This $1.5M Bukit Timah Executive HDB Flat With 62-Years Lease Left Just Set A Record: Here’s Why

May 7, 2025

If you’re keeping track of million-dollar HDB transactions, here’s one to add to your list: a Bukit Timah executive maisonette just changed hands for an eye-watering $1,501,555 in May 2025.

And no, that’s not a typo.

This 154 sqm (1,658 sq. ft.) unit at Toh Yi Gardens has just claimed the title of Singapore’s most expensive executive HDB flat, just edging out the $1.5m executive HDB over at Bishan.

But before you start fretting about “astronomical HDB prices,” here’s why this particular transaction stands apart from the usual million-dollar flat headlines.

Table of contents

The Numbers: Breaking Down Singapore’s Latest Record HDB Sale

Let’s first look at what you’re actually getting for $1.5 million:

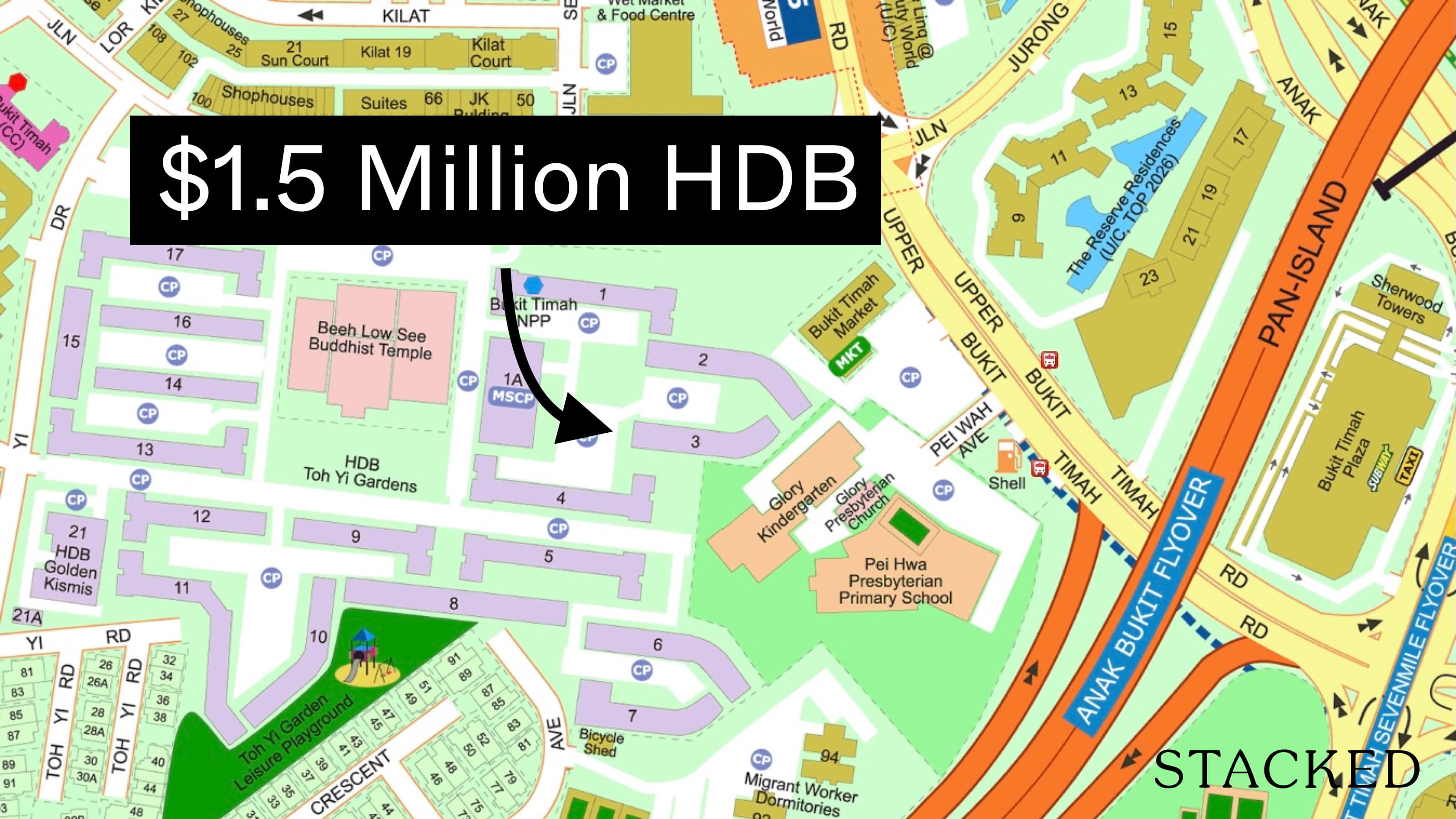

- Address: 3 Toh Yi Drive (Toh Yi Gardens)

- Flat Type: Executive Maisonette

- Size: 154 sqm (1,658 sq. ft.)

- Storey Range: 7th to 9th floor

- Lease Commenced: 1988

- Lease Remaining: 62 years and 4 months

This record-breaking flat sits between the 7th and 9th floors of Block 3, offering two increasingly rare commodities in Singapore—space and elevation. At 1,658 square feet, it’s almost twice the size of today’s standard 4-room BTO flat (typically around 90 sqm or 970 sqft).

For context, the previous highest transaction in this estate was also an executive flat that sold for $1.29 million in the same month, but was located between the 1st and 3rd floors. Another executive flat in Block 2 sold for $1.46 million in February 2025.

Past Record-Breaking Prices

For those who are curious, here’s a look at the top 10 highest Executive flat prices so far.

| Period | Estate | Address | Price | Floor | Size (Sqm) | Flat Type | Lease Started |

| 2025-05 | BUKIT TIMAH | 3 TOH YI DR | $1,501,555 | 07 TO 09 | 154 | Maisonette | 1988 |

| 2024-05 | BISHAN | 286 BISHAN ST 24 | $1,500,000 | 22 TO 24 | 172 | Maisonette | 1992 |

| 2025-03 | BISHAN | 135 BISHAN ST 12 | $1,500,000 | 22 TO 24 | 163 | Maisonette | 1987 |

| 2024-02 | BISHAN | 286 BISHAN ST 24 | $1,480,000 | 22 TO 24 | 172 | Maisonette | 1992 |

| 2024-06 | BISHAN | 447 BRIGHT HILL DR | $1,480,000 | 22 TO 24 | 174 | Maisonette | 1990 |

| 2025-02 | BUKIT TIMAH | 2 TOH YI DR | $1,460,000 | 10 TO 12 | 146 | Maisonette | 1988 |

| 2023-09 | BISHAN | 278 BISHAN ST 24 | $1,450,000 | 19 TO 21 | 172 | Maisonette | 1992 |

| 2024-05 | BISHAN | 241 BISHAN ST 22 | $1,448,000 | 07 TO 09 | 141 | Apartment | 1992 |

| 2025-04 | BUKIT TIMAH | 6 TOH YI DR | $1,418,000 | 07 TO 09 | 150 | Maisonette | 1989 |

| 2024-10 | BISHAN | 103 BISHAN ST 12 | $1,410,000 | 22 TO 24 | 163 | Maisonette | 1986 |

The Scarcity Factor

HDB presence in Bukit Timah is already a rarity in itself. The entire Toh Yi Gardens estate comprises just 20 residential blocks housing 1,713 units total. Breaking this down further:

| Block | 2 Room Flats | 3 Room Flats | 4 Room Flats | 5 Room Flats | Executive Flats | Studio Apartments |

| 1 | 0 | 0 | 72 | 60 | 0 | 0 |

| 2 | 0 | 0 | 0 | 0 | 78 | 0 |

| 3 | 0 | 0 | 0 | 0 | 64 | 0 |

| 4 | 0 | 0 | 72 | 60 | 0 | 0 |

| 5 | 0 | 0 | 72 | 60 | 0 | 0 |

| 6 | 0 | 0 | 0 | 0 | 78 | 0 |

| 7 | 0 | 0 | 0 | 0 | 76 | 0 |

| 8 | 0 | 0 | 0 | 0 | 32 | 0 |

| 9 | 0 | 0 | 54 | 42 | 0 | 0 |

| 10 | 0 | 0 | 0 | 0 | 36 | 0 |

| 11 | 0 | 0 | 69 | 46 | 0 | 0 |

| 12 | 0 | 0 | 48 | 40 | 0 | 0 |

| 13 | 0 | 0 | 81 | 57 | 0 | 0 |

| 14 | 0 | 0 | 54 | 42 | 0 | 0 |

| 15 | 0 | 0 | 0 | 0 | 16 | 0 |

| 16 | 0 | 0 | 54 | 42 | 0 | 0 |

| 17 | 0 | 0 | 75 | 63 | 0 | 0 |

| 18 | 0 | 13 | 9 | 0 | 0 | 0 |

| 19 | 0 | 8 | 8 | 0 | 0 | 0 |

| 21 | 57 | 0 | 0 | 0 | 0 | 75 |

| Total | 57 | 21 | 668 | 512 | 380 | 75 |

More from Stacked

I Sold 3 Condos In My First Month As An Agent, But Nothing For 18 Months After: Here’s Why New Agents Need To Worry

With the property market being at a new peak, we’ve seen a familiar phenomenon; one that we also witnessed back…

- Total executive flats: 380 units (22% of all units)

- Most flats here are 146 sqm in size

- Maisonette configurations are no longer built by HDB, creating a fixed supply

When you combine the limited supply of HDB flats in Bukit Timah with the discontinued maisonette layout, you’re looking at what economists might call “artificial scarcity” – a limited supply that cannot be increased.

Location Attributes That Set This Unit Apart

This particular unit comes with several notable features:

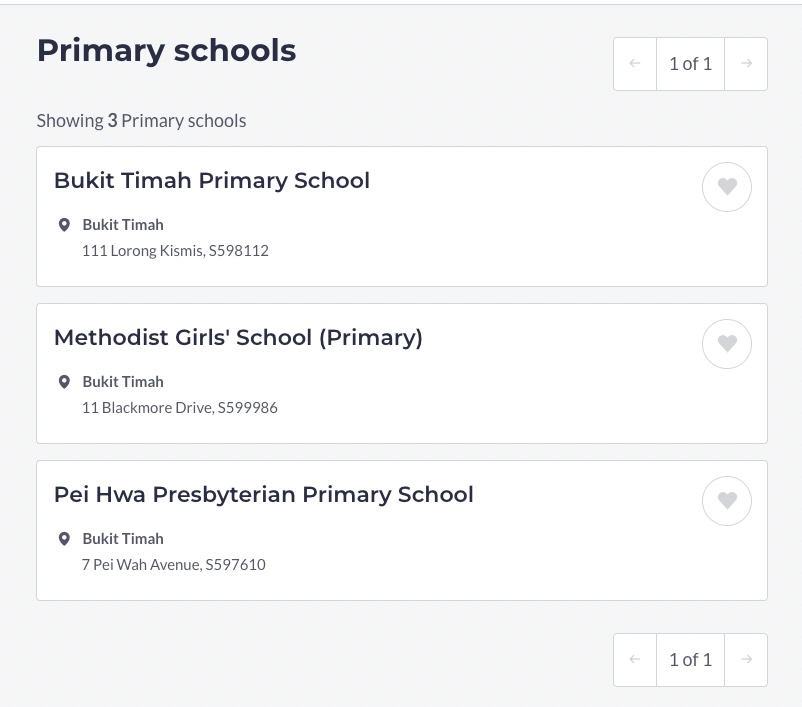

- School zone advantages: Next to Pei Hwa Presbyterian Primary (ranked #3 in popularity) and within 1km of Methodist Girls’ Primary (ranked #25).

- Transportation convenience: About a 5-minute walk to Beauty World MRT, one stop from King Albert Park which will become an interchange with the Cross Island Line.

- Retail amenities: Bukit Timah Plaza, Beauty World Plaza, Bukit Timah Shopping Centre, Beauty World Centre, and KAP Mall are all within walking distance.

- Nature proximity: The Rail Corridor is a short cycle away.

- View factor: Being between the 7th and 9th floors likely provides some views toward the Holland landed enclave, although it does face the expressway.

Price vs. Value: The Complex Equation

While $1.5 million for an HDB flat with 62 years of lease remaining raises obvious questions about price versus value, comparing it with private alternatives presents an interesting paradox.

Recent transactions for similar-sized private condos in the area:

| Project | Price | Size | Bedrooms | $PSF | Date Transacted |

| FLORIDIAN | $3,880,000 | 1,679 | 3 | 2311 | 25 Jul 2024 |

| FLORIDIAN | $3,880,000 | 1,679 | 3 | 2311 | 26 Aug 2024 |

| FLORIDIAN | $4,048,000 | 1,668 | 3 | 2426 | 17 Mar 2025 |

| THE CREEK @ BUKIT | $2,513,000 | 1,668 | 4 | 1506 | 25 Nov 2024 |

| LA SUISSE | $2,630,000 | 1,657 | 3 | 1587 | 7 Jan 2025 |

| LA SUISSE | $2,780,000 | 1,657 | 3 | 1677 | 14 Jan 2025 |

| LA SUISSE | $2,500,000 | 1,657 | 3 | 1508 | 17 Jan 2025 |

| BUKIT REGENCY | $2,568,000 | 1,646 | 4 | 1559 | 10 Dec 2024 |

| HIGHGATE | $2,588,000 | 1,636 | 4 | 1582 | 22 Aug 2024 |

| HUME PARK I | $2,578,000 | 1,582 | 3 | 1629 | 9 Jan 2025 |

| HUME PARK I | $2,700,000 | 1,582 | 3 | 1706 | 23 Jan 2025 |

| THE RAINTREE | $2,260,000 | 1,582 | 4 | 1428 | 13 Jun 2024 |

| THE HILLSIDE | $2,358,000 | 1,571 | 3 | 1500 | 21 Apr 2025 |

| SHERWOOD TOWER | $1,525,000 | 1,560 | 3 | 977 | 25 Feb 2025 |

| FORETT@BUKIT TIMAH | $3,300,000 | 1,560 | 4 | 2114 | 4 Sept 2024 |

- The Floridian: $3.88-$4.04 million (around $2,300-2,400 psf)

- La Suisse: $2.5-$2.78 million (around $1,500-1,700 psf)

- The Creek @ Bukit: $2.51 million ($1,506 psf)

- Bukit Regency: $2.56 million ($1,559 psf)

What’s particularly interesting is the comparison with Sherwood Tower, where a 1,560 sq. ft. unit transacted for $1.52 million in February 2025. That’s virtually identical pricing to this HDB unit, despite Sherwood Tower offering condominium facilities and status.

This raises a legitimate question: Why would a buyer pay essentially the same price for an HDB flat as they could for a comparable-sized leasehold condo in the same area? The typical advantages of an HDB purchase (lower price point, no maintenance fees) seem negated at this price level.

The answer might lie in factors beyond the tangibles – perhaps the specific unit layout, the orientation, or other subjective elements that made this particular HDB unit more appealing than its private counterpart.

What Does This Sale Tell Us About The Market?

This transaction represents a fascinating case study in how traditional pricing models can break down when extreme scarcity meets high desirability.

At $1.5 million, this unit sold for approximately $906 per square foot. While this is substantially below what you’d pay for a new private development, it’s certainly high for an HDB property with 62 years of lease remaining.

The pricing suggests we may be witnessing a blurring of lines between how certain segments of buyers value public and private housing, especially in locations where HDB supply is extremely limited.

Future Implications

This record sale coincides with plans for new HDB development in the Bukit Timah area after a 40-year hiatus. The Beauty World transformation plan is gradually taking shape, with the URA’s rejuvenation efforts potentially adding more value to existing properties.

This has naturally led to speculation about a possible SERS (Selective En bloc Redevelopment Scheme) for some older blocks, though this remains purely speculative at this point.

The Bigger Picture

While this $1.5 million transaction makes for attention-grabbing headlines, it’s important to view it as what it truly is – an outlier representing the upper end of the HDB market.

For the vast majority of HDB buyers and sellers, transactions like these have little bearing on their own property decisions. Most HDB units don’t possess the unique combination of factors that drove this particular sale.

Nevertheless, it does illustrate an interesting trend where certain HDB properties with unique attributes are being valued more like private properties than traditional public housing.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

Why did the Bukit Timah executive HDB flat sell for over $1.5 million?

What makes this Bukit Timah HDB flat different from other public housing?

How does the price of this HDB flat compare to private condos in the area?

What factors contribute to the scarcity of HDB flats in Bukit Timah?

What could this record-breaking sale indicate about the HDB market?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Singapore Property News

Singapore Property News REDAS-NUS Talent Programme Unveiled to Attract More to Join Real Estate Industry

Singapore Property News Three Very Different Singapore Properties Just Hit The Market — And One Is A $1B En Bloc

Singapore Property News Singapore Could Soon Have A Multi-Storey Driving Centre — Here’s Where It May Be Built

Singapore Property News Will the Freehold Serenity Park’s $505M Collective Sale Succeed in Enticing Developers?

Latest Posts

On The Market Here Are Hard-To-Find 3-Bedroom Condos Under $1.5M With Unblocked Landed Estate Views

Pro Why Some Central Area HDB Flats Struggle To Maintain Their Premium

Property Advice We Sold Our EC And Have $2.6M For Our Next Home: Should We Buy A New Condo Or Resale?

0 Comments