Is There Room For Conservation In Land-Hungry Singapore?

July 9, 2023

Remember the old saying about poetry being the “luxury we cannot afford?”

It’s from our late, and much venerated, Minister Mentor Lee Kuan Yew. Granted, he said it a long time ago in 1968, back when Singapore seemed to run into a nationwide crisis every other Tuesday. Perhaps there was a change of heart later, once Singapore was developed.

But I can’t help seeing an echo of that in recent land space arguments. We all know that golf and horse races are apparently like poetry: luxuries not everyone can afford. But now, there’s also the issue of Ridout Road’s Black & White Bungalows. And this, like poetry, is supposed a piece of our cultural legacy.

Yet there’s been grumbling about the land size given over to these buildings. With that come debates over whether they’re a benefit to the public or an icon of wealth inequality. This is the question:

Is conservation a luxury we cannot afford when we’re badly in need of land?

Now, I’m going to say that I won’t want a flat there. Ridout Road is as bad as the Turf Club to me.

I mean, have you been to the part of Kranji where the club is? It’s the dictionary definition of ulu. They should keep the horses when they shut the club, those might be the best way to get to the nearest MRT.

Likewise, the Ridout Road bungalows, if converted for public housing, would probably need a lot of work. Landed enclaves and GCB areas are notoriously inconvenient if you don’t drive. (Although obviously, Ridout is in a much better location).

So perhaps a solution lies somewhere in between.

We may not have to tear down the Black & White bungalows and build flats over them. But instead of just renting them out to rich people – which is bound to cause resentment – we could repurpose them while still conserving them.

Those Black & White bungalows can be converted to training hubs, subsidised family retreats, start-up incubators for local companies (don’t worry about it being ulu, I’ve worked for start-ups; we have superhuman tolerance for inconveniences), etc.

And this can be done while keeping the bungalows intact. SLA can still offset some of the maintenance costs, via the tenants they take on.

We could also look into turning more into hotels (like Villa Samadhi), or these could also be really cool spots for other cafes (take a look at this Starbucks cafe at Rochester Park).

It’s easier to justify conservation if we make it accessible to the public. Repurposing the bungalows into public amenities can foster the notion that we share these national icons.

It is, indeed, a matter of optics

A while back, I mentioned one of the problems with SERS sites being replaced by condos: it looks a lot like poorer people being kicked off good land, for their wealthier counterparts.

I’ve always felt it’s a good idea to have Prime Location Housing (PLH) take the place of former SERS sites, for precisely that reason.

The same goes for Ridout Road. Even if everything is by the books, there’s psychological bruising when the average Singaporean sees how our upper-crust live. It’s especially prickly right now, in an environment of high home prices.

This isn’t helped by Singapore being a small country. In larger states, the rural poor might live several days from where their wealthier counterparts reside. In Singapore, people living in rental flats can see $2 million condos across the street. The wealth and income divide are too visible over such short distances.

So for political leaders and celebrities, a home must be sufficient to reflect their status but also understated enough not to prompt envious outrage. I think our outgoing President had the right idea in trying to stay on in her jumbo-sized flat.

Meanwhile, in other serious property news:

More from Stacked

Our 10 Most Read Articles About Singapore Real Estate In 2022

As 2022 draws to a close, it’s time to look back and see which of our editorial pieces has really…

- We checked out some flats that may soon reach $1 million. Perhaps it’s not too late to grab one yet.

- Want a three-bedder, but all the prices are insane? Check out where you can get one for under $2 million; and they’re all 1,700 sq. ft. and above too.

- Or if a three-bedder isn’t doing it for you, check out where you might find a landed property for under $1.95 million.

- Our private home prices have dropped for the first time in 3 years, here’s what you need to know.

- It’s always interesting to see other people’s experiences of living in a brand new mega-development. Here’s what living in Parc Esta, a 1,399-unit development is like.

Weekly Sales Roundup (26 June – 02 July)

Top 5 Most Expensive New Sales (By Project)

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| LES MAISONS NASSIM | $32,748,700 | 6179 | $5,300 | FH |

| CAIRNHILL 16 | $4,800,000 | 1744 | $2,753 | FH |

| THE ATELIER | $4,250,000 | 1496 | $2,841 | FH |

| ONE PEARL BANK | $3,880,000 | 1399 | $2,773 | 99 yrs (2019) |

| PICCADILLY GRAND | $3,462,000 | 1679 | $2,062 | 99 yrs (2021) |

Top 5 Cheapest New Sales (By Project)

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| NORTH GAIA | $1,231,000 | 958 | $1,285 | 99 yrs (2021) |

| TENET | $1,240,000 | 893 | $1,388 | 99 yrs (2021) |

| TEMBUSU GRAND | $1,472,000 | 527 | $2,791 | 99 yrs (2022) |

| LEEDON GREEN | $1,499,000 | 603 | $2,487 | FH |

| PULLMAN RESIDENCES NEWTON | $1,533,000 | 463 | $3,312 | FH |

Top 5 Most Expensive Resale

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| TRILIGHT | $4,950,000 | 2099 | $2,358 | FH |

| MARINA COLLECTION | $4,522,886 | 2788 | $1,622 | 99 yrs (2007) |

| THE VIEW @ MEYER | $3,830,000 | 1690 | $2,266 | FH |

| MOUNT FABER LODGE | $3,780,000 | 2594 | $1,457 | FH |

| THE DAIRY FARM | $3,550,000 | 2336 | $1,520 | FH |

Top 5 Cheapest Resale

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| THE HILLFORD | $546,000 | 398 | $1,371 | 60 yrs (2013) |

| THE HILLFORD | $560,000 | 398 | $1,406 | 60 yrs (2013) |

| PARC ELEGANCE | $635,000 | 398 | $1,594 | FH |

| PARC ROSEWOOD | $646,800 | 506 | $1,278 | 99 yrs (2011) |

| CANBERRA RESIDENCES | $710,000 | 614 | $1,157 | 99 yrs (2010) |

Top 5 Biggest Winners

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | RETURNS | HOLDING PERIOD |

| ONE AMBER | $2,920,000 | 1335 | $2,188 | $1,948,900 | 17 Years |

| TRILIGHT | $4,950,000 | 2099 | $2,358 | $1,436,000 | 6 Years |

| THE VIEW @ MEYER | $3,830,000 | 1690 | $2,266 | $1,379,500 | 15 Years |

| FORT GARDENS | $2,560,000 | 1442 | $1,775 | $1,030,000 | 8 Years |

| THE SAIL @ MARINA BAY | $1,700,000 | 893 | $1,903 | $937,880 | 18 Years |

Top 5 Biggest Losers

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | RETURNS | HOLDING PERIOD |

| MARINA COLLECTION | $4,522,886 | 2788 | $1,622 | -$2,447,114 | 13 Years |

| SCOTTS SQUARE | $2,900,000 | 947 | $3,062 | -$450,000 | 13 Years |

| URBAN VISTA | $1,235,000 | 893 | $1,382 | -$120,985 | 10 Years |

| REFLECTIONS AT KEPPEL BAY | $2,540,000 | 1496 | $1,698 | -$100,600 | 16 Years |

| ESPIRA SUITES | $715,000 | 441 | $1,620 | -$13,500 | 9 Years |

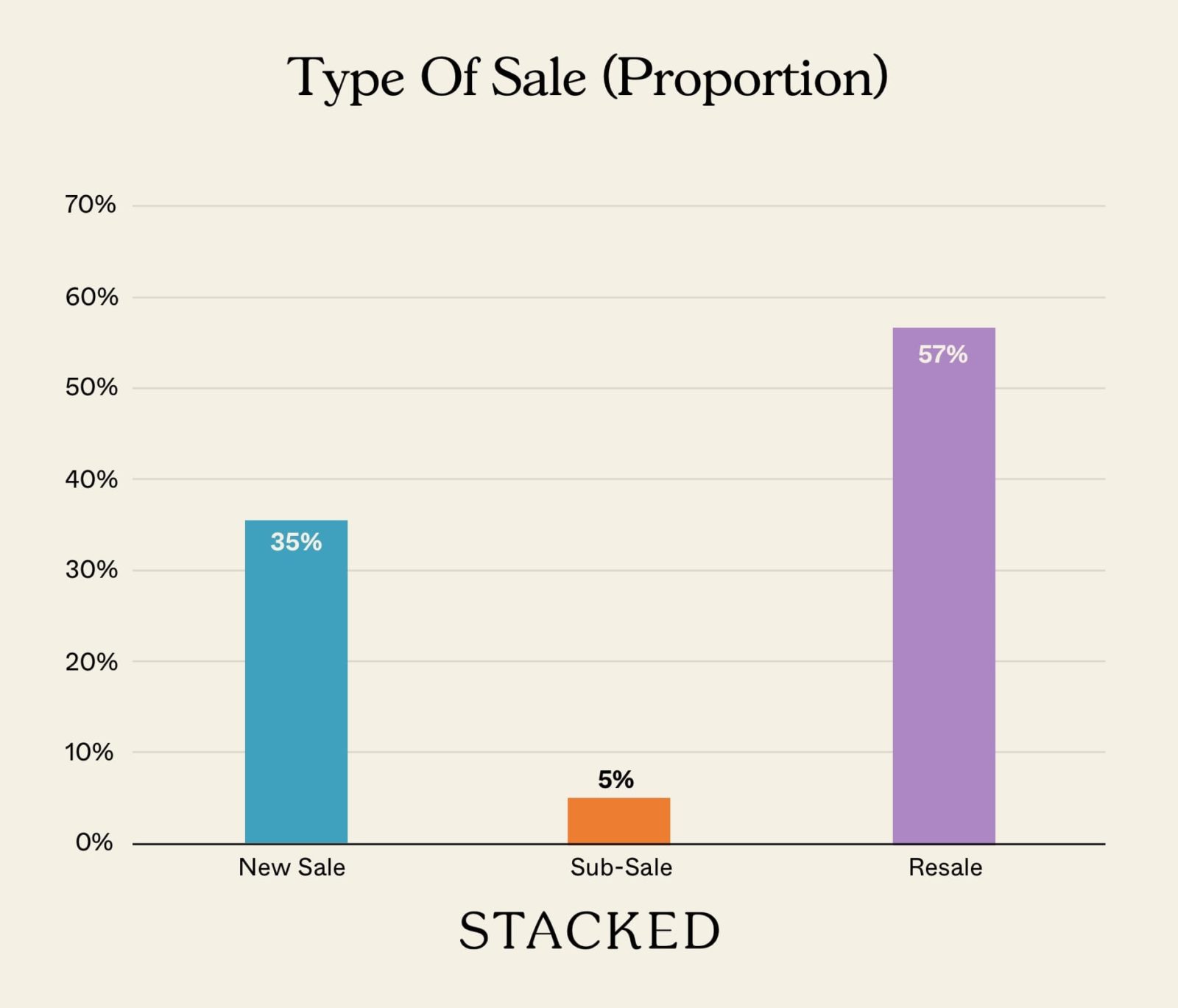

Transaction Breakdown

My interesting links of the week

- A ludicrous luxury apartment marketing video

This isn’t in Singapore (if that isn’t obvious enough), but boy is this one cheesy marketing video for the apartment.

Luxury Apartment website lifestyle marketing is hilarious in its directness:

— Bobby Fijan (@bobbyfijan) July 5, 2023

"Live here, and you'll have sex with ludicrously fit & pretty people"

(Tho the ambiguity is brilliant. Is this a couple? Friends? Threesome? Clearly someone is about to get laid, just not clear who) pic.twitter.com/LBjJ8s1Bop

I’ve seen my fair share of lifestyle marketing videos in Singapore, and while they don’t quite capture the attention like this one, they are all so cookie-cutter that none of them really stand out either.

I would love to see a tasteful example being done. None of that typical going to school, having a picnic by the park type of video, but one that is really able to organically capture the lifestyle of the consumer that they are trying to attract.

- Ann Siang Hill shophouses in the 1970s

I saw this on @ivanpoluninarchives, this was a photo taken at Ann Siang Hill in the 1970s. This was around the same time apartments like Golden Mile Complex and Pandan Valley was built, so you can imagine the era it was in.

I couldn’t quite find data on how much one of these properties was going for in the 1970s, but today a recent 3-storey shophouse in the area was asking for $22 million. It’s a stark reminder of how much Singapore has progressed (and also in terms of the value of its real estate). Very few people back then would have looked at this area in its current condition, and predict just how valuable everything would get.

Follow us on Stacked for more news in the Singapore property market, as well as updates and reviews on new and resale properties across the island.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

Is conservation of historic buildings in Singapore considered a luxury or a necessity?

Should Singapore prioritize land conservation over development to address land scarcity?

How does the visibility of wealth in Singapore impact opinions on land use and conservation?

What are some alternative uses for historic bungalows besides luxury residences?

Why is it important to make conserved buildings accessible to the public in Singapore?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Singapore Property News

Singapore Property News New Lentor Condo Could Start From $2,700 PSF After Record Land Bid

Singapore Property News This Tampines EC Will Preview on Friday — It Is One of Two New ECs in the East in 2026

Singapore Property News I’m Retired And Own A Freehold Condo — Should I Downgrade To An HDB Flat?

Singapore Property News REDAS-NUS Talent Programme Unveiled to Attract More to Join Real Estate Industry

Latest Posts

Pro This 130-Unit Boutique Condo Launched At A Premium — Here’s What 8 Years Revealed About The Winners And Losers

On The Market A Rare Freehold Conserved Terrace In Cairnhill Is Up For Sale At $16M

Property Investment Insights This 55-Acre English Estate Owned By A Rolling Stones Legend Is On Sale — For Less Than You Might Expect

0 Comments