Single And 35 Years Old? Here Are Your HDB Options (BTO + Resale Affordability Calculations)

January 27, 2021

The Singapore public housing market, while often regarded as one of the most successful in the world, comes with one little glitch. A common complaint is that for single Singaporeans – or couples who can’t be legally married for some reason – it’s much harder to secure a flat.

Well before you sigh in resignation and start renting, you should know there are some avenues of HDB ownership open to you. Here’s what you can buy from HDB, as a 35-year-old single:

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

What can you buy as a 35-year-old single?

| Can you buy: | Single Singapore Citizen Scheme | Joint Singles Scheme |

| BTO flats? | Only if they’re 2-room flats | Only if they’re 2-room flats |

| Resale flats? | Yes, with no restriction | Yes, with no restriction |

| New ECs? | No | Yes |

| In mature locations? | Only if it’s a resale flat | Only if it’s a resale flat |

| With grants? | Yes (see below) | Yes for flats, but no for ECs (see below) |

Option 1: Buying under the Single Singapore Citizen Scheme (SCCS)

You can buy under this scheme if you are a Singapore Citizen, and at least 35 years old (unless you are an orphan or widowed, in which case the minimum age is lowered to 21 years). You must also have an income not exceeding $7,000 per month.

If you want to buy a Built To Order (BTO) flat, you are restricted to 2-room flats in non-mature estates. At present, these are the HDB estates generally defined as non-mature (less than 20 years old):

- Bukit Batok

- Bukit Panjang

- Choa Chu Kang

- Hougang

- Jurong (East & West)

- Punggol

- Sembawang

- Sengkang

- Tengah

- Woodlands

- Yishun

Note that these may change over time. The HDB website will always specify whether an estate is considered mature or non-mature, for each sale exercise.

If you are willing to settle for a resale flat though, there’s no restriction on size (with the exception of Multi-Generational flats) and location. You may buy any kind of resale flat, in any location, under the SCCS.

Other requirements to remember:

- You must not own another property at the time of application. If you just sold a private property, you must wait 30 months before you can apply for a BTO flat (this restriction doesn’t apply for resale flats).

- You must still meet the requirements for the ethnic quota / Singapore Permanent Residents quota for the area.

(You can find out more about the quota on the HDB website).

Grants for the SCCS

There are two possible grants under the SCCS: the Enhanced Housing Grant (EHG), and the Singles Grant.

The EHG is as follows:

| Monthly income | Grant amount |

| Below $750 | $40,000 |

| $751 to $1,000 | $37,500 |

| $1,001 to $1,250 | $35,000 |

| $1,251 to $1,500 | $32,500 |

| $1,501 to $1,750 | $30,000 |

| $1,751 to $2,000 | $27,500 |

| $2,001 to $2,250 | $25,000 |

| $2,251 to $2,500 | $22,500 |

| $2,501 to $2,750 | $20,000 |

| $2,751 to $3,000 | $17,500 |

| $3,001 to $3,250 | $15,000 |

| $3,251 to $3,500 | $12,500 |

| $3,501 to $3,750 | $10,000 |

| $3,751 to $4,000 | $7,500 |

| $4,001 to $4,250 | $5,000 |

| $4,251 to $4,500 | $2,500 |

| Above $4,500 | No grant available |

All housing grants are disbursed into your CPF Ordinary Account, or CPF OA, and they are never provided in cash.

Other grant requirements to remember:

- You must be working for 12 consecutive months prior to application; and you must still be working at the time of application.

- The flat must have at least 20 years of lease remaining. In addition, the remaining lease must last until you are 95 years old to secure the full grant; otherwise the grant amount will be pro-rated.

The Singles Grant

The Singles Grant is only available to first-timer singles buying a resale flat. The Singles Grant is straightforward:

- $25,000 for 2, 3, and 4-room flats

- $20,000 for 5-room flats

Other requirements are similar to the EHG, as described above.

A quick note about upgrading from a 2-room flat later

It’s possible that you’re single now, but will get married later. If this happens, you can upgrade from your 2-room to a larger flat as a First-Timer / Second-Timer (FT/ST) couple.

As this article is meant for singles, we’ll discuss this in a future piece; but do bear in mind you can get your own flat first, and upgrade if your situation changes.

Option 2: Buying under the Joint Singles Scheme (JSS)

The JSS allows for two to four singles to jointly purchase an HDB property. Note that all the singles involved must be Singapore Citizens, who are at least 35 years old. As there are more co-applicants involved, the income ceiling for the JSS is higher, at $9,000 per month instead of $7,000.

As with SCCS, you are restricted to 2-room flats in non-mature neighbourhoods, if you want a BTO flat (see above). If you want a resale flat, there is no restriction on size and location.

The biggest difference between SCCS and JSS is that, with JSS, you can purchase a new Executive Condominium (EC) unit. At present, this is the only way for singles to purchase a new EC unit. There is also no size restriction on the EC unit.

There is, unfortunately, no housing grant if you purchase an EC under the JSS.

Other requirements to remember:

- You must not own another property at the time of application. If you just sold a private property, you must wait 30 months before you can apply for a BTO flat (this restriction doesn’t apply for resale flats).

- You must still meet the requirements for the ethnic quota / Singapore Permanent Residents quota for the area.

Grants for the JSS

The EHG is also available under this scheme, but the grant amount differs:

| Monthly income | Grant amount |

| Below $1,500 | $80,000 |

| $1,501 to $2,000 | $75,000 |

| $2,001 to $2,500 | $70,000 |

| $2,501 to $3,000 | $65,000 |

| $3,001 to $3,500 | $60,000 |

| $3,501 to $4,000 | $55,000 |

| $4,001 to $4,500 | $50,000 |

| $4,501 to $5,000 | $45,000 |

| $5,001 to $5,500 | $40,000 |

| $5,501 to $6,000 | $35,000 |

| $6,001 to $6,500 | $30,000 |

| $6,501 to $7,000 | $25,000 |

| $7,001 to $7,500 | $20,000 |

| $7,501 to $8,000 | $15,000 |

| $8,001 to $8,500 | $10,000 |

| $8,501 to $9,000 | $5,000 |

| Above $9,000 | No grant available |

The disbursement of the EHG is slightly different under the JSS. Note that only two applicants will have the grant disbursed to their CPA OA, with a 50-50 split. This is regardless of whether there are two, three, or four co-applicants.

Other grant requirements to remember:

- You must not be buying a new EC

- All applicants must be first-timers

- At least one applicant must have been working for 12 consecutive months prior to application; this person must still be working at the time of application.

- The flat must have at least 20 years of lease remaining. In addition, the remaining lease must last until the youngest applicant is 95 years old to secure the full grant; otherwise the grant amount will be pro-rated.

How much should you be prepared to pay?

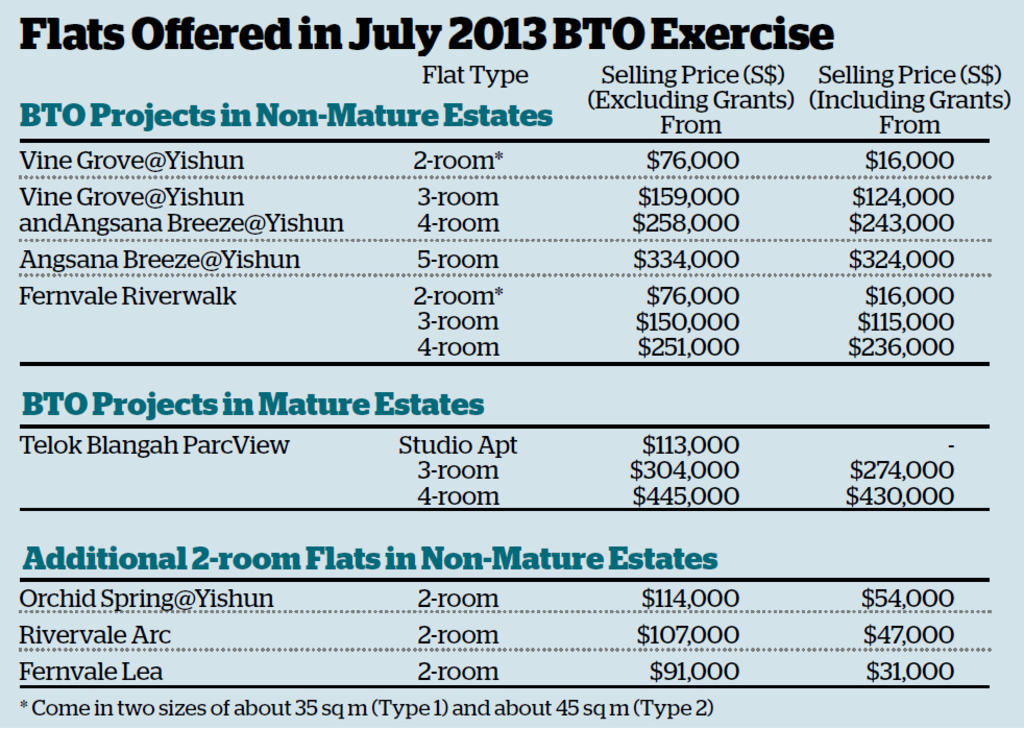

For new flats, the HDB website will provide indicative prices for each sale exercise. You can also review past sales launches in the same locations, to get a sense of the price.

For resale flats, please see the table below. We’ve taken a 3-room resale flat as our example, as this is the most common flat size picked by singles (it’s affordable on a single income, and it’s more spacious than a 2-room BTO flat):

| BTO Exercise | Estate | Unit | Selling Prices Ex. Grants | Selling Prices Incl. Grants |

| Nov-20 | Sembawang | 2-Room Flexi | $ 92,000 | $ 12,000 |

| Nov-20 | Tengah | 2-Room Flexi | $ 108,000 | $ 28,000 |

| Nov-20 | Bishan | 2-Room Flexi (40-year lease) | $ 121,000 | $ 41,000 |

| Nov-20 | Tampines | 2-Room Flexi | $ 130,000 | $ 50,000 |

| Aug-20 | Choa Chu Kang | 2-Room Flexi | $ 99,000 | $ 19,000 |

| Aug-20 | Tengah | 2-Room Flexi | $ 108,000 | $ 28,000 |

| Aug-20 | Woodlands | 2-Room Flexi | $ 90,000 | $ 10,000 |

| Aug-20 | Bishan | 2-Room Flexi | $ 176,000 | $ 96,000 |

| Aug-20 | Pasir Ris | 2-Room Flexi | $ 137,000 | $ 57,000 |

| 2-Room | HDB Loan | Bank Loan | ||||||

| Estate | Median Price | Median Lease | Down Payment | Monthly Instalments | Minimum Income | Down Payment | Monthly Instalments | Minimum Income |

| Ang Mo Kio | $204,000 | 57 | $20,400 | $925 | $3,085 | $51,000 | $754 | $1,527 |

| Bedok | $215,000 | 64 | $21,500 | $975 | $3,251 | $53,750 | $795 | $1,609 |

| Bishan | NA | NA | NA | NA | NA | NA | NA | NA |

| Bukit Batok | NA | NA | NA | NA | NA | NA | NA | NA |

| Bukit Merah | $210,000 | 51 | $21,000 | $953 | $3,176 | $52,500 | $776 | $1,572 |

| Bukit Panjang | $235,000 | 93 | $23,500 | $1,066 | $3,554 | $58,750 | $869 | $1,759 |

| Bukit Timah | NA | NA | NA | NA | NA | NA | NA | NA |

| Central Area | NA | NA | NA | NA | NA | NA | NA | NA |

| Choa Chu Kang | $220,000 | 93 | $22,000 | $998 | $3,327 | $55,000 | $813 | $1,646 |

| Clementi | $310,500 | 92 | $31,050 | $1,409 | $4,695 | $77,625 | $1,148 | $2,324 |

| Geylang | $200,000 | 49 | $20,000 | $907 | $3,024 | $50,000 | $739 | $1,497 |

| Hougang | $231,500 | 92 | $23,150 | $1,050 | $3,501 | $57,875 | $856 | $1,733 |

| Jurong East | $250,00 | 92 | $25,000 | $1,134 | $3,781 | $62,500 | $924 | $1,871 |

| Jurong West | $230,000 | 87 | $23,000 | $1,043 | $3,478 | $57,500 | $850 | $1,721 |

| Kallang/Whampoa | $199,000 | 48 | $19,900 | $903 | $3,009 | $49,750 | $736 | $1,489 |

| Marine Parade | NA | NA | NA | NA | NA | NA | NA | NA |

| Pasir Ris | NA | NA | NA | NA | NA | NA | NA | NA |

| Punggol | $250,000 | 93 | $25,000 | $1,134 | $3,781 | $62,500 | $924 | $1,871 |

| Queenstown | $220,000 | 45 | $22,000 | $998 | $3,327 | $55,000 | $813 | $1,646 |

| Sembawang | $227,000 | 94 | $22,700 | $1,030 | $3,433 | $56,750 | $839 | $1,699 |

| Sengkang | $241,250 | 92 | $24,125 | $1,094 | $3,648 | $60,313 | $892 | $1,806 |

| Serangoon | $240,000 | 56 | $24,000 | $1,089 | $3,629 | $60,000 | $887 | $1,796 |

| Tampines | $257,500 | 92 | $25,750 | $1,168 | $3,894 | $64,375 | $952 | $1,927 |

| Toa Payoh | $198,000 | 50 | $19,800 | $898 | $2,994 | $49,500 | $732 | $1,482 |

| Woodlands | $230,000 | 94 | $23,000 | $1,043 | $3,478 | $57,500 | $850 | $1,721 |

| Yishun | $225,000 | 92 | $22,500 | $1,021 | $3,403 | $56,250 | $832 | $1,684 |

| 3 ROOM | HDB Loan | Bank Loan | |||||||

| Estate | Median Price | Median Lease | Down payment | Monthly Instalments | Minimum Income | Down payment | Monthly Instalments | Minimum Income | |

| Ang Mo Kio | $285,000 | 53 | $28,500 | $1,293 | $4,310 | $71,250 | $1,053 | $2,133 | |

| Bedok | $280,000 | 53 | $28,000 | $1,270 | $4,234 | $70,000 | $1,035 | $2,096 | |

| Bishan | $365,000 | 53 | $36,500 | $1,656 | $5,520 | $91,250 | $1,349 | $2,732 | |

| Bukit Batok | $262,000 | 55 | $26,200 | $1,189 | $3,962 | $65,500 | $968 | $1,961 | |

| Bukit Merah | $320,000 | 52 | $32,000 | $1,452 | $4,839 | $80,000 | $1,183 | $2,395 | |

| Bukit Panjang | $310,000 | 64 | $31,000 | $1,406 | $4,688 | $77,500 | $1,146 | $2,320 | |

| Bukit Timah | $397,500 | 51 | $39,750 | $1,803 | $6,011 | $99,375 | $1,469 | $2,975 | |

| Central Area | $410,000 | 52 | $41,000 | $1,860 | $6,200 | $102,500 | $1,515 | $3,068 | |

| Choa Chu Kang | $315,000 | 60 | $31,500 | $1,429 | $4,764 | $78,750 | $1,164 | $2,357 | |

| Clementi | $310,000 | 52 | $31,000 | $1,406 | $4,688 | $77,500 | $1,146 | $2,320 | |

| Geylang | $257,000 | 52 | $25,700 | $1,166 | $3,886 | $64,250 | $950 | $1,923 | |

| Hougang | $286,000 | 54 | $28,600 | $1,297 | $4,325 | $71,500 | $1,057 | $2,140 | |

| Jurong East | $280,000 | 53 | $28,000 | $1,270 | $4,234 | $70,000 | $1,035 | $2,096 | |

| Jurong West | $263,000 | 54 | $26,300 | $1,193 | $3,977 | $65,750 | $972 | $1,968 | |

| Kallang/Whampoa | $292,250 | 51 | $29,225 | $1,326 | $4,419 | $73,063 | $1,080 | $2,187 | |

| Marine Parade | $360,000 | 52 | $36,000 | $1,633 | $5,444 | $90,000 | $1,331 | $2,694 | |

| Pasir Ris | $380,000 | 63 | $38,000 | $1,724 | $5,746 | $95,000 | $1,405 | $2,844 | |

| Punggol | $363,000 | 60 | $36,300 | $1,647 | $5,489 | $90,750 | $1,342 | $2,717 | |

| Queenstown | $318,000 | 52 | $31,800 | $1,443 | $4,809 | $79,500 | $1,175 | $2,380 | |

| Sembawang | $300,000 | 70 | $30,000 | $1,361 | $4,537 | $75,000 | $1,109 | $2,245 | |

| Sengkang | $347,000 | 59 | $34,700 | $1,574 | $5,247 | $86,750 | $1,283 | $2,597 | |

| Serangoon | $310,000 | 53 | $31,000 | $1,406 | $4,688 | $77,500 | $1,146 | $2,320 | |

| Tampines | $328,888 | 54 | $32,889 | $1,492 | $4,974 | $82,222 | $1,216 | $2,461 | |

| Toa Payoh | $257,000 | 51 | $25,700 | $1,166 | $3,886 | $64,250 | $950 | $1,923 | |

| Woodlands | $260,000 | 55 | $26,000 | $1,180 | $3,932 | $65,000 | $961 | $1,946 | |

| Yishun | $278,000 | 55 | $27,800 | $1,261 | $4,204 | $69,500 | $1,028 | $2,081 | |

As a point of reference, an HDB loan can finance up to 90 per cent of the flat’s price or value, whichever is lower. So if your 3-room resale flat costs $350,000, you would have a minimum down payment of $35,000 (this can be in any combination of cash or CPF).

That said, do be prepared for the possibility of Cash Over Valuation (COV). This is when the seller has a price higher than the actual valuation. For example, if the seller’s price is $350,000, but the valuation is $340,000, then the excess of $10,000 has to be paid in cash.

To understand the risk of COV where you’re buying, do get in touch with us.

A quick note about upgrading from a 2-room flat later

It’s possible that you’re single now, but will get married later. If this happens, you can upgrade from your 2-room to a larger flat as a First-Timer / Second-Timer (FT/ST) couple.

As such, it may be financially beneficial to own your flat as soon as you can, and worry about upgrading later. This way, you at least won’t end up throwing away money on rent.

On a related aside, singles should think carefully before buying a private shoebox unit as a first property. If you do decide to get married later, a 500 sq.ft. unit may be too small – and you won’t be able to buy an HDB flat while holding on to the shoebox. Should you sell the shoebox, you’d then have to buy a resale flat, or wait 30 months to apply for a BTO flat.

Do talk to us directly, if you need further help on your decision. In the meantime, you can follow us on Stacked for reviews of condos new and old, as well as the latest updates on the Singapore property market.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Property Advice

Property Advice These Freehold Condos Near Orchard Haven’t Seen Much Price Growth — Here’s Why

Property Advice We Sold Our EC And Have $2.6M For Our Next Home: Should We Buy A New Condo Or Resale?

Property Advice We Can Buy Two HDBs Today — Is Waiting For An EC A Mistake?

Property Advice I’m 55, Have No Income, And Own A Fully Paid HDB Flat—Can I Still Buy Another One Before Selling?

Latest Posts

Singapore Property News These 4 Freehold Retail Units Are Back On The Market — After A $4M Price Cut

Pro This 130-Unit Boutique Condo Launched At A Premium — Here’s What 8 Years Revealed About The Winners And Losers

Editor's Pick New Lentor Condo Could Start From $2,700 PSF After Record Land Bid

0 Comments