Property Market Update: Private Home Sales Dip, While Prices Keep Climbing (August 2021)

September 25, 2021

2021 continues to be an interesting year. First-time homeowners continue to keep their fingers crossed, hoping for a break; while at the same time sellers wonder if now’s the time to sell (if you sell high, you might buy high too right?) Through it all, the soft rental market suddenly shows signs of turning around. Here’s an update on the Singapore private property market, in the unusual month of August 2021:

What’s unusual about August 2021?

In summary, we’re seeing:

- HDB resale prices bounced back after the June dip

- The highest number of million-dollar flats sold in a single month

- A 23.6 per cent drop in new condo sales

- Property agent transaction data has gone public

As an interesting aside, the car park on top of People’s Park Complex was finally sold in August.

1. HDB resale prices bounced back after the June dip

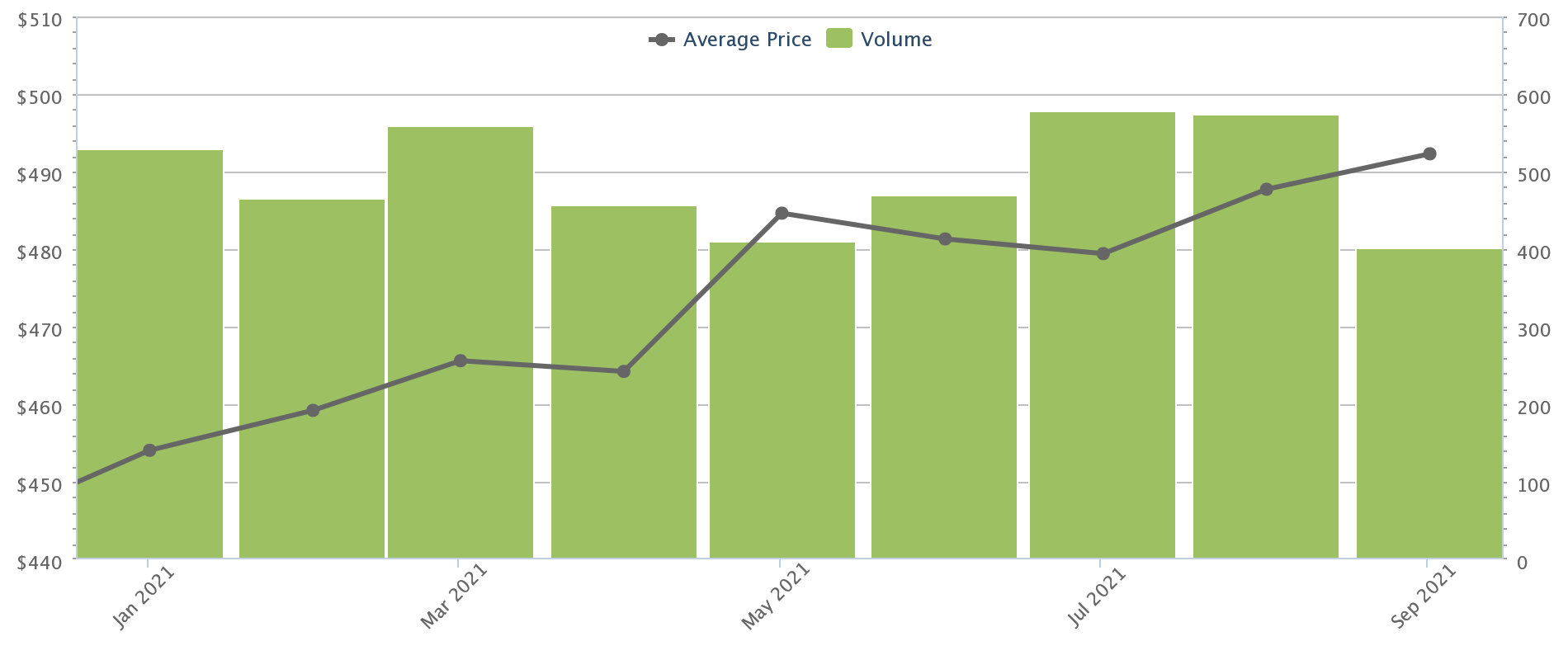

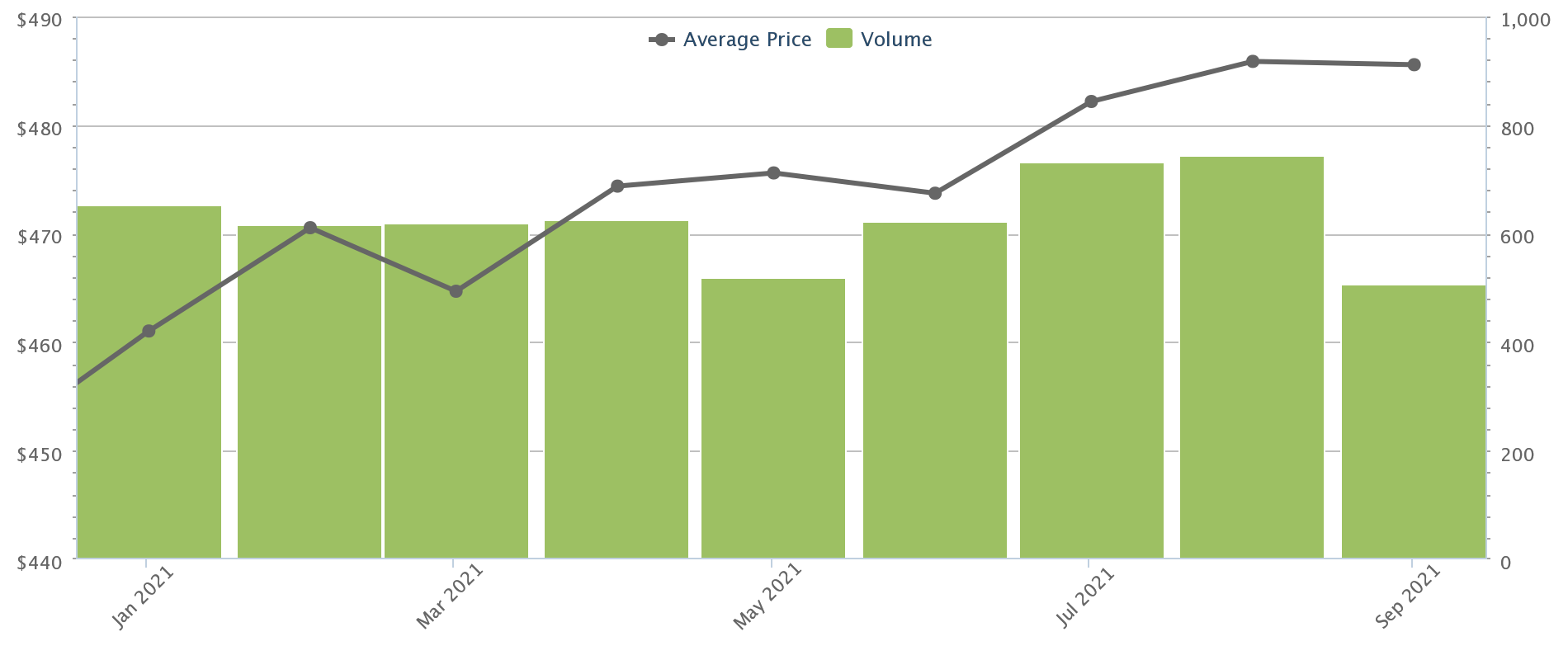

HDB rental rates had risen for almost 10 consecutive months, from August 2020 to May 2021, before a slight dip in June and July. Many buyers, in particular first-timers, had hoped that signalled an end to fast-rising prices.

However, it proved to be a temporary effect from a return to Phase II (heightened alert), and prices have now risen even higher than May:

3-room flats averaged $488 psf in August 2021, up from just $431 psf a year ago.

4-room flats hit $504 psf in August; not yet at their May levels of $509 psf, but there’s a clear upward trend. This is up from just $439 psf a year ago.

5-room flats averaged $486 psf, having already recovered by July. Prices are up from $417 psf, in August 2020.

Overall, it seems clear that June was little more than a momentary speed bump. In fact, resale prices in August are a mere 0.1 per cent below the last peak, in April 2013.

It’s bad news for first-time homebuyers looking for a resale flat, and we don’t see any changes in the near future.

Realtors we spoke to indicated two main factors driving up the price:

First, the higher price psf may be reflective of five-year old flats entering the market. There’s a bumper crop of these units on the market in 2020 and 2021; and these newer resale flats are priced at a premium. There’s no waiting time for construction, and their lease decay is negligible (see our list of where you’re likely to find these).

2. The highest number of million-dollar flats sold in a single month

26 resale flats transacted at $1 million or above in August 2021. This is the highest on record for a single month.

Natura Loft, a DBSS flat in Bishan, saw the highest transaction at $1.28 million for a five-room flat.

Including August, we have seen 151 flats transact at $1 million or over. The year is not even over, and we are already well past the 82 such transactions last year.

Nonetheless, keep in mind million-dollar flats are still outliers. There were 2,748 resale flat transactions for the month, which means the million-dollar flats made up less than one per cent of the transactions.

3. A 23.6 per cent drop in new condo sales

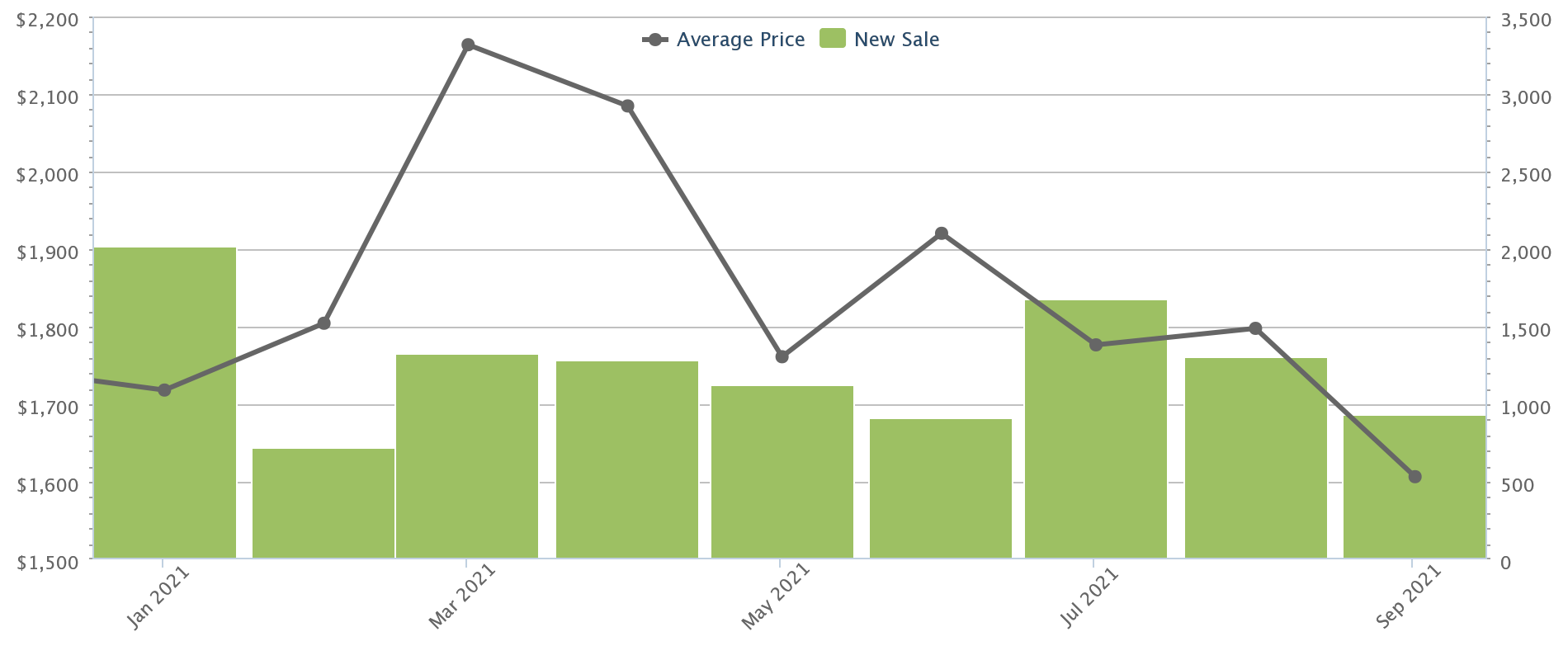

New private home sales fell to 1,215 units in August, compared to 1,591 in July; a drop of around 23.6 per cent.

To be sure, a dip was expected due to the seventh month festival, when most buyers refrain from home purchases. However, realtors we spoke to said the seventh month festival alone wouldn’t have made such a big impact.

(As we just mentioned above, a record number of million-dollar flats were sold in the same month!)

Property TrendsWill We See Million Dollar HDBs In Non-Mature Estates Soon? A Closer Look At The Narrowing Gap

by Ryan J. OngThe drop is more likely due to fewer new launches. There were only around 830 units launched in August, down by around 50 per cent from a year ago.

More from Stacked

Can Singaporeans Really Afford Their Properties During Covid-19?

Last year, MAS issued cautions as new launches grew, side-lining resale units. Then the re-issue of Options To Purchase (OTPs)…

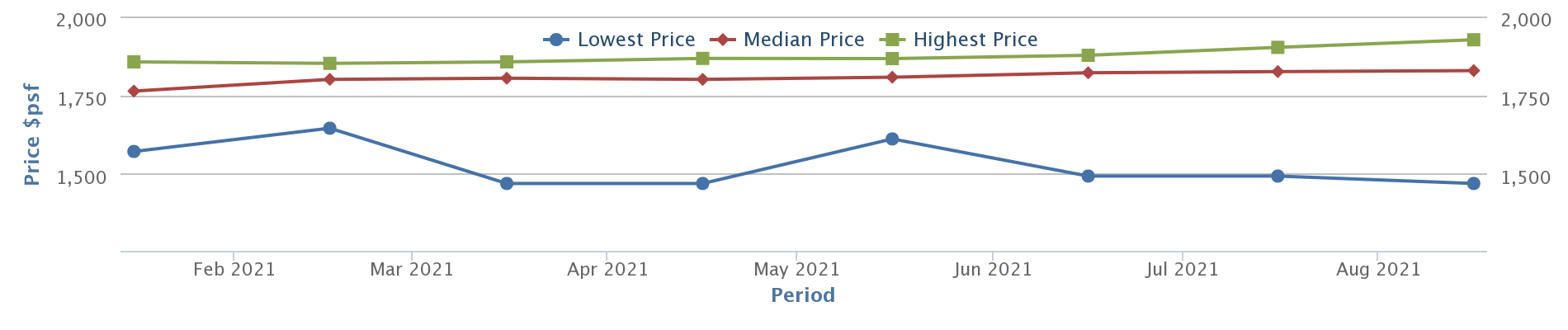

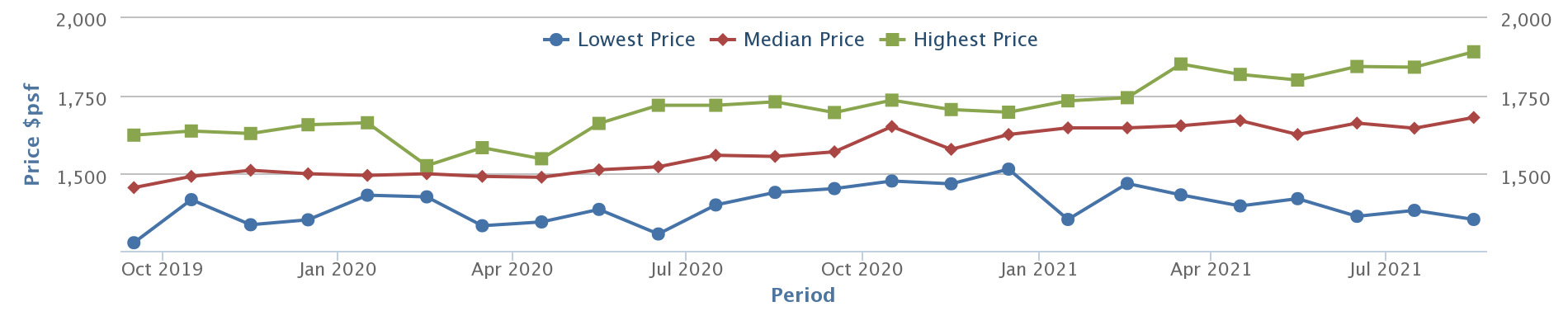

Watergardens at Canberra made up the majority of sales for August, with 267 units sold (300 available at launch, 448 units total). The current transactions indicate a median price of $1,469 psf so far.

Normanton Park and Florence Residences were the next two top sellers for August:

Normanton Park moved another 131 units in August, and is now 63 per cent sold – that’s a pretty good showing considering its early no-sale license problems (and it does have a mega 1,862 units to contend with). Median prices have risen to $1,828 psf, up from $1,763 psf at launch.

The Florence Residences moved 66 more units in August, and is now over 84 per cent sold. Median prices were at $1,679 psf, up from $1,456 psf at launch.

Realtors also told us that, besides fewer new launches, attention has been turning to the resale condo market for 2021. This is due to fears of construction delays, as well as a new trend toward larger homes (older resale condos tend to be bigger).

4. Property agent transaction data has gone public

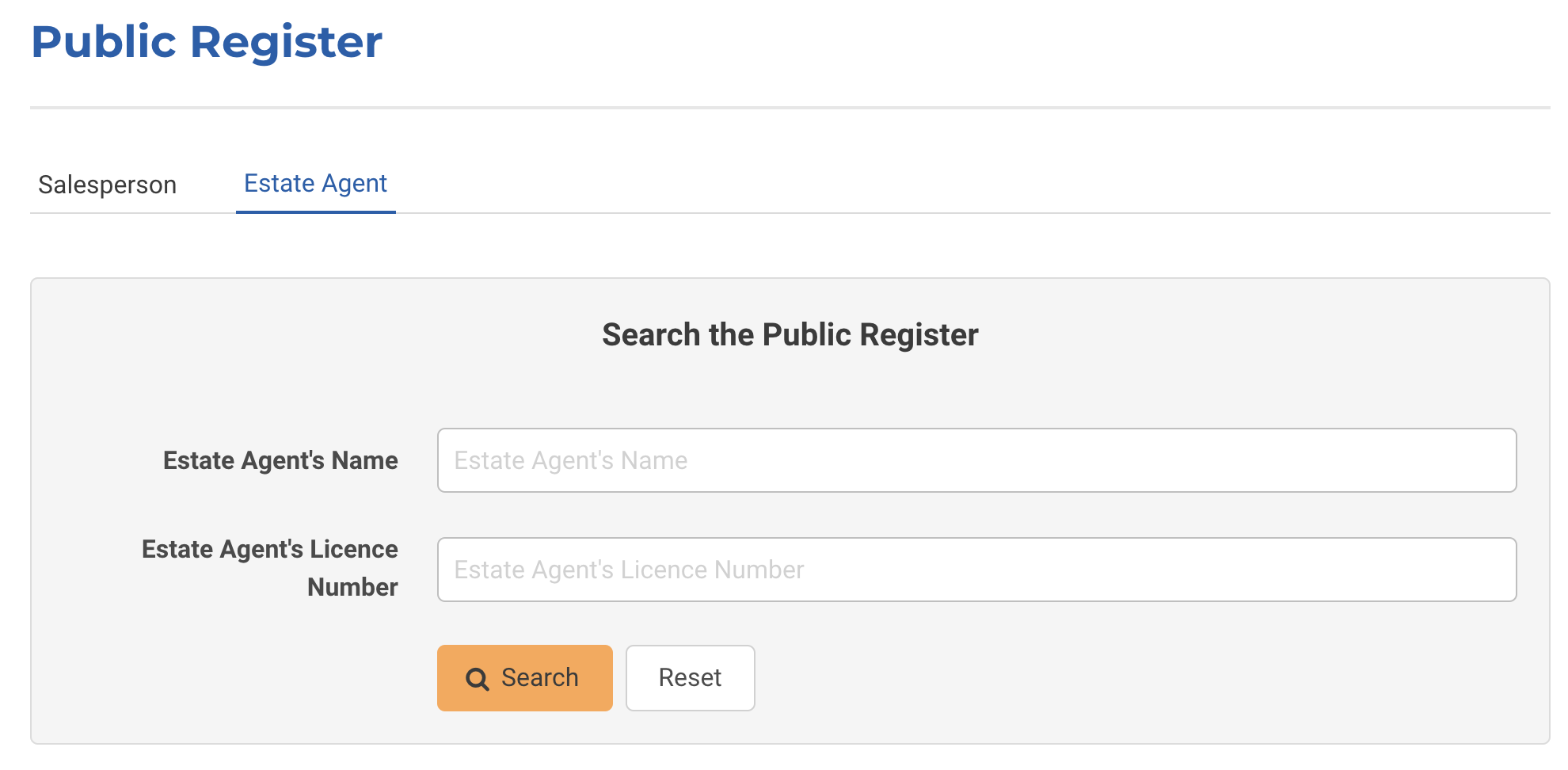

The CEA public register is now open. You can use this to check any property agent’s recent transactions, in the past 24 months.

The record also shows the property type, whether it’s new or resale, and whether the whole unit or rooms were leased out (for rental transactions). Records older than 24 months are also available, but you need to get it off data.gov.sg instead.

In previous articles, we’ve mentioned that you should prefer agents who have recently handled transactions in your area or development. This site now provides an easy way to find them.

The register also ensures you can verify each agent’s claims (e.g., if they claim to have sold a unit in your block, you can just check their record to ensure it happened).

This could potentially create stronger demand for veteran agents, who have a more established track record – but it’s more about transparency here and buyers are definitely better for it than without.

Given that commissions are negotiable in Singapore, there’s a chance this may cause a little more divergence from the standard two per cent commission; agents with a better history might start charging a bit more, while newer agents are likely to stick with standard rates.

Finally, you may be interested to know someone bought the parking lot on top of the People’s Park Complex

Lucky Pineapple (an entity under Far East Organization) bought the multi-storey car park for $39.33 million; somewhat less than the $42 million asking price we saw for it.

This is about $195 psf, with $1,533 psf for the restaurant unit situated in the car park. This is a reasonably good deal, even if the entire development has just 46 years to go; the car park is one of the few options for drivers in the area (if you’ve tried driving in Chinatown, you’ll know what we mean).

In addition, the en-bloc prospects are high, given the central location.

For more news and updates on the Singapore private property market, follow us on Stacked. We’ll also provide you with the latest reviews of new and resale condos alike.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

How have resale flat prices changed in Singapore recently?

What was notable about the sale of million-dollar flats in August 2021?

Why did private new condo sales drop in August 2021?

What new transparency measures are available for property agents in Singapore?

Who bought the car park on top of People’s Park Complex, and what was the deal?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Singapore Property News

Singapore Property News REDAS-NUS Talent Programme Unveiled to Attract More to Join Real Estate Industry

Singapore Property News Three Very Different Singapore Properties Just Hit The Market — And One Is A $1B En Bloc

Singapore Property News Singapore Could Soon Have A Multi-Storey Driving Centre — Here’s Where It May Be Built

Singapore Property News Will the Freehold Serenity Park’s $505M Collective Sale Succeed in Enticing Developers?

Latest Posts

On The Market Here Are Hard-To-Find 3-Bedroom Condos Under $1.5M With Unblocked Landed Estate Views

Pro Why Some Central Area HDB Flats Struggle To Maintain Their Premium

Property Advice We Sold Our EC And Have $2.6M For Our Next Home: Should We Buy A New Condo Or Resale?

0 Comments