Why Are Homebuyers Choosing Pricier New Launch 2-Bedders Over Resale Options In 2025?

March 24, 2025

In the current property market, we’re seeing a change of attitude toward two-bedders. These were once seen as little more than rental assets which give tenants the option to take one a room mate; but now they’re viewed as being more versatile than a one-bedder, and possibly even a viable family home (for smaller families.) This is also on the back of rising home prices, which force some buyers to compromise. But this raises the curious question as to why – if buyers are acting out of budget constraints – all the interest seems to be focused on new launch two-bedders. Here’s something that homebuyers in 2025 may have lost sight of, in the recent flurry:

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

The recent rise of the new launch two-bedder

Go back about a decade and two-bedders, like one-bedders today, would have been considered a rental asset rather than a family home. But in recent new launches, agents on the ground have seen a surge of homebuyers opting to purchase two-bedders. According to one agent, small families often accept new two-bed, two-bath units, in the range of around $1.8 million to $2 million, at around 700 sq.ft.

At the recent launch of Parktown Residence, for example, we noted that two-bedders were among the first to sell. The same happened with The Orie, where two-bedders again moved fast, as well as with Lentor Central Residences.

From the word on the ground, the reason boils down to price. Realtors said the most comfortable quantum for HDB upgraders is between $1.8 million to $2.1 million, which is about the price of a two-bedder in the current new launch market. Three-bedders, on the other hand, tend to reach about $2.4 million and up.

This begs the question as to why resale two-bedders aren’t drawing equal interest

If homebuyers now accept that a two-bed, two-bath unit is sizeable enough for them, why isn’t there interest in cheaper (and quite often bigger) resale two-bedder units? Depending on the region and project, a fairly new resale two-bedder might still be in the $1.4 million to $1.6 million price range.

(There’s also the inherent resale advantage of being able to move in immediately, or move in first and then sell your flat later; only having to move once is no small benefit to some families).

The reasons, from conversations with realtors and homeowners, seem to boil down to the following:

1. An impending change once the OCR stock runs out

One of the explanations put forward is that a tilt toward resale two-bedders is about to happen; it just hasn’t kicked in yet. The tipping point is likely to be in the next few months in fact, when the new launch market shifts to the CCR (Core Central Region).

There are around 30 new launches this year*, of which eight are already out or concluded. Of the remaining 22, more than half (14 launches) will be in the CCR. From Aurea (former Golden Mile) this month, the next ones we’ll likely see are upcoming in River Valley and Orchard Boulevard.

Once this shift to the CCR happens, it will sorely test the limits of the $2 million+ range. While the price gap between the RCR (Rest of Central Region) and CCR has narrowed for various reasons (some explained here), it’s a fundamental fact that CCR launches will be pricier than OCR counterparts.

With more upgraders priced out, and a lack of other OCR launches, there’s no other avenue to turn to besides existing resale two-bedders. This should be interesting news to sellers of two-bed, two-bath units, as it may indicate a coming surge of buyer interest.

*Correction: The earlier version of this article read “month” instead of “year,” and this was an error. My apologies for this – Ryan

2. Changes in price perception have yet to set in (but likely will soon)

The current perception is that, at a quantum of about $1.4 million, resale two-bedders are still expensive; especially in contrast to how they were once viewed (i.e., cheap units to be rented out, for higher gross yields).

Let’s also keep in mind that, around a decade ago, $1.6 million was the accepted price of many three-bedder condos. So perhaps it’s not surprising that, when they see resale listings at such prices, these buyers find it unpalatable.

More from Stacked

I’ve A $3 Million Budget. Is Riviere Or The Hyde A Better Option?

Hello there,

But one realtor explained how this impression tends to shift, through the example of the recent launch of The Continuum. And as it so happens, we have a detailed description of that in this article where we perceived the same phenomenon he described:

“The Continuum was first perceived as being too pricey. But as nearby condos sold out their available stock and prices started to climb, sales in The Continuum saw transaction volumes climb sharply. Buyers who previously dismissed Continuum seemed to change their minds almost overnight; and in the space of days, there were almost no more complaints on the price of Continuum.”

In the same vein, the higher prices of new launch two-bedders – especially because we’re cruising into CCR prices – can make existing resale two-bedders seem more and more reasonable over the next few months. Once the paradigm shift fully sinks in, resale two-bedder listings could receive more attention.

3. Limited resale supply is an across-the-board issue

Some realtors noted that, even if the price perception changes, an ongoing issue right now is the lack of supply in the resale market. Due to the higher prices after COVID, there are concerns over the cost of a replacement property; and sellers may be unwilling to part with their units if they can’t bridge the gap to a new or bigger one.

One realtor also opined that ABSD would play a significant role, given the nature of the unit. As we mentioned above, one and two-bedders were purchased by many investors in search of rental gains. However, those who purchased two-bedders as a second unit in the past would have paid less ABSD (e.g., ABSD rates were only 12 per cent on the second property, after the 2018 cooling measures; they were raised to 20 per cent in 2023).

An investor who sells a two-bedder, which was purchased for rental gains, would have to pay higher ABSD for its replacement. This could be a psychological barrier (unless, perhaps, they’ve decided to sell and end their rental investment once and for all.)

In any case, all of this bodes well for those who do want to sell a resale two-bedder in the very near future, as it could mean a bigger pool of prospective buyers.

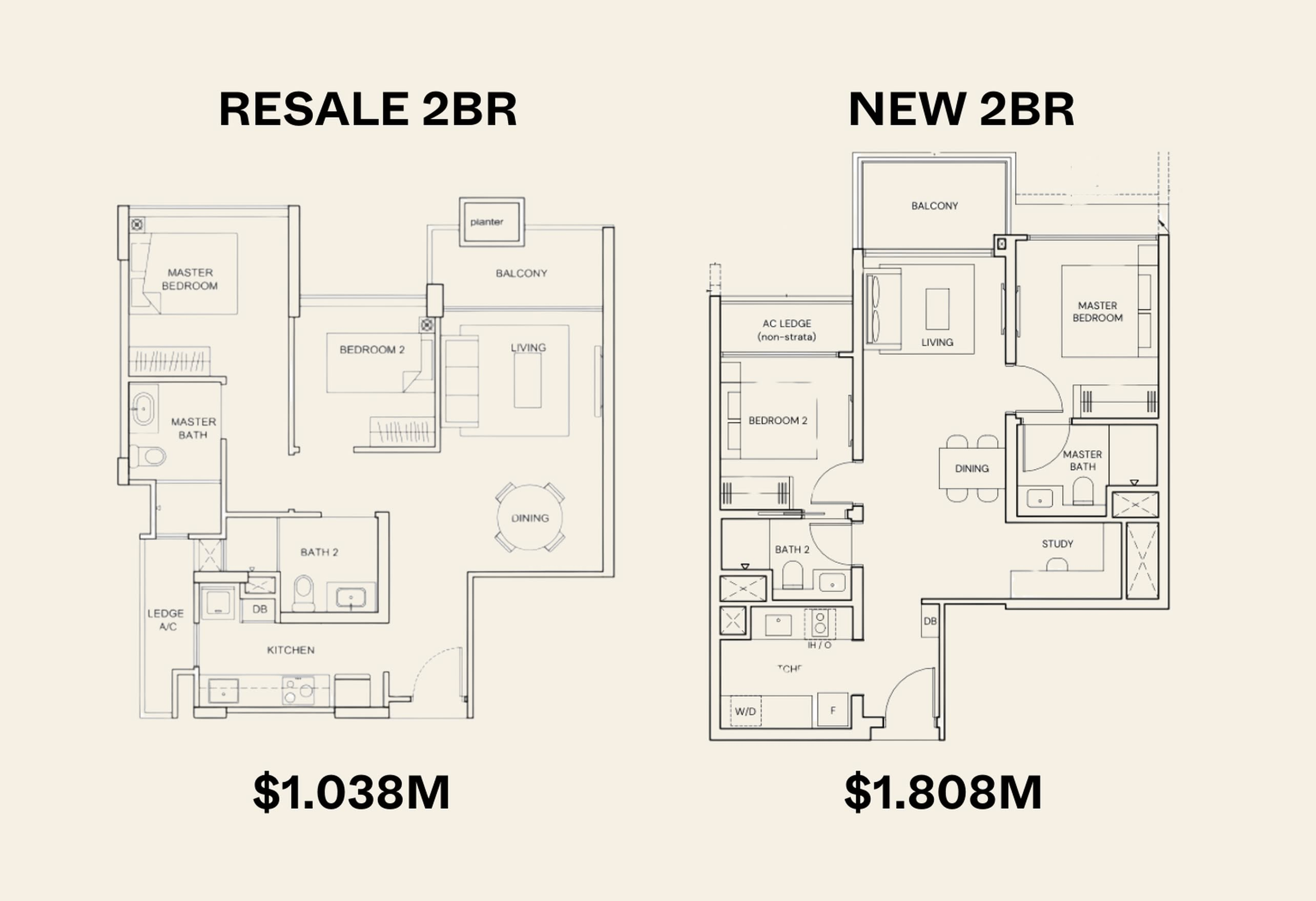

4. Less efficient layouts in older resale condos

This is harder to generalise, as it depends on the specific condos being compared. But newer two-bedders are going to be post-harmonisation projects, which means they’ll be free of space-wasting features found in earlier condos.

Elements like big planter boxes, bay windows, large air-con ledges, etc. tend to characterise pre-harmonisation resale projects, where developers used these tricks to maximise profits; sometimes at the cost of liveable floor space to residents.

(For reference, Lentor Mansion is the first post-harmonisation project, and anything before that is pre-harmonisation).

Newer two-bedders also tend to use dumbbell layouts, such as the ones shown and described here. These layouts, where bedrooms flank the living/dining area, mitigate the need for wasted corridor space.

(Do note, however, that there are older projects that have dumbbell layouts as well, so you do need to check the specific floor plans.)

As some homebuyers have told us, however, there is an attraction to the raw square footage of older resale condos; and this can be attractive if you’re trying to fit a family into a two-bedder.

Ultimately, we think the demand for resale two-bedders may be just around the corner; and love it or hate it, we may be entering an era where the two-bedder is being accepted as family-sized. For the record, we wish that wasn’t the case; but at the quantum we’re seeing, we expect more upgraders will have to go this route.

What we can do is try to compare specific regions and projects where the price gap between two and three-bedders is narrower, while this is still possible. If you need help with this, reach out to us on Stacked to help with comparisons.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

Why are homebuyers in 2025 preferring new launch two-bedroom units over resale options?

What is causing the increased interest in new two-bedroom condos among homebuyers?

Why aren’t resale two-bedroom units attracting as much interest despite being cheaper?

How will the shift to the Core Central Region (CCR) affect the market for two-bedroom units?

What role do layout and design features play in the preference for new two-bedroom condos?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Property Market Commentary

Property Market Commentary How I’d Invest $12 Million On Property If I Won The 2026 Toto Hongbao Draw

Property Market Commentary We Review 7 Of The June 2026 BTO Launch Sites – Which Is The Best Option For You?

Property Market Commentary Why Some Old HDB Flats Hold Value Longer Than Others

Property Market Commentary We Analysed HDB Price Growth — Here’s When Lease Decay Actually Hits (By Estate)

Latest Posts

Singapore Property News I’m Retired And Own A Freehold Condo — Should I Downgrade To An HDB Flat?

New Launch Condo Reviews What $1.8M Buys You In Phuket Today — Inside A New Beachfront Development

Overseas Property Investing This Singaporean Has Been Building Property In Japan Since 2015 — Here’s What He Says Investors Should Know

0 Comments