Is The 99-1 Loophole Illegal? We Clear Up 6 Common Property Misconceptions In 2023

April 12, 2023

As we head into 2023, some erroneous beliefs about the property market are starting to surface. Some are new, but many are from a few years before. This may be related to recent shake-ups and changes to the rules, such as IRAS finally clamping down on 99-1 property arrangements. To clear the air, here are some of the issues you may have misunderstood, or which may have been explained to you the wrong way:

Table Of Contents

- 1. The “99-1 loophole” is not the same thing as decoupling

- 2. The lease doesn’t coincide exactly with the TOP, and that’s normal

- 3. Some confusion still exists over ECs and MOP

- 4. The fixed-rate home loan is not fixed all the way till the end of the loan

- 5. Your leasehold condo is not necessarily on leasehold land

- 6. Mixed-use is not the same as integrated

1. The “99-1 loophole” is not the same thing as decoupling

In recent news, IRAS has been going after buyers who avoided taxes with a 99-1 arrangement. When this got out, there was a huge panic among some buyers, especially those who had avoided ABSD through decoupling.

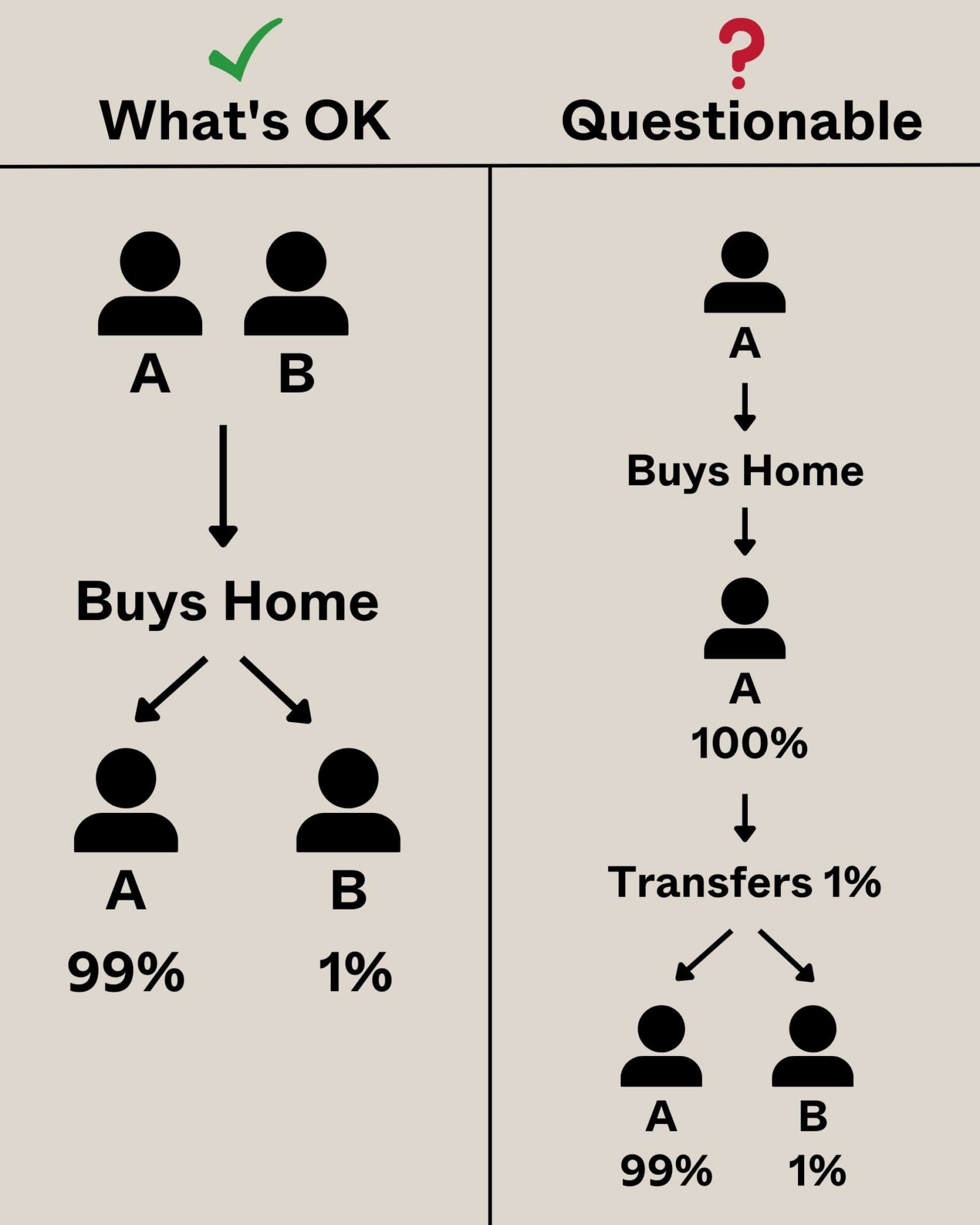

While the two sound familiar, they aren’t referring to the same thing. The loophole that IRAS is chasing down occurs when you buy a property, and then transfer one per cent of that property to another buyer, who already owns a property. The ABSD payable will then apply to just one per cent. For example:

Say Person A wants to own a second property but doesn’t want to pay 17 per cent ABSD on the property price. She then gets Person B to buy the property instead, at $1.5 million.

Person B then transfers one per cent of the property (a value of $15,000) to Person A. Person A then pays 17 per cent ABSD on just this $15,000, or $2,550.

Had Person A just outright bought the second property, the ABSD would be (17 per cent of $1.5 million) = $255,000.

That said, not everyone used this to avoid taxes (at least, not entirely), but because they didn’t have enough to take a loan. So after exercising, this method was used to bring in Person B so that both owners can now take a bigger loan (and pay minimal ABSD).

This is different from decoupling

An example of decoupling would be spouses who buy their first private home, using a 99-1 holding arrangement. That is, one spouse owns 99 per cent, and the other owns one per cent.

Later on, the spouse who owns one per cent transfers it to the other spouse, and so effectively owns no properties. This spouse is then free to buy another property, entirely under their own name, with no ABSD.

Note the difference between this arrangement, and the questionable counterpart: in this version, both parties purchase the same property first, and one party later transfers their share to the other.

In the now-questionable counterpart, one party buys the property first and then transfers one per cent of it to another party (this is more prevalent for new launches).

So when your realtor explains decoupling and uses terms like 99-1, it doesn’t necessarily mean they’re asking you to participate in a tax dodge. But if you’re doubtful of such arrangements, you can always check with your conveyancing lawyer first.

2. The lease doesn’t coincide exactly with the TOP, and that’s normal

We’ve still heard some people express shock that their 99-year lease commenced two to three years before their condo’s TOP date. This isn’t some kind of “scam,” it’s entirely normal.

The lease starts up from the moment the developer tops up and acquires the land, but building and completing the condo takes time. As such, a few years would have lapsed between the point of land acquisition and the actual TOP date.

In most cases, this is just around two to three years difference (maybe even longer, due to Covid-19-related delays), so it doesn’t make a huge impact on the price or resale prospects.

3. Some confusion still exists over ECs and MOP

This confusion stems from how regular flats (and even PLH flats) are still subject to the Minimum Occupancy Period (MOP), even if you buy them as resale flats.

There are still many buyers who seem unaware that resale ECs have no MOP at all. You’re free to sell them whenever you like after buying (although Sellers Stamp Duty still applies), and you can buy and rent out the entire EC unit straight away.

Another common point of confusion is mistaking privatisation for the end of the MOP. The two are not related. ECs become fully privatised after the 10th year, but the MOP would have already ended in the fifth year.

More from Stacked

Which HDB Towns Are Getting Close To Condo Prices In 2025?

In 2025, some resale flats are hitting prices once thought impossible. A handful of towns now see 4-room, 5-room, and…

The only difference between a privatised EC, and an EC just out of MOP, is that the privatised EC can be sold without restriction to entities and foreigners.

4. The fixed-rate home loan is not fixed all the way till the end of the loan

We’ve come across some home buyers who believe that, by opting for a fixed-rate loan, they’re insulated from any further interest rate hikes.

It’s important to clarify that this is only true for a given period. There are still no perpetual fixed-rate home loans, and most loan packages fix the rates only for three to five years. As such, those who want fixed rates should still be prepared to refinance, further down the road.

When you hear about buyers who have used fixed rates “all the way”, it most typically refers to a strategy where they constantly refinanced from one fixed-loan package to another. In these cases, interest can still rise, such as if all fixed-rate packages at the time of refinancing were higher.

In the past, there were abnormally long fixed rate packages (at one point POSB had an eight-year fixed rate for flats), but these have largely vanished in the face of 2023’s higher interest environment.

Do note that fixed-rate home loans may not even be offered during high-interest rate environments. In the recent spike, there were times when fixed rates were only offered for 1-2 years, or not even offered at all.

5. Your leasehold condo is not necessarily on leasehold land

We’ll have an upcoming article that clears this up further; but for now, note that 99-year leases (or sometimes 101 or 104-year leases) may be reversionary leases.

That is, the land may be freehold or owned by someone else and is simply leased out for the leasehold period. At the end of the lease, the land goes back to the actual owner. Some property developers may discreetly own the land under leasehold condos built by other developers.

None of this bodes well for owners of such condos, as these types of leases tend to prevent successful en-bloc sales. If the land under your condo is owned by a developer, for instance, they may not be inclined to allow a collective sale and another developer to build on it.

These details have to be disclosed, but we notice that few people ask at show flats; and that few sales teams volunteer the information.

6. Mixed-use is not the same as integrated

A mixed-use development is not the same as an integrated development. In fact, some buyers may consider the term mixed-use to be a rather negative one, unless the developer is very well established.

“Mixed-use” can be applied whenever at least 40 per cent of the Gross Floor Area (GFA) is given over to commercial purposes. To give you a sense of how wide this term is, both Orchard Residences (on top of Ion Orchard) and People’s Park Complex can be called mixed-use. Orchard Towers too is mixed-use.

You can see how the “mixed” element here can be of wildly different worth to the project, and why it carries positive or negative connotations based on the developer’s reputation. It’s believed that a good developer will take steps to control the tenant mix, such as ensuring a supermarket, a food court, etc.

An Integrated Development, on the other hand, is one that doesn’t just have some commercial aspects. It’s a development that may also link to a part of the transport infrastructure (e.g., connected to an MRT station), or also includes some civic facilities (e.g., libraries, healthcare, and so forth).

Integrated developments are almost always pricier, and the term carries clear positive connotations; it’s assumed the authorities won’t allow seedy or substandard projects to be linked to major civic or transport facilities, and that only the best developers have the means to compete for such projects.

If there are any other terms, conditions, or issues that seem muddy to you, tell us in the comments below; or reach out to us at Stacked for help. We’ll keep you in touch with the latest changes and developments in the Singapore private property market.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

Is the 99-1 loophole illegal in property transactions?

Why does my property lease start before the TOP date?

Are resale ECs subject to the Minimum Occupancy Period (MOP)?

Does choosing a fixed-rate home loan mean my interest rate won't change?

Is my leasehold condo built on leasehold land?

What is the difference between mixed-use and integrated developments?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Singapore Property News

Singapore Property News I’m Retired And Own A Freehold Condo — Should I Downgrade To An HDB Flat?

Singapore Property News REDAS-NUS Talent Programme Unveiled to Attract More to Join Real Estate Industry

Singapore Property News Three Very Different Singapore Properties Just Hit The Market — And One Is A $1B En Bloc

Singapore Property News Singapore Could Soon Have A Multi-Storey Driving Centre — Here’s Where It May Be Built

Latest Posts

New Launch Condo Reviews What $1.8M Buys You In Phuket Today — Inside A New Beachfront Development

Overseas Property Investing This Singaporean Has Been Building Property In Japan Since 2015 — Here’s What He Says Investors Should Know

On The Market Here Are Hard-To-Find 3-Bedroom Condos Under $1.5M With Unblocked Landed Estate Views

2 Comments

Hi, in the “99-1” loophole, under the “questionable” practice, why wouldn’t A and B jointly purchase the new property outright, with A owning 99% and B holding 1%? Can they do that on the S&P?