Why Are Good Class Bungalows (GCBs) Headed For A Record High In 2021?

September 15, 2021

Property prices really have gone up across all segments, even the extreme luxury end. Good class bungalows (GCBs) have been all the rage in 2021: from $144 million worth in transactions in 48 hours (in July), to news of tech billionaires developing a penchant for these. There’s also a good likelihood that, with Covid-19 continuing to wreak havoc, the GCB trend will be ongoing for quite a while longer. Here’s what’s happening:

GCB transaction volumes are close to the last highs of 2010

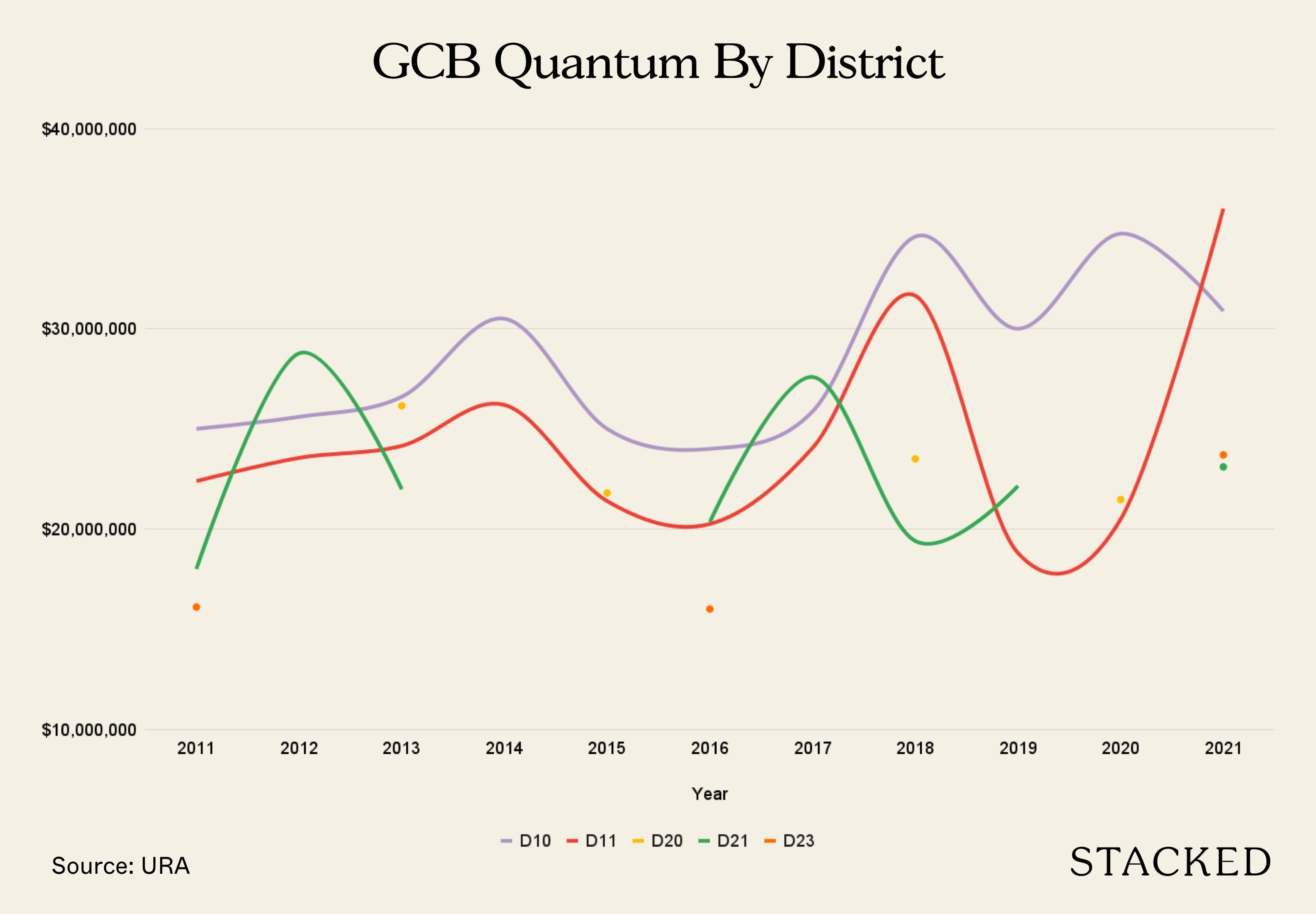

The last peak for GCBs was in 2010, when transactions totalled $1.85 billion, with around 101 transactions. By comparison, the first half of 2021 alone saw about $2.05 billion in transactions, with 68 transactions.

The contrast is even sharper, between 2020 and 2021. Last year, total GCB transactions only reached around $415.8 million, with 21 transactions. On a year-on-year basis (January to August), GCB prices averaged $1,391 psf in 2021, but have since jumped to about $1,713 psf.

The highlight of the year was in July, when four GCBs transacted at around $36 million each, all within the span of 48 hours. These were:

- Binjai Park ($1,318 psf)

- Swettenham Road ($1,954 psf)

- Coronation West Road (no caveat lodged)

- Olive Road ($1,536)

Meanwhile, the most expensive GCB transaction of the year was at Nassim Road, where a 32,160+ sq. ft. home transacted at $128.8 million, or around $4,005 psf.

It’s also been noticed that most buyers, in 2021, seem to be in tech-related businesses. For example, the record-breaking Nassim Road GCB was bought by the wife of Nanofilm Technologies head Shi Xu.

Secretlab founder Ian Ang bought a GCB on Caldecott Hill, while Razer CEO Tan Min-Liang bought a unit at Third Avenue.

There doesn’t seem to be a specific reason why tech entrepreneurs are more inclined toward real estate these days. However, some theories we’ve heard are having a more stable component to their overall portfolio, cheap leveraging, and financing options like home equity loans.

(This refers to taking out a loan against the appreciated property, at a very low-interest rate).

How much have GCB prices moved since 2010?

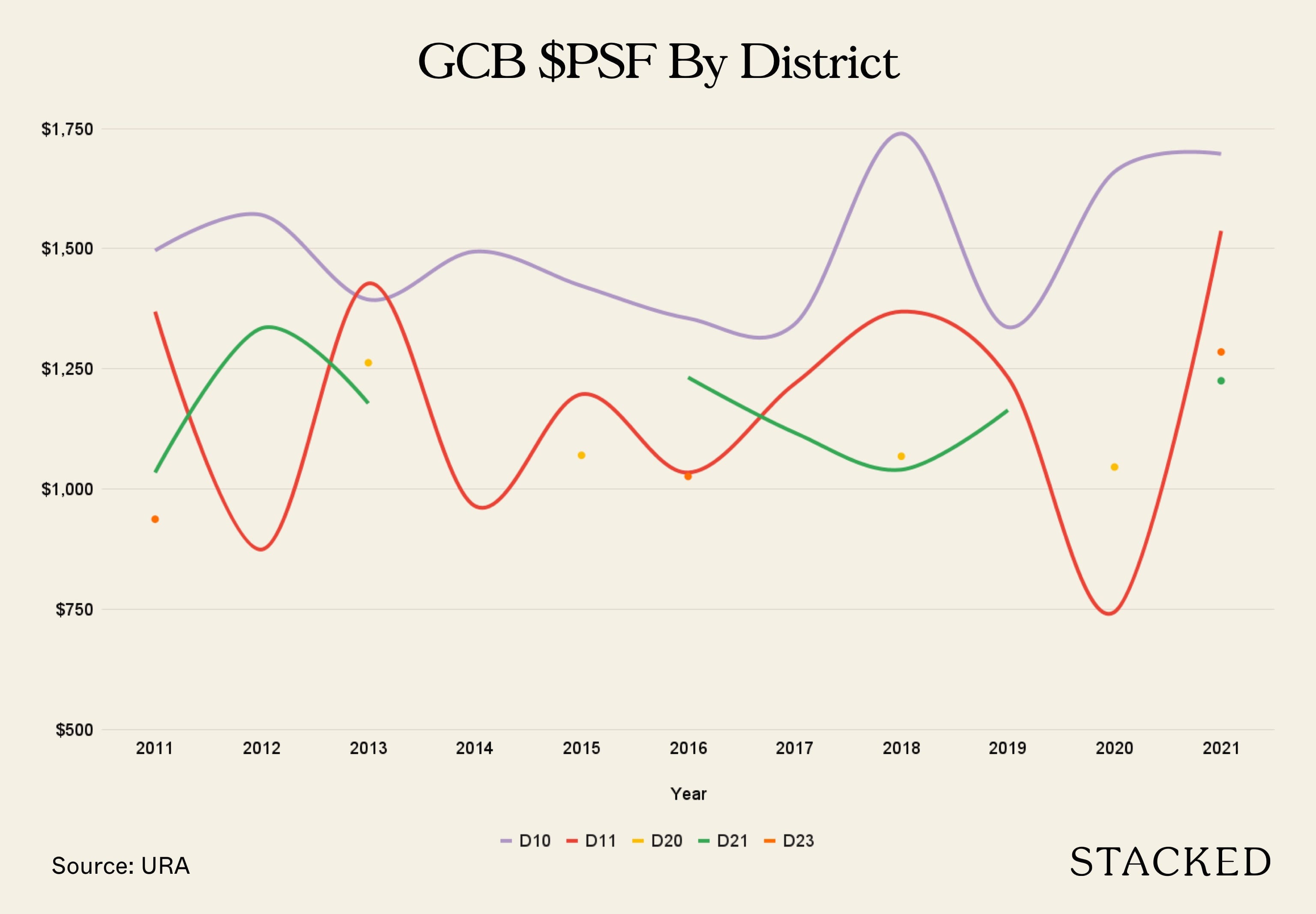

As GCB transactions are few and far between, it’s not easy to get a sense of the overall price movement. However, we can see that Cluny and Nassim appeared to have fared best.

On September 2011, a GCB at Cluny Hill transacted at just $1,246 psf. By the same time in 2015, any nearby GCB had transacted at $1,425 psf, and the last transaction in December 2020 reached $2,315 psf.

On September 2016 and October 2017, two GCBs along Nassim Road transacted at $1,423 psf and $1,372 psf respectively.

But in September 2020 and March 2021, two GCBs along Nassim Road managed to reach $1,831 psf and $4,005 psf.

While prices appear to have gone up in almost all the 39 GCB areas, the rise is not proportionate.

For example, King Albert Park saw a GCB transaction at $1,194 psf in February 2011. Another transaction in the same area, in February 2017, was only at $1,117 psf, whilst the latest transactions (August and September this year) were at $1,244 psf and $1,108 psf.

Property Investment InsightsShophouse Versus Bungalows: Which Are Better Investments?

by Ryan J. OngWhy the surge in Good Class Bungalows in 2021?

The reasons are somewhat similar to the overall surge in landed homes, which we covered in a previous article. But to summarise, note that the last peak for GCBs was in 2010, as recovery from the ‘08/09 financial crisis settled in. We’ve seen that investors like to consider Singapore real estate – especially freehold landed homes – as a safe haven in volatile times. With the supply of GCBs limited to just the 39 areas in Singapore, there’s seemingly little supply to meet the demand of such luxurious landed living in Singapore.

More from Stacked

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

Selling Your Property? 6 Key Details To Check For A Smooth Sale

Whether or not you’ve engaged a realtor to sell your property, it pays to keep an eye on the process. …

That aside, agents have noted that the surge among tech industry buyers may be related to Work From Home arrangements, and lockdown measures (worldwide, not just in Singapore). This fuels a surge in digital entertainment and media, and owners of these companies are likely seeking a safe place to park their windfall. There have also been people making eye-popping amounts of money off crypto, and because of the lack of supply in GCBs, these have also contributed to the increasing demand.

As the ultra-rich will not have issues getting financing, the property also doesn’t “lock up” their capital as much as it would many regular buyers. For example, it’s quite common for the ultra-rich to use financing options such as home equity loans, to borrow against their properties at low rates; this allows them to quickly reinvest in other assets.

There are surprisingly good rental prospects for GCBs

It’s often said that landed homes are bad for rental yields. In terms of more run-of-the-mill landed housing, this tends to be true, with gross rental yields often at two per cent or under.

However, GCBs tend to outperform their regular counterparts, and can reach yields of close to three per cent. In 2020, for example, we saw GCBs of rental rates hitting records of $75,000 to $85,000 per month; while the record for 2021 is $150,000 per month.

This is partly helped by restrictions on foreign ownership. Only Singaporeans can buy freehold landed properties such as GCBs (barring special permission). Foreigners can only buy leasehold landed properties on Sentosa Cove, which has not been a popular area in recent years.

(However, the renewed demand for landed homes could bring a turnaround in Sentosa Cove’s fortunes this year).

Given that home loan rates are at record lows, averaging 1.3 per cent per annum, owners who rent out their GCBs will find it easy to cover interest and maintenance.

While GCBs are out of most budget ranges, a conventional landed home may not be as pricey as you think

We compiled some of the cheapest landed properties you can find in Singapore. For those of you who are pure home buyers, you might want to consider looking in the leasehold landed market – prices here haven’t soared as high, but many offer equal comfort in terms of lifestyle.

For more details as the situation unfolds, follow us on Stacked. You can also get in-depth reviews of new and resale properties alike.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

Why are Good Class Bungalows (GCBs) in Singapore seeing a price surge in 2021?

How have GCB prices changed since 2010 in Singapore?

Are GCBs a good investment in terms of rental income?

Who are the typical buyers of GCBs in Singapore in 2021?

What makes GCBs more attractive compared to other landed properties?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Property Market Commentary

Property Market Commentary How I’d Invest $12 Million On Property If I Won The 2026 Toto Hongbao Draw

Property Market Commentary We Review 7 Of The June 2026 BTO Launch Sites – Which Is The Best Option For You?

Property Market Commentary Why Some Old HDB Flats Hold Value Longer Than Others

Property Market Commentary We Analysed HDB Price Growth — Here’s When Lease Decay Actually Hits (By Estate)

Latest Posts

Pro This 130-Unit Condo Launched 40% Above Its District — And Prices Struggled To Grow

Property Investment Insights These Freehold Condos Barely Made Money After Nearly 10 Years — Here’s What Went Wrong

Singapore Property News Why Some Singaporean Parents Are Considering Selling Their Flats — For Their Children’s Sake

0 Comments