I Own A 55-Year-Old HDB Flat, But May Have To Sell — Can I Realistically Buy A Freehold Condo With $700K?

December 10, 2025

I am at a state of not knowing what is the next step. My husband, who is a Singapore citizen, just passed away recently. I am a Singapore PR and married to him for more than 30 years; I turn 60 this year. We stay in a two-bedroom HDB flat which is already 55 years old, and it is under both of our names; but fully paid for using my CPF. I love this flat as it is our home and has many memories for me, and I had not thought I would need to move out. But friends around me are telling me that:

(1) this old flat is not worth staying as its lease has decayed – only 40+ years left

(2) as a PR to a deceased Singapore citizen (without children, as they have married overseas and are now non-Singaporeans); I may be forced to sell the flat.

So in the event that I am ordered to sell the flat, I started looking for an alternative. Given my age and not having an income, I think I can only afford to purchase a one-bedroom. I do prefer freehold, but know that it may be out of my reach. I have an available budget of $700,000. I am quite lost and reaching out to get some advice.

Hi there,

First of all, we’re really sorry to hear about what you’re going through. Losing your husband and facing uncertainty about your home at the same time is incredibly difficult, and we hope our advice can offer you some clarity as you weigh your next steps.

The first priority would be to clarify your situation with HDB. Under the usual rules, when a joint owner passes away, the surviving owner will usually inherit the flat through the right of survivorship. However, inheriting the flat and being allowed to retain it could be separate matters. Based on HDB’s published eligibility conditions, a single PR owner would typically not qualify to hold an HDB flat on their own; however, it’s worth calling the HDB hotline to verify this in light of your situation.

HDB is known to be flexible when there are extenuating circumstances, and appeals are heard on a case-by-case basis. We recommend writing in to HDB and, if needed, speaking with an MP, if you feel the best course is to hold on to your flat.

But should you decide to sell, or are not able to keep the flat, here’s a look at your possible moves:

We’ll begin by looking at the average transacted prices of 3-room flats aged 54 to 56 years, within the first three quarters of 2025. This is to give us a sense of how much you might possibly get, if you really have to sell the flat:

| Street | Average price |

| BEO CRES | $376,578 |

| C’WEALTH CRES | $376,000 |

| CIRCUIT RD | $340,562 |

| HAVELOCK RD | $386,944 |

| HO CHING RD | $329,143 |

| JLN BAHAGIA | $315,300 |

| JLN BATU | $366,600 |

| JLN BT HO SWEE | $397,000 |

| JLN DUA | $353,333 |

| JLN KLINIK | $386,378 |

| JLN RUMAH TINGGI | $328,667 |

| LOR 1 TOA PAYOH | $396,939 |

| LOR 2 TOA PAYOH | $419,792 |

| LOR 3 TOA PAYOH | $385,000 |

| LOR 4 TOA PAYOH | $412,000 |

| LOR 5 TOA PAYOH | $375,000 |

| LOR 6 TOA PAYOH | $337,750 |

| LOR 7 TOA PAYOH | $363,379 |

| MEI LING ST | $429,053 |

| OLD AIRPORT RD | $348,333 |

| STIRLING RD | $374,857 |

| TAMAN HO SWEE | $361,333 |

| TAO CHING RD | $313,667 |

| TOA PAYOH EAST | $367,161 |

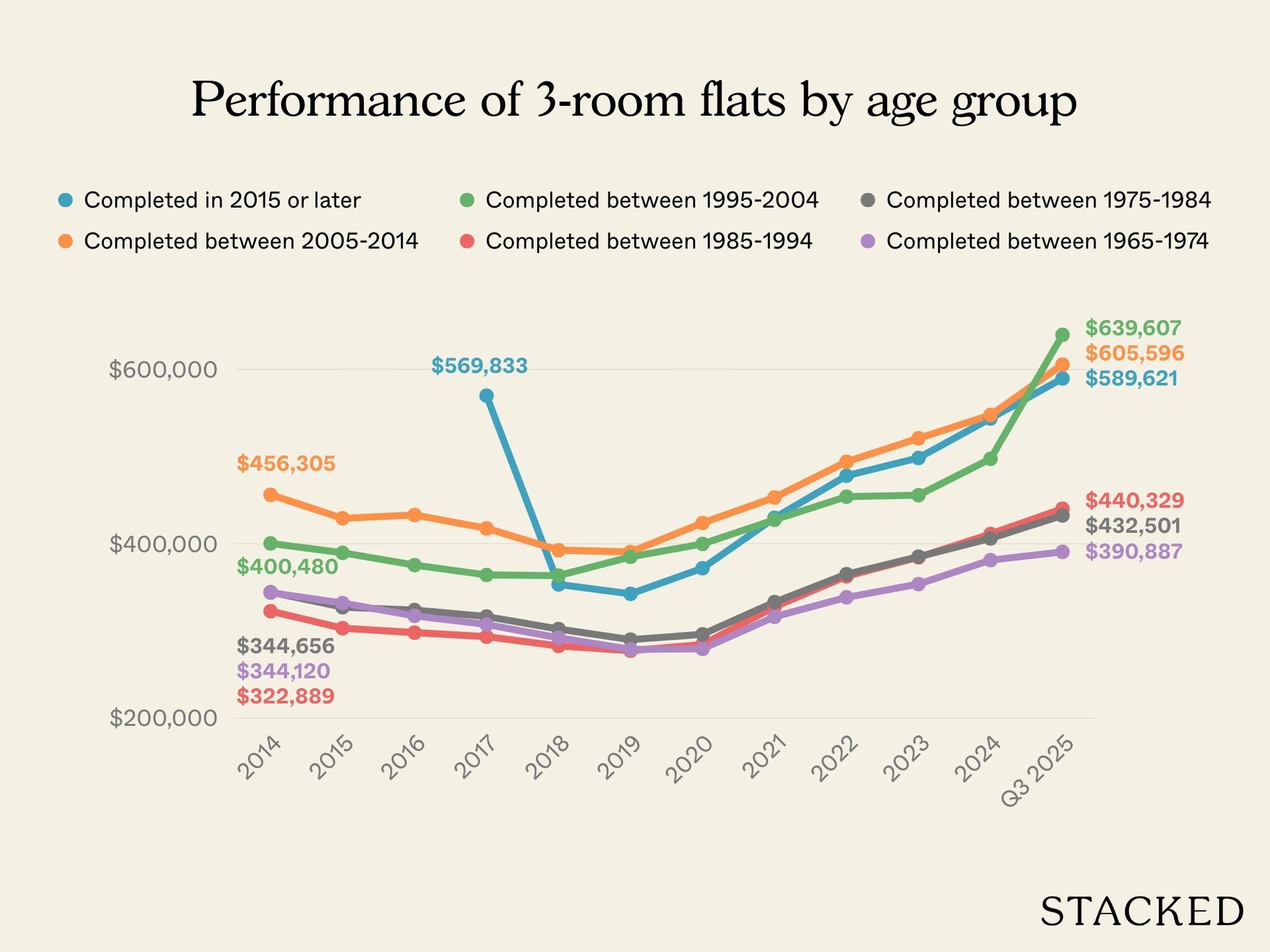

Now let’s look at the price movements of these flats in different age groups over time, so we can forecast the outcome of holding on to the flat later:

| Year | Completed in 2015 or later | Completed between 2005 – 2014 | Completed between 1995 – 2004 | Completed between 1985 – 1994 | Completed between 1975 – 1984 | Completed between 1965 – 1974 |

| 2014 | $456,305 | $400,480 | $322,889 | $344,656 | $344,120 | |

| 2015 | $429,267 | $389,765 | $303,312 | $327,437 | $332,123 | |

| 2016 | $433,080 | $375,710 | $298,278 | $324,217 | $317,491 | |

| 2017 | $569,833 | $417,820 | $364,395 | $293,590 | $316,694 | $307,603 |

| 2018 | $353,548 | $392,832 | $363,603 | $283,001 | $302,399 | $292,325 |

| 2019 | $342,736 | $390,739 | $385,079 | $277,590 | $290,224 | $279,096 |

| 2020 | $372,060 | $423,930 | $399,996 | $284,633 | $296,270 | $279,601 |

| 2021 | $429,792 | $453,204 | $427,648 | $327,775 | $333,165 | $316,444 |

| 2022 | $478,105 | $494,072 | $454,068 | $362,846 | $365,240 | $338,669 |

| 2023 | $498,504 | $521,074 | $455,879 | $384,607 | $385,327 | $353,861 |

| 2024 | $543,813 | $547,653 | $497,466 | $411,273 | $406,235 | $381,420 |

| 2025 (Up to Q3) | $589,621 | $605,596 | $639,607 | $440,329 | $432,501 | $390,887 |

Here it is in visual form:

You may notice that all the flat prices have been going up since 2020. This is something that happened across the whole housing market because there was a housing shortage in the years following COVID.

Nonetheless, even though average prices rose during the pandemic, the growth rates for older 3-room flats have noticeably slowed. Before COVID-19, older flats also tended to see sharper price dips compared to younger ones, which reflects increasing concern over lease decay.

The sharp dip in prices for the youngest 3-room flats is mainly due to transaction patterns. In 2017, only six units in Queenstown were sold – pushing the average price up. In 2018, however, more transactions took place, including sales in the outskirts, which brought the overall average down.

From what we’re seeing, current prices appear close to their peak, especially for ageing flats; so this may be a reasonable window to sell, if you’re already leaning toward that option.

However, this is with the caveat that an older 3-room flat is not the easiest property to sell. The remaining lease will narrow the prospective pool of buyers. Younger buyers face prorated loan amounts, CPF usage limits, and reduced CPF grants if a flat’s remaining lease plus their age does not add up to 95 years.

This can mean a higher cash or CPF outlay if they want to buy your older flat, which can deter them. Given the unit size, your most likely buyers would be singles or older couples who are right-sizing in their retirement years. This is a more niche buyer pool compared to family buyers.

So if it ends up that you’re allowed to keep the flat (fingers crossed), that may actually be the better outcome for your situation. After all, your home is fully paid up, your monthly expenses remain low (conservancy fees are much lower than condo maintenance fees), and you can allocate your remaining funds toward a more comfortable retirement, rather than paying for a pricier property.

But let’s say you do sell the flat; in that case, let’s continue with the key factors:

Important things to understand if you sell the flat

According to CPF’s rules:

“If you are aged 55 and above and selling your current flat, the CPF refunds will first be used to top up your Retirement Account (RA) up to your Full Retirement Sum (FRS). The remaining refunds will be retained in your Ordinary Account (OA).”

Based on your current age of 60, the Full Retirement Sum stands at $181,000. This means that when you sell your existing flat, any CPF monies you used to buy the flat – together with the accrued interest – will first be refunded to your CPF account. This money will first be channelled into your RA until it reaches the FRS of $181,000.

Any amount above that will flow into your OA, and those OA funds can then be used for your next property purchase.

(If you’re not sure how much CPF you used when buying the flat, you can log in to your CPF account via SingPass and check the amount.)

As we currently don’t know how much CPF you previously used for the flat though, we can’t predict your available cash-in-hand after you make your CPF refund. But you mentioned an available property budget of $700,000, so we can explore what this price range typically offers today.

Potential options

You did mention you prefer freehold, so below are some 999-year/freehold projects where studio or one-bedders have transacted below $700,000. This is based on sales recorded in the first three quarters of 2025.

| Project | Average price | District | Average unit size (sqft) – based on transactions done | No. of units in project |

| GRANDVIEW SUITES | $590,000 | 14 | 409 | 52 |

| PRIME RESIDENCE | $602,888 | 14 | 398 | 39 |

| TREASURES @ G20 | $627,500 | 14 | 420 | 38 |

| GLASGOW RESIDENCE | $635,000 | 19 | 431 | 31 |

| CENTRA RESIDENCE | $640,000 | 14 | 398 | 78 |

| EDENZ SUITES | $648,000 | 14 | 474 | 34 |

| SUNNY LODGE | $650,000 | 14 | 398 | 20 |

| TREASURES@G6 | $650,000 | 14 | 409 | 39 |

| CENTRA STUDIOS | $655,229 | 14 | 388 | 51 |

| THE OCTET | $660,000 | 14 | 431 | 56 |

| PARK RESIDENCES KOVAN | $661,500 | 19 | 355 | 41 |

| SUITES @ SIMS | $662,000 | 14 | 348 | 48 |

| SUNSHINE LOFT | $662,000 | 15 | 366 | 10 |

| SUITES @ EUNOS | $668,888 | 14 | 366 | 28 |

| SUITES @ KOVAN | $674,444 | 19 | 382 | 17 |

| MELOSA | $675,000 | 14 | 431 | 54 |

| SUITES @ PAYA LEBAR | $675,000 | 19 | 388 | 99 |

| VIBES@UPPER SERANGOON | $675,000 | 19 | 399 | 60 |

| NESS | $680,000 | 14 | 431 | 62 |

| SUITES AT BUKIT TIMAH | $680,000 | 21 | 366 | 71 |

| PRESTIGE HEIGHTS | $680,429 | 12 | 369 | 154 |

| SILVERSCAPE | $686,000 | 14 | 431 | 45 |

| OPAL SUITES | $687,333 | 12 | 431 | 20 |

| D’WEAVE | $688,000 | 14 | 398 | 71 |

| SUITES@ KATONG | $688,000 | 15 | 409 | 51 |

| D’ ALMIRA | $692,000 | 13 | 463 | 25 |

| CITY LOFT | $692,963 | 8 | 384 | 40 |

| 91 MARSHALL | $696,500 | 15 | 377 | 30 |

| ISUITES @ PALM | $697,500 | 19 | 447 | 64 |

| THE VUE | $697,500 | 19 | 436 | 50 |

| IDYLLIC SUITES | $699,000 | 14 | 431 | 71 |

| SUITES@CHANGI | $699,000 | 14 | 441 | 44 |

One thing to note is that many of these are smaller boutique projects, with fewer than 100 units. This has some potential drawbacks to watch out for:

- Maintenance fees can be higher for boutique projects. This is simply because there are fewer households to split the maintenance cost (e.g., 50 units splitting the cost makes it much pricier than 500 units splitting the cost, even if the facilities are fewer).

- Boutique projects tend to have less land space, so facilities may not be as extensive.

- Price appreciation might not match larger projects, as transaction volumes tend to be lower, and boutique condos tend to be less well known on the market.

- Prices for boutique projects can be volatile for the same reason: a low transaction volume. If the previous unit before yours sold for a very low or very high price, the value of your unit can be impacted accordingly (so this can be good or bad).

On the upside, at least a boutique condo is more private and exclusive. You can check out a few more concerns here.

Next, let’s look at how 999-year/freehold one-bedder condos have performed over the past 10 years. This will give you some sense of what to expect if you ever sell later. We’re only going to look at resale and subsale transactions here, not new sales (as developer discounts could distort the data):nts could distort the data):

| Year | Average $PSF |

| 2015 | $1,500 |

| 2016 | $1,435 |

| 2017 | $1,480 |

| 2018 | $1,548 |

| 2019 | $1,490 |

| 2020 | $1,425 |

| 2021 | $1,506 |

| 2022 | $1,555 |

| 2023 | $1,717 |

| 2024 | $1,748 |

| 2025 (Up to Q3) | $1,749 |

| Annualised | 1.55% |

For the sake of comparison, here’s how 99-year leasehold one-bedders perform, so you can compare:

| Year | Average $PSF |

| 2015 | $1,384 |

| 2016 | $1,729 |

| 2017 | $1,550 |

| 2018 | $1,509 |

| 2019 | $1,472 |

| 2020 | $1,493 |

| 2021 | $1,495 |

| 2022 | $1,584 |

| 2023 | $1,709 |

| 2024 | $1,756 |

| 2025 (Up to Q3) | $1,807 |

| Annualised | 2.70% |

So while your preference is freehold, do take note that leasehold one-bedders outperform the freehold ones on average. This is partly because a leasehold property is cheaper, and thus has more room to appreciate.

Whether a development performs well depends on many other factors besides tenure; such as its size, the unit mix within the project, the surrounding supply in the neighbourhood, etc. So a well-located leasehold project can outperform a freehold boutique development, which is something to consider before deciding to pay more for freehold.

If you are willing to consider leasehold, here are some 99-year condos with one-bedders that are under $700,000

| Project | Average price | District | Average unit size (sqft) – based on transactions done | No. of units in project | Completion year |

| PEOPLE’S PARK COMPLEX* | $613,750 | 1 | 409 | 288 | 1972 |

| PARC ROSEWOOD | $665,894 | 25 | 454 | 689 | 2014 |

| THE INFLORA | $676,695 | 17 | 468 | 396 | 2016 |

| PARC OLYMPIA | $684,444 | 17 | 495 | 486 | 2015 |

| STRATUM | $689,500 | 18 | 479 | 380 | 2016 |

| HEDGES PARK CONDOMINIUM | $690,400 | 17 | 484 | 501 | 2015 |

*We include People’s Park Complex more for completeness, as it is within the budget range. But unless you really like Chinatown or living near the CBD, this is really more of a commercial building than a residential one. It’s also very old compared to the others.

Assuming a purchase price of $700,000 (to be fully paid), this is the calculation breakdown:

| Purchase price | $700,000 |

| Buyer’s Stamp Duty (BSD) | $15,600 |

| Additional Buyer’s Stamp Duty (ABSD)* | $35,000 |

| Legal fees | $3,000 |

| Total cost | $753,600 |

As you are currently a PR, ABSD is payable. For your first property as a PR, the ABSD rate is five per cent of the purchase price.

But if your total budget is capped at $700,000 including all fees, then the allowable purchase price must be reduced. A more workable benchmark is then around $650,000.

| Purchase price | $650,000 |

| Buyer’s Stamp Duty (BSD) | $14,100 |

| Additional Buyer’s Stamp Duty (ABSD)* | $32,500 |

| Legal fees | $3,000 |

| Total cost | $699,600 |

Besides these, it is important to consider the monthly recurring fees, as you mentioned you don’t have an income. Here’s a look at the rough recurring fees if you can keep the flat, versus the fees for the condo:

HDB Flat:

| Service and conservancy fees | $73 (assuming the normal rate instead of the reduced rate) |

| Property tax | $22 |

| Total cost | $95 |

Condo:

| Monthly outgoings for the property | |

| Maintenance fees | ~$150 – $300 (depending on the project you purchase) |

| Property tax | $43 |

| Total cost | ~$193 – $343 |

What should you do?

To be blunt, the maintenance fees alone are a good reason to keep the flat instead, if you’re allowed to do so. Retaining your HDB flat is the safer route, whichever way one looks at it.

Your flat is already fully paid for, and the monthly expenses are very low. Keeping the flat also allows you to preserve your available funds for other needs, like adding to a retirement portfolio, maintaining a comfortable standard of living, or just having peace of mind at retirement.

We would try for this first, and if your initial appeal is unsuccessful, don’t be discouraged; many homeowners in similar situations have received approval only after subsequent appeals, or after speaking with their MP. Do try more than once.

If retaining the flat really isn’t possible, then with a budget of around $700,000 (or $650,000 + ABSD), you can still purchase a one-bedroom unit in a condo, as shown above.

As for which specific projects to consider, it would be best to work with a property agent familiar with your budget. Give them your preferred locations and requirements, and they can shortlist suitable developments and guide you through the process.

Do also remember to check with CPF on how much of your refunded CPF funds can be used for the next property purchase; especially if you have included these funds in your $700,000 budget. This will ensure you have an accurate understanding of your true budget, which you’ll need before buying.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Property Advice

Property Advice We Can Buy Two HDBs Today — Is Waiting For An EC A Mistake?

Property Advice I’m 55, Have No Income, And Own A Fully Paid HDB Flat—Can I Still Buy Another One Before Selling?

Property Advice We’re Upgrading From A 5-Room HDB On A Single Income At 43 — Which Condo Is Safer?

Property Advice We’re In Our 50s And Own An Ageing Leasehold Condo And HDB Flat: Is Keeping Both A Mistake?

Latest Posts

Pro This Singapore Condo Has Bigger Units Near The MRT — But Timing Decided Who Made Money

Editor's Pick Happy Chinese New Year from Stacked

Singapore Property News Nearly 1,000 New Homes Were Sold Last Month — What Does It Say About the 2026 New Launch Market?

0 Comments