Should I Buy J Gateway Even Though The HSR Was Cancelled?

October 15, 2021

Hi there!

I’ve been a follower of your page and I’ve benefited much from your analysis of the private property landscape in S’pore. Data driven and no upselling like some sites! I’m currently single and 33 years old and looking to buy a 1BR apartment for own stay, with the likelihood of selling it after 5-7 years to upgrade to a bigger sized unit.

I have a rather stringent set of criteria and after some searching, I have narrowed my choice down to J Gateway. Would like to ask if you’ve any advice for me.

I have narrowed my option to a unit under 500 sqft in J Gateway for these reasons:

Want a place in the West near my parents’ home in Jurong EastClose to MRT station, food and amenities (all are within walking distance for J Gateway). Mix of cheap food options and restaurants. Windows in the toilet preferred (available in J Gateway, quite rare to find this in new launches or 1BR). Minimal road noise (sound is okay on higher floors).

However, I have seen some statistics online. It is noted that J Gateway was launched at a very high price in 2012, because the SG-KL high speed rail and redevelopment of Jurong was factored in. The Jurong redevelopment has stagnated after the high speed rail project was stalled. I’m not sure how much capital appreciation the unit will gain in the next few years because of this reason. I don’t need to make a big profit when I resell the unit. It will be good enough that I do not make a loss.

I’m also not confident if it’s easy to resell a 1BR unit under 500 sqft. I imagine with such a size, my pool of buyers would only be singles or investors. It would be tough for couples due to the smaller size. There is a good rental pool for this property, but it’s not the first option for me because I would need a place to stay. Would love to hear your views on this.

Thank you!

(This is part of an ongoing series where we answer reader questions about the property market. If you have one of your own, send it to stories@stackedhomes.com.)

Hey there,

Thank you for writing in to us and thanks for sharing your intended purchase. J Gateway is located in a strategic location where Jurong East area which is namely known as the “second CBD” will take transformation in the next couple of years. Since the cancelation of High Speed Railway (HSR), the Urban Redevelopment Authority (URA) is gathering feedback on master plan proposals for the Jurong Lake District. With the construction of Jurong East Integrated transport Hub and Jurong Regional Line, Jurong East vicinity will see lots of changes in the future.

Thus, J Gateway being located in close proximity to all these transformations will have the spillover effect with the likelihood of demand coming from investors for rental income or professionals/single profile looking to stay near the “second CBD”. These will be your targeted profiles when it comes to exiting from the intended 1-bedroom purchase.

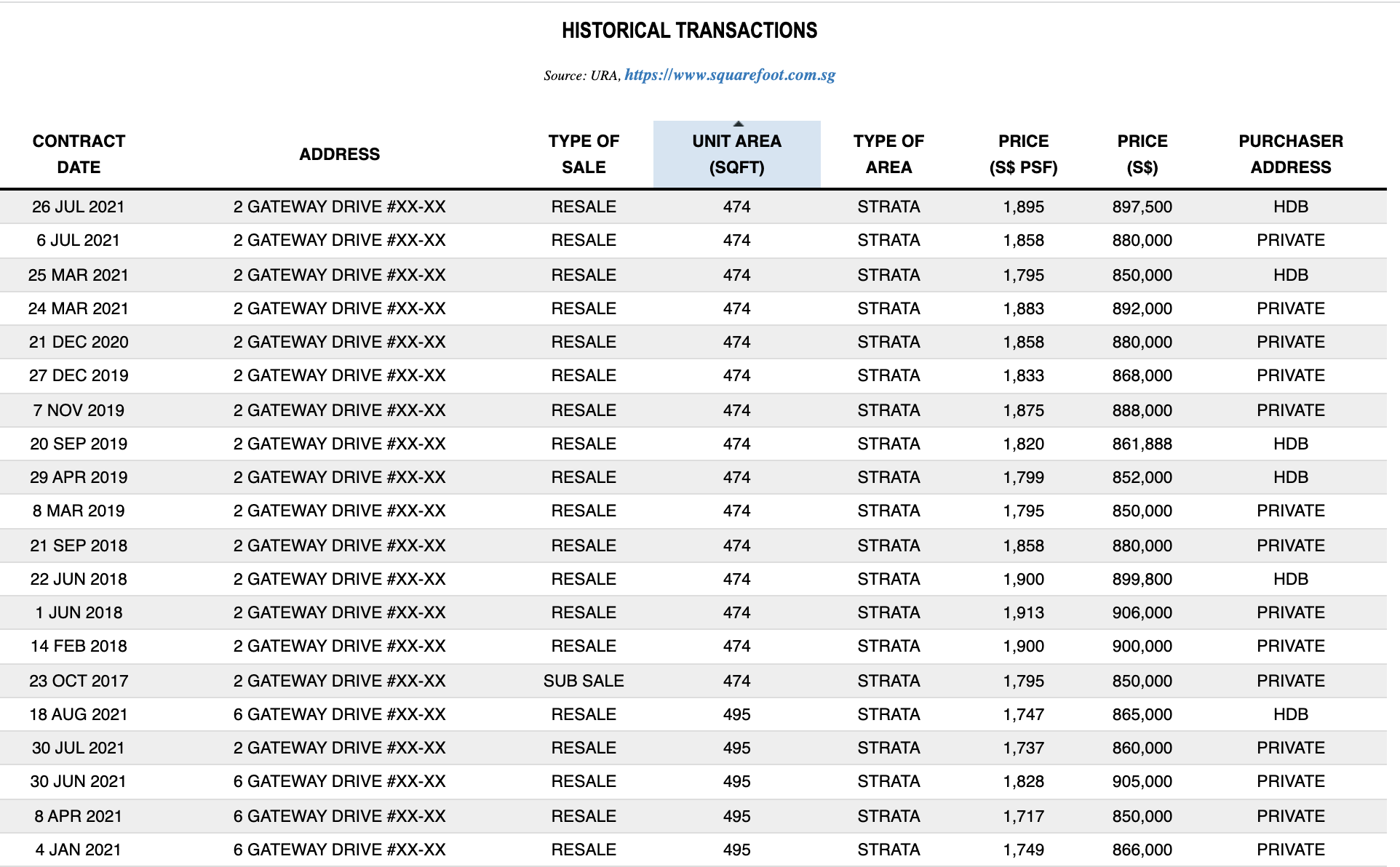

Price-wise, the 474/495 sq ft 1-bedroom has mostly remained under $900k (a few slightly above $9xxk) or in the $17xx-$18xxpsf range in the past few years, which indicates that prices have remained relatively stable even with the sudden news of HSR cancelation which many of the current owners were hoping for back in 2013 when they bought J gateway during launch.

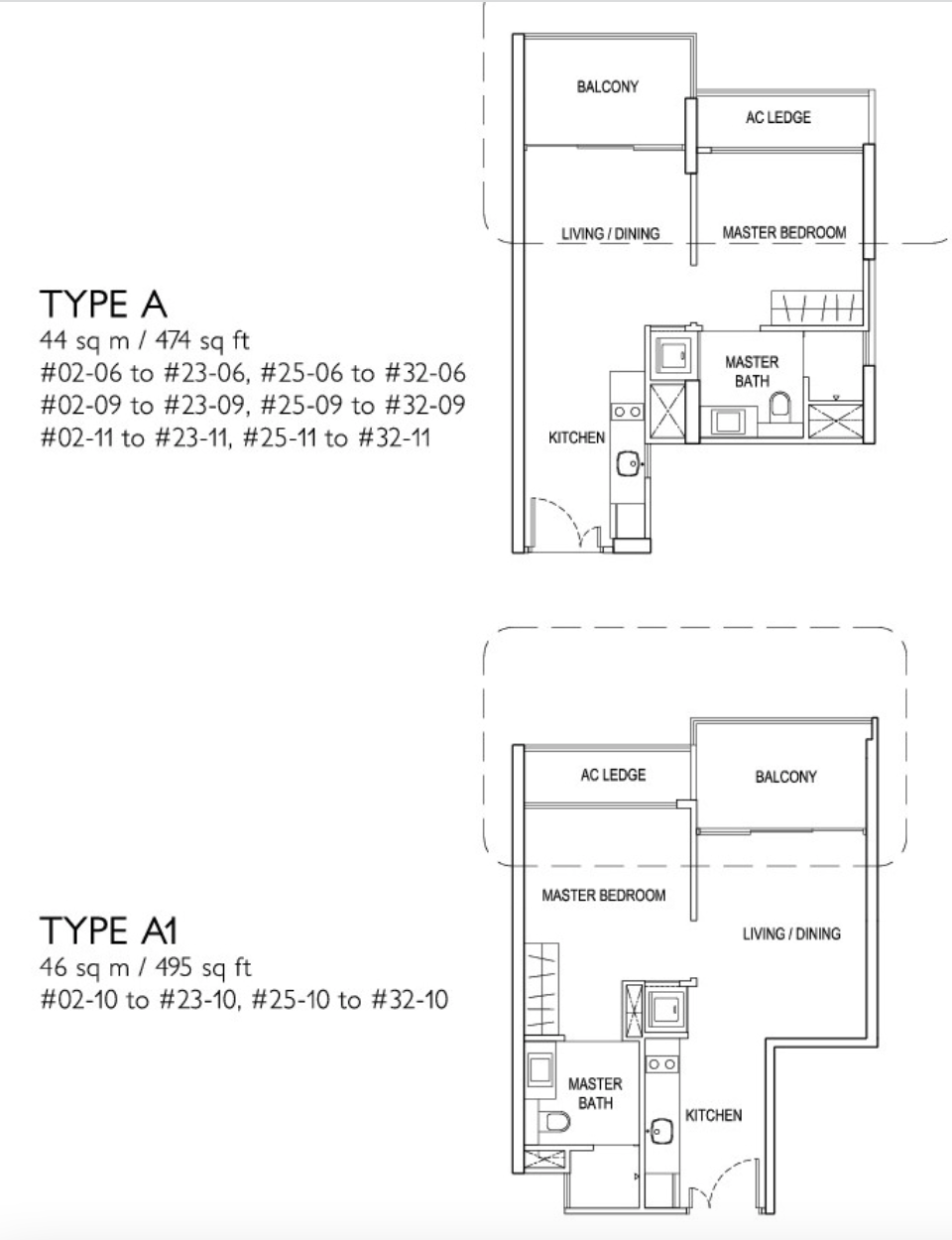

The good thing about the 1-bedder units here, all the 1-bedder (Non-Soho) stacks are located away from the MRT line thus minimal MRT noise will be heard from the unit. Layout wise, it is squarish and efficient with decent size bedroom and kitchen cabinet area, sufficient for single occupancy.

Depending on one’s preference, proper one bedroom with walls separating the living and bed area would be recommended as compared to Loft unit type as many still prefer a proper one bedder over loft units as not many like the idea of climbing up to get to bed on a daily basis thus SOHO loft unit would cater to a niche market.

As we could not foresee what the future prices will be like, we can say that the project is strategically located in the heart of the major transformation of the area thus it is safe to say that entering J Gateway now would be a decent move especially with the convenience of MRT and major malls right at its doorstep. Easier said than done now with the market, but best is to be able to get a unit for below $900k thus leaving some room for future appreciation. However, it also depends on the overall market sentiments and how well it rides along with the future transformation.

Have a question to ask? Shoot us an email at stories@stackedhomes.com – and don’t worry, we will keep your details anonymous.

For more news and information on the Singapore private property market, or an in-depth look at new and resale properties, follow us on Stacked.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Need help with a property decision?

Speak to our team →Read next from Property Advice

Property Advice These Freehold Condos Near Orchard Haven’t Seen Much Price Growth — Here’s Why

Property Advice We Sold Our EC And Have $2.6M For Our Next Home: Should We Buy A New Condo Or Resale?

Property Advice We Can Buy Two HDBs Today — Is Waiting For An EC A Mistake?

Property Advice I’m 55, Have No Income, And Own A Fully Paid HDB Flat—Can I Still Buy Another One Before Selling?

Latest Posts

Singapore Property News This 88-Year Leasehold HDB Shophouse on Bedok Reservoir Rd Is on Sale for $4M

Singapore Property News We Toured A New Co-Living Space In Bugis With Ice Baths, Gyms And Chef Dinners

On The Market Here Are Some Of The Cheapest Newly MOP 4-Room HDB Flats You Can Still Buy

1 Comments

Short answer? No. It’s Jurong, and way overpriced. I gave the answer within like 3 seconds of seeing the question. It’s an instinct. Can’t be learnt no matter how many excel spreadsheets you pull out of your bag. You guys miss the most important thing in property. Giddy up!