New Launches That Dropped Prices in 2013/14: How Are They Faring Now?

September 13, 2021

2013 was the peak of the last property market, with all the havoc that often implies. As cooling measures swept in, many developments – especially new launches at the time – took a nosedive. Now if you’re buying in 2021, this is a pertinent question:

Could new launches also see a sharp drop in price, if cooling measures kick in overnight? And if they do, does it mean the first few buyers get “burned”?

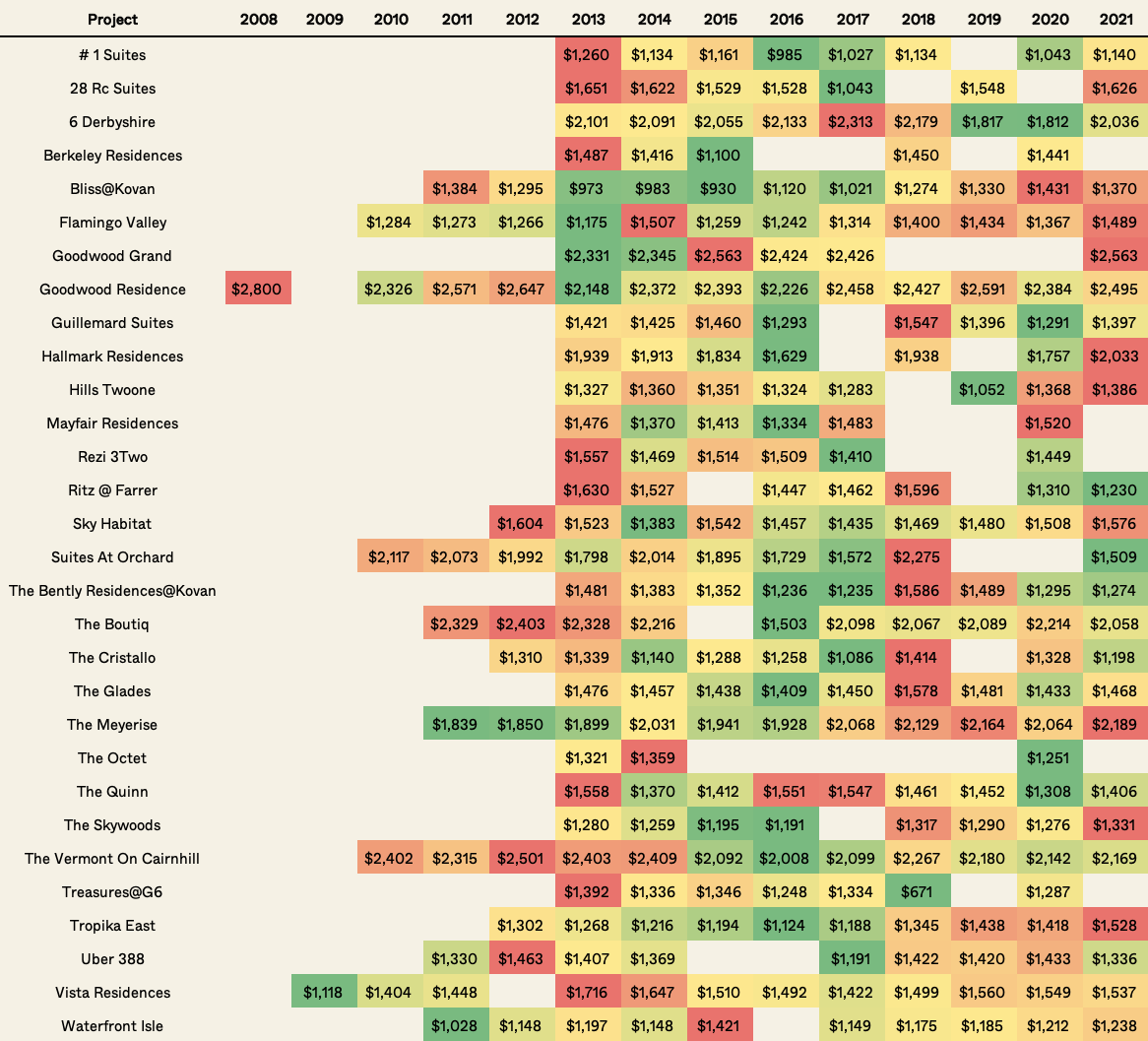

We took a look at developments that saw prices drop in 2013/14, to see whether they’ve recovered. The following developments have all seen a gradual pick-up in prices again, but to varying degrees:

How did we derive data for the following?

We have stuck to developments with new sales in 2013/14. In addition, we have kept to developments where transaction volumes in 2014 are greater than in 2013.

We have also excluded sub-sales (units that were sold before completion), as these would distort the overall picture in the first few years of sales since it includes the effects of the secondary market.

As a caution, do note that some of these developments have low transaction volumes. This sometimes cannot be avoided, especially for small developments with few units. In addition, the price psf can fall outside of normal ranges for unusual units, such as penthouses. This aside, we have made every effort to give as accurate a representation as is available.

Which developments have seen a “U-shaped” price movement?

The most notable recoveries were Sky Habitat, and The Skywoods

For many of the developments above, a price drop followed by recovery is not 100 per cent certain. This is due to some of them showing a low volume of transactions. However, the pattern is most visible in Sky Habitat and The Skywoods.

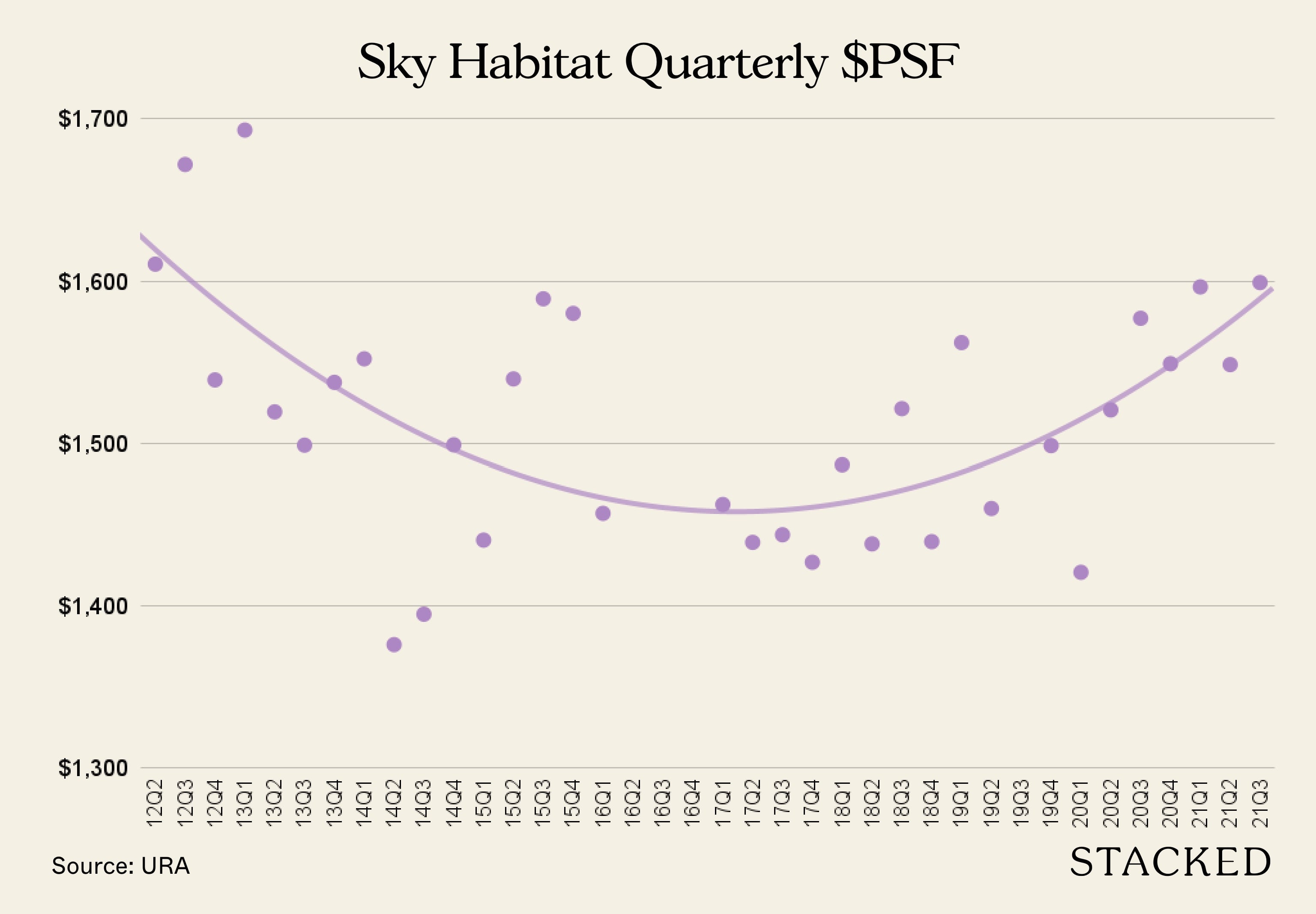

Sky Habitat

Location: Bishan Street 15 (District 20)

Developer: Bishan Residential Development Pte. Ltd.

Lease: 99-years

TOP: 2015

Number of units: 509

$PSF Chart:

Highlights:

The developer of Sky Habitat was overconfident at launch, probably because 2013 saw the property market at dizzying heights. Sky Habitat was – and still is – the tallest skyscraper in Bishan.

It was designed by famed architect Moshe Safdie, and a key selling point was the sky parks and walkways, as well as a sky pool (the pool is suspended between two blocks at the highest floor).

It was also the most expensive, non-CCR condo in Singapore to date. There were units with a quantum that reached $2 million; and in 2013, this was a price point associated with District 9 or 10 condos.

The situation was compounded by cooling measures and the Total Debt Servicing Ratio (TDSR), which started to bite down around 2014. By around April 2014, Sky Habitat had relaunched, with prices about 10 to 15 per cent lower.

At that point, you can see developer prices started to plummet – by Q2 of 2015, prices averaged $1,376 psf, down from heights of $1,630 in 2013.

The good news is that, on our last check for Q3 this year, sellers had been able to reach an average of $1,599 psf. This means buyers who moved in at the relaunch or after (i.e., 2014 or later) likely still see gains – but those who bought during the initial launch are still out of luck.

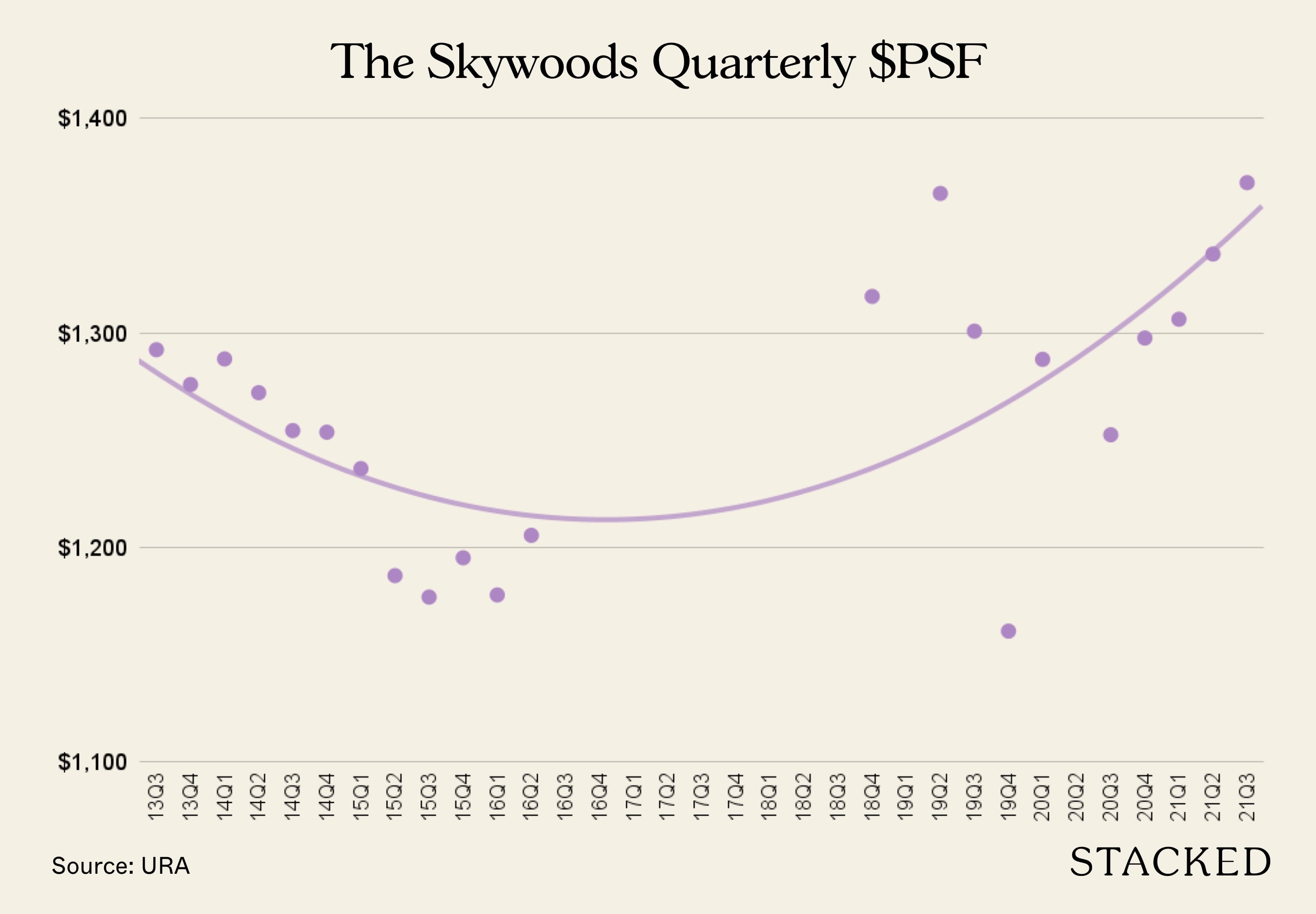

The Skywoods

Location: 9 Dairy Farm Heights (District 23)

Developer: Bukit Timah Green Development Pte. Ltd.

Lease: 99-years

TOP: 2016

Number of units: 420

$PSF Chart:

Highlights:

The Skywoods saw an aggressive marketing push, almost certainly motivated by the new stamp duties and TDSR limits.

Buyers tend to react to cooling measures by going into “wait and see” mode, so dropping the price – to as low as $1,378 psf in 2015 – was painful but probably necessary.

The Skywoods was already a niche condo in 2013, catering to those who value privacy over across-the-road amenities.

We should keep in mind that, at the time of its launch, The Skywoods was in a highly inaccessible location, with no amenities within walking distance. The situation is much improved in recent years, with the coming of Hillview MRT station (650 metres away). However, retail options such as The Rail Mall and HillV2 are still not really within very close walking distance.

We feel that The Skywoods crept back onto buyers’ radars, after the launch of Dairy Farm Residences. With Dairy Farm Residences averaging $1,585 psf for its three-bedders, The Skywoods’ pricing looks competitive; after all, both condos are in the same general location, and The Skywoods is not much older. Also, for those seeking a cheaper alternative to Dairy Farm Residences, there aren’t many other options.

More from Stacked

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

How This Singaporean Homeowner Transformed A 1,818 Sqft Maisonette Condo

High-ceiling, double-volume units hold a fascination for many homeowners. It’s impressive, gives a sense of space, and has twice the…

New Launch Condo ReviewsDairy Farm Residences Review: 84m Infinity Pool + 40,000 Sqft Retail

by Matthew KwanOverall, the “U-turn” in pricing appears to have been caused by sharp price drops in response to cooling measures, followed by the emergence of Hillview MRT, and a nearby new launch.

Some notable takeaways

If there’s one thing to be seen in the above, it’s that buying early provides no guarantee of “immediate returns”. It’s possible that the developers will drop prices for later-stage buyers.

In many of the cases above, the prices did not recover to the original average, even by Q3 2021. For example, only eight of the developments averaged a higher recent price than their 2013/14 price:

- 28 RC Suites ($1,650 to $1,711 psf)

- Bliss @ Kovan ($1,384 to $1,545 psf)

- Hallmark Residences ($2,002 to $2,033 psf)

- Hills Twoone ($1,327 to $1,386 psf)

- The Cristallo ($1,270 to $1,286 psf)

- The Skywoods ($1,292 to $1,370 psf)

- Tropika East ($1,298 to $1,528 psf)

- Uber 388 ($1,304 to $1,333 psf)

There seems to be no clear indication that any given region (CCR, RCR, OCR) shows better odds of a recovery, after the prices drop.

Why do prices fall and rise this way?

It’s difficult to isolate the exact reasons, as it varies for each condo. In general, however, you should take note of the following:

- The five-year ABSD limit for developers

- New policy changes

- New launches nearby

1. The five-year ABSD limit for developers

Developers that don’t finish and sell a development within five years can end up paying over 30 per cent of the land price, in ABSD (it’s over 30 per cent if you include interest).

As such, developers will sometimes drop the price, if they feel they won’t reach the deadline. But note that this is less common for condos with a high proportion of unsold units – if the development is only 30 per cent sold, and the deadline is close, the developer is likely to miss it even with a discount.

So you tend to see “fire sales” only when there’s a handful of units left, and the deadline looms.

This generally doesn’t apply for the condos listed here; most of the ones above would have seen discounts due to new cooling measures. However, it is applicable in some new launches today, which come from the last tranche of en-bloc sales in 2017.

2. New policy changes

It’s not just cooling measures like ABSD which can drive down prices. Fundamental changes, such as TDSR-style loan curbs, can also prompt further discounts.

The worst-off buyers tend to be the ones who buy just before new measures kick in; the developer may then be unable to raise the price, and their “discounted” price ends up just being the norm (or in the case of some condos above, higher than the norm).

This is a bit of a tight rope to walk, as buying too late can mean new cooling measures price you out; but buying just before can mean you end up saddled with peak pricing.

3. New launches nearby

In general, having more condos nearby is undesirable. It creates competition for tenants, and at the point of resale. However, assuming demand remains consistent, and there aren’t too many new units nearby, a new launch can help pull up resale prices.

In recent years, we’ve seen buyers turned off by the shrinking sizes of new launch units. These buyers often turn to resale alternatives, which share the location but have larger units. This can contribute somewhat, to a rise in resale value.

But we should stress that, in most cases, it’s preferable not to have too many new launches competing with your condo.

Don’t rush to buy, and don’t count on discounts for returns

Steep developer discounts are always nice. However, they should be considered a nice bonus, rather than a major incentive to buy. Take your time and focus on the fundamentals: amenities, accessibility, and rentability (if you’re a landlord).

For more updates on the Singapore private property market, follow us on Stacked. Also, visit us for more detailed reviews of these new and resale condos alike.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

Did property prices recover after dropping in 2013/14 in Singapore?

Which property developments in Singapore experienced a price drop and later recovered?

Why do property prices fall after new launches in Singapore?

Can buying early in a property development guarantee immediate profit in Singapore?

How do government policies like cooling measures affect property prices in Singapore?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Property Market Commentary

Property Market Commentary A 60-Storey HDB Is Coming To Pearl’s Hill — The First Public Housing Here In 40 Years

Property Market Commentary How I’d Invest $12 Million On Property If I Won The 2026 Toto Hongbao Draw

Property Market Commentary We Review 7 Of The June 2026 BTO Launch Sites – Which Is The Best Option For You?

Property Market Commentary Why Some Old HDB Flats Hold Value Longer Than Others

Latest Posts

Overseas Property Investing In Niseko’s Booming Property Market, Investors Are Buying Individual Hotel Rooms

Singapore Property News This 88-Year Leasehold HDB Shophouse on Bedok Reservoir Rd Is on Sale for $4M

Singapore Property News We Toured A New Co-Living Space In Bugis With Ice Baths, Gyms And Chef Dinners

0 Comments