When Property Listings Are Accurate — But Still Misleading

Get The Property Insights Serious Buyers Read First: Join 50,000+ readers who rely on our weekly breakdowns of Singapore’s property market.

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.

What methods should we consider to control how a property is presented on online listing platforms? This is a longstanding challenge in an industry where, for the most part, the sales process is fragmented and often individualised.

Some weeks ago, I mentioned that a real estate agency received a censure over their handling of an errant agent. In that instance, it was an old, ever-resurfacing issue of an agent using inaccurate and ‘clickbait’ style listings – such as putting up a listing for an unusually low price, but then directing the prospective buyer toward something else when they call.

Now this is a very well-worn form of misdirection we sometimes see among a slim number of property listings. Past instances saw it being used by some agents long before online property portals, before WhatsApp, and before the prevalence of the internet.

Some of our younger readers can ask their parents or grandparents, and they can probably tell you how agents still did it in the days of classified newspaper ads. Although back then it was harder to spot genuine cases of misdirection, as a property really could sell right after an ad was placed, and print newspapers didn’t instantly update.

But clickbait listings are one reflection of a wider issue – that of how exactly a property is represented to a buyer.

Every agent has their own approach. Every property is also unique. So, the way a property gets presented is somewhere between the agent’s personal judgment, the marketing angle (if it’s a new launch), and perhaps the current owner’s insistence if it’s a resale. Regulatory oversight is genuinely tough here, as the “correctness” of the representation differs on a case-by-case basis.

Listing prices and descriptions are also just the surface of this deeper question. Take, for example, a description of how the property has fared. An agent might show you how the average $PSF of a particular property has increased, perhaps relative to your other choices.

The information may be based on real transaction data and there may be no intentional deception on the part of the agent. But it’s less common for these representations to distinguish between new-to-resale transactions versus resale-to-resale.

This matters because condos bought very early from developers tend to see much higher $PSF and price growth, as that’s when prices are lowest. But for those who buy a property when it’s sold on the resale market – as you may be – the subsequent price growth can be relatively weaker. A recent example of this that Stacked covered was Grandeur Park Residences.

And yet, it would be difficult for a regulatory body to argue that an agent who simply shows the starting $PSF and the current $PSF is “wrong.”

Another common example involves percentages.

A high percentage growth, often in $PSF, can mislead prospective buyers as to how well a given property is performing. Projects that come from a lower base price, such as an older Executive Condominium (EC) that got privatised, can show explosive percentage gains because they were cheaper to begin with. Other new projects, which could have been launched at prices higher that their resale comparables in that area, can seem to have very muted percentage gains.

Buyers familiar with the private home market will usually be quick to catch this. But new buyers, or those doverwhelmed by the variety of factors involved in a property purchase, are likely to fall back to mental shortcuts like “high percentage growth = better.”

Again though, this isn’t a clear-cut case of “wrong” representation. It’s tough to regulate this because it’s not about factual accuracy, but about the interpretation that arises in the buyer’s own mind.

There are many other concerns such as the unit facing and floor height, the year it was purchased (it may have been bought cheaper or pricier based on the how the market was faring), and even the likely future performance based on surrounding properties.

But it’s also fair to say that, if an agent goes into all of this, the result could be a classic case of analysis paralysis in the buyer. As such, it often boils down to selective representation: what the agent thinks is most relevant to show or highlight. And when it comes to selective presentation, intent is extremely difficult to prove.

The Council for Estate Agencies (CEA), the watchdog monitoring the real estate agency industry, or any government body can easily regulate outright falsehoods; but it’s not as easy to regulate selective truths. This is the grey zone where the chances of misrepresentation are likely to occur.

Asymmetry of information also makes this somewhat inevitable.

Most people buy property at landmark points in their lives. Some might buy only once in their lives. Even among those who end up shopping more than once, there’s often a decade or more between purchases; a long time for market conditions to change, cooling measures to tighten, and even basic assumptions – such as what “normal pricing” is in certain areas – to see significant changes.

More from Stacked

How Covid-19 May Have Ended Up A Boon To Resale Flats

HDB resale prices and volumes have seen a sharp rebound as of Q3 2020. After almost seven straight years of…

It’s a rare buyer who, like the agents, monitors or operates in the property space on a daily basis. Even without bad intent, this natural imbalance often means buyers are much more susceptible to how information is framed and prioritised.

A useful example is in the recent cases involving “99-1” property transactions, specifically when it was used to sidestep paying taxes. For years, these arrangements were openly discussed. In some circles they were treated as a normal workaround. Many buyers were told it was common, many agents believed it was market practice. As for conveyancing firms, I don’t know how they felt about it; but a lot of the deals were processed without an issue (at the time.)

Only later, when the IRAS clampdown began, did the whole issue of misrepresentation come up. Some buyers then claimed they’d been misled, which I’d argue was effectively true from their position; but most of them were left holding the bag.

In the end, the only real defence is for buyers to avoid heuristics and common sayings.

Unfortunately this makes the buying process much less fun. You still get to view the nice homes, but it has to be coupled with a lot of hard, unglamarous, and frankly boring work. It means looking at layers of transactions, knowing policy nuances, and identifying all sorts of uncomfortable trade-offs.

It also means acknowledging that our regulatory environment – effective though it is – can’t realistically authorise every way a property will be represented to you. They can ensure that the facts presented are accurate, but not the way that facts are presented and framed.

The most practical defence for buyers is a simple one: write down your assumptions regarding each shortlisted property.

These are assumptions like “it’s cheap because it has the lowest quantum in this area,” or “it’s freehold but still cheaper than the leasehold next door, so it’s good value.”

Once your assumptions are clear, try to disprove the assumptions with the agent’s help, and with whatever independent checks you’re able to make. This will naturally lead you to why it’s cheaper, when most of the gains were made, which units had better or worse gains in the same project.

If your assumption still holds up under that scrutiny, then you may be dealing with a tangible reality. But weaker assumptions tend to unravel when you tug hard enough at any single loose thread; and in that case, it’s better to find out early than to argue about misdirections in court later.

Meanwhile in other property news…

- What does the fading of strata-titled malls mean for your lived experience? Check out this often overlooked effect on your amenities.

- We addressed a reader’s question on how to pick a condo when upgrading from an HDB flat. A lot of this applies to other upgraders too, so check it out if you’re buying this year.

- For those interested in a BTO flat next month, here’s a look at the various sites. Only four towns are available, but we see some strong locations nonetheless.

- We found locations where some HDB flats are defying lease decay, despite their advanced age. Check them out here.

Weekly Sales Roundup (19 – 25 January)

Top 5 Most Expensive New Sales (By Project)

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| GRAND DUNMAN | $5,274,000 | 2131 | $2,475 | 99 yrs (2022) |

| PINETREE HILL | $4,669,000 | 1733 | $2,694 | 99 yrs (2022) |

| NAVA GROVE | $4,555,300 | 1722 | $2,645 | 99 yrs (2024) |

| AMBER HOUSE | $3,983,000 | 1238 | $3,218 | FH |

| PENRITH | $3,878,000 | 1281 | $3,028 | 99 yrs (2024) |

Top 5 Cheapest New Sales (By Project)

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| THE CONTINUUM | $1,428,000 | 560 | $2,551 | FH |

| OTTO PLACE | $1,486,000 | 872 | $1,704 | 99 yrs (2024) |

| COASTAL CABANA | $1,532,000 | 872 | $1,757 | 99 yrs |

| THE MYST | $1,602,000 | 678 | $2,362 | 99 yrs (2023) |

| BLOOMSBURY RESIDENCES | $1,852,000 | 689 | $2,688 | 99 yrs (2024) |

Top 5 Most Expensive Resale

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| SILVERSEA | $4,800,000 | 2508 | $1,914 | 99 yrs (2007) |

| THE SHELFORD | $4,730,000 | 1851 | $2,555 | FH |

| BEDOK RESIDENCES | $4,500,000 | 3122 | $1,442 | 99 yrs (2011) |

| THE HOLLAND COLLECTION | $4,480,000 | 1841 | $2,434 | FH |

| CYAN | $4,200,000 | 1475 | $2,848 | FH |

Top 5 Cheapest Resale

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| THE INFLORA | $660,000 | 463 | $1,426 | 99 yrs (2012) |

| LE REGAL | $775,000 | 517 | $1,500 | FH |

| HILLION RESIDENCES | $832,000 | 474 | $1,757 | 99 yrs (2013) |

| WOODHAVEN | $850,000 | 646 | $1,316 | 99 yrs (2011) |

| THE HILLIER | $905,000 | 624 | $1,450 | 99 yrs (2011) |

Top 5 Biggest Winners

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | RETURNS | HOLDING PERIOD |

| COSTA RHU | $2,800,000 | 1647 | $1,700 | $2,035,000 | 21 Years |

| COTE D’AZUR | $2,838,800 | 1539 | $1,844 | $1,997,510 | 24 Years |

| MOULMEIN COURT | $2,550,000 | 1647 | $1,548 | $1,947,000 | 20 Years |

| CLYDESVIEW | $4,080,000 | 2121 | $1,924 | $1,800,000 | 16 Years |

| THE CHUAN | $2,750,000 | 1281 | $2,147 | $1,755,200 | 19 Years |

Top 5 Biggest Losers

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | RETURNS | HOLDING PERIOD |

| BELLE VUE RESIDENCES | $4,150,000 | 1981 | $2,095 | -$512,000 | 16 Years |

| 26 NEWTON | $1,750,000 | 775 | $2,258 | -$277,455 | 8 Years |

| SILVERSEA | $4,800,000 | 2508 | $1,914 | -$220,000 | 14 Years |

| DEVONSHIRE RESIDENCES | $1,020,000 | 495 | $2,060 | -$174,000 | 15 Years |

| CAIRNHILL NINE | $1,550,000 | 657 | $2,361 | -$105,001 | 10 Years |

Top 5 Biggest Winners (ROI%)

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | ROI (%) | HOLDING PERIOD |

| MOULMEIN COURT | $2,550,000 | 1647 | $1,548 | 323% | 20 Years |

| LE WOOD | $1,648,000 | 1270 | $1,297 | 283% | 20 Years |

| COSTA RHU | $2,800,000 | 1647 | $1,700 | 266% | 21 Years |

| COTE D’AZUR | $2,838,800 | 1539 | $1,844 | 237% | 24 Years |

| CASCADALE | $1,900,000 | 1550 | $1,226 | 233% | 20 Years |

Top 5 Biggest Losers (ROI%)

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | ROI (%) | HOLDING PERIOD |

| DEVONSHIRE RESIDENCES | $1,020,000 | 495 | $2,060 | -15% | 15 Years |

| 26 NEWTON | $1,750,000 | 775 | $2,258 | -14% | 8 Years |

| BELLE VUE RESIDENCES | $4,150,000 | 1981 | $2,095 | -11% | 16 Years |

| AVENUE SOUTH RESIDENCE | $1,150,000 | 527 | $2,180 | -8% | 4 Years |

| CAIRNHILL NINE | $1,550,000 | 657 | $2,361 | -6% | 10 Years |

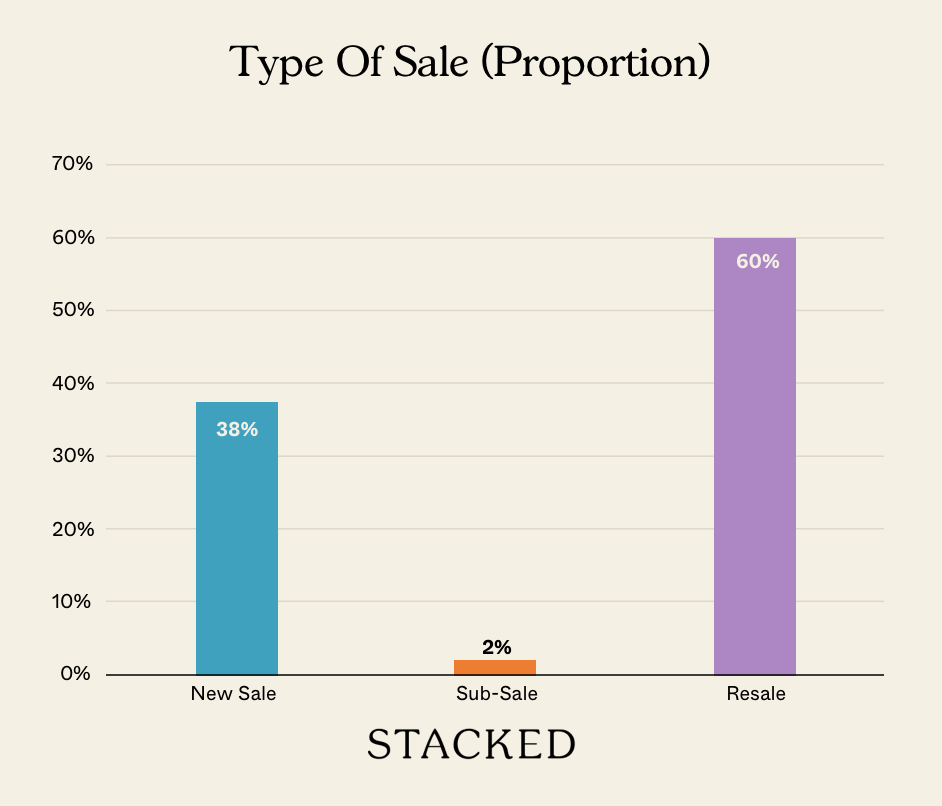

Transaction Breakdown

For more on the Singapore property market as it unfolds, follow us on Stacked.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Read next from Singapore Property News

Singapore Property News Narra Residences Sets a New Price Benchmark for Dairy Farm at $2,180 PSF — and the sales breakdown offers

Singapore Property News Newport Residences Sells 57% at Launch Weekend — But the Real Surprise Came From the Large Units

Singapore Property News A Rare Freehold Mall Is Up for Sale At $295 Million: Why the Market Is Paying Attention

Singapore Property News We Review The February 2026 BTO Launch Sites (Bukit Merah, Toa Payoh, Tampines, Sembawang)

Latest Posts

Overseas Property Investing This Overlooked Property Market Could Deliver 12–20% Growth — But There’s a Catch

Property Market Commentary Landed Home Sales Hit a Four-Year High — Here’s What That Could Mean for Prices in 2026

On The Market Here Are The Rare HDB Flats With Unblocked Views That Hardly Come Up for Sale

Pro Where HDB Flats Continue to Hold Value Despite Ageing Leases

Property Market Commentary What A Little-Noticed URA Rule Means For Future Neighbourhoods In Singapore

Editor's Pick We’re Upgrading From A 5-Room HDB On A Single Income At 43 — Which Condo Is Safer?

Pro What Happens When a “Well-Priced” Condo Hits the Resale Market

New Launch Condo Analysis This New Dairy Farm Condo Starts From $998K — How the Pricing Compares

Homeowner Stories We Could Walk Away With $460,000 In Cash From Our EC. Here’s Why We Didn’t Upgrade.

On The Market Here Are The Cheapest Newer 3-Bedroom Condos You Can Still Buy Under $1.7M

New Launch Condo Reviews Narra Residences Review: A New Condo in Dairy Farm Priced Close To An EC From $1,930 PSF

Property Market Commentary Why Looking at Average HDB Prices No Longer Tells the Full Story: A New Series

On The Market Orchard Road’s Most Unlikely $250 Million Property Is Finally Up for Sale — After 20 Years

Editor's Pick We Analyse “Safer” Resale Condos in Singapore to See If They’re Actually Worth Buying: A New Series

Editor's Pick Why 2026 May Be a Good Year to Buy an EC — With an Important Caveat