How Buying A Condo With This Agent Resulted In A Huge $380k Loss For This Buyer

September 17, 2023

After all these years, the Option To Purchase still terrifies me.

If there’s a reason I’ll never be a property agent (besides having the persuasive power of a neurotic pigeon, that is), it will be the Option To Purchase (OTP). I’ve seen too many instances of things going wrong here:

From someone dying just after signing the OTP (preventing the surviving spouse from obtaining the loan), to loans coming through a single day late (causing the deposit to be forfeited), to people who don’t get in-principle approval before the OTP.

And now, I see even being conned by a corrupt property agent doesn’t excuse you from losing this deposit.

Liu Siyu – a former realtor who pocketed money from her clients – caused the transaction of a $1.9 million property to fall through. And in the Court’s ruling, it’s confirmed the seller (in this case the developer) has the contractual right to retain the 20 per cent deposit. That’s a loss of $380,000, on top of whatever damages were caused by the agent’s embezzlement. Last I checked, I could sell both kidneys and still not cover that deposit.

(Which, come to think of it, is quite the comment on runaway home prices)

But despite the serious financial consequences, I still meet people who treat the deposit like a minor formality. People who whip out cheque books before they even approach a bank, or wait until they have half-a-day left before finally exercising the OTP. Fortunately I’m not their property agent, because I feel a need for a Xanax prescription just watching them, let alone handling their transaction.

Take the OTP seriously, people. Because I assure you, the seller is very serious about keeping it if they can.

And as for corrupt property agents, once again, say it with me: don’t give the money directly to your agent. They’re not even supposed to handle it anyway. If cash for a transaction ends up in your agent’s personal account, something isn’t about to go wrong; something already has.

Then again, for some people OTP issues may now be moot

That’s because the number of HDB upgraders is dwindling. There are a number of factors behind this, but I think the last reader I spoke to described the situation in a very succinct way:

“We can’t afford your stupid condos anymore lah Ryan”

Hey, it’s not as if I’m the developer. If I were, all my projects would be reasonably priced*. But I agree with most of the reasons in the linked article: tighter loan limits, higher private home prices, rising interest rates, etc. There’s just one that’s missing:

Greater financial maturity.

I increasingly see people buying homes just to be, well, homes. Fewer retirement plans involve having a private property to sell – there’s more interest in other options, from laddering bonds to stock dividends. These days, more people ask me what I think about annuities, endowments, etc. as well as just property. I can’t actually answer that, as I’m not a financial planner (though as an unqualified non-expert, my retirement advice is to try and be born really rich).

More from Stacked

An RHB Analyst View Of The Singapore Property Market (Post Covid-19): A Recap

As we head into the second phase of the circuit breaker in Singapore, things are looking to be slightly more…

But in any case, I’m not against the notion of people seeing residential properties as plain old homes.

Don’t get me wrong, I still see a place for property investment; I just think it’s nice that more people will look at old walk-ups, quirky boutique condos, or odd fringe areas, and see value in them. It’s nice when not every property buyer’s plan ends with “…and then I will be a zillionaire”.

*And in Malaysia.

Meanwhile in other serious property news…

- After Ridout Road, a lot more people are curious about what SLA rents out. We spoke to someone who has rented a walk-up from them.

- We have some latest findings on leasehold versus freehold property. It works quite differently for landed than it does for condos; check this out.

- HDB maisonettes often make the million-dollar list; but we still find some owners who wish they’d bought something else.

- Can you still get a three-bedroom condo for $1.6 million or under in this day and age? Yes, yes you can. (And just like that, we brought back all the HDB upgraders).

- Some great new land plots are coming up, in this article where I previously made the mistake of writing “MacPherson” instead of Mountbatten. (I think I accidentally said that on the radio once too, so if you heard it, sorry. I don’t know why I keep making that mistake. Apologies).

Weekly Sales Roundup (04 September – 10 September)

Top 5 Most Expensive New Sales (By Project)

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| THE RESERVE RESIDENCES | $4,215,000 | 1625 | $2,593 | 99 yrs (2021) |

| PULLMAN RESIDENCES NEWTON | $3,623,400 | 1163 | $3,117 | FH |

| ONE BERNAM | $3,532,000 | 1421 | $2,486 | 99 yrs (2019) |

| NEU AT NOVENA | $3,333,120 | 1302 | $2,559 | FH |

| ENCHANT | $3,133,300 | 1087 | $2,882 | FH |

Top 5 Cheapest New Sales (By Project)

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| THE LAKEGARDEN RESIDENCES | $1,088,600 | 527 | $2,064 | 99 yrs (2023) |

| THE ARDEN | $1,304,000 | 721 | $1,808 | 99 yrs (1969) |

| GRAND DUNMAN | $1,404,000 | 549 | $2,558 | 99 yrs (2022) |

| THE MYST | $1,431,000 | 678 | $2,110 | 99 yrs (2023) |

| LENTOR HILLS RESIDENCES | $1,573,000 | 689 | $2,283 | 99 yrs (2022) |

Top 5 Most Expensive Resale

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| NASSIM PARK RESIDENCES | $14,000,000 | 3477 | $4,027 | FH |

| ELIZABETH TOWER | $5,250,000 | 2928 | $1,793 | FH |

| THE SHELFORD | $5,100,000 | 2411 | $2,115 | FH |

| THE IMPERIAL | $3,930,000 | 1733 | $2,268 | FH |

| CAIRNHILL CREST | $3,910,000 | 1733 | $2,256 | FH |

Top 5 Cheapest Resale

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| PRESTIGE LOFT | $608,000 | 377 | $1,614 | FH |

| SUITES @ PAYA LEBAR | $620,000 | 398 | $1,557 | FH |

| EDENZ LOFT | $660,000 | 420 | $1,572 | FH |

| THE INFLORA | $668,000 | 463 | $1,443 | 99 yrs (2012) |

| SELETAR PARK RESIDENCE | $708,000 | 527 | $1,342 | 99 yrs (2011) |

Top 5 Biggest Winners

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | RETURNS | HOLDING PERIOD |

| NASSIM PARK RESIDENCES | $14,000,000 | 3477 | $4,027 | $3,993,000 | 15 Years |

| THE SHELFORD | $5,100,000 | 2411 | $2,115 | $3,588,248 | 21 Years |

| COUNTRY GRANDEUR | $2,720,000 | 1442 | $1,886 | $1,800,000 | 28 Years |

| THE REGENCY AT TIONG BAHRU | $3,088,000 | 1281 | $2,411 | $1,688,000 | 14 Years |

| ONE DEVONSHIRE | $3,680,000 | 1216 | $3,025 | $1,440,720 | 14 Years |

Top 5 Biggest Losers

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | RETURNS | HOLDING PERIOD |

| URBAN VISTA | $810,000 | 549 | $1,476 | -$9,482 | 10 Years |

| SELETAR PARK RESIDENCE | $708,000 | 527 | $1,342 | $50,875 | 11 Years |

| PRESTIGE LOFT | $608,000 | 377 | $1,614 | $70,500 | 9 Years |

| KENSINGTON SQUARE | $950,000 | 614 | $1,548 | $77,000 | 10 Years |

| J GATEWAY | $950,000 | 517 | $1,839 | $81,000 | 10 Years |

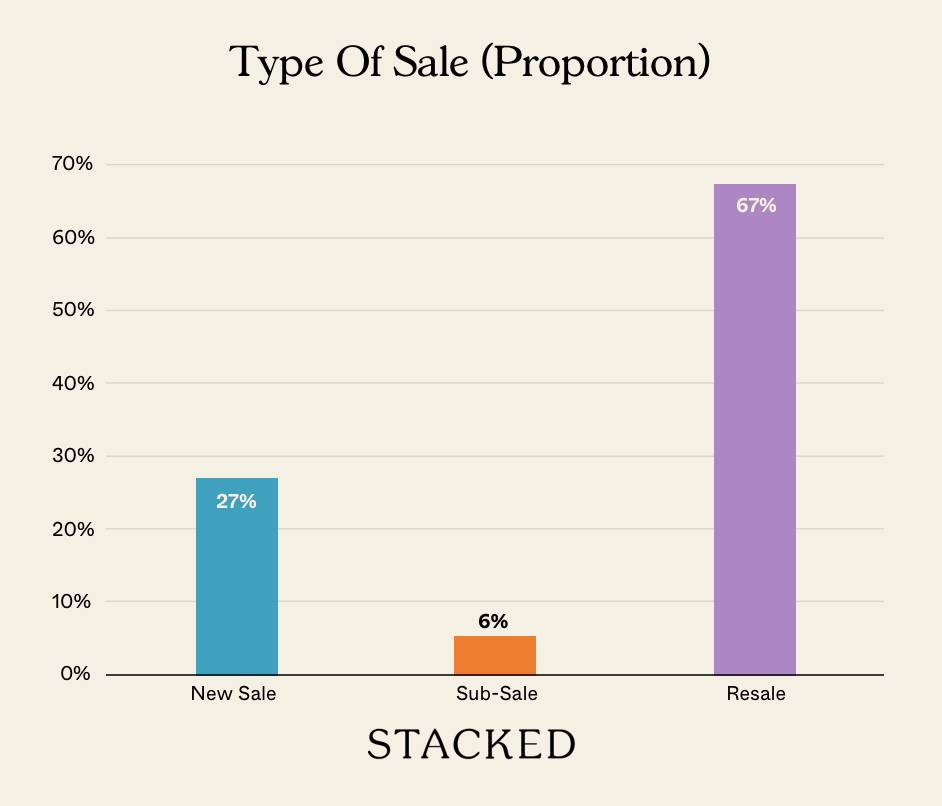

Transaction Breakdown

For more news and trends in the Singapore private property market, follow us on Stacked Homes.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

What are the risks of using the Option To Purchase when buying property?

How can buyers protect themselves from losing their deposit in property transactions?

Why are fewer people upgrading from HDB flats to private condos nowadays?

Are there still affordable three-bedroom condos available today?

What recent property market trends are highlighted in the article?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Singapore Property News

Singapore Property News Why Some Singaporean Parents Are Considering Selling Their Flats — For Their Children’s Sake

Singapore Property News Nearly 1,000 New Homes Were Sold Last Month — What Does It Say About the 2026 New Launch Market?

Singapore Property News The Unexpected Side Effect Of Singapore’s Property Cooling Measures

Singapore Property News The Most Expensive Resale Flat Just Sold for $1.7M in Queenstown — Is There No Limit to What Buyers Will Pay?

Latest Posts

Pro River Modern Starts From $1.548M For A Two-Bedder — How Its Pricing Compares In River Valley

New Launch Condo Reviews River Modern Condo Review: A River-facing New Launch with Direct Access to Great World MRT Station

On The Market Here Are The Cheapest 5-Room HDB Flats Near An MRT You Can Still Buy From $550K

0 Comments