Where To Find The Cheapest 5-room Resale Flats In 2022

July 29, 2022

It’s been more than a year since we last looked for the cheapest 5-room flats; and given that 2021 to 2022 has seen significant changes, it’s high time for an update. While the most affordable HDB towns haven’t changed much (save for one), you may want to take note of the price differences to date:

Table Of Contents

- The resale flat market in Q2 2022

- First, buyers who cannot take HDB loans will face higher interest rates

- Second, a record number of HDB flats will reach their Minimum Occupancy Period (MOP) this year

- The cheapest places to find 5-room resale flats this year

- 1. Woodlands

- 2. Jurong West

- 3. Sembawang

- 4. Choa Chu Kang

- 5. Sengkang

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

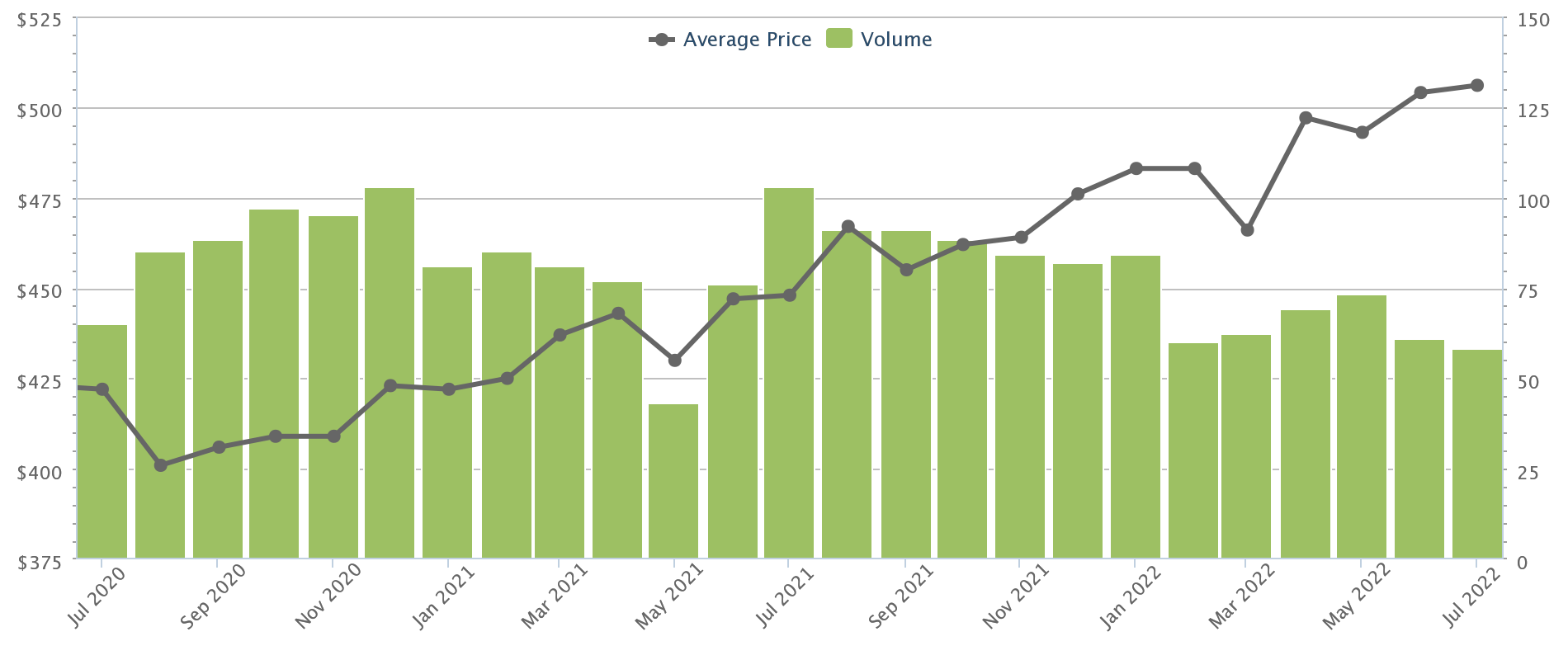

The resale flat market in Q2 2022

It’s tough news for home buyers: resale flat prices have continued to climb, and were up 11.4 per cent from last year in June 2022. So far, we’ve had nine consecutive quarters of price increases, but there is a glimmer of hope: prices rose a little slower in Q2 (2.6 per cent as opposed to 2.4 per cent in Q1), and price increases have stayed at around 2.5 per cent this year. This is about half a percentage point lower than in 2021.

In short, the momentum does seem to be slowing, although prices are still rising. Realtors mentioned two factors that could put downward pressure on resale prices this year:

First, buyers who cannot take HDB loans will face higher interest rates

Home loan rates are rising across the board, and many bank fixed rates have since climbed above 2.6 per cent. This is significant, because the HDB loan rate is 2.6 per cent, and HDB loans had been more expensive than bank loans for almost a decade.

The US government is embarking on aggressive rate hikes to curb record-high inflation, so there’s a possibility that rates may be even higher by the end of the year.

For resale flat prices who cannot use HDB loans, concerns over rising monthly repayments could prompt them to be more cautious.

Second, a record number of HDB flats will reach their Minimum Occupancy Period (MOP) this year

This is the highest number of flats reaching MOP in a single year, since around 2007. The average number of flats that reached MOP each year, from 2013 to 2021, was just around 16,667. This could create a greater surplus of resale flats in the market, helping to cool prices.

That said, realtors disagreed on how immediate the effect would be, or the exact impact on pricing. Some realtors also noted that five-year old flats tend to fetch higher prices, on account of their negligible lease decay – this could even push up the average price in recorded transactions.

Before proceeding to highlight the cheapest estates, here’s a look at prices between the first half of 2021 and 2022, as well as their respective changes.

| Estate | 5 Room (H2 2022) | 5 Room (H2 2021) | Change (Total) | Change (%) |

| Woodlands | $543,694 | $482,009 | +$61,686 | +11.3% |

| Jurong West | $551,967 | $494,684 | +$57,283 | +10.4% |

| Sembawang | $570,053 | $464,073 | +$105,980 | +18.6% |

| Choa Chu Kang | $571,125 | $508,409 | +$62,716 | +11.0% |

| Sengkang | $597,828 | $526,950 | +$70,878 | +11.9% |

| Jurong East | $600,638 | $548,581 | +$52,057 | +8.7% |

| Bukit Panjang | $601,161 | $548,169 | +$52,992 | +8.8% |

| Yishun | $601,823 | $530,384 | +$71,438 | +11.9% |

| Punggol | $610,990 | $567,343 | +$43,647 | +7.1% |

| Pasir Ris | $611,320 | $555,663 | +$55,657 | +9.1% |

| Hougang | $627,581 | $589,237 | +$38,344 | +6.1% |

| Tampines | $639,697 | $599,390 | +$40,307 | +6.3% |

| Bedok | $661,131 | $605,271 | +$55,860 | +8.4% |

| Serangoon | $690,603 | $610,140 | +$80,463 | +11.7% |

| Bukit Batok | $706,327 | $559,174 | +$147,153 | +20.8% |

| Geylang | $792,246 | $710,595 | +$81,651 | +10.3% |

| Ang Mo Kio | $802,698 | $665,556 | +$137,142 | +17.1% |

| Marine Parade | $825,887 | $778,673 | +$47,214 | +5.7% |

| Kallang/Whampoa | $828,975 | $753,993 | +$74,982 | +9.0% |

| Bukit Merah | $840,530 | $792,553 | +$47,977 | +5.7% |

| Toa Payoh | $841,640 | $784,013 | +$57,627 | +6.8% |

| Clementi | $843,051 | $754,137 | +$88,914 | +10.5% |

| Bukit Timah | $865,600 | $850,099 | +$15,501 | +1.8% |

| Bishan | $876,870 | $790,749 | +$86,121 | +9.8% |

| Queenstown | $928,879 | $875,914 | +$52,965 | +5.7% |

| Central Area | $1,131,138 | $961,757 | +$169,380 | +15.0% |

The cheapest places to find 5-room resale flats this year

Note: You can find last year’s list in this article.

1. Woodlands

Average price: $543,694 ($424 psf)

Change since 2021: Average price up from $482,009 (+11.3%)

| Woodlands | 3 Room | 4 Room | 5 Room | Executive |

| 5 – 10 Years Old | $403,340 | $510,373 | $637,954 | No Data |

| 11 – 20 Years Old | No Data | $448,462 | $515,122 | No Data |

| 21 – 30 Years Old | $345,250 | $447,096 | $543,297 | $770,202 |

| 31 – 40 Years Old | $322,425 | $422,135 | $505,185 | $686,667 |

| > 40 Years Old | $303,456 | $353,111 | $464,923 | No Data |

| Average | $342,016 | $451,184 | $541,869 | $765,881 |

Realtors told us Woodlands has seen an uptick in not just price, but rental rates. This is due to the return of Malaysian workers, as the pandemic seems to be winding down. Some agents have told us rental rates for 5-room flats in Woodlands have risen to between $2,100 and $2,400, as opposed to a range of $1,900 to $2,200 the year before.

Owners who are considering rental income may think twice about selling, now that Woodlands is seeing improved prospects.

A recent point of interest is the expansion of the Marsiling checkpoint, which promoted nine blocks to undergo SERS. The affected blocks were 210 to 218 (Marsiling Crescent). Unfortunate news for buyers eyeing the area, as these older and larger flats also had one of the best waterfront views in Woodlands.

Other than this, the main draw of Woodlands is still the upcoming Woodlands North Corridor, which will complete its transformation into a regional centre. This is still, for now, one of the cheapest places to buy a 5-room flat in Singapore; but it might not stay that way for long.

Top 5 Cheapest Transactions (2022):

More from Stacked

5 Most Affordable 5-Room HDB Flats in Central Singapore Under $780K

This week, we have narrowed down five 5-room HDB units located in central locations (like Bishan and Toa Payoh) under…

| Month | Flat Type | Address | Storey Range | Size (SQM) | Lease Started | Age | Price | $PSF |

| 2022-03 | 5 Room | 685B Choa Chu Kang Cres | 01 TO 03 | 111 | 2002 | 20 | $420,000 | $352 |

| 2022-04 | 5 Room | 684B Choa Chu Kang Cres | 01 TO 03 | 110 | 2002 | 20 | $428,000 | $361 |

| 2022-01 | 5 Room | 12 Teck Whye Lane | 16 TO 18 | 119 | 1979 | 43 | $450,000 | $351 |

| 2022-02 | 5 Room | 13 Teck Whye Lane | 10 TO 12 | 119 | 1979 | 43 | $452,000 | $353 |

| 2022-01 | 5 Room | 690D Choa Chu Kang Cres | 07 TO 09 | 110 | 2003 | 19 | $455,000 | $384 |

2. Jurong West

Average price: $551,967 ($442 psf)

Change since 2021: Average price up from $494,684 (+10.4%)

| Jurong West | 3 Room | 4 Room | 5 Room | Executive |

| 5 – 10 Years Old | $422,579 | $569,899 | $692,222 | No Data |

| 11 – 20 Years Old | $368,000 | $459,460 | $529,204 | $614,317 |

| 21 – 30 Years Old | No Data | $465,425 | $551,931 | $655,883 |

| 31 – 40 Years Old | $352,072 | $427,827 | $519,126 | $663,050 |

| > 40 Years Old | $282,411 | No Data | $413,770 | No Data |

| Average | $329,590 | $466,280 | $547,083 | $653,326 |

Jurong West has moved up our list from last year, when it placed third for the cheapest 5-room flats. Like Woodlands, rental prospects are looking up for this area – Jurong West is home to several industrial parks. Realtors we spoke to said that rentability has improved, but nothing has yet moved the needle on rental rates; this is expected to change as more workers return.

As resale flat prices climb – especially in the highly desirable Jurong East – we expect more buyers to consider this town as an alternative. It is, after all, just four stops from Boon Lay to Jurong East. As Boon Lay MRT is only three stops from Jurong East, it’s where you’d see a spillover as buyers and tenants who want to avoid the prices in Jurong East are increasingly considering Jurong West.

Top 5 Cheapest Transactions (2022):

| Month | Flat Type | Address | Storey Range | Size (SQM) | Lease Started | Age | Price | $PSF |

| 2022-01 | 5 Room | 204 Boon Lay Dr | 04 TO 06 | 111 | 1976 | 46 | $373,888 | $313 |

| 2022-01 | 5 Room | 199 Boon Lay Dr | 01 TO 03 | 112 | 1976 | 46 | $375,000 | $311 |

| 2022-04 | 5 Room | 200 Boon Lay Dr | 04 TO 06 | 121 | 1976 | 46 | $405,000 | $311 |

| 2022-06 | 5 Room | 199 Boon Lay Dr | 01 TO 03 | 112 | 1976 | 46 | $415,000 | $344 |

| 2022-03 | 5 Room | 198 Boon Lay Dr | 01 TO 03 | 112 | 1976 | 46 | $430,000 | $357 |

3. Sembawang

Average price: $570,053 ($451 psf)

Change since 2021: Average price up from $464,073 (+18.6%)

| Sembawang | 3 Room | 4 Room | 5 Room | Executive |

| 5 – 10 Years Old | $380,000 | $505,024 | No Data | No Data |

| 11 – 20 Years Old | No Data | $457,351 | $511,376 | $608,888 |

| 21 – 30 Years Old | No Data | $446,157 | $517,733 | $611,164 |

| Average | $380,000 | $459,838 | $516,384 | $611,107 |

Sembawang moves into Jurong West’s former spot, as prices continue to climb. As we mentioned last year, the ongoing development of Bukit Canberra will help to drive demand. In Q3 this year, Bukit Canberra will open its massive 800-seater hawker centre (there are 44 stalls), an indoor sports hall (12 badminton courts), polyclinic, 5 swimming pools, and the biggest ActiveSG gym in Singapore.

These ongoing changes, as well as private launches like The Commodore and The Watergardens at Canberra, have raised prestige and attention in the area. Realtors also suggest that buyers who were unable to secure an EC in this area (referring to Parc Canberra) may now have turned their attention to resale flat options. As such, prices here have had quite a significant increase, with an 18.5 per cent increase since 2021.

Prices here are likely to maintain their momentum, as Canberra sees further improvement.

Top 5 Cheapest Transactions (2022):

| Month | Flat Type | Address | Storey Range | Size (SQM) | Lease Started | Age | Price | $PSF |

| 2022-01 | 5 Room | 476 Sembawang Dr | 04 TO 06 | 110 | 2000 | 22 | $425,000 | $359 |

| 2022-03 | 5 Room | 338 Sembawang Cres | 01 TO 03 | 115 | 1999 | 23 | $445,000 | $359 |

| 2022-01 | 5 Room | 491 Admiralty Link | 04 TO 06 | 112 | 2004 | 18 | $465,000 | $386 |

| 2022-01 | 5 Room | 481 Sembawang Dr | 07 TO 09 | 110 | 2000 | 22 | $468,000 | $395 |

| 2022-01 | 5 Room | 469B Admiralty Dr | 04 TO 06 | 118 | 2001 | 21 | $470,000 | $370 |

New Launch Condo ReviewsThe Watergardens At Canberra Review: Affordable PSF Entry But Far From City

by Matthew Kwan4. Choa Chu Kang

Average price: $571,125 ($455 psf)

Change since 2021:

Average price up from $508,409 (+11%)

| Choa Chu Kang | 3 Room | 4 Room | 5 Room | Executive |

| 5 – 10 Years Old | $408,319 | $511,287 | $612,254 | No Data |

| 11 – 20 Years Old | No Data | $427,844 | $491,318 | No Data |

| 21 – 30 Years Old | No Data | $458,597 | $566,325 | $695,327 |

| 31 – 40 Years Old | $344,846 | $456,392 | $536,914 | $704,883 |

| > 40 Years Old | $328,600 | $386,000 | $472,800 | No Data |

| Average | $378,276 | $476,804 | $569,855 | $697,820 |

Choa Chu Kang maintains its same place as last year. Realtors said that transactions are slowing down though – there were 150 transactions and 170 transactions in July and August respectively, in 2021. As of February this year, however, there hasn’t been a single month that has reached 150 sales.

Nonetheless, Choa Chu Kang is home to many older flats, that are more sizeable than their newer counterparts. Realtors expect that this will be a key selling point for the neighbourhood; especially for right-sizers who don’t want to compromise on living space.

And like what we’ve explored in our tour of uniquely designed HDB’s with unusual layouts, many of such are located in Choa Chua Kang.

Top 5 Cheapest Transactions (2022):

| Month | Flat Type | Address | Storey Range | Size (SQM) | Lease Started | Age | Price | $PSF |

| 2022-01 | 5 Room | 312B Anchorvale Lane | 01 TO 03 | 111 | 2002 | 20 | $450,000 | $377 |

| 2022-03 | 5 Room | 122A Sengkang East Way | 01 TO 03 | 108 | 2000 | 22 | $455,000 | $391 |

| 2022-06 | 5 Room | 122E Rivervale Dr | 01 TO 03 | 108 | 2000 | 22 | $459,000 | $395 |

| 2022-03 | 5 Room | 183C Rivervale Cres | 04 TO 06 | 110 | 2003 | 19 | $465,000 | $393 |

| 2022-03 | 5 Room | 311A Anchorvale Lane | 01 TO 03 | 111 | 2002 | 20 | $466,000 | $390 |

5. Sengkang

Average price: $597,828 ($458 psf)

Change since 2021:

Average price up from $526,950 (+11.9%)

| Sengkang | 3 Room | 4 Room | 5 Room | Executive |

| 5 – 10 Years Old | $416,341 | $535,196 | $677,973 | No Data |

| 11 – 20 Years Old | $423,818 | $506,452 | $535,573 | $668,157 |

| 21 – 30 Years Old | No Data | $456,969 | $540,835 | $680,743 |

| Average | $417,155 | $515,809 | $594,840 | $678,756 |

Sengkang is the newcomer to our list, replacing Bukit Batok from last year. In terms of age demographics, Sengkang is the town with the youngest Singaporeans; a fact that was even cited as the reason for the political opposition’s win here.

Part of the reason is the lower home prices here: for first-time buyers, who don’t have sale proceeds from a previous flat or condo, Sengkang is one of the few reasonable options right now.

The other key attraction in Sengkang is that many of the flats are new (10 years old or younger). As we mentioned above, a large number of flats are going to reach MOP this year – and many of these will likely be in the Sengkang area (with Yishun and Punggol close behind).

Realtors disagreed on whether this new supply will lower prices, or will cause a price increase due to the demand for young flats.

Top 5 Cheapest Transactions (2022):

| Month | Flat Type | Address | Storey Range | Size (SQM) | Lease Started | Age | Price | $PSF |

| 2022-03 | 5 Room | 9 Marsiling Dr | 07 TO 09 | 117 | 1976 | 46 | $400,000 | $318 |

| 2022-07 | 5 Room | 720 Woodlands Ave 6 | 07 TO 09 | 120 | 1997 | 25 | $400,000 | $310 |

| 2022-01 | 5 Room | 11 Marsiling Dr | 16 TO 18 | 126 | 1976 | 46 | $420,000 | $310 |

| 2022-02 | 5 Room | 10 Marsiling Dr | 07 TO 09 | 123 | 1976 | 46 | $425,000 | $321 |

| 2022-06 | 5 Room | 36 Marsiling Dr | 01 TO 03 | 124 | 1978 | 44 | $425,000 | $318 |

Overall, we can see that average (resale) 5-room flat prices below $500,000 are, for now, a thing of the past. It’s quite likely that many new home buyers will have to opt for smaller units, if they absolutely must buy a resale flat. 5-room flats below $500,000 is still a possibility as shown from the cheapest transactions – but they are among the oldest or least convenient of places.

For those who can wait, we hope the increased number of BTO launches provides a way out.

For more about the situation as it unfolds, follow us on Stacked. We’ll provide you with the data and tips you need to make the best-informed decision.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

Where are the cheapest 5-room resale flats in Singapore in 2022?

How have resale flat prices changed in Singapore from 2021 to 2022?

What factors might influence the resale flat market in 2022?

Which estate saw the largest increase in average resale flat prices in 2022?

Are 5-room resale flats in Singapore still affordable in 2022?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Property Picks

Property Picks Where to Find Singapore’s Oldest HDB Flats (And What They Cost In 2025)

Property Picks Where To Find The Cheapest 2 Bedroom Resale Units In Central Singapore (From $1.2m)

Property Picks 19 Cheaper New Launch Condos Priced At $1.5m Or Less. Here’s Where To Look

Property Picks Here’s Where You Can Find The Biggest Two-Bedder Condos Under $1.8 Million In 2025

Latest Posts

Pro This 130-Unit Boutique Condo Launched At A Premium — Here’s What 8 Years Revealed About The Winners And Losers

Singapore Property News New Lentor Condo Could Start From $2,700 PSF After Record Land Bid

On The Market A Rare Freehold Conserved Terrace In Cairnhill Is Up For Sale At $16M

2 Comments

Hi Ryan, maybe you should take a look at Chai Chee St. 5 rms 40 yrs quite cheap over there n location not too bad.

Hi, i think there might be some tables that have been switched around, matched to the wrong estates.