Is Bloomsbury Residences Worth A Look? A Detailed Pricing Review Against One-North Condo Alternatives

April 4, 2025

Bloomsbury Residences launches in One-North with good differentiating factors: it’s a post-harmonisation project with newer and more efficient layouts, and some might say its facilities are a step-up from surrounding alternatives. But the most important factor, as most of us would agree, is price. This is where Bloomsbury Residences stands out: we’re seeing an indicative starting price of $2,396 to $2,433 psf, which is lower than that of same-district projects like ELTA, The Hill @ One-North, and Blossoms by the Park. Here’s how the prices compare:

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

Indicative starting prices:

| Unit type | Estimated size (sq ft) | Indicative starting price | Estimated starting $PSF |

| 2-Bedrooms | |||

| 2 Bedroom | 570 | $1,366,000 | $2,396 |

| 2 Bedroom Premium | 646 | ||

| 2 Bedroom Premium | 678 | ||

| 2 Bedroom Premium + Study | 689 | ||

| 3-Bedrooms | |||

| 3 Bedroom + Study | 904 | $2,166,000 | $2,396 |

| 3 Bedroom Premium | 980 | ||

| 3 Bedroom Premium + Study | 980 | ||

| 3 Bedroom Premium + Study | 990 | ||

| 3 Bedroom Premium + Flexi | 1,098 | ||

| 4-Bedrooms | |||

| 4 Bedroom Premium + Study | 1,173 | $2,866,000 | $2,443 |

| 4 Bedroom Premium + Study | 1,206 | ||

| 4 Bedroom Suite + Flexi | 1,421 | ||

| Penthouses | |||

| 4 Bedroom Penthouse | 1,345 | ||

| 5 Bedroom Penthouse + Study | 1,668 | ||

| 5 Bedroom Penthouse + Study | 1,916 | ||

| 5 Bedroom Penthouse + Flexi | 1,711 | ||

| 6 Bedroom Penthouse + Study | 2,131 | ||

Let’s compare this against recent 99-year leasehold new launches.

| Project | District | Year that land was purchased | Land size (sqm) | Estimated breakeven $PSF | Price range for new sale transactions | Average $PSF for new sale transactions | Average quantum | Average developer’s profit margin (based on average $PSF) |

| The Orie | 12 | 2023 | 15,743.0 | $2,305 | $2,399 – $3,064 | $2,733 | $2,311,840 | 19% |

| The Collective at One Sophia | 9 | 2021 | 7,117.9 | $1,768 | $2,561 – $2,917 | $2,745 | $1,442,711 | 55% |

| ELTA | 5 | 2023 | 13,451.1 | $2,156 | $2,200 – $2,881 | $2,545 | $2,009,908 | 18% |

| Parktown Residence | 18 | 2023 | 50,679.7 | $1,661 | $2,146 – $2,605 | $2,369 | $1,972,348 | 43% |

| Lentor Central Residences | 26 | 2023 | 14,703.0 | $1,793 | $1,982 – $2,573 | $2,216 | $1,970,329 | 24% |

At $2,396 – $2,443, the indicative prices of Bloomsbury Residences is slightly lower than the average $PSF of ELTA, which is located in the same district. However, it remains comparable to Parktown Residences’ average $PSF, while being higher than that of Lentor Central Residences – both of which are also situated in the OCR.

Additionally, the table indicates that the average developer’s profit margin for these new launches ranges between 19% and 55%.

Now, let’s take a look at past projects that were launched in the vicinity of Bloomsbury Residences.

| Project | District | Year that land was purchased | Land size (sqm) | Estimated breakeven $PSF | Price range for new sale transactions | Average $PSF for new sale transactions | Average quantum | Average developer’s profit margin (based on average $PSF) |

| Normanton Park | 5 | 2017 | 61,409.0 | $1,516 | $1571 – $1993 | $1,808 | $1,449,681.24 | 19% |

| One-North Eden | 5 | 2019 | 5,778.7 | $1,674 | $1779 – $2257 | $1,988 | $1,789,674.91 | 19% |

| Blossoms by the Park | 5 | 2021 | 7,957.3 | $1,986 | $2,241 – $2,673 | $2,468 | $2,155,437.00 | 24% |

| The Hill @ One-North | 5 | 2021 | 5,936.6 | $1,941 | $2,272 – $2,708 | $2,579 | $2,344,465.00 | 33% |

The average developer’s profit margins for these projects fall on the lower end compared to recent new launches.

Meanwhile, units are still available for sale at Blossoms by the Park and The Hill @ One-North. When comparing their average $PSF to Bloomsbury Residences’s indicative starting $PSF, Bloomsbury Residences is priced slightly lower.

| Project | Land size (sqm) | Estimated breakeven $PSF | Average starting $PSF | Average developer’s profit margin (based on average $PSF) |

| Bloomsbury Residences | 10,632.1 | $2,076 | $2,412 | 16% |

With an estimated breakeven $PSF of $1,867 and an average starting $PSF of $2,412 (midpoint of $2,396 and $2,443), the developer’s profit margin is approximately 16%.

Assuming prices were to increase by 10% to 30%, let’s explore the potential price matrix.

| % above average starting $PSF of $2,412 | Estimated $PSF |

| 10% | $2,653 |

| 20% | $2,894 |

| 30% | $3,136 |

| Unit type | Estimated size (sqft) | Price based on $PSF of $2,653 (10%) | Price based on $PSF of $2,894 (20%) | Price based on $PSF of $3,136 (30%) |

| 2-Bedrooms | ||||

| 2 Bedroom | 570 | $1,512,286 | $1,649,766 | $1,787,247 |

| 2 Bedroom Premium | 646 | $1,713,924 | $1,869,735 | $2,025,546 |

| 2 Bedroom Premium | 678 | $1,798,824 | $1,962,353 | $2,125,883 |

| 2 Bedroom Premium + Study | 689 | $1,828,008 | $1,994,191 | $2,160,374 |

| 3-Bedrooms | ||||

| 3 Bedroom + Study | 904 | $2,398,432 | $2,616,471 | $2,834,511 |

| 3 Bedroom Premium | 980 | $2,600,070 | $2,836,440 | $3,072,810 |

| 3 Bedroom Premium + Study | 980 | $2,600,070 | $2,836,440 | $3,072,810 |

| 3 Bedroom Premium + Study | 990 | $2,626,601 | $2,865,383 | $3,104,165 |

| 3 Bedroom Premium + Flexi | 1,098 | $2,913,140 | $3,177,971 | $3,442,802 |

| 4-Bedrooms | ||||

| 4 Bedroom Premium + Study | 1,173 | $3,112,125 | $3,395,045 | $3,677,966 |

| 4 Bedroom Premium + Study | 1,206 | $3,199,678 | $3,490,558 | $3,781,438 |

| 4 Bedroom Suite + Flexi | 1,421 | $3,770,102 | $4,112,838 | $4,455,575 |

| Penthouses | ||||

| 4 Bedroom Penthouse | 1,345 | $3,568,464 | $3,892,869 | $4,217,275 |

| 5 Bedroom Penthouse + Study | 1,668 | $4,425,425 | $4,827,737 | $5,230,048 |

| 5 Bedroom Penthouse + Study | 1,916 | $5,083,402 | $5,545,530 | $6,007,657 |

| 5 Bedroom Penthouse + Flexi | 1,711 | $4,539,510 | $4,952,193 | $5,364,876 |

| 6 Bedroom Penthouse + Study | 2,131 | $5,653,826 | $6,167,810 | $6,681,794 |

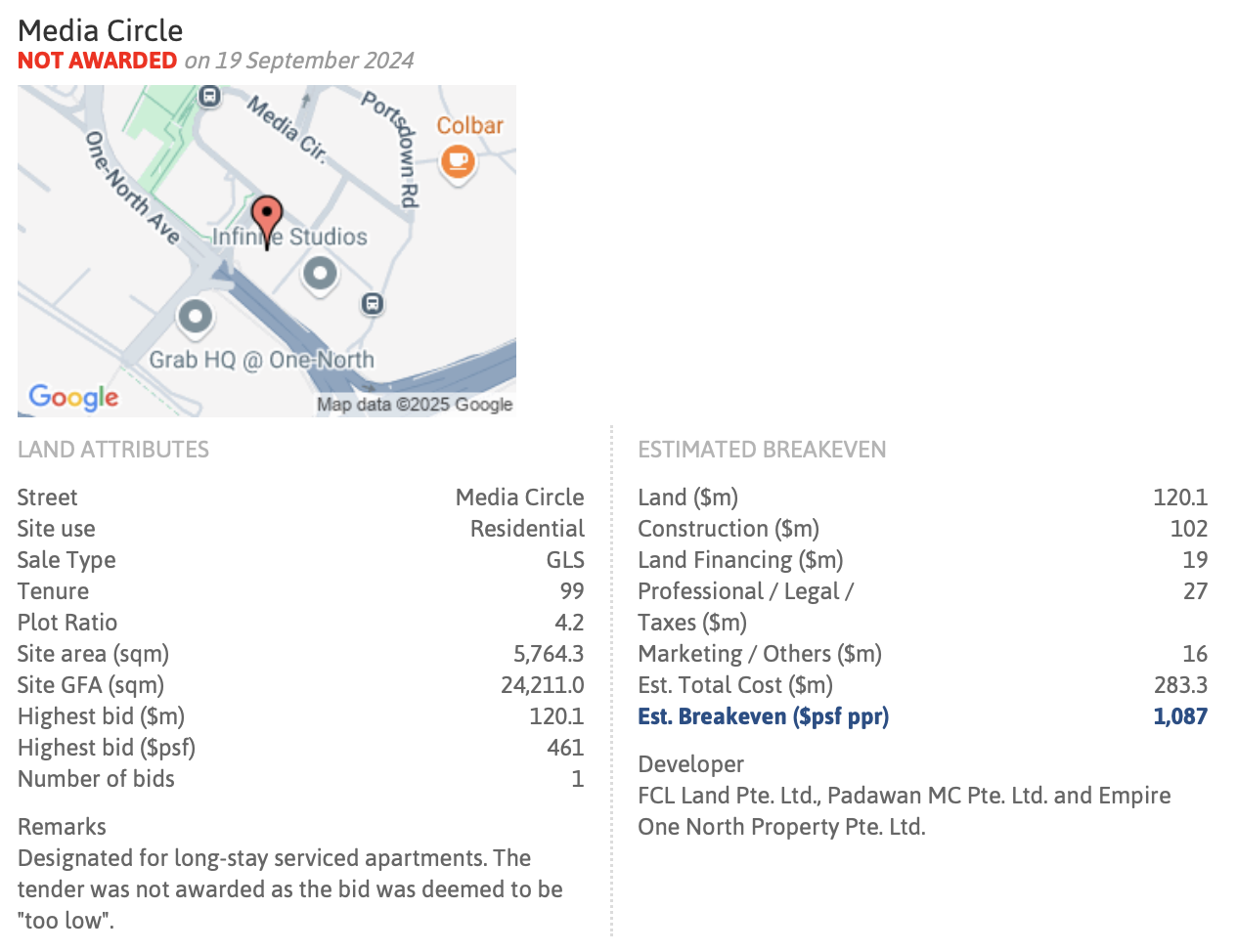

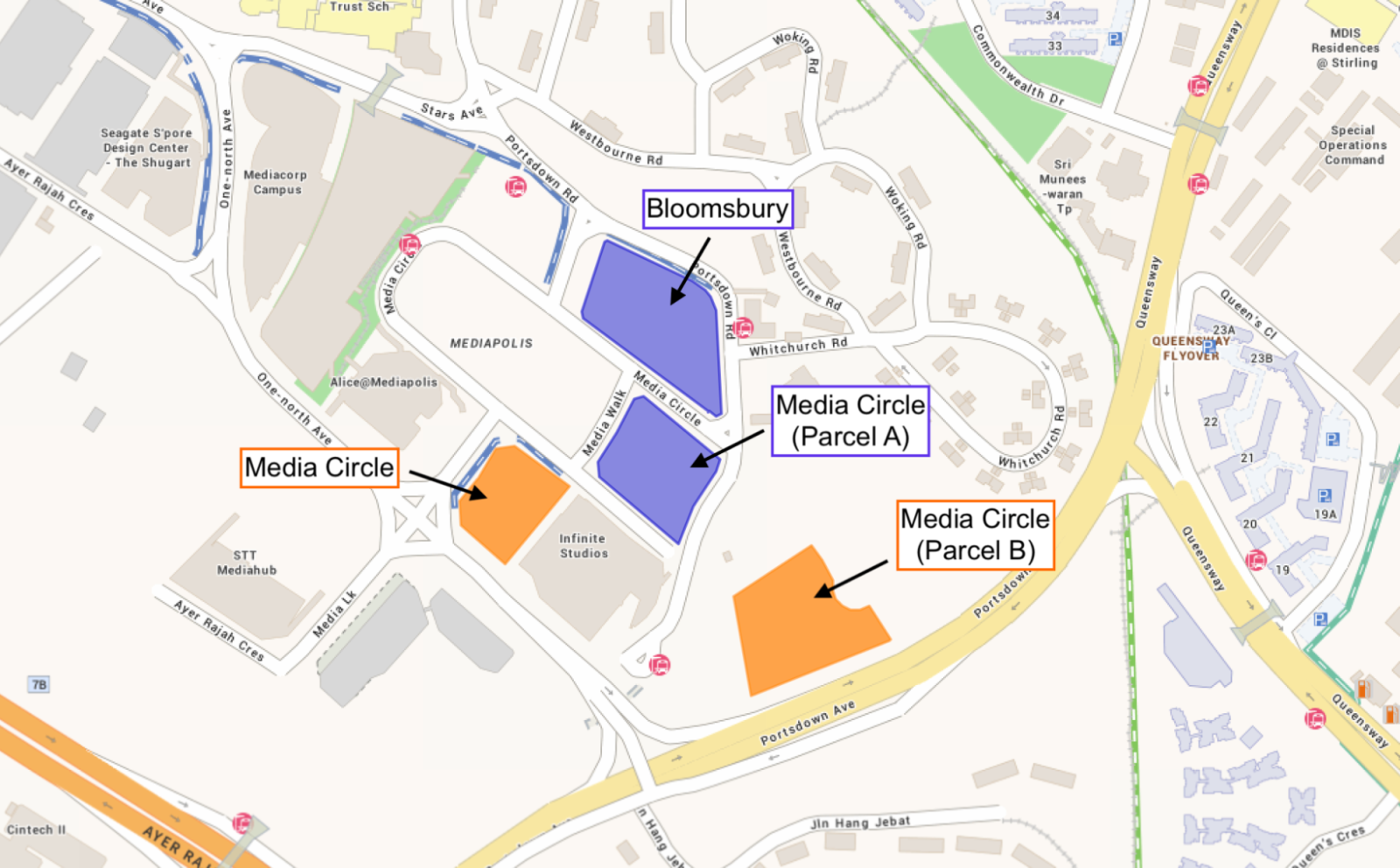

Upcoming developments in Media Circle

In the vicinity of Bloomsbury Residences, there are three land plots, one of which (Media Circle – Parcel A) has already been sold. Qingjian and Forsea Holdings (the same group as Bloomsbury) have secured the Parcel A site at a land price roughly 13 per cent lower than Bloomsbury Residences.

The difference, according to the developer, lies in the management of the commercial component—Bloomsbury retains and manages its retail spaces, while Parcel A’s will fall under MCST control. However, given their shared stake in the precinct’s future, it’s unlikely the two projects will compete directly on pricing.

That said, there is still one more plot (Parcel B), with the tender set to close on April 29, and its selling price could have an impact in the future.

Notably, only one developer submitted a bid for the Media Circle plot, and it was not awarded due to its relatively low offer. This may suggest that developer demand for land in the area may not be as strong as expected.

Resale landscape and new launch competitors

The One-North area has a limited number of residential properties, all of which are 99-year leasehold.

Currently, the secondary market consists of One-North Residences, Normanton Park, and One-North Eden, while the two ongoing new launches are Blossoms by the Park and The Hill @ One-North.

Let’s take a closer look at their project details.

| Project | Completion year | No. of units | Unit mix | Avg $PSF |

| One-North Residences | 2009 | 405 | 1, 2, 3, 4, 5 | $1,598 (resale tnx from 2024 till date 28/03) |

| Normanton Park | 2023 | 1840 condos and 22 landed | 1, 2, 3, 4, 5 | $2,118 (subsale tnx from 2024 till date 28/03) |

| One-North Eden | 2024 | 165 | 1, 2, 3, 4 | $2,341 (subsale tnx from 2024 till date 28/03) |

| The Hill @ One-North | 2026 | 142 | 2, 3, 4 | $2,579 (all new sale tnx) |

| Blossoms by the Park | 2027 | 275 | 1, 2, 3, 4 | $2,468 (all new sale tnx) |

Since One-North Eden is the youngest project on the secondary market and offers similar unit types to Bloomsbury Residences, it is likely to be a key benchmark for buyers making comparisons.

Among the new launches, The Hill @ One-North still has 54% of its units available (primarily 2- and 3-bedders). Whereas Blossoms by the Park is nearly sold out, with only 6% of units left (all of which are 4-bedders). Given this, we will use One-North Eden as the resale benchmark while comparing The Hill @ One-North and Blossoms by the Park as new launch competitors.

Next, we will analyse the sub sale transactions of One-North Eden and compare them against the potential pricing matrix for Bloomsbury Residences.

| Unit type | One-North Eden | % difference compared to Bloomsbury Residences at varying developer’s profit margins | |||||

| Size (sqft) | Avg $PSF | Avg transacted price | Indicative starting prices | 10% | 20% | 30% | |

| 2-bedroom | 689 | 2,405 | 1,656,780 | -0.34% | 10.34% | 20.37% | 30.40% |

| 3-bedroom | 947 | 2,375 | 2,250,000 | -3.73% | 6.60% | 16.29% | 25.98% |

| 1,119 | 2,282 | 2,554,360 | 2.99% | 14.05% | 24.41% | 34.78% | |

| 4-bedroom | 1,259 | 2,204 | 2,775,000 | 6.18% | 15.30% | 25.79% | 36.27% |

As the unit sizes of the two projects are different, this is what we are comparing:

| Unit type | One-North Eden | Bloomsbury Residences |

| Size (sq ft) | Size (sq ft) | |

| 2-bedroom | 689 | 689 |

| 3-bedroom | 947 | 904 |

| 1,119 | 1,098 | |

| 4-bedroom | 1,259 | 1,206 |

Based on the indicative starting $PSF, both the 2-Bedroom + Study and 3-Bedroom + Study units are priced below the average transacted prices at One-North Eden. In contrast, the largest 3-Bedroom + Flexi and 4-Bedroom + Study units are priced higher—even at the starting $PSF. The price differences are 2.99% (or $76,467) and 6% (or $171,629), respectively.

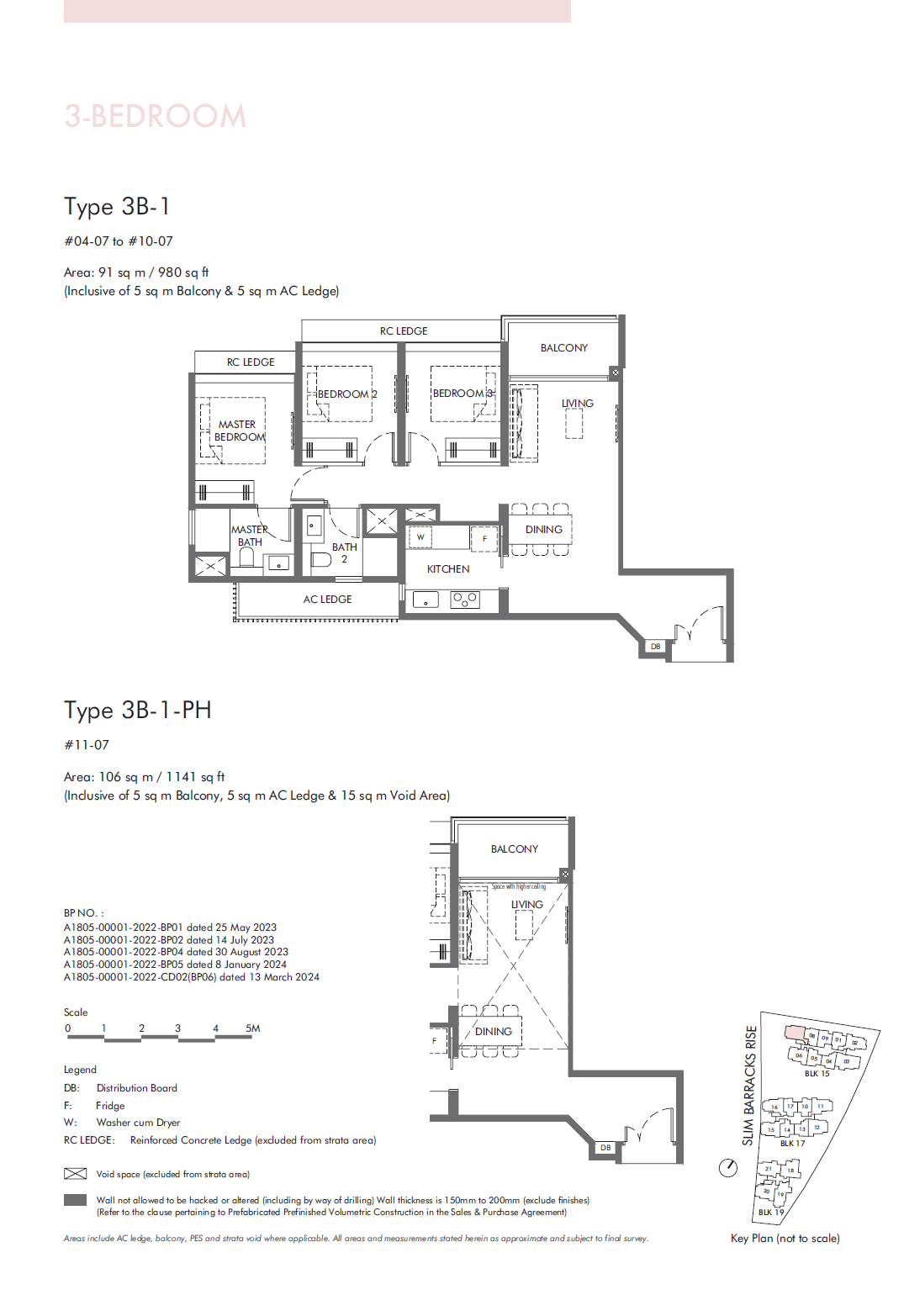

Let’s now take a look at their floor plans for a more detailed comparison.

Layout analysis

2-bedrooms

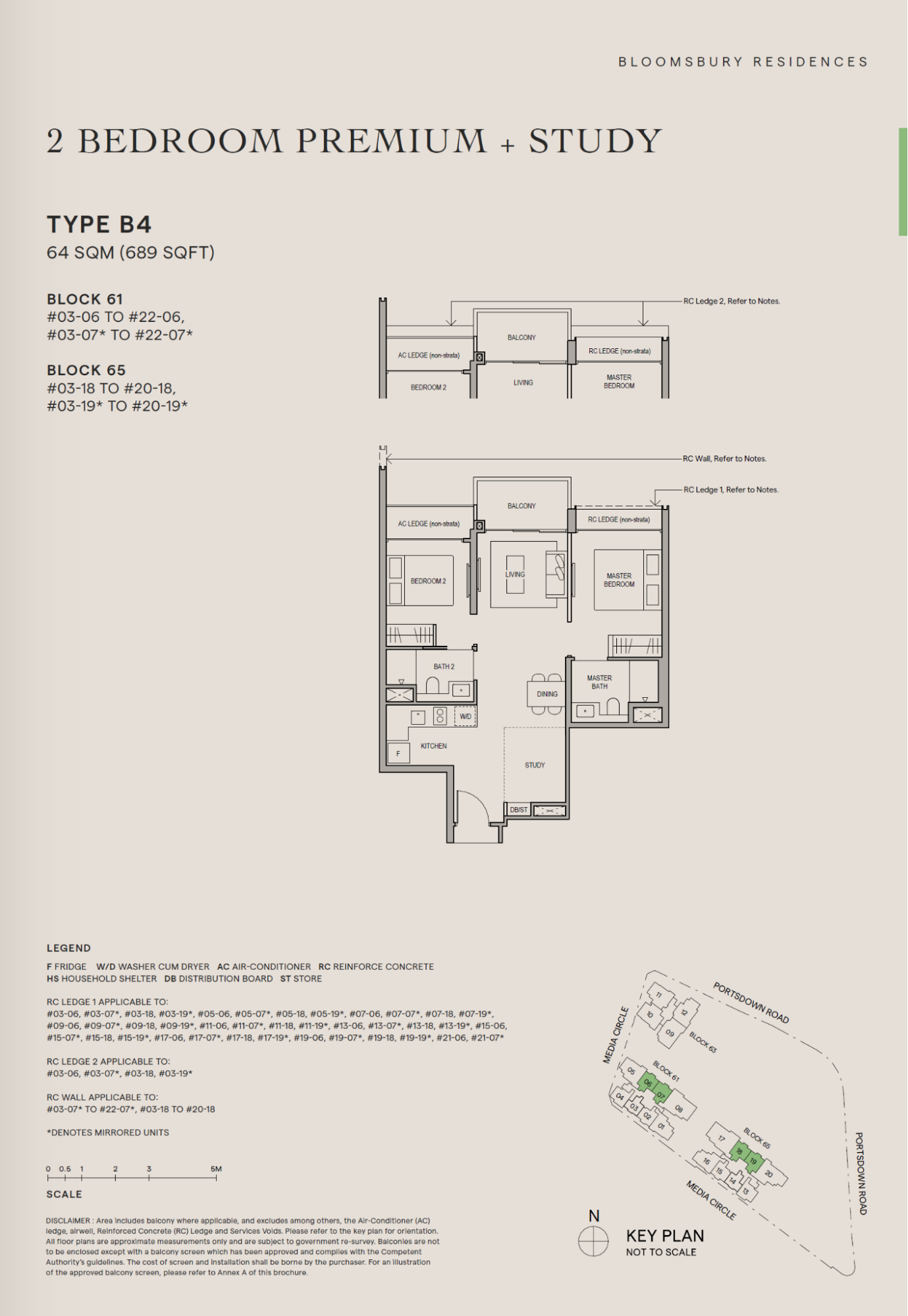

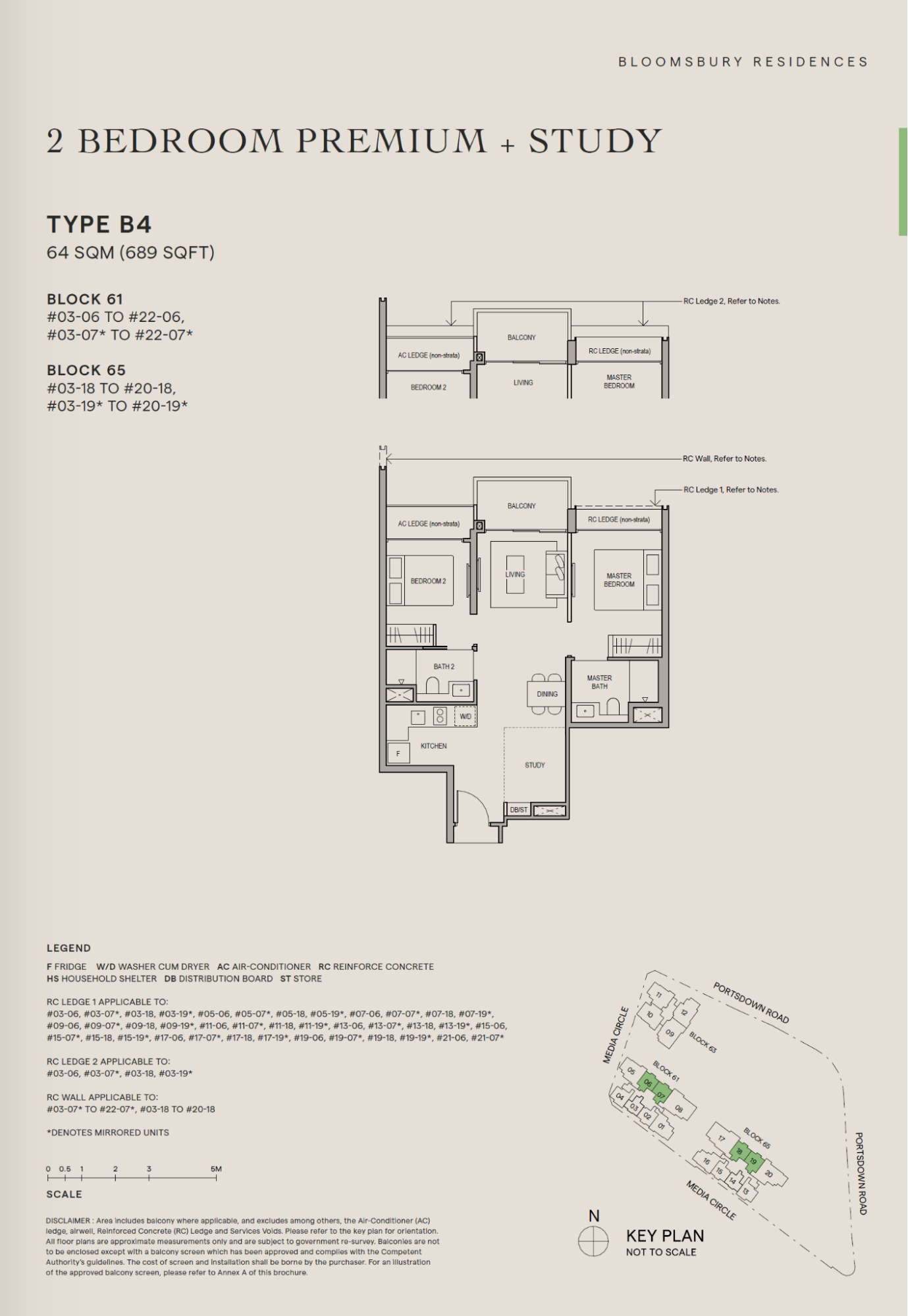

Bloomsbury Residences – 689 sq ft

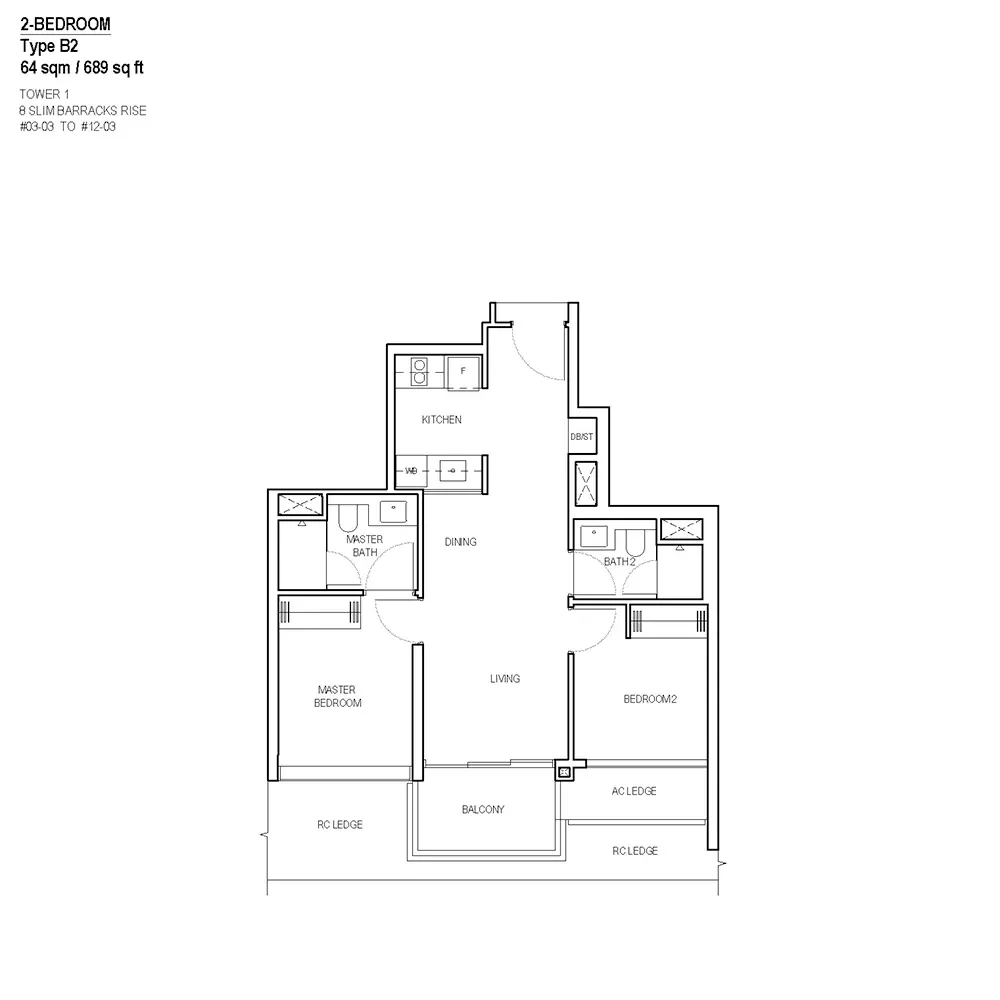

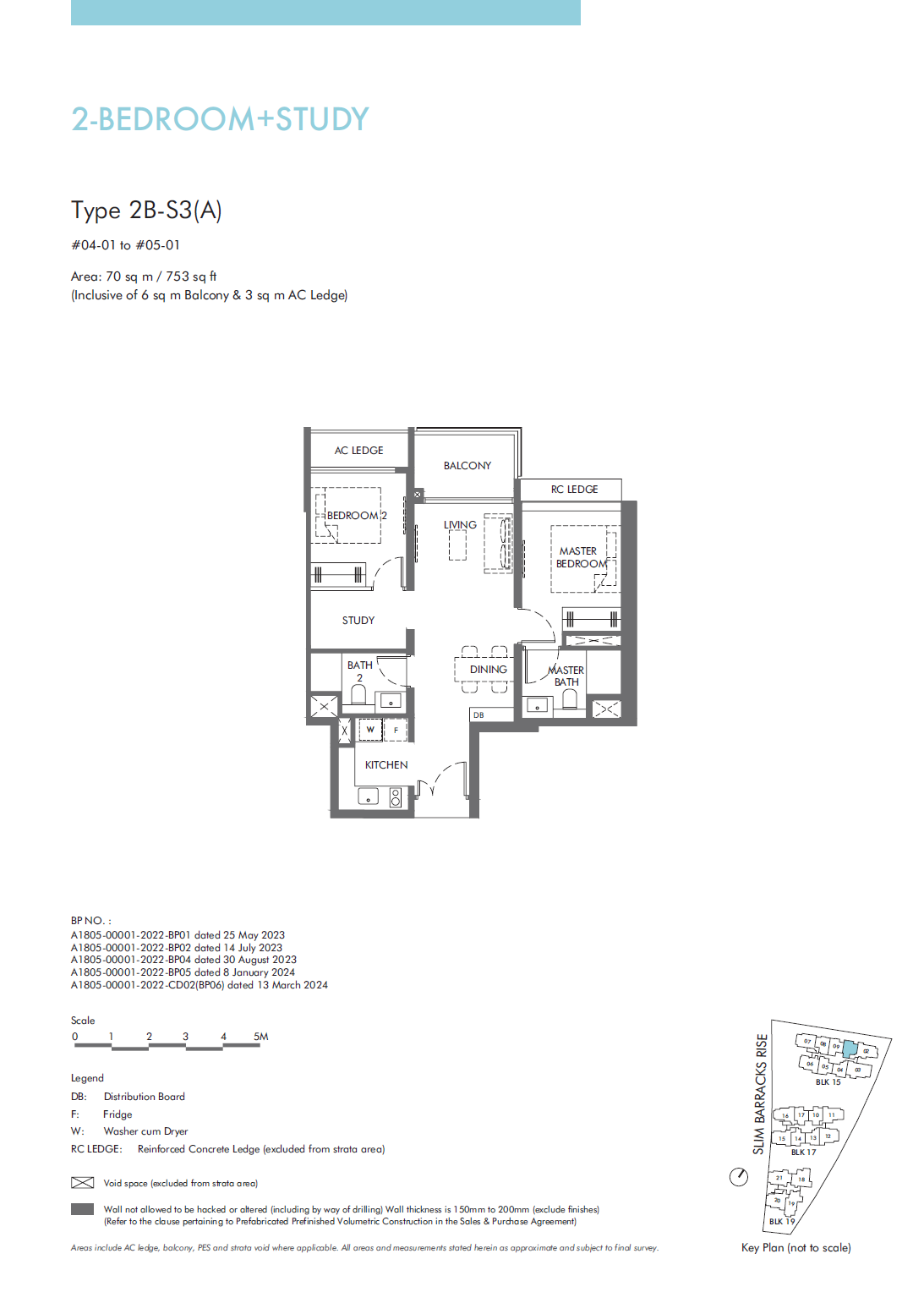

One-North Eden – 689 sq ft

Although both units are the same size, Bloomsbury Residences’s square footage is harmonised and excludes the AC and RC ledges, offering more livable space compared to One-North Eden. There are several similarities and differences worth noting:

- Both units are 2-bedroom, 2-bathroom configurations with a dumbbell layout that eliminates walkways, maximising usable space.

- Although both are listed as 2-bedroom + Study units, One-North Eden’s layout doesn’t seem to offer much space for a study area.

- Both units feature a decently sized balcony in the living area.

- Bloomsbury Residences’s common bathroom has Jack-and-Jill entries, allowing access from the common bedroom, effectively making both bedrooms en suite.

- The L-shaped kitchen in Bloomsbury Residences may be more functional, as the stove and sink are positioned next to each other, with additional space for food preparation or appliances.

When considering the indicative starting $PSF, the price difference between the two units is minimal (under $6,000), with the resale unit at One-North Eden being slightly more expensive. However, if the $PSF increases by 10%, the price difference becomes more substantial, with Bloomsbury Residences costing around $171,000 more.

Of the two layouts, Bloomsbury Residences has more user-friendly features, and has the edge especially if priced at the indicative starting $PSF.

3-bedrooms

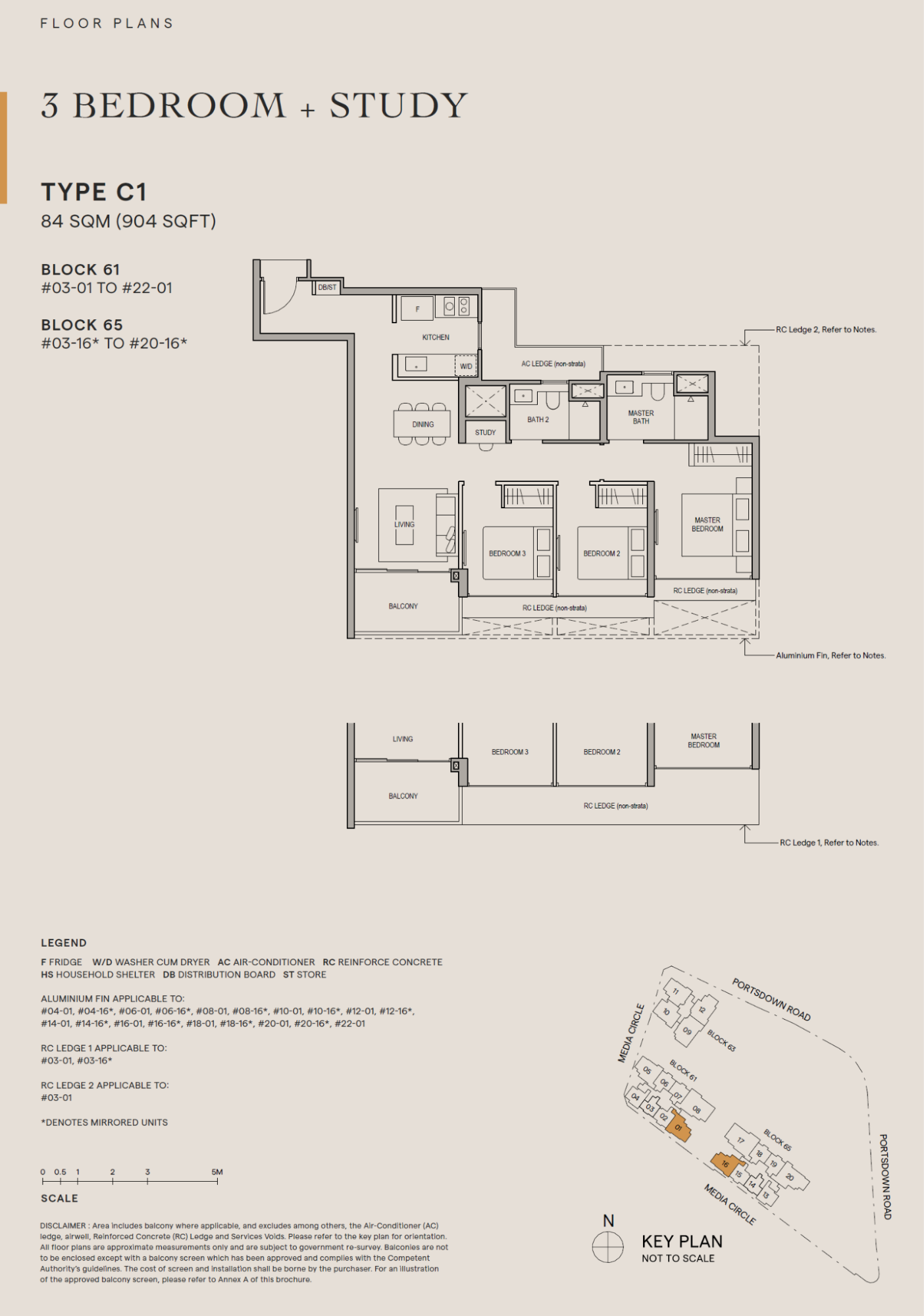

Bloomsbury Residences – 904 sq ft

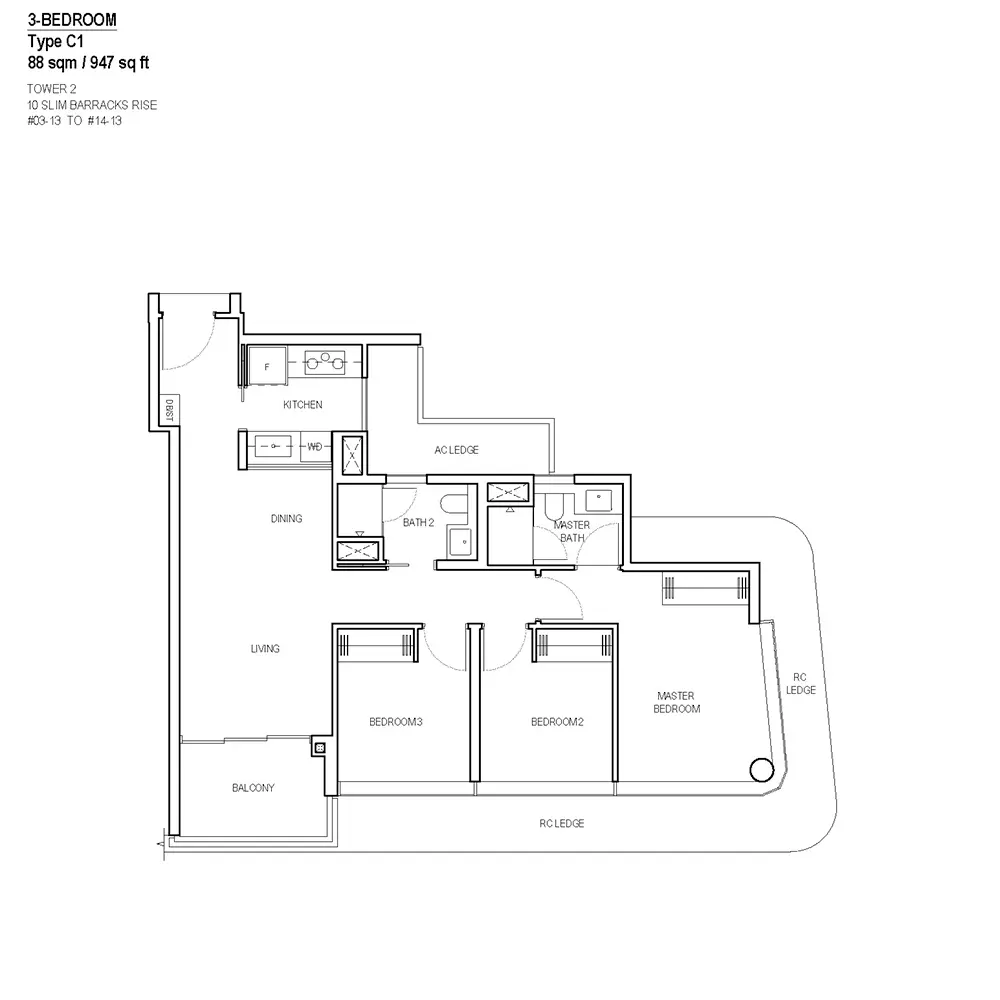

One-North Eden – 947 sq ft

Although the unit at One-North Eden is larger than Bloomsbury Residences, it includes AC and RC ledges that extend along nearly half of the unit’s perimeter, which means the actual interior space may be quite similar.

More from Stacked

Treasure at Tampines Pricing Review: How Its Prices Compare to D18, OCR, and the Wider Market

A pricing review of Treasure at Tampines has some challenges; the main one being scale. As of 2025, Treasure at…

The 904 sq ft unit in Bloomsbury Residences is a 3-bedroom + Study, but the study is more of a small nook rather than a designated space.

The layouts of both units are largely similar, with one key difference: in Bloomsbury Residences, there is a short walkway from the main entrance to the kitchen and living area, providing more privacy for those who prefer to keep their doors open.

In contrast, while there’s a slight protrusion in the wall for the distribution box in One-North Eden, passersby would still be able to see into the living area if the door is left open.

At the indicative starting $PSF, the price difference between the two units is around $84,000, with the resale unit at One-North Eden being the pricier option. This makes it competitively priced compared to its One-North Eden counterparts.

4-bedrooms

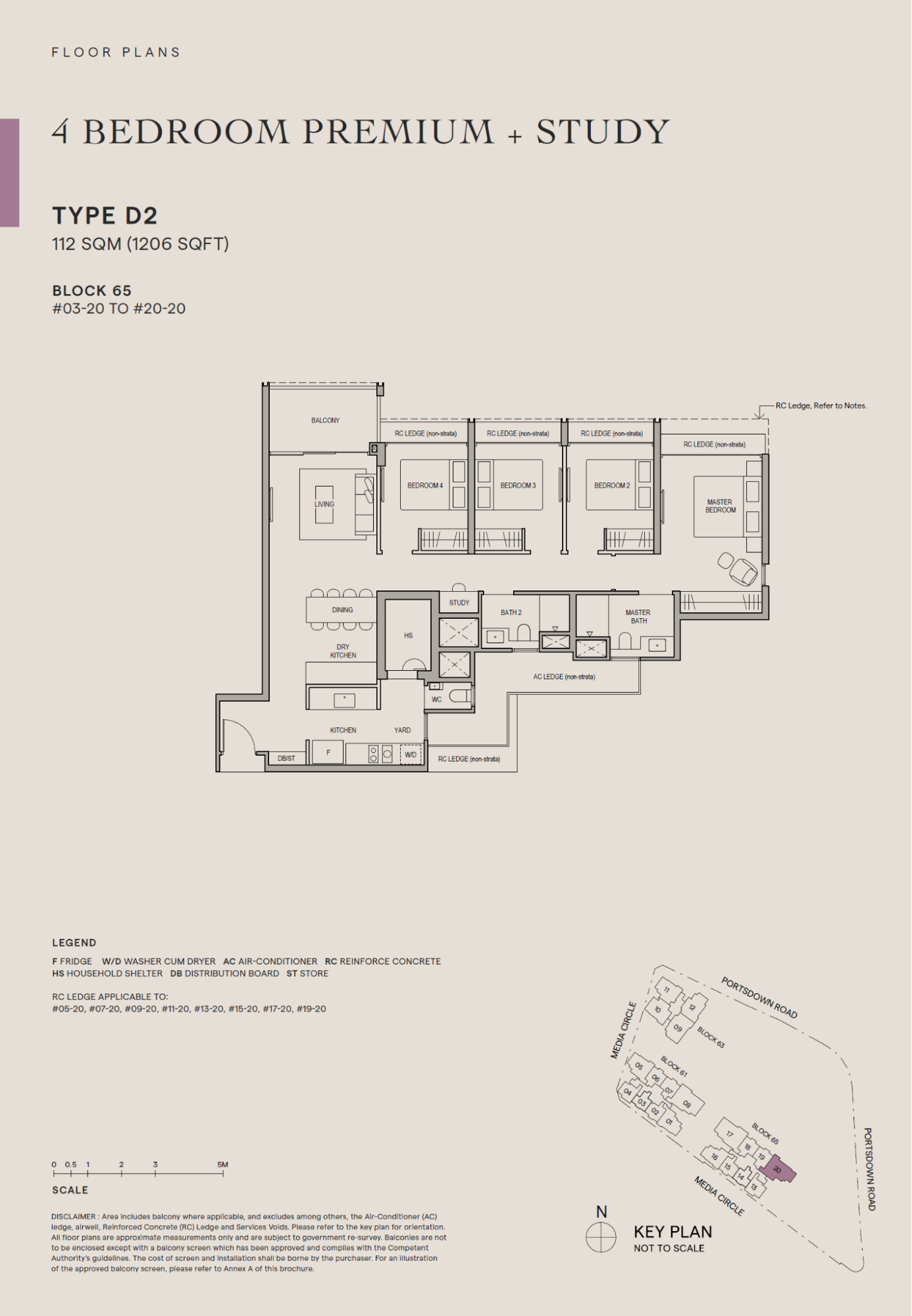

Bloomsbury Residences – 1,206 sq ft

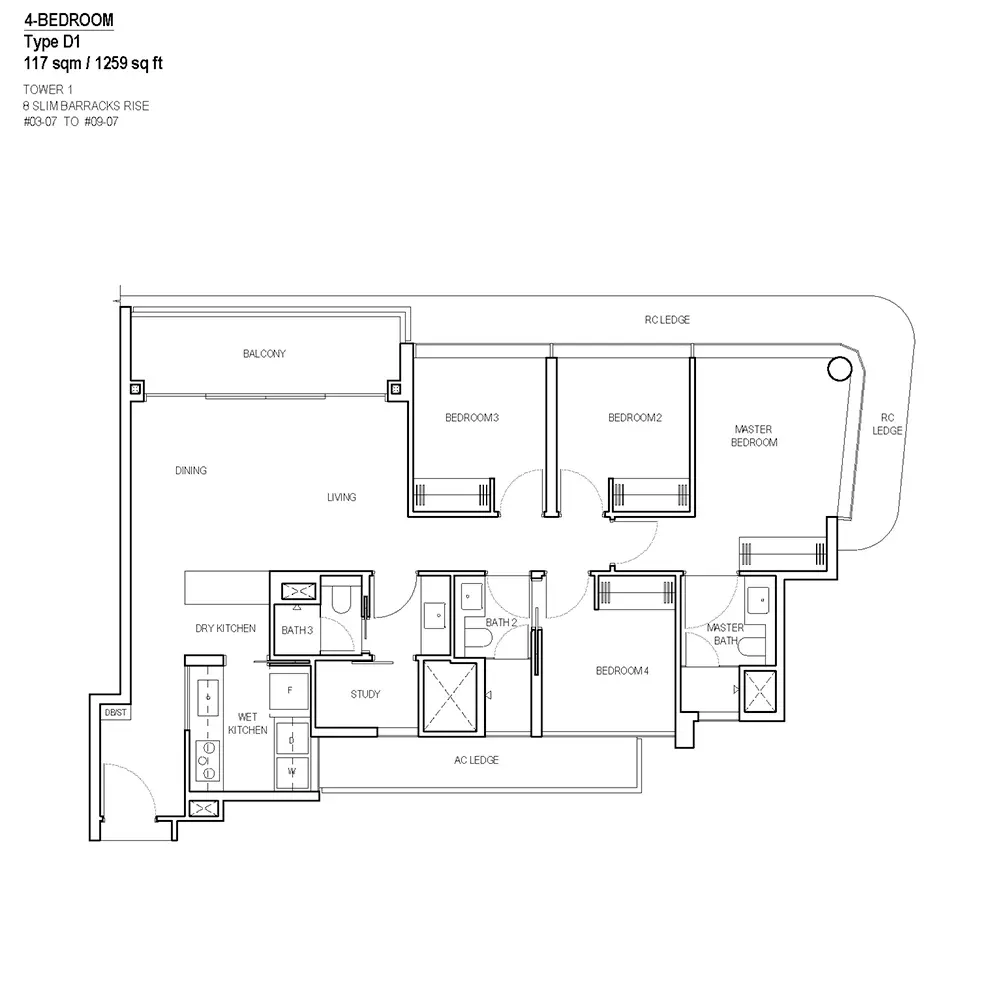

One-North Eden – 1,259 sq ft

Similar to the 3-bedroom unit, although One-North Eden has a larger floor plate, it includes AC and RC ledges that extend around nearly half of the unit’s perimeter. As a result, the actual interior space may only be slightly larger than the unit at Bloomsbury Residences.

There are several similarities and differences between the two units:

- Both are 4-bedroom + Study configurations, although One-North Eden is listed as a 4-bedroom compact unit.

- The One-North Eden unit features an actual study/flexi room, whereas Bloomsbury Residences’s study is a small nook in the wall.

- One-North Eden has 3 full bathrooms, one of which is next to the study/flexi room. This bathroom includes a small area with a sink just outside, which could be used as a guest bathroom due to its more accessible location.

- Both units have balconies that span the length of the living room. However, since One-North Eden’s living and dining areas share the same space, the combined length of these areas is much longer than Bloomsbury Residences’s, creating a more spacious feel.

- In Bloomsbury Residences, the living and dining areas are separated.

- Both units feature kitchens with wet and dry areas, though Bloomsbury Residences includes a small yard space, WC, and home shelter—features that One-North Eden lacks.

- In Bloomsbury Residences, the 4 bedrooms are arranged side by side, resulting in a longer walkway to the bedrooms, while One-North Eden has 3 bedrooms on one side and 1 on the other.

The layouts of both units are functional in different ways, and deciding which is better is ultimately subjective and likely dependent on the price point.

At the indicative starting $PSF, Bloomsbury Residences will cost about 6% higher, which is approximately $171,000.

Let’s now look at its new launch competitors.

For the 2 and 3-bedders, we will compare it against The Hill @ One-North.

| Unit type | The Hill @ One-North | % difference compared to Bloomsbury Residences at varying developer’s profit margins | |||||

| Size (sqft) | $PSF based on lowest asking price | Lowest asking price (as of 28/03) | Indicative starting prices | 10% | 20% | 30% | |

| 2-bedroom | 753 | 2,523 | 1,900,000 | -13.10% | -3.79% | 4.96% | 13.70% |

| 3-bedroom | 980 | 2,479 | 2,429,000 | -3.33% | 7.04% | 16.77% | 26.51% |

As the unit sizes of the two projects are different, this is what we are comparing:

| Unit type | The Hill @ One-North | Bloomsbury Residences |

| Size (sqft) | Size (sqft) | |

| 2-bedroom | 753 | 689 |

| 3-bedroom | 980 | 980 |

For the 4-bedders, we will compare it against Blossoms by the Park.

| Unit type | Blossoms by the Park | % difference compared to Bloomsbury Residences at varying developer’s profit margins | |||||

| Size (sqft) | $PSF based on lowest asking price | Lowest asking price (as of 28/03) | Indicative starting prices | 10% | 20% | 30% | |

| 4-bedroom | 1507 | 2,214 | 3,336,000 | 4.07% | 13.01% | 23.29% | 33.56% |

As the unit sizes of the two projects are different, this is what we are comparing:

| Unit type | Blossoms by the Park | Bloomsbury Residences |

| Size (sqft) | Size (sqft) | |

| 4-bedroom | 1507 | 1421 |

As before, we will also do a layout analysis.

2-bedrooms

Bloomsbury Residences – 689 sq ft

The Hill @ One-North – 753 sq ft

The listed size at The Hill @ One-North is 753 sq ft, but because it is not harmonised, the actual interior space is slightly smaller—though likely still larger than the unit at Bloomsbury Residences.

Both are 2-Bedroom + Study units, but The Hill @ One-North includes a dedicated, enclosed study, while Bloomsbury’s study area is more of an open nook. At The Hill, the study sits next to the common bedroom and can be reconfigured as part of the bedroom or used as a walk-in closet, offering more flexibility.

Both units have a dumbbell layout with two bedrooms and two bathrooms, maximising space by eliminating hallways. Bloomsbury’s common bathroom has Jack-and-Jill access, allowing both bedrooms to function as en suites.

Apart from these differences, the layouts are generally similar. However, at the indicative starting $PSF, The Hill @ One-North is priced about 13% higher—roughly $249,000 more. While it offers slightly more space and is closer to the MRT, the price gap may lead some buyers to favour the unit at Bloomsbury Residences.

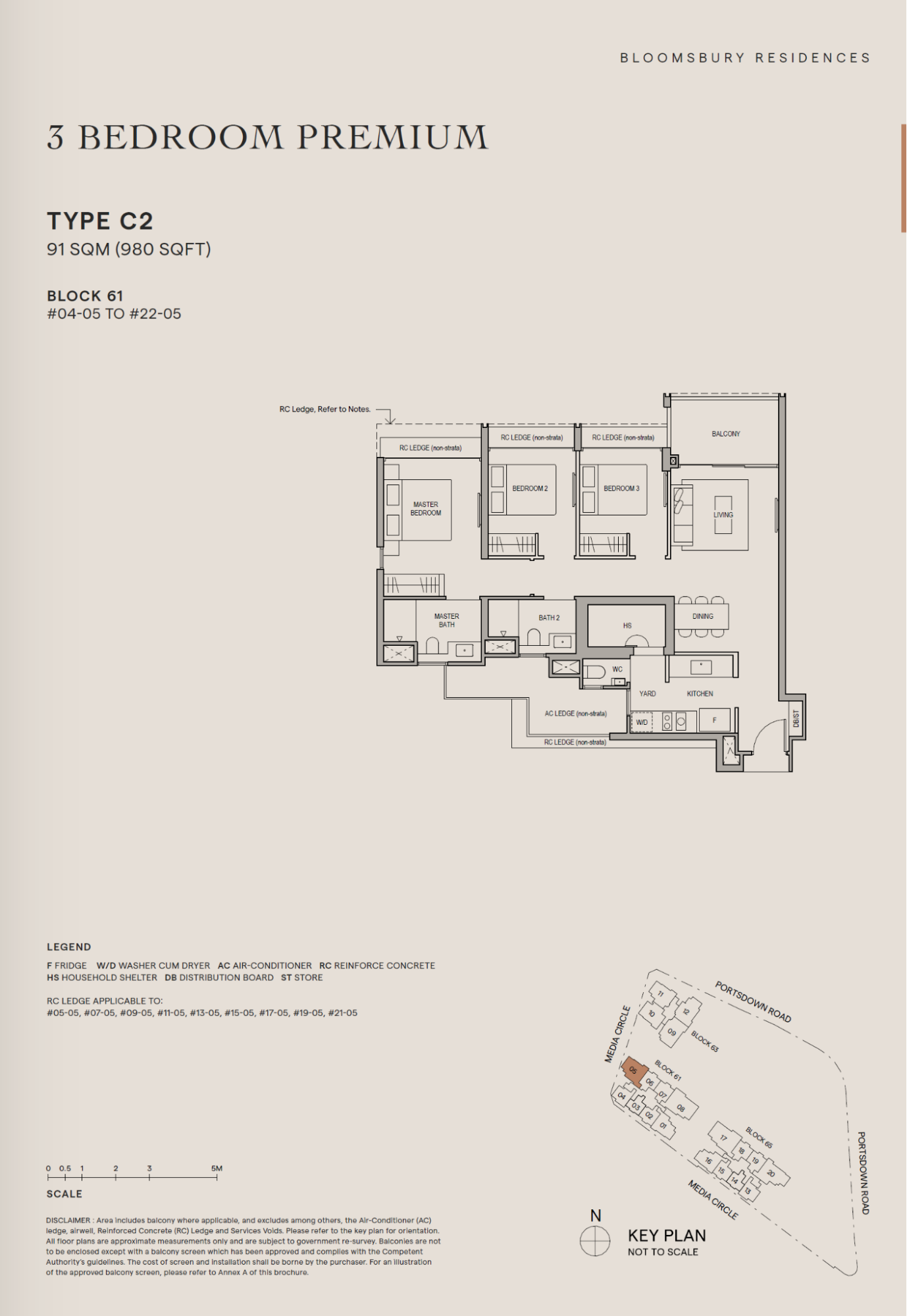

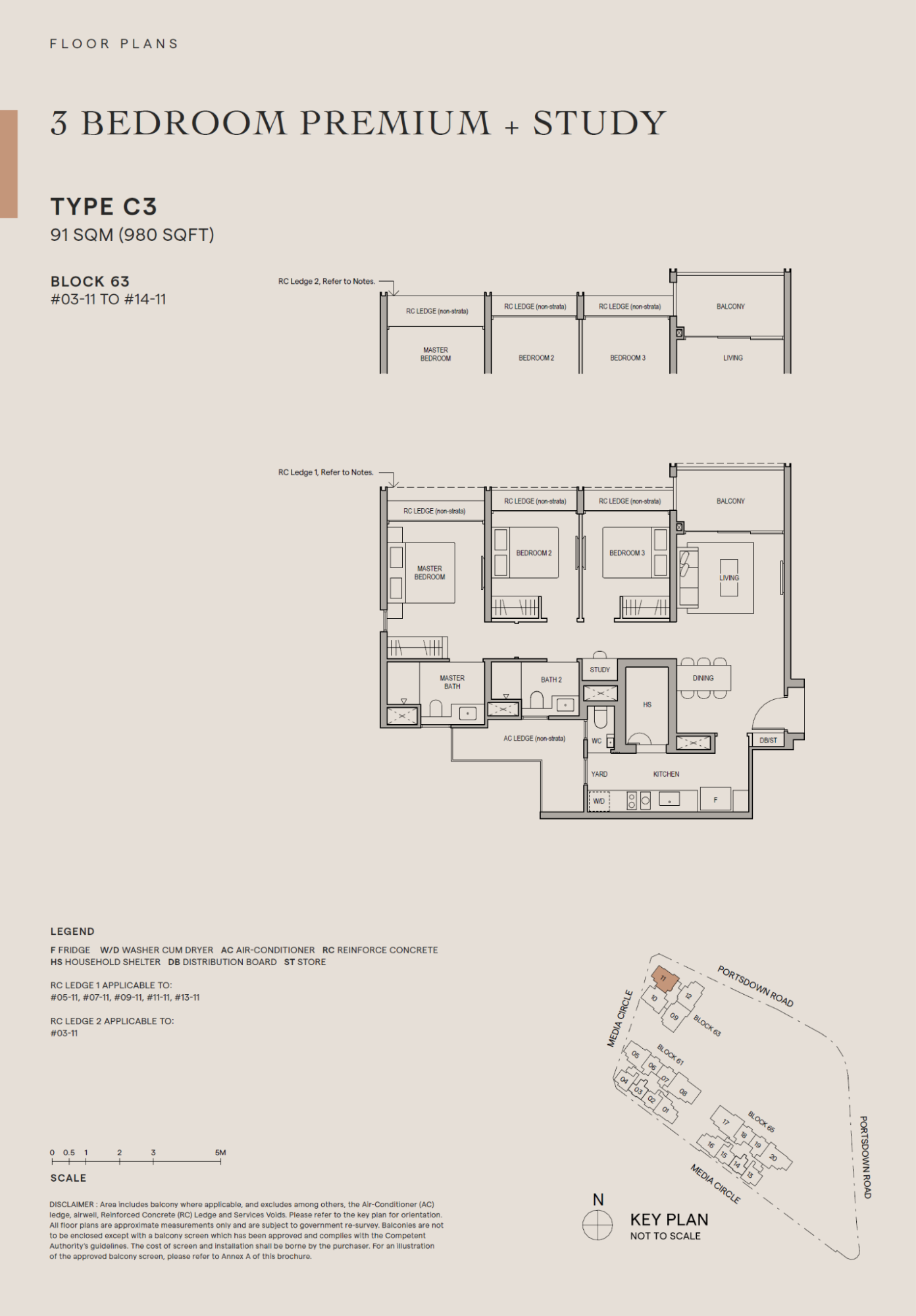

3-bedrooms

Bloomsbury Residences – 980 sq ft

The Hill @ One-North – 980 sq ft

Although both units are listed at 980 sq ft, Bloomsbury Residences excludes non-strata areas from its measurement, resulting in a larger usable interior space compared to The Hill @ One-North.

Bloomsbury Residences offers two layout options: a 3-Bedroom and a 3-Bedroom + Study – the latter featuring a small recess that functions as a study nook. While the overall layouts are quite similar, there are a few key differences.

At The Hill, the main entrance opens into a short foyer, offering added privacy for those who like to keep their door ajar. In contrast, Bloomsbury Residences’s layouts both open directly into the living space, though the 3-Bedroom + Study option limits visibility to just the dining area.

Bloomsbury Residences units also come with a yard, WC, and home shelter in the kitchen – practical features that The Hill lacks. Kitchen layouts differ as well: one Bloomsbury configuration is square-shaped with cabinetry on both sides, while the other is a longer, narrower galley with cabinets on one side.

Despite Bloomsbury’s larger interior and added features, The Hill @ One-North is priced about 3% higher at the indicative starting $PSF—translating to roughly $81,000.

4-bedrooms

Bloomsbury Residences – 1,421 sq ft

Blossoms by the Park – 1,507 sq ft

The 4-bedroom unit at Blossoms by the Park is noticeably larger than the one at Bloomsbury Residences, though part of that space is taken up by AC and RC ledges along both sides, as well as a long balcony that stretches across three bedrooms.

In contrast, Bloomsbury’s 4-Bedroom + Study layout includes a study nook—similar to its other layouts—better suited as a small workspace than a full room.

Blossoms by the Park offers two en suite bedrooms and a third common bathroom, while Bloomsbury has just one en suite and one common bathroom.

Both units feature main entrances that don’t open directly into the living area, offering more privacy for residents who prefer to keep their doors open. The living and dining spaces are also separated in both layouts. At Blossoms, the dining area is placed farther from the kitchen, which may feel slightly awkward—but is easily reconfigured.

Both units come with wet and dry kitchens, a yard, WC, and home shelter. However, the bedroom layout at Blossoms is more compact, with bedrooms placed on opposite sides of the unit, resulting in a shorter corridor than the side-by-side arrangement at Bloomsbury.

At the indicative starting $PSF, Bloomsbury is priced about 4% higher—roughly $136,000 more. Given that Blossoms is larger and closer to the MRT, this price gap may make give some buyers pause.

Now, let’s explore the potential buyers for Bloomsbury Residences.

Potential buyers

The One-North area is primarily a business park, with a handful of private residential properties. It offers an excellent location for rental, given its proximity to office spaces, as well as several renowned schools nearby.

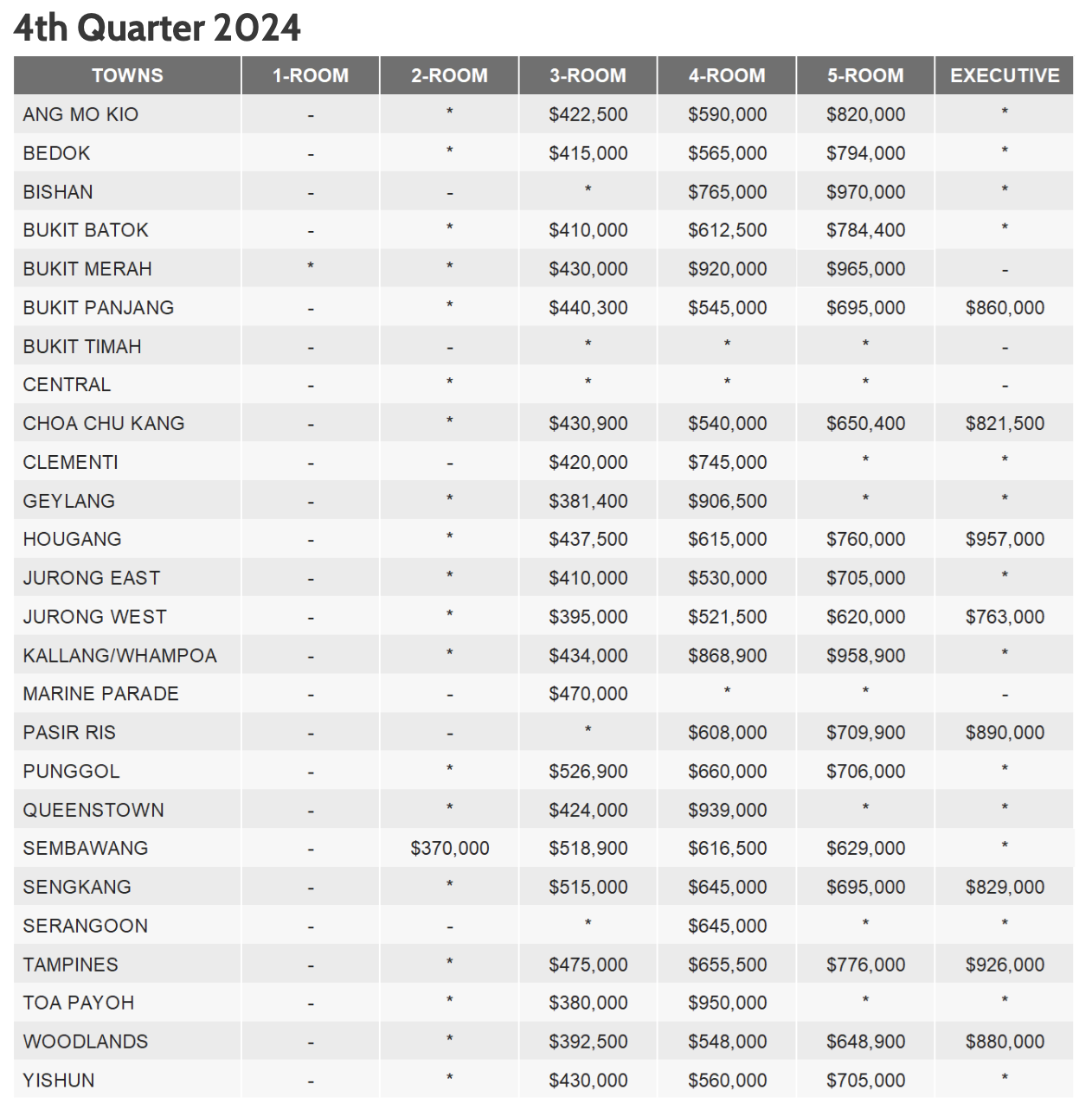

There are a decent number of HDB estates in the surrounding areas, including Dover, Commonwealth, and Queenstown, all of which fall under the Queenstown HDB town. These HDB flats are generally on the higher end of the pricing spectrum, especially the newer ones.

In these HDB estates, there are also private condominiums, which raises the question of whether HDB upgraders from these areas would consider moving further out and purchasing properties in the One-North area.

Let’s examine the number of HDB upgraders who have purchased properties in the One-North area over the past 5 years.

| Project | Previous address before purchase | Grand Total | % Of HDB upgraders | % Of PTE buyers | ||

| HDB | Unknown | Private | ||||

| Blossoms By The Park | 60 | 38 | 156 | 254 | 23.62% | 61.42% |

| Normanton Park | 712 | 353 | 838 | 1903 | 37.41% | 44.04% |

| One-North Eden | 38 | 41 | 101 | 180 | 21.11% | 56.11% |

| One-North Residences | 25 | 0 | 78 | 103 | 24.27% | 75.73% |

| The Hill @One-North | 11 | 21 | 24 | 56 | 19.64% | 42.86% |

| Total | 846 | 453 | 1197 | 2496 | 33.89% | 47.96% |

The table clearly shows that the majority of buyers in the One-North area are existing private property owners, rather than HDB upgraders.

Now, let’s take a closer look at the supply of private properties in One-North.

| Project | Tenure | Completion | Total number of units |

| Bloomsbury Residences | 99-years | 2028 | 358 |

| Blossoms By The Park | 99-years | 2027 | 275 |

| Normanton Park | 99-years | 2023 | 1840 |

| One-North Eden | 99-years | 2024 | 165 |

| One-North Residences | 99-years | 2009 | 405 |

| The Hill @One-North | 99-years | 2026 | 142 |

| Project | No. of 1-bedroom units | No. of 2-bedroom units | No. of 3-bedroom units | No. of 4-bedroom units | No. of 5-bedroom units | % of 1 and 2 bedders |

| Bloomsbury Residences | 190 | 92 | 70 | 6 | 53.1% | |

| Blossoms By The Park | 25 | 100 | 100 | 50 | 45.5% | |

| Normanton Park | 552 | 598 | 529 | 115 | 46 | 62.5% |

| One-North Eden | 24 | 70 | 50 | 21 | 57.0% | |

| One-North Residences | 168 | 125 | 85 | 25 | 2 | 72.3% |

| The Hill @One-North | 72 | 64 | 6 | 50.7% |

Given its proximity to offices and schools, rental demand in the area is likely to be strong, which may explain the high percentage of 1- and 2-bedroom units available across most projects. Having said that, these developments still feature a well-balanced unit mix that caters to a variety of buyer and tenant profiles.

Number of sub sale/resale transactions in recent years

| Project | 2023 | 2024 | % of project sold in 2024 |

| Normanton Park | 2 | 61 | 3.32% |

| One-North Eden | 15 | 9.09% | |

| One-North Residences | 16 | 22 | 5.43% |

| Total | 18 | 98 | 4.07% |

While transaction volume in 2024 appears to be relatively low, this may not be fully indicative of market trends, given that Normanton Park and One-North Eden have only recently obtained their TOP.

Additionally, if rental demand is indeed strong, investors may be purchasing properties with the intention of generating rental income, leading to longer holding periods and fewer resale transactions.

Now, let’s examine the rental yield of these projects in 2024.

| Project | 1-bedroom | 2-bedroom | 3-bedroom | 4-bedroom | 5-bedroom |

| Normanton Park | 3.68% | 3.30% | 2.82% | 3.08% | 2.79% |

| One-North Eden | 3.61% | 3.78% | 3.09% | 3.51% | |

| One-North Residences | 3.79% | 3.46% | 3.64% | 3.53% |

Many of the unit types are achieving rental yields of 3.5% and above, which suggests a healthy demand for rental properties in the area. Smaller units such as 1- and 2-bedroom apartments tend to offer higher yields, due to their lower entry prices, but we do see here that the 4-bedders are also seeing comparable yields.

Conclusion

With a steady tenant pool from nearby offices and schools, investors eyeing the One-North area are likely focused on rental yields. This is reflected in the high proportion of 1- and 2-bedroom units across most nearby developments.

Bloomsbury Residences’ indicative starting price of $2,396–$2,443 PSF is slightly below the average at ELTA, a new launch in the same district, and also lower than other nearby projects like Blossoms by the Park and The Hill @ One-North – positioning it competitively.

Compared to resale rival One-North Eden, Bloomsbury’s smaller units (such as the 2-bedders and the smallest 3-bedder) are expected to launch at lower PSFs. Thanks to harmonised square footage, some units may also offer more usable interior space than their One-North Eden counterparts. This could appeal to buyers seeking better spatial efficiency at a more attractive price. That said, Bloomsbury Residences is slightly farther from the MRT, though still within a 15-minute walk.

One factor that may affect buyer sentiment is the future pricing of nearby land plots. Media Circle (Parcel A) has an estimated breakeven PSF about 11.2% lower than Bloomsbury’s, which may cause some buyers to hold off. The outcome of the Parcel B tender, closing April 29, could also influence perceptions – especially if it signals a more competitive future launch. However, with Parcel A receiving just one (rejected) bid, developer appetite for the area remains unclear.

Overall, Bloomsbury Residences’s starting price and efficient layouts make it an interesting proposition, but market sentiment may hinge on upcoming land tenders in the vicinity.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

How does the price of Bloomsbury Residences compare to other nearby projects?

What are the key differences between Bloomsbury Residences and One-North Eden in terms of pricing and layout?

Are there any upcoming developments in the Media Circle area near Bloomsbury Residences?

How does the resale market for One-North area properties compare to new launches like Bloomsbury Residences?

What are the potential price increases for Bloomsbury Residences if market prices rise by 10% to 30%?

Cheryl Teo

Cheryl has been writing about international property investments for the past two years since she has graduated from NUS with a bachelors in Real Estate. As an avid investor herself, she mainly invests in cryptocurrency and stocks, with goals to include real estate, virtual and physical, into her portfolio in the future. Her aim as a writer at Stacked is to guide readers when it comes to real estate investments through her insights.Need help with a property decision?

Speak to our team →Read next from New Launch Condo Analysis

New Launch Condo Analysis This New Dairy Farm Condo Starts From $998K — How the Pricing Compares

New Launch Condo Analysis This New Freehold CBD Condo Starts From $1.29M — Here’s How the Pricing Compares

New Launch Condo Analysis This Freehold New Launch Condo In The CBD Is Launching From Just $1.29M

New Launch Condo Analysis I Reviewed A New Launch 4-Bedroom Penthouse At Beauty World

Latest Posts

Overseas Property Investing This Singaporean Has Been Building Property In Japan Since 2015 — Here’s What He Says Investors Should Know

Singapore Property News REDAS-NUS Talent Programme Unveiled to Attract More to Join Real Estate Industry

Singapore Property News Three Very Different Singapore Properties Just Hit The Market — And One Is A $1B En Bloc

0 Comments