Will The New HDB Resale Listing Portal Really Cut Out Agents?

May 20, 2024

If I were a good property agent, I’d be pretty happy with the HDB resale portal.

In fact, I’d want it to be bigger and have all the listings. Far from a threat of being “cut out”, the resale portal can actually make life easier for agents in many ways; and if HDB is cutting out unrealistic prices, that probably helps to temper expectations too.

At the very least, it might bring an end to property portals that have effectively cornered the market, forcing agents to spend jaw-dropping amounts on marketing. Ask some veteran agents, and they’ll tell you that the cost of advertising on portals is even higher than in the days of classified newspaper ads and flyers. Having all the resale listings on the HDB portal – if that ever happens – might mitigate the need to spend so much on online listings.

As to the issue of being “replaced,” the resale listing portal doesn’t entirely replace a realtor – it replaces a narrow segment of what a realtor does. But this is a very small part of why people still use property agents; if it was simply a matter of knowing where to sign, realtors would have vanished decades ago. We’d have an AI replacing them all by next Tuesday.

The true value of a realtor is (at least when it comes to HDB sales), in my frank opinion, is in handling inquiries and viewings.

Everything else that they do could conceivably be replaced – you can look up property transaction histories on your own (on the URA transaction site), you can list your own unit on some (not all) portals, and you can learn quite a bit about price comparisons or projects online (that’s what we’re here for).

What’s essential, and difficult to be replaced, is having someone to screen out nonsense callers, conduct viewings, deal with no-shows, spend hours on negotiations, and do the little things like tidy up a unit before the next batch of viewers arrive.

And when it comes to negotiations, a lot of people overlook the issue of language. From my experience, having an agent who can speak dialect can bring in a lot more offers; and I’ve seen DIY buyers and sellers lose out just because of issues like not being comfortable negotiating in Chinese, Malay, English, etc. Among older Singaporeans, who may only be comfortable speaking in a dialect, property agents are also invaluable.

There’s also some people who will never feel comfortable buying or selling on their own

The fact is, your home is probably the most expensive thing you’ll ever buy in your life. And when it comes to something you’ll spend the next 20 to 25 years paying for, there’s often a comfort in knowing a real flesh-and-blood professional is taking the time and effort to settle things for you.

More from Stacked

Oversupply of housing in Singapore – Should you be worried?

As early as last year in December 2017, there were warnings of a possible oversupply of housing in Singapore from…

Whilst the real estate transaction process has gotten simpler, there’s a non-zero chance of issues like losing the deposit (due to a lapsed Option), or being hit by unexpectedly high cash requirements (due to Cash Over Valuation). It’s possible that these reasons alone will see good property agents unscathed by DIY portals.

We’ve learned this from trying to cut out the property agent once before (remember, when we tried to create our own direct buy/sell property portal), and that ultimately, it’s not that people want to cut out the agent – but the standards of property agents in Singapore is low and can be improved.

Perhaps given the headwinds of cries of too many agents and this new resale listing service, we might see further streamlining of property agent numbers in the future. If it’s a matter of competition that forces the quality of property agents in Singapore to increase, then that’ll surely be a welcome move.

Meanwhile, in other property news…

- 5-room flats in central areas, from just $720,000. Do they exist? Yes they do.

- It may not be common, but we know some of you may need to rent a landed home. Here’s where we’ve seen them start from as low as $3,000 per month (for real!)

- HDB upgraders at least have a flat to fund their condo purchase; but at the rate things are going, even they’re struggling right now. Here’s why.

- Freehold landed homes in Sixth Avenue from $3 million? It’s actually possible.

Weekly Sales Roundup (06 May – 12 May)

Top 5 Most Expensive New Sales (By Project)

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| WATTEN HOUSE | $7,678,000 | 2368 | $3,242 | FH |

| 19 NASSIM | $5,686,000 | 1733 | $3,281 | 99 yrs (2019) |

| THE RESERVE RESIDENCES | $5,211,495 | 1916 | $2,720 | 99 yrs (2021) |

| LENTOR MANSION | $3,351,000 | 1507 | $2,224 | 99 yrs (2023) |

| THE REEF AT KING’S DOCK | $2,989,440 | 1076 | $2,777 | 99 yrs (2021) |

Top 5 Cheapest New Sales (By Project)

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| THE MYST | $1,227,000 | 517 | $2,375 | 99 yrs (2023) |

| LENTORIA | $1,248,000 | 538 | $2,319 | 99 yrs (2022) |

| THE LAKEGARDEN RESIDENCES | $1,336,500 | 592 | $2,258 | 99 yrs (2023) |

| TEMBUSU GRAND | $1,399,000 | 527 | $2,652 | 99 yrs (2022) |

| THE LANDMARK | $1,512,000 | 495 | $3,054 | 99 yrs (2020) |

Top 5 Most Expensive Resale

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| N.A. | $8,000,000 | $4,858 | $1,647 | FH |

| THE LADYHILL | $7,228,000 | $2,271 | $3,182 | FH |

| REGENCY PARK | $6,450,000 | $3,175 | $2,031 | Freehold |

| CITYVISTA RESIDENCES | $5,800,000 | 2809 | $2,064 | FH |

| THE WHARF RESIDENCE | $5,105,000 | 2207 | $2,313 | 999 yrs (1841) |

Top 5 Cheapest Resale

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| STRATUM | $645,000 | 452 | $1,427 | 99 yrs (2012) |

| PALM ISLES | $676,000 | $517 | $1,308 | 99 yrs (2011) |

| SPACE @ KOVAN | $690,000 | $420 | $1,644 | FH |

| 28 IMPERIAL RESIDENCES | $700,000 | $409 | $1,711 | FH |

| KINGSFORD WATERBAY | $732,000 | $484 | $1,511 | 99 yrs (2014) |

Top 5 Biggest Winners

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | RETURNS | HOLDING PERIOD |

| N.A. | $3,980,000 | 1798 | $2,214 | $2,530,000 | 25 Years |

| RIVERGATE | $4,310,000 | 1539 | $2,800 | $2,424,980 | 18 Years |

| THE LADYHILL | $7,228,000 | 2271 | $3,182 | $2,028,000 | 15 Years |

| THE BELVEDERE | $3,088,000 | 1259 | $2,452 | $1,892,000 | 17 Years |

| THE STERLING | $4,500,000 | 1970 | $2,284 | $1,850,000 | 13 Years |

Top 5 Biggest Losers

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | RETURNS | HOLDING PERIOD |

| CITYVISTA RESIDENCES | $5,800,000 | 2809 | $2,064 | -$2,274,106 | 17 Years |

| SEASCAPE | $5,050,000 | 2680 | $1,884 | -$1,750,000 | 11 Years |

| MARINA BAY SUITES | $3,300,000 | 1572 | $2,100 | -$1,097,000 | 14 Years |

| ST REGIS RESIDENCES SINGAPORE | $5,080,000 | 2153 | $2,360 | -$308,000 | 15 Years |

| THE FORESTA @ MOUNT FABER | $888,000 | 431 | $2,062 | $4,400 | 13 Years |

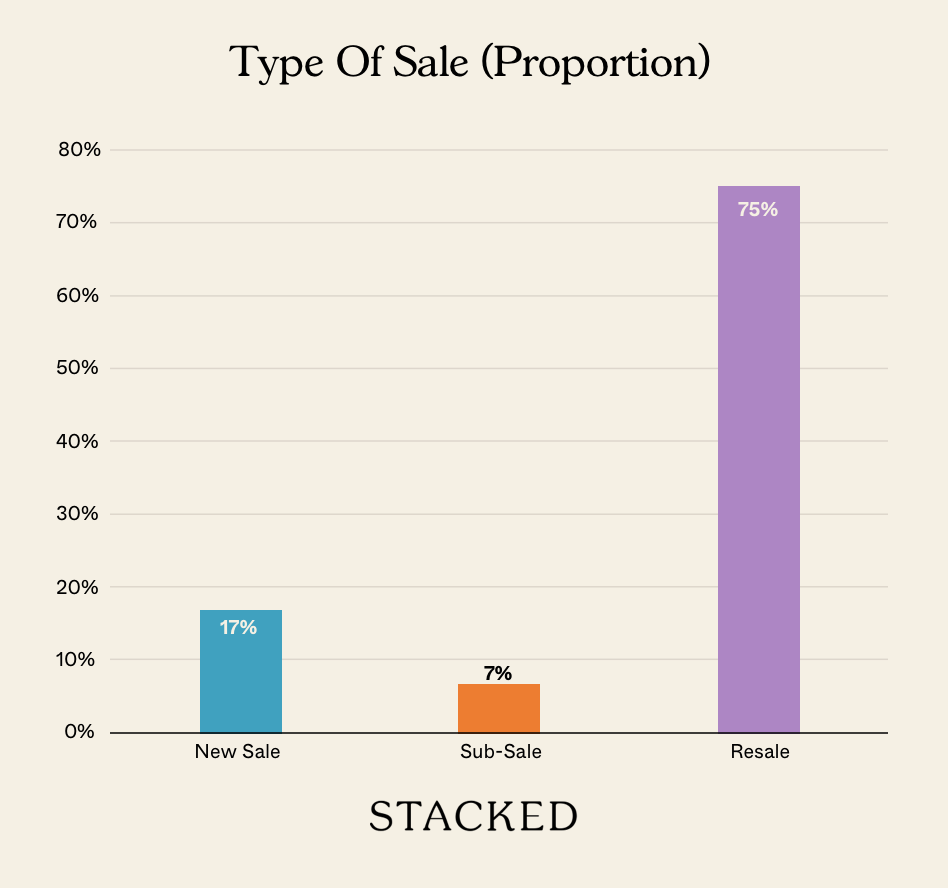

Transaction Breakdown

For more on the Singapore private property market, follow us on Stacked.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

Will the new HDB resale listing portal eliminate the need for property agents?

How might the HDB resale portal benefit property agents?

What are the main reasons people still use property agents despite online listings?

Can the resale portal help lower the costs of property marketing?

Why do some buyers and sellers prefer to work with real estate agents?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Singapore Property News

Singapore Property News Why The Feb 2026 BTO Launch Saw Muted Demand — Except In One Town

Singapore Property News One Of The Last Riverfront Condos In River Valley Is Launching — From $2,877 PSF

Singapore Property News When A “Common” Property Strategy Becomes A $180K Problem

Singapore Property News Tanjong Rhu’s First GLS In 28 Years Just Sold For $709M — Here’s What The Next Condo May Launch At

Latest Posts

Editor's Pick We Can Buy Two HDBs Today — Is Waiting For An EC A Mistake?

Pro This Singapore Condo Skipped 1-Bedders And Focused On Space — Here’s What Happened 8 Years Later

Editor's Pick Why Some Old HDB Flats Hold Value Longer Than Others

0 Comments