Hi there!

I’ve been a follower of your page and I’ve benefited much from your analysis of the private property landscape in S’pore. Data driven and no upselling like some sites! I’m currently single and 33 years old and looking to buy a 1BR apartment for own stay, with the likelihood of selling it after 5-7 years to upgrade to a bigger sized unit.

I have a rather stringent set of criteria and after some searching, I have narrowed my choice down to J Gateway. Would like to ask if you’ve any advice for me.

I have narrowed my option to a unit under 500 sqft in J Gateway for these reasons:

Want a place in the West near my parents’ home in Jurong EastClose to MRT station, food and amenities (all are within walking distance for J Gateway). Mix of cheap food options and restaurants. Windows in the toilet preferred (available in J Gateway, quite rare to find this in new launches or 1BR). Minimal road noise (sound is okay on higher floors).

However, I have seen some statistics online. It is noted that J Gateway was launched at a very high price in 2012, because the SG-KL high speed rail and redevelopment of Jurong was factored in. The Jurong redevelopment has stagnated after the high speed rail project was stalled. I’m not sure how much capital appreciation the unit will gain in the next few years because of this reason. I don’t need to make a big profit when I resell the unit. It will be good enough that I do not make a loss.

I’m also not confident if it’s easy to resell a 1BR unit under 500 sqft. I imagine with such a size, my pool of buyers would only be singles or investors. It would be tough for couples due to the smaller size. There is a good rental pool for this property, but it’s not the first option for me because I would need a place to stay. Would love to hear your views on this.

Thank you!

Hey there,

Thank you for writing in to us and thanks for sharing your intended purchase. J Gateway is located in a strategic location where Jurong East area which is namely known as the “second CBD” will take transformation in the next couple of years. Since the cancelation of High Speed Railway (HSR), the Urban Redevelopment Authority (URA) is gathering feedback on master plan proposals for the Jurong Lake District. With the construction of Jurong East Integrated transport Hub and Jurong Regional Line, Jurong East vicinity will see lots of changes in the future.

Thus, J Gateway being located in close proximity to all these transformations will have the spillover effect with the likelihood of demand coming from investors for rental income or professionals/single profile looking to stay near the “second CBD”. These will be your targeted profiles when it comes to exiting from the intended 1-bedroom purchase.

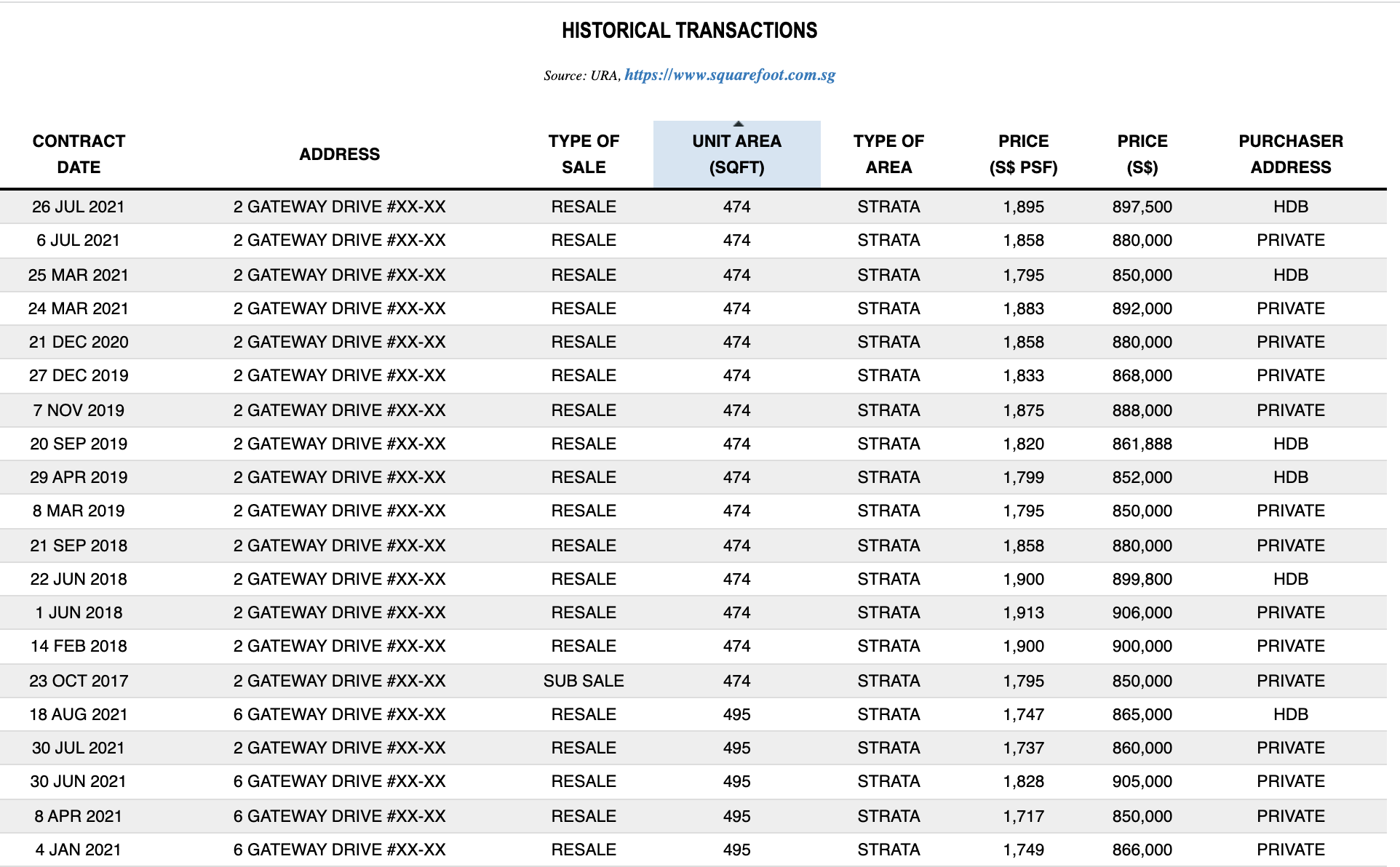

Price-wise, the 474/495 sq ft 1-bedroom has mostly remained under $900k (a few slightly above $9xxk) or in the $17xx-$18xxpsf range in the past few years, which indicates that prices have remained relatively stable even with the sudden news of HSR cancelation which many of the current owners were hoping for back in 2013 when they bought J gateway during launch.

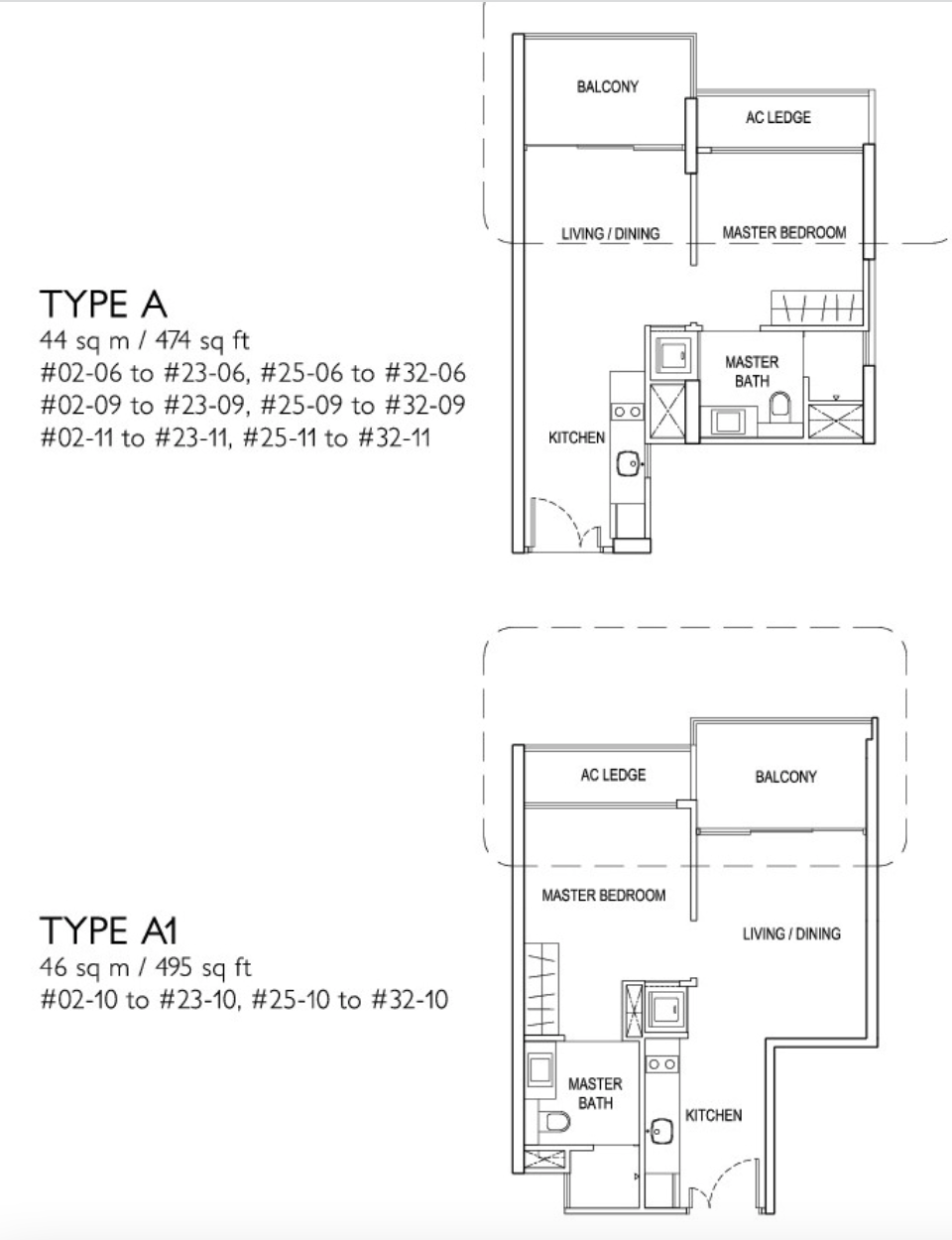

The good thing about the 1-bedder units here, all the 1-bedder (Non-Soho) stacks are located away from the MRT line thus minimal MRT noise will be heard from the unit. Layout wise, it is squarish and efficient with decent size bedroom and kitchen cabinet area, sufficient for single occupancy.

Depending on one’s preference, proper one bedroom with walls separating the living and bed area would be recommended as compared to Loft unit type as many still prefer a proper one bedder over loft units as not many like the idea of climbing up to get to bed on a daily basis thus SOHO loft unit would cater to a niche market.

As we could not foresee what the future prices will be like, we can say that the project is strategically located in the heart of the major transformation of the area thus it is safe to say that entering J Gateway now would be a decent move especially with the convenience of MRT and major malls right at its doorstep. Easier said than done now with the market, but best is to be able to get a unit for below $900k thus leaving some room for future appreciation. However, it also depends on the overall market sentiments and how well it rides along with the future transformation.

Have a question to ask? Shoot us an email at hello@stackedhomes.com – and don’t worry, we will keep your details anonymous.

For more news and information on the Singapore private property market, or an in-depth look at new and resale properties, follow us on Stacked.

We hope that our analysis will help you in your decision-making. If you’d like to get in touch for a more in-depth consultation, you can do so here.

Read next from Property Advice

Property Advice We Ranked The Most Important Things To Consider Before Buying A Property In Singapore: This One Came Top

Property Advice Why Punggol Northshore Could Be The Next Hotspot In The HDB Resale Market

Property Advice How Much Is Your Home Really Worth? How Property Valuations Work in Singapore

Property Advice Why I Had Second Thoughts After Buying My Dream Home In Singapore

Latest Posts

On The Market 5 Biggest HDB Flats Over 1,700 Sqft From $950k

Pro 2 Reasons Costa Del Sol Underperformed—Despite Its Seafront Location And Family Appeal

Homeowner Stories I’ve Lived in Twin VEW for Four Years: What It’s Like Living Without an MRT Nearby

Editor's Pick The Surprising Truth Behind Singapore’s Longest Held Condos – And Why Residents Refuse To Sell After 20 Years

Pro 7 Reasons Reflections at Keppel Bay Underperformed—Despite Its Iconic Design and Prime Waterfront Location

Singapore Property News Clementi 4-Room HDB Sold For Record $1.28 Million – Here’s What Makes It So Special

Editor's Pick This New River Valley Condo Starts At $1.2M: And It’s Cheaper Than Some City-Fringe Launches

New Launch Condo Analysis This New 376-Unit Condo In Sembawang Might Be The Best Pick For Young Families: Here’s Why

Editor's Pick Where To Find Freehold Semi-D Landed Homes From $4.4m: Touring Gilstead Road

Singapore Property News The Trick to Seeing Through a Condo Showflat (Most Buyers Never Do This)

Editor's Pick Can You Really Buy A House In Italy For €1? Here’s What Singaporeans Should Know

On The Market 5 Cheapest 5-Room HDB Flats Near MRT Stations From $550k

Pro Why Seletar Park Residence Underperformed—Despite Its District 28 Location And Large Unit Sizes

On The Market Inside A Luxury Waterfront Home at The Residences At W Singapore Sentosa Cove

New Launch Condo Analysis Singapore’s Tallest New Condo Comes With the Highest Infinity Pool: Is The 63-Storey Promenade Peak Worth A Look?

Short answer? No. It’s Jurong, and way overpriced. I gave the answer within like 3 seconds of seeing the question. It’s an instinct. Can’t be learnt no matter how many excel spreadsheets you pull out of your bag. You guys miss the most important thing in property. Giddy up!