Why This Rare New Queenstown Condo Nearly Sold Out Even At $2,800 Psf

October 20, 2025

When you mention Margaret Drive, most people will think of million-dollar HDBs. But while Dawson has become a household name for record-breaking resale flat prices, it’s on the radar for a whole different reason this week. At the time we’re writing this (evening of 18th October), a new launch condo here – Penrith – looks likely to move 100 per cent of its units, or close to it.

By around 4 p.m., Penrith had moved 447 out of 462 units, achieving roughly 97 per cent sales. Prices reportedly ranged from around $2,435 to $3,088 psf, with an average of about $2,800 psf, and there were two price increases at 11 a.m. and 12.30 p.m.

But the momentum really started a day earlier, during the priority sales phase, when 58 per cent of all units were already sold before the public launch even began. Notably, all four-bedders were taken up on that day, reflecting strong end-user demand from family upgraders who were already familiar with the Queenstown area and saw long-term value in its location. It was a strong signal of demand heading into the public launch, and by the following afternoon, that confidence translated into one of the best-performing launches of 2025 so far.

Why this is one of the most significant launch events

Penrith is the fifth new launch in 2025 (excluding ECs) to exceed 90 per cent launch-day sales; it looks likely to beat Lentor Central Residences (93 per cent), LyndenWoods (94 per cent), Springleaf Residence (92 per cent), and getting very close to Skye at Holland (99 per cent). But what makes Penrith stand out is that it did so at one of the highest average $PSFs in the RCR.

Consider that Bloomsbury Residences recorded a median of about $2,474 psf, while Grand Dunman was transacting around $2,500 psf; but Bloomsbury moved around 25 per cent of its inventory at launch, and Grand Dunman managed around 54 per cent (although they both had more competition in the area).

According to news at this time, more than 90 per cent of buyers were Singaporeans, with the rest comprising Permanent Residents and foreigners. The three- and four-bedroom units were the fastest to go, which is also another significant factor: usually, it’s expected that lower-quantum two-bedders will move faster. While we’ve seen more families willing to accept two-bedders lately, perhaps this signals the market can stretch a little past the $1.8 million to $2 million mark for two-bedders.

What made this happen?

Several factors aligned just right, to drive demand at Penrith

1. Pent-up demand since 2018

Penrith is the first private launch in Queenstown since 2018, following Margaret Ville and Stirling Residences. During this seven year gap, Queenstown’s resale HDB market has continued to soar, with over 100 transactions above the $1 million mark in 2025 alone.

This means there’s a large pool of HDB upgraders who (1) don’t want to surrender the excellent location, and (2) have sufficient sale proceeds to afford Penrith. This explains why Penrith was able to see strong sales, even at the given price point.

More from Stacked

Sign of the Times: Comparing An Old Resale HDB To A New BTO

Having stayed in an (old) resale flat for almost my entire life, I have grown accustomed to having sufficient space…

And speaking of price…

2. Penrith came in at an acceptable quantum (overall price)

While $2,800 psf may appear steep, quantum matters more to buyers today. The two-bedders, for instance, were priced at around $1.5 million. This is below the $1.8 million range expected for many new launch condos today.

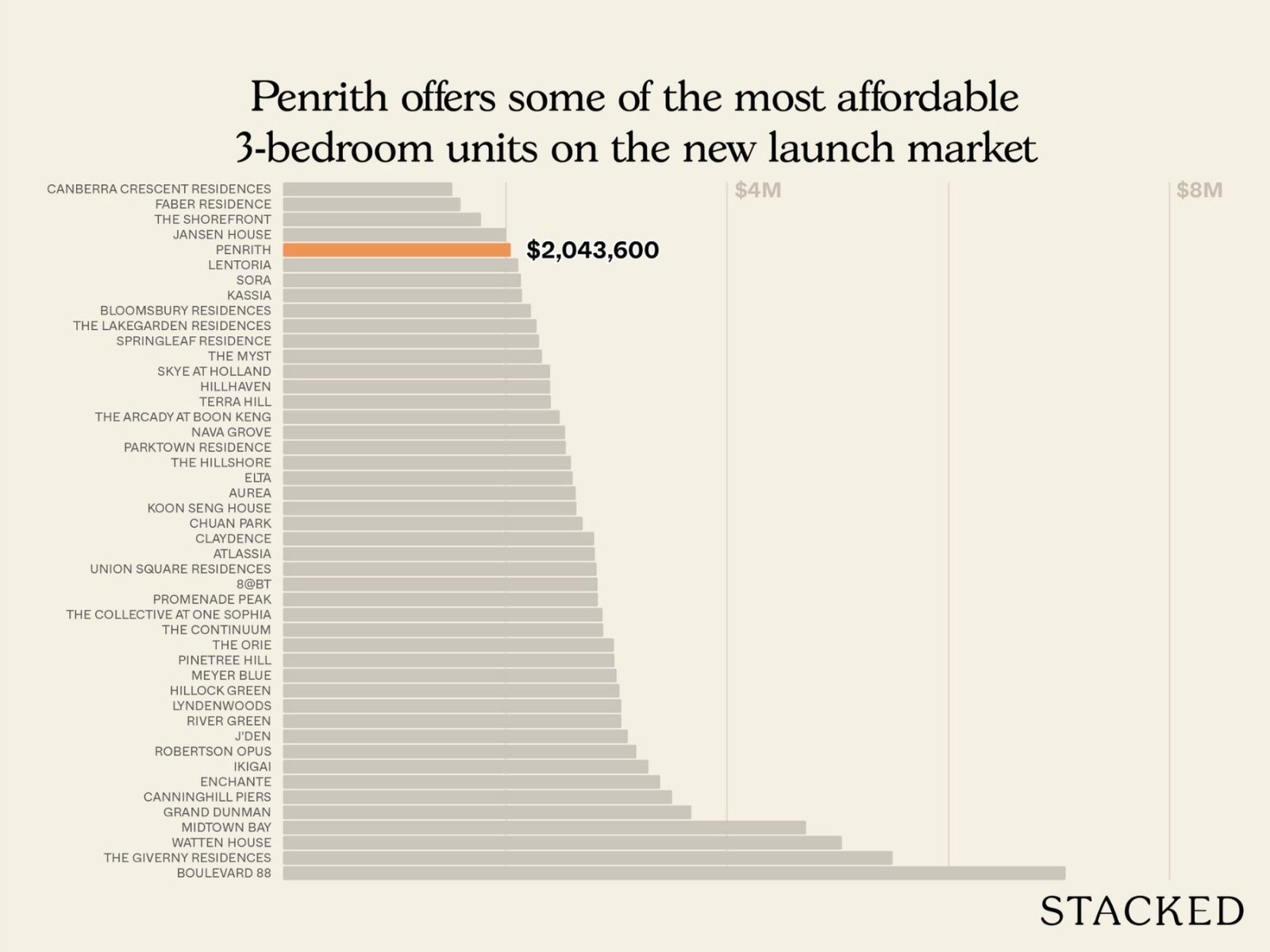

The three-bedders reportedly ranged from $2.1 million to $2.3 million, whilst some of the four-bedders managed to stay under $3 million. This is contextually a value buy, if we consider it’s a city fringe location that’s close to an MRT station.

3. Decent spaciousness despite the quantum

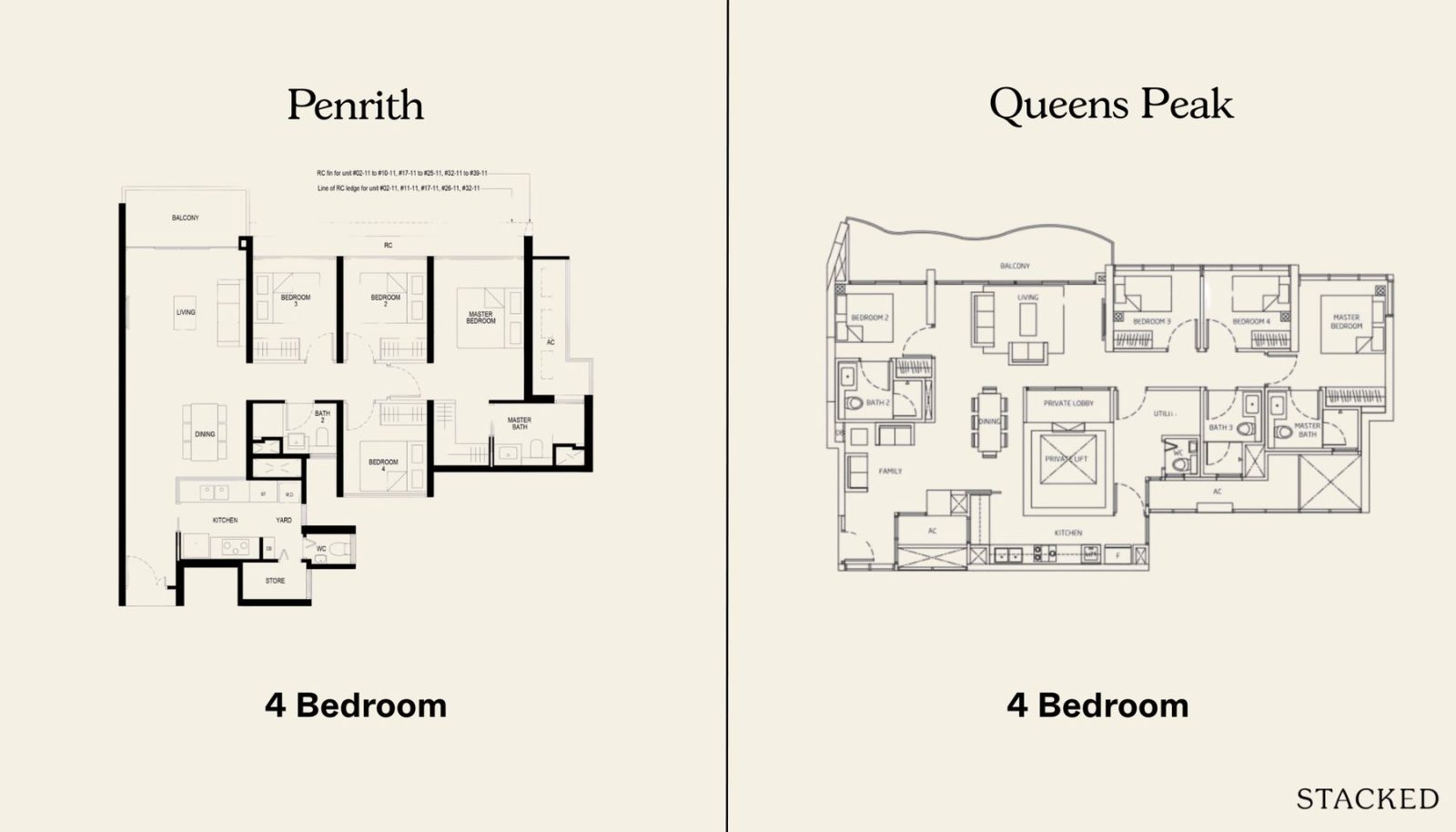

To fit an affordable quantum, developers often compromise on space. But Penrith managed to remain decently spacious. Note the unit sizes despite this being a post-GFA harmonisation project:

The developer didn’t give space to one bedders, and offered only two- to four-bedroom units. Two-bedders start from 614 sq ft, while four-bedders go up to 1,281 sq ft. The lack of one-bedders and the stronger tilt toward three- and four-bedroom layouts (together making up about 67 per cent of the mix).

These are the unit sizes that we’re used to seeing in some other pre-harmonisation projects – but in this case, we know that the square footage also cuts out unlivable spaces like air-con ledges.

We have more extensive details on this in our review; but suffice it to say that, in the eyes of some buyers, Penrith delivered an acceptable quantum without serious compromises in spaciousness.

4. Future alternatives and further competition seem improbable

The Dawson – Margaret Drive stretch has been largely built up, leaving few potential plots for new residential projects. As such, buyers probably recognised that another chance at a new launch here is very slim. For the more investment-minded, it’s also an advantage that future competition will be limited at most.

This would have contributed a sense of urgency in the owner-occupier crowd, as a shot at a new Queenstown condo is a once-in-a-blue-moon affair (especially one this close to the MRT station).

Penrith’s quick sales reflect a lot on the recent property market

There was little or no concern about Penrith’s 99-year leasehold status, so perhaps the obsession with freehold is weakening. In addition, the quick sales show buyers today are less inclined to chase lower psf figures; what matters to them is overall quantum.

Penrith also demonstrates how – in areas where resale flat prices have soared – HDB upgraders might be able to stretch further past the $2 million mark, into three and four-bedders.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

Why did the Penrith condo in Queenstown sell out so quickly?

What makes Penrith's launch notable compared to other new condos?

How does Penrith's pricing compare to other recent launches in the area?

Who are the main buyers for Penrith condos?

What factors contributed to the high demand for Penrith?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Singapore Property News

Singapore Property News REDAS-NUS Talent Programme Unveiled to Attract More to Join Real Estate Industry

Singapore Property News Three Very Different Singapore Properties Just Hit The Market — And One Is A $1B En Bloc

Singapore Property News Singapore Could Soon Have A Multi-Storey Driving Centre — Here’s Where It May Be Built

Singapore Property News Will the Freehold Serenity Park’s $505M Collective Sale Succeed in Enticing Developers?

Latest Posts

Overseas Property Investing This Singaporean Has Been Building Property In Japan Since 2015 — Here’s What He Says Investors Should Know

On The Market Here Are Hard-To-Find 3-Bedroom Condos Under $1.5M With Unblocked Landed Estate Views

Pro Why Some Central Area HDB Flats Struggle To Maintain Their Premium

0 Comments