We Review The February 2026 BTO Launch Sites (Bukit Merah, Toa Payoh, Tampines, Sembawang)

January 27, 2026

The incoming month of February heralds the first Build-To-Order (BTO) sales exercise of this year.

This time around, we’re looking at around 4,600 new flats across Bukit Merah, Sembawang, Tampines, and Toa Payoh. A concurrent Sale of Balance Flats (SBF) exercise will also take place, offering 3,000 flats across the island.

What’s interesting to note for next month’s BTO sales exercise is the concentration of new projects in just these four towns, which is less locationally varied compared to some of the previous launches last year.

It could be the start of a shift from 2025: HDB has said they will launch around 19,600 BTO flats in 2026, with more supply planned for 2027 if demand holds up; all part of a broader push to deliver 55,000+ new flats between 2025 and 2027.

This is against a backdrop where application rates have cooled, resale price growth has moderated, and more flats are reaching their Minimum Occupation Period (MOP) this year. These are all factors that could ease pressure across the wider HDB market, so that may explain the smaller and more selective start to the year.

Here’s a look at what’s on offer:

| Town | Site | Expected Classification | 2-room | 3-room | 4-room | 5-room | Total Units |

| Bukit Merah | Redhill / Bukit Merah Central | Prime | 360 | 90 | 590 | – | 1,040 |

| Sembawang | Sembawang Drive | Standard | 290 | – | 450 | 420 | 1,160 |

| Sembawang | Admiralty Lane | Standard | 180 | 80 | 270 | 230 | 760 |

| Tampines | Tampines Central 8 | Plus | 120 | – | 130 | – | 250 |

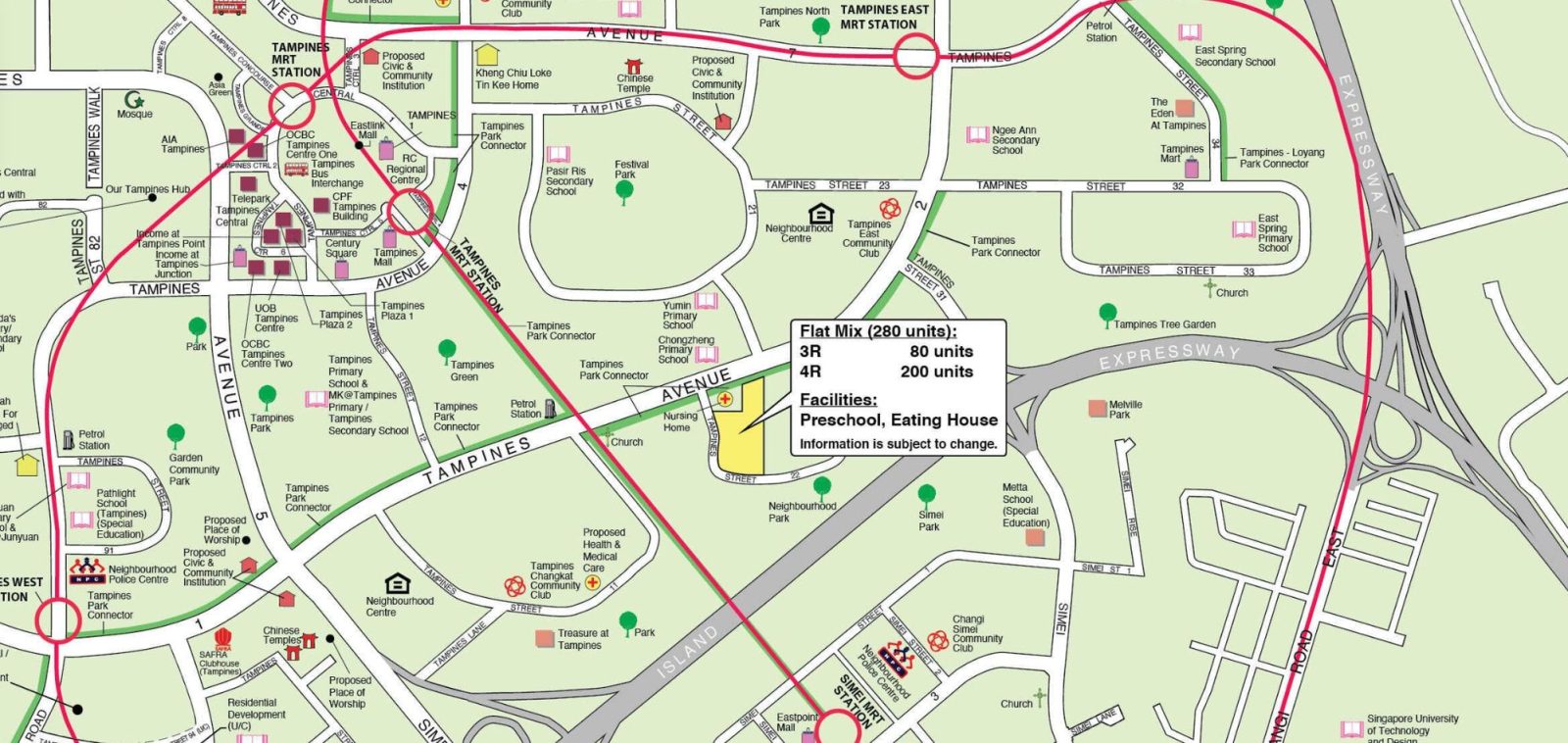

| Tampines | Tampines Street 22 | Plus / Standard | – | 80 | 200 | – | 280 |

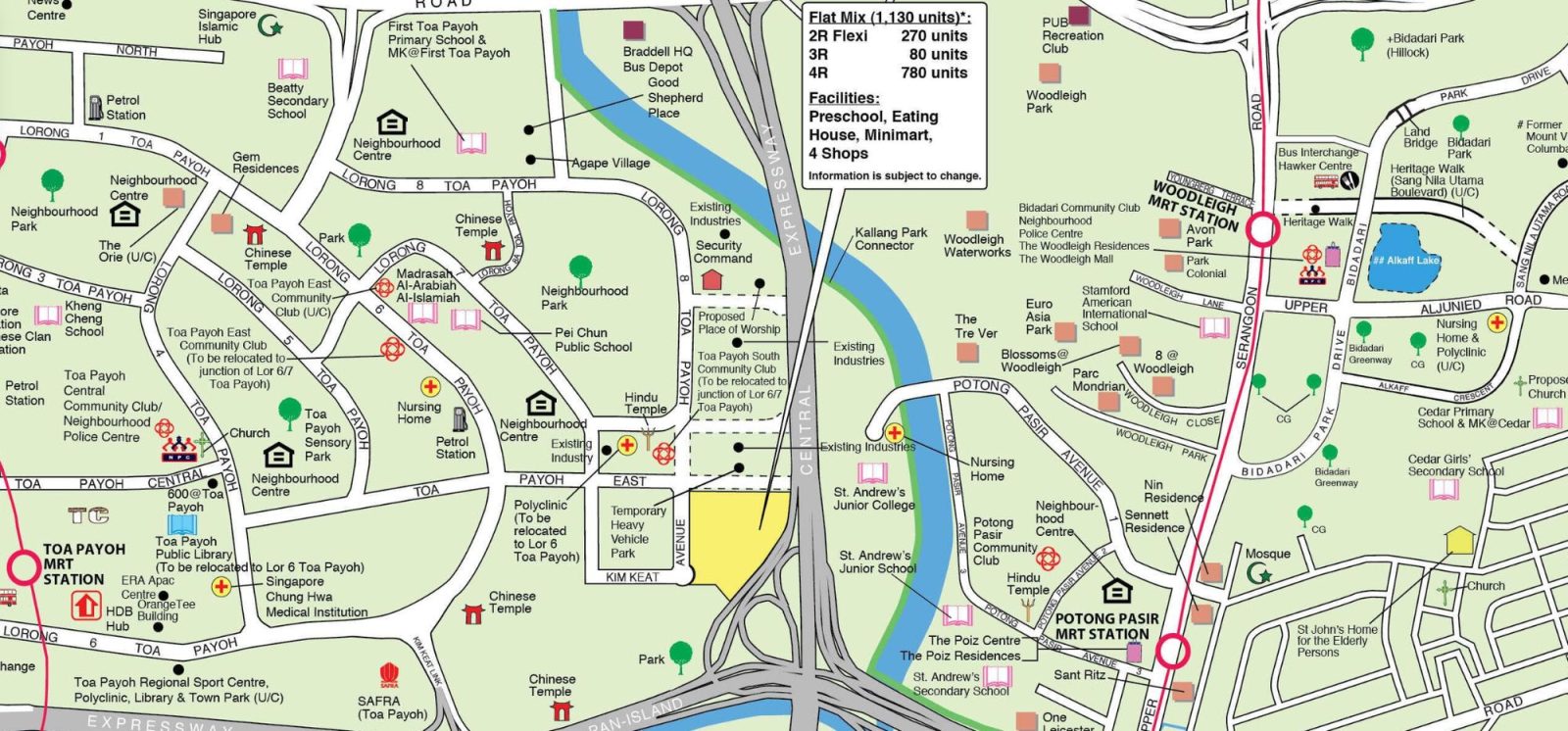

| Toa Payoh | Kim Keat | Prime / Plus | 270 | 80 | 780 | – | 1,130 |

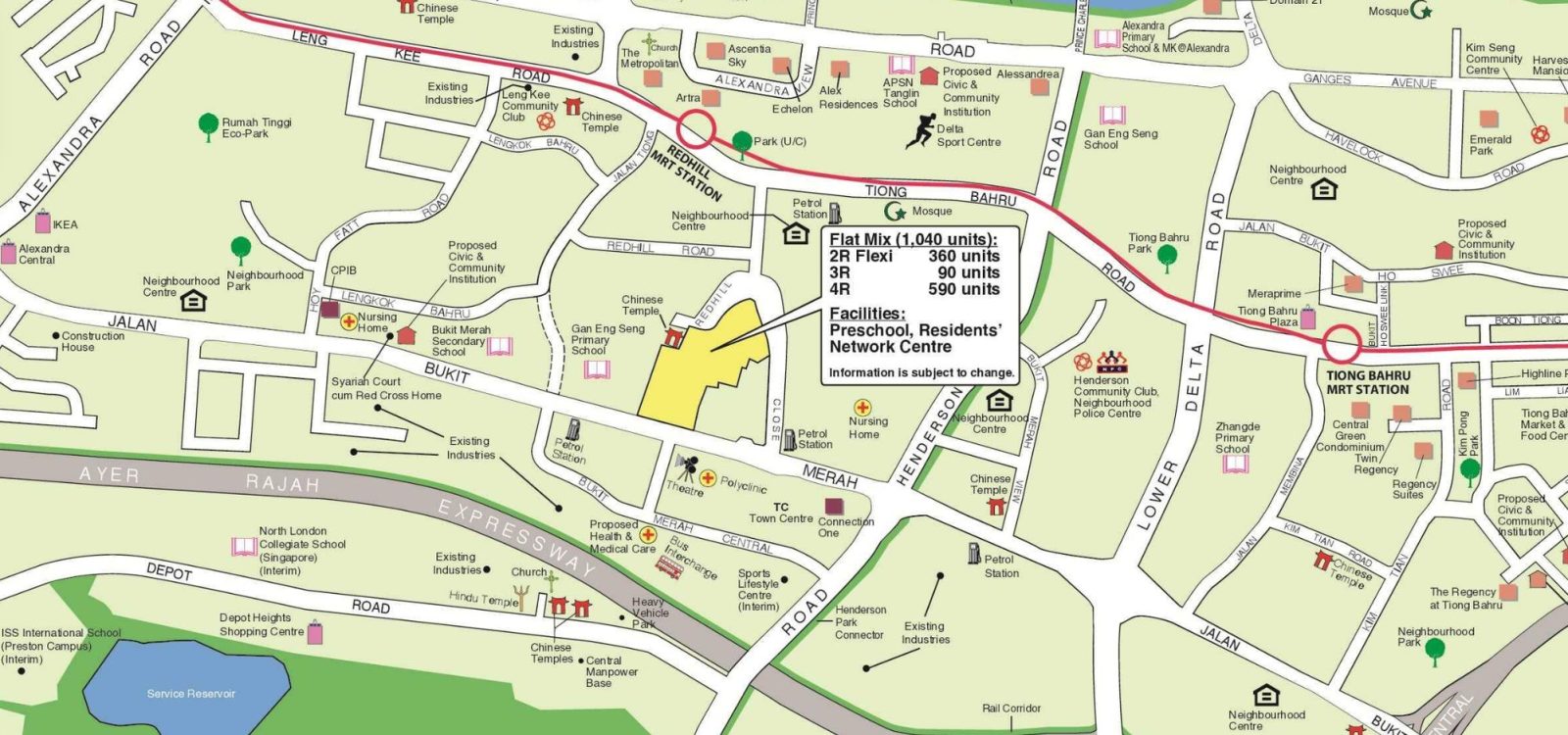

1. Bukit Merah

Bukit Merah is the highlight of the February BTO launch exercise. The new project will comprise 1,040units with a mix of two-room flexi, three- and four-room flats available. This is a familiar unit mix for most Prime BTO projects so far, and chances are high that this project will likely fall into the Prime category as well.

The latest site is close to Redhill MRT station on the East-West Line (EWL), and it is just one stop away from Tiong Bahru or Queenstown in either direction. The site is also next to Gan Eng Seng Primary School, and across the road from the Bukit Merah Town Centre.

We covered this neighbourhood in a 2023 article, and most of the improvements we mentioned are in place, so amenities from supermarkets to eateries are already plentiful.

This area last saw two BTO projects during the October 2025 sales exercise. The 1,021-unit Redhill Peaks was a Prime project and is next to the upcoming BTO development. The other is the 880-unit Berlayar Residences, which is also a Prime project, and is close to Telok Blangah MRT station on the Circle Line (CRL).

We expect the upcoming project will likely be heavily oversubscribed, regardless of whether it turns out to be a Prime BTO project or not, so you have to be quite lucky to land a unit here. We’d make backup plans just in case.

For reference, Redhill Peaks and Berlayar Residences offered a total of 1,078 four-room flats and attracted 5,521 applicants – an application rate of 3.1 from first-timer families and 23.8 from second-timer families.

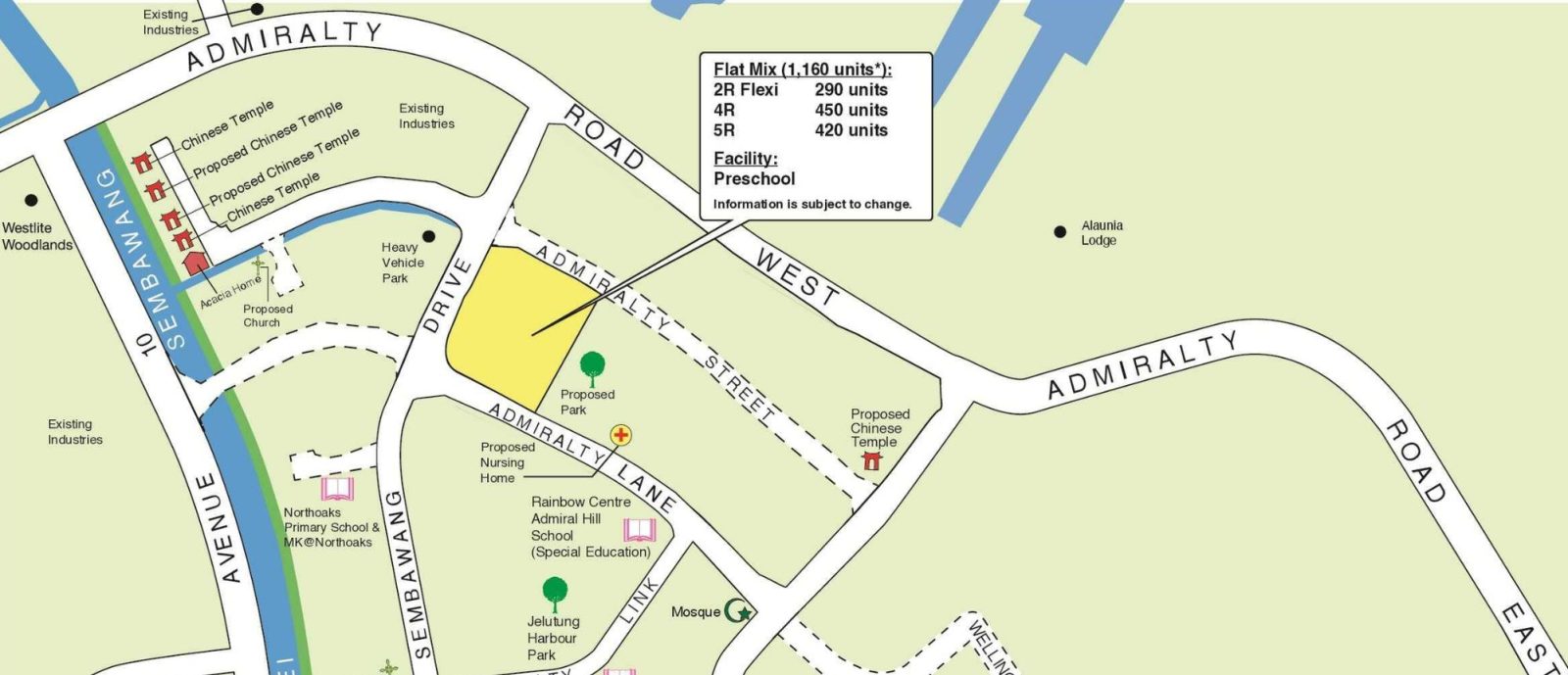

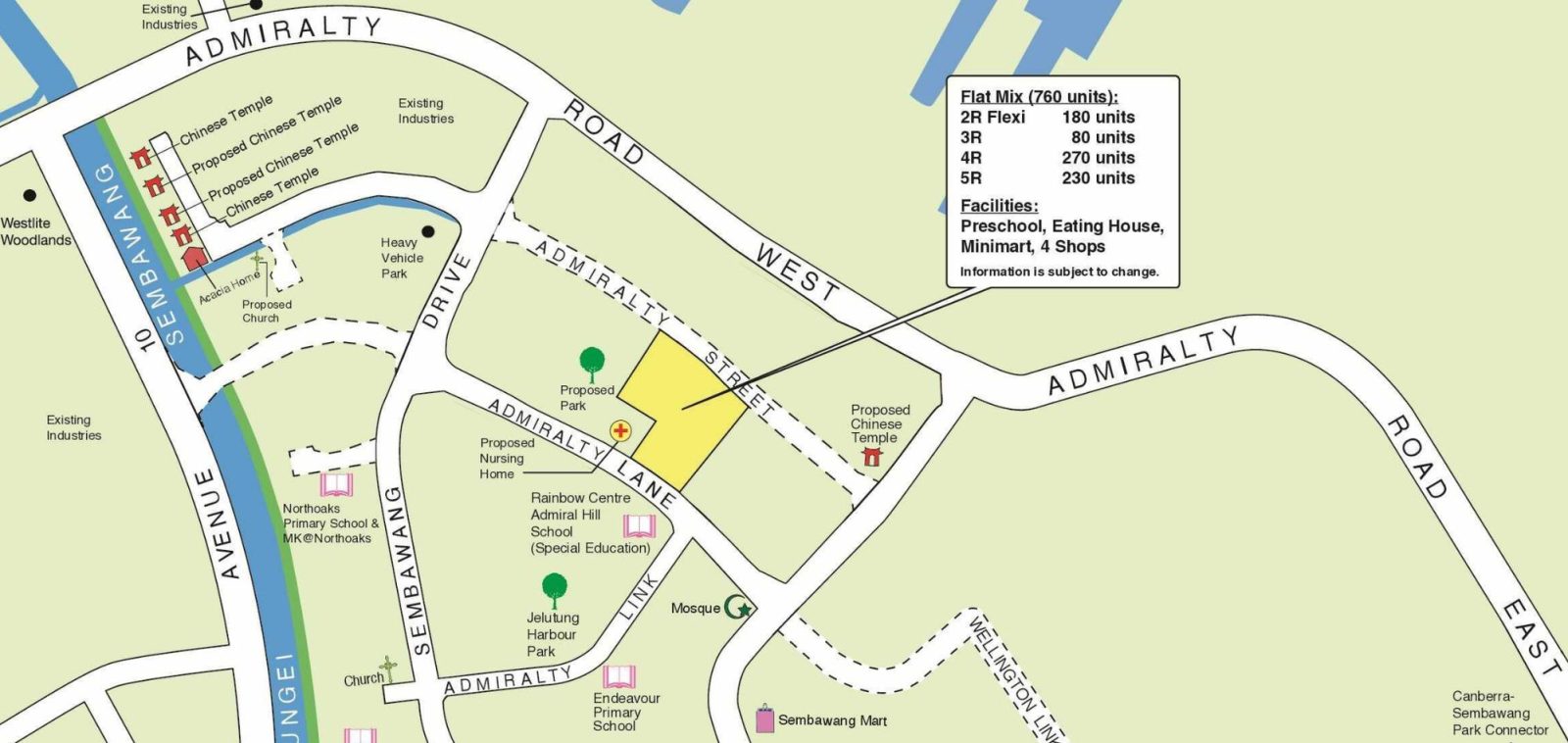

2. Sembawang

Sembawang will see two new BTO projects launched next month, and both projects seem to be close to each other and separated by a new public park.

The larger development, in terms of unit count, will offer 1,160 flats with a mix of two-room flexi, four- and five-room flats, while the other development comprises 760 flats with a mix of two-room flexi, and three- to five-room flats.

We expect both projects might fall under the Standard category, and the total unit count of about 1,920 flats makes Sembawang the overall best bet for securing a unit for this sales exercise.

According to HDB, the 1,160-unit BTO project will include a preschool, and there is a site zoned for commercial next to it. This implies future amenities, which would help in this still-developing area.

Other than that, accessibility isn’t great as there’s no MRT station within walking distance. The nearby Sembawang Mart has a food court and supermarket with some other shops, but beyond this, there isn’t much in this neighbourhood for now.

In terms of nearby schools, Endeavour Primary School is likely to be within one-kilometre, as it’s also within walking distance. Wellington Primary, Northoaks Primary, and Canberra Primary may also be within range, but we can’t confirm it until more details are released when these projects are launched next month.

This part of Sembawang is slated to be developed into the new Sembawang North neighbourhood, and development plans include 8,000 new public housing flats and 2,000 private homes.

The first BTO project in this neighbourhood was launched last July during the BTO sales exercise – Sembawang Beacon is a 775-unit project with a mix of two-room flexi, three-to five-room flats, and 3Gen flats. It was announced to have a waiting time of about three years. There were 237 five-room flats offered at Sembawang Beacon, and it attracted 308 applicants.

More from Stacked

Japan Vs Singapore: Why Japan’s Zoning Laws Make Sense And What We Can Learn

It’s no surprise that space constraints are a major factor in Singapore. However, Japan – while admittedly bigger – often…

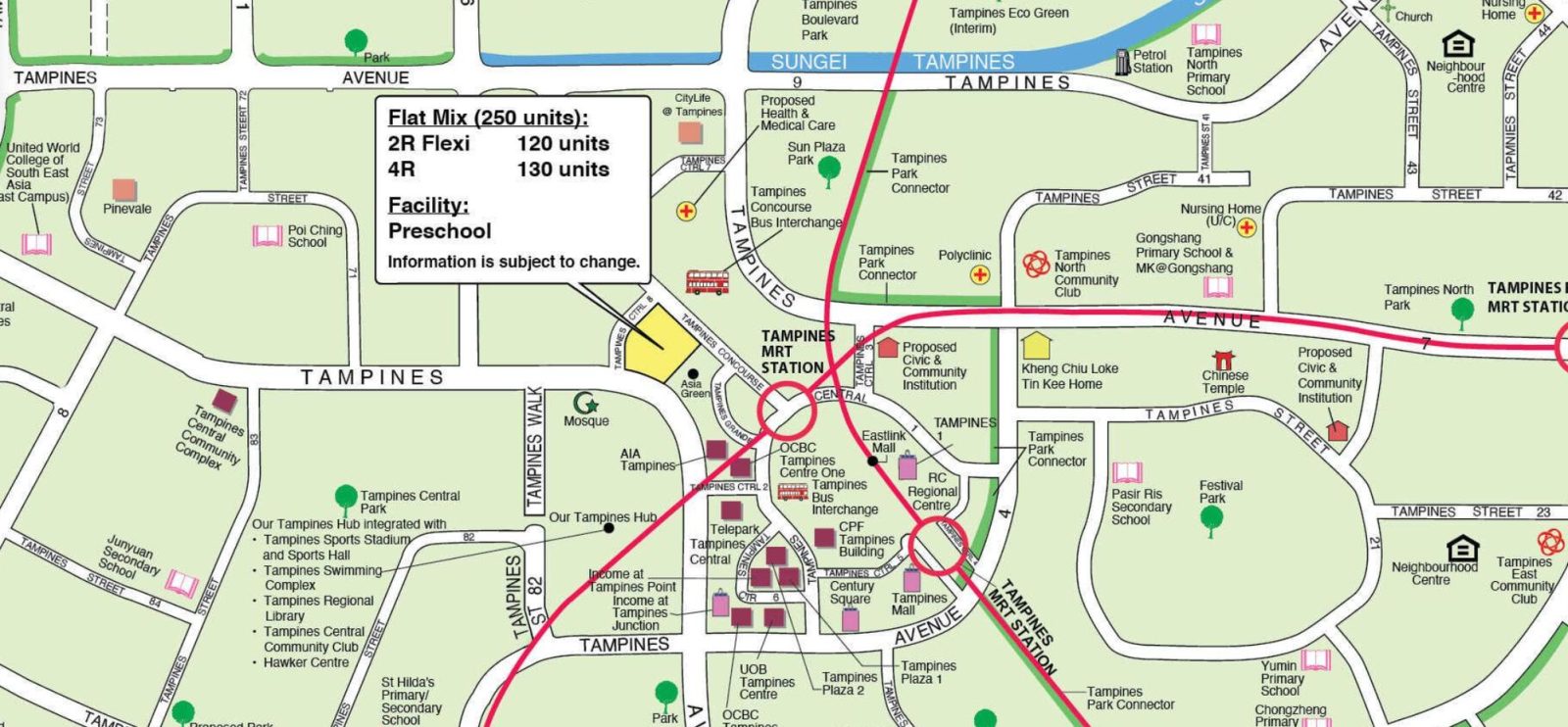

3. Tampines Central 8

This is one of two Tampines sites in the February BTO launch, with the other located on Tampines Street 22 (see below).

We expect this BTO project at Tampines Central might be classified as a Plus development, since it is close to Tampines MRT Interchange on the EWL and Downtown (DTL) lines.

It’s also in a major neighbourhood hub with three nearby malls – Century Square, Tampines Mall, and Tampines 1, as well as several other commercial buildings. In general, the amenities here are on par with most central areas, as Tampines is the regional centre for many areas in the east.

There are several primary schools in the vicinity, such as Angsana Primary School, Gongshang Primary School, Poi Ching School, St Hilda’s Primary School, Tampines North Primary School, and Tampines Primary School.

But an important consideration is that there are only 250 flats available in the upcoming project, with only two-room flexi and four-room options. So, despite the limited unit mix and restrictions attributed to its likely Plus categorisation, we expect this project to be heavily oversubscribed.

4. Tampines Street 22

This is the second of the two upcoming BTO projects in Tampines as part of next month’s BTO sales launch. It’s further from Tampines Central, roughly sits between Tampines Interchange and Simei station on the EWL.

The 280-unit project has a mix of three- and four-room flats. The upcoming BTO project may be either a Standard or Plus project. If it’s the latter, we can see its 280 units still being heavily subscribed. It would be a windfall to get flats so close to the hub of Tampines, without Plus category restrictions.

Whether you can walk to the MRT is up for debate – we’d call it a long walk, perhaps okay for the young and fit, but less so for older folks. In any case, we feel that its location is relatively less convenient than the other project at Tampines Central 8.

One advantage is that this site is just across from Chongzheng Primary and Yumin Primary School. Otherwise, the locational advantages are comparable to Tampines Central 8, which is really not all that far.

The upcoming BTO project is located next to existing HDB flats on Tampines St 22, which comprise a mixof three-, four-, and executive flats. Based on resale transactions, the most expensive resale flat is a 1,129.8 sq ft unit that fetched $630,000 ($557 psf) when it was sold last June.

5. Toa Payoh (Kim Keat)

Truth be told, we’re uncertain what to make of this new BTO project in Toa Payoh. The 1,130-unit development has a mix of two-room flexi, as well as three- and four-room flats. But the site is bounded by some undesirable factors, such as a stretch of the Central Expressway (CTE) and JTC’s Toa Payoh Industrial Park.

The area is undeniably a strong location given it’s a mature town with plenty of established amenities, but we feel this particular site has an accessibility issue. It’s not within walking distance to any MRT station, so you’ll need a bus if you’retaking public transport out of the estate.

But the proximity to Toa Payoh means good access to heartland-style amenities. Kim Keat Palm Market & Food Centre, as well as the Toa Payoh Lorong 8 Market & Hawker Centre, are close to this site. There’s also a Giant supermarket near Block 258.

Several schools are also in the vicinity, namely First Toa Payoh Primary School, Pei Chun Public School, and St Andrew’s School (Junior).

Overall, we think this site could end up being a Prime project. We could see some grumbling if it falls under the Prime category, which will push up pricing expectations.

Moreover, previous BTO launches in this neighbourhood were better located and closer to MRT stations, such as the 741-unit Toa Payoh Ascent at Toa Payoh Rise and the 1,348-unit Mount Pleasant Crest at Mount Pleasant Avenue. Both are Prime projects.

Regardless, we still expect the 1,130 units at the upcoming Toa Payoh BTO project to be heavily subscribed on the basis of its central and mature location.

For reference, Toa Payoh Ascent has 468 four-room flats that attracted 3,973 applicants – an application rate of 6.4 from first-timer families and 27.9 from second-timer families. Meanwhile, Mount Pleasant Crest has 709 four-room flats that attracted 3,208 applicants – an application rate of 3.3 from first-timer families and 15.6 from second-timer families.

For more updates as the BTO launch exercise progresses, follow us on Stacked.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Editor's Pick

Singapore Property News Executive Condo Prices Have Doubled In A Decade — Raising New Questions About Affordability In 2026

Singapore Property News River Modern Sells Over 90% Of Units At Launch — Here’s What Buyers Paid

Singapore Property News This 88-Year Leasehold HDB Shophouse on Bedok Reservoir Rd Is on Sale for $4M

Singapore Property News We Toured A New Co-Living Space In Bugis With Ice Baths, Gyms And Chef Dinners

Latest Posts

Overseas Property Investing In Niseko’s Booming Property Market, Investors Are Buying Individual Hotel Rooms

On The Market Here Are Some Of The Cheapest Newly MOP 4-Room HDB Flats You Can Still Buy

Property Market Commentary A 60-Storey HDB Is Coming To Pearl’s Hill — The First Public Housing Here In 40 Years

0 Comments