Why ‘Cheap’ Johor Property Can Get Expensive Very Quickly For Singaporeans

January 14, 2026

This contributed article by Malaysian property veteran Samuel Tan, founder & CEO of Olive Tree Property Consultants, offers his perspective on the Malaysian property market as well as important tips Singapore-based buyers and investors should keep in mind.

New cross-border investments, such as the Johor-Singapore Special Economic Zone (Johor-SG SEZ), have thrown the spotlight on real estate investment opportunities for buyers who are keen to capitalise on the potential uplift the Johor property market might see in the coming years.

By the end of this year, Singaporeans and Malaysians will enjoy a more seamless experience crossing the border when the Rapid Transit System (RTS) Link between Woodlands North and Bukit Chagar is completed. Coupled with Malaysia’s new inter-city higher speed rail, the KTM Electric Train Service (ETS), cross-border activity between Singapore and Malaysia is expected to significantly ramp up in the coming years.

However, venturing into Malaysia’s real estate market is not for the faint of heart given the unique complexities and regulations that govern foreign investors, says Samuel Tan, founder and CEO of Olive Tree Property Consultants.

“There are different sets of considerations in property investments across different countries and it is good to know them, so that the investments are done in the right manner and have a better chance of ending profitability,” says Tan.

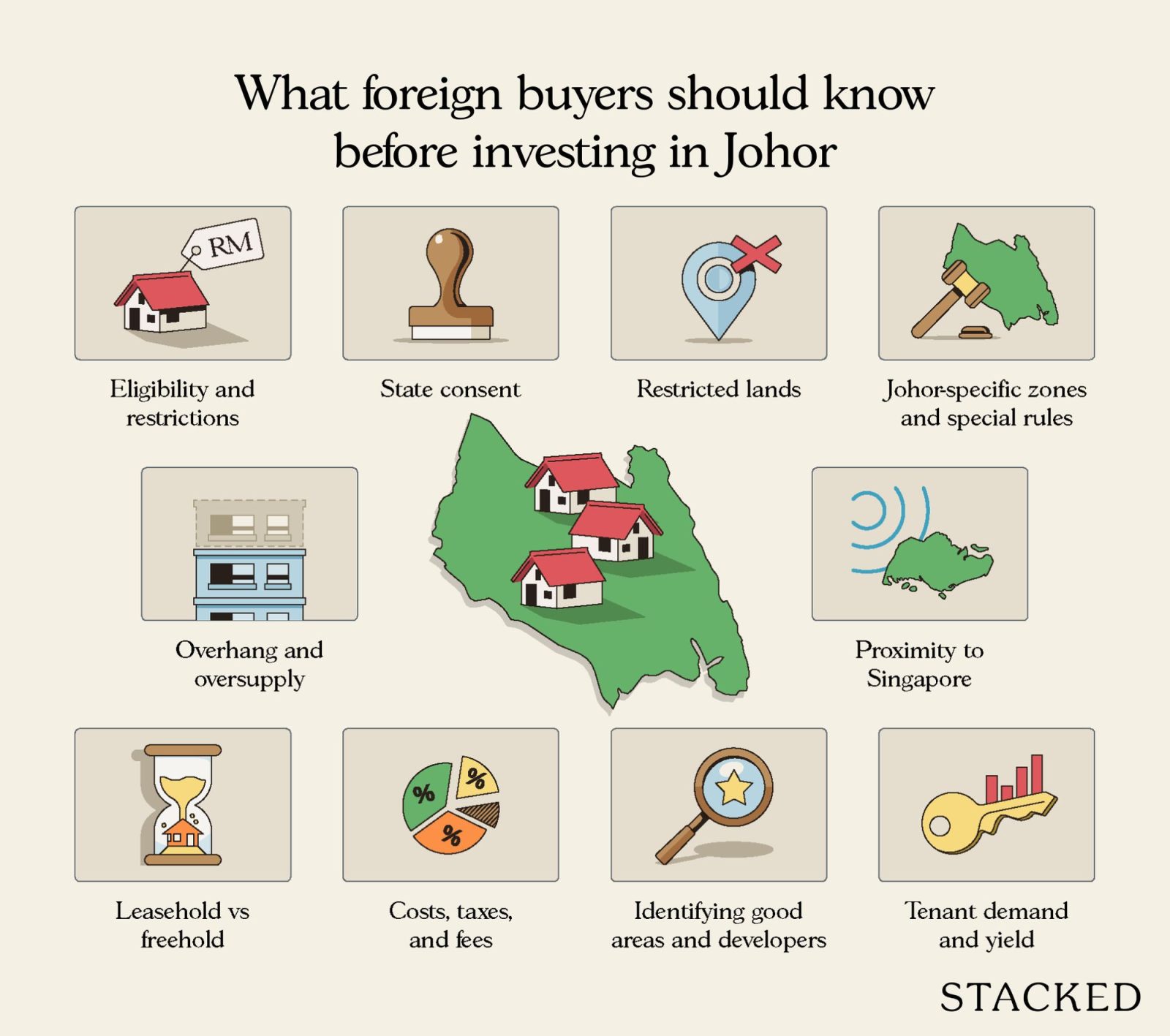

Here are 10 things investors should keep in mind if they plan to invest in Malaysia:

- Eligibility and foreign buyer restrictions

- State consent to purchase

- Restricted Land

- Johor-specific considerations

- Residential supply overhang and over-supply

- Properties in proximity to Singapore

- Leasehold vs freehold properties

- Costs involved in purchasing properties

- How to identify good properties in Johor

- Understanding tenant demand and rental yield

Price growth subdued and fragmented

Malaysia’s property market has recovered at a steady pace since the end of the Covid-19 pandemic, but price growth has been subdued and fragmented, except for some well-performing cities. Likewise, transaction volumes have recorded stable to moderate growth.

“Sales and investment demand in the Malaysian property market has been selective, with most buying demand focused on completed and well-located properties in major urban centres,” says Tan.

Residential properties in Johor have seen mixed performance but are showing signs of rejuvenation, especially since the second half of 2025, he says, and adds that Singaporean buyers have been a significant catalyst that have spurred demand for investment properties in Johor.

The announcement of the Johor-SG SEZ and Forest City Financial Zone also positively boosted investment sentiment and interest. But while the broad strokes of the economic zone across the Iskandar region made headlines last year, there’s a lot of details we still don’t know.

Until concrete master plans for each of the nine flagship zones and their anchor tenants are announced, investors will remain prudent before sinking capital into the wrong type of investment asset. This will be an important year for the Malaysian and Singapore governments to translate policy into tangible process for the SEZ. Only then will we see demand trends shift away from just sentiment driven.

In addition, rising construction costs in the Malaysian state have raised the price floor of most new launch projects there. The central bank of Malaysia, Bank Negara Malaysia, has also maintained stable OPR interest rates that contributed to manageable mortgage costs.

The relatively weaker Malaysian Ringgit (RM) against the Singapore Dollar (SGD) and US Dollar have also made the price of Malaysian real estate assets highly attractive for foreign investors. The RM reached a peak last year when it traded above 3.30 per SGD.

“In 2026, the currency dynamic will persist as long as the interest rate differential exists. Foreign buying demand, especially from Singapore and China, is expected to remain strong throughout this year,” says Tan.

Price limits, foreign buyer restrictions, and State consent

All this doesn’t mean you should hop across the Causeway and immediately start house hunting. Tan shares that there are significant procedural and cost barriers, which can be daunting for first-time foreign investors.

Take the market for landed properties in Johor. Over the years there have been stories about Singaporean’s who have bought bungalows and terrace homes there, commuting regularly to work in Singapore while benefiting from the lower cost of living in Johor.

But foreigners can only purchase properties above a State-specific minimum price, and in Johor, the threshold is RM1 million ($316,578) for landed properties like terraces, semi-detached homes, and bungalows. This limit also applies to serviced apartments.

In some cases, developers can apply to the state government to lower the threshold, in some instances to as low as RM500,000, says Tan. But foreign purchasers are still required to obtain approval from the State authority, a process which could take three to six months. This is a critical step and is not always guaranteed, he says.

If that wasn’t enough of a road bump, buyers have to pay a consent fee after receiving the approval. The fee, based on the purchase price, is 3% for non-industrial properties.

Oh, and don’t forget the registration fee. The minimum for residential and commercial properties is RM30,000, and if you’re buying a serviced apartment it increases to RM50,000.

Finally, a State Consent Application Fee is a flat rate of RM2,000 per property title and the appeal fee, should you fail, is RM3,000. “The State Consent Fee is mandatory for foreigners in most states. It’s not just a fee but a discretionary approval process. Fees vary by states, and it does add complexity, time, and upfront cost,” says Tan.

He adds that the process foreign buyers face in Johor to buy property is not insurmountable and necessitates proper budgeting and professional guidance. Indeed, the measures deter speculative ‘flipping’ by adding friction to the transaction process.

At the end of the day, if you’re spending hard earned money investing in a property market like Malaysia, you need to go in with a plan and not just hope that the relatively low prices today will automatically translate into gains down the road.

Forest City and the Johor-SG SEZ

The announcement of the Johor-SG SEZ, and plans to turn the multi-billion dollar Forest City development into an exclusive financial zone, have raised the area’s profile among some hopeful investors.

Attractive regulations also target foreign buyers who enjoy a 50% stamp duty remission when they purchase a property in Forest City. Real property gains tax is imposed on the chargeable profits when you sell the property in or after the fourth year of ownership, subject to conditions.

There’s been a marked increase in buyer enquiries, site visits, and primary market sales in Forest City and the surrounding Iskandar Puteri area since these announcements, says Tan. He adds that developers currently marketing new projects in the area are actively rebranding them to capitalize on the surge in interest.

“Foreign buyers are advised to understand factors like the project’s long-term viability, estimated occupancy rates, and the developer’s track record. The Johor-SG SEZ could boost certain areas, especially the industrial spaces and service apartments,” says Tan.

More from Stacked

How Purchase Timing Affects Returns In Mega Developments: A Case Study Of Treasure At Tampines

In this Stacked Pro breakdown:

In general, the minimum price threshold for foreign buyers in Forest City purchasing directly from the developer is RM500,000 to 600,000.

If you’re a MM2H holder, a long-term residency scheme in Malaysia for foreigners, you won’t be allowed to sell your property for 10 years and must buy directly from the developer, unless you’re upgrading an existing Malaysian property to one with a higher capital value.

But the specter of Forest City’s ‘ghost town’ image, and the failure of Chinese developer Country Garden, still lingers despite the Johor government’s strident effort to rebrand the waterfront area.

So, is it too soon to get into the area?

The timing depends on your risk profile, says Tan. Tolerant investors might see the early entry prices now as a path to high capital appreciation as the zone develops, especially since prices there are more affordable than mature precincts.

“For the risk-averse investors, it may be prudent to wait for concrete progress to de-risk the investment. The market here is nascent and reliant on successful policy implementation,” says Tan.

Oversupply in Johor’s residential market and identifying tenant demand

Johor has historically had an oversupply of high-end serviced apartments. This means investors must be highly selective when they shortlist properties.

Tan says that foreign buyers should avoid over-saturated suburban areas with poor transport connectivity. The supply situation also means that the resale market can be challenging outside prime, well-established areas.

“Any investment plan must include an analysis of your holding power. Assume a medium- to long-term horizon of five to 10 years, building a buffer to ride out market cycles and all surrounding infrastructure to mature,” he says.

In short, there’s no way your investment exit strategy can rely on speculative flipping.

The same cautionary tale goes for the rental market, and Tan says to plan for ‘rental voids’ with little to no catchment of tenants. “Consider an ‘upgrade’ strategy that starts with a smaller condo in a proven location, building equity over time, and later moving into a more premium asset, rather than expecting a quick high-return exit,” he says.

Areas near education hubs of industrial parks offer steady rental demand but lower yields due to competitive rents in the area.

Have realistic expectations, advises Tan. Gross yields of 4 to 5% are considered decent in Johor’s current market. “Johor’s property market is complex and cyclical. It offers high potential due to its Singapore adjacency but comes with specific risks like oversupply and policy shifts. Patience, thorough research, and professional guidance are the keys to a successful investment”.

Proximity to Singapore and finding good properties in Johor

Properties close to the Causeway and Second Link generally command a premium due to buying interest from Singaporeans and strong rental demand. Historically, capital from Singapore-based investors has been the top source of foreign real estate investment capital flowing into Johor, and this trend remains true today.

The lower property prices compared to housing in Singapore, affordable cost of living, and strong rental demand from Singapore commuters translate to high rental yields and significant capital appreciation. Cross-border activity is also booming in anticipation of the RTS, Johor-SG SEZ, and ETS link to Kuala Lumpur.

But this also makes them highly susceptible to cross-border policy changes. Ambitious cross-border projects have a strong tendency to get delayed, or the political winds in Malaysia may shift government priorities.

“Scope out areas with growth drivers and tangible infrastructure benefits. Proximity to cross-border connectors like the customs, immigration,and quarantine (CIQ) complex in Johor Bahru, RTS Link and ETS stations are good spots,” says Tan.

- Major employment hubs like Pasir Gudang Industrial Estate, Senai Airport City, SiLC Industrial Hub are also good choices.

- Established townships with mature amenities like Senibong Cove, Setia Tropika, Austin Height, Horizon Hills, Sutera Utama, Impian Emas are logical choices.

- It’s also good to go with established developers with a proven track record. Companies like Sunway, UEM Sunrise, IOI Properties, Genting Property Group, SP Setia, and Ecoworld stand out.

Leasehold vs freehold; Purchasing costs

The good news is that foreigners are allowed to buy freehold land, subject to the aforementioned restrictions like price thresholds. But most residential properties normally carry a 99-year leasehold tenure.

Just keep in mind that some properties do not have leasehold tenures, but are leases with ownership still held by the State government.

In general, the costs involved in purchasing properties amounts to approximately 4 to 6% of the purchase price. This includes legal fees for the Sale & Purchase Agreement and loan agreement, if any.

- Stamp duty is a tiered structure with a maximum of 4% of the property price or market value, whichever is higher.

- The mortgage stamp duty is 0.5% of the total loan amount. Real property gains tax is based on profit from the disposal of the property. For foreigners, it is a flat 30% if sold within 6 years.

- You can also expect most agents’ commissions to range between 2 to 3%, and is usually paid by the seller.

Other incidental costs that may creep up on you include a nominal fee for the state consent application, disbursements and miscellaneous costs for land search. Ongoing costs once you own a property include maintenance fees, sinking fund, quit rent, assessment tax and insurance.

How should you grow an investment portfolio in Johor?

Any good investment portfolio comprising Johor properties should feature a mix of mid to high-rise condos and serviced apartments in master planned developments that boast strong transport connectivity.

Some savvy investors eye the Iskandar Puteri area, banking on the area’s growth potential as a direct beneficiary of the Johor-SG SEZ and proximity to the Malaysia-Singapore Second Link. Zones around the upcoming RTS Link Terminal in Bukit Chagar also look to be future growth areas.

Alternatively, the Johor Bahru city centre features several established and mature areas with proven demand from Malaysians and Singaporeans.

“There will be intense competition in prime areas for well-priced, credible projects. Singaporean investors, local buyers, and even other foreign investors are actively searching for properties that meet these criteria,” says Tan.

There is a chance you could snag some early-bird discounts from developers, but be prepared to move quickly, he says. “Coming prepared with financing ready and a knowledgeable consultant is crucial.”

The Johor property market is at an inflection point, spurred by major cross-border projects and long-term policy initiatives. Tan advises first-time buyers and investors, as well as veterans, to have a clear understanding of the procedural landscape, and realistic financial planning with a long-term investment horizon.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

How old is the flat in Johor for foreign buyers?

What are the costs involved in buying property in Johor?

Can foreigners buy freehold land in Johor?

What should I consider before investing in Johor property?

Is it better to wait before investing in Forest City?

Timothy Tay

As Editor-in-Chief of Stacked, Timothy leads the newsroom and shapes our editorial direction, ensuring readers receive timely, thoughtful, and well-researched news and analysis. He brings over eight years of experience as a business and real estate journalist, with a strong track record across both print and digital platforms. His reporting spans luxury residential, commercial real estate, and capital markets, alongside in-depth coverage of sustainability and design.Need help with a property decision?

Speak to our team →Read next from Overseas Property Investing

Overseas Property Investing Savills Just Revealed Where China And Singapore Property Markets Are Headed In 2026

Overseas Property Investing What Under $200K Buys In Malaysia Today — From Freehold Apartments to Beachfront Suites

Overseas Property Investing A London Landmark Is Turning Into 975-Year Lease Homes — And The Entry Price May Surprise Singapore Buyers

Overseas Property Investing This Overlooked Property Market Could Deliver 12–20% Growth — But There’s a Catch

Latest Posts

Pro This 130-Unit Condo Launched 40% Above Its District — And Prices Struggled To Grow

Property Investment Insights These Freehold Condos Barely Made Money After Nearly 10 Years — Here’s What Went Wrong

Singapore Property News Why Some Singaporean Parents Are Considering Selling Their Flats — For Their Children’s Sake

0 Comments