Why The New Prime, Plus & Standard HDB Classification Makes Sense And How It Impacts Singaporeans

August 21, 2023

The big news for the National Day Rally 2023 is the new classification of HDB flats, to prime, plus, and standard. This will replace the old system of mature versus non-mature estates, which we’ve used since around 1992.

More importantly though, along with it comes new restrictions in the form of longer Minimum Occupancy Periods (MOP), for the plus and prime flats. Like anything else that’s newly introduced to the property market, this will certainly have effects on prices as well as go some way to help HDB flats from being a profit-driven exercise. We looked at the changes and some opinions on the ground:

Main changes to HDB classification

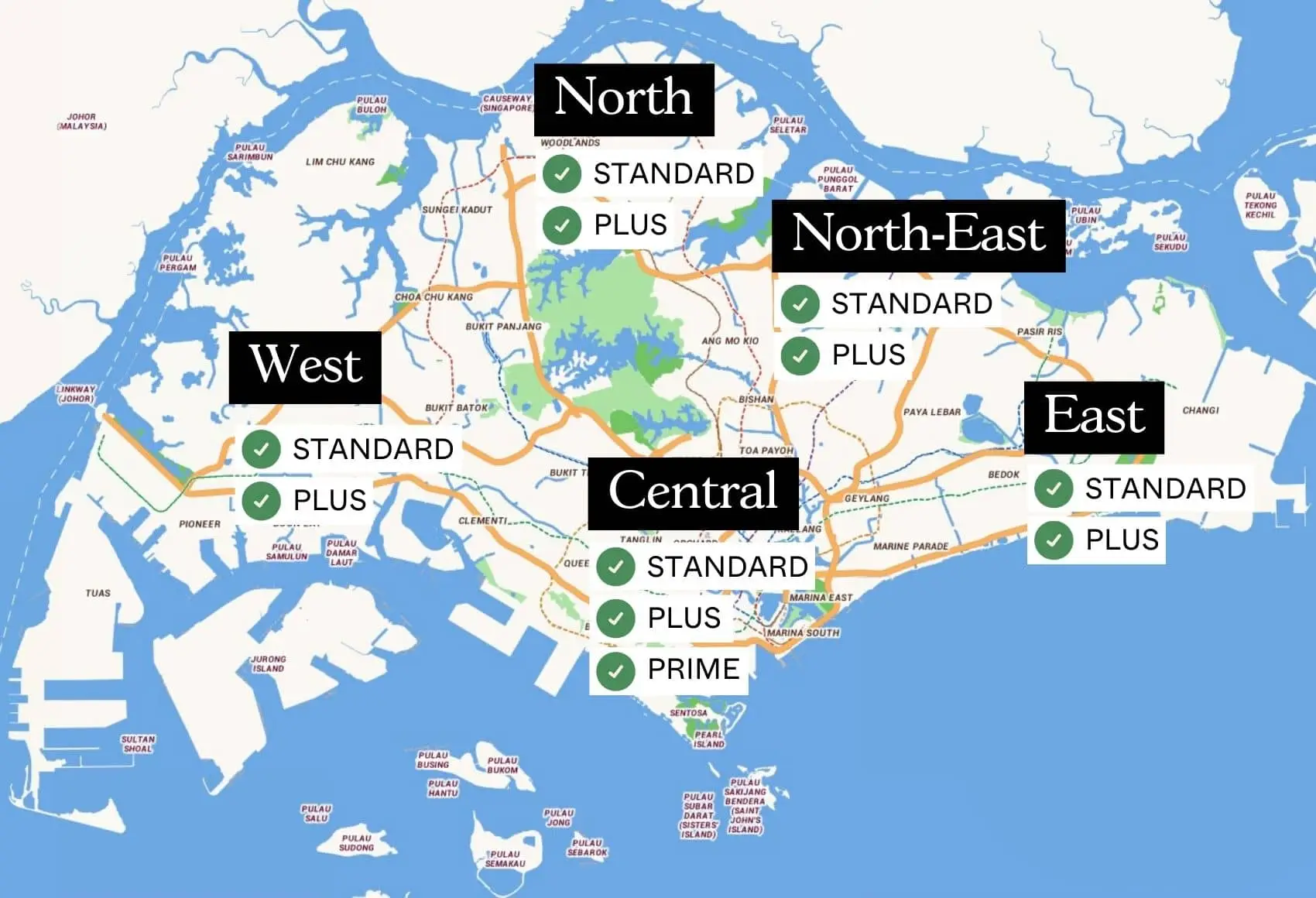

HDB flats will now be classed into three categories:

- Prime – These are under the Prime Location Housing (PLH) model, described in this article. These flats come with a Subsidy Recovery (SR) for the first batch of buyers, and a 10-year MOP.

- Plus – These are flats located near MRT stations or town centres, but are not quite prime material yet. One cited example is the upcoming cluster in Bayshore, which will have an MRT station, mall, and community centre in close proximity. These flats also come with SR for the first batch of buyers, and a 10-year MOP.

- Standard – These are regular flats with all the standard rules (i.e., no SR and the usual five-year MOP)

(SR rates are not standardised, and vary according to the project in question. HDB will provide the SR rate before you buy).

We’ll see the first batches of plus-rated flats in 2024. And yes, we know what you are thinking: the new classification system is not retroactive, and will not be applied to existing flats.

Resale restrictions will also apply differently to the three categories of flats

Prime flats will apply full eligibility restrictions on subsequent buyers. This means that future buyers need to meet all the eligibility requirements of buying a BTO flat, such as the $14,000 income ceiling, ethnic quota, age requirements, etc.

(You can see the full range of eligibility restrictions here).

Plus flats will have “some” BTO-type eligibility restrictions, on future buyers. Further details are still forthcoming, but we know for a fact that the $14,000 income ceiling still applies even to resale buyers later on. Furthermore, only Singaporeans will be eligible to purchase resale Plus flats. Buyers who are coming from a private property must abide by a 30-month waiting period before being able to purchase these flats on the resale market. As with Prime flats, owners of Plus flats cannot rent out the entire flat at any time.

More from Stacked

Which HDB Towns Are Getting Close To Condo Prices In 2025?

In 2025, some resale flats are hitting prices once thought impossible. A handful of towns now see 4-room, 5-room, and…

Standard flats don’t have any changes to existing rules. This means that buyers of resale flats still won’t face any income ceiling.

The new classification system also benefits singles

Previously, singles could not buy 2-room BTO flats in mature areas. As the new system does away with such categories, singles can now apply for 2-room flats in any area, provided they meet the usual eligibility requirements (e.g., they still need to be 35 and meet the income ceiling).

Doing away with mature and non-mature labels was a matter of time

Realtors and analysts we spoke to were not surprised with HDB dropping these categories, with many saying it’s an expected move.

The classification of mature versus non-mature was considered dated even in the 2010s, when it was clear that – following Singapore’s decentralisation efforts – there would one day be no more “non-mature” areas.

Realtors also said the categorisation was meaningless in larger HDB towns. One cited example was Tampines: although it’s a mature town, Tampines Central is where most of the malls, offices, and the MRT are clustered, whereas some other areas (e.g., the parts of Tampines near IKEA) are closer to a non-mature town.

One senior executive from a property agency, who declined to be named, said the new system accommodates a change that the PLH model could not: it isn’t feasible to place certain hotspots like Bishan under the PLH model, despite the high demand for flats there (partly because of the situation where you’d have many standard flats just across the street, that didn’t have the same 10-year MOP or SR, which would then skyrocket in price).

The “plus” flats provide an intermediary, between a high-demand area and a truly PLH-worthy location.

So the general consensus is that using proximity to amenities, rather than overall estate maturity, is a fairer way to classify flats.

Property AdviceIs A PLH Model Flat Worth Buying? We Break Down The Pros And Cons

by Ryan J. OngWhat’s the likely impact of the new system?

Some of the main changes are directly intended by the government, but realtors, analysts, and home buyers we spoke to had other opinions as well:

1. Mitigate windfall effects

The PLH model went some way to correcting windfall effects, in which winning a ballot for a desirable flat was like “winning the lottery.” With SR and a 10-year MOP, demand for these flats is lower than it might be otherwise. This helps to ensure those who really want a flat in those locations for their own stay would be able to obtain one, over someone who just has an eye for potential profits.

The plus flats allow this to be employed for non-PLH flats, which can also be considered something of a windfall. For example, flats near Yishun Central or Tampines Central don’t justify PLH status; but they’ll almost certainly outperform flats in most other parts of those towns.

Most realtors agreed that the 10-year MOP would be a major deterrent for now, but some added that we would need to see the price impact of the longer MOP to see if it’s working.

It will be around 2031 2038 before we see the first batch of PLH flats (in the Rochor area) reach MOP. We’ll also be able to see the impact on the resale market at that point.

Speculatively, however, realtors said buyers might favour resale flats close to prime or plus locations, which have the same locational advantages but are free of such restrictions.

2. Further reposition flats as homes rather than investments

The longer 10-year MOP discourages house-flipping, in the sense of buyers who purchase a flat with the intent to immediately upgrade after five years. It’s also likely that upgraders won’t tolerate a 10-year MOP, in addition to the construction time.

If it takes four to five years to build the flat, for instance, and there’s a 10-year MOP, then it will be 14 to 15 years before they can upgrade. As private home prices tend to appreciate quicker, upgraders probably won’t risk such a long wait (and such a large price gap at the end of it).

If someone still decides to ballot and buy despite the 10-year MOP, it’s likely they intend to stay there for a long time, or possibly for the rest of their life (in which case, the SR won’t matter either).

Most home buyers we spoke to are in favour of this, as they see the owner-investor crowds as being the main cause behind today’s high resale flat prices. One reader said that:

“Some of them (owner-investors) are only buying the flat to use it as a stepping stone, which I don’t mind – it’s just that if they are going to do that, then they should not be given priority over those who really need a home. So leave the better-located flats to those who genuinely intend to live there, not to those who just want to make enough to buy a condo.”

Another reader had a more radical suggestion, and felt a longer MOP was too weak a policy. He says:

“If they really want to prevent a windfall and stop investment speculation, the simple way is to drop all the best locations to a 60-year lease. Then investors will definitely not be interested, because when there are 30 to 40 years left, there’s no more resale value.

The younger ones will think twice before buying, because they know they will have to move again later; but with a 60-year lease the price will also be a lot lower for them, and they will use less of their CPF.

But 60-year lease is still enough for most middle-aged Singaporeans, and our ageing population. And it ensures that older people who cannot travel have better access to amenities. To me, this 10-year MOP is just for show.”

Nevertheless, the new Plus model will help to keep HDB flats more affordable with the longer MOP period and tighter restrictions.

3. Possibly drive up resale flat prices in the near-term

Some realtors speculated that, because the new rules don’t apply retroactively, it could increase demand for the existing stock of flats that are in strong locations. One realtor explained it thus:

“The new prime and plus flats have SR and a 10-year MOP, but existing flats in places like Queenstown or Bishan have no such restrictions. This can raise their attractiveness, and further push up the prices of these ‘unrestricted’ flats; at least in the near term.”

One home buyer also noted that, given the 10-year MOP, the plus and prime flats would take much longer to join the resale market. This led the reader to question if:

“When we make it longer for these flats to become resale flats, are we lowering the supply of resale flats in the best areas? Because they take twice as long* before they can enter the resale market?”

On our end, however, we feel that this is a naturally correcting issue; at least over the next decade or two. It’ll be difficult to apply it retroactively, without upending the whole property market.

The “hotspot” flats in Tiong Bahru, Bishan, Queenstown, etc. are also among the oldest flats (at least, until the new flats at Queenstown come up). So even though these units have no 10-year MOP, their increasingly advanced lease decay may still keep their prices down.

*We assume this refers to the MOP, and not the total length of time including construction.

4. Slight benefit to singles

From some of the responses we’ve seen online, enthusiasm among singles is limited. Most agree it’s nice to finally have a wider choice; but many also felt the impact is not huge. It may solve some supply issues, but the bigger problem of the age and affordability on a single income still remains.

On Reddit, for instance, we saw comments like:

Comment

by u/Kyrie0314 from discussion Singles can apply for new HDB flats in all locations, buy 2-room Prime resale flats

in singapore

Also:

Comment

by u/Anonvoiceofreason from discussion Singles can apply for new HDB flats in all locations, buy 2-room Prime resale flats

in singapore

While other single still feel (pun unintended but appropriate) singled out:

Comment

by u/ALJY21 from discussion Singles can apply for new HDB flats in all locations, buy 2-room Prime resale flats

in singapore

It seems that the main impediment to singles was not so much restrictions on where they could buy (although that was part of it), but rather the required age of 35; and this continues to be an issue.

Overall, it’s a necessary step forward, for no reason besides the increasing irrelevance of the mature/non-mature label

The new system is closer to practical realities. A flat near an MRT station and local mall is going to be convenient and worth more, regardless of how developed the wider town is. Likewise, there are parts of mature towns that remain inaccessible (we’re looking at you, Sunset Way in mature Clementi).

In terms of overall impact, we do think this helps to separate genuine home buyers from those seeking an intermediary asset. The 10-year MOP can ensure certain hotspots – such as areas near the MRT – remain more affordable, by removing the need to compete with investment-oriented types.

Moving forward, we are also curious as to how Plus flats will be defined exactly. Just how close to transportation, or good schools is close to being considered a Plus flat?

And finally, how would this also impact the private property market? There could be an effect as more HDB flats take a longer period to MOP, as well as a moderation of prices.

For more on the situation as it unfolds, follow us on Stacked. Also do let us know your thoughts and opinions in the comments, on this new change by HDB.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

What are the new categories for HDB flats introduced in Singapore?

How do the restrictions differ for resale of Prime, Plus, and Standard flats?

Will the new HDB classification system apply to existing flats?

How does the new classification affect singles wanting to buy HDB flats?

Why was the mature versus non-mature estate classification dropped?

What is the expected impact of the new HDB classification system on property prices?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Singapore Property News

Singapore Property News I’m Retired And Own A Freehold Condo — Should I Downgrade To An HDB Flat?

Singapore Property News REDAS-NUS Talent Programme Unveiled to Attract More to Join Real Estate Industry

Singapore Property News Three Very Different Singapore Properties Just Hit The Market — And One Is A $1B En Bloc

Singapore Property News Singapore Could Soon Have A Multi-Storey Driving Centre — Here’s Where It May Be Built

Latest Posts

Property Investment Insights This 55-Acre English Estate Owned By A Rolling Stones Legend Is On Sale — For Less Than You Might Expect

New Launch Condo Reviews What $1.8M Buys You In Phuket Today — Inside A New Beachfront Development

Overseas Property Investing This Singaporean Has Been Building Property In Japan Since 2015 — Here’s What He Says Investors Should Know

5 Comments

Would like to clarify the first PLH was introduced in 2021, it will only TOP around 2028. Hence, it will reach MOP around 2038, correct?

Do central region they also build standard flat? I though only plus and prime……

if a prime project is launched late 2023, TOP 2029, and unit is selected before 2H 2024.

does the resale restriction (e.g. income ceiling of $14k) applies to this prime hdb, which will MOP in 2039?