What next for Singapore housing market after July 6 cooling measures?

October 24, 2018

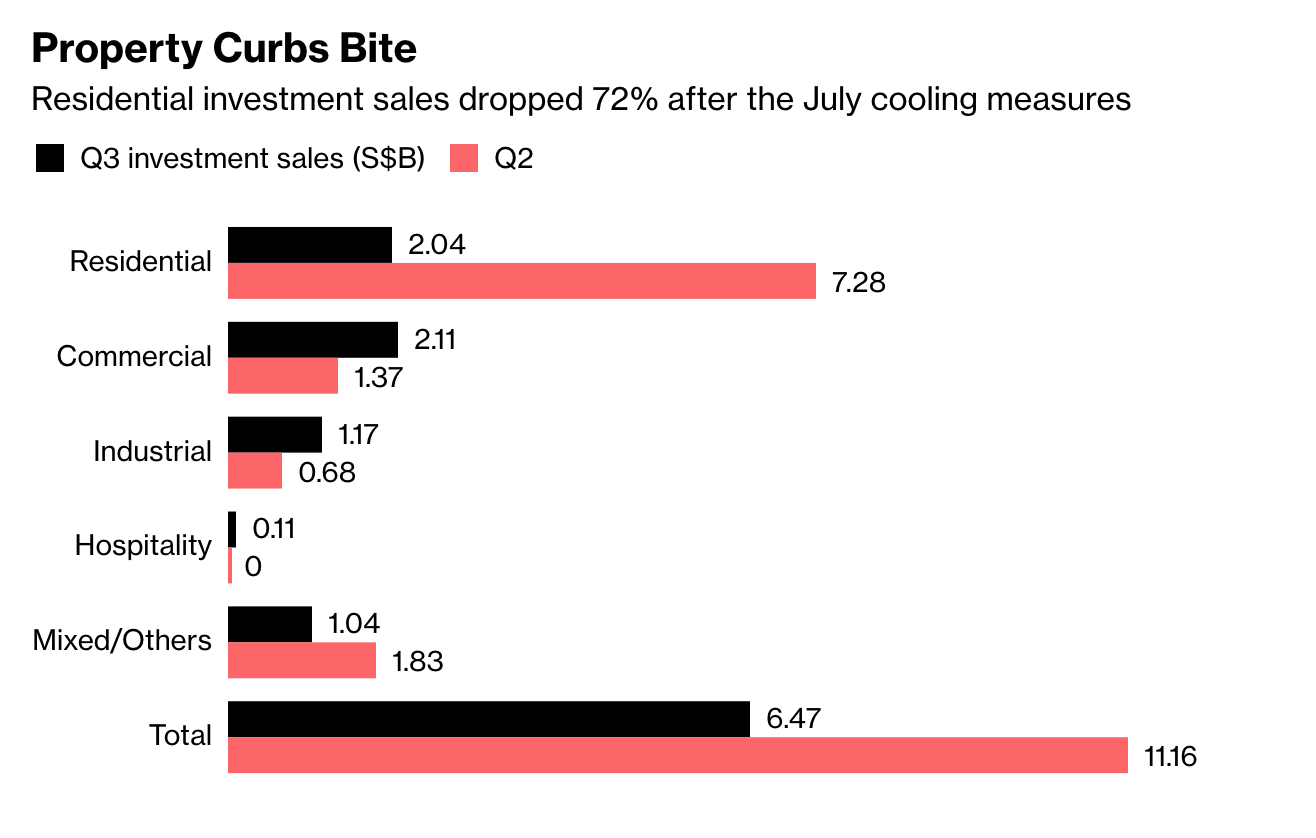

Residential property investment sales have collapsed in Singapore after another series of housing curbs halted ‘en-bloc’ redevelopment deals. The last round of cooling measures for the Singapore housing market took place just more than 3 months ago on July 6 and ever since that day speculation about when the next crash will occur have been rife. Many investors hoped that the market was resilient enough to withstand a major failure. But that was not to be as merely 2 redevelopment sales worth S$353 million were finalised in the third quarter of this year, down from the impressive S$3.8 billion worth of transactions of the second quarter according to Cushman & Wakefield Inc.

The calm before the storm

In May this year, it was reported that the Singapore housing market was once again expanding after a 4-year slump in property prices. Demand was on the increase with residential construction also rising along an improved homebuilder sentiment. Once adjusted for inflation, house prices increased by as much as 5.2% during 2017 and Q1 of 2018 according to the Urban Redevelopment Authority. Home buyers regained faith in the market, financial institutions enjoyed an upsurge in business as more individuals required home financing, eager to invest in their dream homes.

The crash was a long time coming

According to Christine Li, head of research for Singapore at Cushman “the collective sales market was decimated after the recent cooling measures”. The prices of private homes increased at a snail’s pace after the additional curbs were enforced. During July this year, the Singapore government took steps to cool down the market after a precipitous rise in en bloc sales during the first half of the year. The recoil in prices following a 4-year slide fuelled a host of belligerent bids from property developers which led to an eruption of en bloc sales – a strategy employed by a group of property owners who group together to sell whole apartment buildings at a time. This means homeowners get an increased payoff for their property, in some cases it can easily be double the market value. The government’s new rules resulted in a raising the buyer’s stamp duty, making it increasingly more expensive for developers to redevelop old properties.

More from Stacked

The 5 Most Common Property Questions Everyone Asks In Singapore – But No One Can Answer

Although I’ve been investing and writing about real estate for over a decade now, some questions still make me pause…

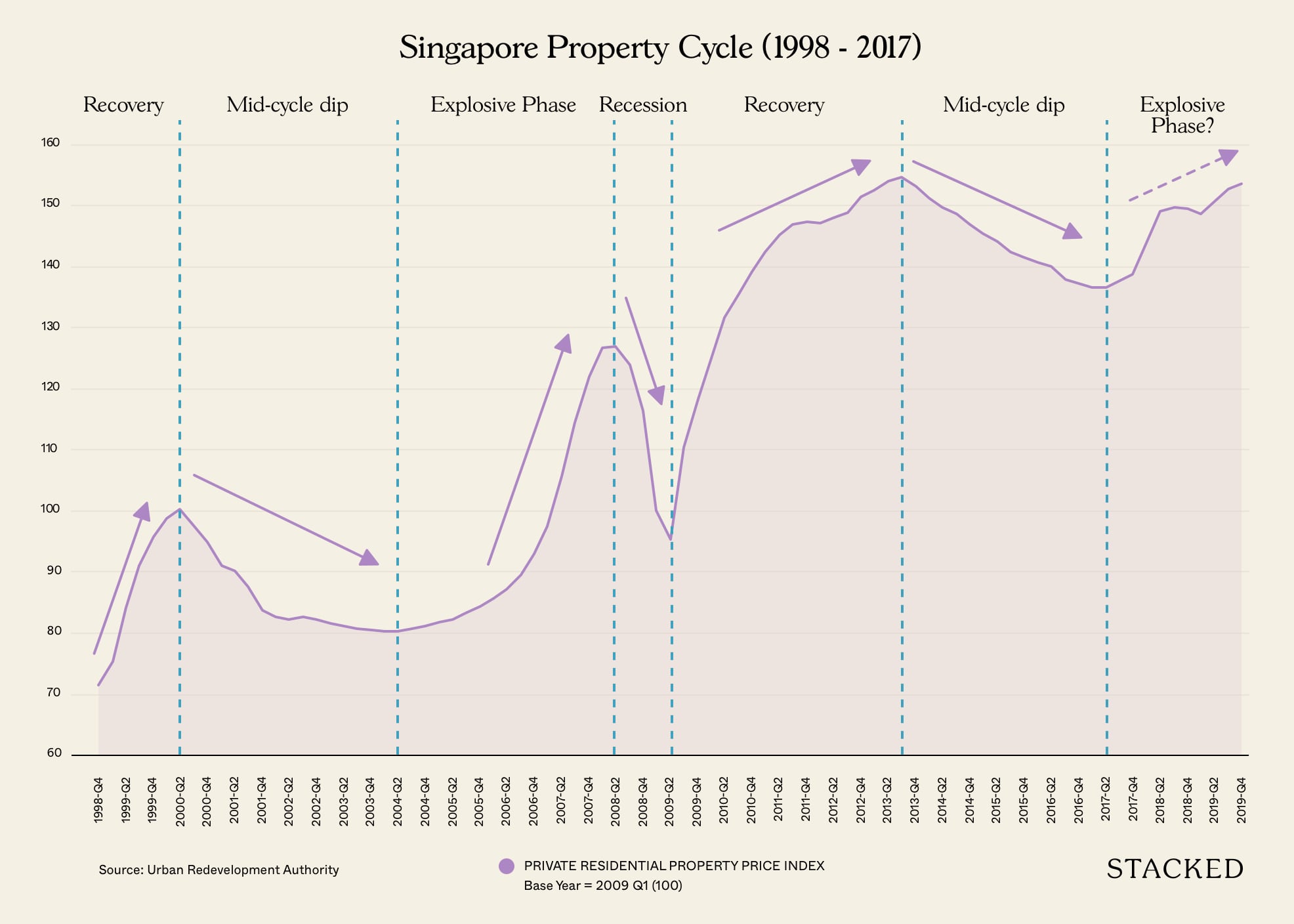

Property Market CommentaryWhy Knowing The Singapore Property Cycle Can Make You A Better Investor

by Sean GohNew rules, new risks

Under the new rules, individuals looking to take out their first home loan faced increasingly stringent loan limits, increasing the need for a lump cash sum. Foreign investors in the residential property market also came face to face with a higher stamp duty which looks to impact house sales and prices significantly. Not to mention, the recent news of the new policy on shoebox units could also possibly have an even higher impact on the Singapore housing market prices as developers now have to build larger units, which are traditionally harder to sell. This could put a dent in profitability, leading to a bigger drop in en bloc deals and less cash in the market.

Source: Bloomberg

This is not the country’s first property market collapse and will more than likely not be the last. It is still early days after the collapse and forecasters are yet unable to predict what long-term impact the latest crash will have on the overall property market in Singapore. What can, however, confidently be ascertained is the fact that investors will be significantly more hesitant in parting with their money in the foreseeable future.

As always, feel free to reach out to us at stories@stackedhomes.com or leave a comment down below!

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

What caused the collapse of property investment sales in Singapore after July 6?

How did the July 6 cooling measures impact Singapore's housing market?

What are en-bloc sales, and how did they affect Singapore's property market?

Are there signs of recovery or further decline in Singapore's housing market after the recent measures?

What new risks do the recent Singapore housing policies introduce for developers and investors?

Stanley Goh

Stanley loves crunching numbers in excel and analysing them. Naturally, he helps Stacked Homes generate articles based on his analysis as much as he can. When he's not using Excel, he enjoys watching movies and eating chocolates.Need help with a property decision?

Speak to our team →Read next from Singapore Property News

Singapore Property News Nearly 1,000 New Homes Were Sold Last Month — What Does It Say About the 2026 New Launch Market?

Singapore Property News The Unexpected Side Effect Of Singapore’s Property Cooling Measures

Singapore Property News The Most Expensive Resale Flat Just Sold for $1.7M in Queenstown — Is There No Limit to What Buyers Will Pay?

Singapore Property News Why Housing Took A Back Seat In Budget 2026

Latest Posts

Pro This Singapore Condo Has Bigger Units Near The MRT — But Timing Decided Who Made Money

Editor's Pick Happy Chinese New Year from Stacked

Editor's Pick How I’d Invest $12 Million On Property If I Won The 2026 Toto Hongbao Draw

0 Comments