Should We Buy An Old 99-Year Leasehold Condo To Live In: Will It’s Value Fall When The Lease Runs Out?

December 24, 2025

Hi Stacked Homes, this is Mrs Lim. I have been following Stacked for many years as you all have given very detailed info on housing projects. Thank you. I would like to seek your advice on a condominium next to Parkway Parade. It is already 25 years old and is a 99-year leasehold condo. I like the location as it is very convenient and windy. However, I am concerned about the impact of the decaying lease. Have you encountered a condo that is close to, or older than, 50 years; and has it been stayed in until the lease ran out? I’m just wondering if it’s ok to buy a unit there for own stay use? What is your frank opinion? Thank you.

Hi Mrs. Lim. Thank you so much for reaching out.

To answer one part of your question; Yes, there are some non-landed private homes in Singapore that have a 99-year leasehold tenure and are more than 50 years old, although they are rare. Some examples in the Marine Parade area are Mandarin Gardens and Laguna Park which we explore below.

That said, we have yet to encounter anyone who has lived in a project until the very end of its lease.

To answer the next part of your question, we need to go into a little more detail.

We assume you are referring to Cote D’Azur when you mention the condo next to Parkway Parade. In considering whether you should buy, we decided to look at the following:

- How 99-year leasehold condos have performed, categorised by age bands

- A closer look at relevant older projects to see how they’ve actually held up

- A detailed case study on Cote D’Azur’s performance

- How Cote D’Azur compares with nearby developments to put its results in proper context

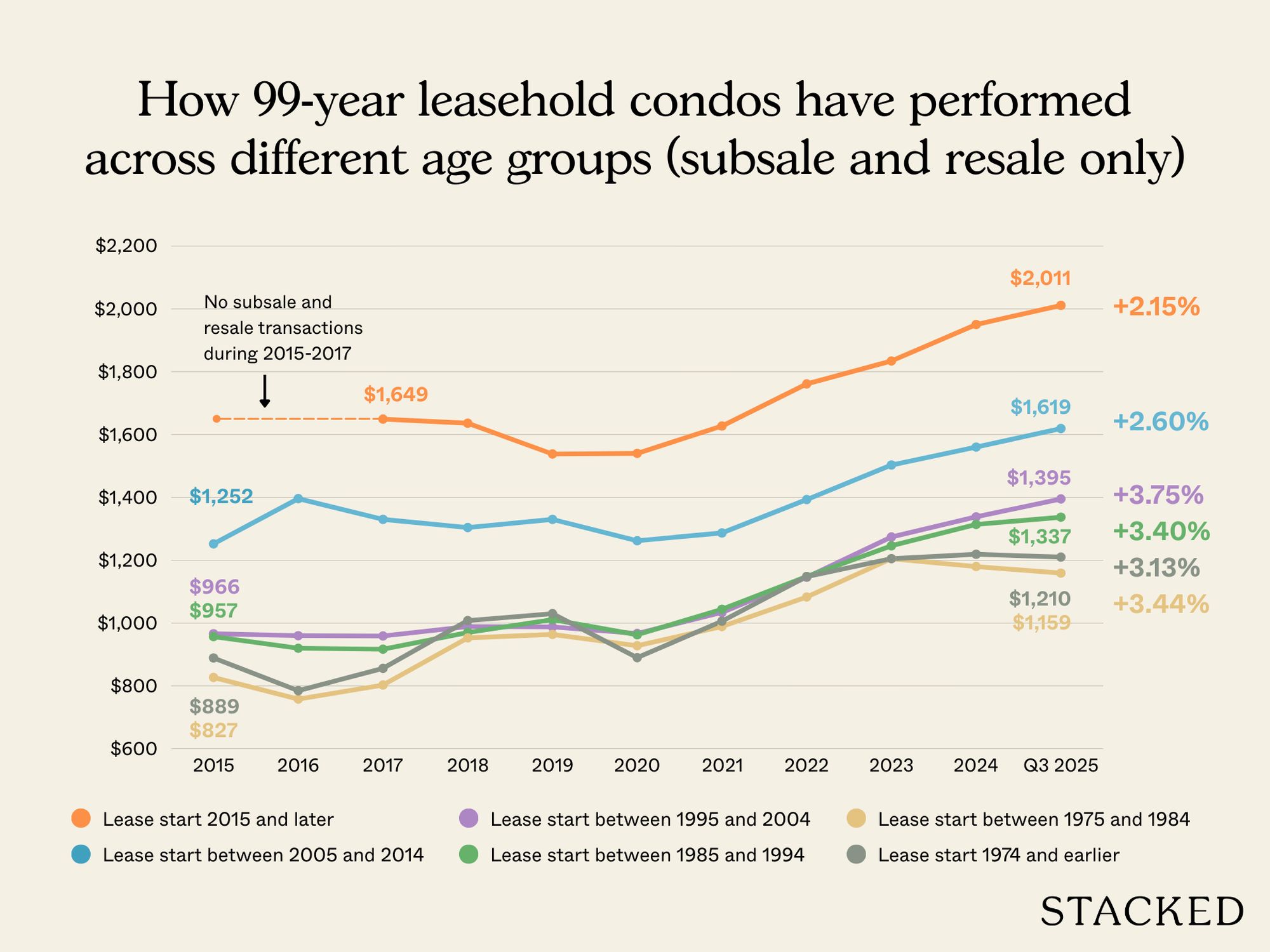

Let’s begin by looking at the performance of various 99-year leasehold condos, according to their age groups:

| Lease start year | Lease start 2015 and later | Lease start between 2005 and 2014 | Lease start between 1995 and 2004 | Lease start between 1985 and 1994 | Lease start between 1975 and 1984 | Lease start 1974 and earlier |

| Current age | Age 10 years and below | Age 11 to 20 years | Age 21 – 30 years | Age 31 to 40 years | Age 41 – 50 years | Age above 51 years |

| Year | Lease start 2015 and later | Lease start between 2005 and 2014 | Lease start between 1995 and 2004 | Lease start between 1985 and 1994 | Lease start between 1975 and 1984 | Lease start 1974 and earlier |

| 2015 | $1,252 | $966 | $957 | $827 | $889 | |

| 2016 | $1,396 | $960 | $920 | $758 | $785 | |

| 2017 | $1,649 | $1,330 | $959 | $917 | $803 | $856 |

| 2018 | $1,636 | $1,304 | $989 | $970 | $953 | $1,008 |

| 2019 | $1,538 | $1,330 | $988 | $1,011 | $964 | $1,030 |

| 2020 | $1,540 | $1,262 | $967 | $963 | $928 | $890 |

| 2021 | $1,627 | $1,287 | $1,034 | $1,044 | $989 | $1,006 |

| 2022 | $1,761 | $1,393 | $1,146 | $1,148 | $1,083 | $1,148 |

| 2023 | $1,834 | $1,503 | $1,274 | $1,246 | $1,205 | $1,205 |

| 2024 | $1,950 | $1,560 | $1,338 | $1,314 | $1,180 | $1,219 |

| 2025 (Up to Q3) | $2,011 | $1,619 | $1,395 | $1,337 | $1,159 | $1,210 |

| Annualised | 2.51% (2017 to 2025) | 2.60% | 3.75% | 3.40% | 3.44% | 3.13% |

Note: The reason newer condos (under 20 years old) show lower growth rates is because new launches are always priced higher than existing resale condos. So because the newer condos come in at a much higher average price per square foot ($PSF), the apparent percentage growth is lower. It does not mean they are “worse performers.”

From the above, we can see that price growth does moderate as a condo ages. Even though their average $PSF can continue to increase, the rate at which they rise tends to slow.

We can also see that the launch of a newer condo nearby doesn’t automatically lift the prices of older projects nearby, as is widely believed. It may happen that the higher $PSF of the new condo raises price expectations in the area, which in turn has a knock-on effect on older nearby condos. But this assumes demand for the older resale condos stay resilient.

That said, the data also shows that price growth moderates as projects continue to age. That is, the average $PSF of an older condo can continue to rise even after 20 or 30 years, but the rate at which it appreciates begins to slow.

Now let’s see if this applies to District 15, where Cote D’Azur is located

| Year | Lease start 2015 and later | Lease start between 2005 and 2014 | Lease start between 1995 and 2004 | Lease start between 1985 and 1994 | Lease start between 1975 and 1984 |

| 2015 | $1,687 | $1,152 | $1,223 | $859 | |

| 2016 | $1,539 | $1,105 | $1,138 | $797 | |

| 2017 | $1,576 | $1,090 | $1,200 | $836 | |

| 2018 | $1,665 | $1,170 | $1,259 | $950 | |

| 2019 | $1,656 | $1,601 | $1,159 | $1,365 | $958 |

| 2020 | $1,950 | $1,630 | $1,172 | $1,307 | $932 |

| 2021 | $2,046 | $1,709 | $1,294 | $1,371 | $1,031 |

| 2022 | $2,112 | $1,895 | $1,422 | $1,491 | $1,125 |

| 2023 | $2,218 | $1,888 | $1,540 | $1,593 | $1,166 |

| 2024 | $2,254 | $1,964 | $1,624 | $1,642 | $1,169 |

| 2025 (Up to Q3) | $2,413 | $1,903 | $1,694 | $1,716 | $1,160 |

| Annualised | 6.48% (2019 to 2025) | 1.21% | 3.94% | 3.44% | 3.05% |

In this case, District 15 shows a slightly different pattern from what we expected. Projects that are 10 years old and younger saw their highest annualised growth rate of 6.48 per cent between 2019 and 2025.

This is unusual because newer projects usually come in at a higher price and usually results in relatively lower percentage growth.

But looking deeper, from 2019 to 2024, we noticed that nearly all of the resale transactions in this age group came from Seaside Residences, an 841-unit condo off Siglap Road . As a result, this one condo heavily skewed the averages.

Later in 2025, there were a handful of subsale transactions (i.e., units sold before the official completion of the condo) at LIV @ MB, a 298-unit development off Mountbatten Road that launched in 2022. This further pushed up the overall average $PSF for condos aged 10 and under in this district.

Setting aside that outlier, the condos in older age groups followed a more predictable pattern where the average $PSF continued to rise over time, but the pace at which they rose began to slow over the decades.

Now that we have a sense of how older condos appreciate in D15, let’s examine the 41 to 50 year old age group.

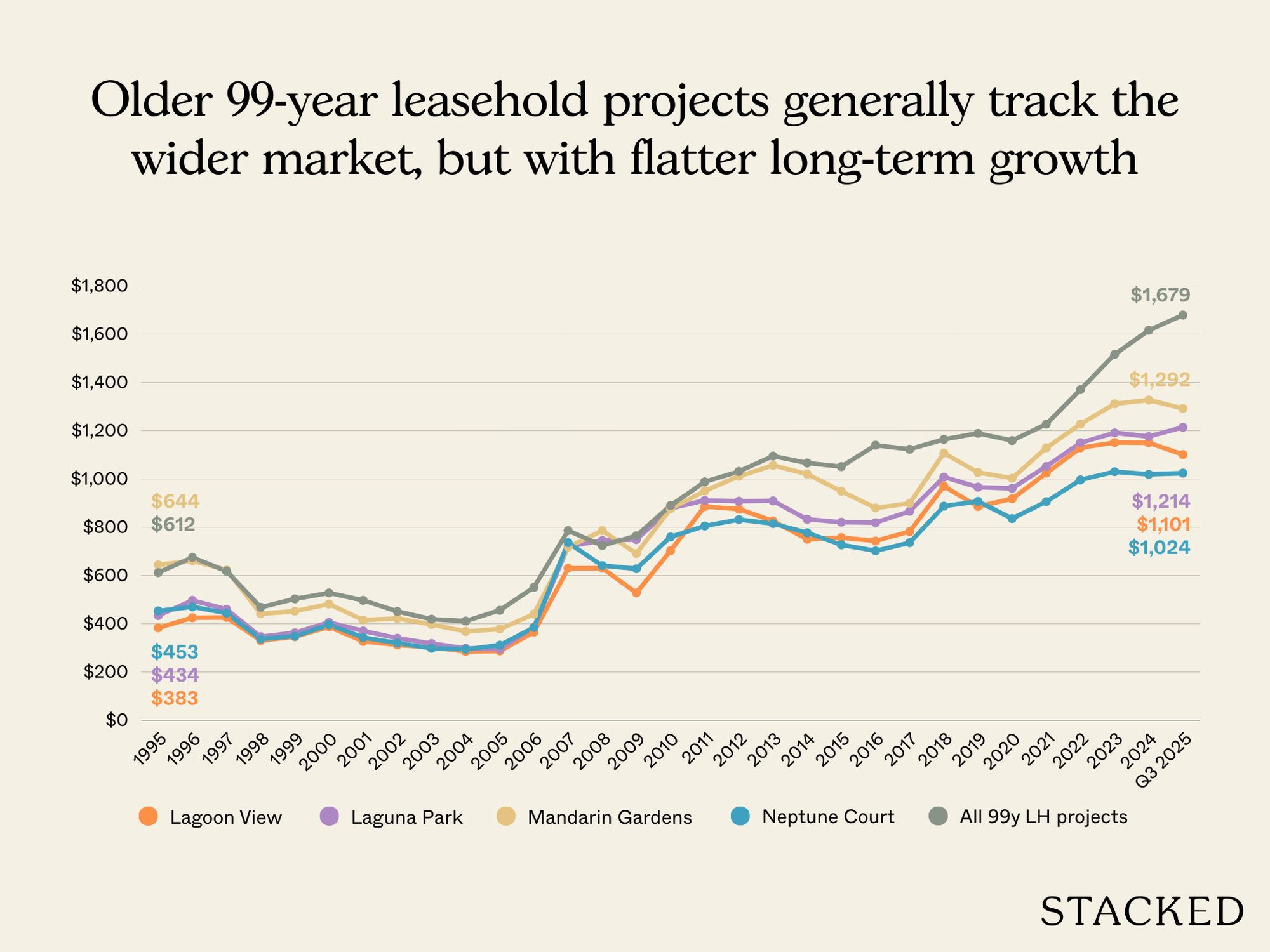

We are only looking at resale and subsale transactions here. We’ve started from 1995 because transaction data before then isn’t available.

One factor we notice is that the price trends of these older condos are relatively more volatile. Compared to the overall leasehold market, these older projects tend to experience steeper drops during market corrections and more uneven recoveries. We can see this in the late 1990s and early 2000s, where price declines were steeper and more prolonged than the broader market.

But during strong upcycles, particularly 2006 to 2007 and again from 2018 to 2022, all four developments recorded sharp price recoveries. In some years they even exceeded the islandwide leasehold average. Agents we spoke to noted that the upkeep of maintenance and the condition of facilities* have a bigger impact on the liveability and price of older condos. This can cause them to behave quite differently from each other, compared to newer projects where these factors tend to be more standardised.

Overall, the takeaway is that 40+ year old condos in D15 can still appreciate, but at a slower pace. You can also expect a bit more price movement volatility and potentially more divergences with other condos in the same age range.

*Squash courts, for instance, are not as widely used today, and some homebuyers don’t like condos that only have irregular shaped pools. These are some qualitative concerns to take into account before you buy.

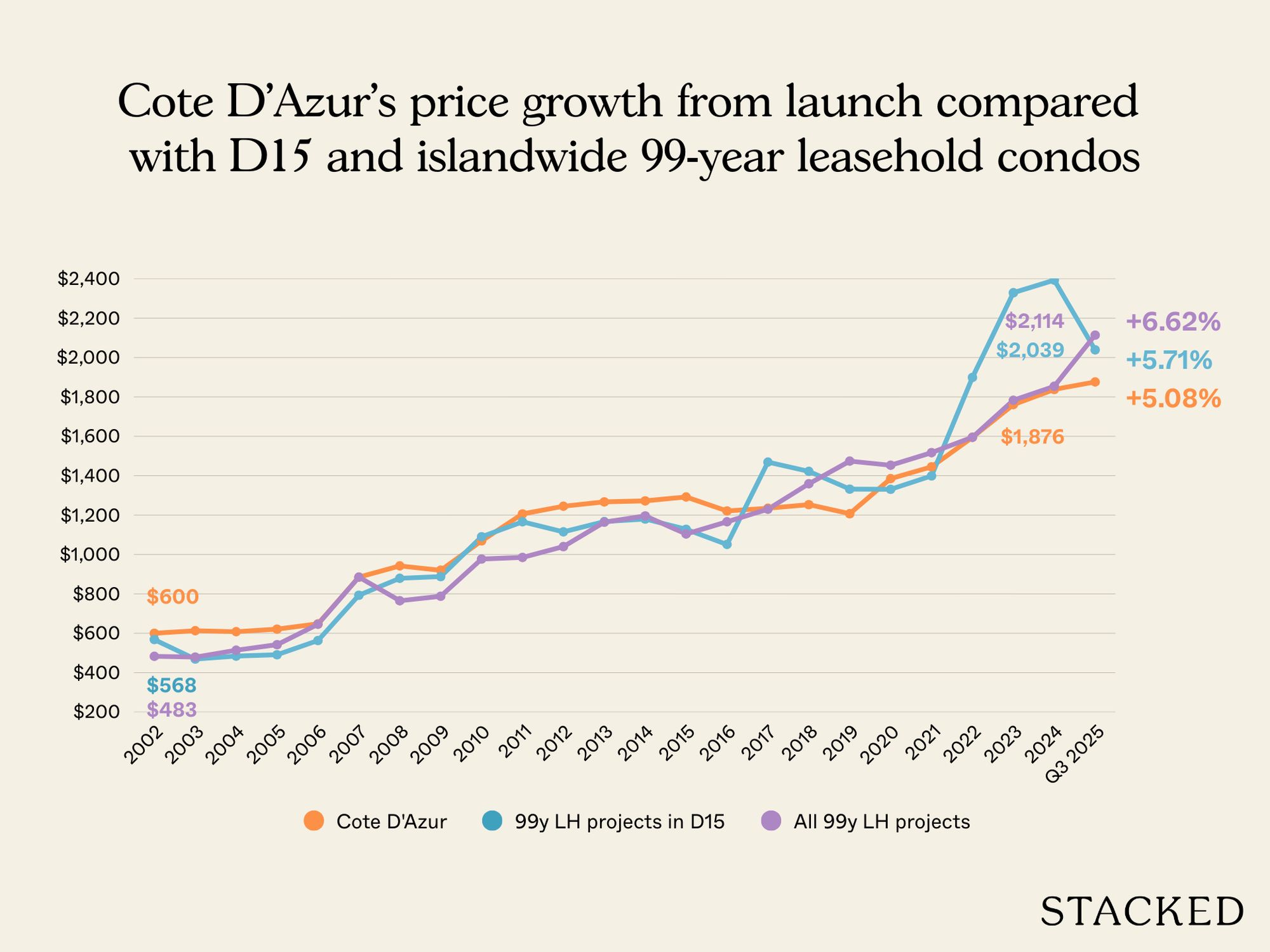

Next, we looked at the performance of Cote D’Azur from launch to Q3 2025

| Year | Cote D’Azur | 99y LH projects in D15 | All 99y LH projects |

| 2002 | $600 | $568 | $483 |

| 2003 | $613 | $469 | $479 |

| 2004 | $608 | $484 | $514 |

| 2005 | $621 | $491 | $542 |

| 2006 | $648 | $563 | $646 |

| 2007 | $885 | $793 | $885 |

| 2008 | $942 | $879 | $765 |

| 2009 | $920 | $888 | $788 |

| 2010 | $1,069 | $1,090 | $977 |

| 2011 | $1,206 | $1,166 | $985 |

| 2012 | $1,245 | $1,115 | $1,040 |

| 2013 | $1,267 | $1,167 | $1,164 |

| 2014 | $1,272 | $1,180 | $1,196 |

| 2015 | $1,292 | $1,128 | $1,104 |

| 2016 | $1,221 | $1,051 | $1,166 |

| 2017 | $1,235 | $1,469 | $1,230 |

| 2018 | $1,253 | $1,422 | $1,359 |

| 2019 | $1,207 | $1,332 | $1,474 |

| 2020 | $1,385 | $1,331 | $1,453 |

| 2021 | $1,445 | $1,399 | $1,517 |

| 2022 | $1,595 | $1,899 | $1,595 |

| 2023 | $1,761 | $2,329 | $1,783 |

| 2024 | $1,838 | $2,393 | $1,854 |

| 2025 (Up to Q3) | $1,876 | $2,039 | $2,114 |

| Annualised | 5.08% | 5.71% | 6.62% |

The annualised growth rate of 5.08 per cent trails the wider leasehold market and District 15, which – as we’ve established – is not surprising for an older project. But results over such a long period are a bit of an abstraction, and we want to see how well it’s been doing in a way that’s more relevant to today.

So here’s how Cote D’Azur compares in the past 10 years only:

| Year | Cote D’Azur | 99y LH projects in D15 | All 99y LH projects |

| 2015 | $1,292 | $1,127 | $1,051 |

| 2016 | $1,221 | $1,051 | $1,140 |

| 2017 | $1,235 | $1,062 | $1,123 |

| 2018 | $1,253 | $1,177 | $1,164 |

| 2019 | $1,207 | $1,168 | $1,189 |

| 2020 | $1,385 | $1,184 | $1,159 |

| 2021 | $1,445 | $1,381 | $1,227 |

| 2022 | $1,595 | $1,469 | $1,370 |

| 2023 | $1,761 | $1,534 | $1,516 |

| 2024 | $1,838 | $1,646 | $1,616 |

| 2025 (Up to Q3) | $1,876 | $1,675 | $1,679 |

| Annualised | 3.80% | 4.05% | 4.79% |

This is quite a strong performance, since despite its age Cote D’Azur comes quite close to the price performance of the two wider markets we are comparing. The difference is only around a single percentage point or less.

Let’s get more specific and compare Cote D’Azur to its surrounding condos, since there’s quite a few in the surrounding area:

These are the condos nearby, a mix of both freehold and leasehold projects:

| Project | KING’S MANSION | AMBER POINT | Cote D’Azur | THE ESTA | THE SEA VIEW | ONE AMBER | AMBER RESIDENCES | SILVERSEA | THE SHORE RESIDENCES | AMBER SKYE | AMBER 45 | NYON | AMBER PARK | COASTLINE RESIDENCES |

| Tenure | Freehold | Freehold | 99-year | Freehold | Freehold | Freehold | Freehold | 99-year | 103-year | Freehold | Freehold | Freehold | Freehold | Freehold |

| Completion year | 1982 | 1991 | 2004 | 2008 | 2008 | 2010 | 2011 | 2014 | 2014 | 2017 | 2020 | 2022 | 2023 | 2023 |

| No. of units | 196 | 100 | 612 | 400 | 546 | 562 | 114 | 383 | 408 | 109 | 139 | 92 | 592 | 144 |

Again, to keep it relevant to today, we’ll only compare the performance from 2015 to Q3 2025, and not across their entire histories:

| Year | KING’S MANSION | AMBER POINT | Cote D’Azur | THE ESTA | THE SEA VIEW | ONE AMBER | AMBER RESIDENCES | SILVERSEA | THE SHORE RESIDENCES | AMBER SKYE | AMBER 45 | NYON | AMBER PARK | COASTLINE RESIDENCES |

| 2015 | $1,153 | $1,257 | $1,292 | $1,475 | $1,655 | $1,394 | $1,380 | $1,687 | $1,531 | |||||

| 2016 | $1,118 | $1,158 | $1,221 | $1,416 | $1,589 | $1,357 | $1,223 | $1,539 | $1,514 | |||||

| 2017 | $1,153 | $1,304 | $1,235 | $1,483 | $1,607 | $1,438 | $1,481 | $1,575 | $1,504 | $2,071 | ||||

| 2018 | $1,253 | $1,704 | $1,766 | $1,797 | $1,695 | $1,665 | $1,589 | $2,183 | ||||||

| 2019 | $1,657 | $1,207 | $1,808 | $1,743 | $1,658 | $1,558 | $1,626 | $1,541 | $2,024 | |||||

| 2020 | $1,372 | $1,385 | $1,745 | $1,803 | $1,636 | $1,583 | $1,642 | $1,580 | $1,671 | |||||

| 2021 | $1,554 | $1,606 | $1,445 | $1,814 | $1,979 | $1,761 | $1,689 | $1,724 | $1,682 | $1,803 | $2,533 | |||

| 2022 | $1,713 | $1,696 | $1,595 | $2,012 | $2,195 | $1,929 | $1,757 | $1,935 | $1,750 | $2,061 | $2,461 | $2,720 | ||

| 2023 | $1,877 | $2,144 | $1,761 | $2,156 | $2,316 | $2,169 | $2,042 | $1,915 | $1,923 | $1,933 | $2,674 | $2,441 | $2,832 | $2,745 |

| 2024 | $1,926 | $2,036 | $1,838 | $2,247 | $2,516 | $2,196 | $2,204 | $2,099 | $2,057 | $2,235 | $2,665 | $2,422 | $2,852 | $2,834 |

| 2025 (Up to Q3) | $1,917 | $2,260 | $1,876 | $2,402 | $2,702 | $2,281 | $2,048 | $2,076 | $2,071 | $2,197 | $2,620 | $2,446 | $2,911 | $2,872 |

| Annualised | 5.21% | 6.04% | 3.80% | 4.99% | 5.02% | 5.05% | 4.03% | 2.09% | 3.07% | 0.74% (2017 to 2025) | 0.84% (2021 to 2025) | 0.11% (2023 to 2025) | 2.28% (2022 to 2025) | 2.29% (2023 to 2025) |

Most of Cote D’Azur’s immediate neighbours are freehold. But among the 99-year leasehold condos in the area, Cote D’Azur has the strongest annualised growth over the past decade.

Now let’s compare specific unit sizes and prices, between Cote D’Azur and the surrounding condos:

Average price of 1-bedroom units

| Year | AMBER PARK | AMBER SKYE | COASTLINE RESIDENCES | Cote D’Azur | NYON | ONE AMBER | THE SEA VIEW | THE SHORE RESIDENCES |

| 2015 | $970,000 | $930,000 | $929,667 | |||||

| 2016 | $930,000 | $990,563 | $890,000 | |||||

| 2017 | $966,900 | $953,056 | $966,500 | $871,333 | ||||

| 2018 | $1,303,000 | $1,089,722 | $1,074,000 | $1,084,600 | $978,200 | |||

| 2019 | $1,055,000 | $1,040,000 | $953,333 | |||||

| 2020 | $1,160,000 | $964,222 | ||||||

| 2021 | $1,250,000 | $842,089 | $1,275,000 | $998,350 | ||||

| 2022 | $1,305,000 | $1,210,000 | $1,270,000 | $1,005,799 | ||||

| 2023 | $1,334,000 | $1,240,000 | $1,066,667 | |||||

| 2024 | $1,318,200 | $1,230,000 | $1,288,000 | $1,260,000 | $1,250,000 | $1,360,000 | $1,122,500 | |

| 2025 (Up to Q3) | $1,300,000 | $1,200,000 | $1,200,000 | $1,374,000 | $1,070,000 |

Average size of 1-bedroom units (based on transactions done)

| Year | AMBER PARK | AMBER SKYE | COASTLINE RESIDENCES | Cote D’Azur | NYON | ONE AMBER | THE SEA VIEW | THE SHORE RESIDENCES |

| 2015 | 570 | 560 | 592 | |||||

| 2016 | 570 | 560 | 592 | |||||

| 2017 | 840 | 570 | 560 | 592 | ||||

| 2018 | 527 | 856 | 570 | 560 | 592 | |||

| 2019 | 933 | 570 | 628 | |||||

| 2020 | 840 | 592 | ||||||

| 2021 | 861 | 570 | 560 | 610 | ||||

| 2022 | 861 | 570 | 560 | 592 | ||||

| 2023 | 463 | 570 | 592 | |||||

| 2024 | 463 | 452 | 904 | 484 | 570 | 560 | 592 | |

| 2025 (Up to Q3) | 463 | 484 | 570 | 560 | 592 |

Cote D’Azur has the largest sized one-bedders on average compared to its neighbours. Its average quantum (overall price) is comparable to its freehold counterparts, but the development has much more sizeable units than its freehold peers in the area.

It’s also worth noting that The Shore Residences, a 408-unit condo on Amber Road, despite being a newer 103-year leasehold project records a lower average one-bedder price than Cote D’Azur.

That being said, Cote D’Azur’s 800 to 900+ sq ft. is on par with a three-bedder today, so some buyers may not consider it a “true” one-bedder. As an advantage, it is more versatile than a typical shoebox unit and may fit the space needs and lifestyle requirements of a family.

Average price of 2-bedroom units

| Year | AMBER 45 | AMBER PARK | AMBER RESIDENCES | AMBER SKYE | COASTLINE RESIDENCES | Cote D’Azur | NYON | ONE AMBER | SILVERSEA | THE ESTA | THE SHORE RESIDENCES |

| 2015 | $1,650,000 | $1,413,600 | $1,572,500 | $1,620,000 | $1,362,917 | ||||||

| 2016 | $1,680,000 | $1,442,857 | $1,424,000 | $1,400,000 | $1,516,667 | $1,386,000 | |||||

| 2017 | $1,766,929 | $2,318,131 | $1,394,099 | $1,495,000 | $1,403,750 | $1,665,000 | $1,396,333 | ||||

| 2018 | $1,944,444 | $2,415,855 | $1,374,167 | $1,687,296 | $1,589,375 | $1,798,000 | $1,554,000 | ||||

| 2019 | $2,154,000 | $2,450,714 | $1,386,667 | $1,732,000 | $1,969,000 | $1,420,978 | |||||

| 2020 | $2,038,000 | $2,200,000 | $1,513,600 | $1,800,000 | $1,648,127 | $1,892,500 | $1,456,288 | ||||

| 2021 | $1,580,000 | $2,064,250 | $2,204,300 | $1,580,429 | $1,776,000 | $1,737,500 | $2,006,198 | $1,555,813 | |||

| 2022 | $2,020,000 | $2,313,472 | $2,550,000 | $1,722,099 | $1,915,000 | $1,830,000 | $1,610,000 | ||||

| 2023 | $1,831,667 | $2,071,000 | $2,423,333 | $2,580,000 | $1,980,000 | $1,886,667 | $1,760,000 | $2,251,669 | $1,925,714 | $2,269,333 | $1,591,940 |

| 2024 | $1,751,250 | $2,040,401 | $2,520,000 | $2,377,600 | $2,195,000 | $2,027,000 | $1,852,667 | $2,182,250 | $2,076,074 | $2,250,000 | $1,791,111 |

| 2025 (Up to Q3) | $2,287,500 | $2,055,000 | $2,590,000 | $2,555,000 | $2,054,444 | $2,066,543 | $2,020,000 | $2,178,600 | $2,636,000 | $1,862,597 |

Average size of 2-bedroom units (based on transactions done)

| Year | AMBER 45 | AMBER PARK | AMBER RESIDENCES | AMBER SKYE | COASTLINE RESIDENCES | Cote D’Azur | NYON | ONE AMBER | SILVERSEA | THE ESTA | THE SHORE RESIDENCES |

| 2015 | 1163 | 1115 | 980 | 1173 | 884 | ||||||

| 2016 | 1163 | 1120 | 958 | 980 | 1001 | 886 | |||||

| 2017 | 1188 | 1119 | 1124 | 958 | 977 | 1044 | 929 | ||||

| 2018 | 1206 | 1178 | 1122 | 958 | 973 | 1061 | 954 | ||||

| 2019 | 1249 | 1211 | 1120 | 1042 | 1066 | 930 | |||||

| 2020 | 1163 | 1216 | 1124 | 958 | 1040 | 1033 | 918 | ||||

| 2021 | 614 | 1195 | 1216 | 1128 | 958 | 1042 | 1073 | 901 | |||

| 2022 | 743 | 1228 | 1119 | 1128 | 958 | 1000 | 899 | ||||

| 2023 | 671 | 743 | 1163 | 1119 | 721 | 1109 | 721 | 958 | 1040 | 1044 | 883 |

| 2024 | 681 | 718 | 1163 | 1016 | 721 | 1179 | 786 | 958 | 1019 | 1071 | 897 |

| 2025 (Up to Q3) | 872 | 717 | 1192 | 1135 | 727 | 1133 | 818 | 958 | 1096 | 885 |

We see the same pattern here. Because Cote D’Azur’s average two-bedder sizes are so huge, they end up having almost the same quantum as freehold two-bedders in the area (but they are much bigger.)

If you compare freehold units with the same actual square footage as Cote D’Azur’s two-bedders, you will see that the price difference compared to those freehold units can exceed $500,000.

Against other leasehold condo alternatives in the area, Silversea, a 383-unit project on Marine Parade Road, is one of the closest comparisons. While its average two-bedder prices are broadly similar to Cote D’Azur, the average unit sizes at Silversea are still smaller.

Average price of 3-bedroom units

| Year | AMBER 45 | AMBER PARK | AMBER POINT | AMBER RESIDENCES | AMBER SKYE | COASTLINE RESIDENCES | Cote D’Azur | KING’S MANSION | NYON | ONE AMBER | SILVERSEA | THE ESTA | THE SEA VIEW | THE SHORE RESIDENCES |

| 2015 | $2,125,000 | $2,290,000 | $1,776,625 | $2,010,200 | $1,828,125 | $2,511,876 | $2,083,500 | $2,166,600 | $1,950,000 | |||||

| 2016 | $1,940,000 | $1,850,000 | $1,651,429 | $1,942,000 | $1,831,600 | $2,225,972 | $1,971,250 | $1,967,208 | $1,810,000 | |||||

| 2017 | $2,193,333 | $2,405,000 | $1,705,714 | $2,027,500 | $1,903,333 | $2,450,200 | $2,035,638 | $2,152,500 | $1,843,333 | |||||

| 2018 | $3,025,000 | $3,200,000 | $1,842,500 | $2,533,250 | $2,580,000 | $2,342,200 | $2,010,000 | $1,858,714 | ||||||

| 2019 | $2,800,000 | $1,657,000 | $2,516,667 | $2,490,000 | $2,465,333 | $2,459,296 | $1,780,000 | |||||||

| 2020 | $2,901,500 | $1,851,143 | $2,340,000 | $2,216,667 | $2,538,333 | $2,365,000 | $2,505,378 | $1,886,200 | ||||||

| 2021 | $2,950,000 | $2,680,000 | $2,650,000 | $3,570,350 | $1,948,182 | $2,650,000 | $2,388,185 | $2,588,333 | $2,543,889 | $2,712,857 | $1,960,000 | |||

| 2022 | $2,830,000 | $2,800,000 | $2,915,000 | $2,288,571 | $3,000,000 | $2,622,409 | $3,269,857 | $2,811,270 | $2,946,000 | $2,173,000 | ||||

| 2023 | $3,025,000 | $2,995,775 | $3,600,000 | $3,130,000 | $2,969,000 | $2,387,500 | $3,166,000 | $2,872,550 | $3,026,667 | $2,857,500 | $3,240,000 | $2,450,000 | ||

| 2024 | $3,350,000 | $2,915,000 | $3,440,000 | $3,680,000 | $3,150,000 | $3,092,667 | $2,643,111 | $3,259,167 | $2,868,000 | $3,034,955 | $3,482,154 | $3,109,500 | $3,410,500 | $2,629,333 |

| 2025 (Up to Q3) | $3,242,815 | $3,820,000 | $3,625,000 | $2,950,000 | $3,350,000 | $2,627,500 | $3,319,722 | $2,880,000 | $3,105,384 | $3,232,778 | $3,246,115 | $3,556,463 | $2,680,000 |

Average size of 3-bedroom units (based on transactions done)

| Year | AMBER 45 | AMBER PARK | AMBER POINT | AMBER RESIDENCES | AMBER SKYE | COASTLINE RESIDENCES | Cote D’Azur | KING’S MANSION | NYON | ONE AMBER | SILVERSEA | THE ESTA | THE SEA VIEW | THE SHORE RESIDENCES |

| 2015 | 1690 | 1611 | 1328 | 1726 | 1347 | 1539 | 1391 | 1294 | 1507 | |||||

| 2016 | 1675 | 1518 | 1332 | 1726 | 1345 | 1507 | 1414 | 1281 | 1227 | |||||

| 2017 | 1683 | 1658 | 1301 | 1757 | 1354 | 1557 | 1377 | 1362 | 1191 | |||||

| 2018 | 1658 | 1335 | 1313 | 1346 | 1543 | 1339 | 1216 | 1227 | ||||||

| 2019 | 1690 | 1311 | 1607 | 1534 | 1342 | 1345 | 1141 | |||||||

| 2020 | 1658 | 1301 | 1706 | 1517 | 1563 | 1378 | 1332 | 1232 | ||||||

| 2021 | 1184 | 1668 | 1518 | 1833 | 1338 | 1706 | 1364 | 1539 | 1408 | 1355 | 1217 | |||

| 2022 | 1668 | 1518 | 1335 | 1333 | 1604 | 1366 | 1605 | 1405 | 1345 | 1262 | ||||

| 2023 | 1157 | 1028 | 1679 | 1518 | 1335 | 1328 | 1686 | 1339 | 1507 | 1330 | 1362 | 1201 | ||

| 2024 | 1184 | 1001 | 1690 | 1658 | 1335 | 1116 | 1332 | 1672 | 1216 | 1406 | 1588 | 1359 | 1345 | 1191 |

| 2025 (Up to Q3) | 1082 | 1690 | 1658 | 1528 | 1130 | 1357 | 1655 | 1216 | 1348 | 1546 | 1346 | 1289 | 1292 |

The average price of Cote D’Azur’s three-bedders are the lowest priced options in this neighbourhood. The only close comparison that matches Cote D’Azur’s price is The Shore Residences, but that’s just because the size of its three-bedders are slightly smaller.

The very large units here have a drawback though. The huge sizes and high quantum will price out most buyers today and you might find a more narrow pool of prospective buyers (likely ones who can also easily afford new launches) if you choose to sell in the future.

Average price of 4-bedroom units

| Year | AMBER 45 | AMBER PARK | AMBER RESIDENCES | AMBER SKYE | Cote D’Azur | KING’S MANSION | ONE AMBER | SILVERSEA | THE ESTA | THE SEA VIEW | THE SHORE RESIDENCES |

| 2015 | $2,850,000 | $1,600,000 | $3,000,000 | $2,252,500 | $4,722,667 | $2,341,115 | $2,638,595 | $2,200,000 | |||

| 2016 | $4,070,000 | $2,092,220 | $3,000,000 | $2,547,500 | $4,326,667 | $2,188,333 | $2,513,333 | $4,700,000 | |||

| 2017 | $1,965,760 | $2,286,667 | $5,825,333 | $2,576,667 | $2,650,500 | $2,105,000 | |||||

| 2018 | $3,500,000 | $1,950,000 | $2,907,233 | $4,700,000 | $2,662,500 | $2,966,857 | $2,180,200 | ||||

| 2019 | $4,560,000 | $1,875,000 | $2,650,000 | $3,750,000 | $2,771,250 | $3,146,250 | $2,220,000 | ||||

| 2020 | $4,380,000 | $5,079,453 | $2,225,000 | $2,800,000 | $4,660,000 | $2,641,200 | $2,709,600 | ||||

| 2021 | $3,955,984 | $5,661,748 | $2,375,556 | $2,989,000 | $4,714,286 | $2,810,000 | $3,280,778 | $2,255,000 | |||

| 2022 | $3,920,000 | $6,780,000 | $4,250,000 | $2,430,000 | $4,250,000 | $3,396,000 | $5,380,000 | $3,205,000 | $3,281,850 | $2,475,000 | |

| 2023 | $3,569,000 | $4,200,000 | $2,810,200 | $3,476,667 | $5,034,000 | $3,327,500 | $3,623,000 | $2,715,000 | |||

| 2024 | $4,022,500 | $4,618,000 | $4,780,000 | $3,377,500 | $5,864,000 | $3,636,000 | $4,035,944 | $3,070,000 | |||

| 2025 (Up to Q3) | $3,970,694 | $9,305,000 | $3,073,333 | $4,760,000 | $3,638,888 | $5,015,000 | $3,618,888 | $4,359,333 |

Average size of 4-bedroom units (based on transactions done)

| Year | AMBER 45 | AMBER PARK | AMBER RESIDENCES | AMBER SKYE | Cote D’Azur | KING’S MANSION | ONE AMBER | SILVERSEA | THE ESTA | THE SEA VIEW | THE SHORE RESIDENCES |

| 2015 | 2217 | 1539 | 2734 | 1666 | 2465 | 1636 | 1610 | 1432 | |||

| 2016 | 4047 | 1905 | 2734 | 2054 | 2598 | 1593 | 1604 | 2906 | |||

| 2017 | 1539 | 1687 | 3200 | 1841 | 1658 | 1378 | |||||

| 2018 | 2217 | 1539 | 1680 | 2530 | 1561 | 1745 | 1378 | ||||

| 2019 | 3665 | 1550 | 1658 | 2508 | 1569 | 1916 | 1378 | ||||

| 2020 | 4080 | 3315 | 1632 | 1672 | 2492 | 1567 | 1570 | ||||

| 2021 | 2505 | 3572 | 1586 | 1675 | 2554 | 1622 | 1724 | 1405 | |||

| 2022 | 1593 | 5845 | 2659 | 1539 | 2734 | 1946 | 2753 | 1572 | 1518 | 1378 | |

| 2023 | 1346 | 2217 | 1539 | 1672 | 2530 | 1561 | 1595 | 1405 | |||

| 2024 | 1470 | 1625 | 2734 | 1637 | 2928 | 1593 | 1583 | 1378 | |||

| 2025 (Up to Q3) | 1372 | 6717 | 1586 | 2734 | 1658 | 2498 | 1561 | 1604 |

Cote D’Azur also has the lowest average price for its four-bedders, but note that surrounding condos tend to have slightly bigger four-bedders. The average price of The Shore Residences comes closest to Cote D’Azur.

What should you do?

The data suggests that the average price of older developments can still rise in tandem with the market, despite their age. It’s simply that the pace of price growth slows as they grow older. This is true for older developments in District 15.

As an aside, while Cote D’Azur is twenty-four years old, it would not typically be considered a “very old” property, although your concerns about lease decay over a long holding period are understandable.

In this part of District 15, the price gap between freehold and 99-year leasehold projects is especially wide, particularly for larger-sized three- and four-bedders. This works in favour of leasehold developments, where buyers who might be priced out of freehold options often turn to 99-year projects. Some buyers may even do so just because they prioritise a home with more space.

In either case, both these demographics help to sustain buying demand, even for older 99-year leasehold condos in this neighbourhood.

Ultimately, suitability comes down to priorities. If you’re looking for a spacious home that is likely to hold its value, Cote D’Azur makes sense. But, if your primary goal is maximising upside and profitability, Cote D’Azur may be a little too big for its own good – from an investment perspective, a two-bedder that crosses the $2 million mark – because it’s gigantic at over 1,100 sq ft – is tougher to justify.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Editor's Pick

Editor's Pick Happy Chinese New Year from Stacked

Property Market Commentary How I’d Invest $12 Million On Property If I Won The 2026 Toto Hongbao Draw

Overseas Property Investing Savills Just Revealed Where China And Singapore Property Markets Are Headed In 2026

Property Market Commentary We Review 7 Of The June 2026 BTO Launch Sites – Which Is The Best Option For You?

Latest Posts

Pro This Singapore Condo Has Bigger Units Near The MRT — But Timing Decided Who Made Money

Singapore Property News Nearly 1,000 New Homes Were Sold Last Month — What Does It Say About the 2026 New Launch Market?

Singapore Property News The Unexpected Side Effect Of Singapore’s Property Cooling Measures

3 Comments

Hi Ryan,

I have been reading your articles. Appreciate if you can help to analyse the following:

My husband and I owned a unit in Windermere and a 5 room HDB at Yew tee, both are fully paid. We are both at late 50, one retired and another semi retired. Our HDB is presently rented and we are wondering if we should sell our Windermere unit and shift back to our hdb due to its age Or carry on the present status Or sell both a buy a smaller hdb be it resale or BTO. BTW our children are all grown up having their own house.

Ryan, I really like your thorough and professional analysis on the above D15 project.

I wonder if you can also run an analysis on whether I should keep or sell a 28 years old freehold property in District 9 – Mirage Towers . The unit is 958 sqft and rented out to an expatriate .

Hi, currently living in Laguna Pk, since 1997.

LP has gone thru 4 enbloc attempts, its in the midst of a 5th attempt.

It had received 80% during the first 3 attempts, and failed at the last attempt.

I feel LP’s location compared to our neighbors, Lagoon View & Mandarin Gardens, is more superior than our immediate neighbors, because of the TEL Mrt’s proximity

In the news recently, it has been mentioned the the enbloc threshold of 80% could be lowered to 70%, which may trigger another round of enbloc in our area.

My question, should I sell & downgrade now or wait….

Me & my wife are senior citizens.

Would appreciate some advice.

Thanks