Is There A ‘Best’ Time To Buy (Or Sell) Property In Singapore? We Analysed 56,000 Transactions To Find Out

May 15, 2025

In this Stacked Pro breakdown:

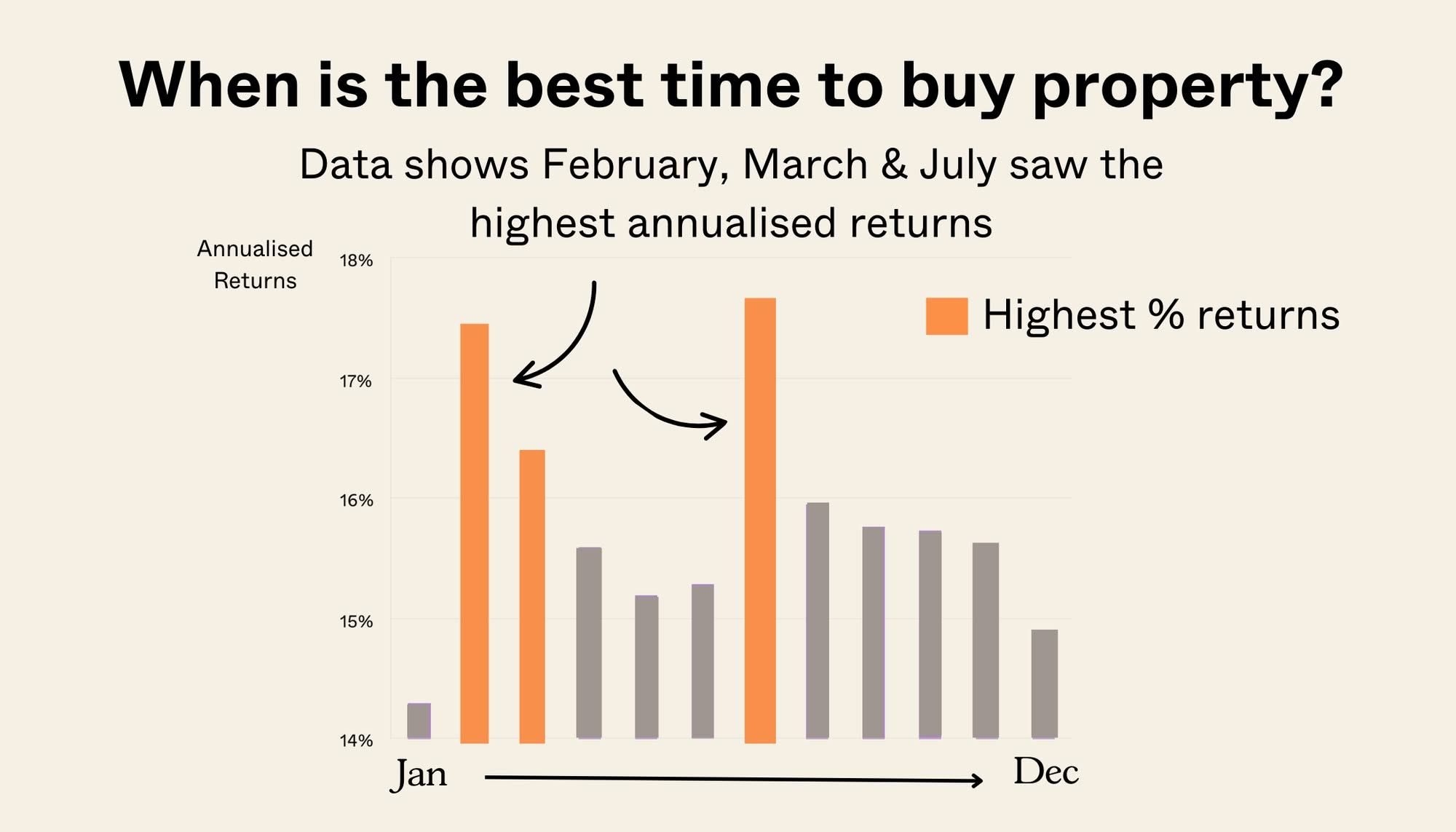

- We analysed over 56,000 property transactions to uncover when buyers consistently paid less and sellers walked away with the biggest gains

- Our data shows a clear seasonal pattern, with certain months offering a statistically better chance of securing a better deal

- We reveal which quarter consistently tilts the odds in favour of buyers across the Singapore property market

Already a subscriber? Log in here.

For those familiar with the Singapore property market, certain periods are often considered “dead zones” with little activity—Chinese New Year and the Hungry Ghost Month being prime examples. Some buyers believe prices peak right after these lull periods as demand rushes back, while others argue that the best deals appear at the end of the year when sellers become eager to close deals before December 31. But what do the numbers say?

Join our Telegram group for instant notifications

Join Now

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.

Popular Posts

On The Market

Here Are The Cheapest 5-Room HDB Flats Near An MRT You Can Still Buy From $550K

New Launch Condo Reviews

River Modern Condo Review: A River-facing New Launch with Direct Access to Great World MRT Station

Property Investment Insights

River Modern Starts From $1.548M For A Two-Bedder — How Its Pricing Compares In River Valley

Need help with a property decision?

Speak to our team →Read next from Property Investment Insights

Property Investment Insights This 55-Acre English Estate Owned By A Rolling Stones Legend Is On Sale — For Less Than You Might Expect

March 2, 2026

Property Investment Insights Why Some Central Area HDB Flats Struggle To Maintain Their Premium

February 26, 2026

Property Investment Insights This 130-Unit Condo Launched 40% Above Its District — And Prices Struggled To Grow

February 24, 2026

Property Investment Insights These Freehold Condos Barely Made Money After Nearly 10 Years — Here’s What Went Wrong

February 24, 2026

Latest Posts

Singapore Property News I’m Retired And Own A Freehold Condo — Should I Downgrade To An HDB Flat?

March 2, 2026

New Launch Condo Reviews What $1.8M Buys You In Phuket Today — Inside A New Beachfront Development

March 1, 2026

Overseas Property Investing This Singaporean Has Been Building Property In Japan Since 2015 — Here’s What He Says Investors Should Know

February 28, 2026

Singapore Property News REDAS-NUS Talent Programme Unveiled to Attract More to Join Real Estate Industry

February 27, 2026

0 Comments