A Housing Issue That Slips Under the Radar in a Super-Aged Singapore: Here’s What Needs Attention

November 30, 2025

We often focus on the needs of Singaporeans being relocated, which is great – but we need to spend more time thinking about their caregivers as well.

By the time you read this, Henderson Heights will be gone. The blocks of rental flats here – 91, 92, and 93 Henderson Road – would have been emptied around two months ago. The 675 households here (all 2-room flats) are part of the sixth relocation exercise for rental flats, over the past five years.

And to the government’s credit, a lot of effort has been made to ensure the residents’ lives are minimally disrupted. Well, as minimally as possible, under these circumstances. However, there is one important element we tend to overlook – and this is also a concern for agents helping buyers and sellers, or people shortlisting a property: that’s the caregivers for the affected residents.

Even for those in tough, low-income situations, a solution like a rental flat is usually devised by the government. So from my interactions on the ground, the concern is often less “Will my elderly family member have a roof over their head,” and more along the lines of “How will I move to support them? Will it be necessary?”

To use an example that’s not HDB-related, but absolutely could be, I once met a Stacked reader who sold her condo to move into a resale flat. It wasn’t a financially motivated decision; she needed to live near her parents after her father had a stroke, and needed help with daily activities and keeping the flat clean. Now, in this circumstance, she was lucky: she owned a condo asset, so the possibility of moving was there. But there are caregivers who don’t have the assets to fund a move, or who can’t practically move due to issues like work and school locations.

But when an elderly or immobile family member is relocated, the care plan has to relocate also

If your mum needs help bathing, or your dad can’t get to medical appointments alone, distance is no longer some kind of lifestyle preference. It just becomes essential logistics. And from experience – both mine and the people who are caregivers (ask them, I’m sure they’ll tell you) – a simple change from 15 minutes away to 45 minutes away can make a shocking difference. Going both ways, every day, adds an hour to your commute.

This is without factoring in other critical issues, like how quickly you can get to them when your neighbour texts “How come your dad hasn’t come out for two days?” or to do required daily checks, like taking blood pressure or noticing the pills are not getting fewer every week.

And contrary to what some detractors claim, it is important for the caregivers to visit almost every day. Because most of the warning signs, like loss of appetite, a growing discolouration of the skin, signs of moodiness, etc, are observed from frequent interaction.

Simply stretching the distance makes all of the above much harder. Because it’s a daily necessity, which doesn’t stop for the remaining lifespan of the person they’re caring for, some caregivers exhaust themselves. Eventually, some cut back on the amount of care they provide, or they mentally crack themselves.

This is going to be an increasingly significant issue in the coming years

I don’t mean “in decades,” like this is some kind of far-future demographic cliff. The problem is dead ahead of us.

More from Stacked

Budget 2022 Property Tax: How Much More It’ll Cost You + What It Means For The Market

In the recent budget 2022 announcement, the government said it would raise property taxes starting next year. While the increment…

Singapore will be super-aged in the year 2026. That means close to a quarter of our population (around 21 per cent) will be aged 65 and above. And on top of that, our flats are ageing too. Many post-1970s HDB towns are at the stage where redevelopment is around the corner. With VERS lurking, relocation exercises may become more common than we’re currently used to.

So we’re entering a period where more seniors will need more care, at the same time that more older estates may need to be refreshed. Those two trends may intersect in a way we really need to prepare for; and a big part of that is to focus on the caregiver community that will support the shift.

It may be time to consider something beyond a Proximity Housing Grant, and to see if existing programmes – like Community Care Apartments – can be complemented with support for (perhaps registered) caregivers as well. Right now, support for caregivers is still fragile in our larger systems.

Meanwhile in other property news…

- Coastal Cabana is the latest EC in Pasir Ris, and a three-bedder can be as low as $1.43 million. Check out the details.

- If you want a private new launch condo instead, here’s one that looks promising in terms of pricing: The Sen is the current new highlight of District 21.

- Waiting for property prices to fall is something of a risky gamble. It can just as easily go the other way, as some buyers have painfully found out. Sometimes after nine ballots.

- The Jovell is, at first glance, a spacious property along Flora Drive – one that provides exclusivity and larger units. So why is it struggling to perform in the market? Join our Stacked Pro readers in uncovering the reasons.

Weekly Sales Roundup (17 – 23 November)

Top 5 Most Expensive New Sales (By Project)

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| GRAND DUNMAN | $5,788,000 | 2217 | $2,610 | 99 yrs (2022) |

| AMBER HOUSE | $3,914,652 | 1238 | $3,162 | FH |

| ONE MARINA GARDENS | $3,798,722 | 1238 | $3,069 | 99 yrs (2023) |

| J’DEN | $3,658,000 | 1485 | $2,463 | 99 years |

| THE CONTINUUM | $3,620,000 | 1249 | $2,899 | FH |

Top 5 Cheapest New Sales (By Project)

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| HILL HOUSE | $1,371,000 | 452 | $3,033 | 99 years |

| THE CONTINUUM | $1,380,000 | 560 | $2,465 | FH |

| ZYON GRAND | $1,436,000 | 474 | $3,032 | 99 yrs (2024) |

| OTTO PLACE | $1,455,000 | 872 | $1,669 | 99 yrs (2024) |

| THE LAKEGARDEN RESIDENCES | $1,590,000 | 678 | $2,345 | 99 yrs (2023) |

Top 5 Most Expensive Resale

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| TOMLINSON HEIGHTS | $10,880,000 | 2745 | $3,964 | FH |

| LEEDON RESIDENCE | $7,500,000 | 2669 | $2,810 | FH |

| DRAYCOTT EIGHT | $6,200,000 | 2896 | $2,141 | 99 yrs (1997) |

| ST REGIS RESIDENCES SINGAPORE | $5,560,000 | 2153 | $2,583 | 999 yrs (1995) |

| THE WATERSIDE | $5,530,000 | 2411 | $2,294 | FH |

Top 5 Cheapest Resale

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| THE HILLFORD | $570,000 | 398 | $1,431 | 60 yrs (2013) |

| SUITES @ TOPAZ | $660,000 | 388 | $1,703 | FH |

| PARC ROSEWOOD | $690,000 | 517 | $1,335 | 99 yrs (2011) |

| VIVA VISTA | $718,000 | 398 | $1,803 | FH |

| URBAN VISTA | $735,000 | 441 | $1,665 | 99 yrs (2012) |

Top 5 Biggest Winners

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | RETURNS | HOLDING PERIOD |

| THE IMPERIAL | $3,828,000 | 1464 | $2,615 | $2,523,260 | 22 Years |

| THE EDGE ON CAIRNHILL | $5,100,000 | 2131 | $2,393 | $2,122,000 | 19 Years |

| LEEDON RESIDENCE | $7,500,000 | 2669 | $2,810 | $2,000,000 | 9 Years |

| THE BEVERLY | $2,780,000 | 1507 | $1,845 | $1,527,581 | 16 Years |

| RIDGEWOOD | $3,670,000 | 2002 | $1,833 | $1,370,000 | 14 Years |

Top 5 Biggest Losers

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | RETURNS | HOLDING PERIOD |

| MARINA COLLECTION | $3,008,000 | 1873 | $1,606 | -$1,979,000 | 18 Years |

| MARINA ONE RESIDENCES | $1,438,000 | 753 | $1,908 | -$284,350 | 11 Years |

| V ON SHENTON | $1,950,000 | 1098 | $1,776 | -$255,000 | 13 Years |

| THE CLIFT | $1,090,000 | 527 | $2,067 | -$161,625 | 13 Years |

| ST REGIS RESIDENCES SINGAPORE | $5,560,000 | 2153 | $2,583 | -$114,600 | 19 Years |

Top 5 Biggest Winners (ROI%)

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | ROI (%) | HOLDING PERIOD |

| THE IMPERIAL | $3,828,000 | 1464 | $2,615 | 193.39% | 22 Years |

| MANDARIN GARDENS | $1,280,000 | 1001 | $1,279 | 190.91% | 28 Years |

| STRATFORD COURT | $1,630,000 | 1625 | $1,003 | 176.27% | 27 Years |

| THE FLORIDA | $1,540,000 | 1389 | $1,109 | 160.14% | 27 Years |

| RIO VISTA | $1,200,000 | 1055 | $1,138 | 147.42% | 19 Years |

Top 5 Biggest Losers (ROI%)

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | ROI (%) | HOLDING PERIOD |

| MARINA COLLECTION | $3,008,000 | 1873 | $1,606 | -39.68% | 18 Years |

| MARINA ONE RESIDENCES | $1,438,000 | 753 | $1,908 | -16.51% | 11 Years |

| THE CLIFT | $1,090,000 | 527 | $2,067 | -12.91% | 13 Years |

| V ON SHENTON | $1,950,000 | 1098 | $1,776 | -11.56% | 13 Years |

| URBAN TREASURES | $950,000 | 517 | $1,839 | -7.14% | 6 Years |

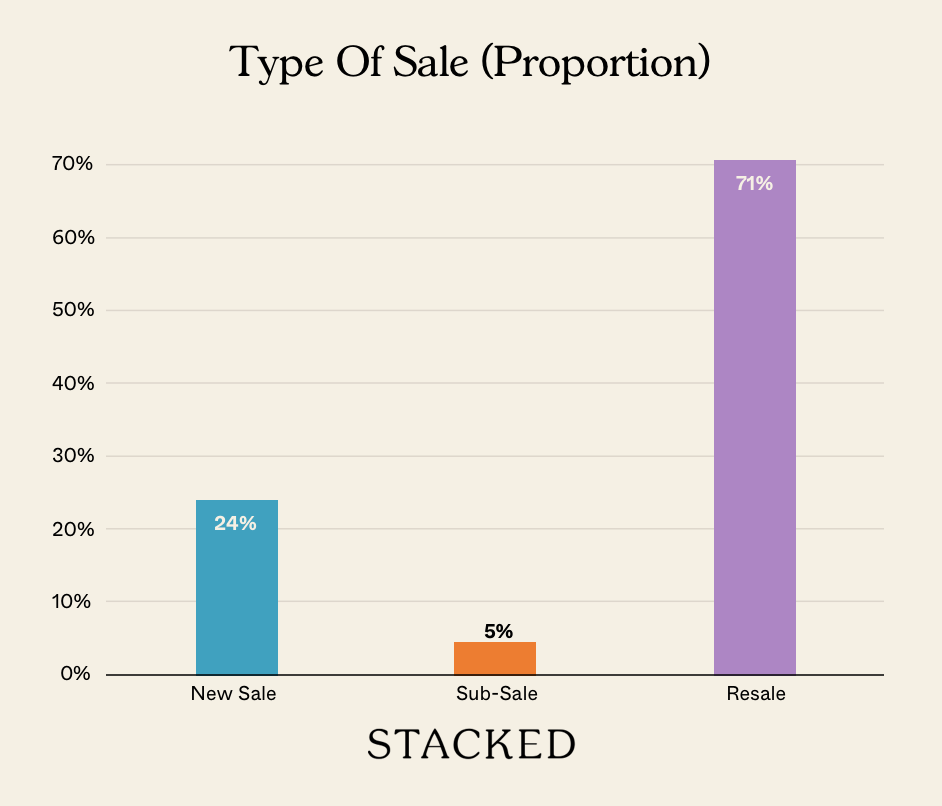

Transaction Breakdown

Follow us on Stacked for developments and changes in the Singapore property market.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

Why is the support for caregivers in Singapore's housing system important?

How does the age of a flat affect its suitability for elderly residents?

What challenges do caregivers face when elderly family members are relocated to new flats?

What is the projected impact of Singapore becoming a super-aged society in 2026?

Are there existing programs to support caregivers in Singapore's housing plans?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Singapore Property News

Singapore Property News Why Some Singaporean Parents Are Considering Selling Their Flats — For Their Children’s Sake

Singapore Property News Nearly 1,000 New Homes Were Sold Last Month — What Does It Say About the 2026 New Launch Market?

Singapore Property News The Unexpected Side Effect Of Singapore’s Property Cooling Measures

Singapore Property News The Most Expensive Resale Flat Just Sold for $1.7M in Queenstown — Is There No Limit to What Buyers Will Pay?

Latest Posts

Pro This 130-Unit Condo Launched 40% Above Its District — And Prices Struggled To Grow

Property Investment Insights These Freehold Condos Barely Made Money After Nearly 10 Years — Here’s What Went Wrong

Pro River Modern Starts From $1.548M For A Two-Bedder — How Its Pricing Compares In River Valley

0 Comments