The Real Reason Homes Keep Getting Snapped Up in Singapore

October 6, 2025

Next to the prices in coffee shops, I think the most sensitive and inflammatory topic is population numbers.

But that’s exactly the recent issue we’re contending with, now that Singapore has reached a population of 6.11 million; the highest on record. And what’s bound to set off your disgruntled taxi driver – should you dare to join in on this topic – is that the growth is mainly due to the non-resident population.

Singapore isn’t growing because locals are having more children. In fact, the opposite is happening: marriages are down, fertility is stuck at 0.97, and large families are fading faster than your chances at a sub-$2 million condo. And unless there’s a miracle baby boom*, the citizen share of the population is going to keep hovering where it is – around 60 per cent if you count just citizens, and just under 70 per cent if you add PRs into the mix.

*Spoiler: there won’t be. After years of government effort, we seem to be barely one rung above pandas when it comes to procreation.

How does all this affect the property market?

In the most immediate sense, it’s reshaping how our homes are being built. With marriages trending downward, the traditional three- or four-bedder family unit isn’t the default anymore (in the private segment).

Developers are increasingly pivoting toward two-bedders or compact three-bedders (2+1 units), which also keep the overall price low. Once, these types of projects were targeted at landlords; today, they’re increasingly considered for owner-occupancy.

And on the flip side, developers are increasingly avoiding large, high-quantum homes; this has spread even into the prime districts, as we can see from units in River Green or the upcoming Skye at Holland.

The second effect is the more urgent drive toward decentralisation. It’s not just about housing: it’s about transport. If many more people are rushing to and from the CBD area, at roughly the same hours, our MRT system will probably scream and rage-quit at some point.

Train breakdowns have already become more frequent of late; from the September 2024 EWL disruption that affected 2.6 million journeys, to signalling and power faults across multiple lines. Concentrating everyone in the core only means longer queues, packed carriages, and more points of failure. That’s why decentralisation isn’t just about convenience; it’s really a transport survival strategy. By building up separate hubs in Jurong, Tampines, Woodlands, and Punggol, we reduce the need for more Singaporeans to commute.

But that also means a major disruption in formerly entrenched “luxury zones.’ For decades, the Core Central Region (CCR) was treated as the ultimate address, with Orchard, River Valley, and Tanglin carrying an aura of permanence in their premium. Decentralisation chips away at that narrative: when you can get jobs, schools, and amenities in Jurong or Tampines, the pull of the CCR weakens. I don’t mean Orchard will lose its shine right away; but it does mean neighbourhood hubs could one day rival the city core.

It also means ABSD rates may be needed more than ever now.

Which, frankly, may be a good thing. In fact, the government’s decision to raise the ABSD rates makes a little more sense now: The 60 per cent ABSD rate reduces competition for private homes, versus locals; and ABSD hikes on multiple properties (even for citizens and PRs) dissuade a surge of would-be landlords, who might otherwise jump at the potential for rental income.

And here’s the harder truth: with an ageing population, there are fewer young children to support elderly parents.

That means more Singaporeans will end up shouldering both eldercare and housing costs; potentially on a single income. If mum and dad need a live-in helper, or to move in with you (hence requiring a larger home), the last thing you want is 55 per cent of your income already going into a maxed-out mortgage loan.

More from Stacked

Why Early Buyers In New Housing Estates May See Less Upside In 2026

In the early 2000s, buying a home in locales like Punggol or Woodlands was considered a compromise. In less generous…

All of this could mean that, for the coming generation of homebuyers, experiences will be very different from the boom years of their forebears. The previous generation experienced huge income and population growth as Singapore transitioned to developed nation status – it was more probable for them to see a “HBD to condo to multiple properties/landed” journey.

But for the generation to come, who are burdened with looking after their parents (possibly as the only child), and contending with limitations like ABSD and debt ratios, the horizon seems dimmer. They may have to accept that their homes will be smaller and that owning a second rental property is a pipe dream.

But hey, at least living on the fringes may end up being just as convenient as living near the CBD. And may they never have to know the screaming rage of missing your third train at 8.30 am, when the office is all the way in Outram.

All of this is also why land release and the GLS programme have been so aggressive in the last few years. The rising population means we can’t just sit on our hands and assume gradual redevelopment of old properties will fix it.

We need more land not only in the core areas, but close to the new hubs like Jurong East, Tampines, and Woodlands, where the next waves of housing will take shape. With luck, we’ll see more GLS sites popping up close to these new hubs as well.

Meanwhile, in other property news:

- Is it wise to move from a 40+ year old flat when the lease is depreciating, and how easy is it? A homeowner shares her story.

- On a related note, are HDB flats “going to zero” now that SERS is gone? Here’s what the data shows.

- Selling when there’s a new launch nearby, or an EC reaching MOP, or any other market shift, is nerve-wracking. Here’s a way to spot the signs and get through it.

- Skye at Holland is one of the most affordable properties (in terms of overall quantum) to launch in District 10; but does that necessarily mean it’s a good buy? Join our Stacked Pro readers in our detailed pricing analysis.

Weekly Sales Roundup (22 – 28 September)

Top 5 Most Expensive New Sales (By Project)

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| PROMENADE PEAK | $6,658,100 | 1884 | $3,535 | 99 yrs (2024) |

| GRAND DUNMAN | $4,437,000 | 1927 | $2,303 | 99 yrs (2022) |

| TEMBUSU GRAND | $4,040,000 | 1711 | $2,361 | 99 yrs (2022) |

| THE ORIE | $3,952,000 | 1453 | $2,720 | 99 yrs (2024) |

| BLOOMSBURY RESIDENCES | $3,642,000 | 1421 | $2,563 | 99 yrs (2024) |

Top 5 Cheapest New Sales (By Project)

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| CANBERRA CRESCENT RESIDENCES | $1,335,800 | 667 | $2,002 | 99 yrs (2024) |

| RIVER GREEN | $1,365,000 | 420 | $3,252 | 99 yrs (2024) |

| COPEN GRAND | $1,516,000 | 936 | $1,619 | 99 yrs (2021) |

| THE SHOREFRONT | $1,533,542 | 775 | $1,979 | 999 yrs (1937) |

| HILL HOUSE | $1,540,000 | 452 | $3,406 | 999 yrs (1841) |

Top 5 Most Expensive Resale

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| THE MARQ ON PATERSON HILL | $19,180,000 | 3057 | $6,274 | FH |

| 3 ORCHARD BY-THE-PARK | $8,150,000 | 2260 | $3,605 | FH |

| DRAYCOTT EIGHT | $6,000,000 | 2896 | $2,072 | 99 yrs (1997) |

| ST THOMAS SUITES | $5,750,000 | 2605 | $2,207 | FH |

| BOULEVARD 88 | $5,385,300 | 1313 | $4,101 | FH |

Top 5 Cheapest Resale

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| PARC OLYMPIA | $688,888 | 495 | $1,391 | 99 yrs (2012) |

| SPACE @ KOVAN | $708,000 | 431 | $1,644 | FH |

| KANDIS RESIDENCE | $735,000 | 495 | $1,484 | 99 yrs (2016) |

| CITY REGENCY | $750,000 | 484 | $1,548 | FH |

| EUHABITAT | $780,000 | 527 | $1,479 | 99 yrs (2010) |

Top 5 Biggest Winners

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | RETURNS | HOLDING PERIOD |

| SKY@ELEVEN | $5,150,000 | 2271 | $2,268 | $2,925,000 | 19 Years |

| MERALODGE | $3,050,000 | 1916 | $1,592 | $2,150,000 | 19 Years |

| PINEWOOD GARDENS | $3,188,000 | 1249 | $2,553 | $2,108,000 | 19 Years |

| HILLCREST ARCADIA | $3,288,000 | 2745 | $1,198 | $2,088,000 | 25 Years |

| HUME PARK I | $2,700,000 | 1496 | $1,805 | $2,067,000 | 20 Years |

Top 5 Biggest Losers

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | RETURNS | HOLDING PERIOD |

| MARINA ONE RESIDENCES | $3,380,000 | 1582 | $2,136 | -$453,500 | 6 Years |

| UP@ROBERTSON QUAY | $1,125,000 | 527 | $2,133 | -$365,000 | 13 Years |

| SEASCAPE | $4,080,000 | 2164 | $1,886 | -$308,000 | 6 Years |

| THE SAIL @ MARINA BAY | $2,200,000 | 883 | $2,492 | -$272,400 | 15 Years |

| MARTIN MODERN | $2,050,000 | 764 | $2,682 | -$16,000 | 5 Years |

Top 5 Biggest Winners (ROI%)

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | ROI (%) | HOLDING PERIOD |

| HUME PARK I | $2,700,000 | 1496 | $1,805 | 327% | 20 Years |

| SUMMER GREEN | $1,800,000 | 1292 | $1,394 | 296% | 21 Years |

| MERALODGE | $3,050,000 | 1916 | $1,592 | 239% | 19 Years |

| THE GARDENS AT BISHAN | $1,320,000 | 883 | $1,495 | 208% | 22 Years |

| PARC PALAIS | $2,148,000 | 1249 | $1,720 | 205% | 27 Years |

Top 5 Biggest Losers (ROI%)

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | ROI (%) | HOLDING PERIOD |

| UP@ROBERTSON QUAY | $1,125,000 | 527 | $2,133 | -24% | 13 Years |

| MARINA ONE RESIDENCES | $3,380,000 | 1582 | $2,136 | -12% | 6 Years |

| THE SAIL @ MARINA BAY | $2,200,000 | 883 | $2,492 | -11% | 15 Years |

| SEASCAPE | $4,080,000 | 2164 | $1,886 | -7% | 6 Years |

| MARTIN MODERN | $2,050,000 | 764 | $2,682 | -1% | 5 Years |

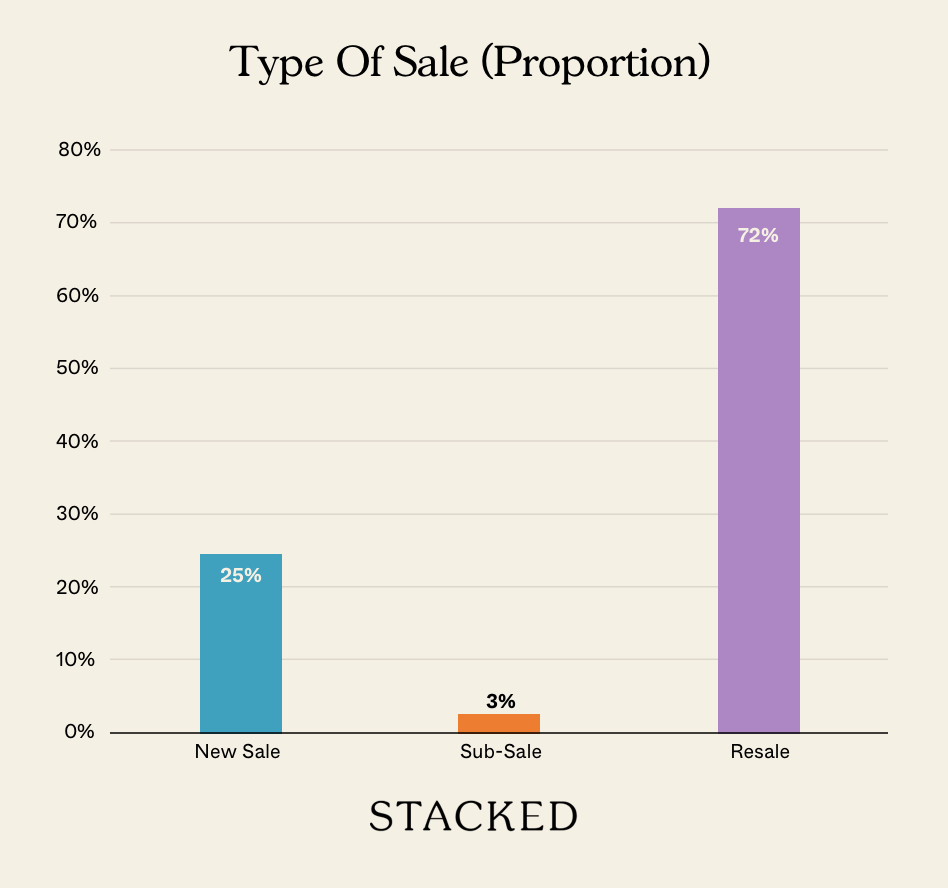

Transaction Breakdown

Follow us on Stacked for more property news and updates in Singapore.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

Why are homes in Singapore being bought quickly now?

How does Singapore's population growth affect the property market?

What changes are developers making to housing options in Singapore?

Why is decentralisation important for Singapore’s transport system?

How might Singapore’s ageing population impact future housing?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Singapore Property News

Singapore Property News These 4 Freehold Retail Units Are Back On The Market — After A $4M Price Cut

Singapore Property News New Lentor Condo Could Start From $2,700 PSF After Record Land Bid

Singapore Property News This Tampines EC Will Preview on Friday — It Is One of Two New ECs in the East in 2026

Singapore Property News I’m Retired And Own A Freehold Condo — Should I Downgrade To An HDB Flat?

Latest Posts

Editor's Pick These Freehold Condos Near Orchard Haven’t Seen Much Price Growth — Here’s Why

Pro This 130-Unit Boutique Condo Launched At A Premium — Here’s What 8 Years Revealed About The Winners And Losers

Editor's Pick A Rare Freehold Conserved Terrace In Cairnhill Is Up For Sale At $16M

0 Comments