How The HDB Resale Market Performed In 2025, And What It Means For 2026 Prices

December 30, 2025

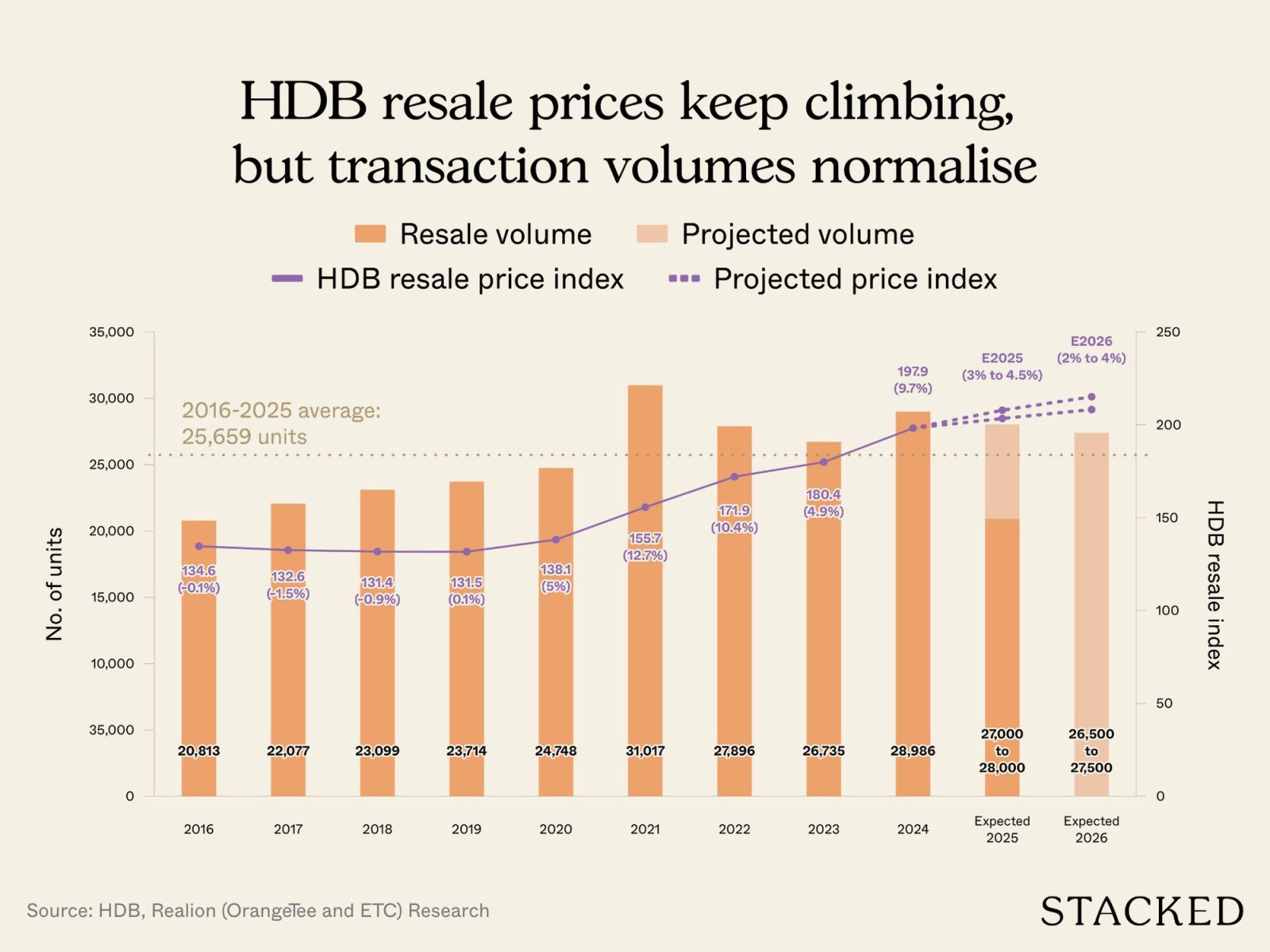

In 2025, most of the news headlines about the public housing market in Singapore were dominated by early signs that it would be a year of price moderation and market stabilisation after years of rapid price growth in the resale market.

As market watchers take stock of the performance of the HDB market this year, some expect that HDB resale prices could see the slowest yearly price increase in nearly six years.

Over the first nine months of 2025, the HDB resale market recorded an average price increase of 2.9%, a significantly weaker performance compared to the 6.9% price growth the market achieved during the first nine months of 2024, according to data compiled by PropNex Research.

Most market watchers, including agencies like PropNex Realty, Realion (OrangeTee & ETC), and Huttons Asia, expect HDB resale prices over the whole of 2025 to increase by about 3% to 4%.

This is a far cry from the recent yearly price performance of the HDB resale market.

| Year | HDB resale price index | Total number of transactions |

| 2020 | + 5% | 24,748 |

| 2021 | + 12.7% | 31,017 |

| 2022 | + 10.4% | 27,896 |

| 2023 | + 4.9% | 26,735 |

| 2024 | + 9.7% | 28,986 |

| 2025 (forecasted) | + 3% to + 4.5% | Approx. 28,000 |

| 2026 (forecasted) | + 2% to + 4% | Approx. 27,500 |

HDB resale market cools, but BTO and SBF sales heat up

An exceptionally strong supply of attractively located Build-to-Order (BTO) and Sale of Balance Flats (SBF) launched by the government in 2025 was behind the moderation in HDB resale prices this year.

Sellers in the HDB resale market faced stiff competition due to the strong line up of BTO projects offered this year, says Christine Sun, chief researcher and strategist at Realion (OrangeTee &ETC).

In 2025, the government offered 29,975 new public housing units for sale over three BTO and SBF sales exercises.

The Stacked editorial team covered the latest BTO sales exercise in October which comprised 9,144 flats across 10 projects in eight HDB towns. In addition to the wide mix of Prime, Plus, and Standard flats available, the October sales exercise debuted the first BTO project in the Greater Southern Waterfront, a long-term rejuvenation plan that stretches from Pasir Panjang to Marina East.

Overall, the three BTO and SBF sales exercises this year attracted more than 100,000 applicants, marking a three-year high. In comparison, previous sales exercises saw 82,000 applicants in 2024 and 80,000 applicants in 2023.

In total, the government has launched 102,433 BTO flats in the last five years, marking an annual average of about 20,487 flats. The last time the government significantly ramped up the supply of new flats was between 2011 to 2014 when 100,174 BTO flats were offered.

“When HDB increased the BTO supply from 2011 to 2014, HDB resale prices started to ease from 2013 to 2019. There are early signs that the pace of growth in HDB resale prices is beginning to taper off in 4Q 2025,” says Lee Sze Teck, senior director of data analytics at Huttons Asia.

Policy adjustments, and more Prime and Plus flats

Adjustments to some public housing policies have also been implemented to ease public housing demand from singles and second-timer families. Since October 2024, singles are allowed to purchase two-room Flexi BTO flats in all locations, and singles buying two-room Flexi flats near or with their parents get priority. The allocation of BTO flats set aside for second timer families was increased by five percentage points.

HDB is also adapting to the lifestyle needs and housing preferences of young couples and families, with a growing number of new flats that offer flexible floor plans that facilitate customisation, observes Sun.

Likewise, HDB seems to be responding to calls from BTO applicants for more housing options in popular areas. “We expect more Prime and Plus flats to be released for sale in sought-after areas like Mount Pleasant, Greater Southern Waterfront, and Bayshore. These projects may draw buyers away from the resale market in prime locations,” says Sun.

If the government is successful in completing most of these new BTO projects within a relatively short time, it would be a game-changer since immediate occupancy is a key advantage that resale flats have over BTO projects.

On the demand side, policy measures such as the lowered loan-to-value (LTV) limits for HDB loans to 75% are also likely to keep resale demand and prices in check, says Wong Siew Ying, head of research and content at PropNex.

Top HDB resales of 2025

Turning back to the HDB resale market, despite the broad moderation in price growth this year, new price highs continue to be set in the last twelve months.

The most expensive resale flat, in terms of absolute price, sold this year was a 1,313 sq ft, five-room flat at SkyTerrace @ Dawson which changed hands for an eye-watering $1.659 million ($1,263 psf) in June.

More from Stacked

CapitaLand–UOL’s $1.5 Billion Hougang Central Bid May Put Future Prices Above $2,500 PSF

A consortium of developers comprising CapitaLand Development, CapitaLand Integrated Commercial Trust, and UOL Group have submitted the top bid of…

According to transaction data, the unit is a Premium Apartment Loft that is located between the 22nd and 24th floors. SkyTerrace @ Dawson is located on Dawson Road in District 3 in Queenstown. The nearly ten-year-old development comprises five 43-storey blocks.

While this is an impressive sale, the record in the HDB resale market is still held by the sale of a 1,915 sq ft, five-room flat at nearby SkyOasis @ Dawson which fetched a record $1.73 million ($1,444 psf) when it was sold last July.

| HDB Town | Unit Type | Street | Unit Size (sq ft) | Year Completed | Price ($) |

| Queenstown | Five-room | Dawson Road | 1,312 | 2016 | 1,658,888 |

| Bishan | Five-room | Bishan St 24 | 1,291 | 2011 | 1,632,000 |

| Bishan | Executive | Bishan St 12 | 1,753 | 1987 | 1,600,000 |

| Central Area | Five-room | Cantonment Rd | 1,129 | 2011 | 1,600,000 |

| Toa Payoh | Five-room | Lor 1A Toa Payoh | 1,258 | 2012 | 1,600,000 |

Meanwhile, the second-most expensive HDB resale transaction this year was a 1,291 sq ft, five-room flat at Natura Loft which sold for $1.632 million ($1,264 psf) in November. Natura Loft is a 480-unit development along Bishan Street 24, and was constructed under the now-defunct Design, Build, and Sell Scheme.

This year, we also covered the sale of a 1,022 sq ft, four-room flat in Natura Loft that transacted for $1.25 million ($1,223 psf). Read our coverage of this sale, and how much profit the sellers could have made, here.

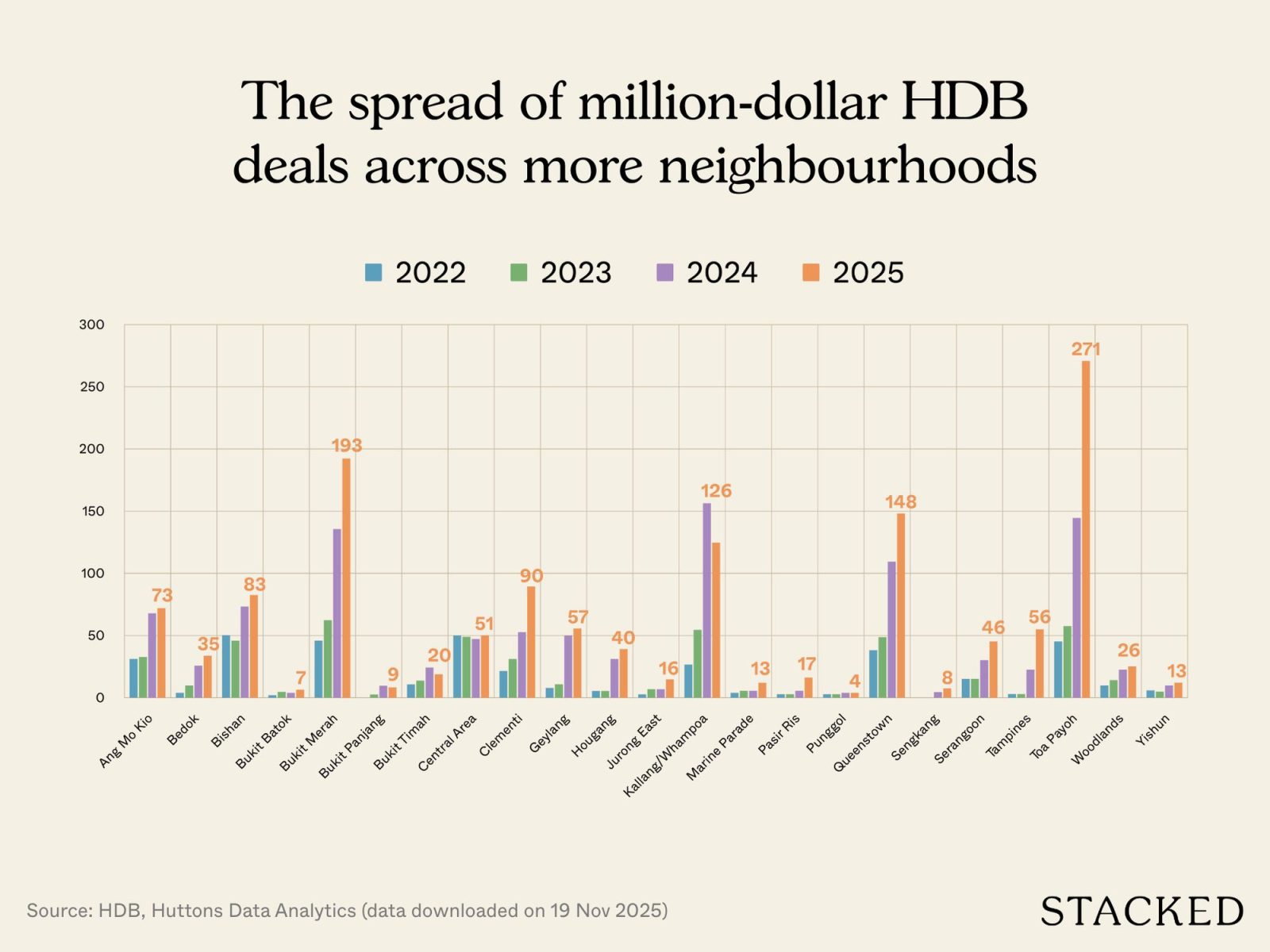

Record number of million-dollar flats

The number of resale flats transacting for over a million dollars in 2025 is expected to jump by nearly 50%, with about 1,550 of these deals expected to be lodged and far exceeding last year’s record of 1,035 units.

Toa Payoh saw the greatest number of million-dollar deals this year with 283 of these transactions as of 4 December 2025. The top five HDB towns based on the number of million-dollar resale flat deals this year are:

- Toa Payoh: 283

- Bukit Merah: 205

- Queenstown: 158

- Kallang/Whampoa: 134

- Clementi: 96

Source: HDB, PropNex Research

So far, Choa Chu Kang, Jurong West, and Sembawang have yet to record the sale of a million-dollar flat. A closer examination reveals that certain locations attracted a high number of million-dollar deals:

- Bidadari Park Drive: 83

- Dawson Rd: 59

- Cantonment Rd: 49

- Clementi Ave 3: 45

- Lor 1A Toa Payoh: 44

- Alkaff Cres: 39

- Boon Tiong Rd: 38

- Circuit Road: 36

- St George’s Lane: 34

- Lor 1 Toa Payoh: 32

- Boon Keng Rd: 32

Source: HDB, PropNex Research

Most of the million-dollar transactions in the HDB resale market were flats in centrally located areas, had fulfilled their minimum occupation period (MOP) a few years earlier, and were less than 10 years old, observes Lee of Huttons Asia. He adds that flats in this category made up 32% of the million-dollar deals recorded this year.

In general, the average price of flats that fetched a million dollars and higher in 2025 was $1.14 million, which is 1.8% higher compared to the average price of $1.12 million set last year.

“Compared to 2024 where there were several benchmark prices, there was a lower number of benchmark prices set (this year). This may suggest some form of price resistance (has started to set in) among buyers,” says Lee.

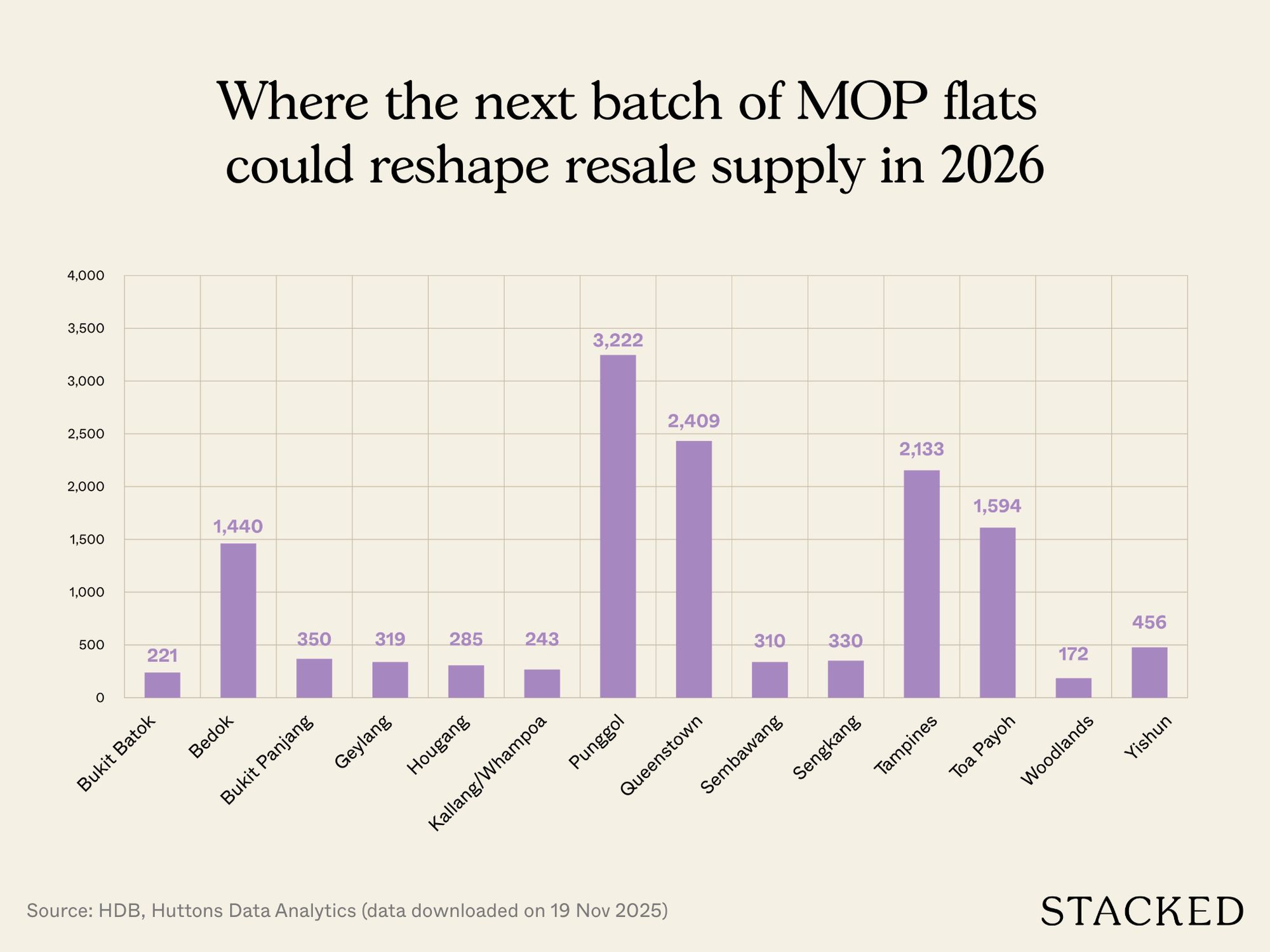

Bumper crop of MOP flats in 2026

In the year ahead, the number of flats expected to attain their MOP is expected to significantly influence the HDB resale market.

A bumper crop of nearly 13,500 flats is expected to fulfil their five-year MOP next year; a significant increase compared to the nearly 8,000 MOP flats that were eligible to enter the resale market this year.

About 60% of the MOP flats next year are in mature estates. The three HDB towns with the greatest number of MOP flats entering the market next year are Punggol (3,222 flats), Queenstown (2,409 flats), and Tampines (2,133 flats).

The government will also continue its drive to offer more BTO projects in the upcoming sales exercises in 2026 and 2027. It previously announced that about 55,000 BTO flats will be launched between 2025 and 2027.

This means that 35,277 BTO flats will be offered in 2026 and 2027 – a yearly average of about 17,600 units.

A more favourable interest rate environment will also help to improve some homeowner’s mortgage costs next year, says Sun of Realion (OrangeTee & ETC). “More HDB owners have already switched to private home loans, which are lower than HDB loan rates,” she says.

Overall, the HDB resale market in 2026 will be characterised by a moderate price growth, a high supply of new flats, a bumper crop of MOP flats, prevailing property cooling measures, and the settling in of some price resistance among prospective buyers, says Wong of PropNex.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Timothy Tay

As Editor-in-Chief of Stacked, Timothy leads the newsroom and shapes our editorial direction, ensuring readers receive timely, thoughtful, and well-researched news and analysis. He brings over eight years of experience as a business and real estate journalist, with a strong track record across both print and digital platforms. His reporting spans luxury residential, commercial real estate, and capital markets, alongside in-depth coverage of sustainability and design.Need help with a property decision?

Speak to our team →Read next from Editor's Pick

Editor's Pick Happy Chinese New Year from Stacked

Property Market Commentary How I’d Invest $12 Million On Property If I Won The 2026 Toto Hongbao Draw

Overseas Property Investing Savills Just Revealed Where China And Singapore Property Markets Are Headed In 2026

Property Market Commentary We Review 7 Of The June 2026 BTO Launch Sites – Which Is The Best Option For You?

Latest Posts

Singapore Property News This Tampines EC Will Preview on Friday — It Is One of Two New ECs in the East in 2026

Property Investment Insights This 55-Acre English Estate Owned By A Rolling Stones Legend Is On Sale — For Less Than You Might Expect

Singapore Property News I’m Retired And Own A Freehold Condo — Should I Downgrade To An HDB Flat?

1 Comments

It’s time that HDB revise the income thrash hole for families applying for HDB BTO. The current income ceiling of $14,000/ isn’t practical considering the higher cost of living at the present day. Hopefully the government should be more realistic in today’s Singapore families who need to struggle with children to cope with the expenses to support the whole family whereby both husband and wife have to work.