How Grand Dunman “Helped” To Sell The Continuum: The Hidden Influence Of Price Anchoring In Real Estate

August 2, 2023

Imagine intending to buy a stock, but it’s jumped from $50 to $100 since you started tracking it. Suddenly, $50 becomes your anchor point, making $100 seem costly.

But is $100 truly expensive? It’s hard to tell.

If the company’s revenue and earnings have significantly increased (or there’s a much bigger potential upside now), $100 now might actually present a better deal than $50 from a year ago. But the issue is, that we don’t concentrate on the value of the company’s business, we compare the current price to previous prices.

As such, all of us tend to be affected by price anchoring, whether it’s at the high end or the low.

Likewise in the property market, we like to think that most buyers are rational, and evaluate properties based on location, facilities, convenience, etc. But there’s no getting around some deep-rooted psychological quirks, that prevent us from making totally balanced price comparisons. One of the issues we often come across is price anchoring, and even developers and sales teams need to contend with this. Here’s how it works:

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

What is price anchoring?

There’s a human tendency to seek out a baseline, when it comes to comparing costs. Before we buy something, we want to know the usual price for a similar item, so we can decide if what we’re looking at is expensive. That’s generally a smart thing to do. The problem is, we’re not very good at it.

Most people don’t do a lot of active research in finding that “baseline,” and can be misled into thinking something is cheaper (or pricier, in the case of bad marketing) than it really is. Let’s apply this to condo prices for example:

The priciest penthouse on sale – which you’re probably not expected to buy – is at $3,000 psf. But just below that, you’ll see the lowest floor priced at $2,000 psf.

As the contrast between $2,000 and $3,000 is pretty big, you may feel that $2,000 psf now seems reasonable.

The developer is counting on the fact that hopefully, your brain won’t go further than that (e.g., not to the point of comparing it to a $1,000 EC, by which standards $2,000 seems like a very expensive condo).

In the property market, the same effect is used when pricing units; but there are cases – such as when one launch occurs soon after another – where accidental price anchoring happens.

The case of Grand Dunman vs. The Continuum vs. Tembusu Grand

You can see a rundown of these three condos here.

Tembusu Grand moved first, launching in April 2023. The Continuum launched soon after in early May 2023, while Grand Dunman previewed a few months later in July (the actual launch date was around a fortnight later).

The Continuum didn’t see good sales during its launch weekend.

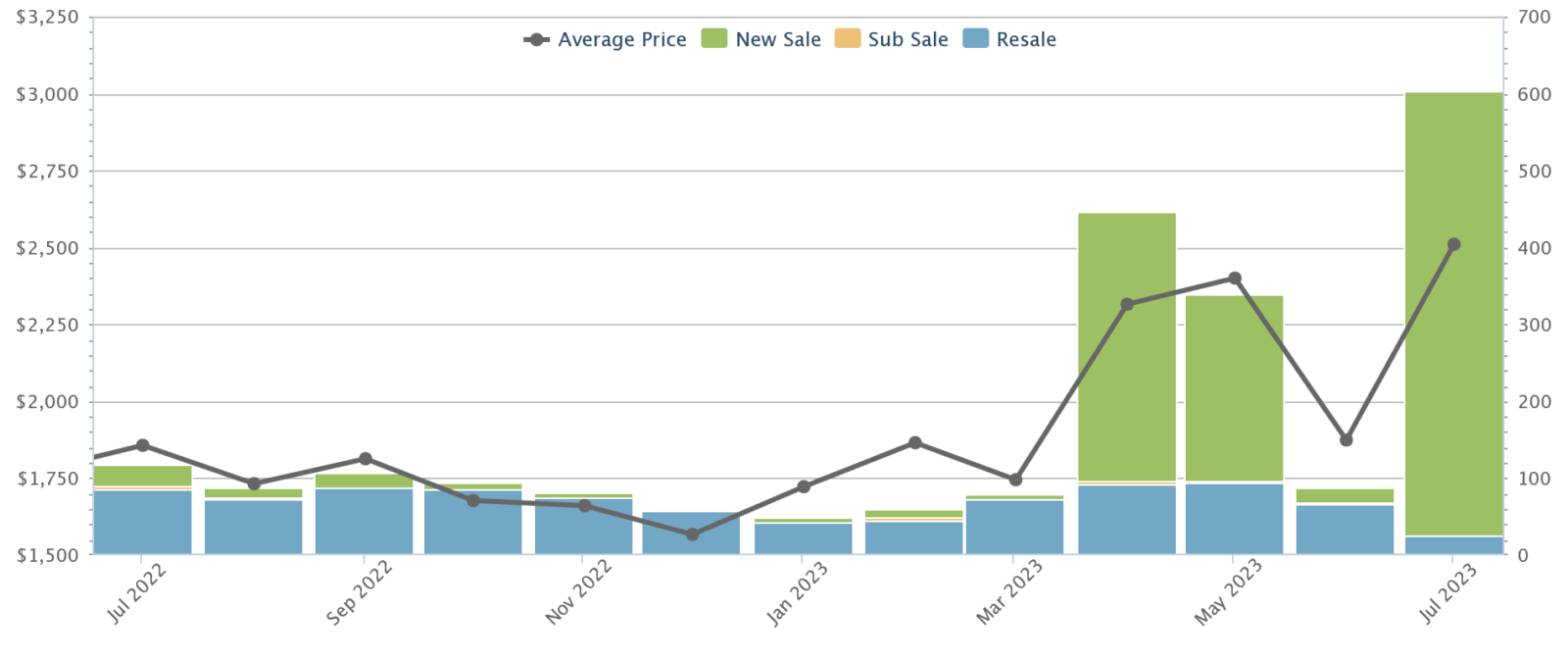

The Continuum moved just 216 of 816 units (26.5 per cent sold) during the launch weekend, averaging $2,732 psf. The most common gripe at the time was pricing; $2,700+ psf seemed high relative to both Tembusu Grand, and the District 15 average.

The developers of Tembusu Grand, perhaps wary of the price gap between the resale condos, had averaged just $2,465 psf (resale counterparts averaged just $1,728 psf).

The green bar shows new launch prices in District 15, while the blue bar shows resale prices. The recent spikes are caused by the three new launches.

So by being the second to launch, The Continuum got stuck with the “expensive” label, thanks to Tembusu Grand anchoring a lower price.

Next comes Grand Dunman

Grand Dunman launched in July, moving 550 of its 1,008 units (54.6 per cent sold) at $2,500 psf. Now more than half is a good number, for a mega-development with a 1,000+ unit count and in the current high interest rate climate.

What’s interesting is that fewer buyers balked at the price, and some even said it was well-priced. Well priced relative to what? Well, The Continuum.

Keep in mind that Grand Dunman is a 99-year leasehold condo. A freehold counterpart in the same location (e.g., The Continuum) would typically be priced about 20 per cent higher (that’s around $3,000 psf).

So while Grand Dunman is cheaper than The Continuum, it’s not way cheaper as some buyers seem to perceive. It’s just more tolerable due to the initial price anchor set by The Continuum.

More from Stacked

How This Korean/Singaporean Couple Created A Stylish Mid-Century Modern Home With $45k

There's definitely a lot to love about living near Orchard, but then again, it's not for everybody. "Orchard was not…

Timing was a crucial element here, as being the first, second, third, etc. to launch can all create different impressions of how pricey the project is. Once a launch has set the price anchor, the subsequent launch will be seen as affordable or expensive based on that anchor.

That said, the pendulum has recently swung back toward The Continuum

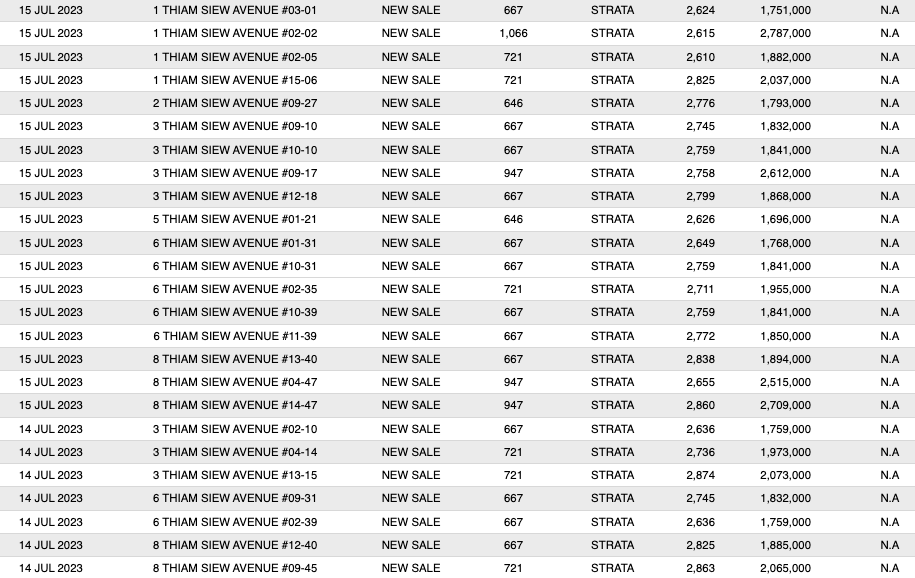

We’re told that Grand Dunman has now moved the bulk of its lower-quantum units (one and two-bedders), thus leaving just the family-sized or larger units. With most of the units left being higher floors (and price staging), this has allowed a closer price gap between Grand Dunman and The Continuum. This is helping to push sales at The Continuum – since the launch weekend of Grand Dunman, 33 units at The Continuum have been sold, as compared to the 9 units sold in the first half of July.

This may cause a reversal in subsequent months: buyers checking out District 15 may run into the pricier remaining Grand Dunman units first, and then come across The Continuum. If so, this could reverse initial impressions.

In any case, this is a good issue to be aware of, when buying in an area with multiple new launches. You can also watch for it in the resale market (e.g., the first batch of owners in a condo could set the price anchor, when they start selling their units).

These are some other times we’ve seen price anchoring in effect as well

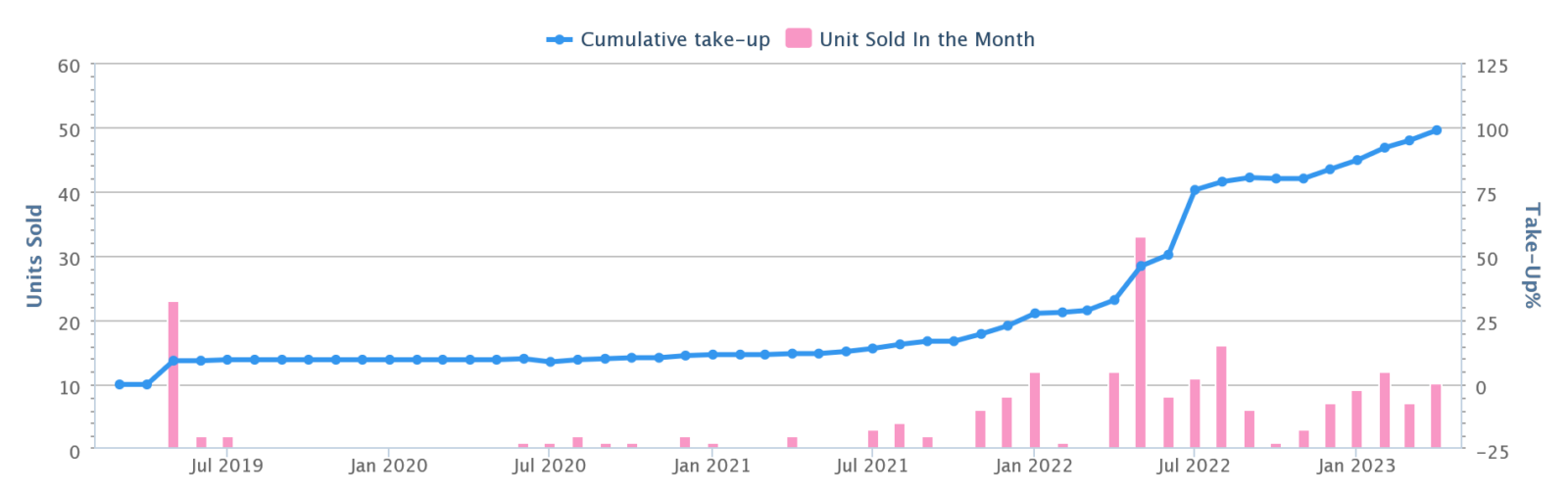

Another case was the Gazania, which launched at around $2,000 psf in May 2019. It moved only 23 out of 165 released units on launch day (15 per cent), and then sold only four units for the rest of 2019.

At the time, $2,000 psf – or a quantum reaching about $1 million for a one-bedder – was widely considered too pricey for a District 19 condo (even if it was freehold). But then in June 2020, and right up to the start of 2023, Gazania started to sell out its remaining units more quickly. This was likely due to $2,000 psf becoming a new launch norm, and Gazania’s price now looking acceptable as a result.

Property Market CommentaryIs $2,000 PSF Going To Be The New Norm For New Launches In 2022 And Beyond?

by Ryan J. Ong

We also saw this with Jadescape. It moved 327 units during launch in September 2018; this was at around $1,669 psf. After that, sales were slow and sporadic right up till January 2020. Again, the same complaint of “too expensive” was used, couched in so many polite terms by analysts.

| Project | Average of Unit Price ($ PSF) | Sales | Total Units | % Sold by 20th Jan 2020 |

| AFFINITY AT SERANGOON | $1,507 | 646 | 1,052 | 61% |

| PARC ESTA | $1,696 | 1034 | 1,399 | 74% |

| PARK COLONIAL | $1,760 | 706 | 805 | 88% |

| RIVERFRONT RESIDENCES | $1,317 | 1204 | 1,472 | 82% |

| STIRLING RESIDENCES | $1,796 | 908 | 1,259 | 72% |

| THE TRE VER | $1,592 | 649 | 729 | 89% |

| JADESCAPE | $1,679 | 608 | 1,206 | 50% |

But after January 2020, other ongoing projects – from Parc Esta to Stirling Residences to Affinity – had sold out the bulk of their low quantum units. They were mostly left with larger units, with price tags proportional to size.

Suddenly, Jadescape (hovering at around $1,690 psf at the time) was regarded as one of the more competitively priced options; and sales started to ramp up.

A check with recent sales also shows that Jadescape has earned its first buyers on average the most out of its quicker-selling new launch competitors at that time. As of this point of writing, the average profit at Jadescape is $317,118, as compared to $146,489 at Affinity, and $279,447 at Stirling Residences.

So it seems how “expensive” a property looks isn’t just tied to its cost for its workmanship, facilities, location, etc. It’s more about the prices that first confront the buyers, and which sets the baseline against which others get measured.

This could make second-mover advantage quite potent for developers, if they’re in time to adjust prices in response to a prior launch.

For more on the Singapore private property market, and its quirks and trends, follow us on Stacked. We’ll also provide you with in-depth reviews of new and resale projects alike.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

What is price anchoring in real estate and how does it affect buyers?

How did the launch timing of Grand Dunman influence its sales and perception of price?

Can the initial prices set during a property launch impact future sales of similar projects?

What are some examples of how price anchoring has affected property sales in Singapore?

How can developers or buyers use understanding of price anchoring to their advantage?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Property Market Commentary

Property Market Commentary How I’d Invest $12 Million On Property If I Won The 2026 Toto Hongbao Draw

Property Market Commentary We Review 7 Of The June 2026 BTO Launch Sites – Which Is The Best Option For You?

Property Market Commentary Why Some Old HDB Flats Hold Value Longer Than Others

Property Market Commentary We Analysed HDB Price Growth — Here’s When Lease Decay Actually Hits (By Estate)

Latest Posts

Pro This 130-Unit Condo Launched 40% Above Its District — And Prices Struggled To Grow

Property Investment Insights These Freehold Condos Barely Made Money After Nearly 10 Years — Here’s What Went Wrong

Singapore Property News Why Some Singaporean Parents Are Considering Selling Their Flats — For Their Children’s Sake

0 Comments