50 New Launches With Remaining Units in 2025 (From $1,654 PSF)

Get The Property Insights Serious Buyers Read First: Join 50,000+ readers who rely on our weekly breakdowns of Singapore’s property market.

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.

As we reach the end of 2025, it’s fair to say demand is still roaring. The last few new launches, like Springleaf Residence, River Green, Skye at Holland, etc., have shown how quickly projects can sell out (or almost sell out) over a single launch weekend. This was definitely a “blink-and-you’ll-miss-it” year of new launch sales. Fortunately, there are still new launches out there with remaining units, as of November 2025, and we’ve put together the remaining inventory as of today:

And if you’ve missed out on earlier launches but still want to enter the market, it might help to see which remaining projects still line up with your criteria. Tell us what you’re looking for and we’ll connect you with one of our trusted partner agents who can compare prices, layouts, and incentives across the developments still on the market.

Full list of condos with remaining units

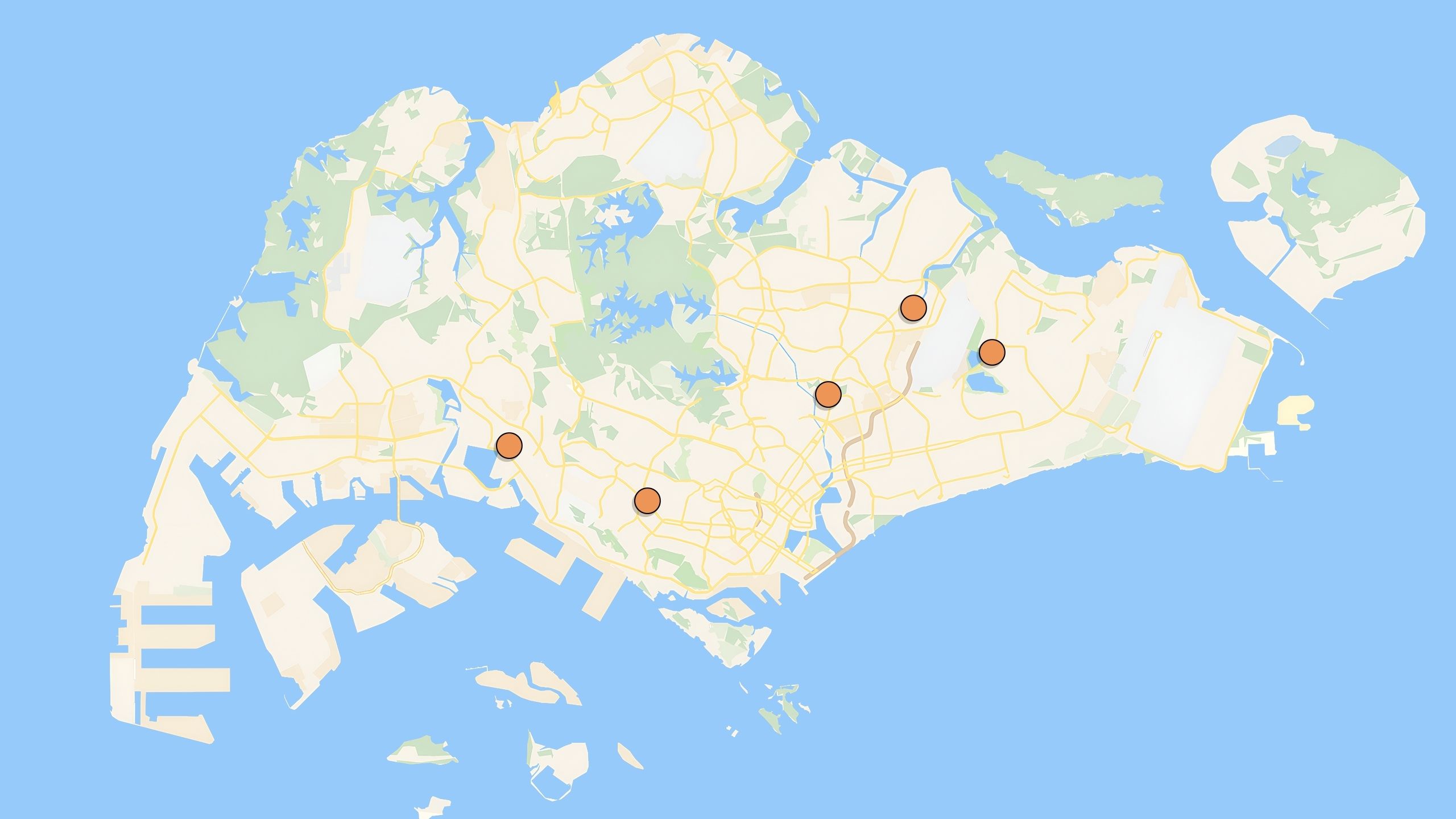

West Projects

| Launched Date | District | Project | Total units | Total Sold | Sold % | Balance Units | |||||||||||||||||||||||

| 25 Feb 2023 | 5 | Terra Hill | 270 | 160 | 59.26% | 110 | |||||||||||||||||||||||

| 29 Apr 2023 | 5 | Blossoms by the Park | 275 | 269 | 97.82% | 6 | |||||||||||||||||||||||

| 20 Apr 2024 | 5 | The Hillshore | 59 | 8 | 13.56% | 51 | |||||||||||||||||||||||

| 22 Feb 2025 | 5 | ELTA | 501 | 350 | 69.86% | 151 | |||||||||||||||||||||||

| 12 Apr 2025 | 5 | Bloomsbury Residences | 358 | 248 | 69.27% | 110 | |||||||||||||||||||||||

| 12 Jul 2025 | 5 | Lyndenwoods | 343 | 341 | 99.42% | 2 | |||||||||||||||||||||||

| 18 Oct 2025 | 5 | Faber Residence | 399 | 352 | 88.22% | 47 | |||||||||||||||||||||||

| 15 Jul 2023 | 21 | Pinetree Hill | 520 | 476 | 91.54% | 44 | |||||||||||||||||||||||

| 16 Nov 2024 | 21 | Nava Grove | 552 | 501 | 90.76% | 51 | |||||||||||||||||||||||

| 21 Sep 2024 | 21 | 8 @ BT | 158 | 93 | 58.86% | 65 | |||||||||||||||||||||||

| 5 Aug 2023 | 22 | The Lakegarden Residences | 306 | 269 | 87.91% | 37 | |||||||||||||||||||||||

| 11 Nov 2023 | 22 | J’den | 368 | 355 | 96.47% | 13 | |||||||||||||||||||||||

| 6 Jul 2024 | 22 | Sora | 440 | 199 | 45.23% | 241 | |||||||||||||||||||||||

| 8 Jul 2023 | 23 | The Myst | 408 | 357 | 87.50% | 51 | |||||||||||||||||||||||

| 20 Jan 2024 | 23 | Hillhaven | 341 | 336 | 98.53% | 5 | |||||||||||||||||||||||

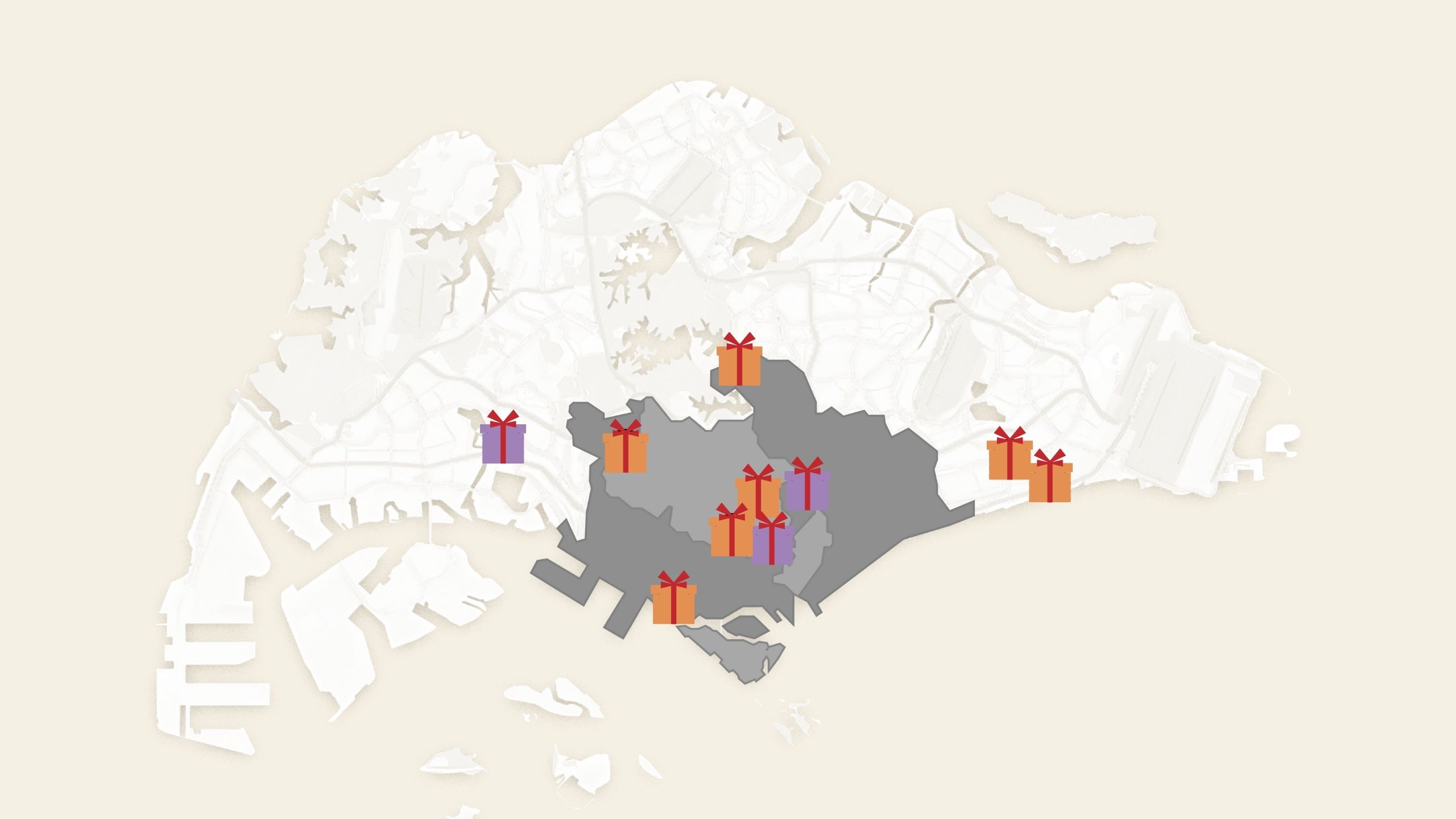

Central Projects

| Launched Date | District | Project | Total units | Total Sold | Sold % | Balance Units | ||||||||||||||||||||||||

| 18 Oct 2025 | 3 | Penrith | 462 | 447 | 96.75% | 15 | ||||||||||||||||||||||||

| 25 Jul 2025 | 8 | The Ranz | 17 | 6 | 35.29% | 11 | ||||||||||||||||||||||||

| 5 Nov 2022 | 9 | Hill House | 72 | 71 | 98.61% | 1 | ||||||||||||||||||||||||

| 19 Nov 2022 | 9 | Sophia Regency | 38 | 0 | 0.00% | 38 | ||||||||||||||||||||||||

| 12 Aug 2023 | 9 | Orchard Sophia | 78 | 72 | 92.31% | 6 | ||||||||||||||||||||||||

| 6 Nov 2024 | 9 | The Collective @ One Sophia | 367 | 88 | 23.98% | 279 | ||||||||||||||||||||||||

| 8 Mar 2022 | 11 | Ikigai | 16 | 14 | 87.50% | 2 | ||||||||||||||||||||||||

| 20 Jan 2024 | 12 | The Arcardy at Boon Keng | 172 | 81 | 47.09% | 91 | ||||||||||||||||||||||||

| 18 Jan 2025 | 12 | The Orie | 777 | 730 | 93.95% | 47 | ||||||||||||||||||||||||

| 1 Nov 2024 | 1 | Union Square Residences | 366 | 135 | 36.00% | 231 | ||||||||||||||||||||||||

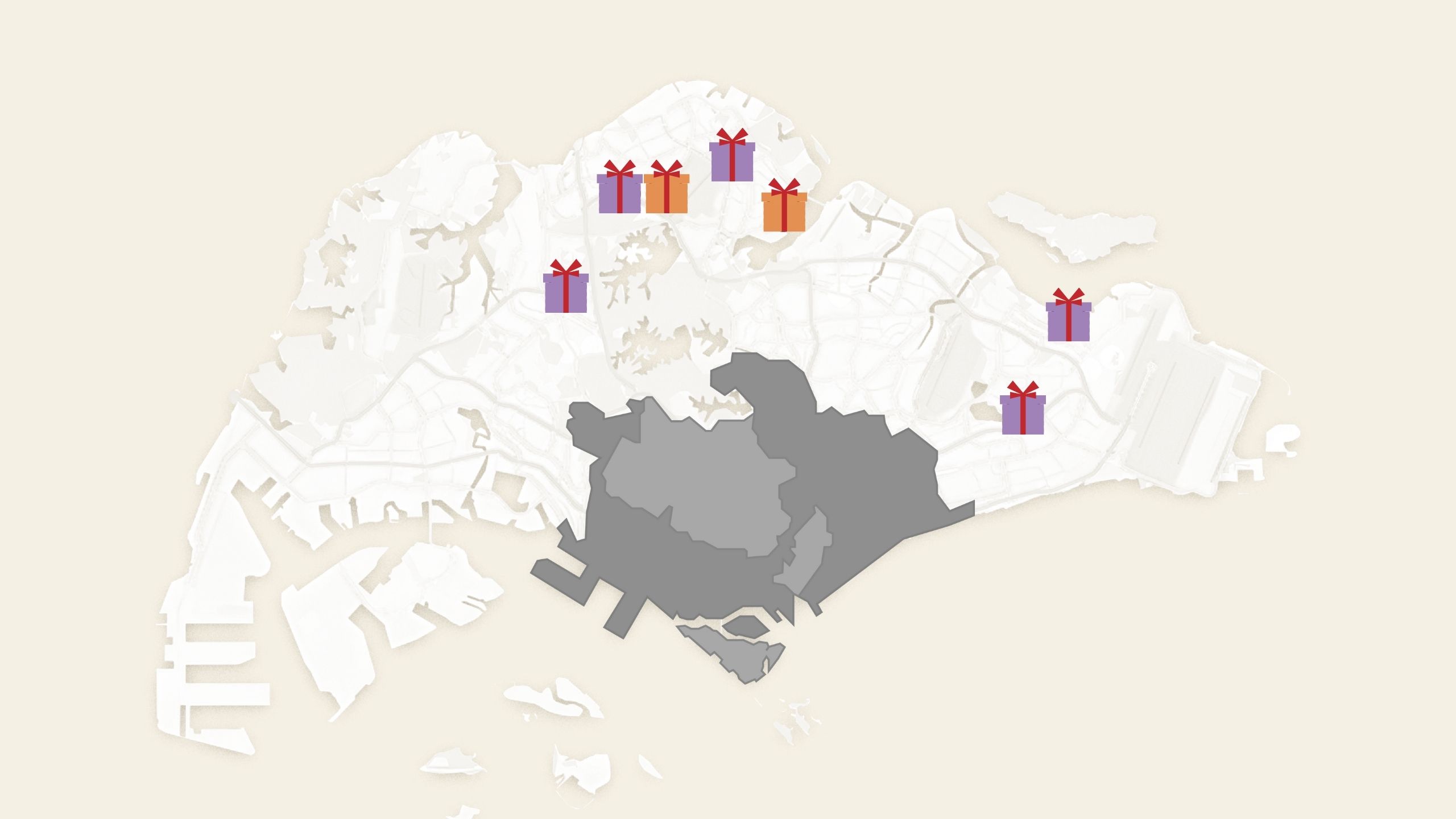

North Projects

| Launched Date | District | Project | Total units | Total Sold | Sold % | Balance Units | |||||||||||||||||||||||||

| 4 May 2024 | 19 | Jansen House | 21 | 11 | 52.38% | 10 | |||||||||||||||||||||||||

| 2 Nov 2024 | 19 | The Chuan Park | 916 | 806 | 87.99% | 110 | |||||||||||||||||||||||||

| 16 Aug 2025 | 20 | Spingleaf Residence | 941 | 904 | 96.07% | 37 | |||||||||||||||||||||||||

| 21 Aug 2025 | 20 | Artisan 8 | 42 | 24 | 57.14% | 18 | |||||||||||||||||||||||||

| 19 Oct 2024 | 25 | Norwood Grand | 348 | 303 | 87.07% | 45 | |||||||||||||||||||||||||

| 11 Nov 2023 | 26 | Hillock Green | 474 | 465 | 98.10% | 9 | |||||||||||||||||||||||||

| 2 Mar 2024 | 26 | Lentoria | 267 | 233 | 87.27% | 34 | |||||||||||||||||||||||||

| 16 Aug 2025 | 26 | Springleaf Collection | 10 | 9 | 90.00% | 1 | |||||||||||||||||||||||||

| 2 Aug 2025 | 26 | Canberra Crescent Residences | 376 | 280 | 74.47% | 96 | |||||||||||||||||||||||||

| 14 Oct 2024 | 27 | Skies Miltonia | 12 | 4 | 33.33% | 8 | |||||||||||||||||||||||||

East Projects

| Launched Date | District | Project | Total units | Total Sold | Sold % | Balance Units | |||||||||||||||||||||||

| 4 Feb 2023 | 14 | Gem ville | 24 | 12 | 50.00% | 12 | |||||||||||||||||||||||

| 21 May 2022 | 15 | Atlassia | 39 | 35 | 89.74% | 4 | |||||||||||||||||||||||

| 8 Oct 2022 | 15 | K Suites | 19 | 11 | 57.89% | 8 | |||||||||||||||||||||||

| 26 Nov 2022 | 15 | Claydence | 28 | 10 | 35.71% | 18 | |||||||||||||||||||||||

| 8 Apr 2023 | 15 | Tembusu Grand | 638 | 625 | 97.96% | 13 | |||||||||||||||||||||||

| 6 May 2023 | 15 | The Continuum | 816 | 632 | 77.45% | 184 | |||||||||||||||||||||||

| 15 Jul 2023 | 15 | Grand Dunman | 1008 | 891 | 88.39% | 117 | |||||||||||||||||||||||

| 2 Mar 2024 | 15 | Koon Seng House | 17 | 11 | 64.71% | 6 | |||||||||||||||||||||||

| 11 May 2024 | 15 | Straits @ Joo Chiat | 16 | 13 | 81.25% | 3 | |||||||||||||||||||||||

| 7 Jun 2025 | 15 | Arina East Residence | 107 | 23 | 21.50% | 84 | |||||||||||||||||||||||

| 18 Jan 2025 | 16 | Bagnall Haus | 115 | 101 | 87.83% | 14 | |||||||||||||||||||||||

| 23 Sep 2023 | 17 | The Shorefront | 23 | 11 | 47.83% | 12 | |||||||||||||||||||||||

| 20 Jul 2024 | 17 | Kassia | 276 | 215 | 77.90% | 61 | |||||||||||||||||||||||

| 22 Feb 2025 | 18 | Parktown Residence | 1193 | 1109 | 92.96% | 84 | |||||||||||||||||||||||

EC Project Balance

| Launched Date | District | Project | Total units | Total Sold | Sold % | Balance Units | ||||||||||||||||||||||||

| 19 Jul 2025 | 24 | Otto Place | 600 | 573 | 95.50% | 27 | ||||||||||||||||||||||||

Projects with the highest number of remaining units as of November 2025

- W Residences Singapore – Marina View (679 units)

- One Marina Gardens (389 units)

- Union Square Residences (324 units)

- TMW Maxwell (318 units)

- The Collective @ One Sophia (279 units)

- Sora (241 units)

- Promenade Peak (206 units)

1. W Residences Singapore – Marina View (679 units)

W Residences Singapore – Marina View is a 683-unit leasehold project, and is Singapore’s first W-branded hotel residence. It’s located at 22 Marina View in District 1.

The reason for W Residences’ high number of remaining units is because sales just started last month; and only 100 units were released during its October 2025 launch. During the initial launch, offerings were between the 16th and 20th floors, offering mostly one- to three-bedroom units, with a small batch from the Signature Collection (four- and five-bedders).

The private homes are above the W Hotel component, within a 51-storey tower. The benefit of the hotel brand is that owners will also have access to services like a concierge, housekeeping, laundry, etc. This project also has a 25 metre infinity pool (on the 15th floor), and another 25 metre lap pool on the 51st storey (that will be heated). Due to the height, many of the units will have panoramic views of the CBD and Marina Bay.

Location-wise, it’s within walking distance of Lau Pa Sat and the CBD in general. There are also multiple train lines within this area: Shenton Way (TEL), Downtown (DTL), and Marina Bay (NSL, CCL, and TEL). This is within the heart of the city, so it’s about as accessible as you can get.

Units have launched from around $3,230 psf, with a one-bedroom starting around $1.78 million and a five-bedroom unit from about $11.36 million.

This is very clearly catered toward a luxury audience. For families, this may not be the most ideal location unless you’re pure urbanites; Marina Bay lacks school access, and fewer Singaporeans have friends or family living in the immediate area.

2. One Marina Gardens (389 units)

One Marina Gardens (OMG) is a leasehold project with 937 units, located at 3 Marina Gardens Lane in District 1. OMG launched quite recently in April this year; back then, we noted that it moved 38 per cent of its units at an average price of $2,953 psf. As of now, about 59 per cent of the units are sold.

Unlike the Marina Bay area next door, Marina South is still a very early-stage district. In fact, this is the very first residential development in Marina South, so it’s something of a first-mover play for buyers. Because Marina South is so new, surrounding amenities are still limited, but the Marina South MRT station (TEL) is directly connected to the project and has already been completed. It’s not operational for now because the government is waiting for more residents to move in; but it can start running any time.

More from Stacked

Should You “Sell One, Buy Two”, Or Just Buy A Bigger Condo Unit?

With a bumper crop of resale flats hitting the market, and prices rising across the board, it seems the Singapore…

OMG has top-end facilities, as you’d expect from a District 1 property—vertical gardens, co-working space, sky decks, and an infinity pool; and the elevated viewing lounges and units will benefit from a view of the waterfront. Depending on the stack, it’s likely that Marina Bay, Gardens by the Bay, and the CBD skyline will all be in view.

The unit mix also skews smaller: roughly 26 per cent are one-bedders and 45 per cent are two-bedders, so this may work for singles, young couples, and landlords. At last check, one-bedders start from about $1.16 million, two-bedrooms from around $1.8 million, and three-bedrooms from around $2.45 million. The 4-bedroom premium units start from about $4.45 million.

This project won’t appeal to those who want immediate convenience, but for buyers comfortable with a longer holding period (and willing to bet on Marina South’s future transformation), OMG is likely to benefit as the precinct fills out.

3. Union Square Residences (324 units)

Union Square Residences is a 99-year leasehold, 366-unit mixed-use project at 28 Havelock Road in District 1. This was formerly Central Square/Central Mall.

Union Square’s main draw is the walking distance to two MRT stations: Clarke Quay (NEL) and Chinatown (NEL, DTL). This also means being within striking distance of the CBD; and while Clarke Quay’s nightlife scene is not what it used to be since COVID, it still is a major clubbing spot.

Union Square combines a new 40-storey residential tower with preserved conservation shophouses, car-free streets, and about 65 upcoming retail units. The concept is a sort of self-contained urban “village” of cafés, dining, and small shops, with Clarke Quay’s added entertainment nearby. Facilities include a rooftop infinity pool and a sky gym that overlooks nearby buildings for a Singapore River view.

Layouts lean heavily toward smaller units: 74 per cent of homes here are one- and two-bedders, ranging from 463 to 743 sq ft. Larger formats exist, including three- and four-bedders (up to 1,518 sq ft) and a handful of 2,476 sq ft Sky Suites, but these form a very small portion of the mix. So overall, a project that leans very much toward young couples and singles, as well as landlords.

The launch pricing put one-bedders from $1.38 million and two-bedders from $1.998 million (around $2,850–$3,000 psf). However, this may be higher by the time you’re reading this. Whilst not really a project for families, Union Square is a very central, lifestyle-driven project; and it will suit those who like being in the middle of bustling city life (and do the opposite for those who like greenery and wide spaces, as this is in a very dense part of the city core.)

4. TMW Maxwell (318 units)

TMW Maxwell is a leasehold, 324-unit project at 31 Tras Street in District 2. This project is very close to both Maxwell (TEL) and Tanjong Pagar MRT (EWL) stations. It’s very deliberately built for singles, couples, and investors: 62 per cent of units are under 500 sq ft, and there are no family-sized three- or four-bedders here.

Its selling point is the product design. The “Flip/Switch” studios come with integrated carpentry: a murphy bed with sofa, flip-down study table, pull-out counter, balcony dining table, and even an integrated ironing board. The concept is a CBD micro-unit where the layout transforms to suit different needs.

Facilities are stacked vertically through the tower: sky lounges, co-working spaces, a rooftop infinity pool, wellness deck, etc. Plus, there are some commercial elements at the base. This project also turns part of Maxwell Road into a pedestrian link to Tras Street, with room for F&B and retail right under the residences. Chinatown Complex and the famous Maxwell Food Centre are also just across the street.

Sales have been slow, partly because of initial shock at the launch pricing – around $3,188 psf at the time, with many one-bedders from roughly $1.5 million to $2 million. It remains to be seen if attitudes will change, now that buyers tend to focus more on quantum rather than $PSF; this could make the pricing more palatable going forward.

Overall, this is a niche, central project with an original twist, but because it’s angled at singles and landlords, its prospective buyer pool may be smaller.

5. The Collective @ One Sophia (279 units)

The Collective is a 367-unit mixed-use development at the junction of Selegie, Prinsep, and Sophia Road. Buyers here get a fairly central location in the Orchard/Rochor fringe, with Dhoby Ghaut MRT interchange reachable on foot, and Bras Basah and Little India MRT close by. The project also integrates an office tower, retail podium, and serviced residences, so it’s one of the denser, more urban new launches in the CCR.

The venerable Plaza Singapura Mall is also within walking distance, albeit an uphill walk.

Because of its city location and compact unit mix, this is aimed at singles, couples, and investors. About half the units are one-bedrooms or smaller, and layouts are on the more space-efficient side. Facilities include a rooftop pool and dining decks, co-working spaces, social lounges, and gym zones; so it is a bit more lifestyle-focused than being a family condo.

Recent price lists suggest the developer has been nudging prices a little for selected units: a 452 sq ft studio was listed from around $1.223 million (~$2,705 psf), a 484 sq ft one-bedder at around $1.365 million (~$2,820 psf), and a 646 sq ft two-bedder from about $1.806 million (~$2,795 psf). Even a 1,023 sq ft three-bedder was recently seen at around $2.872 million (~$2,807 psf).

If you want central convenience and smaller layouts, the Collective still has a fair number of units available; but families who prioritise space, school access, or green areas will probably look elsewhere.

6. Sora (241 units)

Sora is a 440-unit, 99-year leasehold condo at Yuan Ching Road in District 22. It launched in mid-2024 with prices we never see anymore: some units started at around $1,850 psf(!), keeping even the one-bedders below the $1 million mark.

Sora sits right at the edge of Jurong Lake Gardens, and that’s one of the main highlights of the development: around 78 per cent of units face the lake, and all residents have access to four terraced rooftop gardens. You can come up here to look at the famous Chinese Garden, Japanese Garden, etc., even if your unit is not among the 78 per cent.

Sora has facilities that can be called extravagant for an OCR condo: sky lounges, co-working spaces, community gardens, relaxation decks, and even a Sky Bar; these are facilities more common to luxury projects.

One of the main issues though, is that Sora is not close to an MRT station. Lakeside MRT (EWL) is around 1.5 km away, which is too far to walk (though there is a shuttle bus arranged by the developer- whether that lasts is up to the residents later.) For daily needs, Taman Jurong Food Centre and SuperBowl Jurong are the nearest clusters. Otherwise, Jurong East is very nearby, and it’s Singapore’s “second CBD” with malls like JEM, IMM, and so forth.

The location improves exponentially if you drive, as you can get on the AYE in less than five minutes from here.

Two- and three-bedrooms make up around 84 per cent of the development, thus keeping the average quantum manageable. Starting prices at launch were around $1.3 million for a two-bedder and $2 million for a three-bedder.

We do expect competition from LakeGarden Residences though, especially at the point of resale. You can see our pricing comparison here.

7. Promenade Peak (206 units)

Promenade Peak is a 596-unit, 99-year leasehold condo at 1 Zion Promenade in District 3. It was surprising when it launched in July 2025 with a starting price of just $2,680 psf, which most people would find competitive for a development this central.

The defining feature of Promenade Peak is its height. At 63 storeys, it will be one of Singapore’s tallest pure residential towers, and definitely the tallest in its immediate surroundings. Facilities are spread vertically across four levels: Level 1, Level 22, Level 43, and a rooftop SkyPeak with an infinity pool and viewing deck. Depending on the floor, many units will get panoramic views of Marina Bay, Orchard Road, and the CBD.

As an interesting aside, the whole of level 43 is dedicated entirely to wellness, with an outdoor fitness deck, cross-training and boxing arenas, and a steam room.

Accessibility is excellent – Promenade Peak is a short walk to both Great World MRT and Havelock MRT on the TEL. Great World City is a major mall with cinemas, supermarkets, etc., while Zion Riverside Food Centre is pretty well established among foodies.

The unit mix is 54 per cent two-bedders, plus a full suite of larger family units, including 19 five-bedroom units and two penthouses (4,144 sq ft). At the time of launch, it came to around $1.4+ million for a one-bedroom + study and $1.8+ million for a two-bedroom.

As we’ve seen in recent launches, sales tend to move fast, and launch weekend sellouts are more common. If you need help securing a new launch option, reach out to us at Stacked.

If you’d like to get in touch for a more in-depth consultation, you can do so here.

Ryan J

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Read next from Property Market Commentary

Property Market Commentary The Rare Condos With Almost Zero Sales for 10 Years In Singapore: What Does It Mean for Buyers?

Property Market Commentary 5 Upcoming Executive Condo Sites in 2026: Which Holds the Most Promise for Buyers?

Property Market Commentary We Analysed Dual-Key Condo Units Across 2, 3 and 4 Bedders — And One Clear Pattern Emerged

Property Market Commentary Are New Launch Condos Really Getting Cheaper in 2025? The Truth Isn’t What You Think

Latest Posts

Property Advice We Own A 2-Bedder Condo In Clementi: Should We Decouple To Buy A Resale 3 Bedder Or Sell?

On The Market We Found the Cheapest Yet Biggest 4-Room HDBs You Can Buy From $480K

Pro Why This Freehold Mixed-Use Condo in the East Is Underperforming the Market

Singapore Property News 10 New Upcoming Housing Sites Set for 2026 That Homebuyers Should Keep an Eye On

Homeowner Stories I Gave My Parents My Condo and Moved Into Their HDB — Here’s Why It Made Sense.

Singapore Property News Will Relaxing En-Bloc Rules Really Improve the Prospects of Older Condos in Singapore?

Pro Why This Large-Unit Condo in the Jervois Enclave Isn’t Keeping Up With the Market

Singapore Property News A Housing Issue That Slips Under the Radar in a Super-Aged Singapore: Here’s What Needs Attention

Landed Home Tours Inside One of Orchard’s Rarest Freehold Enclaves: Conserved Homes You Can Still Buy From $6.8M

Property Investment Insights These 5 Condos In Singapore Sold Out Fast in 2018 — But Which Ones Really Rewarded Buyers?

On The Market We Found The Cheapest 4-Bedroom Condos You Can Still Buy from $2.28M

Pro Why This New Condo in a Freehold-Dominated Enclave Is Lagging Behind

Homeowner Stories “I Thought I Could Wait for a Better New Launch Condo” How One Buyer’s Fear Ended Up Costing Him $358K

Editor's Pick This New Pasir Ris EC Starts From $1.438M For A 3-Bedder: Here’s What You Should Know

Singapore Property News This 5 Room Clementi Flat Just Hit a Record $1.488M — Here’s What the Sellers Took Home