Which Condos Made the Biggest Profits in 2025? One Owner Earned $3.8M in Just 5 Years

October 22, 2025

With so many new launch options in 2025, it’s easy to lose sight of the equally thriving resale market. Going from 2014 to 2025 is an especially interesting time period, as it encompasses two significant events: the slew of cooling measures following 2013, which drove a down market, followed by the sharp upward recovery in the post-COVID years of 2022 and 2023. In this study, we looked at which resale projects have benefited the most from a roller-coaster decade:

A note on our method:

In this article, we look at where some of the biggest gains have occurred so far in 2025.

We’ve broken them down by both bedroom type and the kind of gains achieved – total profit and ROI.

All of the transactions featured here were purchased from 2014 onward and sold in 2025. For accuracy, Executive Condominiums (ECs) are excluded from this study, as projects like Sol Acres would otherwise skew the results due to launch subsidies.

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

Most profitable condos to date:

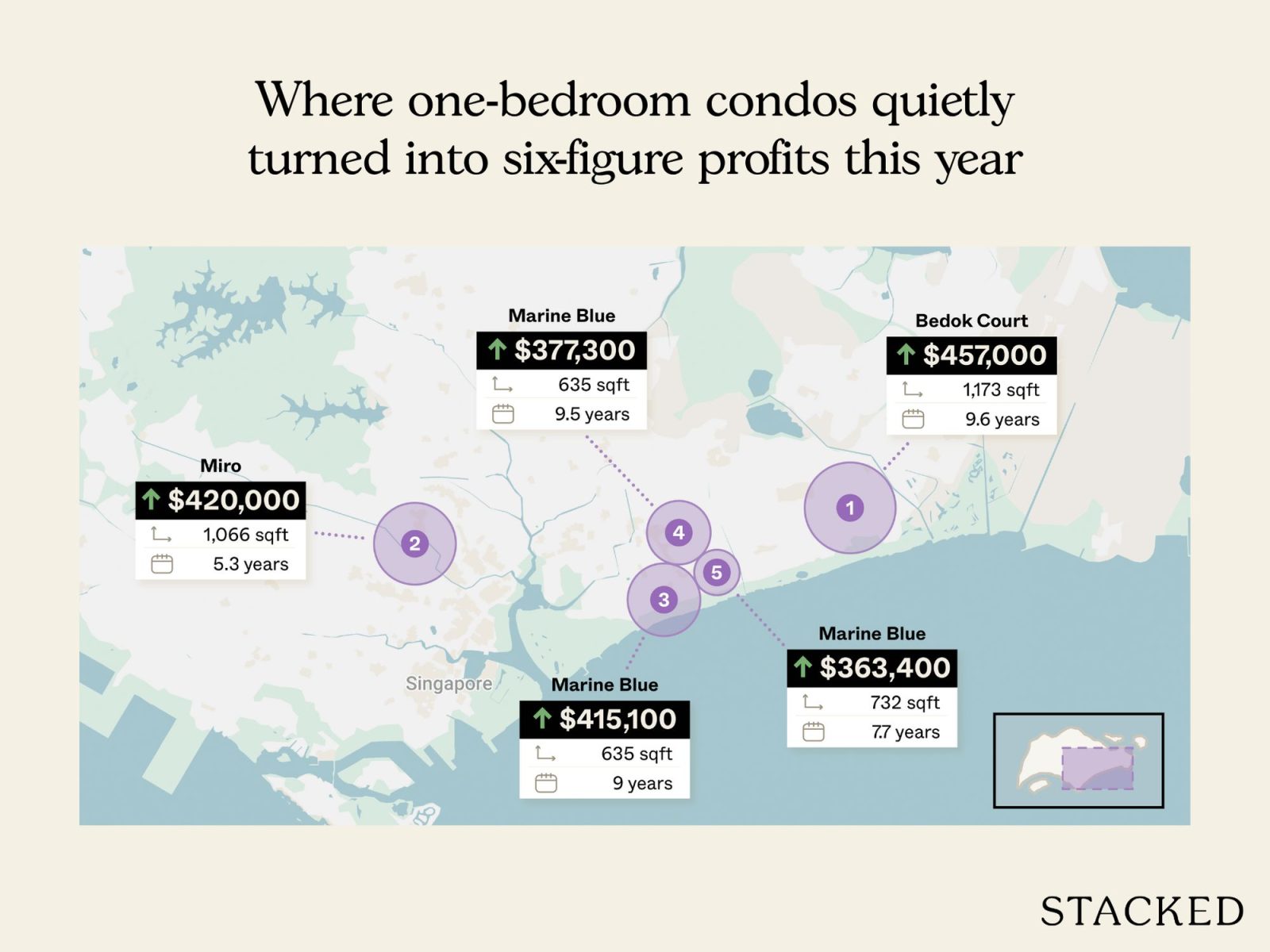

1BR Biggest Gains

| Project | Bought In | Buy Price | Sell Price | Size (Sq Ft) | Gains ($) | Gains (%) | Tenure | Area | Holding Period |

| BEDOK COURT | 22/12/15 | $808,000 | $1,265,000 | 1,173 | $457,000 | 56.6% | 99 yrs from 10/04/1982 | Bedok | 9.6 Years |

| MIRO | 10/2/20 | $1,330,000 | $1,750,000 | 1,066 | $420,000 | 31.6% | Freehold | Novena | 5.3 Years |

| MARINE BLUE | 28/4/16 | $1,134,900 | $1,550,000 | 635 | $415,100 | 36.6% | Freehold | Marine Parade | 9 Years |

| MARINE BLUE | 2/8/15 | $1,172,700 | $1,550,000 | 635 | $377,300 | 32.2% | Freehold | Marine Parade | 9.5 Years |

| MARINE BLUE | 9/7/17 | $1,286,600 | $1,650,000 | 732 | $363,400 | 28.2% | Freehold | Marine Parade | 7.7 Years |

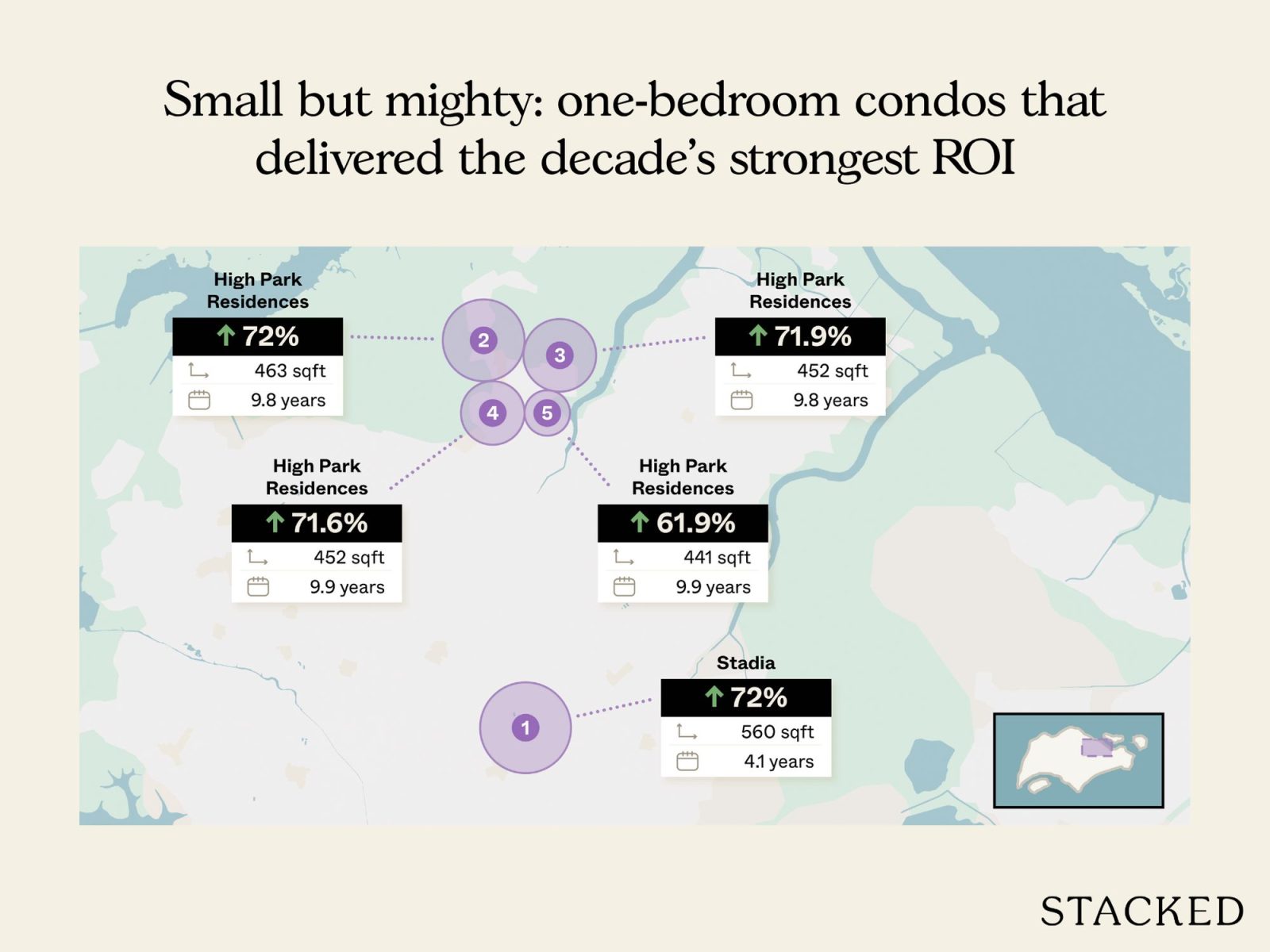

1BR Biggest ROI

| Project | Bought In | Buy Price | Sell Price | Size (Sq Ft) | Gains ($) | Gains (%) | Tenure | Area | Holding Period |

| STADIA | 17/5/21 | $500,000 | $860,000 | 560 | $360,000 | 72.0% | Freehold | Serangoon | 4.1 Years |

| HIGH PARK RESIDENCES | 18/7/15 | $441,000 | $758,333 | 463 | $317,333 | 72.0% | 99 yrs from 05/11/2014 | Sengkang | 9.8 Years |

| HIGH PARK RESIDENCES | 18/7/15 | $427,000 | $734,000 | 452 | $307,000 | 71.9% | 99 yrs from 05/11/2014 | Sengkang | 9.8 Years |

| HIGH PARK RESIDENCES | 18/7/15 | $443,000 | $760,000 | 452 | $317,000 | 71.6% | 99 yrs from 05/11/2014 | Sengkang | 9.9 Years |

| HIGH PARK RESIDENCES | 18/7/15 | $488,000 | $790,000 | 441 | $302,000 | 61.9% | 99 yrs from 05/11/2014 | Sengkang | 9.9 Years |

2BR Biggest Gains

| Project | Bought In | Buy Price | Sell Price | Size (Sq Ft) | Gains ($) | Gains (%) | Tenure | Area | Holding Period |

| THE TRILLIUM | 24/3/15 | $2,660,000 | $3,750,000 | 1,399 | $1,090,000 | 41.0% | Freehold | Singapore River | 10 Years |

| VALLEY PARK | 10/4/15 | $1,680,000 | $2,600,000 | 1,216 | $920,000 | 54.8% | 999 yrs from 21/06/1877 | Tanglin | 10.1 Years |

| THE DAIRY FARM | 23/10/15 | $1,430,000 | $2,330,000 | 1,518 | $900,000 | 62.9% | Freehold | Bukit Panjang | 9.8 Years |

| VALLEY PARK | 13/9/16 | $1,650,000 | $2,550,000 | 1,216 | $900,000 | 54.5% | 999 yrs from 21/06/1877 | Tanglin | 8.4 Years |

| URBANA | 1/8/16 | $1,800,000 | $2,700,000 | 1,012 | $900,000 | 50.0% | Freehold | River Valley | 8.6 Years |

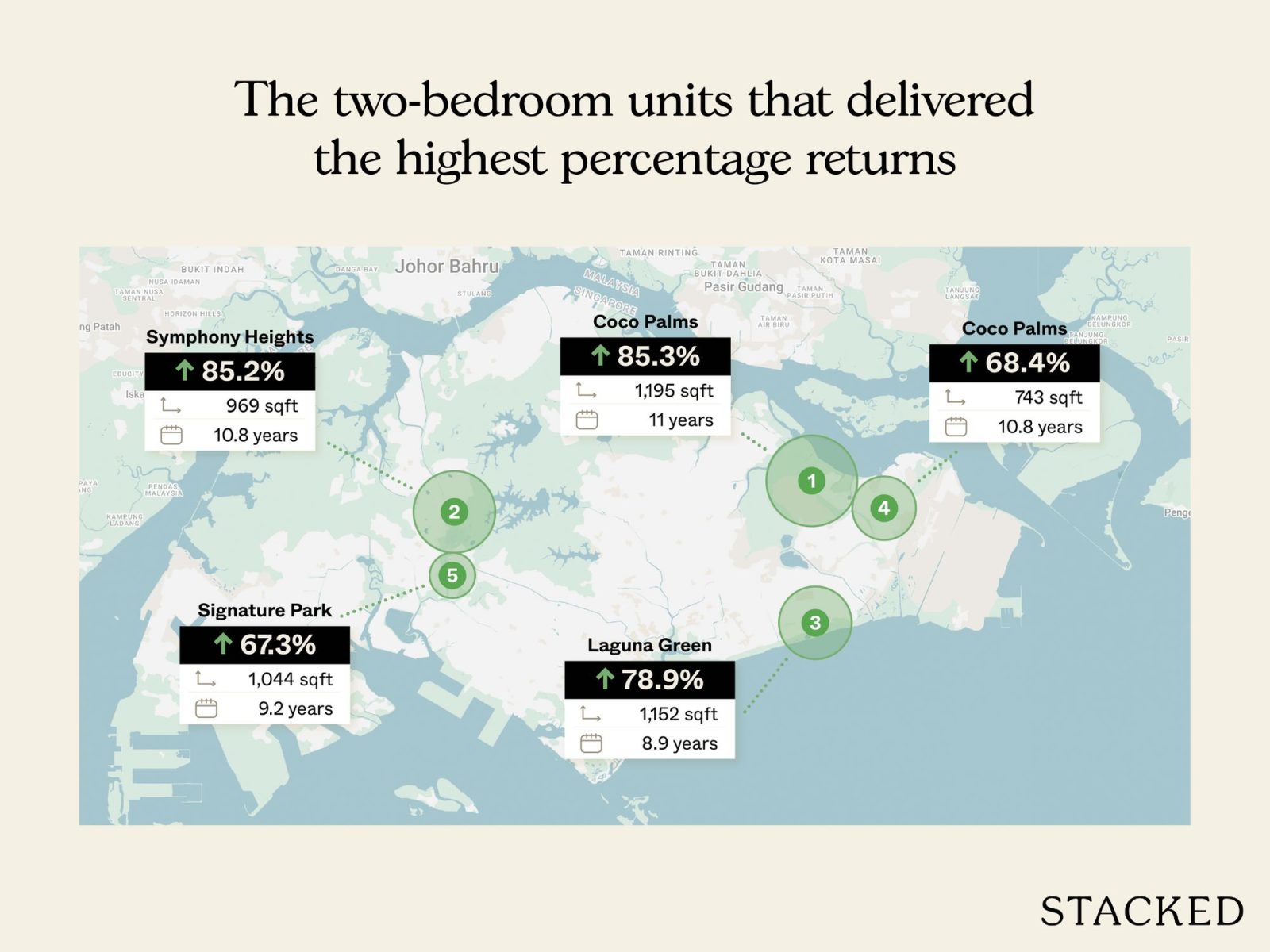

2BR Biggest ROI

| Project | Bought In | Buy Price | Sell Price | Size (Sq Ft) | Gains ($) | Gains (%) | Tenure | Area | Holding Period |

| COCO PALMS | 2/6/14 | $814,720 | $1,510,000 | 1,195 | $695,280 | 85.3% | 99 yrs from 07/01/2008 | Pasir Ris | 11 Years |

| SYMPHONY HEIGHTS | 26/9/14 | $945,000 | $1,750,000 | 969 | $805,000 | 85.2% | Freehold | Bukit Batok | 10.8 Years |

| LAGUNA GREEN | 19/5/16 | $950,000 | $1,700,000 | 1,152 | $750,000 | 78.9% | 99 yrs from 13/02/1995 | Bedok | 8.9 Years |

| COCO PALMS | 9/6/14 | $742,500 | $1,250,000 | 743 | $507,500 | 68.4% | 99 yrs from 07/01/2008 | Pasir Ris | 10.8 Years |

| SIGNATURE PARK | 29/3/16 | $1,039,888 | $1,740,000 | 1,044 | $700,112 | 67.3% | Freehold | Bukit Timah | 9.2 Years |

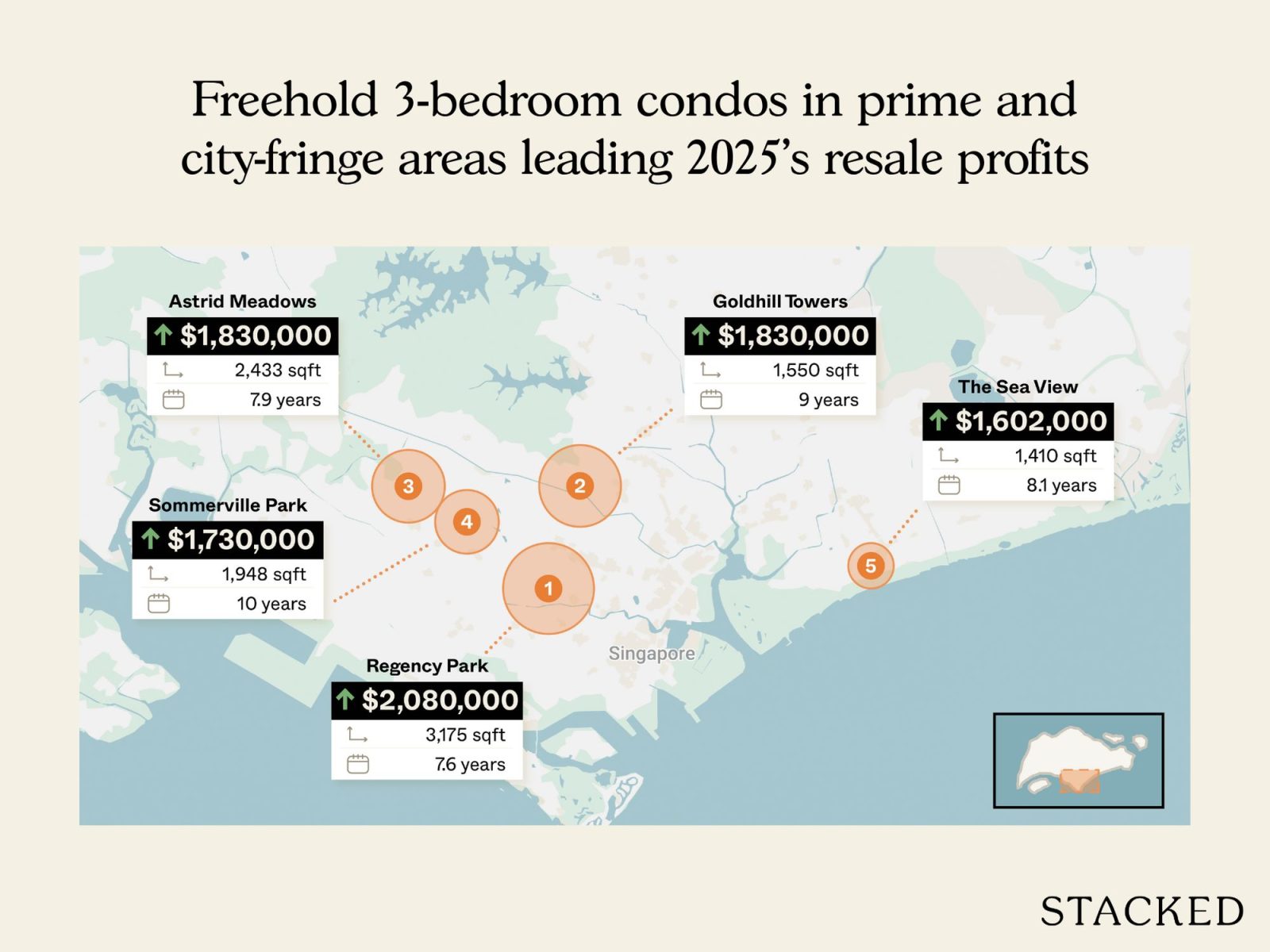

3BR Biggest Gains

| Project | Bought In | Buy Price | Sell Price | Size (Sq Ft) | Gains ($) | Gains (%) | Tenure | Area | Holding Period |

| REGENCY PARK | 10/10/17 | $5,070,000 | $7,150,000 | 3,175 | $2,080,000 | 41.0% | Freehold | Tanglin | 7.6 Years |

| GOLDHILL TOWERS | 24/6/16 | $2,000,000 | $3,830,000 | 1,550 | $1,830,000 | 91.5% | Freehold | Novena | 9 Years |

| ASTRID MEADOWS | 22/5/17 | $3,625,000 | $5,455,000 | 2,433 | $1,830,000 | 50.5% | Freehold | Bukit Timah | 7.9 Years |

| SOMMERVILLE PARK | 3/3/15 | $2,700,000 | $4,430,000 | 1,948 | $1,730,000 | 64.1% | Freehold | Tanglin | 10 Years |

| THE SEA VIEW | 3/2/17 | $2,220,000 | $3,822,000 | 1,410 | $1,602,000 | 72.2% | Freehold | Marine Parade | 8.1 Years |

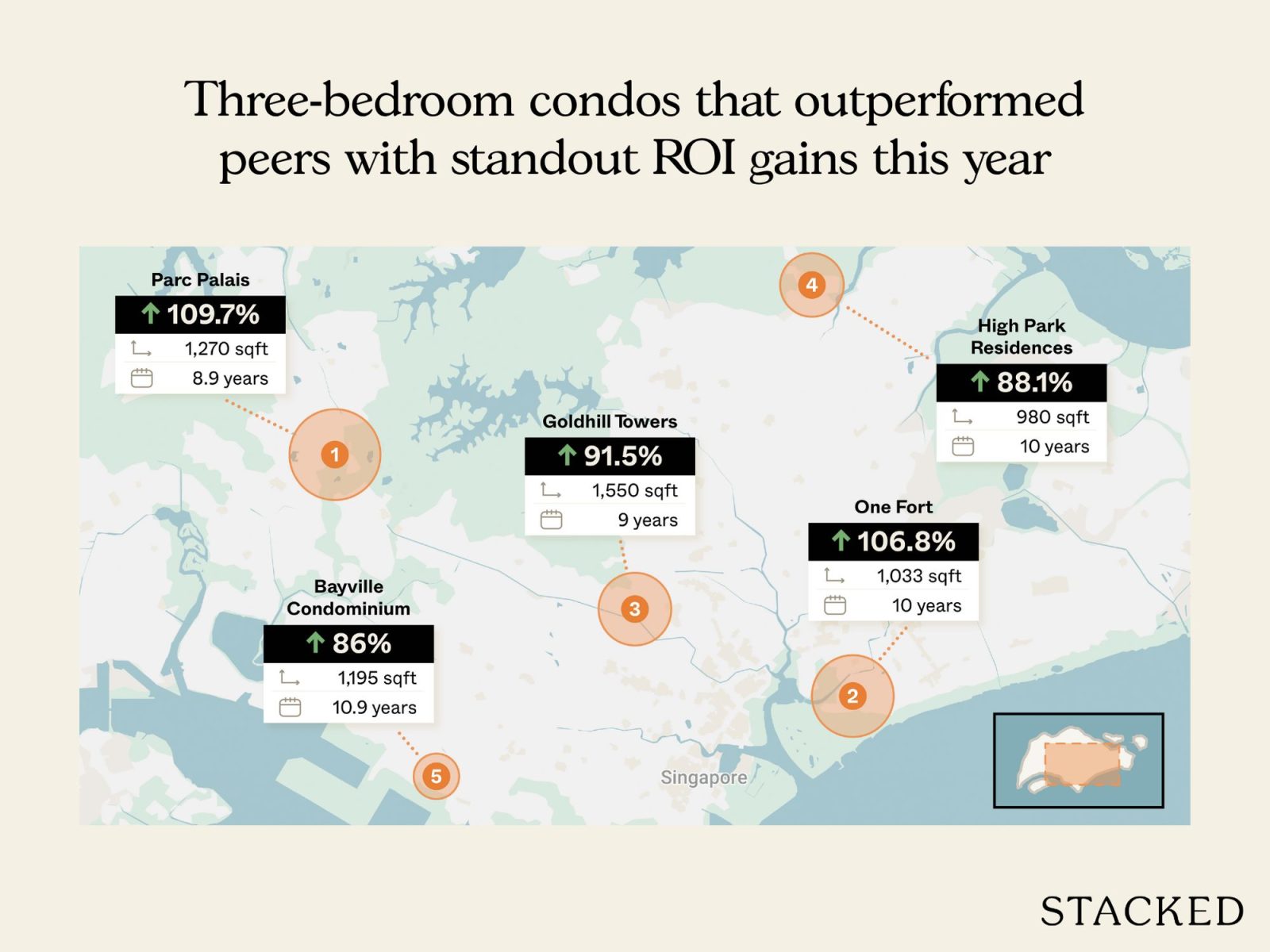

3BR Biggest ROI

| Project | Bought In | Buy Price | Sell Price | Size (Sq Ft) | Gains ($) | Gains (%) | Tenure | Area | Holding Period |

| PARC PALAIS | 19/8/16 | $1,030,000 | $2,160,000 | 1,270 | $1,130,000 | 109.7% | Freehold | Bukit Batok | 8.9 Years |

| ONE FORT | 4/7/15 | $1,000,000 | $2,068,000 | 1,033 | $1,068,000 | 106.8% | Freehold | Kallang | 10 Years |

| GOLDHILL TOWERS | 24/6/16 | $2,000,000 | $3,830,000 | 1,550 | $1,830,000 | 91.5% | Freehold | Novena | 9 Years |

| HIGH PARK RESIDENCES | 23/8/15 | $840,020 | $1,580,000 | 980 | $739,980 | 88.1% | 99 yrs from 05/11/2014 | Sengkang | 10 Years |

| BAYVILLE CONDOMINIUM | 22/5/14 | $1,000,000 | $1,860,000 | 1,195 | $860,000 | 86.0% | Freehold | Queenstown | 10.9 Years |

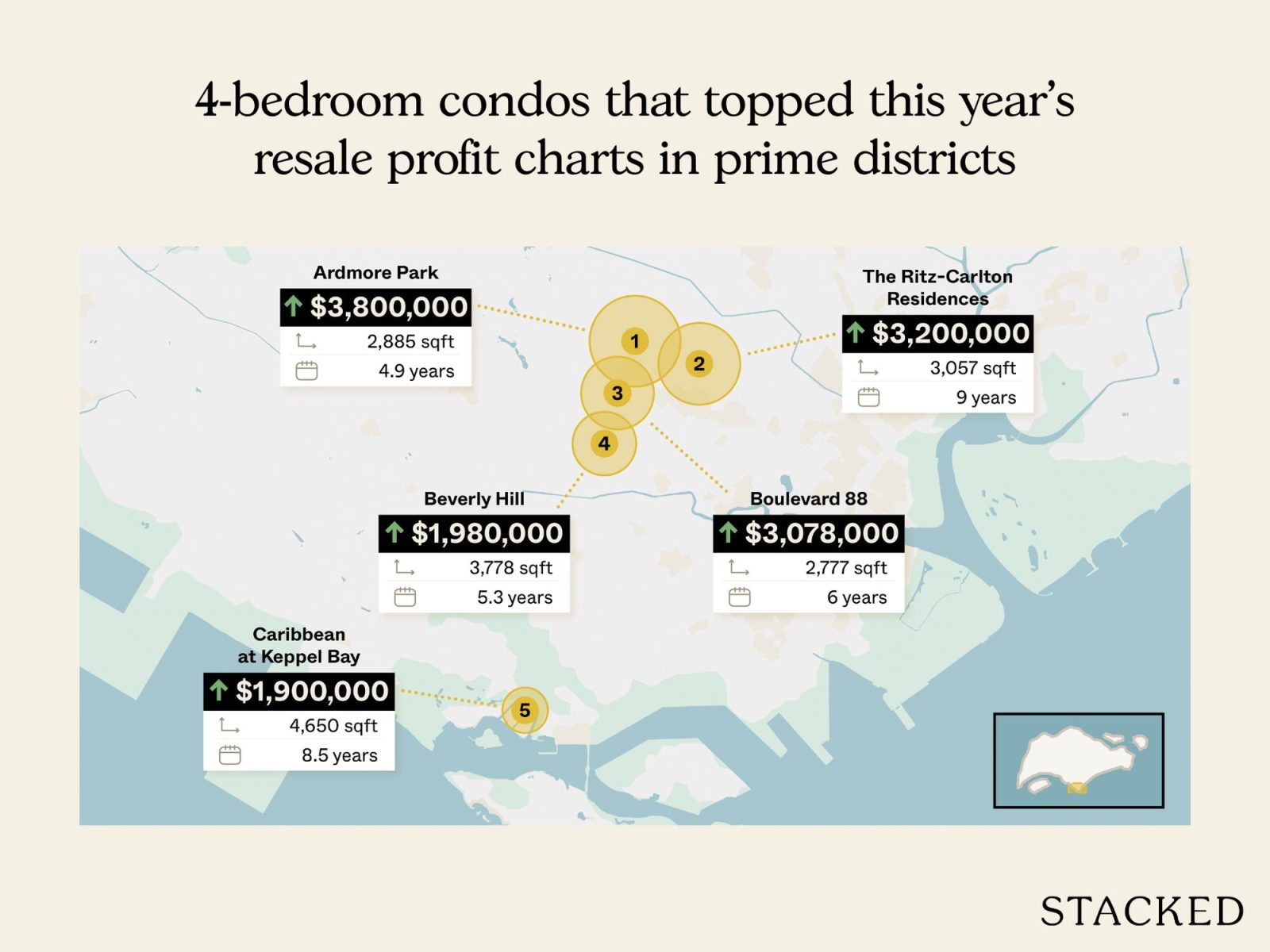

4BR Biggest Gains

| Project | Bought In | Buy Price | Sell Price | Size (Sq Ft) | Gains ($) | Gains (%) | Tenure | Area | Holding Period |

| ARDMORE PARK | 2/4/20 | $8,000,000 | $11,800,000 | 2,885 | $3,800,000 | 47.5% | Freehold | Newton | 4.9 Years |

| THE RITZ-CARLTON RESIDENCES SINGAPORE CAIRNHILL | 5/2/16 | $10,600,000 | $13,800,000 | 3,057 | $3,200,000 | 30.2% | Freehold | Newton | 9 Years |

| BOULEVARD 88 | 30/6/19 | $9,922,000 | $13,000,000 | 2,777 | $3,078,000 | 31.0% | Freehold | Orchard | 6 Years |

| BEVERLY HILL | 16/10/19 | $8,100,000 | $10,080,000 | 3,778 | $1,980,000 | 24.4% | Freehold | Tanglin | 5.3 Years |

| CARIBBEAN AT KEPPEL BAY | 27/2/17 | $3,800,000 | $5,700,000 | 4,650 | $1,900,000 | 50.0% | 99 yrs from 16/08/1999 | Bukit Merah | 8.5 Years |

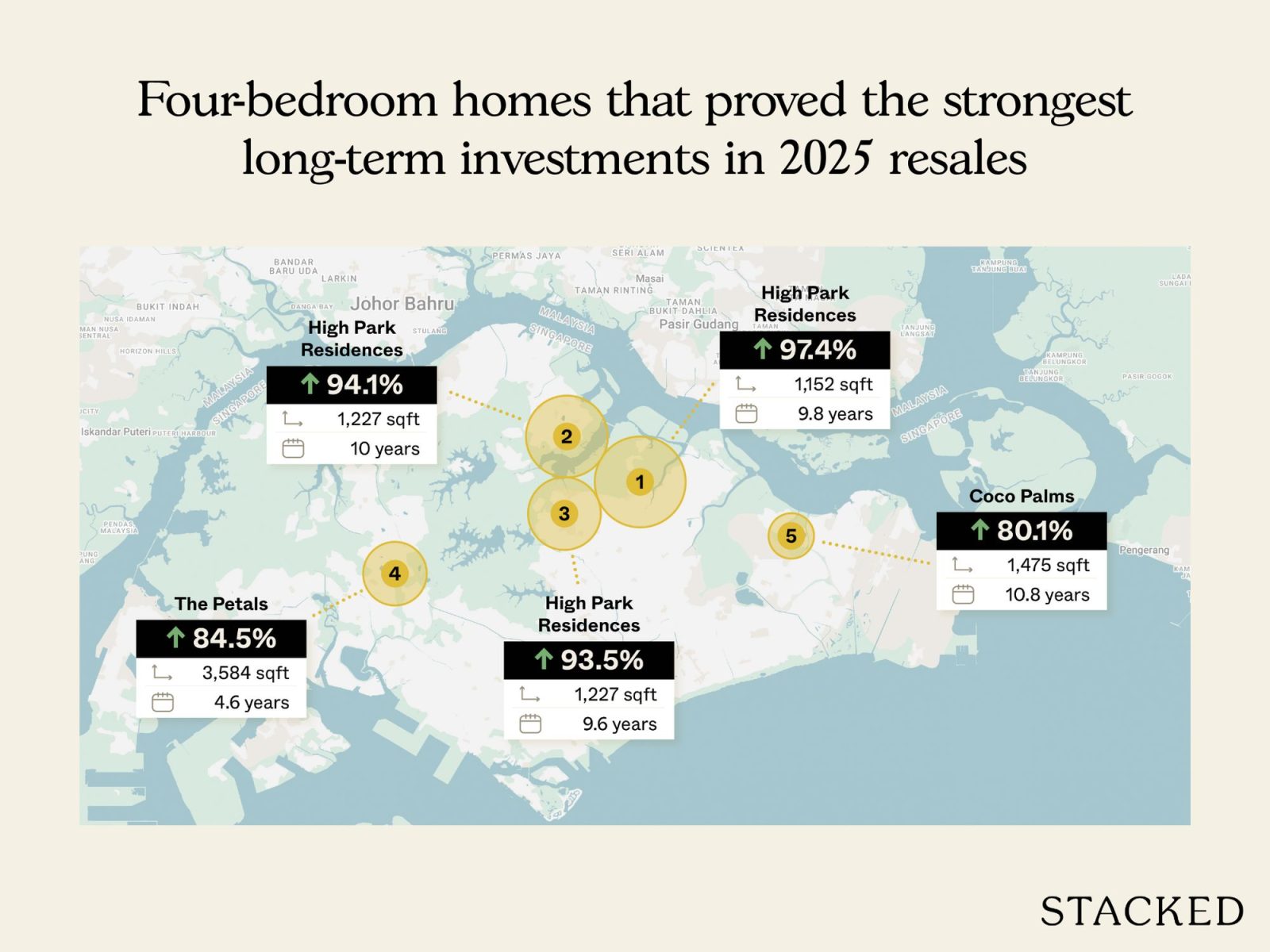

4BR Biggest ROI

More from Stacked

2 Reasons Costa Del Sol Underperformed—Despite Its Seafront Location And Family Appeal

In this Stacked Pro breakdown:

| Project | Bought In | Buy Price | Sell Price | Size (Sq Ft) | Gains ($) | Gains (%) | Tenure | Area | Holding Period |

| HIGH PARK RESIDENCES | 17/7/15 | $993,000 | $1,960,000 | 1,152 | $967,000 | 97.4% | 99 yrs from 05/11/2014 | Sengkang | 9.8 Years |

| HIGH PARK RESIDENCES | 22/7/15 | $1,050,000 | $2,038,000 | 1,227 | $988,000 | 94.1% | 99 yrs from 05/11/2014 | Sengkang | 10 Years |

| HIGH PARK RESIDENCES | 17/7/15 | $1,023,000 | $1,980,000 | 1,227 | $957,000 | 93.5% | 99 yrs from 05/11/2014 | Sengkang | 9.6 Years |

| THE PETALS | 13/8/20 | $2,000,000 | $3,690,000 | 3,584 | $1,690,000 | 84.5% | Freehold | Bukit Batok | 4.6 Years |

| COCO PALMS | 4/7/14 | $1,298,080 | $2,338,000 | 1,475 | $1,039,920 | 80.1% | 99 yrs from 07/01/2008 | Pasir Ris | 10.8 Years |

Notable trends from the most profitable sales

- Holding periods of eight to 10 years are a common trait

- Large landscaped areas

- High Park Residences is one of the best performers of the decade by ROI

- Luxury clusters still stand out for absolute profit

- Marine Parade and Tanglin stood out for older freehold condos

1. Holding periods of eight to 10 years are a common trait

From the above, we can see sellers with the biggest profits often bought their units roughly a decade ago (early 2010s) and held on till around 2021–2023. For example, many of the top profit-makers in 2022/23 had purchase dates circa 2011–2013. They patiently waited through the market downturn between 2013 to 2018, and benefited when prices surged post-COVID (around 2022 to 2023).

For those who missed the previous bull market (from the trough of the Global Financial Crisis in 2008/9, to the 2013 peak), their patience was rewarded in the post-COVID wave, when tight housing supply drove prices higher.

We do see some profitable projects with shorter holding periods, like Stadia’s four-year turnaround; this can happen if, for instance, you get steep developer discounts at launch. But in general, a longer holding period is your best bet.

2. Large landscaped areas

Realtors pointed out that many of these projects were very large, in terms of land area. High Park Residences, for instance, is around 366,000 sq ft in total, while Ardmore Park is over 348,000 sq ft. Coco Palms has a site area of close to 447,000 sq ft. This is all much larger than the average land parcel sizes you’ll find today – Grand Dunman, for instance, is only about 271,500 sq ft, while Irwell Hill Residences is around 137,570 sq ft.

While the land size of a condo (and quality of the landscaping) is not the biggest factor, it does lend a lot of weight. Realtors noted a psychological effect from seeing the larger open grounds, and blocks that are generously spaced from each other; this has a mitigating effect on age on wear.

There’s also an assumed correlation between unit sizes and large land parcels (e.g., it’s assumed that fewer units on larger land parcels mean more spacious layouts.) In reality this isn’t always true; but it is a common enough assumption. So while it may just be a correlation, it is quite clear that these top performers have leaned toward larger land sizes.

3. High Park Residences is one of the best performers of the decade by ROI

High Park Residences is a 99-year leasehold mega-development in Sengkang (OCR). We’ve highlighted its strong performance before, in previous articles.

The main reason would be the low entry price of this project when it launched in 2015. At the time, the market was still a bit sceptical about mega-developments; this resulted in cautious developer pricing at around $900 psf, low even for its day. At the time, buyers would have accepted around $1,000 to $1,200 psf for an OCR launch. This gave first buyers a cheap base, so even moderate gains translated to large percentages.

The project’s scale and amenities – which we highlighted in the review – are also a big draw in the Sengkang area. This remains the condo with the most extensive facilities in Sengkang even now, and a resale price of under $1.6 million (for a three-bedder) continues to draw interest.

4. Luxury clusters still stand out for absolute profit

It’s not actually surprising to see CCR condos having lower percentage gains, but higher real profits. The reason is simply that the base costs are already very high, so even a small percentage gain translates to a very large absolute amount in dollars.

We see icons like Ardmore Park, The Ritz-Carlton Residences, Boulevard 88, etc. – frequently fetched $3 million to $5 million in absolute profit per sale, the highest dollar gains on record. However, when you look at the return on investment (ROI) in percentage terms, these high-end deals often show only ~25–50 per cent gains, which is much lower than the ROI for cheaper mass-market condos.

However, we may be at a turning point; and this is the decade when things may change. We’ve seen that developers are increasingly building smaller units at a more reasonable quantum, in projects like River Green or Skye at Holland. At the lower entry prices, we may see equally strong percentage gains for these projects as mass-market condos, over the next 10 years.

(Depending, of course, on how well the secondary market receives these smaller units.)

5. Marine Parade and Tanglin stood out for older freehold condos

Among older freehold condos, Marine Parade and Tanglin consistently produced the highest gains. You can also see this reflected in our earlier look at the most profitable condos in 2022/23.

Unfortunately, this probably has little to do with the nature of the condos themselves, or with freehold status.

A lot of it comes down to volume: there are simply far more freehold condos in Marine Parade and Tanglin, compared to leasehold. As such, it’s more probable that the top performers will end up including more freehold condos.

What the results do show, however, is that older condos can hold up well here. Marine Blue is an exception, completed in 2016 – but much of the other developments are from the 1990s and 2000s, such as The Sea View (2008), Cote D’Azur (2004), and Aalto (2010).

In Tanglin, Sommerville Park (1990) and Regency Park (1990) and Valley Park (1997) are all part of an older generation of projects. They have performed well despite their age, even compared to other freehold neighbours.

These aren’t particularly new lessons in the property market

Rather, the data reinforces what we’ve seen over the years. A longer holding period, of close to a decade, can allow you to ride out most market issues and policy shocks.

We can also see that more important than timing (or perhaps related to it) is entry price. High Park Residences’ strong performance is simply down to the fact that, when it launched, it was cheaper than most new sales options. This was sufficient to overcome most issues, including the higher competition at the point of resale.

Beyond that, it’s a reminder not to conflate freehold status with better performance. If the majority of projects in a given area are freehold, as is the case with Marine Parade and Tanglin, then it’s not always representative of freehold providing a huge advantage.

We may see clearer signs of this over the next decade, based on the performance of recent leasehold new launches in the CCR.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

What are the common traits of the most profitable condos in 2025?

Why did High Park Residences perform so well in 2025?

Do older freehold condos tend to make bigger profits?

How does luxury condo performance compare to mass-market condos in terms of profits?

Is it better to buy condos during a market downturn or during a boom?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Property Investment Insights

Property Investment Insights This 130-Unit Condo Launched 40% Above Its District — And Prices Struggled To Grow

Property Investment Insights These Freehold Condos Barely Made Money After Nearly 10 Years — Here’s What Went Wrong

Property Investment Insights River Modern Starts From $1.548M For A Two-Bedder — How Its Pricing Compares In River Valley

Property Investment Insights This Singapore Condo Has Bigger Units Near The MRT — But Timing Decided Who Made Money

Latest Posts

Singapore Property News Why Some Singaporean Parents Are Considering Selling Their Flats — For Their Children’s Sake

New Launch Condo Reviews River Modern Condo Review: A River-facing New Launch with Direct Access to Great World MRT Station

On The Market Here Are The Cheapest 5-Room HDB Flats Near An MRT You Can Still Buy From $550K

0 Comments