Is Chuan Park Residences The Next Hot Mega Development? Here’s What You Should Know

October 5, 2024

When the former Chuan Park was sold in an en-bloc, there was immediate attention: this was a sizeable land plot right next to Lorong Chuan MRT station. That’s a big deal, as this station happens to be situated between the highly desired hotspots of Serangoon and Bishan.

Also this is a mega-development of over 900 units (and we know how much Singaporeans love their mega-developments). So as we approach the launch of Chuan Park Residences sometime in October, there’s now more information available about this closely watched redevelopment. So for waiting upgraders, here are some of the main details so far:

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

The Chuan Park en-bloc deal

The original Chuan Park was a mid-sized (446-unit) condo development from 1985, located around the intersection of Lorong Chuan and Serangoon Avenue 3. In July of ‘22, word was out that MCC Land and Kingsford snagged the site for $890 million in an en-bloc deal. This was slightly under the asking price in October ‘21, when the first collective sale attempt went for a price of $938 million. Even at $890 million though, this would make the Chuan Park en-bloc one of the biggest deals in recent years.

The en-bloc deal is also notable for another reason: it was hotly contested, with some owners filing action with the Strata Titles Board (STB) to stop the sale. While STB did initially stop the sale, the High Court eventually gave the green light to proceed.

The site is around 400,588 sq.ft., with a plot ratio of 2.1. (This was the initial source of the legal issue by the way, as some owners were under the impression the plot ratio would be 2.4, thus causing them to push for a higher price). This will be a 99-year leasehold plot.

Chuan Park Residences has a GFA of 841,236 sq.ft., with an expected 916 units. The developer has mentioned three blocks at 22 storeys, and two blocks at 19 storeys. The project will also include two shop spaces. Such a large development would be quite typical of a developer like Kingsford, which established its name in mega-developments via projects like Normanton Park.

Chuan Park Residences’ location

Chuan Park is next to Lorong Chuan MRT station (CCL), but note that it’s not integrated with the station. While this is an OCR location (District 19), this land parcel is undeniably a great spot to be in. Serangoon MRT is one stop away, providing access to NEX Megamall and the NEL. In the opposite direction, and also just one stop away, Bishan MRT provides access to the NSL and Junction 8, another major mall. For those who drive, note that Serangoon Gardens with the famous Chomp Chomp food centre, and other amenities, is only around five minutes by car.

Location-wise, we’d say the proximity to these amenities is going to be the main draw for Chuan Park Residences.

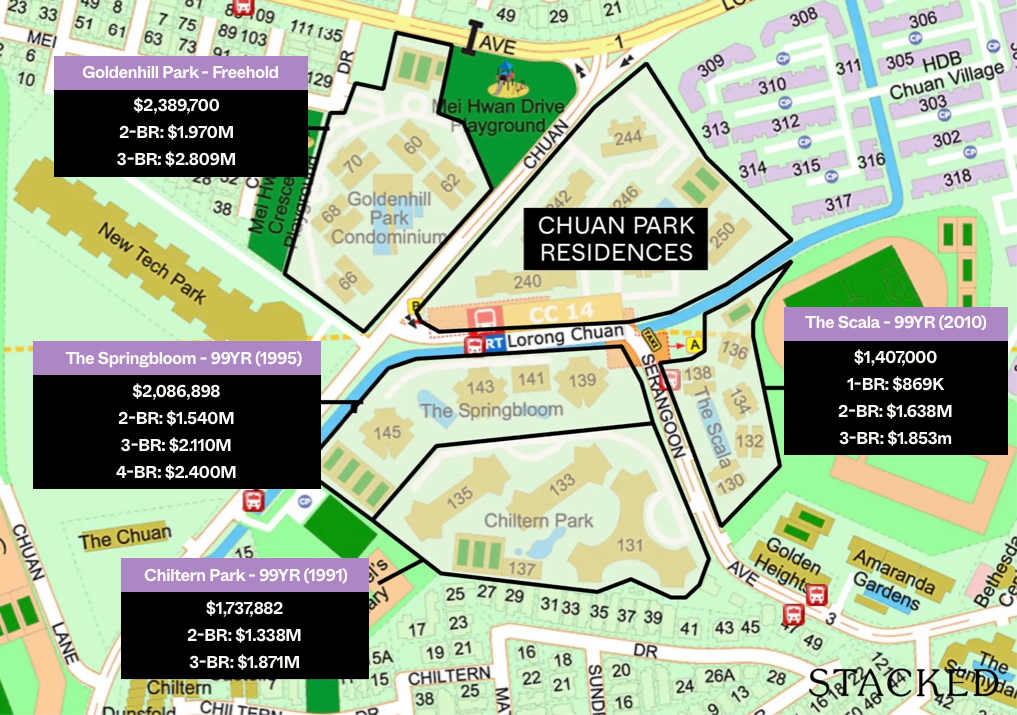

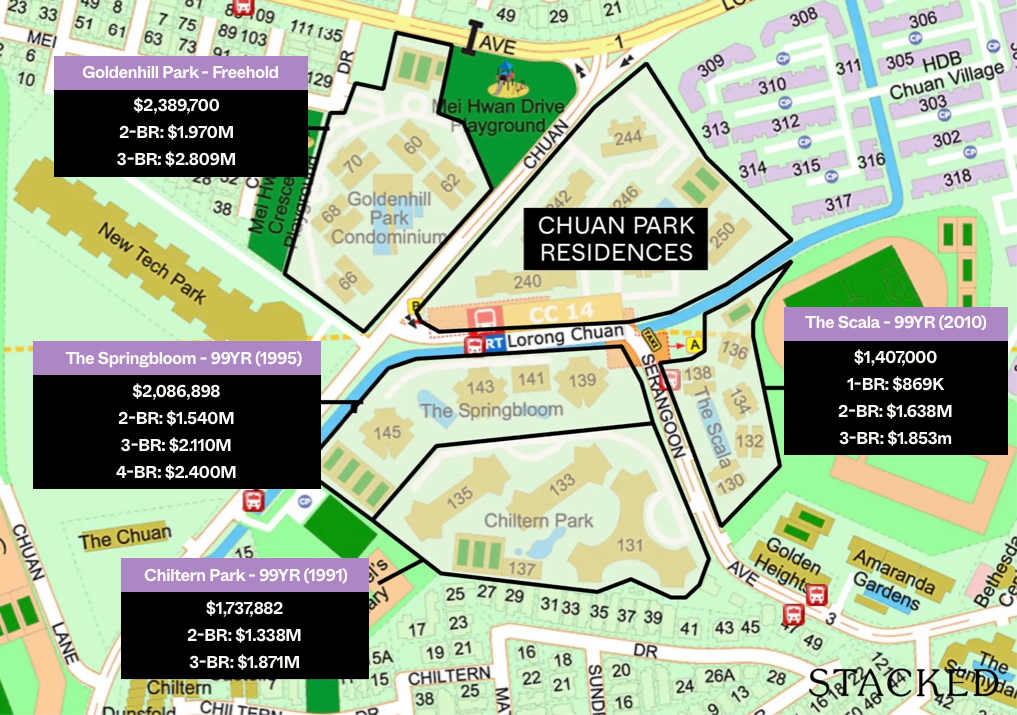

An argument could be made that neighbouring projects (Springbloom, Goldenhill Park, and The Scala) are almost equally close to the MRT station – but these are older, with the newest being Scala (2013). Springbloom and Goldenhill Park date back to 1999 and 2004 respectively, which could give Chuan Park Residences an edge. We last detailed out their prices in April earlier this year (you can see it here).

The nearby New Tech Park has a mall component (NTP+) that provides some nice eateries next door, along with a supermarket. While it’s not the biggest mall, it’s not an issue with Junction 8 or NEX being just one stop away.

School access is above average, with multiple institutions within one kilometre. St. Gabriel’s Primary is the closest and within walking distance, while CHIJ Our Lady of Good Counsel, Yangzheng Primary, Zhonghua Secondary, and Kuo Chuan Secondary are all in range. In addition, Nanyang JC is just a short walk from here.

While we think Chuan Park Residences is more for owner-occupiers than landlords, you may also want to note that there are several international schools nearby (Australian International School, Brighton College, Stamford American Early Learning Village).

There may also be some pent-up demand in this area.

More from Stacked

Promenade Peak Review: A 63-Storey Condo in River Valley from $2,680 Psf

Promenade Peak, along with River Green, will be the first 2 GLS sites to be launched in the River Valley…

The most recent launch in the immediate vicinity of Chuan Park Residences was The Scala, back in 2009. Since then, there haven’t been any new offerings. For upgraders in the area, this is the first time in 15 years they’ve had an option besides the three resale condos (of which two are notably old).

We’ve seen what can happen in this sort of situation: when AMO Residence launched in July 2022, the developer sold out 98 per cent of available units in a single day; and this was during a time when there were fears of rising interest rates.

(At the time we’re writing this, there’s been a jumbo interest rate cut in the US, which works even further in favour of new launches like Chuan Park Residences.)

While we can’t say that this happened simply because AMO Residence was the first new launch in Ang Mo Kio since 2014 (2022 was also a very different time to launch, with supply issues and possibly stronger demand); but Lorong Chuan hasn’t seen a new launch in a full decade and a half. This alone may drive interest from day one.

Overall impressions

Chuan Park Residences has a solid location, and it’s definitely one of the most conveniently located District 19 condos. It has the advantage of keeping some distance from the crowded hotspots, whilst staying within reach – so those who don’t like living too close to the noise of NEX or Junction 8 could see this as an ideal alternative.

The main challenge as always for new launches will be the prices of the nearby resale projects. Scala averages just $1,750 psf, while Springbloom is sitting at $1,522 psf. The lower prices are due to the age difference of course, but those are some rather low numbers for a new launch to price itself against (Goldenhill Park, however, still averages $2,111 psf). The distance between these units and Lorong Chuan station, compared to Chuan Park Residences, is rather negligible.

Here’s how they match up currently:

| Development | Tenure | Completion Year | Average $PSF | Average Price |

| CHILTERN PARK | 99 yrs from 01/03/1991 | 1995 | $1,419 | $1,737,882 |

| 2BR | $1,437 | $1,337,500 | ||

| 3BR | $1,413 | $1,871,343 | ||

| GOLDENHILL PARK CONDOMINIUM | Freehold | 2004 | $2,111 | $2,389,700 |

| 2BR | $2,116 | $1,970,000 | ||

| 3BR | $2,105 | $2,809,400 | ||

| THE SCALA | 99 yrs from 06/01/2010 | 2013 | $1,750 | $1,407,000 |

| 1BR | $1,781 | $868,875 | ||

| 2BR | $1,846 | $1,637,778 | ||

| 3BR | $1,527 | $1,852,600 | ||

| THE SPRINGBLOOM | 99 yrs from 01/03/1995 | 1999 | $1,522 | $2,086,898 |

| 2BR | $1,363 | $1,540,000 | ||

| 3BR | $1,544 | $2,110,278 | ||

| 4BR | $1,457 | $2,400,000 |

That being said, we should add that mega-developments have been better received in recent years

As we’ve pointed out in this previous article, there has been more acceptance of mega-developments in the past few years. It might, to some degree, be an issue of contrast: when we have developments like Treasure at Tampines, which surpasses 2,200 units, and Normanton Park which is at 1,800+ units, the 916-unit count at Chuan Park Residences may seem less intimidating.

Since the bumper crop of mega-developments from the last en-bloc fever, it has not gone unnoticed that the early buyers for the bigger units in these projects have appreciated very well. We’ve highlighted a few, such as the one at Jadescape, and another at Treasure at Tampines, where some owners have easily made high six-digit profits since.

There’s also the fact that more buyers are families, and fewer are investors. For those looking at own-stay use, mega-developments just mean more facilities (due to bigger land area), cheaper maintenance, and possibly lower prices; and in the pricey 2024 environment, more buyers may consider that a good deal.

The next step will be to see how the interiors and facilities are differentiated from the neighbouring projects. This will be especially important given that the older neighbours, with lower unit counts, are likely to have bigger units. Finally, all eyes would be on the indicative prices, so follow us on Stacked for a more thorough review of Chuan Park Residences, once the details are available.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

What is the significance of the Chuan Park en-bloc sale in Singapore property market?

Where is Chuan Park Residences located and what makes its location desirable?

How does Chuan Park Residences compare to nearby older developments in terms of pricing and appeal?

What is the expected size and number of units for Chuan Park Residences?

Why might Chuan Park Residences be appealing to owner-occupiers?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from New Launch Condo Analysis

New Launch Condo Analysis This New Dairy Farm Condo Starts From $998K — How the Pricing Compares

New Launch Condo Analysis This New Freehold CBD Condo Starts From $1.29M — Here’s How the Pricing Compares

New Launch Condo Analysis This Freehold New Launch Condo In The CBD Is Launching From Just $1.29M

New Launch Condo Analysis I Reviewed A New Launch 4-Bedroom Penthouse At Beauty World

Latest Posts

Singapore Property News This Rare Type Of HDB Flat Just Set A $1.35M Record In Ang Mo Kio

Singapore Property News A Rare New BTO Next To A Major MRT Interchange Is Coming To Toa Payoh In 2026

Singapore Property News New Tampines EC Rivelle Starts From $1.588M — More Than 8,000 Visit Preview

1 Comments

Chuan Park Residences definitely seems like a development to watch! The combination of its size, location, and modern amenities could make it a hot favorite among buyers. I’m particularly interested in how it will impact the local scene and property values. Excited to see its progress!