What “Lucky” Singaporean Homebuyers Used To Get Away With — That You Can’t Today

December 17, 2025

Singapore’s property market has evolved as a result of policy adjustments and shifting market trends, spurred by recent crises such as the Global Financial Crisis in 2009 and the Covid-19 pandemic in 2019. Not all of it is bad and some steps, like cooling measures and loan curbs, were probably necessary to ensure stability in the housing market.

But the combination of policy changes, along with shifting market trends, means that Singaporean homeowners in the past enjoyed things that subsequent generations may not; at least in the foreseeable future.

Here are some landmark changes in the housing market younger new homebuyers may not experience anymore:

1. The BTO windfall years

The Housing and Development Board (HDB) rolled out the new location-based classification of Build-to-Order (BTO) flats in 2024. Since October last year, new BTO flats have been classified as Standard, Plus, or Prime, to reflect their locational attributes.

For some, this change could be viewed as a double-edged sword, and view the new generation of homebuyers as lucky to avoid the perceived unfairness of the previous classification, such as those who were on the tail-end of the balloting system.

Previously, scoring an HDB flat in a mature and especially centrally-located area had a high chance of garnering a huge profit windfall when the flat was subsequently sold. One good example of this was the Bidadari estate, where a three-room flat recently sold for around $900,000.

Today, a BTO flat in an area as central as Bidadari is likely to come under the Prime or Plus category. These flats come with a 10-year Minimum Occupancy Period (MOP), a subsidy recovery based on the project in question, and restrictions faced by future buyers such as an income ceiling applicable to resale buyers. This means that while some homeowners who secure a Plus or Prime flat may have a better chance to reap higher capital gains on the resale market, the chances of a windfall are not as assured as it once was.

The owners of Plus and Prime BTO flats would also have to wait at least 13 years before any capital gains on their property could be realised. This period typically comprises a three- to four-year construction time, plus the 10-year MOP. For some aspiring HDB upgraders, this makes these flats less suited to their upgrading plans.

Given the slew of million dollar flats entering the market and the degrees of discontent it has generated among some homeowners, some might claim that Gen Z or subsequent generations are lucky to avoid a repeat.

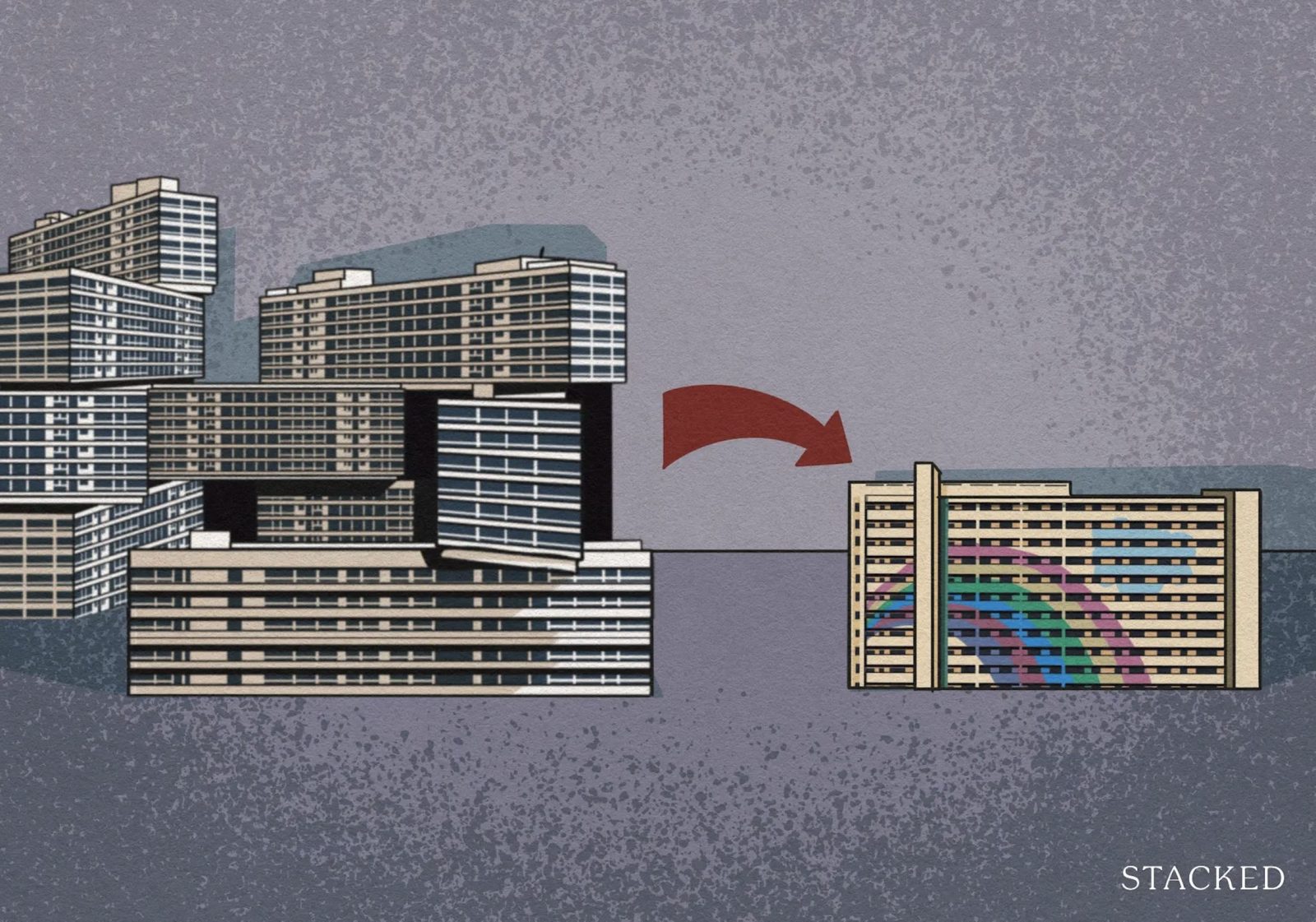

2. An additional layer of “sandwich housing”

Executive Condominiums (ECs) are a category of residential properties for so-called “sandwiched” buyers. For now, ECs make up the only type of residential property that is commonly viewed as partway between public housing and the private market.

But in earlier years, there was another “rung” of semi-private housing: The Design, Build, and Sell Scheme (DBSS) was a short-lived programme that was introduced in 2005 and discontinued in 2012. The policy produced 13 projects that tried to bridge the gap between public and private housing for a growing and affluent middle class. It offered public housing developments that were designed and built by private developers, but did not come with resident facilities like pools or gyms.

The government’s DBSS policy was not well-received when it was offered. We’ve covered some of the reasons in this old article, but construction standards aside, the last few DBSS projects defeated the purpose by sometimes having units that could rival ECs or (at the time) smaller resale condo units in price.

However, in recent years, DBSS projects have fared much better in the resale market, with several record-breaking projects among their ranks. Moreover, the original spirit of the idea, which sought to provide another intermediary step between a flat and a condo besides an EC, might have been welcome to some homebuyers.

For now, the only form of semi-private housing on the market is EC developments. Today, this category of residential developments would benefit from a much-needed review to increase the income ceiling criteria.

3. Being able to “chope” your new launch units for long periods, even over a year sometimes

Before 2020, if you found a new launch unit you liked but needed extra time, such as waiting to sell the previous home or secure a better loan package, you could sometimes still “chope” it.

Back then, after you’d put down the option fee for the option to purchase (OTP), a sympathetic developer would agree to reissue the OTP whenever it expired. There wasn’t a formal limit and it was down to what the developer accepted. But by using this method, some buyers could hold onto the same unit for months on end, and in some cases even beyond a year.

Most developers didn’t complain either, as a reissued OTP often made sales numbers appear healthier, and the units were officially described as “taken.” But this had the unintended effect of distorting buying demand, since it occasionally happened that an “almost fully sold out” condo would see a lot of returned units later.

In any case, all of this ended in September 2020, when URA and the Controller of Housing banned OTP reissues beyond 12 weeks. They also prohibited reissuing the same option to the same buyer for 12 months after expiry.

It was necessary to maintain market discipline, but it also removed a potential advantage for some buyers. For example, buyers now face a tighter timeline to sell off their previous home or to handle any financing difficulties.

4. There was a time when moving from a condo back to a flat was much easier for Singaporeans below 55

This is another double-edged situation. In September 2022, the government introduced a 15-month wait-out period for private property owners selling their property and before they could buy a non-subsidised resale flat. This wait-out period is waived for seniors aged 55 years and older who are buying a four-room or smaller-sized flat.

The wait-out period aimed to stall cash-flush homeowners who recently sold their private property from immediately reallocating their capital into the public housing market and inadvertently driving up resale prices.

More from Stacked

6 Terribly Bad Property “Advice” To Avoid In Singapore

Bad property advice can come from the best of intentions, but that doesn’t change the financial damage it can cause.…

On the downside though, this can be a pain point for those who face changing circumstances. Consider, for instance, a buyer who upgraded to a condo but then suffered a loss of income, when their industry entered a prolonged downturn. There are also some flexibility issues, such as if a younger couple bought a two-bedder but are now expecting more children and need to move back into a larger flat.

This does mean that private home buyers need to plan ahead more extensively, as switching back to a flat is not as simple. Whilst proper foresight and preparations can be made, it is still an added obstacle compared to buyers in the past.

This year, the government announced that it is reviewing the policy.

5. Trading spaciousness for location is easier, but the reverse may not be true

In recent years, developers have built with a higher cost on a per square foot basis, but coupled it with a lower quantum (overall cost). This is one of the reasons we’re seeing more affordable units in traditionally expensive areas, like the Core Central Region (CCR). But that affordability comes at a price – however more efficient today’s units are, the fact remains that they’re usually smaller in terms of raw square footage.

(Although to be clear, that isn’t the only reason for a smaller square footage – on paper, GFA harmonisation has also reduced the recorded total square footage by excluding elements like air-con ledges)

This isn’t just confined to the CCR though. Even one of the cheaper city fringe launches this year – Canberra Crescent Residences – has seen prices of around $1,880 to $2,150 psf. On a $PSF basis, these are prices that – prior to COVID – many would have associated with city centre or city fringe regions.

Developers have tried to compensate for the smaller spaces, using layouts like dumbbell designs and Jack and Jill bathrooms. But for homebuyers who insist on 1,000 sq ft. three-bedders as being the minimum acceptable “family size,” finding an affordable home might be more challenging – especially if they’re insistent on keeping it below $1.8 million to $2 million. For this group of buyers, access to more central locations doesn’t always justify the trade-off.

6. Buying an older property and then exiting via an en-bloc, is going to be a much rarer experience

Some Singaporeans may remember the heady days when the property market experienced an “en-bloc fever” and even a time when there was a rather cyclical five-year cycle (i.e., all the redevelopments would be done in five years due to the ABSD limit, thus sparking off another round of en-bloc sales).

For the current batch of property sellers with older freehold condos, this experience is far less likely. Older freehold estates that once seemed like prime en-bloc candidates – Pandan Valley, Spanish Village, Braddell View, etc. – seem stuck in limbo. Even freehold status doesn’t seem to help much; not when the government is aggressively putting out Government Land Sales (GLS) sites.

Coupled with higher construction costs, GFA harmonisation that reduces saleable floor space, and owners struggling with the cost of replacement properties, en-bloc prospects for these older large freehold projects are quite dim. The best hopes lie with boutique plots of land, such as developments with 50 or so units, that smaller developers can target.

On the buyer side of the equation, this could also be a limitation: it’s much more worrying to buy into an older large freehold project today, when you know an en-bloc is far less likely (even if you’re not banking on it personally, it’s a concern that your future buyer might have.)

It’s not all doom-and-gloom, though

For buyers in 2025, it may be time for their perceptions of the property market to undergo a paradigm shift. Rather than focus on older points of importance such as freehold tenure, sheer square footage of a unit, and en-bloc prospects, it is a good time to look at what wasn’t possible before.

True, you can no longer win as big a BTO lottery as the people before you – but at least having Plus and Prime flats gives you a better chance at getting a central area property. And it’s true that a condo you can afford today is likely to be a lot smaller, but unlike buyers in the 1990’s or 2000’s a condo in District 9 or 10 is not an unattainable dream. Relatively smaller unit sizes and lower price quantum may benefit the budget of some young couples, who may not previously have the chance to own a property there.

You may also notice we haven’t brought up Additional Buyers Stamp Duty (ABSD), which was lower in previous decades

This is partly because for the majority of local buyers in Singapore owning a second property is far less likely today. You don’t need to hear us tell you that. With ABSD and tighter loan curbs, few Singaporeans today can afford to “sell one, buy two.”

But even here, there is a bit of a silver lining. While the benefit is less tangible, at least buyers won’t experience sharp price increases as we saw in the aftermath of the Global Financial Crisis, where buoyant property prices in some segments of the private residential market made some properties beyond the budget of typical buyers in some cases. Without the ABSD, for instance, the post-COVID phase could have raised private home prices even higher than where they are at today.

So while ambitions have to be curbed somewhat, buyers today are armed with advantages. It’s also important to look beyond old-school strategies and biases about Singapore’s property market, which have become less tenable given the evolution of the market in recent years.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Editor's Pick

Editor's Pick Happy Chinese New Year from Stacked

Property Market Commentary How I’d Invest $12 Million On Property If I Won The 2026 Toto Hongbao Draw

Overseas Property Investing Savills Just Revealed Where China And Singapore Property Markets Are Headed In 2026

Property Market Commentary We Review 7 Of The June 2026 BTO Launch Sites – Which Is The Best Option For You?

Latest Posts

Pro This Singapore Condo Has Bigger Units Near The MRT — But Timing Decided Who Made Money

Singapore Property News Nearly 1,000 New Homes Were Sold Last Month — What Does It Say About the 2026 New Launch Market?

Singapore Property News The Unexpected Side Effect Of Singapore’s Property Cooling Measures

0 Comments