The Main Reason Why En Blocs Don’t Go Through..

December 10, 2023

Singapore’s most talented diplomats are wasted in the property market.

When the government needs expert negotiators, they should be looking for the en-bloc specialists in property firms. Because if anyone can pull off even one successful en-bloc negotiation, they’ll have no problems with easier things, like getting the High Speed Rail built.

When it comes to en-bloc meetings, everyone involved really needs to win; because losing means having to buy a condo at today’s prices. And if you think that sounds upsetting, wait till it happens to you when you’re 82 years old, or after you just spent $100,000 renovating your “forever home” a month before the en-bloc meeting.

If you’re old enough to remember too, a bad en-bloc deal can be very upsetting. Most ex-Gillman Heights owners are probably still very sore about the collective sale (which is now The Interlace).

The resulting atmosphere is like an MMA ring where no contestant is actually allowed to hit anyone; so they just project all their violent frustration into gibberish insults, or – later in the week – teenage-level vandalism.

If you think there’s going to be graphs and math and rational discussions of sale proceeds, you’re going to be sorely disappointed. The first hour alone might just be both sides accusing the other of insensitivity, racism, corruption, and being members of the uncaring elite.

I recently heard from a reader who attended one, and left after an hour as the meeting couldn’t even begin. The residents were arguing over who should get to present, or rather, who should be allowed to present. And proceeded to descend into loud heated shouting because “how dare you raise your voice at my wife”.

The representative from the real estate firm needs to rise above the din, and present issues like:

- How the sale proceeds are distributed

- What prices developers may go for

- The current state of the market

- What sellers can expect if the sale does goes through

- How their parents are legitimately married, and it’s okay that the old uncle said that about their mother, emotions are running high, haha

Even if someone manages to cut through the din, there are some wedge issues can cause an en-bloc to fail, no matter how reasonable the sale

So the condo predates the Vietnam War, and the maintenance fund is down to two rolls of masking tape and positive thinking. Well some might still reject the sale, because of these common sticking points:

- They’re foreigners, and if their unit goes up for en-bloc, their replacement unit will now come with 60 per cent ABSD.

- They’re retired and live off the rental income, and buying a new rental asset at 20 per cent ABSD is financial cancer for their portfolio.

- They just bought the place this year, and they’d have to pay 12 per cent Sellers Stamp Duty. Coupled with their renovation and furnishing, they may as well have replaced their toilet rolls with thousand dollar bills.

- The Method of Apportionment is based on share value, so the people with the biggest units (i.e., the higher percentage of ownership) are also most likely to reject it, for these reasons.

- The sale proceeds are going to come way too late, like in 12 months, and they’re too cash strapped to finance a replacement in that time

- The move would happen during their children’s PSLE or O-Levels, so wait two more years. Do not pressure Singaporean parents at those times, they’ll bite your face off.

Then there’s people who just have an emotional attachment to the place, and it would take more money than a developer – or God – has to uproot them. That’s what happened with Mandarin Gardens.

More from Stacked

Is The $16k EC Income Ceiling Too Low? A Look At How New EC Prices Have Risen And Why It Should Be Raised

The income ceiling for Executive Condos currently stands at $16,000. But there has been discussion lately over whether it's time…

These factors, more than the wider economy or the actual math, is what causes en-bloc sales to falter. For those who are looking to buy for a collective sale windfall (and have never attended an en-bloc collective sale meeting), be prepared for it to be a long drawn, and sometimes unpleasant affair.

Meanwhile, in other property news…

- One man’s floor is another man’s ceiling, which is an overused but appropriate analogy for property. Here are some disliked property traits which some buyers may actually prefer.

- This year, HDB is the real Santa Claus. Check out the upcoming BTO sites for December, and best of luck.

- Looking for a three-bedder under $1 million? Here are some older resale options that might fit the budget.

- Get a sense of what it’s like to live in Neptune Court, a massive development in desirable Marine Parade

Weekly Sales Roundup (27 November – 03 December)

Top 5 Most Expensive New Sales (By Project)

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| WATTEN HOUSE | $7,706,000 | 2368 | $3,254 | FH |

| SKY EVERTON | $5,380,000 | 1819 | $2,957 | FH |

| THE RESERVE RESIDENCES | $4,233,881 | 1625 | $2,605 | 99 yrs (2021) |

| MIDTOWN MODERN | $4,179,000 | 1464 | $2,855 | 99 yrs (2019) |

| THE CONTINUUM | $3,490,000 | 1249 | $2,795 | FH |

Top 5 Cheapest New Sales (By Project)

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| GEMS VILLE | $988,000 | 517 | $1,912 | FH |

| THE CONTINUUM | $1,463,000 | 560 | $2,614 | FH |

| J’DEN | $1,488,000 | 527 | $2,821 | 99 yrs |

| THE MYST | $1,555,000 | 700 | $2,223 | 99 yrs (2023) |

| PULLMAN RESIDENCES NEWTON | $1,659,240 | 463 | $3,585 | FH |

Top 5 Most Expensive Resale

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| CAPE ROYALE | $6,100,000 | 2508 | $2,432 | 99 yrs (2008) |

| MARINA COLLECTION | $5,728,000 | 3272 | $1,750 | 99 yrs (2007) |

| REFLECTIONS AT KEPPEL BAY | $4,525,000 | 2637 | $1,716 | 99 yrs (2006) |

| HILLTOPS | $4,500,000 | 1550 | $2,903 | FH |

| MAPLE WOODS | $3,880,000 | 1787 | $2,171 | FH |

Top 5 Cheapest Resale

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| PRESTIGE HEIGHTS | $628,000 | 334 | $1,882 | FH |

| RIVERBAY | $650,000 | 388 | $1,677 | 999 yrs (1882) |

| THE PROMENADE@PELIKAT | $700,000 | 484 | $1,445 | FH |

| PARC SOMME | $707,000 | 452 | $1,564 | 99 yrs (2008) |

| 28 RC SUITES | $750,000 | 452 | $1,659 | FH |

Top 5 Biggest Winners

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | RETURNS | HOLDING PERIOD |

| KOVAN RESIDENCES | $2,970,000 | 1765 | $1,682 | $1,746,000 | 15 Years |

| BRADDELL VIEW | $1,728,000 | 1615 | $1,070 | $1,288,000 | 19 Years |

| BOTANNIA | $2,155,000 | 1270 | $1,697 | $1,145,350 | 14 Years |

| THE ALPS RESIDENCES | $3,500,000 | 2486 | $1,408 | $1,060,000 | 7 Years |

| SOUTHAVEN II | $2,450,000 | 1507 | $1,626 | $1,050,000 | 12 Years |

Top 5 Biggest Losers

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | RETURNS | HOLDING PERIOD |

| HILLTOPS | $4,500,000 | 1550 | $2,903 | -$650,000 | 10 Years |

| ONE SHENTON | $2,850,000 | 1582 | $1,801 | -$512,450 | 17 Years |

| REFLECTIONS AT KEPPEL BAY | $2,720,000 | 1561 | $1,743 | -$436,300 | 17 Years |

| 18 WOODSVILLE | $1,230,000 | 732 | $1,680 | -$142,050 | 12 Years |

| ROBIN SUITES | $1,230,000 | 538 | $2,285 | -$131,140 | 11 Years |

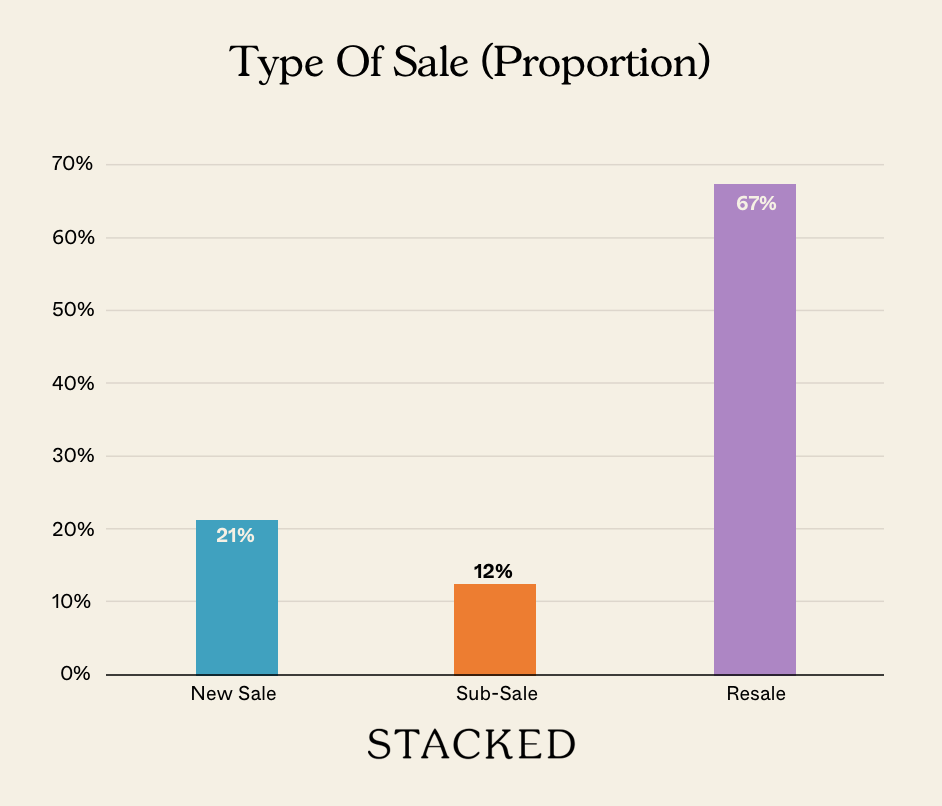

Transaction Breakdown

Follow us on Stacked Homes for on-the-ground details of Singapore’s property market, and in-depth reviews of new and resale projects.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

Why do en-bloc property sales often fail in Singapore?

What are common reasons residents reject en-bloc property deals?

How does emotional attachment affect en-bloc property negotiations?

What role do disagreements during en-bloc meetings play in the sale process?

Are there specific property conditions that can cause en-bloc deals to fall through?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Singapore Property News

Singapore Property News Why Some Singaporean Parents Are Considering Selling Their Flats — For Their Children’s Sake

Singapore Property News Nearly 1,000 New Homes Were Sold Last Month — What Does It Say About the 2026 New Launch Market?

Singapore Property News The Unexpected Side Effect Of Singapore’s Property Cooling Measures

Singapore Property News The Most Expensive Resale Flat Just Sold for $1.7M in Queenstown — Is There No Limit to What Buyers Will Pay?

Latest Posts

Pro River Modern Starts From $1.548M For A Two-Bedder — How Its Pricing Compares In River Valley

New Launch Condo Reviews River Modern Condo Review: A River-facing New Launch with Direct Access to Great World MRT Station

On The Market Here Are The Cheapest 5-Room HDB Flats Near An MRT You Can Still Buy From $550K

0 Comments