Why This Mixed-Use Condo at Dairy Farm Is Lagging Behind the Market

November 25, 2025

Dairy Farm Residences had a bit of a rocky start, and you may remember it from complaints about maintenance fees (which were eventually cut by around 40 per cent). That said, Dairy Farm Residences came to market with a mixed-use concept and a strong nature-focused pitch. With its greenery views and the fact that it would be a hub of amenities in the area, this seemed like a solid proposition – but over time, resale performance has lagged behind the wider market. In this review, we take a closer look at its performance and examine whether pricing, location, or nearby competition played a role.

And once you start lining up the numbers against nearby developments, it becomes clear how complex performance really is: land price, positioning, unit mix, and competition often pull in different directions. If you want help interpreting these patterns across the projects you’re evaluating, reach out here and we’ll link you with a trusted partner agent who studies these trends closely.

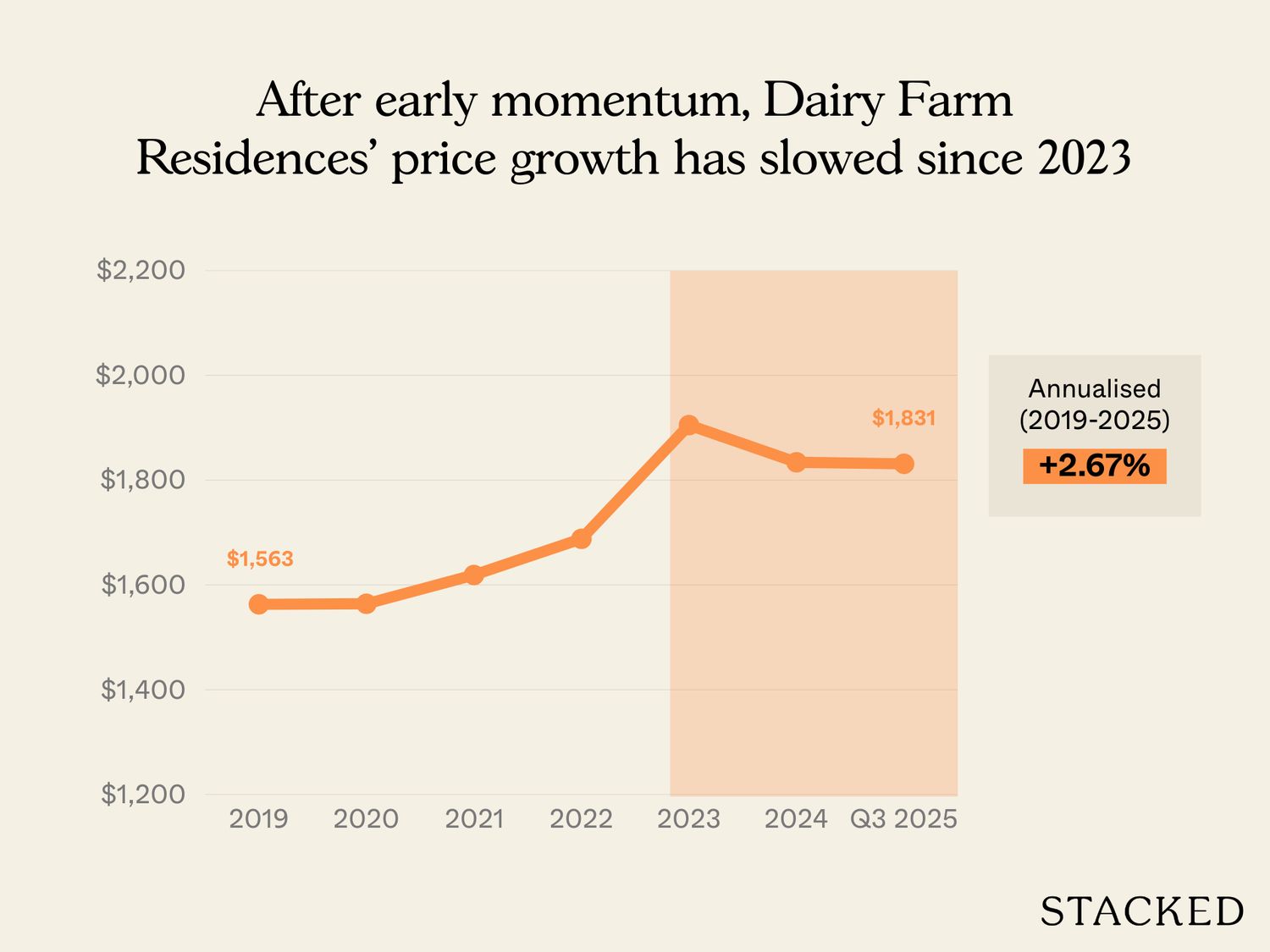

Let’s look at Dairy Farm Residences’ overall performance, from its launch in 2019 to Q3 2025

| Year | Average $PSF |

| 2019 | $1,563 |

| 2020 | $1,564 |

| 2021 | $1,619 |

| 2022 | $1,688 |

| 2023 | $1,905 |

| 2024 | $1,834 |

| 2025 (Up to Q3) | $1,831 |

| Annualised | 2.67% |

Now, let’s compare this to other condos in District 23 (D23) where it’s located. As Dairy Farm Residences is a leasehold condo, we will only compare it to other 99-year leasehold projects.

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Property Investment Insights

Property Investment Insights This Singapore Condo Has Bigger Units Near The MRT — But Timing Decided Who Made Money

Property Investment Insights We Compared Lease Decay Across HDB Towns — The Differences Are Significant

Property Investment Insights This Singapore Condo Skipped 1-Bedders And Focused On Space — Here’s What Happened 8 Years Later

Property Market Commentary Why Some Old HDB Flats Hold Value Longer Than Others

Latest Posts

Editor's Pick Happy Chinese New Year from Stacked

Singapore Property News Nearly 1,000 New Homes Were Sold Last Month — What Does It Say About the 2026 New Launch Market?

Editor's Pick How I’d Invest $12 Million On Property If I Won The 2026 Toto Hongbao Draw

0 Comments