These Resale Condos In Singapore Were The Top Performers In 2025 — And Not All Were Obvious Winners

December 17, 2025

The nine-year period from 2014 to 2025 has been a charged chapter in Singapore’s property market. Unannounced property cooling measures softened buying demand for some periods, shutdowns during the Covid-19 pandemic interrupted the market which later rebounded sharply in the years that followed.

The good news is that most buyers who bought properties since 2014 have a higher chance of coming out ahead, buying in when the property market was relatively weak and now selling as the market strengthened in recent years.

But even among these winners, there are degrees of difference. So we’re taking a deep dive into the condominiums that have excelled even while the wider market has risen. Here’s a look at the top few in each region:

A quick note on methodology:

For the following, we will look at the capital gains and price appreciation of projects with resale transactions between 2014 to 2025. To do this, we analysed transactions lodged in 2025, using transactions held by the same owner from 2014 to November 2025. We have also excluded projects with fewer than five transactions to avoid distortions from outliers.

For each region, we have listed only the top 10 performing projects and rank them based on the highest percentage gains based on their average price.

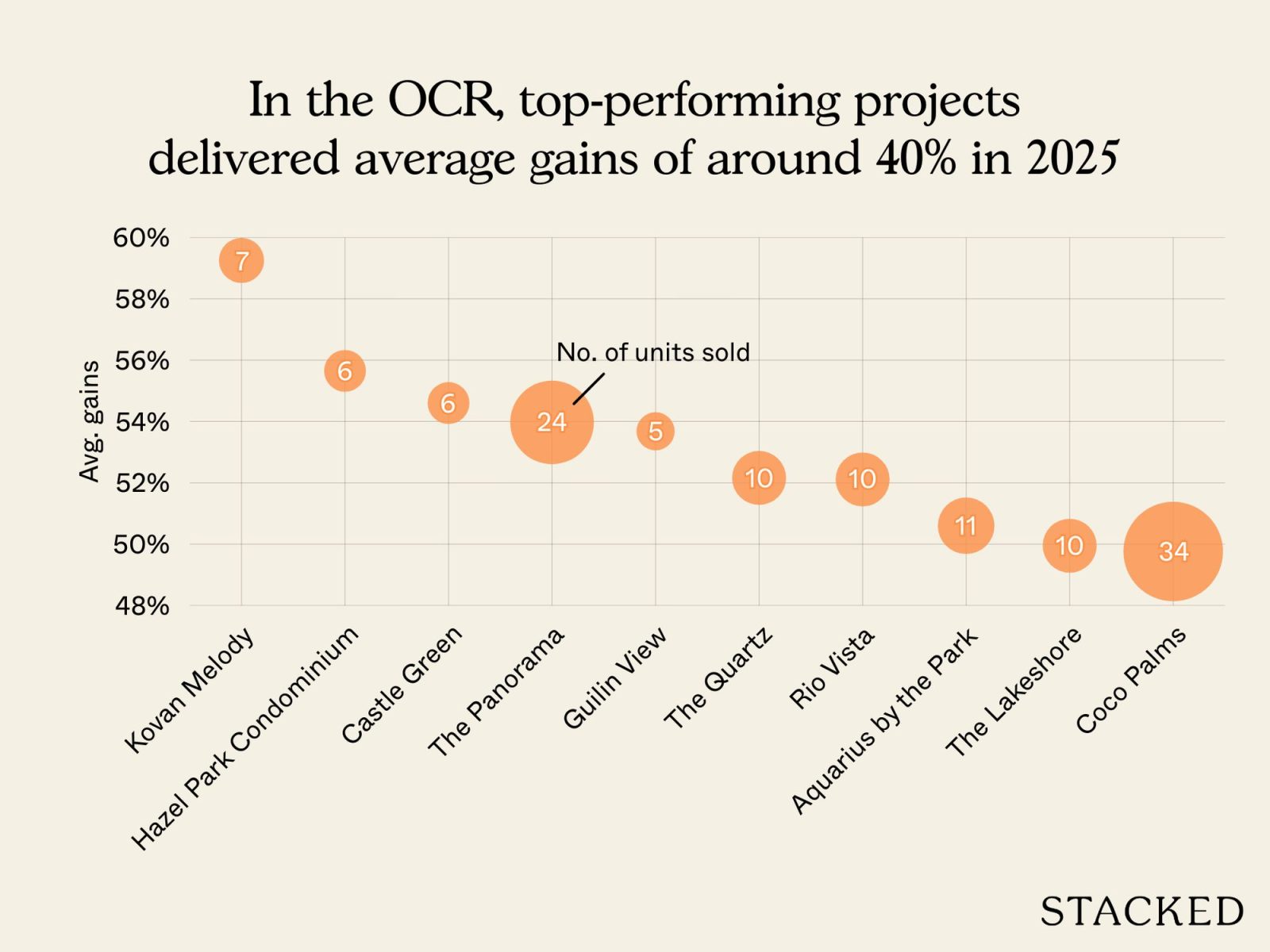

The Outside of Central Region (OCR)

| Project | Average gains | No. of units sold |

| KOVAN MELODY | 59.25% | 7 |

| HAZEL PARK CONDOMINIUM | 55.65% | 6 |

| CASTLE GREEN | 54.60% | 6 |

| THE PANORAMA | 53.97% | 24 |

| GUILIN VIEW | 53.68% | 5 |

| THE QUARTZ | 52.16% | 10 |

| RIO VISTA | 52.11% | 10 |

| AQUARIUS BY THE PARK | 50.60% | 11 |

| THE LAKESHORE | 49.95% | 10 |

| COCO PALMS | 49.76% | 34 |

For comparison, the average gain in the OCR from 2014 to 2025 (across all projects in the region) was 40 per cent; our top 10 condos have beaten that by a significant margin of close to 10 percentage points or more.

All of the top 10 performers have a perfect record of profitable transactions. All the transactions were resale-to-resale, with the exception of The Panorama, where there were 15 new-to-resale transactions. The significance of this is that most gains didn’t come from developer discounts, even those who bought these condos at resale have seen profits.

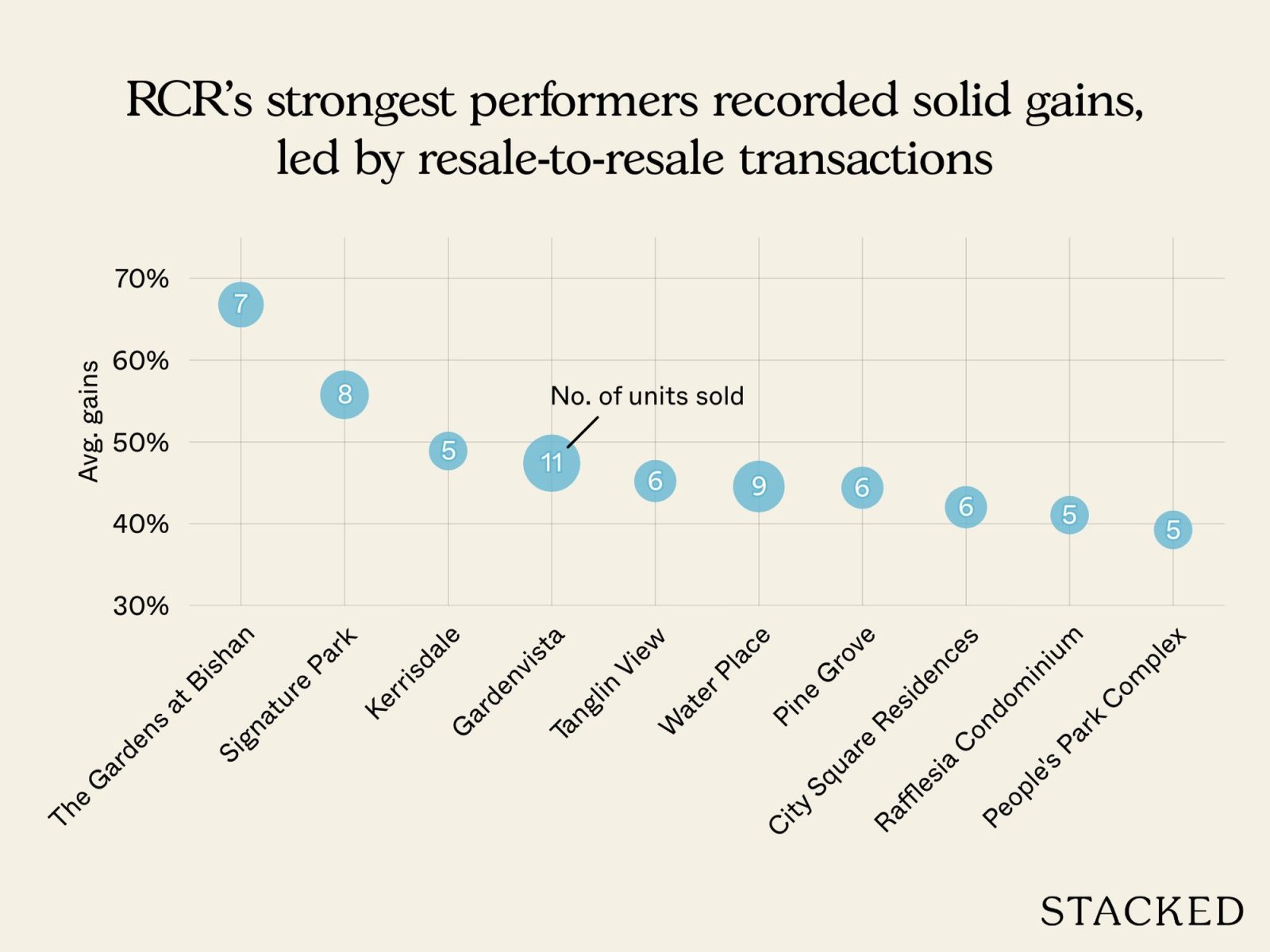

The Rest of Central Region (RCR)

| Project | Average gains | No. of units sold |

| THE GARDENS AT BISHAN | 66.79% | 7 |

| SIGNATURE PARK | 55.77% | 8 |

| KERRISDALE | 48.89% | 5 |

| GARDENVISTA | 47.40% | 11 |

| TANGLIN VIEW | 45.21% | 6 |

| WATER PLACE | 44.55% | 9 |

| PINE GROVE | 44.39% | 6 |

| CITY SQUARE RESIDENCES | 42.02% | 6 |

| RAFFLESIA CONDOMINIUM | 41.06% | 5 |

| PEOPLE’S PARK COMPLEX | 39.25% | 5 |

For comparison, the average gains in the RCR are 26 per cent, from 2014 to 2025. As with their OCR counterparts, our top 10 performers beat the average by a wide margin. For example, the property lowest on our ranking list, People’s Park Complex, still beat the regional average by around 13 per cent. That said, People’s Park Complex is a leasehold project built in 1972, hence it’s one of the lowest-priced options in the RCR – this naturally allows for stronger percentage gains.

More from Stacked

Can a One-Bedder Outperform a Two-Bedder? We Analysed 5 Years of Data

It’s a common saying that if you’re going to buy a smaller unit, you should buy a two-bedder (ideally two-bed,…

All transactions were resale-to-resale, so none of these are affected by developer pricing. There were no unprofitable transactions.

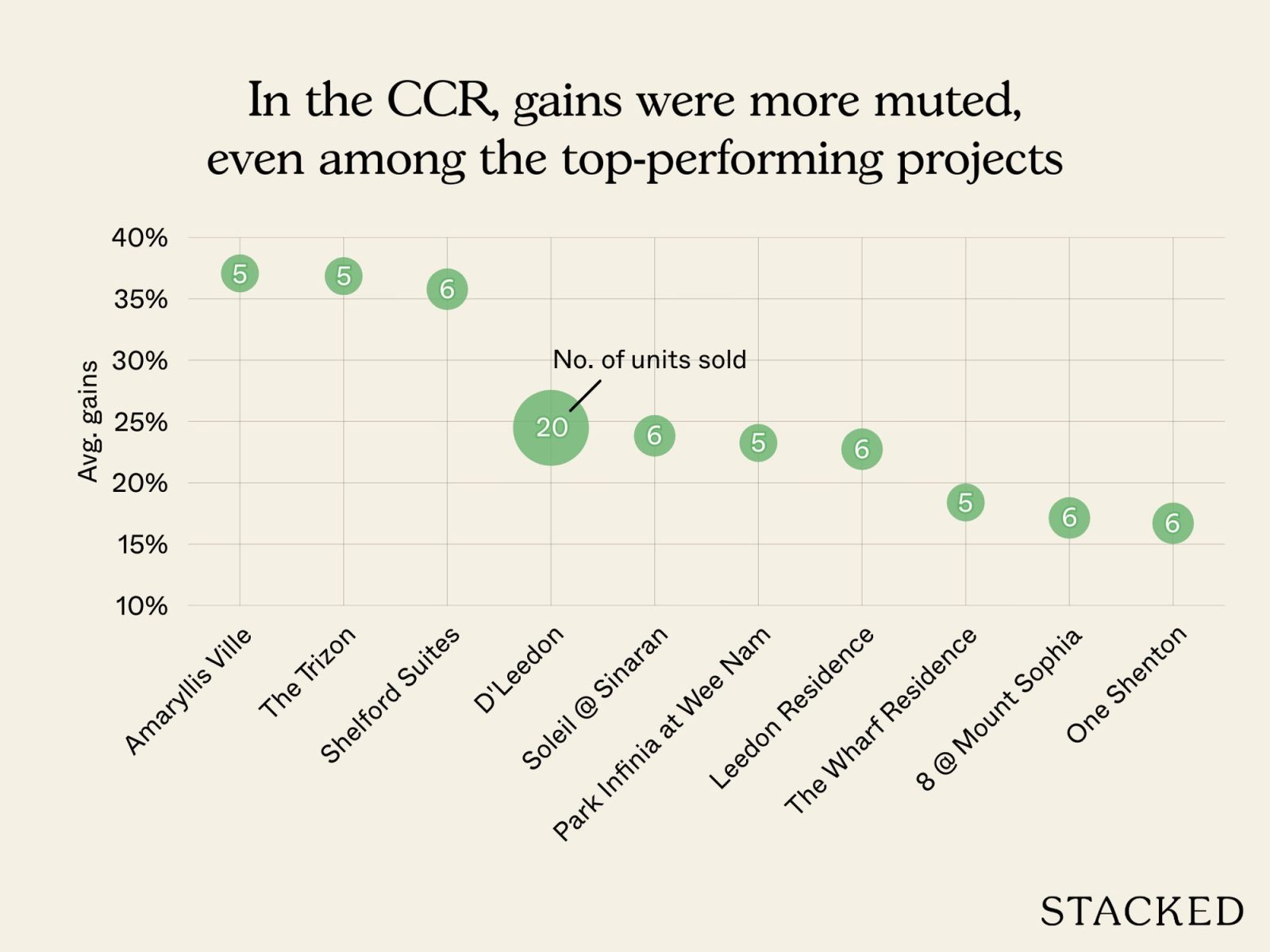

The Core Central Region (CCR)

| Project | Average gains | No. of units sold |

| AMARYLLIS VILLE | 37.07% | 5 |

| THE TRIZON | 36.85% | 5 |

| SHELFORD SUITES | 35.78% | 6 |

| D’LEEDON | 24.48% | 20 |

| SOLEIL @ SINARAN | 23.83% | 6 |

| PARK INFINIA AT WEE NAM | 23.25% | 5 |

| LEEDON RESIDENCE | 22.74% | 6 |

| THE WHARF RESIDENCE | 18.40% | 5 |

| 8 @ MOUNT SOPHIA | 17.14% | 6 |

| ONE SHENTON | 16.70% | 6 |

The average gains for the CCR were 15 per cent, from 2014 to 2025. Percentage based gains are the weakest in this region, which is not unsurprising. It’s because properties here already come in at a higher base price, thus allowing less room for growth.

For example, the strongest performer, Amaryllis Ville, recorded average gains of 37.07 per cent, while projects such as One Shenton and 8 @ Mount Sophia delivered gains below 20 per cent. In contrast, OCR projects like Kovan Melody and Hazel Park were able to post gains of over 55 per cent, due to their lower base price.

All the transactions were resale-to-resale, with the exception of four new-to-resale transactions at D’Leedon. One Shenton also recorded a single unprofitable transaction, but this was an outlier.

Two notable factors that impacted pricing from 2014 to 2025

The first was that in 2014 there was a much greater gap between OCR and RCR/CCR pricing. That year, the condos in the CCR catered toward affluent buyers and investors, quite different to today when higher ABSD rates and a lower quantum are changing CCR buyer demographics.

The second factor is that buyers in 2014 were generally more fortunate. The previous property peak was in 2013 and this caused the government to impose multiple property cooling measures over the next few years, thus softening the market (you can see more details here). As such, most buyers in 2014 would probably have purchased at a lower price point and seen better gains.

This aside, we also notice that most of these are older, unglamorous projects that never made launch headlines. Notably, Hazel Park, Castle Green, Guilin View, Pine Grove, Signature Park. These are not what condo buyers typically queue for. But they tend to share two traits: larger land plots and unit layouts that are hard to replicate today. As the size of some units in new launches get smaller and more compact, these older projects become substitutes for buyers who want space but cannot afford landed homes.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

Which condos in Singapore had the highest price gains from 2014 to 2025?

Are the top resale condos in Singapore mostly new or old projects?

Did the top condos in Singapore's resale market involve developer discounts?

How did the property market performance vary across Singapore regions from 2014 to 2025?

What factors influenced property prices and gains in Singapore from 2014 to 2025?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Property Investment Insights

Property Investment Insights This Singapore Condo Has Bigger Units Near The MRT — But Timing Decided Who Made Money

Property Investment Insights We Compared Lease Decay Across HDB Towns — The Differences Are Significant

Property Investment Insights This Singapore Condo Skipped 1-Bedders And Focused On Space — Here’s What Happened 8 Years Later

Property Investment Insights Why Buyers in the Same Condo Ended Up With Very Different Results

Latest Posts

Editor's Pick Happy Chinese New Year from Stacked

Singapore Property News Nearly 1,000 New Homes Were Sold Last Month — What Does It Say About the 2026 New Launch Market?

Editor's Pick How I’d Invest $12 Million On Property If I Won The 2026 Toto Hongbao Draw

0 Comments