When A “Common” Property Strategy Becomes A $180K Problem

February 8, 2026

What sort of advice do you expect a realtor to give, when it comes to your property transaction?

Sometime back, I wrote about the 99-1 arrangement and how it relates to property ownership and the legal issues surrounding it. Just last month, a case related to this issue came to an end when a buyer dropped their lawsuit against ERA Realty, the agent in question, and a conveyancing law firm.

In brief, the buyer had used a 99-1 ownership structure when purchasing a new launch unit at Normanton Park, with his father taking a one per cent share of the property. It was reported that the arrangement was meant to reduce the Additional Buyer’s Stamp Duty (ABSD) payable.

In a typical 99-1 arrangement, the ABSD would apply only to the 1% share held by the ABSD-liable party, rather than to the full property value.

In December 2024, however, IRAS disregarded the structure and imposed $180,945 in additional stamp duty and penalties. The buyer then sued the agent, agency and law firm, alleging that the 99-1 arrangement that was presented to them as a common and accepted method.

The defendants, in turn, denied giving tax or legal advice and argued that their roles did not extend to guaranteeing the legality of the arrangement.

This case garnered a lot of attention, but before it could be tested in court, the buyer discontinued the lawsuit (with each party bearing its own costs)

I do feel for the buyer here.

From personal experience, I saw on the ground that the 99-1 arrangement was widely known. It was discussed online, surfaced regularly in public Q&A forums, and was treated as normal as a discussion on sell-one-buy-two tactics. It was a part of the property buying discourse.

For almost a decade, this went on with no high-profile public enforcement to shut it down. It was only in recent years that scrutiny tightened and some uncertainty began to set in among those who’d used the structure.

A lot of this, I feel, comes down to what kind of agents should give, and what kind of advice we should be taking from them.

Far be it from me to blame agents for all of this or their clients. My point is that more often than not, buyers and sellers are seldom experts (barring a few seasoned investors) to the nuances of financing, tax laws, and transaction processes. Prevailing market knowledge tends to blur into one face: that of their realtor.

The expectation is that the agents should know everything. From how to get a different valuation (a mortgage broker’s job), to how the CPF rules work (something they should be calling CPF about), to, yes, the consequences of arrangements like 99-1 holding structures.

There’s a tendency for agents to appear to look inexperienced, or sometimes even incompetent (depending on how judgmental a client might get) if they don’t at least appear familiar with all this.

And that’s not really the fault of the client either, since most buyers and sellers go through only a handful of property transactions in their entire lives. Most are highly dependent on the licensed professionals who guide them, amid a sea of migraine-inducing jargon and acronyms.

CEA does have requirements that property agents act in their clients’ best interests.

But this could place a disproportionately high burden on agents. Providing the best advice on tax questions, financing rules, and regulatory interpretations is a big challenge since these are entire professional domains in their own right. There’s a big difference between knowing about stack facings and buyer profiles in Bedok vs. Jurong, versus knowing how IRAS might interpret a complex ownership structure.

More from Stacked

Should You Buy Cuscaden Reserve Because Of The Huge Price Drop?

Cuscaden Reserve has been in the news of late, due to their big relaunch and price drop: we’re now seeing…

These obligations set out by CEA also seem to be grounded in the principles. They define what agents should aim to do with their advice, but they’re less explicit about how the advice should be framed, where its boundaries lie, or how those boundaries are relayed to clients.

Now I’m not saying agents should be completely barred from giving this sort of tangential advice.

I know that’s unrealistic, given how much overlap there is between these topics. What may be workable is a requirement for agents to clearly flag when a discussion strays beyond their core role. Agents can still explain how bank valuations or a 99-1 arrangement is commonly interpreted, but they should also put it in writing that this is not their main field.

Saying “your lawyer is the one who should be doing this, take their word over mine” doesn’t weaken the agent’s role but strengthens it.

Requiring this to be explicit and written down also protects agents in turn. It helps prevent conversational opinions from being mistaken as professional advice or actual endorsement. And if something ever does go wrong, it will be much clearer where the bad or negligent advice came from.

There really isn’t much incremental cost to doing this, and it may help to prevent these sorts of messy lawsuits in future.

Meanwhile, in other property news…

- The February BTO launch sites are out, and as always, here’s the Ultimate Guide for them so you can start planning.

- There may have been fewer BTO launch sites for February, but that’s because it’s part of something bigger. Check out these upcoming areas, some of which are the first in 40 years.

- Singapore’s CBD office rents have now been rising for seven straight quarters; but who’s behind this?

- HDB flats have an unusual relationship with lease decay, and that’s what we’re taking a look at on Stacked Pro. Find out the truth about how lease decay sinks in.

Weekly Sales Roundup (26 January – 01 February)

Top 5 Most Expensive New Sales (By Project)

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| NEWPORT RESIDENCES | $8,650,000 | 2067 | $4,185 | FH |

| ZYON GRAND | $4,875,000 | 1518 | $3,212 | 99 yrs (2024) |

| THE CONTINUUM | $4,769,000 | 1690 | $2,822 | FH |

| NAVA GROVE | $4,585,100 | 1722 | $2,662 | 99 yrs (2024) |

| GRAND DUNMAN | $4,352,000 | 1690 | $2,575 | 99 yrs (2022) |

Top 5 Cheapest New Sales (By Project)

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| NARRA RESIDENCES | $998,000 | 517 | $1,932 | 99 yrs |

| NEWPORT RESIDENCES | $1,298,000 | 431 | $3,015 | FH |

| THE COLLECTIVE AT ONE SOPHIA | $1,363,000 | 484 | $2,814 | 99 yrs (2023) |

| THE CONTINUUM | $1,428,000 | 560 | $2,551 | FH |

| COASTAL CABANA | $1,614,000 | 915 | $1,764 | 99 yrs |

Top 5 Most Expensive Resale

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| SEVEN PALMS SENTOSA COVE | $23,892,159 | 8794 | $2,717 | 99 yrs (2007) |

| TWENTYONE ANGULLIA PARK | $10,800,000 | 3122 | $3,460 | FH |

| CUSCADEN RESERVE | $6,000,000 | 1873 | $3,204 | 99 yrs (2018) |

| URBAN SUITES | $5,600,000 | 2045 | $2,738 | FH |

| MARINA BAY RESIDENCES | $5,398,000 | 1981 | $2,725 | 99 yrs (2005) |

Top 5 Cheapest Resale

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| HIGH PARK RESIDENCES | $656,888 | 388 | $1,695 | 99 yrs (2014) |

| THE OCTET | $670,000 | 431 | $1,556 | FH |

| METRO LOFT | $715,000 | 452 | $1,582 | FH |

| KINGSFORD WATERBAY | $720,000 | 484 | $1,486 | 99 yrs (2014) |

| EASTWOOD REGENCY | $735,000 | 452 | $1,626 | FH |

Top 5 Biggest Winners

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | RETURNS | HOLDING PERIOD |

| VILLAGE TOWER | $3,800,000 | 1830 | $2,077 | $2,140,000 | 17 Years |

| THE LUCENT | $3,358,000 | 2422 | $1,387 | $1,908,000 | 17 Years |

| THE SHELFORD | $2,680,000 | 1076 | $2,490 | $1,779,342 | 24 Years |

| COSTA RHU | $3,231,000 | 1776 | $1,819 | $1,707,500 | 30 Years |

| KOVAN RESIDENCES | $3,158,000 | 1776 | $1,778 | $1,684,000 | 16 Years |

Top 5 Biggest Losers

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | RETURNS | HOLDING PERIOD |

| CUSCADEN RESERVE | $3,042,000 | 936 | $3,248 | -$523,000 | 4 Years |

| MARINA BAY SUITES | $2,900,000 | 1593 | $1,820 | -$368,000 | 16 Years |

| 120 GRANGE | $1,610,000 | 570 | $2,822 | -$210,000 | 8 Years |

| THE URBANITE | $1,225,000 | 936 | $1,308 | -$105,000 | 13 Years |

| UPTOWN @ FARRER | $1,070,000 | 538 | $1,988 | -$1,740 | 5 Years |

Top 5 Biggest Winners (ROI%)

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | ROI (%) | HOLDING PERIOD |

| SIGNATURE PARK | $1,740,000 | 1033 | $1,684 | 225% | 19 Years |

| PINEHURST CONDOMINIUM | $2,425,000 | 1475 | $1,644 | 223% | 19 Years |

| THE SHELFORD | $2,680,000 | 1076 | $2,490 | 198% | 24 Years |

| SPRINGDALE CONDOMINIUM | $1,520,000 | 926 | $1,642 | 183% | 19 Years |

| QUEENS | $2,138,000 | 1184 | $1,806 | 175% | 26 Years |

Top 5 Biggest Losers (ROI%)

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | ROI (%) | HOLDING PERIOD |

| CUSCADEN RESERVE | $3,042,000 | 936 | $3,248 | -15% | 4 Years |

| 120 GRANGE | $1,610,000 | 570 | $2,822 | -12% | 8 Years |

| MARINA BAY SUITES | $2,900,000 | 1593 | $1,820 | -11% | 16 Years |

| THE URBANITE | $1,225,000 | 936 | $1,308 | -8% | 13 Years |

| UPTOWN @ FARRER | $1,070,000 | 538 | $1,988 | 0% | 5 Years |

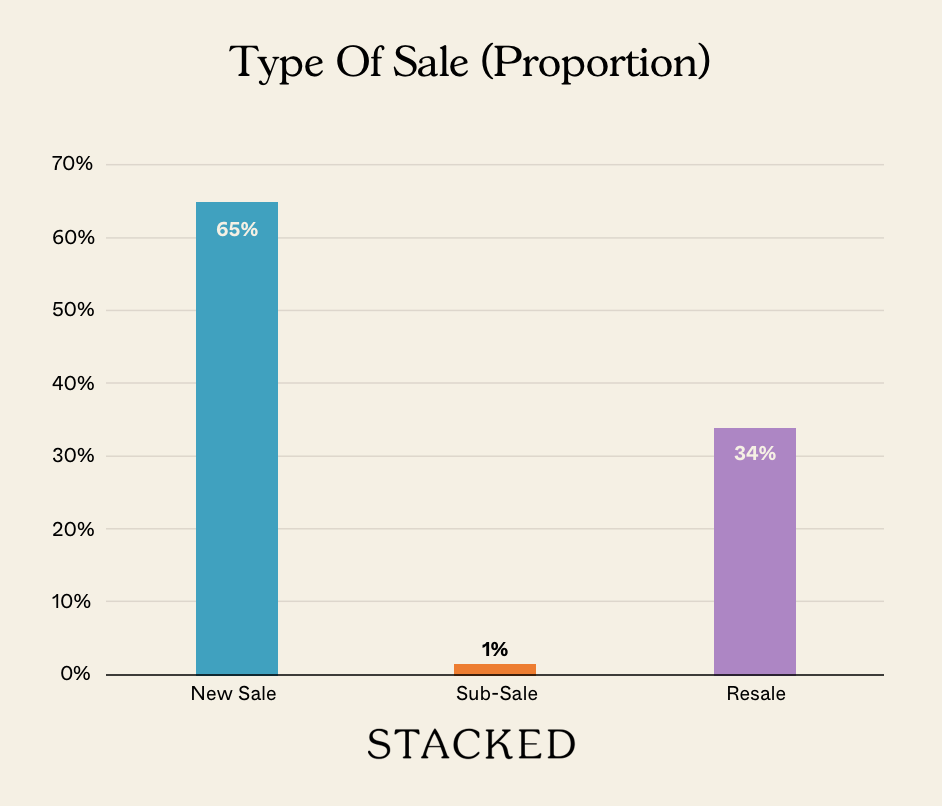

Transaction Breakdown

Follow us on Stacked for news and developments in the Singapore property market.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

What is a 99-1 property ownership arrangement and why is it controversial?

Can real estate agents legally advise clients on complex ownership structures like 99-1 arrangements?

What should property agents do to avoid legal issues when discussing ownership strategies with clients?

Why was the buyer in the case mentioned in the article unable to avoid additional stamp duty despite using a 99-1 structure?

What are the potential risks for buyers relying on agents' advice about property ownership structures?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Singapore Property News

Singapore Property News REDAS-NUS Talent Programme Unveiled to Attract More to Join Real Estate Industry

Singapore Property News Three Very Different Singapore Properties Just Hit The Market — And One Is A $1B En Bloc

Singapore Property News Singapore Could Soon Have A Multi-Storey Driving Centre — Here’s Where It May Be Built

Singapore Property News Will the Freehold Serenity Park’s $505M Collective Sale Succeed in Enticing Developers?

Latest Posts

On The Market Here Are Hard-To-Find 3-Bedroom Condos Under $1.5M With Unblocked Landed Estate Views

Pro Why Some Central Area HDB Flats Struggle To Maintain Their Premium

Property Advice We Sold Our EC And Have $2.6M For Our Next Home: Should We Buy A New Condo Or Resale?

2 Comments

Do we know if there was a settlement? I’m guessing realtors and real estate lawyers don’t want this to hit the court.

Because if the plaintiff is victorious, a lot of lawsuits will follow, and the realtors / real estate lawyers will have to pay out a lot of money.