Landed Home Sales Hit a Four-Year High — Here’s What That Could Mean for Prices in 2026

January 30, 2026

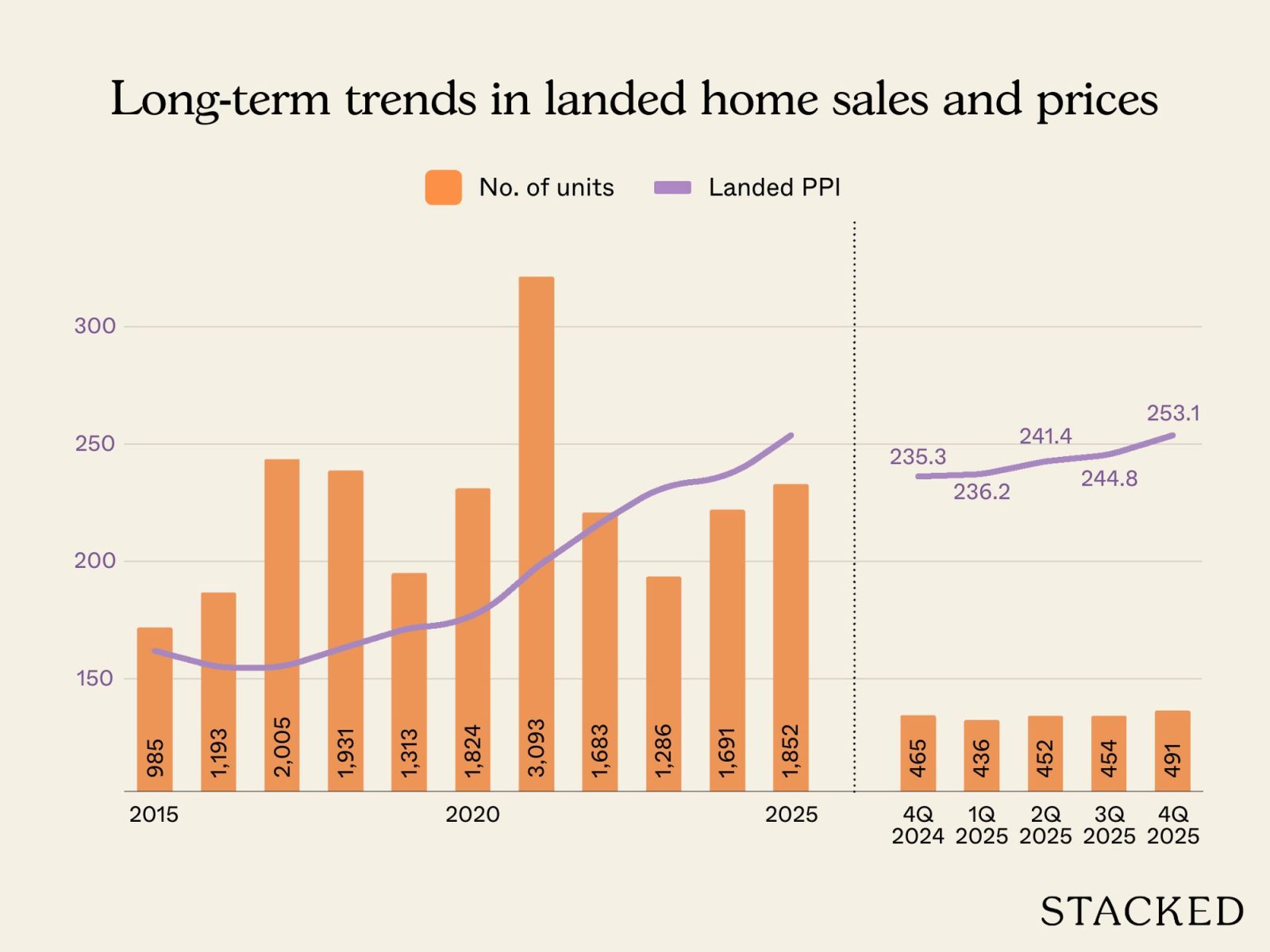

Singapore’s landed home market recorded a stellar year in 2025 when 1,852 landed homes were sold over the 12 months, a yearly increase of 11.2% compared to the year before. This is also the highest yearly sales volume the landed segment has recorded since 2021.

In terms of prices, the landed property price index grew by 7.6% in 2025. If this sales momentum continues this year, landed home prices may see a full-year price growth of 5-7%, according to a market report by ERA Singapore.

As a result of the recent price movements, the proportion of HDB owners upgrading to landed properties continues to fall. In 2025, just 11% of landed home buyers were HDB owners, down from 14% in 2024 and 16% in 2023.

The number of landed home transactions in the last quarter of 2025 rose 4% q-o-q to 491 deals. This is also the quarter with the highest number of landed home transactions since 2Q2022.

“The landed housing market remained broadly resilient in 4Q2025, underpinned by steady overall demand from condominium upgraders. Rising non-landed home prices have enabled them to upgrade, leading to a 2.3% price increase,” says Marcus Chu, CEO of ERA Singapore.

He adds that the rise in price is largely attributed to an increase in the number of transactions in the Rest of Central Region (RCR) and Outside Central Region (OCR). However, the Core Central Region (CCR) saw fewer transactions due to higher prices, as buyers and sellers face a mismatch in price expectations.

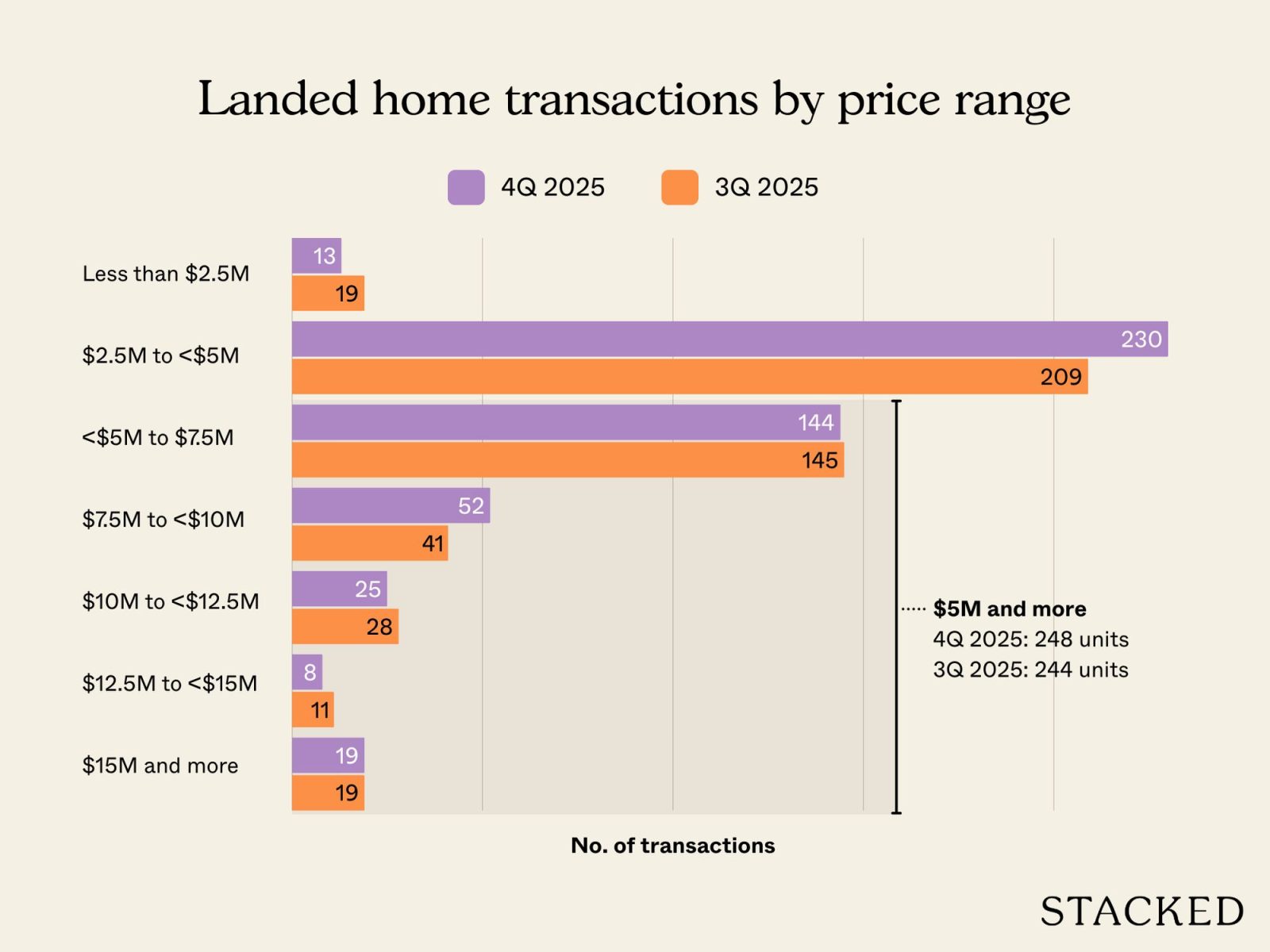

Transaction data also indicates that more landed properties were sold at relatively higher price points in 4Q2025 compared to 3Q2025.

About 248 landed homes, or 50.5% of the total quarterly sales volume, were priced above $5 million. Likewise, 244 landed properties, of 51.5% of the quarterly sales in 3Q2025, fetched prices of $5million and more.

“Rising non-landed home prices have improved affordability for condominium upgraders. Despite higher price barriers, we have seen more transactions in the RCR and OCR. With the ability to command higher prices for their condominiums, these homeowners have greater access to the landed market,” says Chu.

More from Stacked

I’ve Stayed In 40+ Airbnb Homes: 9 Design Pitfalls I’ve Learned To Avoid

One of the wonders of Airbnb is that, instead of seeing generic hotel rooms, you get to see the inside…

As a result, landed home prices in the OCR and RCR notched a quarterly increase of 12.4% and 5.4%, respectively, last quarter.

Overall, the relatively lower prices of less centrally located homes appeared to provide a more appealing price point for some upgraders, who also need to balance locational preferences, spatial needs, and affordability.

More than half (57.2%) of the landed home deals closed last quarter were terrace houses in the OCR, which proved to be a good entry price point into the landed market for this group of buyers. The median absolute price for terrace homes in 4Q2025 was $4.22 million, about 2.8% lower than the $4.35 million in the previous quarter.

| CCR | |||||||||||||

| Terrace House | Semi-Detached House | Detached House | |||||||||||

| Transactions | Median Quantum | Median Price ($psf) | Transactions | Median Quantum | Median Price ($psf) | Transactions | Median Quantum | Median Price ($psf) | Total | ||||

| 4Q 2024 | 8 | $6,000,000 | $2,898 | 19 | $8,360,000 | $2,328 | 12 | $20,990,000 | $2,167 | 20 | |||

| 3Q 2025 | 11 | $6,938,888 | $3,140 | 39 | $9,390,000 | $2,417 | 25 | $17,000,000 | $2,291 | 36 | |||

| 4Q 2025 | 9 | $7,100,000 | $3,309 | 32 | $9,662,500 | $2,583 | 16 | $17,069,000 | $2,299 | 25 | |||

| RCR | |||||||||||||

| Terrace House | Semi-Detached House | Detached House | |||||||||||

| Transactions | Median Quantum | Median Price ($psf) | Transactions | Median Quantum | Median Price ($psf) | Transactions | Median Quantum | Median Price ($psf) | Total | ||||

| 4Q 2024 | 62 | $4,280,000 | $2,373 | 22 | $6,795,000 | $1,997 | 7 | $10,880,000 | $1,620 | 91 | |||

| 3Q 2025 | 60 | $4,600,000 | $2,434 | 23 | $7,150,000 | $2,069 | 10 | $11,450,000 | $2,224 | 93 | |||

| 4Q 2025 | 61 | $4,500,000 | $2,526 | 24 | $6,450,000 | $1,950 | 13 | $14,150,000 | $1,934 | 98 | |||

| OCR | |||||||||||||

| Terrace House | Semi-Detached House | Detached House | |||||||||||

| Transactions | Median Quantum | Median Price ($psf) | Transactions | Median Quantum | Median Price ($psf) | Transactions | Median Quantum | Median Price ($psf)) | Total | ||||

| 4Q 2024 | 213 | $4,000,000 | $1,949 | 213 | $5,700,000 | $1,540 | 31 | $8,388,888 | $1,190 | 457 | |||

| 3Q 2025 | 191 | $4,230,000 | $2,093 | 191 | $5,400,000 | $1,562 | 20 | $9,000,000 | $1,555 | 402 | |||

| 4Q 2025 | 211 | $4,197,000 | $2,104 | 211 | $5,810,000 | $1,642 | 30 | $8,760,000 | $1,504 | 452 | |||

| Island-wide Total | |||||||||||||

| Terrace House | Semi-Detached House | Detached House | |||||||||||

| Transactions | Median Quantum | Median Price ($psf) | Transactions | Median Quantum | Median Price ($psf) | Transactions | Median Quantum | Median Price ($psf) | Total | ||||

| 4Q 2024 | 283 | $4,050,000 | $2,049 | 131 | $5,950,000 | $1,690 | 50 | $11,190,000 | $1,623 | 464 | |||

| 3Q 2025 | 262 | $4,345,000 | $2,176 | 155 | $5,980,000 | $1,816 | 55 | $11,650,000 | $1,948 | 472 | |||

| 4Q 2025 | 281 | $4,222,000 | $2,264 | 151 | $6,380,000 | $1,874 | 59 | $10,580,000 | $1,869 | 491 | |||

However, in the CCR, sales volume in the landed home market fell 30.6% q-o-q to just 25 transactions in 4Q2025. The decline stems from an increase in the median psf price and median absolute price of homes in that region.

“Moreover, CCR landed home sellers, typically with higher holding power, are less inclined to reduce their prices. Thus, buyers and sellers faced an impasse over prices,” says Chu.

Overall, a robust resale market in the non-landed segment has benefited condo upgraders who continue to fuel the landed homes segment. ERA expects that the landed market may record between 1,750 and 1,950 transactions over the whole of 2026, with prices climbing 5-7%.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

How many landed homes were sold in Singapore in 2025?

What is the expected price growth for landed homes in 2026?

Why are fewer HDB owners upgrading to landed homes now?

Which regions saw the most increase in landed home transactions in late 2025?

What types of landed homes are most popular among buyers in late 2025?

Timothy Tay

As Editor-in-Chief of Stacked, Timothy leads the newsroom and shapes our editorial direction, ensuring readers receive timely, thoughtful, and well-researched news and analysis. He brings over eight years of experience as a business and real estate journalist, with a strong track record across both print and digital platforms. His reporting spans luxury residential, commercial real estate, and capital markets, alongside in-depth coverage of sustainability and design.Need help with a property decision?

Speak to our team →Read next from Property Market Commentary

Property Market Commentary How I’d Invest $12 Million On Property If I Won The 2026 Toto Hongbao Draw

Property Market Commentary We Review 7 Of The June 2026 BTO Launch Sites – Which Is The Best Option For You?

Property Market Commentary Why Some Old HDB Flats Hold Value Longer Than Others

Property Market Commentary We Analysed HDB Price Growth — Here’s When Lease Decay Actually Hits (By Estate)

Latest Posts

Pro River Modern Starts From $1.548M For A Two-Bedder — How Its Pricing Compares In River Valley

New Launch Condo Reviews River Modern Condo Review: A River-facing New Launch with Direct Access to Great World MRT Station

On The Market Here Are The Cheapest 5-Room HDB Flats Near An MRT You Can Still Buy From $550K

0 Comments