Why More Land Doesn’t Automatically Fix Housing In Singapore

December 28, 2025

Recently, I was told about a programme by the Government of Ireland that pays around US$90,000 (S$115,632) for you to move to an island. The policy, called ‘Our Living Islands’ doesn’t actually pay you to move there. They’re giving you the money to refurbish an existing home if you relocate to one of the rural island communities.

As always with these sorts of programs, there are eligibility requirements and strings attached. The money is strictly for buying and refurbishing a vacant or derelict home on a qualifying island which has no bridge or causeway connecting it to the mainland.

The Irish government says that there are about 30 islands off the coast of Ireland that are cut off daily by the tide, but still have permanent year-round populations and are not in private ownership. This probably explains why these rural island communities have several vacant or derelict houses.

The house has to have been vacant for two years and built before 1993. The US$90,000 is for houses in the worst state of dereliction. You can’t use it as a holiday home or rent it out, there’s a clawback if you sell it, and you must already have residency, among other conditions of the repopulation policy.

Nonetheless, it parallels other government programs around the world that aim to incentivise people to move into certain areas. For example, we’ve seen similar policies introduced in Japan and Italy. Whenever a programme like this comes up, it tends to spark coffeeshop talk about how property prices are crazy in Singapore, and how in bigger countries there are often at least “cheaper” places to run to.

Time and again, Singaporeans will bring up home sizes or land scarcity as among the biggest challenges faced by the housing market here. But if we scrutinise it more closely, these “cheap home” programmes should be telling us a completely different story.

What those examples show isn’t that bigger countries typically result in fewer housing issues. Rather, it replaces the land scarcity issue with another problem, namely accessibility and livability.

Ireland’s islands have land for communities to grow. Japan’s countryside has land primed for redevelopment. Italy’s hill towns could accommodate larger populations as well. What the rural governments in these countries struggle with isn’t raw square footage but accessibility. These areas are usually so far from central urban areas that there aren’t enough jobs (or at least, not enough jobs that pay well enough), and a severe lack of facilities – sometimes to the point where any cost savings are more than balanced out by transport costs, or the costs of bringing in needed supplies. It’s also nigh-impossible for certain family situations, such as seniors who need nearby healthcare, or children who need school access.

And this problem doesn’t only show up between cities or countries. It appears even within very large cities.

Take Los Angeles, often held up as the archetype of a sprawling urban metropolis with a large land area. On paper, LA has everything we often claim Singapore lacks, like a vast land area, low-rise neighbourhoods, and the ability to just keep expanding outward.

Yet affordability and livability remain persistent problems. Urban sprawl becomes an issue when most jobs are scattered, commutes are long and unpredictable, and public transport coverage is a heavy burden on taxpayers.

My point here is that space alone is not the be-all and end-all of Singapore’s housing challenges.

It’s the reason we can’t solely rely on, for instance, reclaiming more land, or try to incentivise a bunch of people to go live on Kusu island or something. Without equal and convenient access to jobs, healthcare, and schools, having cheaper outskirts is not a real solution. Instead, they’re just trade-offs that certain people can afford.

And there’s also another factor that matters. Singapore is an ageing society. Getting seniors to live in areas further from urban centers to meet their housing affordability needs is a healthcare problem waiting to happen.

More from Stacked

5 Key Future HDB Plans You Need To Know From NDR 2024: BTO Priority For Singles And 120km Coastline

The first National Day Rally by Prime Minister Lawrence Wong covered some upcoming changes to the HDB market. While they…

By this, I don’t just mean they’re further from hospitals, although that’s certainly a part of it. I mean being further from family tends to result in more loneliness and isolation, and fewer ways to remain relevant in the economy.

In an ironic way, what we often call Singapore’s greatest challenge – being a small country – may also be one of our greatest strengths.

Because of our relatively small land size, infrastructure development tends to be more uniform with long-term planning. The MRT and bus network, access to clinics, groceries don’t taper off as sharply the further you go from the city centre. In fact to foreigners, it may seem quite miraculous how it doesn’t taper off at all. What truly critical service can you find in Orchard that you cannot find in Yishun or Punggol?

Which circles back to the original point. The solution to housing challenges is seldom just “more land” and some of the foreign government incentives towards repopulation clearly demonstrate this. The main challenge is making most areas ideal for development liveable. In that sense, Singapore’s small size may be to our advantage, as decentralisation and urban planning is a lot easier.

Although I still really hope I don’t see a $2.5 million flat in the OCR in my lifetime.

Meanwhile in other property news…

- What does a $3,000 psf penthouse unit get you, when it’s in a project in Beauty World? Check out whether the hefty price tag is really worth it.

- The only people who think “renter” is an insult are the ones you should ignore in the YouTube comments. Here’s why renting isn’t just legit, but can be the smarter move.

- Should you buy an older leasehold condo near the lifestyle hub of Marine Parade? Check out our answer to this reader’s query.

- Aquarius By The Park surprised us by being one of 2025’s top performing condos; join our Stacked Pro readers in identifying the factors behind this sleeper hit.

Weekly Sales Roundup (15 – 21 December)

Top 5 Most Expensive New Sales (By Project)

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| NAVA GROVE | $4,081,000 | 1550 | $2,633 | 99 yrs (2024) |

| CHUAN PARK | $3,968,600 | 1550 | $2,560 | 99 yrs (2024) |

| PENRITH | $3,922,000 | 1281 | $3,062 | 99 yrs (2024) |

| BLOSSOMS BY THE PARK | $3,735,000 | 1507 | $2,478 | 99 yrs (2022) |

| THE ORIE | $3,728,000 | 1367 | $2,727 | 99 yrs (2024) |

Top 5 Cheapest New Sales (By Project)

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| THE CONTINUUM | $1,378,000 | 560 | $2,462 | FH |

| OTTO PLACE | $1,521,000 | 872 | $1,744 | 99 yrs (2024) |

| AURELLE OF TAMPINES | $1,651,000 | 840 | $1,966 | 99 yrs (2024) |

| BLOOMSBURY RESIDENCES | $1,772,000 | 689 | $2,572 | 99 yrs (2024) |

| ONE MARINA GARDENS | $1,945,800 | 657 | $2,963 | 99 yrs (2023) |

Top 5 Most Expensive Resale

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| REGENCY PARK | $7,250,000 | 3175 | $2,283 | FH |

| CARIBBEAN AT KEPPEL BAY | $5,008,888 | 2433 | $2,059 | 99 yrs (1999) |

| ONE BALMORAL | $4,980,000 | 2228 | $2,235 | FH |

| MARINE VIEW MANSIONS | $4,800,000 | 2077 | $2,311 | FH |

| CASA ESPERANZA | $3,760,000 | 1873 | $2,008 | FH |

Top 5 Cheapest Resale

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| URBAN VISTA | $735,000 | 441 | $1,665 | 99 yrs (2012) |

| SEASTRAND | $735,000 | 592 | $1,242 | 99 yrs (2011) |

| THE TAPESTRY | $760,000 | 441 | $1,722 | 99 yrs (2017) |

| EUPHONY GARDENS | $780,000 | 732 | $1,066 | 99 yrs (1998) |

| BARTLEY RESIDENCES | $790,000 | 463 | $1,707 | 99 yrs (2011) |

Top 5 Biggest Winners

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | RETURNS | HOLDING PERIOD |

| REGENCY PARK | $7,250,000 | 3175 | $2,283 | $3,960,000 | 17 Years |

| MARINE VIEW MANSIONS | $4,800,000 | 2077 | $2,311 | $3,580,000 | 19 Years |

| CARIBBEAN AT KEPPEL BAY | $5,008,888 | 2433 | $2,059 | $2,712,988 | 25 Years |

| CLOVER BY THE PARK | $2,750,000 | 1292 | $2,129 | $1,661,000 | 17 Years |

| PANDAN VALLEY | $2,930,000 | 2024 | $1,448 | $1,175,000 | 9 Years |

Top 5 Biggest Losers

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | RETURNS | HOLDING PERIOD |

| MARINA ONE RESIDENCES | $3,200,000 | 1539 | $2,079 | -$730,000 | 8 Years |

| REFLECTIONS AT KEPPEL BAY | $3,260,000 | 1615 | $2,019 | -$718,000 | 18 Years |

| THE SAIL @ MARINA BAY | $2,650,000 | 1313 | $2,018 | -$350,000 | 3 Years |

| MARINA ONE RESIDENCES | $1,460,000 | 764 | $1,910 | -$325,198 | 6 Years |

| NORMANTON PARK | $1,100,000 | 657 | $1,675 | -$41,000 | 4 Years |

Top 5 Biggest Winners (ROI%)

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | ROI (%) | HOLDING PERIOD |

| MARINE VIEW MANSIONS | $4,800,000 | 2077 | $2,311 | 293% | 19 Years |

| NEPTUNE COURT | $1,330,000 | 1270 | $1,047 | 211% | 27 Years |

| PLATINUM EDGE | $1,458,888 | 797 | $1,832 | 189% | 21 Years |

| HILLBROOKS | $1,580,000 | 958 | $1,649 | 187% | 19 Years |

| WOODSVALE | $1,160,000 | 1281 | $906 | 184% | 19 Years |

Top 5 Biggest Losers (ROI%)

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | ROI (%) | HOLDING PERIOD |

| MARINA ONE RESIDENCES | $3,200,000 | 1539 | $2,079 | -19% | 8 Years |

| MARINA ONE RESIDENCES | $1,460,000 | 764 | $1,910 | -18% | 6 Years |

| REFLECTIONS AT KEPPEL BAY | $3,260,000 | 1615 | $2,019 | -18% | 18 Years |

| THE SAIL @ MARINA BAY | $2,650,000 | 1313 | $2,018 | -12% | 3 Years |

| NORMANTON PARK | $1,100,000 | 657 | $1,675 | -4% | 4 Years |

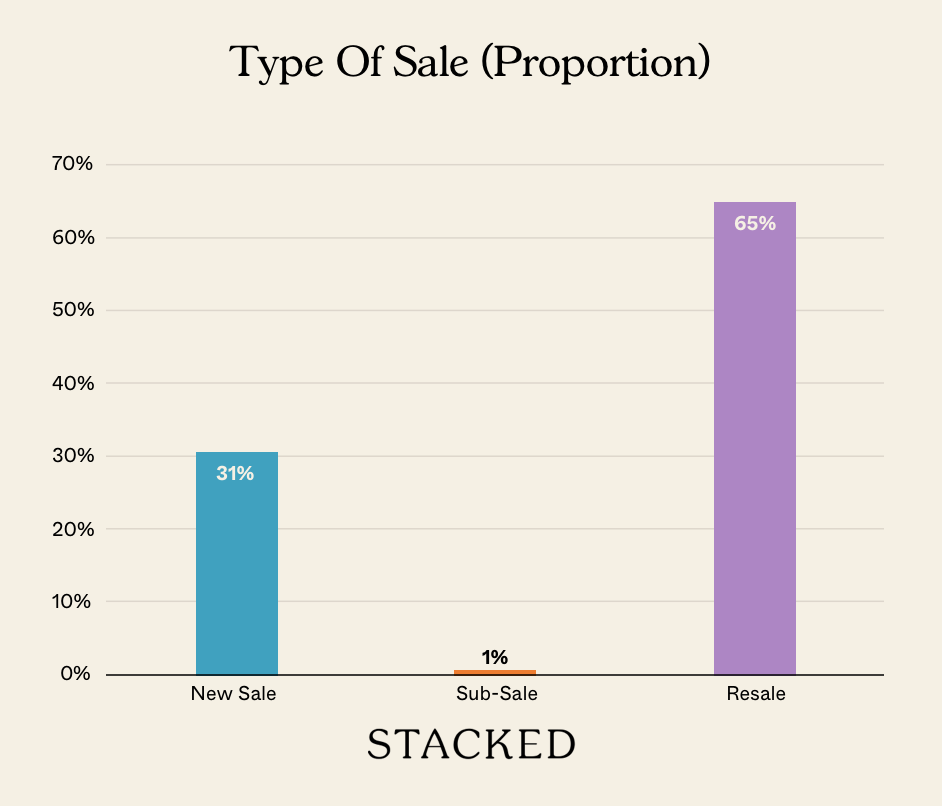

Transaction Breakdown

We hope all our readers at Stacked had a great Christmas this year, and have a great Christmas weekend.

Featured Image Source: Our Living Islands, National Islands Policy 2023-2033.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

Why does more land in Singapore not solve housing problems?

What are the main issues with living in rural islands or countryside areas?

Why is land scarcity not the only problem for Singapore’s housing?

How does Singapore’s small size help with urban planning?

Why is relocating seniors further from urban centers a concern?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Singapore Property News

Singapore Property News These 4 Freehold Retail Units Are Back On The Market — After A $4M Price Cut

Singapore Property News New Lentor Condo Could Start From $2,700 PSF After Record Land Bid

Singapore Property News This Tampines EC Will Preview on Friday — It Is One of Two New ECs in the East in 2026

Singapore Property News I’m Retired And Own A Freehold Condo — Should I Downgrade To An HDB Flat?

Latest Posts

Editor's Pick These Freehold Condos Near Orchard Haven’t Seen Much Price Growth — Here’s Why

Pro This 130-Unit Boutique Condo Launched At A Premium — Here’s What 8 Years Revealed About The Winners And Losers

Editor's Pick A Rare Freehold Conserved Terrace In Cairnhill Is Up For Sale At $16M

0 Comments