Why This District 9 Condo Made Each Owner $775k In Profit: Uncovering The Numbers Behind The Success

April 20, 2024

Luxury condos in Singapore are often skeptically viewed as poor financial commitments. The recent fire sales of high-end developments such as the W Residences at Sentosa or Cuscaden Reserve have only served to add to that ongoing narrative.

But some condos out there have bucked that trend – one of which is the Rivergate condominium in District 9. The development first captured headlines in August 2006 during its sales launch’s second phase, setting a new benchmark by selling a four-bedroom unit at a then-high $1,700 per square foot (psf) – a record for the area at the time.

Despite being launched and sold at a period that was in a run-up to sky-high prices in 2007, even subsequent buyers of this project have profited well.

So why has this particular condo done so well? Let’s take a closer look:

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

A quick look at Rivergate

Rivergate is a freehold condo which was completed in 2009. This 545-unit project is in the heart of Robertson Quay, and right alongside the Singapore River. Most Singaporeans have probably seen Rivergate, even if they don’t know the name (it’s the 43-storey building quite close to M Social Hotel). In fact, Rivergate was the first residential project in Singapore to be given landmark status by URA.

Rivergate is within walking distance to Havelock/Great World MRT (TEL), close to Great World City and UE Square.

Rivergate’s transaction history

According to Square Foot Research, Rivergate has seen 425 profitable transactions and 32 losses in its entire history. But in the last 5 years, there has only been one losing transaction:

| SOLD ON | ADDRESS | UNIT AREA (SQFT) | SALE PRICE (S$ PSF) | BOUGHT ON | PURCHASE PRICE (S$ PSF) | PROFIT (S$) | HOLDING PERIOD (DAYS) | ANNUALISED (%) |

| 31 Oct 2019 | 93 ROBERTSON QUAY #40-XX | 3,143 | 2,163 | 9 May 2007 | 2,701 | -1,690,000 | 4,558 | -1.8 |

The sole losing transaction was due to the excessively high price the unit was bought for ($2,701 psf). This far exceeded the norm of around $1,500 psf at the time.

Let’s look at the annualised returns based on the transactions:

| Year | New Sales (Volume) |

| 2005 | 131 |

| 2006 | 147 |

| 2007 | 111 |

| 2009 | 3 |

| Year | Average Annualised % |

| 2005 | 4.95% |

| 2006 | 3.35% |

| 2007 | 3.09% |

| 2008 | 4.35% |

| 2009 | 4.58% |

| 2010 | 2.10% |

| 2011 | 1.59% |

| 2012 | 2.13% |

| 2013 | 1.80% |

| 2014 | 2.26% |

| 2015 | 4.55% |

| 2017 | 4.17% |

This is a very strong showing, with annualised returns between three to over four per cent in most years. Note that three of the more notable years – 2005, 2009, and 2015 – were close to market downturns, so that makes performance especially good.

2005, for example, should have been a tough time – it was when the market was only just picking up from the 2003 downturn. So even though just 131 of 545 units were sold (24 per cent), this should be considered good given the circumstances.

The buyers in 2005 were also well rewarded, as they made their purchases at a low average of $1,101 psf (which just sounds incredibly low in today’s context for a freehold District 9 condo). These were the ones who saw strong annualised returns of over four per cent.

2009 only saw three transactions though, so it’s harder to conclude from that year; but you can see the three sellers definitely came out on top.

Let’s look at it in the context of other nearby projects

Could the strong performance just be due to being near Robertson Quay, which sees higher demand than some other CBD properties? This is, after all, quite the lifestyle hub.

To compare, we looked at properties within 300 metres of Rivergate, which would share the same general location. We also focused on the 2005 to 2009 period, as this was close to when Rivergate was launched and reached TOP (by happy coincidence, there were also a good number of new launches nearby in the same period).

Here were the new launch prices at the time:

| Project | 2005 | 2006 | 2007 | 2008 | 2009 | |

| 8 RODYK | $1,785 | $1,542 | ||||

| MARTIN EDGE | $808 | |||||

| MARTIN NO 38 | $2,138 | $2,184 | ||||

| RIVERGATE | $1,101 | $1,336 | $1,625 | $1,607 | ||

| ROBERTSON BLUE | $872 | $1,045 | ||||

| THE INSPIRA | $1,126 | $1,129 | $1,045 | $1,211 | ||

| TRIBECA | $1,422 | $1,552 | ||||

| WATERMARK ROBERTSON QUAY | $852 | $929 | $1,597 | |||

| Grand Total | $970 | $1,270 | $1,546 | $1,935 | $1,658 | $1,283 |

More from Stacked

Why This Iconic Hilltop Condo Near Three MRT Lines Is Underperforming

One Pearl Bank drew plenty of attention when it launched in 2019, and not only for its architecture. The redevelopment…

As we mentioned above, Rivergate set a new price record for the area in 2006; so it’s unsurprising that it’s more expensive than most of its neighbours. And yet, its performance versus these other projects is just as good, if not better.

Watermark Robertson Quay makes an especially interesting point of comparison, given how much cheaper it is. The developer likely did this to compete against the nearby launches.

In any case, Watermark started with more than a 25.4 per cent difference in price psf, and continued to be priced lower than Rivergate all through to 2007.

We can also see something interesting in the sub sale transactions of Watermark:

| Watermark | 2005 | 2006 |

| New Sale Volume | 135 | 18 |

| New Sale Avg $PSF | 852 | 929 |

| Sub Sale Volume | 0 | 20 |

| Sub Sale Avg $PSF | NA | 1073 |

Average sub-sale prices for Watermark, in 2006, was about $1,073 psf. This was much lower than Rivergate’s average price of $1,336 psf at the time. Under normal circumstances, this level of price competition should translate to weak returns for Rivergate buyers.

However, Rivergate buyers in 2006 still saw solid annualised returns of 3.35 per cent. It’s as if the market magically ignored a much cheaper condo, just 300 metres or so away.

Another interesting point of comparison is Tribeca, which had a higher average than Rivergate in 2006 ($1,422 psf to Rivergate’s $1,336 psf). Tribeca’s average price was overtaken by Rivergate the next year though, and about half of Tribeca’s purchases were in 2007.

Nonetheless, Tribeca still has a weaker track record than Rivergate, with 144 profitable to 15 unprofitable transactions. Six of these 15 losing transactions were in 2007 alone. Again, Tribeca is a project within 300 metres.

As such, we can conclude Rivergate didn’t just beat the CBD “in general,” it also outperformed other condos in the specific proximity of Robertson Quay.

Speaking of the wider central area, how does it compare to other prime area condos?

A good point of comparison would be Cairnhill as during that era that was the place to be for luxury condos. Let’s look at transaction volumes first:

| Project | 2005 | 2006 | 2007 | 2008 | 2009 | Total |

| ALBA | 16 | 16 | ||||

| CAIRNHILL CREST | 68 | 17 | 85 | |||

| CAIRNHILL RESIDENCES | 31 | 47 | 1 | 79 | ||

| CITYVISTA RESIDENCES | 38 | 38 | ||||

| HELIOS RESIDENCES | 63 | 1 | 64 | |||

| HILLTOPS | 10 | 1 | 11 | |||

| ORCHARD SCOTTS | 19 | 14 | 8 | 1 | 42 | |

| SUITES @ CAIRNHILL | 1 | 1 | ||||

| THE PROMONT | 7 | 7 | ||||

| THE RITZ-CARLTON RESIDENCES SINGAPORE CAIRNHILL | 4 | 1 | 2 | 7 | ||

| VIDA | 5 | 9 | 34 | 2 | 31 | 81 |

| Grand Total | 73 | 76 | 211 | 14 | 57 | 431 |

Keeping to the same period of 2005 to 2009, there were 431 new launch units in Cairnhill. Not a big number, but good enough for a comparison. More than half of these new transactions were in 2007, toward the tail end of Rivergate’s launch sales (i.e., the point at which developer sales tend to be priciest).

Now let’s look at the price movement:

| Condos | 2005 | 2006 | 2007 | 2008 | 2009 | Total |

| ALBA | $2,233 | $2,233 | ||||

| CAIRNHILL CREST | $1,446 | $1,553 | $1,468 | |||

| CAIRNHILL RESIDENCES | $1,716 | $1,794 | $1,919 | $1,765 | ||

| CITYVISTA RESIDENCES | $2,584 | $2,584 | ||||

| HELIOS RESIDENCES | $3,014 | $3,389 | $3,019 | |||

| HILLTOPS | $3,978 | $3,818 | $3,963 | |||

| ORCHARD SCOTTS | $1,454 | $2,254 | $2,608 | $1,750 | $1,948 | |

| SUITES @ CAIRNHILL | $2,382 | $2,382 | ||||

| THE PROMONT | $1,935 | $1,935 | ||||

| THE RITZ-CARLTON RESIDENCES SINGAPORE CAIRNHILL | $4,816 | $5,053 | $3,506 | $4,475 | ||

| VIDA | $1,465 | $1,624 | $2,193 | $2,137 | $2,137 | $2,062 |

| Grand Total | $1,448 | $1,603 | $2,559 | $2,808 | $2,180 | $2,160 |

Prices were even higher here compared to the Robertson Quay area, at $1,448 psf in 2005. The average for Robertson Quay was $970 at the time, making for a difference of 39.5 per cent. This gap rose to about 49.3 per cent in 2007, when the hype for Cairnhill properties rose to a new height.

The biggest contributors to the high-price psf are The Ritz-Carlton Residences, Hilltops, and Helios Residences. These projects also sold for much higher prices than other equivalents like Cairnhill Residences and Cityvista Residences.

Generally though, they were overpriced, as we can see from an example like Helios Residences:

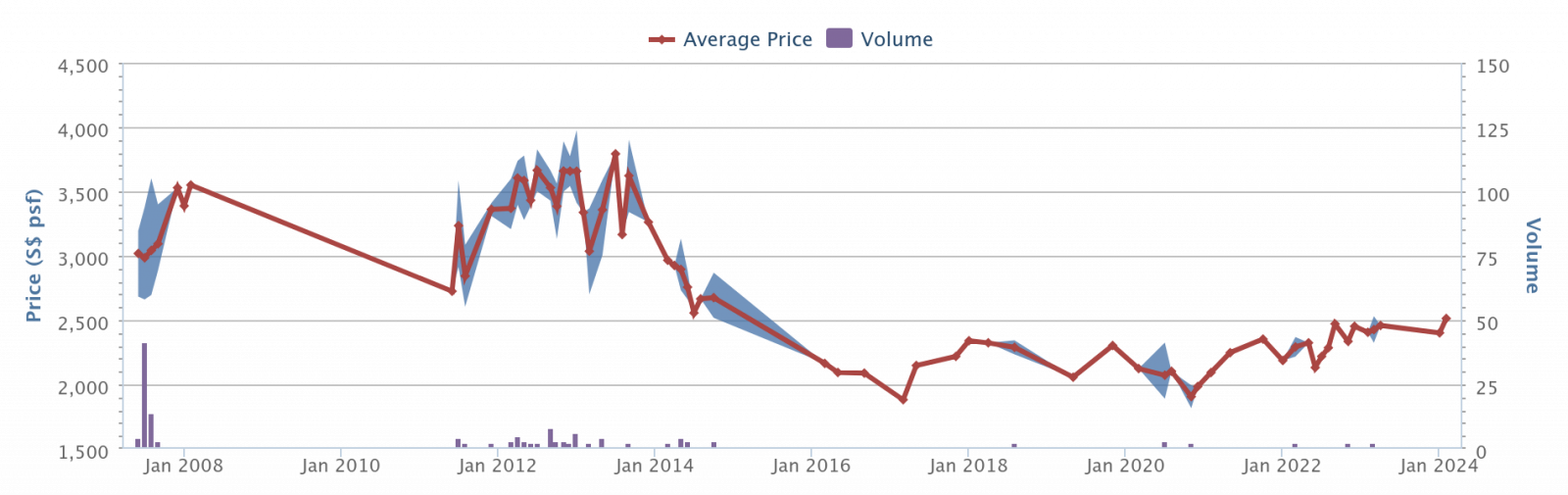

It was much later in 2016 before the resale market finally accepted $2,000 psf as a norm for condos like Helios. And while prices have continued to rise, it’s still not reached its previous peak of $3,500 psf.

Now let’s look at the annualised return for condos in this area:

| Project | 2005 | 2006 | 2007 | 2008 |

| CAIRNHILL CREST | 5.9% | 6.3% | ||

| CAIRNHILL RESIDENCES | 11.9% | 8.7% | ||

| CITYVISTA RESIDENCES | -2.6% | |||

| HELIOS RESIDENCES | -1.5% | |||

| HILLTOPS | -3.1% | |||

| ORCHARD SCOTTS | 5.9% | -3.4% | -3.4% | |

| THE RITZ-CARLTON RESIDENCES SINGAPORE CAIRNHILL | -2.4% | |||

| VIDA | 4.1% | 3.7% | -0.4% | 2.7% |

| Grand Total | 5.8% | 8.3% | 1.6% | -1.9% |

Buyers in 2005 and 2006 saw strong gains, but once $2,500 psf became the new average, buyers who purchased at ‘05 and ‘06 levels started to see negative returns.

So Rivergate stands out quite a bit as a prime region property

When it comes to high-end districts in the CBD, near the Orchard Belt, etc., developers tend to focus on prestige products rather than investments. So it’s uncommon to see a project like Rivergate, which – expensive even for this area at launch – turn out to be a good investment option.

This highlights how individualistic property assets really are: unlike some other assets (e.g., one bar of gold is pretty much the same as another, as is one barrel of oil from the next), you really need to look at each project on a specific basis. This should take precedence over the wider market movements, or a generalised region/district.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

Why did owners of the Rivergate condo in District 9 make such high profits?

How has Rivergate's property performance compared to nearby condos in Robertson Quay?

What makes Rivergate a notable investment compared to other luxury condos in Singapore?

Did Rivergate's location near Robertson Quay influence its investment success?

How did the initial launch prices of Rivergate compare to other projects in the same period?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Property Investment Insights

Property Investment Insights This 130-Unit Boutique Condo Launched At A Premium — Here’s What 8 Years Revealed About The Winners And Losers

Property Investment Insights This 55-Acre English Estate Owned By A Rolling Stones Legend Is On Sale — For Less Than You Might Expect

Property Investment Insights Why Some Central Area HDB Flats Struggle To Maintain Their Premium

Property Investment Insights This 130-Unit Condo Launched 40% Above Its District — And Prices Struggled To Grow

Latest Posts

Editor's Pick These Freehold Condos Near Orchard Haven’t Seen Much Price Growth — Here’s Why

Singapore Property News These 4 Freehold Retail Units Are Back On The Market — After A $4M Price Cut

Editor's Pick New Lentor Condo Could Start From $2,700 PSF After Record Land Bid

0 Comments