Have DBSS Flats Outperformed Regular HDBs? We Analysed The Data

February 3, 2025

When the Design, Build, and Sell Scheme (DBSS) was around, there were a lot of negative comments. Complaints about poor finishing, and excessively high prices, meant the scheme was short-lived: we saw only 13 DBSS projects enter the market before the entire scheme was suspended. And yet, DBSS flats today often set new price records, despite their initially rocky reception. This has given rise to the question: have DBSS flats reliably outperformed “regular” flats? We took a look at the results so far:

A quick note on the DBSS flats

For those who aren’t clear about what we’re talking about, please see this article for an explanation of DBSS projects. We’ve also included a list of all 13 DBSS projects there. As a quick summary: DBSS flats were built by private developers but are HDB flats (and will never be privatised). They have unique layouts not common to many HDB flats, such as high ceilings and picture windows, but they do not have condo facilities like pools or private security.

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

Overall performance between DBSS and regular flats:

| Estate | Project | Type | Lease | 3 ROOM | 4 ROOM | 5 ROOM | 3 ROOM | 4 ROOM | 5 ROOM |

| ANG MO KIO | Park Central @ AMK | DBSS | 2011 | $926,097 | $1,098,779 | ||||

| ANG MO KIO | City View @ Cheng San | Non-DBSS | 2002 | $783,250 | $962,315 | -15.4% | -12.4% | ||

| CLEMENTI | Trivelis | DBSS | 2014 | $622,981 | $921,091 | $1,221,667 | |||

| CLEMENTI | Clementi Ridges | Non-DBSS | 2017 | $679,445 | $979,945 | $1,196,850 | 9.1% | 6.4% | -2.0% |

| HOUGANG | Parkland Residences | DBSS | 2014 | $560,000 | $769,182 | $924,800 | |||

| HOUGANG | Hougang Capeview | Non-DBSS | 2016 | $513,500 | $702,668 | $852,678 | -8.3% | -8.6% | -7.8% |

| HOUGANG | Hougang ParkEdge | Non-DBSS | 2017 | $493,800 | $643,400 | $788,752 | -11.8% | -16.4% | -14.7% |

| HOUGANG | Hougang Parkview | Non-DBSS | 2015 | $632,657 | $834,833 | -17.7% | -9.7% | ||

| JURONG WEST | Lake Vista @ Yuan Ching | DBSS | 2014 | $533,250 | $694,985 | $843,343 | |||

| JURONG WEST | Corporation Tiara | Non-DBSS | 2015 | $598,000 | $734,500 | -14.0% | -12.9% | ||

| JURONG WEST | Yung Ho Spring I | Non-DBSS | 2019 | $446,154 | $614,140 | -16.3% | -11.6% | ||

| JURONG WEST | Yung Ho Spring II | Non-DBSS | 2019 | $456,958 | -14.3% | ||||

| JURONG WEST | Yung Kuang Court | Non-DBSS | 2018 | $588,918 | $711,761 | -15.3% | -15.6% | ||

| KALLANG/WHAMPOA | City View @ Boon Keng | DBSS | 2011 | $1,072,286 | $1,243,583 | ||||

| KALLANG/WHAMPOA | Bendemeer Light | Non-DBSS | 2017 | $792,000 | $986,243 | -8.0% | |||

| PASIR RIS | Pasir Ris ONE | DBSS | 2015 | $621,875 | $780,535 | $914,563 | |||

| PASIR RIS | Costa Ris | Non-DBSS | 2015 | $538,489 | $720,189 | $832,571 | -13.4% | -7.7% | -9.0% |

| TAMPINES | Centrale 8 At Tampines | DBSS | 2014 | $624,000 | $814,925 | $950,254 | |||

| TAMPINES | Parc Lumiere | DBSS | 2011 | $822,099 | $896,818 | ||||

| TAMPINES | The Premiere @ Tampines | DBSS | 2008 | $758,500 | $922,801 | ||||

| TAMPINES | Tampines GreenLeaf | Non-DBSS | 2015 | $527,972 | $741,974 | $888,000 | -15.4% | -9.0% | -6.6% |

| TOA PAYOH | The Peak @ Toa Payoh | DBSS | 2012 | $765,444 | $1,037,037 | $1,371,097 | |||

| TOA PAYOH | Toa Payoh Crest | Non-DBSS | 2018 | $783,574 | $1,083,364 | 2.4% | 4.5% | ||

| TOA PAYOH | Lor 2 Toa Payoh | Non-DBSS | 2006 | $905,447 | $1,086,852 | -12.7% | -20.7% | ||

| YISHUN | Adora Green | DBSS | 2013 | $542,878 | $737,987 | $871,296 | |||

| YISHUN | Floral Spring | Non-DBSS | 2015 | $555,333 | $669,300 | -24.8% | -23.2% | ||

| YISHUN | Jade Spring 1 | Non-DBSS | 2012 | $460,000 | $581,761 | -15.3% | -21.2% | ||

| YISHUN | Park Grove @ Yishun | Non-DBSS | 2018 | $608,049 | $737,563 | -17.6% | -15.3% | ||

| YISHUN | Dew Spring @ Yishun | Non-DBSS | 2013 | $445,500 | $567,773 | -17.9% | -23.1% |

For the above, the green highlights show where regular HDB flats have transacted at a discount compared to DBSS counterparts.

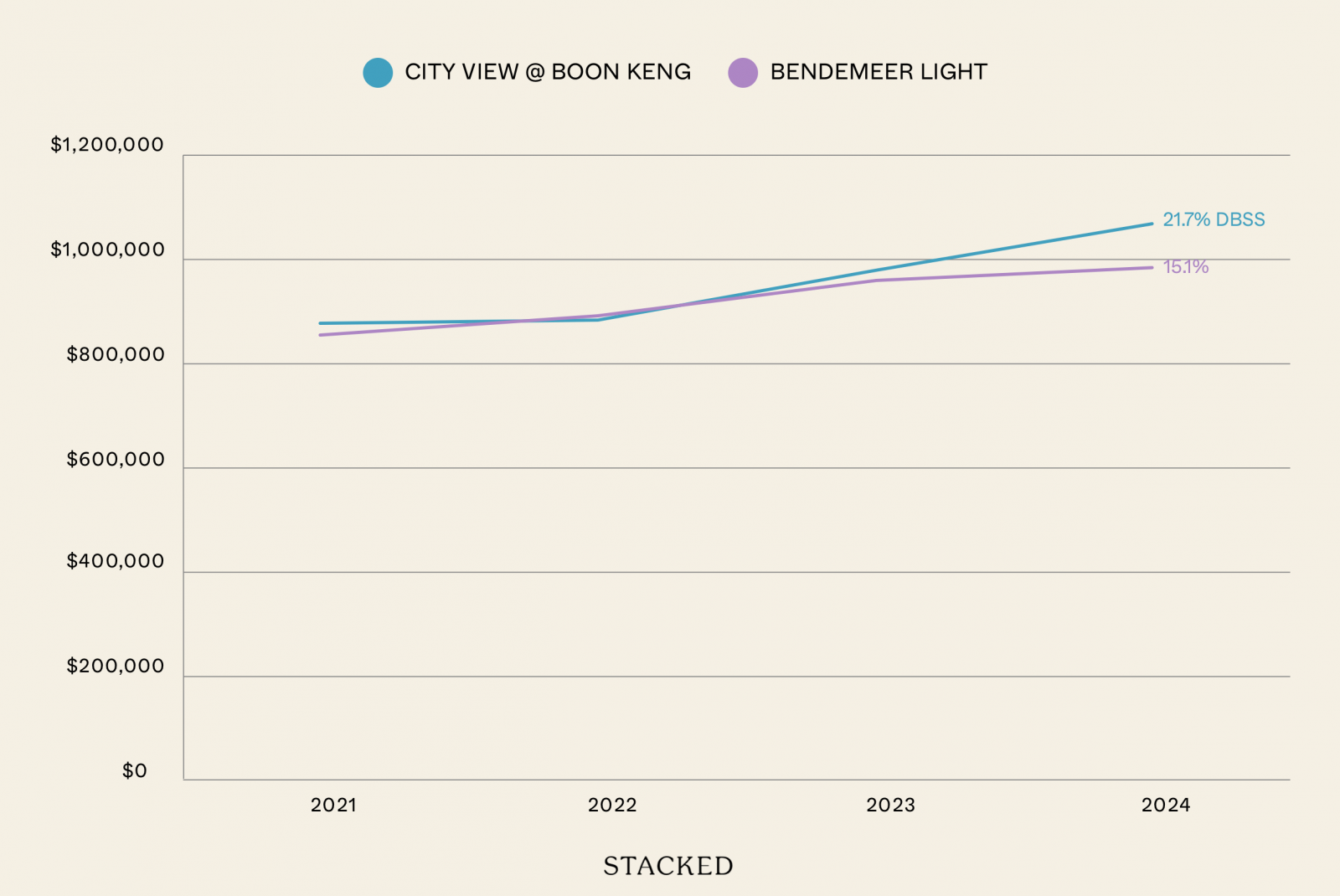

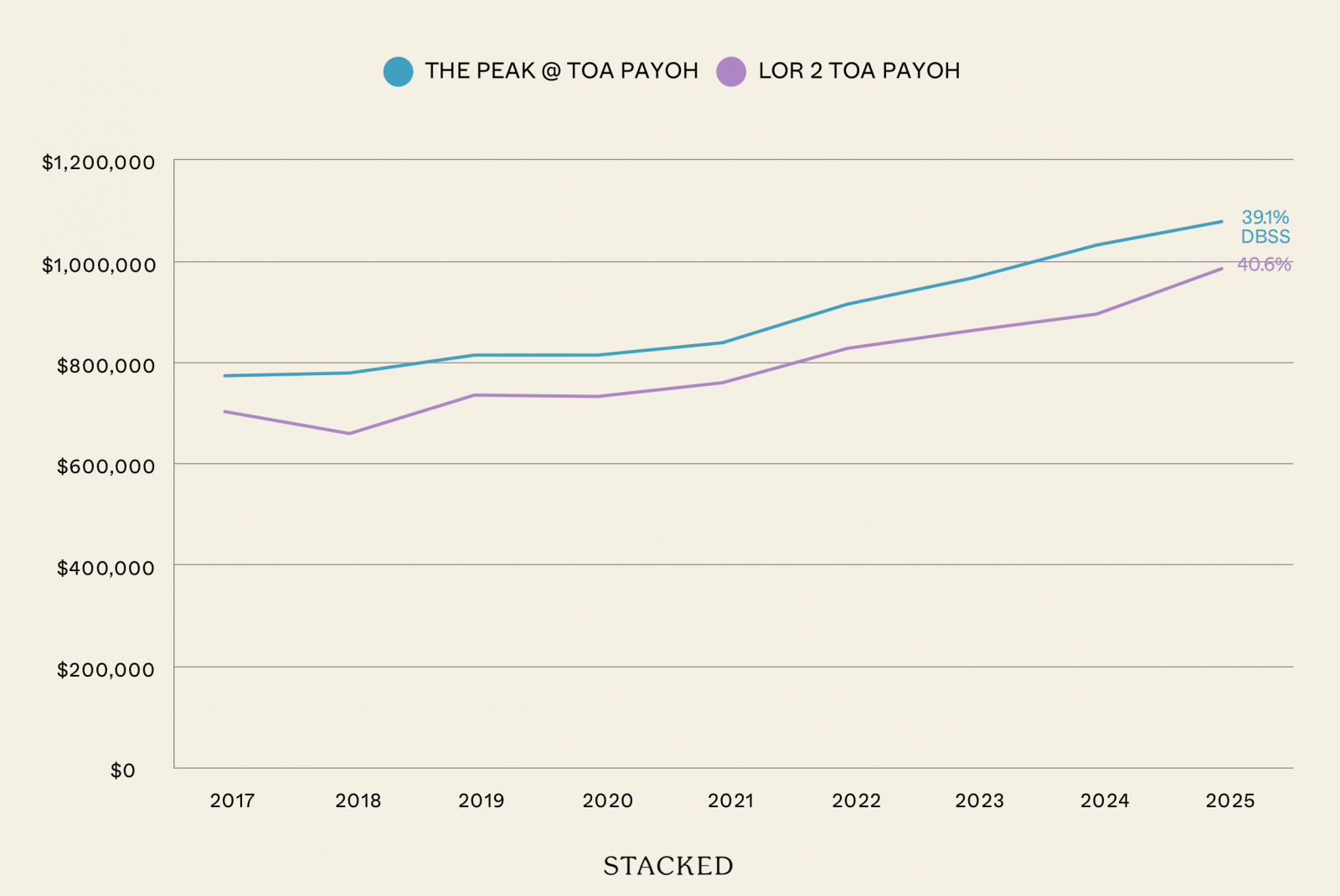

In general, we see that DBSS flats command higher absolute prices than their regular counterparts (obviously). This is evident in comparisons such as City View @ Boon Keng (DBSS) vs. Bendemeer Light (non-DBSS), where City View fetched $84,757 more, despite being six years older. Over in Toa Payoh, The Peak @ Toa Payoh (DBSS) outperformed Toa Payoh Crest (non-DBSS) by $55,221, again despite being six years older.

In most cases, DBSS costs more for the equivalent flat type. The only exception is when we compare Clementi Ridges (which was controversial as it launched just months after the DBSS with a larger size and lower cost) and Toa Payoh Crest. But we’ll delve further into this below.

Let’s look at comparisons by specific estates:

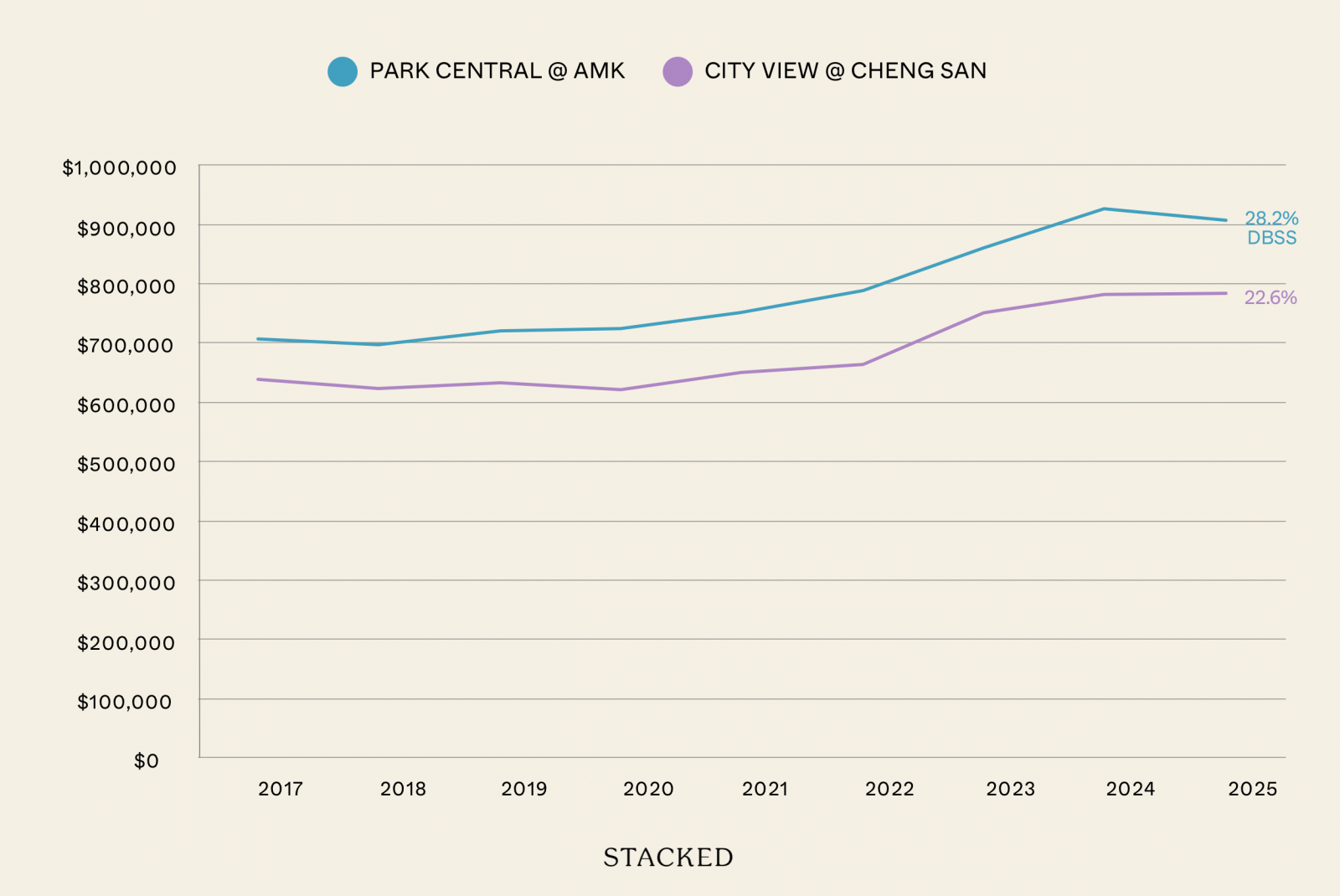

Ang Mo Kio

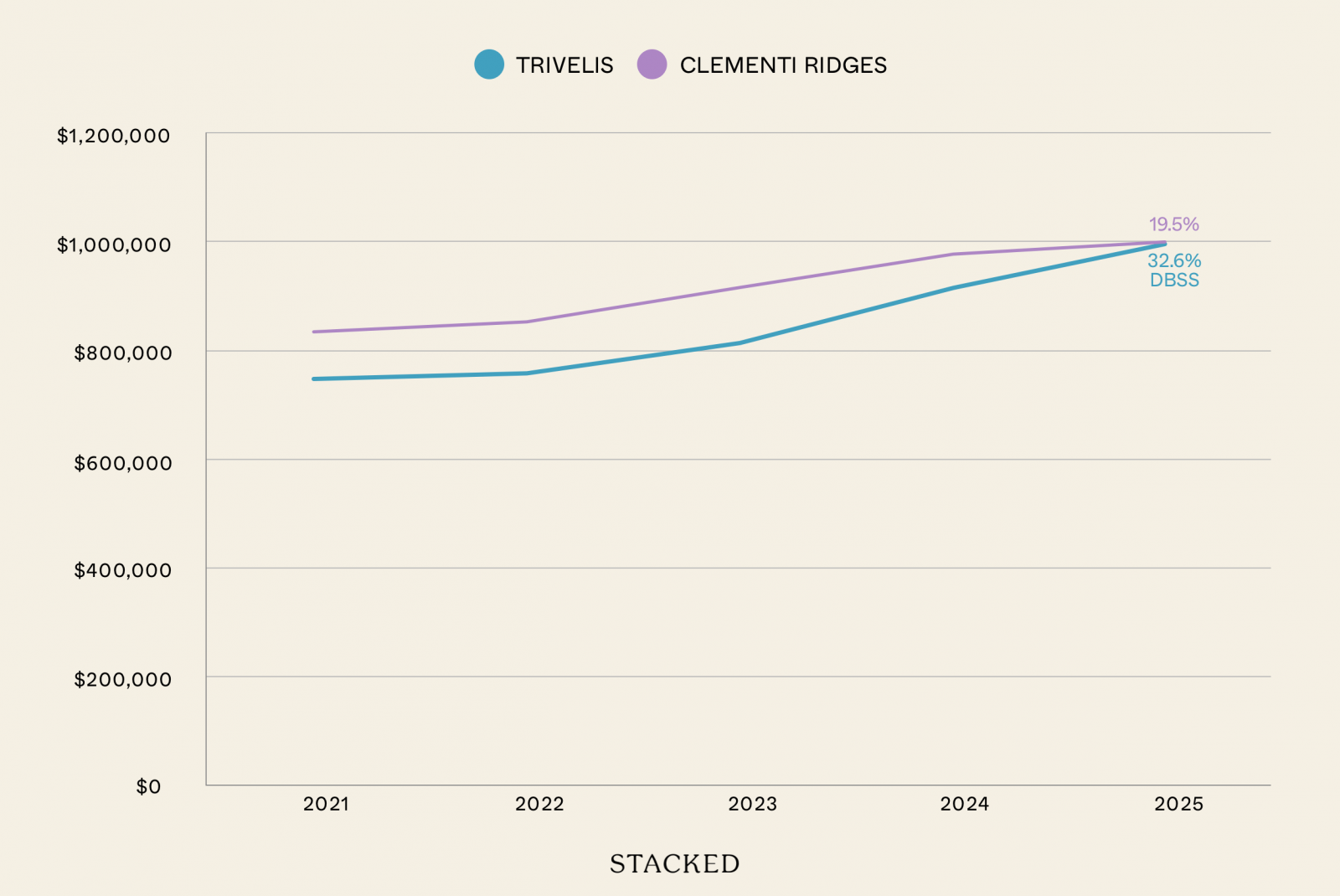

Clementi

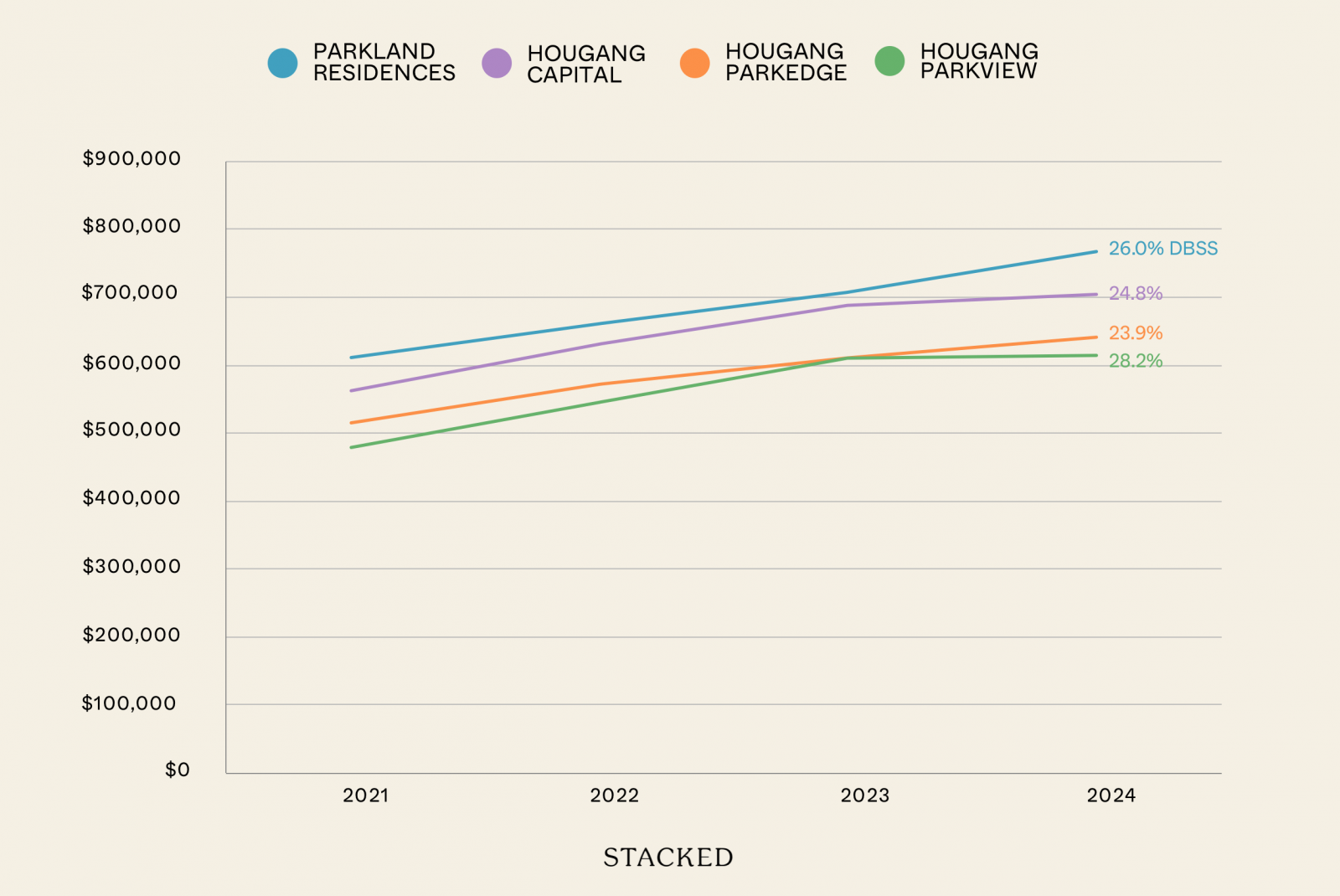

Hougang

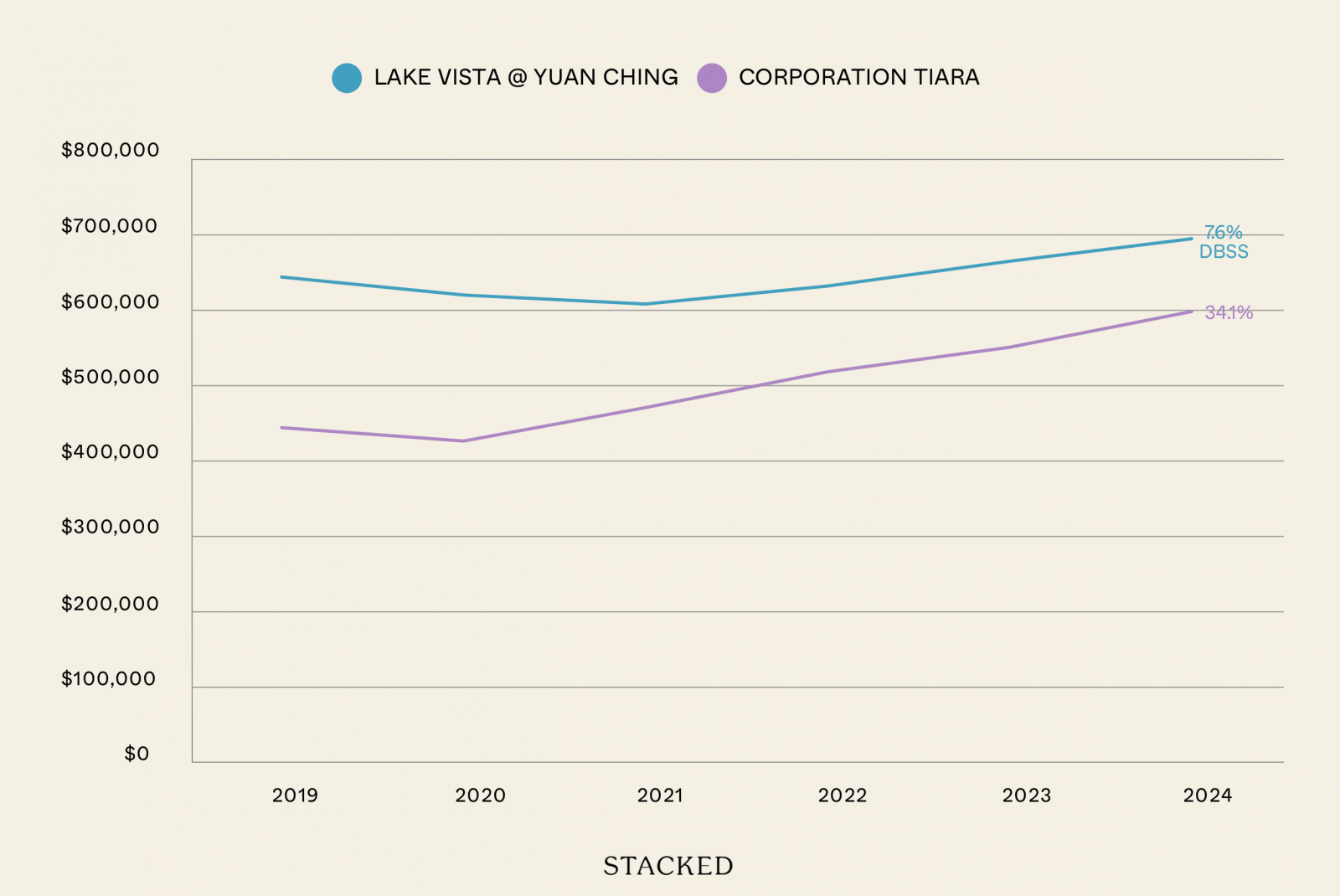

Jurong West

Kallang/Whampoa

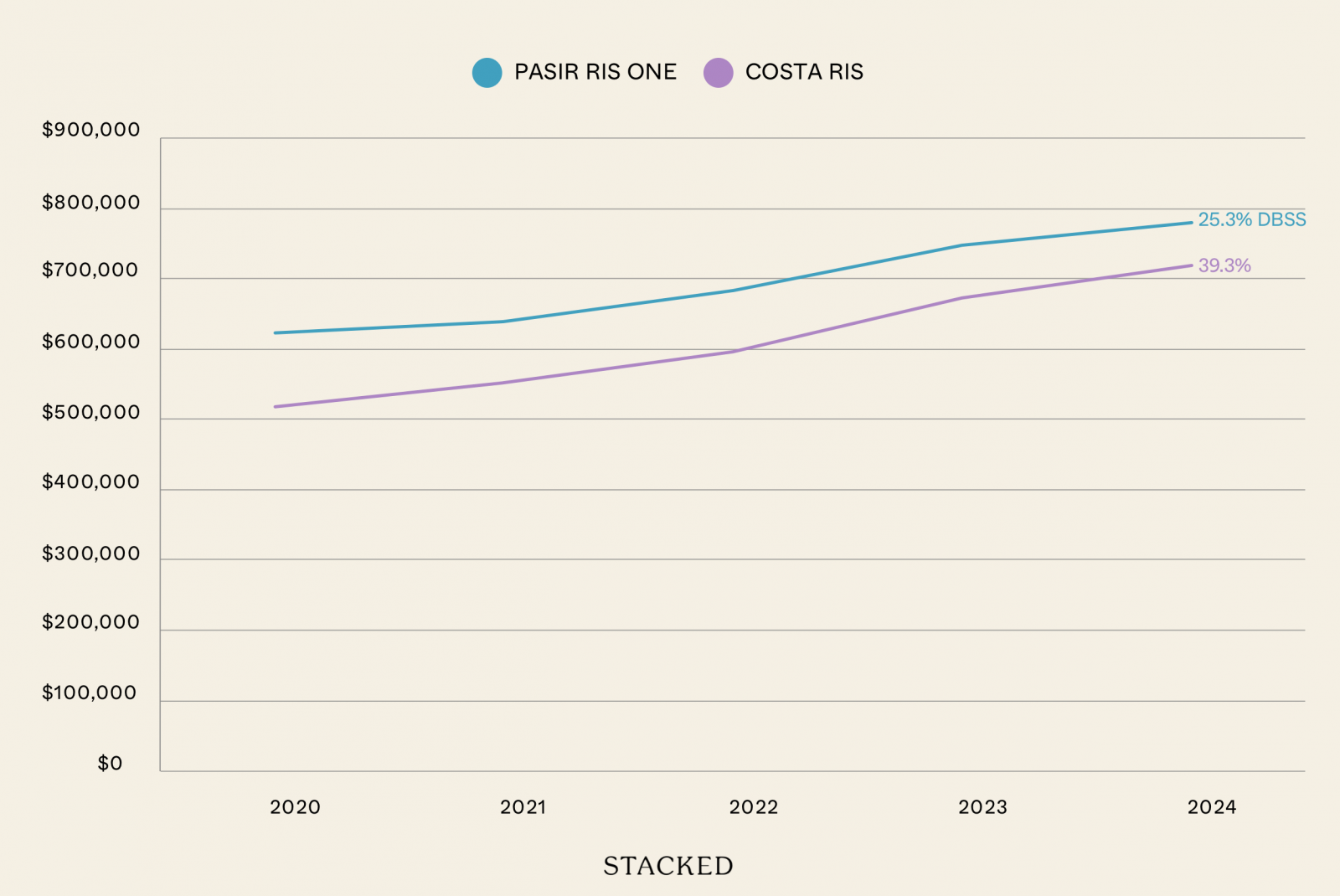

Pasir Ris

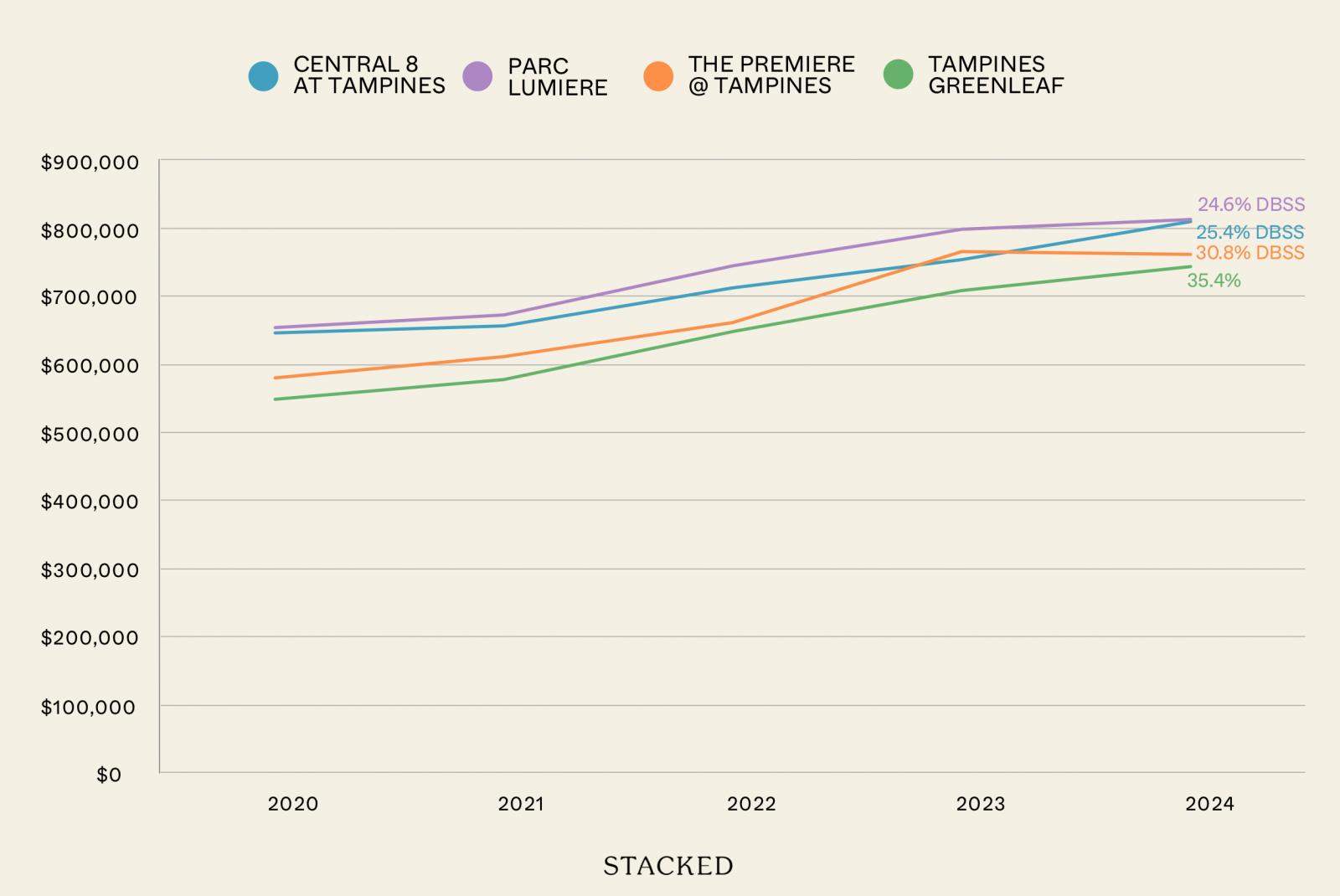

Tampines

Toa Payoh

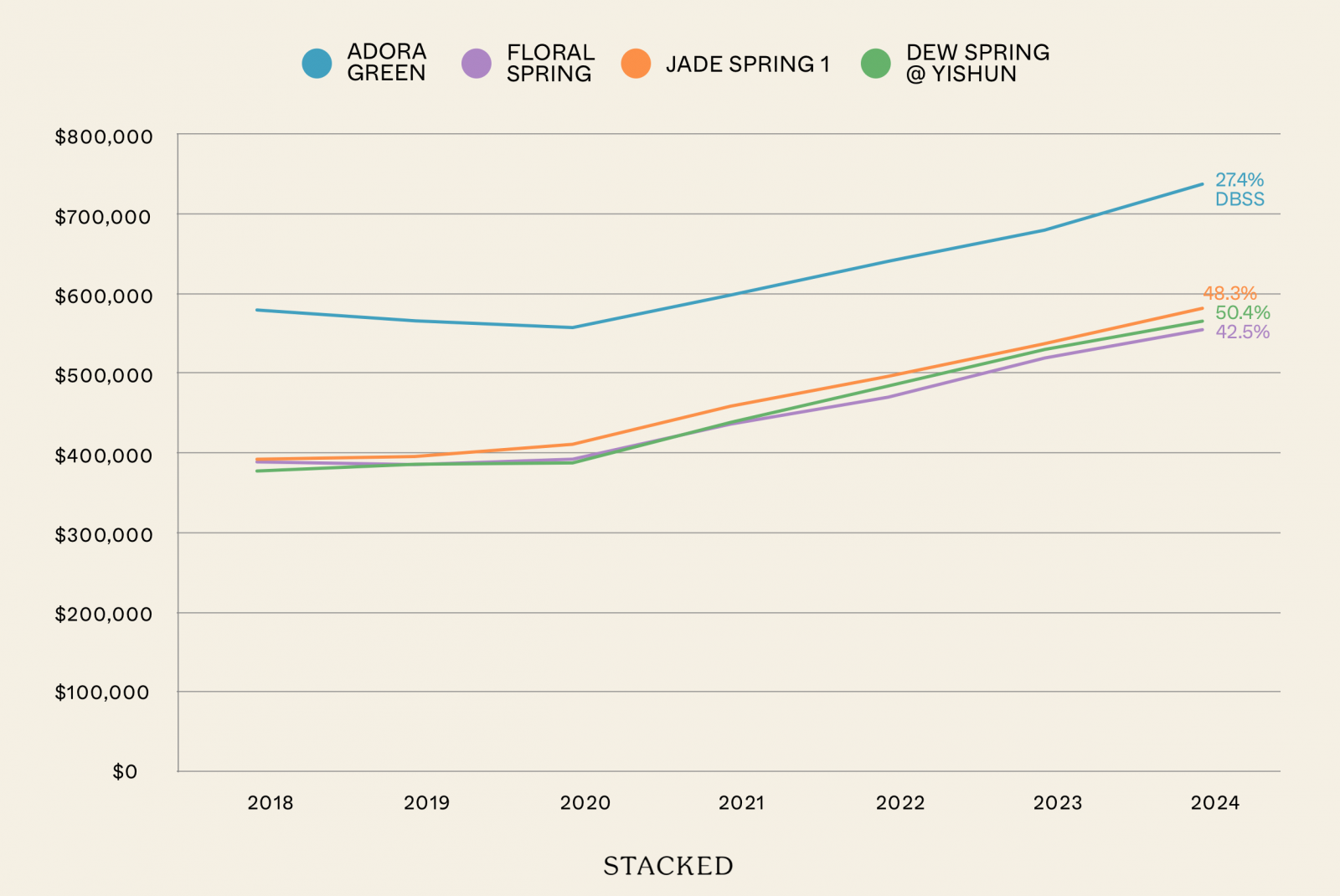

Yishun

Note: We ran into some unavoidable issues here. Namely, not all estates had both DBSS and regular flats launched in the same year; so the start and end dates for our comparisons varied. In addition, some projects had too few transactions and would skew our results; so we had to exclude them in the interest of fair comparisons.

When we compare specific estates, it’s less clear-cut which ones performed better. The price appreciation varies significantly across locations. Some non-DBSS flats, such as Costa Ris in Pasir Ris (+39.3%) and Tampines GreenLeaf (+35.4%), outperformed DBSS counterparts in the same estate.

In contrast, DBSS projects like Trivelis in Clementi (+32.6%) and The Premiere @ Tampines (+30.8%) showed stronger growth than nearby non-DBSS flats.

This is also a good time to explain the special cases of Trivelis versus Clementi Ridges, and other instances where DBSS seemed to lose out

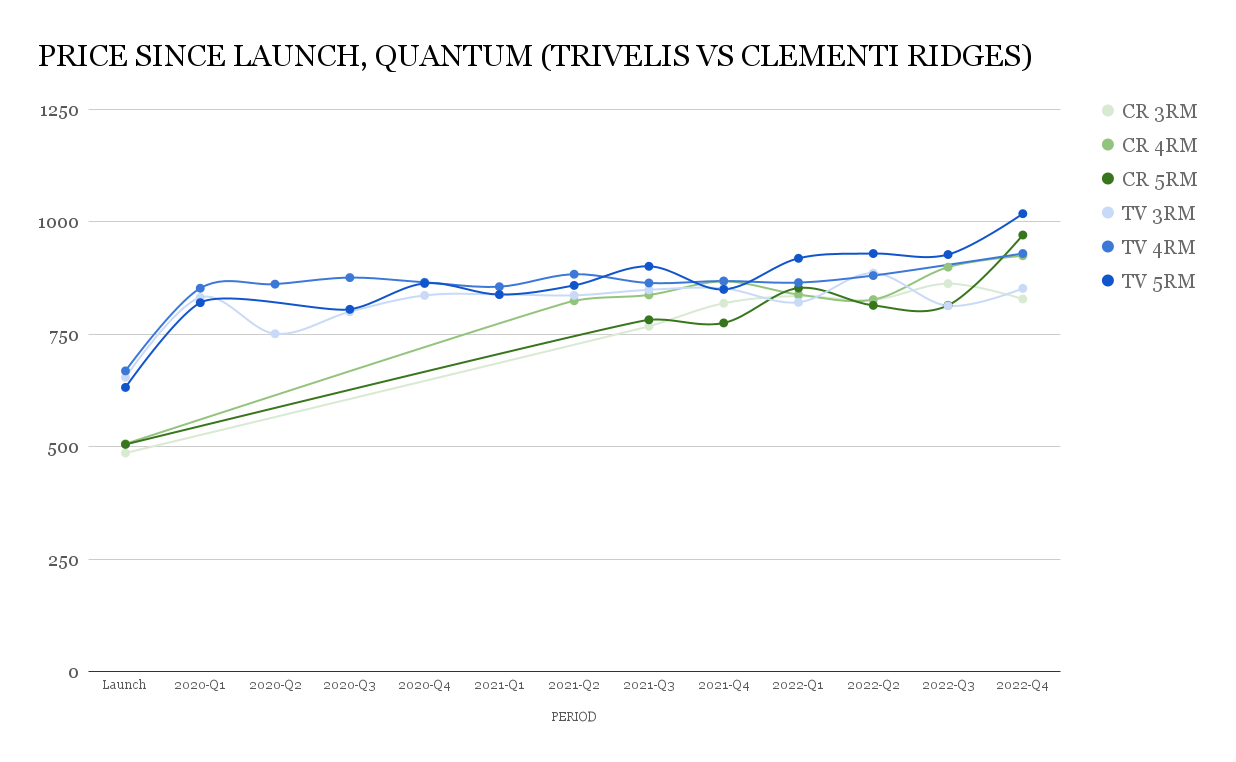

By no coincidence, this was one of the flash points in the anger over DBSS pricing. Around a decade ago, there was significant anger among Trivelis buyers, when they discovered that Clementi Ridges – which is right next to Trivelis – was both bigger and cheaper.

We wrote a detailed explanation of this some time ago in 2022, some of which remains relevant. As we pointed out back then, the fact that Trivelis launched at around 16 to 17 per cent higher than Clementi Ridges (despite being smaller) set it as a disadvantage for gains.

In our more updated look however, we can see that Trivelis, despite its early criticisms, still appreciated more in absolute dollar value (+$598,686) than Clementi Ridges (+$517,405). But Clementi Ridges remained competitive, narrowing the price gap and almost catching up with Trivelis. So the DBSS premium still exists, but in this case, it was smaller due to the launch controversy and perceived quality issues.

Meanwhile, Toa Payoh Crest, a non-DBSS project, is famous for having several four-room flats selling for over $1 million. Its gains are quite comparable with its DBSS counterpart, while in Yishun, Adora Green underperformed compared to non-DBSS flats (which saw growth of 33 to 41 per cent.)

In these instances, there’s a likely similarity compared to the Trivelis situation: the regular flats launched at lower prices that allowed greater room for appreciation. It’s also plausible that, going forward, the DBSS premium in these estates will erode; perhaps due to the lack of significant advantages over newer, non-DBSS flats in the area.

While DBSS flats continue to command an impressive quantum, it’s not guaranteed that they’ll outpace regular flats. Their higher initial prices may also translate to slower growth. It will also be interesting to see if, over time, the introduction of Plus and Prime flats has any effect on the DBSS projects.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

Do DBSS flats generally cost more than regular HDB flats?

Have DBSS flats always outperformed regular flats in terms of price growth?

Why did some people criticize the pricing of DBSS flats when they first launched?

Are DBSS flats better investments than regular HDB flats?

Could the premium of DBSS flats decrease over time?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Property Trends

Property Trends The Room That Changed the Most in Singapore Homes: What Happened to Our Kitchens?

Property Trends Condo vs HDB: The Estates With the Smallest (and Widest) Price Gaps

Property Trends Why Upgrading From An HDB Is Harder (And Riskier) Than It Was Since Covid

Property Trends Should You Wait For The Property Market To Dip? Here’s What Past Price Crashes In Singapore Show

Latest Posts

Property Investment Insights These Freehold Condos Barely Made Money After Nearly 10 Years — Here’s What Went Wrong

Singapore Property News Why Some Singaporean Parents Are Considering Selling Their Flats — For Their Children’s Sake

Pro River Modern Starts From $1.548M For A Two-Bedder — How Its Pricing Compares In River Valley

3 Comments

Hi, I think this article needs to be clearer in framing the comparisons. For example, the tables are showing Clementi Ridges doing better than Trivelis, but why is part of the article saying Trivelis did better? Also what is the point of comparison? Is it vs the launch prices, resale prices (which date)?

Even within the same district, location and size matters when it comes to resale. You need to state distance away from mrt and psf price. Otherwise I can only suspect that it’s painting a narrative according to the conclusion wanted in the first place.