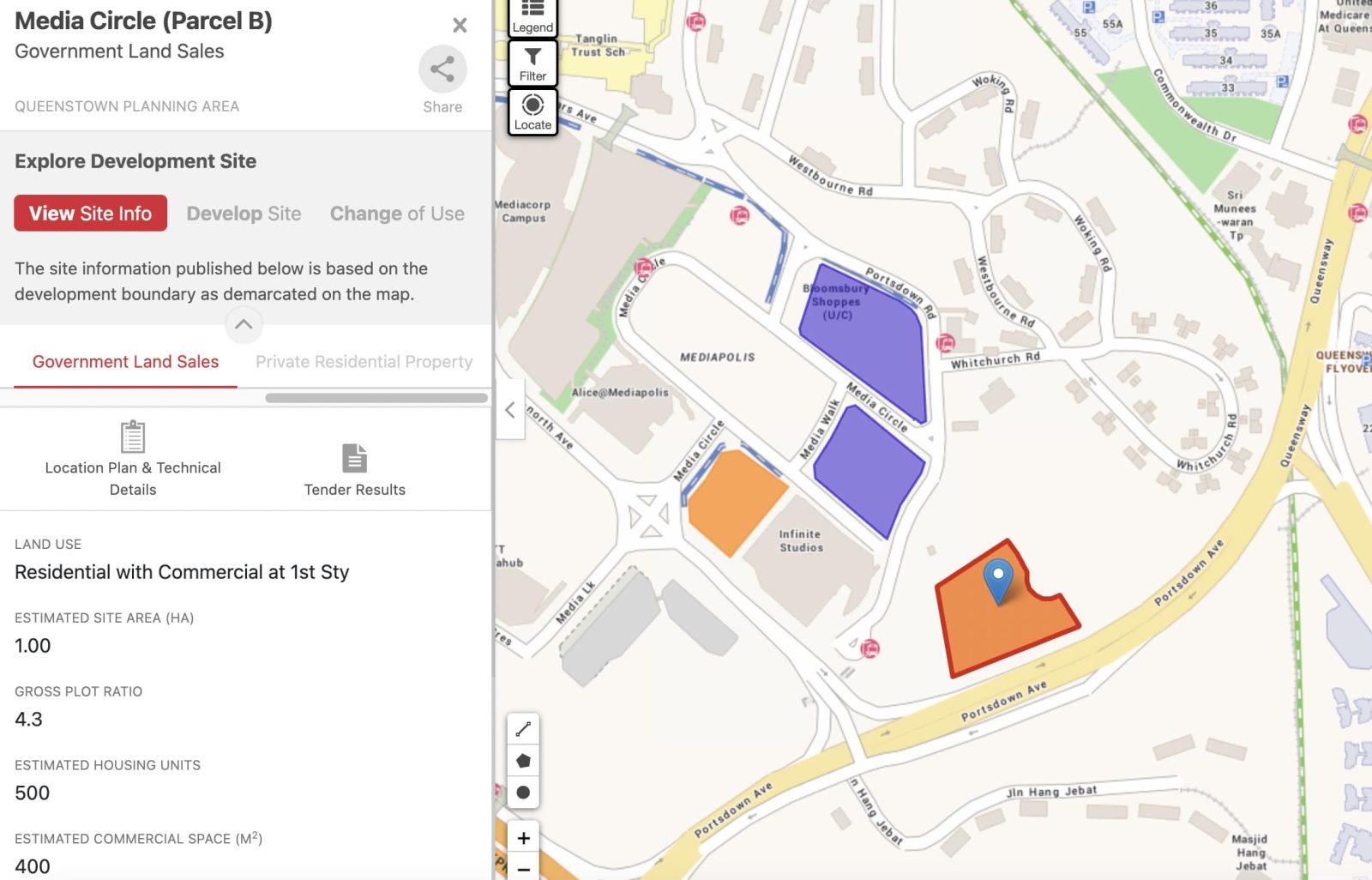

This is a 99-year leasehold site in One-North. It’s about 107,936 sq. ft. (Gross Floor Area or GFA of 464,129 sq. ft.) and was zoned for private residential and commercial use, with commercial on the first storey. It’s estimated that, had the site been developed, it would have yielded around 500 private homes.

Note that this site is just across the road from Bloomsbury Residences, a recent launch.

Initial forecasts estimated bids of between $925 to $1,125 psf, but analysts already laid in modest expectations; we heard predictions of between zero to four bids. The former prediction was accurate, and the tender closed on 29th April with zero bids.

For comparison, Bloomsbury at the time of the land sale was around $395 million (approx. $1,191 psf) at 114,443 sq. ft.. This was not particularly high, but at least there was developer interest.

Why are developers uninterested in the site?

Some of the main issues were:

- Lack of association with family living

- Limited accessibility

- Competition from neighbouring projects

- Concerns over rental prospects in the immediate future

1. Lack of association with family living

In a newsletter a while ago, we briefly mentioned the odd nature of One-North. Most Singaporeans simply don’t think of One-North as a family area, but rather an office hub: the area is for names like A*Star labs and ST Engineering; or perhaps the MediaCorp campus, and schools like INSEAD and ESSEC.

Take, for instance, Primary school access – it appears that only New Town Primary is roughly within 800 metres. Even though institutions like INSEAD and ESSEC are nearby, most buyers prefer having multiple Primary schools in the one-kilometre enrolment range.

Amenities are also a mixed bag. On the one hand, One-North is close to Buona Vista and Holland V; and developments like Fusionopolis have a supermarket, food court, pharmacy, and some eateries. But it’s still not heartland living: there’s no community vibe with the same older folks hanging out in the coffee shop, or a food and market centre.

Even though Bloomsbury adds some more commercial elements (and this land parcel would have had first-floor commercial itself), One-North hasn’t fully transitioned to being a balanced live-work-place area. We definitely think it’s getting there, but developers would rather not sell with messages of patience.

2. Limited accessibility

The site isn’t particularly close to the MRT station, even though you can take a bus. This makes the location an “almost good but not quite” situation. There’s no denying that, in a general sense, the proximity to Holland V and Buona Vista should be exceptional – but this is still ultimately better for drivers, or those who don’t mind the bus and cycling.

More from Stacked

Where HDB Flats Continue to Hold Value Despite Ageing Leases

The “99-year time bomb” has been a topic of public discussion as far back as the 1990s. We all know…

Note that older GLS sites in One-North, such as the Slim Barracks Rise plot, did well as it was closer to Buona Vista MRT station. Media Circle specifically is a tougher spot in the overall One-North area.

3. Competition from neighbouring projects

Bloomsbury Residences isn’t sold out yet (and it was just launched) with 358 units plus a residential component. On top of that, Parcel A, just next door, did get sold; it was awarded in March this year, and is expected to yield about 325 more units.

About a decade ago, One-North did have a lack of accommodation; back then, there were few options besides One-North Residences. But with more new projects appearing nearby, there may be competition for tenants – even in light of all the offices and schools nearby.

Developers are also understandably antsy about getting into a new launch competition right now. In uncertain times, it’s best to avoid a three-corner fight like we saw between The Continuum, Tembusu Grand and Grand Dunman in District 15.

It would seem that, for Media Circle, developers have decided Bloomsbury and upcoming Parcel A are more than enough for now. Besides, there could be more plum sites that developers are eyeing in the GLS list anyway.

4. Concerns over rental prospects in the immediate future

A large appeal of One-North still remains. Even with more competition, this is an area replete with foreign workers in start-ups, tech firms, and students. But the increasingly volatile economic situation is coupled with higher ABSD rates than before: this is not like a decade ago, where one-bedders in a hub (albeit a developing one) would be seen as an easy rental asset

This also relates to the general inaccessibility: tenants will usually want better MRT station access than Media Circle currently provides.

Is it a reflection of the wider property market?

Only in the sense that we can see how cautious developers are becoming, or perhaps to put it in another way, that they are very selective. We do feel that, if it weren’t for the ongoing trade war and global uncertainty, the Media Circle site would have drawn at least one or two modest bids. As of now though, it’s still considered a mostly unproven area; and it’s being sold in a time when developers don’t want to take chances.

For more on-the-ground updates on the Singapore property market, follow us on Stacked.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Editor's Pick

Singapore Property News This Rare Type Of HDB Flat Just Set A $1.35M Record In Ang Mo Kio

Singapore Property News A Rare New BTO Next To A Major MRT Interchange Is Coming To Toa Payoh In 2026

Singapore Property News New Tampines EC Rivelle Starts From $1.588M — More Than 8,000 Visit Preview

Singapore Property News Executive Condo Prices Have Doubled In A Decade — Raising New Questions About Affordability In 2026

Latest Posts

Overseas Property Investing In Niseko’s Booming Property Market, Investors Are Buying Individual Hotel Rooms

On The Market Here Are Some Of The Cheapest Newly MOP 4-Room HDB Flats You Can Still Buy

Property Market Commentary A 60-Storey HDB Is Coming To Pearl’s Hill — The First Public Housing Here In 40 Years

0 Comments